The Best Five Sectors This Week, #34

Key Takeaways

- Technology remains the top sector, but is losing momentum.

- Communication services and consumer discretionary hold firm in the top 3.

- Financials (XLF) makes a surprise entry into the top 5, replacing utilities.

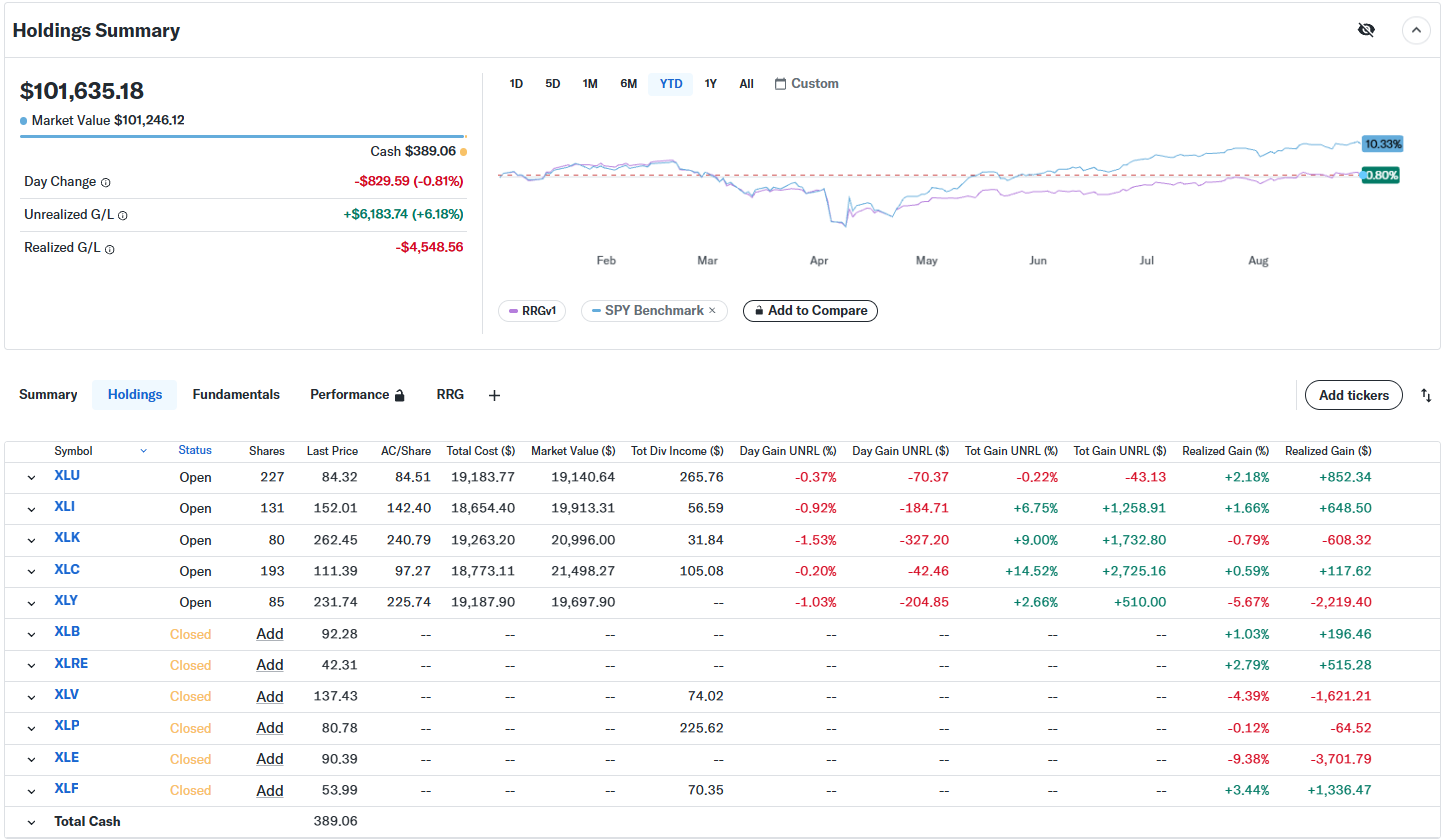

- Portfolio performance still lagging (-9%), but I continue to follow the relative trend strategy.

In a week where the S&P 500 remained nearly unchanged, only slightly lower, we've seen some interesting shifts in sector rankings. These changes, although subtle, provide valuable insights into the market's current dynamics and potential future developments. Let's dive into the details and see what the numbers are telling us about sector rotation and relative strength.

