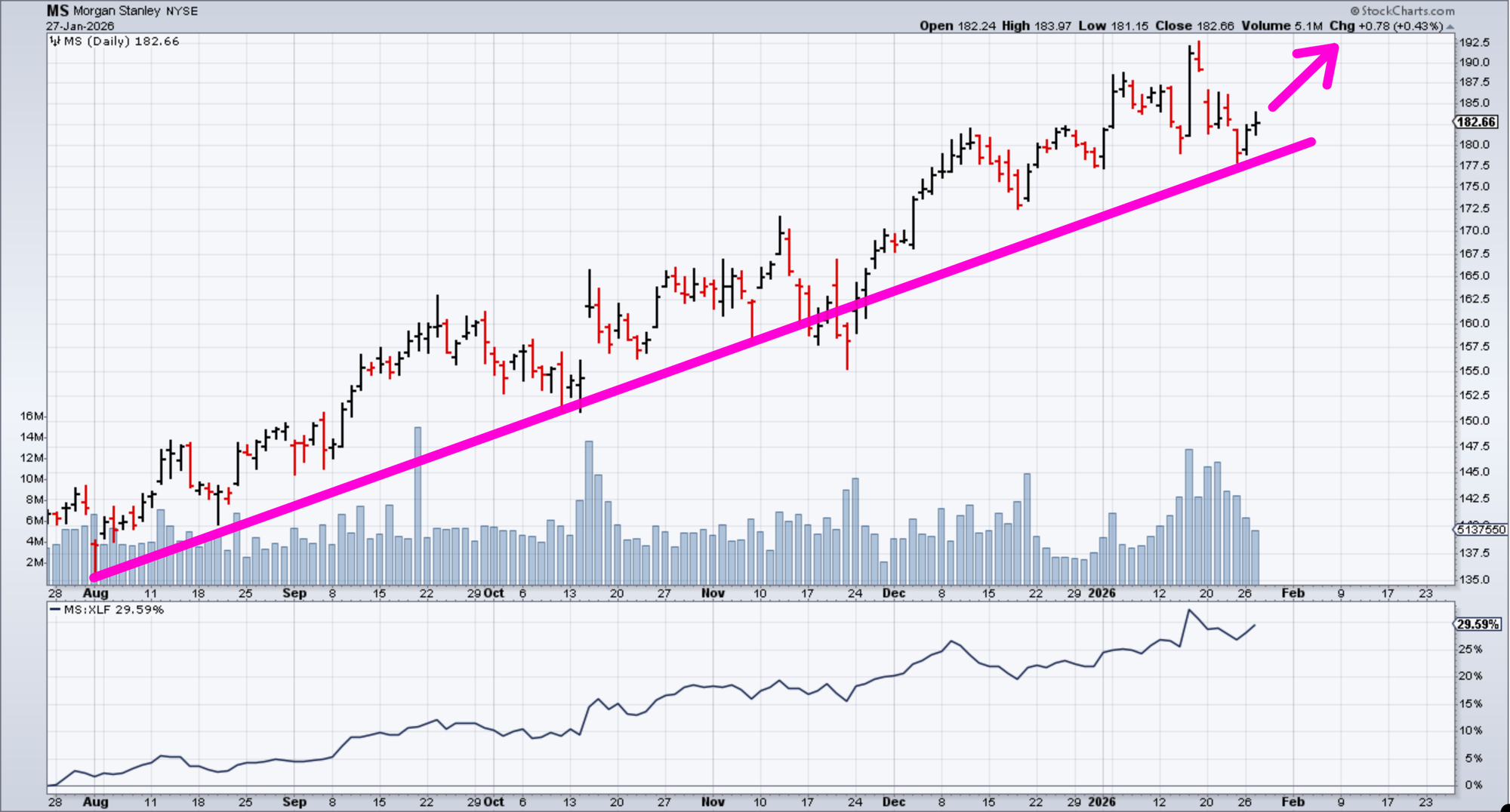

Morgan Stanley’s Momentum Entry Setup

With interest rates ticking back up in January, the "easy money" trade in tech is taking a breather. But while higher rates are a headwind for growth stocks, they are fuel for the financial sector, specifically for the banks that can benefit from rising yields.

Morgan Stanley (MS) is currently in the "Goldilocks" zone.

Why Morgan Stanley Stands Out

In its recent earnings report, Morgan Stanley's management proved it is firing on all cylinders. The Wealth Management division is printing cash thanks to higher net interest income (NII). At the same time, the Investment Banking division is posting record profits as deal activity picked up, despite the rate environment.

The Opportunity: While the broader market (SPX) has been chopping sideways, Morgan Stanley is showing massive relative strength, outperforming both the market and the Financial Select Sector SPDR Fund (XLF) significantly. Investors are fleeing to quality, and MS is the leader of the pack.

The stock has pulled back slightly to test a key support level. This gives us a chance to enter a momentum leader with an attractive risk-to-reward.

