The Next Step in AI Is Here: Powered by Quantum Computing

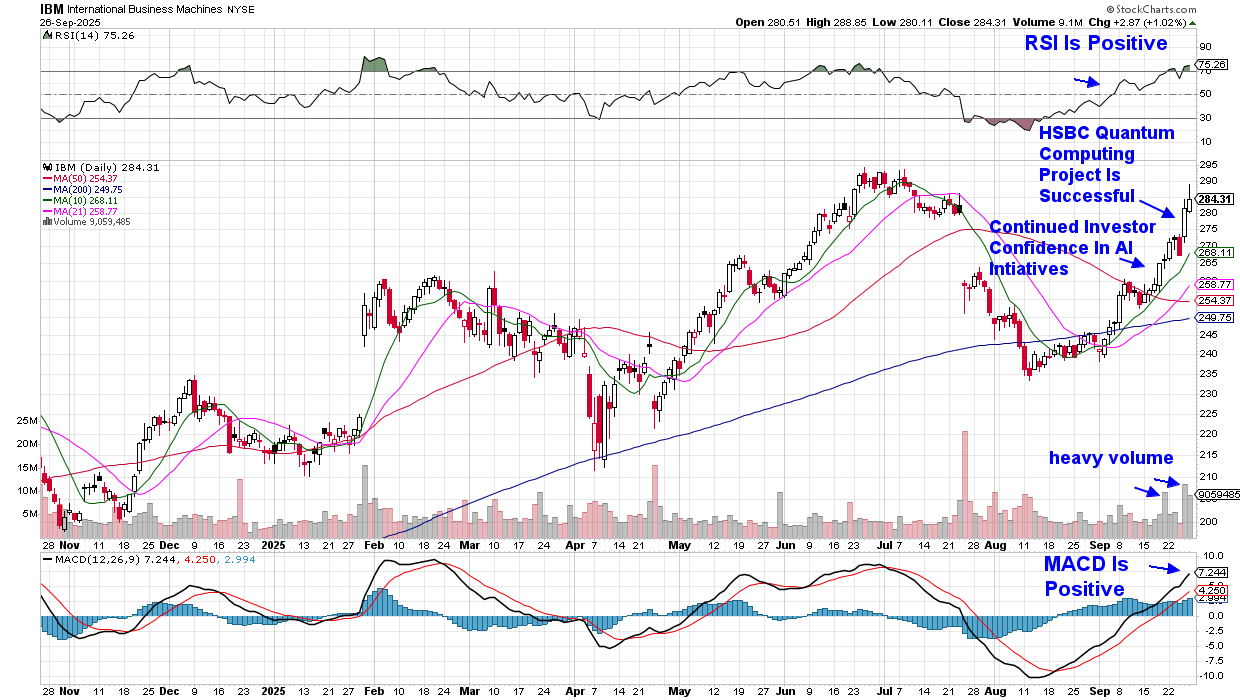

Quantum computing has long promised to revolutionize industries, but the technology has remained largely theoretical. Yet last week’s collaboration between IBM (IBM) and HSBC (HSBC) suggests that the quantum era may be closer than many expected.

In their joint project, the two companies developed a successful quantum model designed to address algorithmic bond trading. This breakthrough signals a shift in the conversation around quantum computing. Instead of waiting for “perfect” fault-tolerant systems, industries are now exploring what’s possible with today’s devices, especially when paired with classical computing resources.

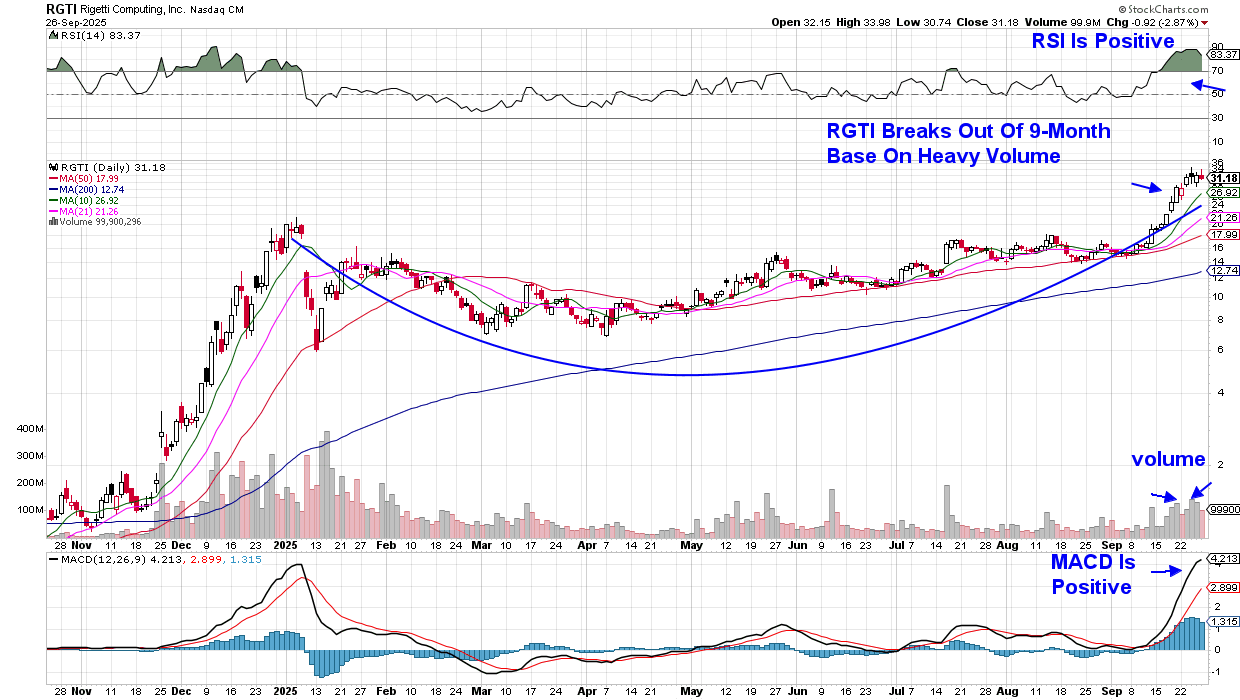

Another company that’s making strides in quantum computing is Rigetti Computing (RGTI), which is building superconducting quantum processors and has a roadmap toward larger, modular systems. The chart below shows that RGTI's stock price has broken out of a base. While RGTI has a good path, scaling and error correction are big technical challenges.

While we may still be a couple of years away from profitable developments in quantum computing, it’s important to remember that Palantir (PLTR) and NVIDIA (NVDA), two big players in AI, began grabbing headlines in late 2022. This was well before today’s AI profitability boom.

The ability to tune into the next innovative cycle’s possible winners is a skill that can put you in front of that cycle’s leadership names. Oftentimes, these leaders go on to far outpace the broader markets.

If you’d like to be kept up to date on entry opportunities in leading stocks, take a free 2-week trial of my twice-weekly MEM Edge Report. It specializes in uncovering top stocks in forward-thinking areas as they begin to take off. Use this link here for this special offer!

Warmly,

Mary Ellen McGonagle

Founder, MEM Investment Research