Sector Ranking Shuffle

The top half of our sector approach has seen some notable changes. Technology (XLK) maintains its crown at number one, with communication services (XLC) holding steady at number two. The Consumer Discretionary (XLY) sector has made a move, climbing from fourth to third place, consequently pushing Industrials (XLI) down a notch to fourth. But the real surprise comes from the financial sector (XLF), which has muscled its way into the top five, up from sixth place last week.

This reshuffling has had a domino effect on the lower ranks. Materials (XLB) popped up to sixth, utilities (XLU) got pushed out of the top five to seventh, and energy (XLE) climbed from ninth to eighth. Consumer staples (XLP) slipped from eighth to ninth, while real estate (XLRE) and health care (XLV) remained static at tenth and eleventh, respectively.

- (1) Technology - (XLK)

- (2) Communication Services - (XLC)

- (4) Consumer Discretionary - (XLY)*

- (3) Industrials - (XLI)*

- (6) Financials - (XLF)*

- (7) Materials - (XLB)*

- (5) Utilities - (XLU)*

- (9) Energy - (XLE)*

- (8) Consumer Staples - (XLP)*

- (10) Real-Estate - (XLRE)

- (11) Healthcare - (XLV)

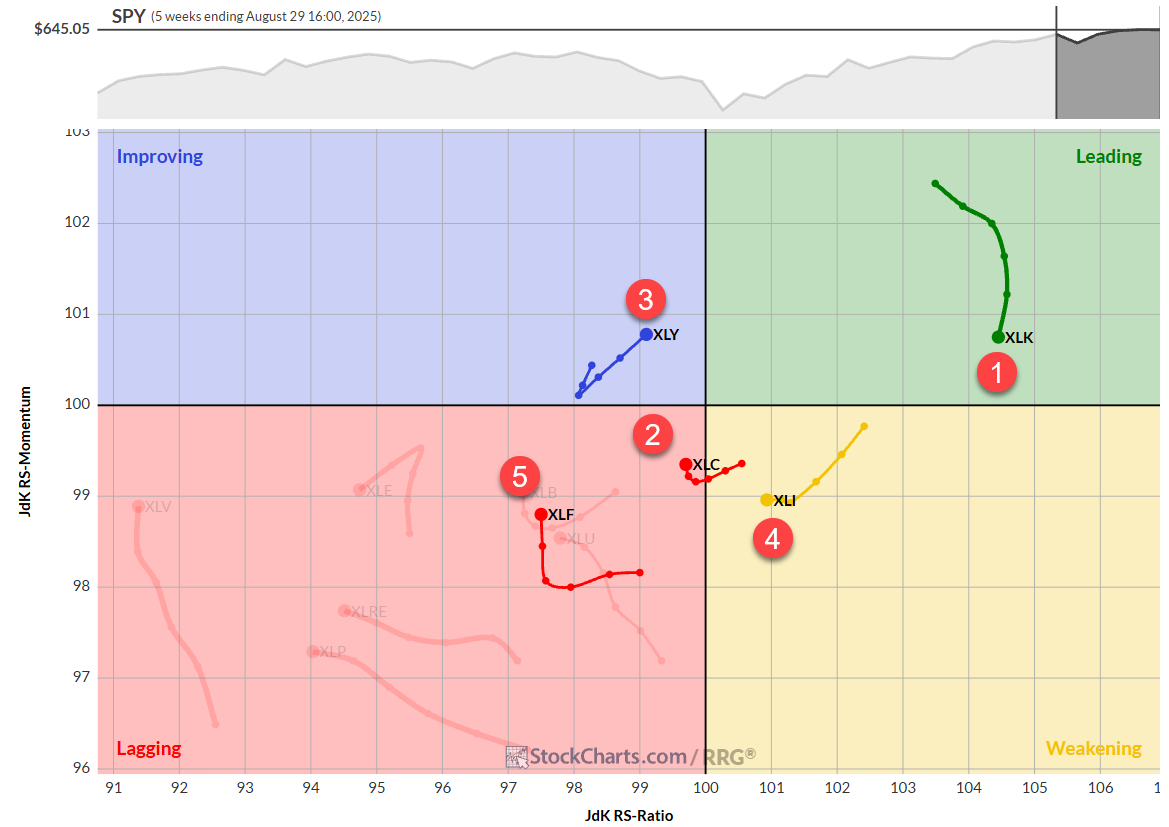

Weekly RRG

The weekly Relative Rotation Graph (RRG) paints an intriguing picture of sector movements. Technology stands alone in the leading quadrant, but it's not all roses. XLK is losing relative momentum, despite maintaining a high RS ratio reading. The high RS-Ratio reading provides enough room for a leading-weakening-leading rotation for the time being.