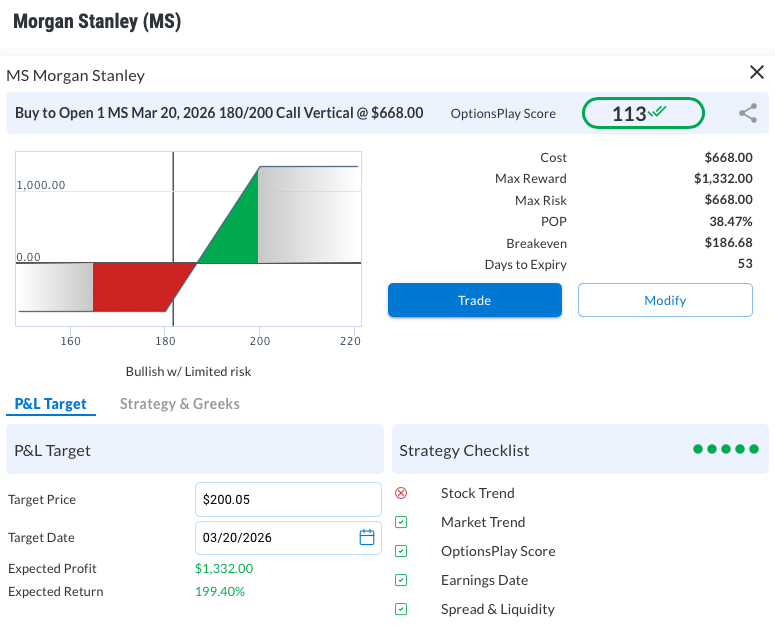

Rather than buying the stock near all-time highs and risking a stall or pullback, I wanted upside exposure without taking on the full downside risk of owning shares outright. That's where options come into play.

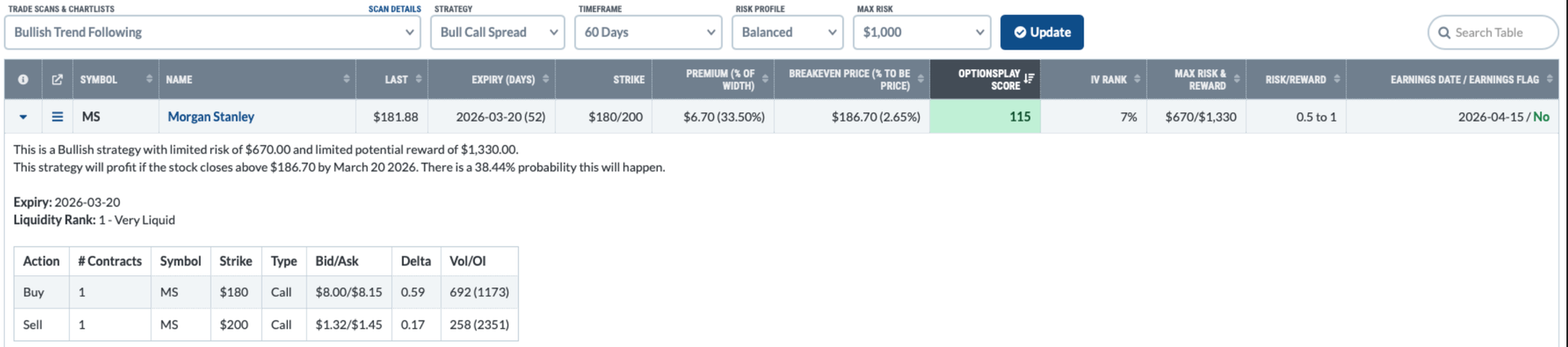

Using the OptionsPlay integration, I structured a trade that profits from the trend while mitigating the downside risk with a call debit vertical spread.

What we are looking at is a textbook "Bullish Trend Following" setup. The stock has been riding a pristine upward trendline for months. It recently dipped to test this trendline near $181, held firm, and is now curling back up. This "dip within an uptrend" is the highest-probability entry point for a momentum trend trader.

The Perfect Trade Execution

If I were to buy a call option, Time Decay (Theta) would work against the trade. If the stock grinds slowly higher, the option can lose value every day. Instead, I used OptionsPlay to find a Bull Call Spread (Debit Spread). This strategy allows me to offset the cost of the trade and neutralize much of that time decay.

The Trade

- Strategy: Bull Call Spread

- Expiry: March 20, 2026 (~52 Days)

- Legs: Buy $180 Call / Sell $200 Call

- Net Debit: ~$6.70

- Breakeven: $186.70

Why this trade works: By selling the $200 call against the long position, the cost of the trade is reduced by nearly 20%, lowering the breakeven price significantly. We don't need MS to go to the moon; we just need it to continue its steady grind higher. If MS rallies to $200 by expiration, the trade nearly doubles our money (risk $670 to make $1,330 per contract).

How I Found This Trade (The Secret)

Normally, finding a debit spread with a 2:1 payout ratio on a stock that has the optimal momentum entry point takes some serious digging and research with plenty of dead ends. You have to search for the optimal stock and then calculate the width of the spread vs. the cost for dozens of expiration dates.

I found this MS trade in less than 5 seconds!

And I did so by opening the OptionsPlay Add-On, selecting the Bullish Trend Following scan, and sorting by OptionsPlay Score. The tool instantly recognized that across all stocks that had an optimal momentum entry point, MS had the most attractive debit spread, with the tool identifying the March $180/$200 vertical spread. It filtered out all the great stocks that didn’t have a suitable options trade and served up the perfect setup on a silver platter.

Stop fighting the math. Let OptionsPlay find the edge for you.

Curious how I found this setup so quickly? The OptionsPlay Add-On for StockCharts helps streamline the process by identifying high-quality options strategies in seconds.