Stock Market Finds Its Footing: Why Friday’s Jobs Report Could Be the Real Test

Key Takeaways

- Key stock market indexes are holding above important support levels.

- Friday’s jobs report is the market’s big test.

- Gold hit another all-time high, cryptocurrencies move higher, and Treasury yields fall.

The first couple of trading days in September haven’t really been dramatic. Tuesday’s dip gave a few investors a scare, but the major indexes found their footing on Wednesday. In other words, so far, it’s been much ado about not much.

On Wednesday, three of the S&P sectors — Communication Services, Consumer Discretionary, and Technology — closed in the green, albeit modestly. This suggests investors are still in offense mode, which is further confirmed by the Key Ratios panel in the Market Summary page.

Investors are anxiously awaiting the non-farm payrolls report on Friday. Remember that last month, we got sharply revised numbers for previous months. Investors will be anxious to see if there’s a similar trend this time.

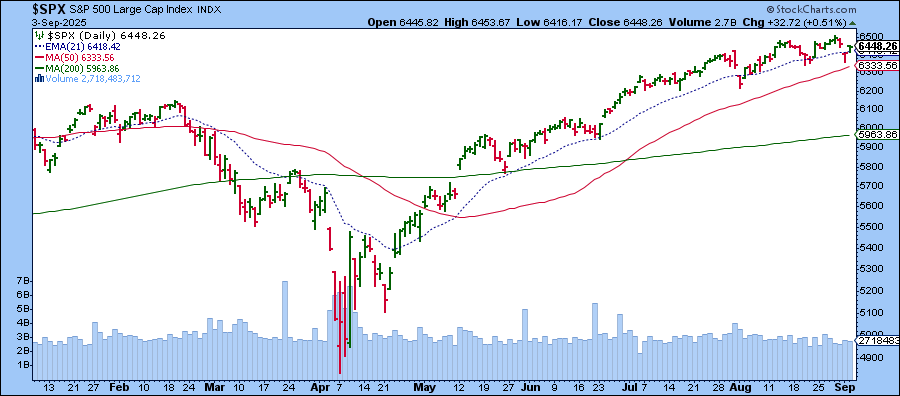

S&P 500 Holding the Line

It’s encouraging to see the S&P 500 ($SPX) holding above its August low. This is important because it retains the pattern of “higher lows”, something you want to see in an uptrend. The index is also trading above its 21-day exponential moving average (EMA) after slipping below it on Tuesday.

The Nasdaq Composite ($COMPQ) is displaying a similar pattern. Small-cap stocks, which have received a lot of attention lately, are also holding up. The S&P 600 Small Cap Index ($SML) is also trading above its 21-day EMA, which is sloping higher.

Overall, things may not be as bad as they looked on Tuesday. Helping Wednesday’s rebound were Alphabet (GOOGL) and Apple (AAPL), both of which stood out as the big winners (see MarketCarpet below).

Action Beyond Stocks

While stocks were relatively muted on Wednesday, a lot was happening elsewhere. Treasury yields fell after a weaker-than-expected JOLTs report, which boosted hopes for a Fed rate cut this month. According to the CME FedWatch Tool, the odds, as of this writing, rose to 96.6%. This helped to push gold and silver prices higher, with gold setting another all-time high. Other fundamental factors, such as a weaker U.S. dollar and central banks increasing their gold reserves, are contributing to gold’s rise.

Precious metals aren’t the only bright spot. On Wednesday, Ethereum gained around 3.0%, while Bitcoin gained 0.76%.

The chart of $ETHUSD below shows that the cryptocurrency was able to hold on to its 21-day EMA during its pullback and is now showing signs of reversing to the upside. A bullish crossover in the Moving Average Convergence/Divergence (MACD) would confirm the upside move.

Looking Ahead

We’re likely not going to see much action on Thursday, unless some unexpected news shakes things up. All eyes are on Friday’s NFP. If it comes in much hotter than expected, the narrative could quickly shift.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.