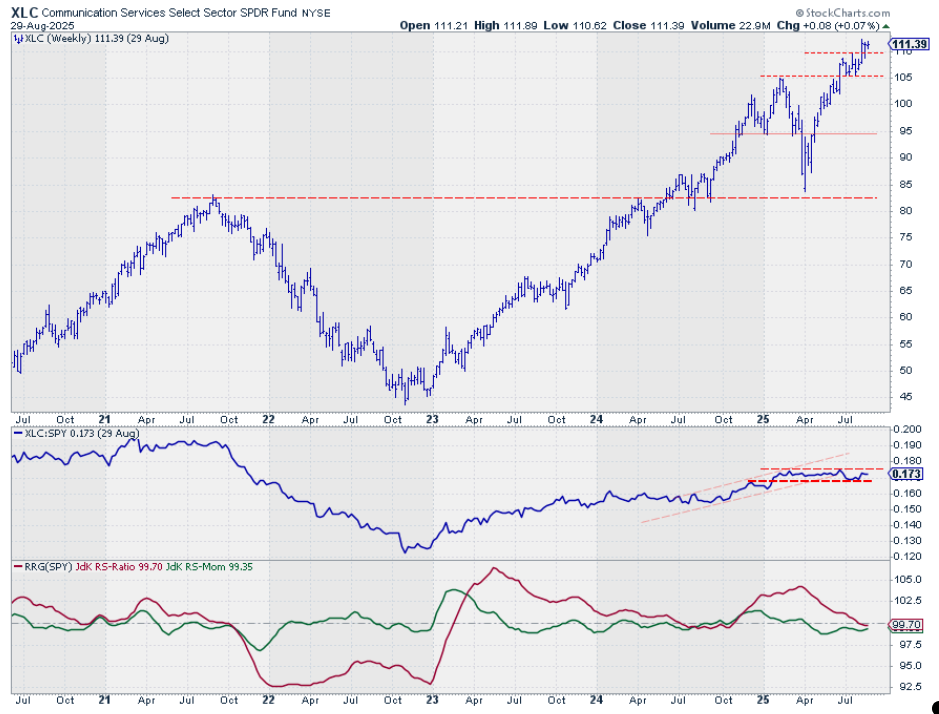

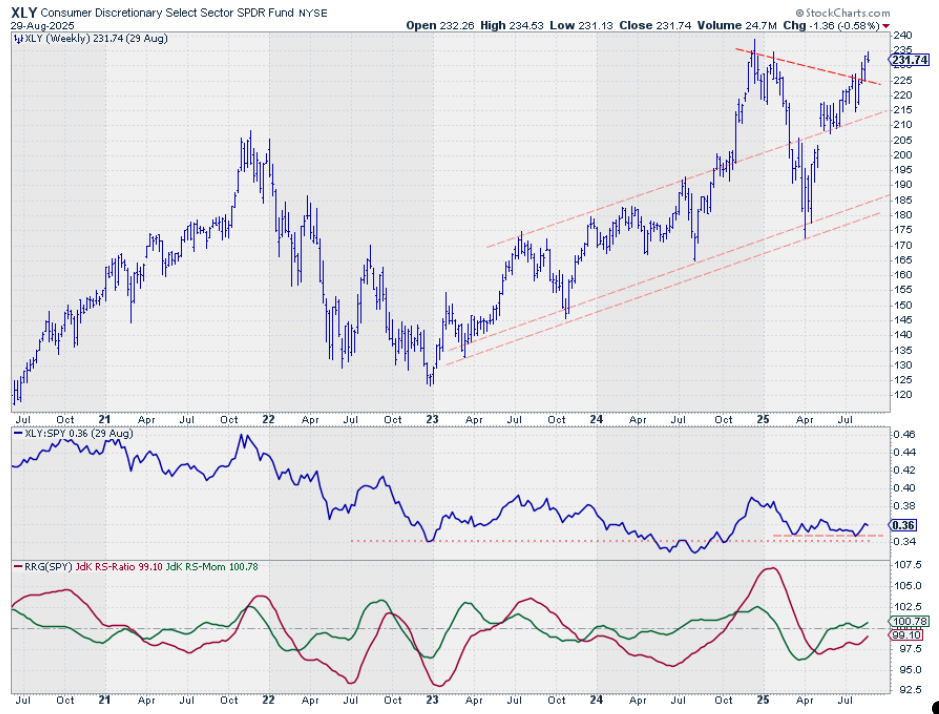

Communication services, our number two sector, is showing signs of life from within the lagging quadrant. It has started to grow back up, picking up relative momentum. Consumer discretionary is on the move too, heading towards the leading quadrant while traveling at a positive RRG-Heading.

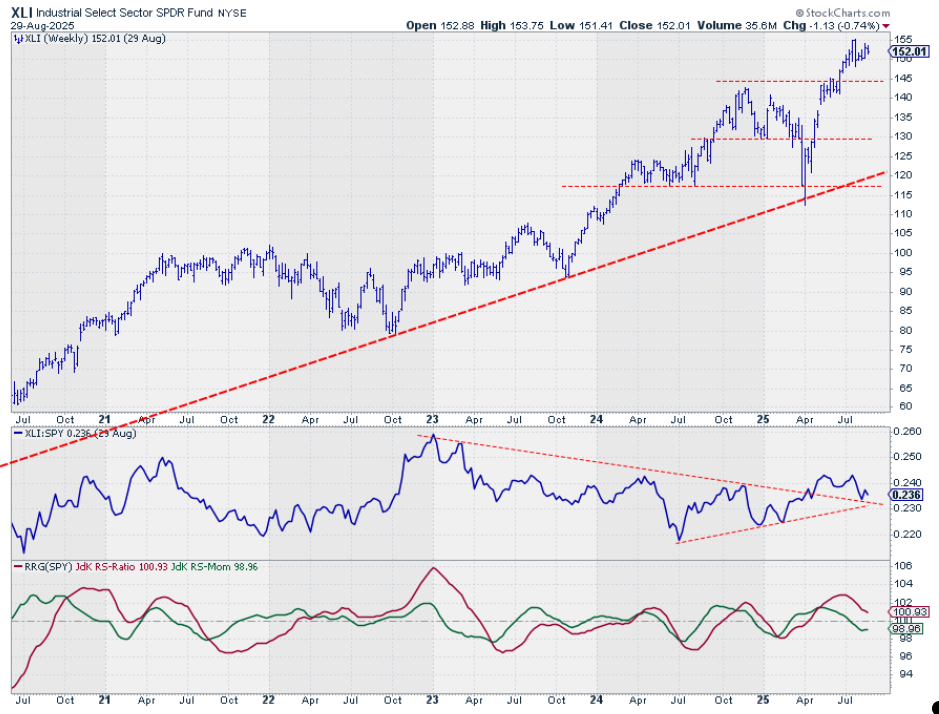

Industrials, on the other hand, is moving from weakening towards lagging, but the tail has already started to flatten, opening up the possibility for a rotation back up to leading.

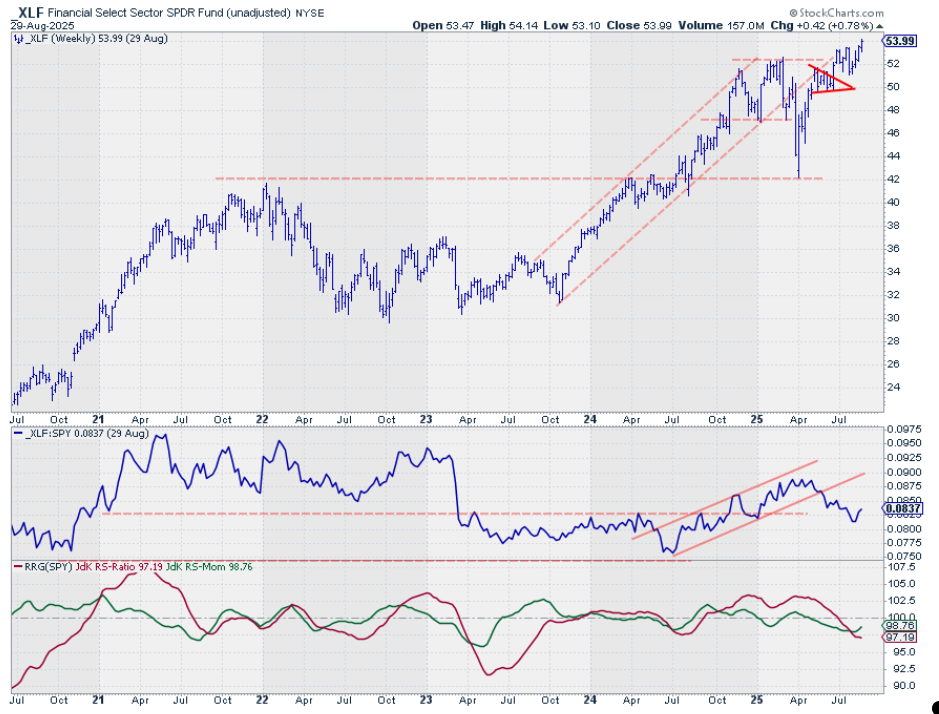

And then there is the financial sector. XLF is positioned inside the lagging quadrant, but has been picking up relative momentum for two consecutive weeks. This momentum, combined with its daily RRG performance, is what's propelled it into the top five.

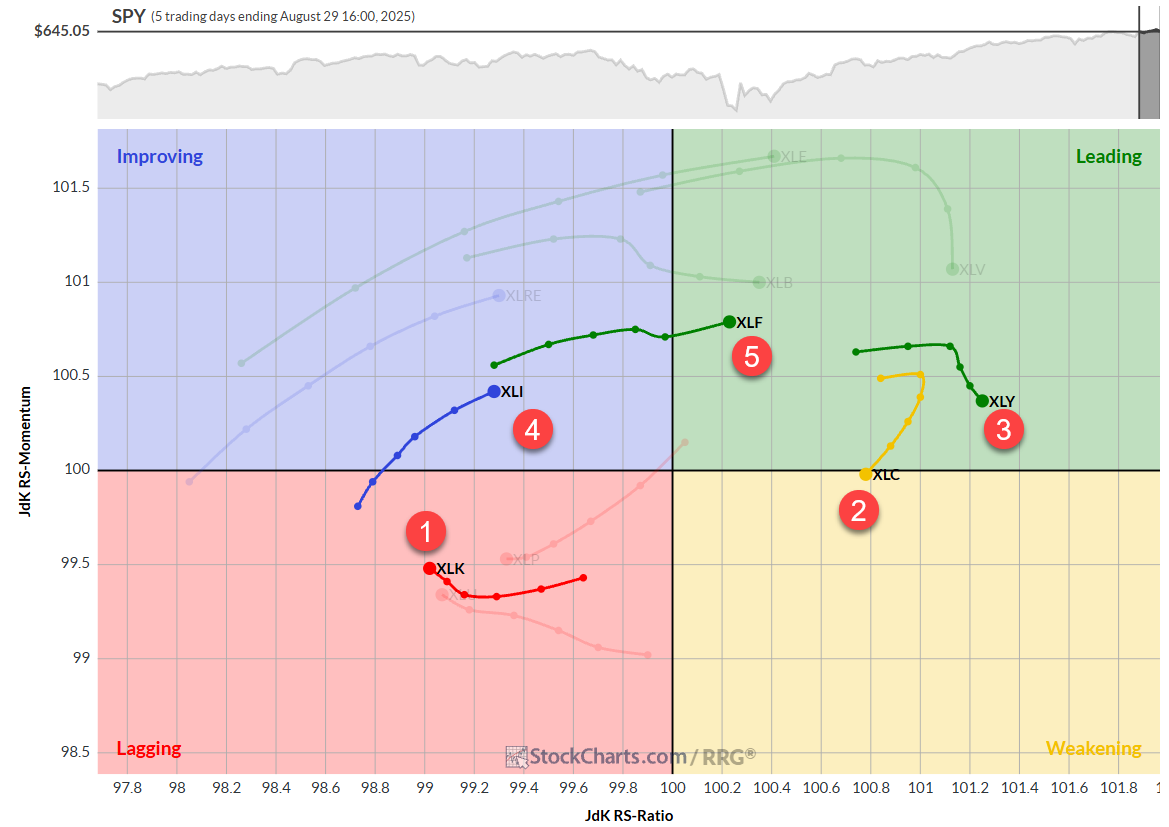

Daily RRG

Switching gears to the daily RRG, we see some interesting contrasts. Technology, our weekly leader, is actually the weakest sector on the daily chart, but it's picking up relative momentum. It's a reminder that different timeframes can tell different stories.

Communication services is straddling the line between leading and weakening, while consumer discretionary is showing strength in the leading quadrant, though it's starting to lose some steam.

Industrials is making a comeback, moving back into the improving quadrant with a strong heading. And financials (XLF) has just crossed into the leading quadrant, showing a long tail that suggests some real power behind this move.

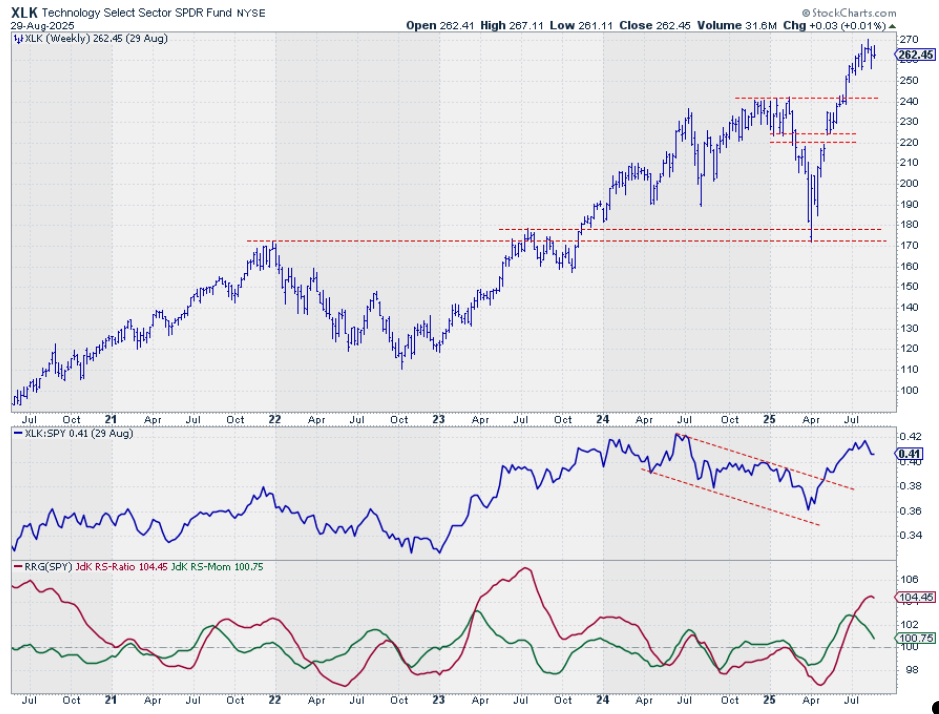

Technology

XLK remains strong price-wise, hovering well above its breakout level of around 240. But the relative strength line has hit a peak, matching levels from July.

This has triggered a bit of a correction, visible in the RRG lines where RS momentum is sharply pointing lower. It's just about to start pulling the RS ratio line around, but it's still comfortably above 100. Something to keep an eye on, imho.

Communication Services

XLC is playing it cool, holding above its breakout level for three weeks now. The raw RS line is moving in a narrow trading range. I'm watching for an upward breakout to confirm continuation of its relative uptrend. Both RRG lines are hugging the 100 level, with RS momentum starting to pick up speed again.

Consumer Discretionary

After breaking through a slowly falling resistance line, XLY is holding up well. It's now facing some overhead resistance from peaks set in 2024 and 2025. The real story is in the relative strength charts. The raw RS line has bottomed out and seems to be forming a new base. This is reflected in the RRG lines, with RS momentum pointing upwards above 100, pulling the RS ratio line upward.

Industrials

XLI is holding above its breakout level, with minimal price changes recently. What's interesting is how the RS line formed a new low at the previously falling resistance line, now acting as support. This coincides with a rising support line, suggesting a new support level is forming at the apex of these converging lines.

Financials

XLF confirmed its breakout to new highs last week, holding up well after breaking out of a small triangle formation. The raw RS line isn't looking fantastic yet, but the RRG lines are picking up slight improvement, especially in RS momentum. It's a classic case of being "less bad than the others", in relative strength terms, that can make you look pretty good.

Portfolio Performance

Our portfolio of the top five sectors is still lagging SPY by around 9%. We're continuing to track this strategy while exploring potential improvements. It's an interesting experiment in how a trend-following relative trend strategy plays out in real life, and a reminder that even sound strategies can face headwinds in certain market conditions.

#StayAlert and have a great week. --Julius