The Stock Market Is Quiet… but Something Big Is Brewing Under the Surface

Key Takeaways

- Market breadth is improving even if the S&P 500 isn’t moving much

- Small caps, transports, and banks are emerging as potential leaders

- Equal-weighted indexes could signal whether a bigger rally is coming

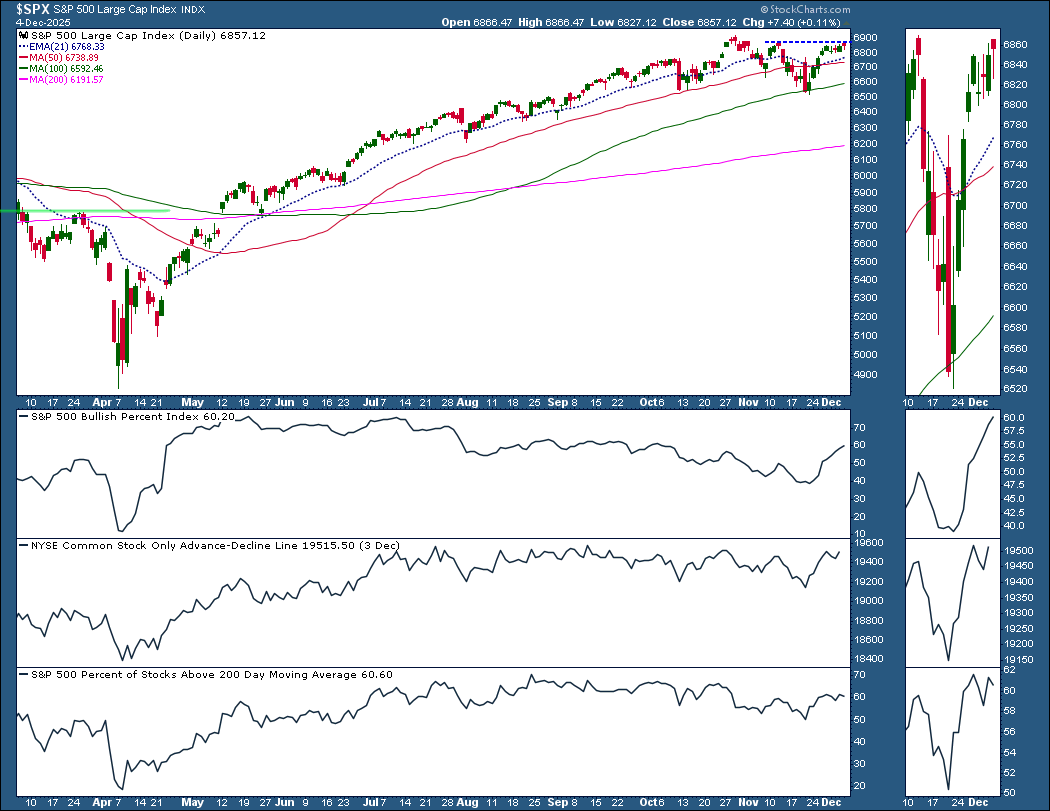

Stocks continue to do a little shilly-shallying this week. Yes, momentum has leaned more bullish since the November 20 selloff, but the S&P 500 ($SPX) has been stuck in neutral for five straight sessions. The index still hasn’t pushed above its November 12 high of 6,870.

If (or when) we finally see that breakout, the S&P 500 will likely make a run to its all-time high and possibly beyond. Friday’s Personal Consumption Expenditure (PCE) and Consumer Sentiment Index numbers could help nudge things along if they support a rate cut decision in next week’s Fed meeting. The PCE is the Fed’s preferred inflation gauge.

S&P 500's Improving Breadth

Under the surface, breadth is improving. The S&P 500 Bullish Percent Index, NYSE Advance-Decline Line, and the percentage of S&P 500 stocks trading above the 200-day moving average are trending higher, which is always a welcome sign.

Despite the S&P 500’s reluctance to move decisively higher or lower, other areas of the market are showing interesting action.

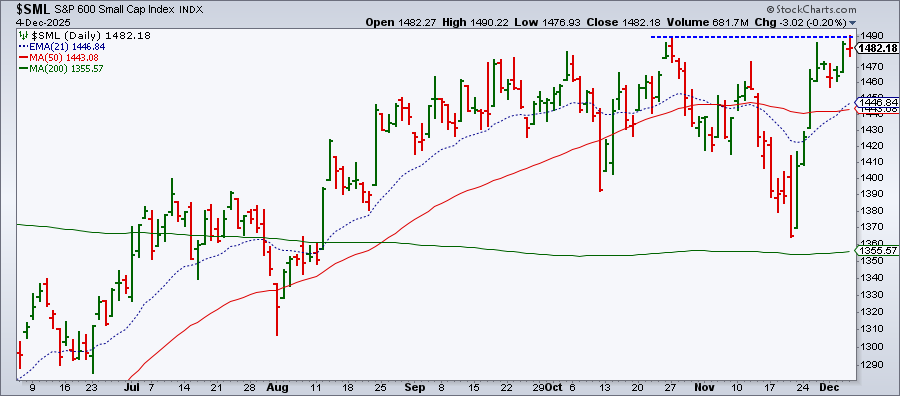

Small Caps Gaining Ground

On Wednesday, the S&P 600 Small Cap Index ($SML) jumped 1.45%, the strongest move among the major equity indexes included in Dashboard’s Market Overview panel. Like the S&P 500, small caps were also meandering sideways, but Wednesday’s pop pushed $SML closer to its October 27 high. On Thursday, $SML cleared that high but pulled back to close below it.

The market is currently pricing in an 87% chance of a 25 basis point rate cut in December, and small-caps tend to respond to interest-rate expectations.

S&P 600 Hits October High

Broader Participation Taking Shape

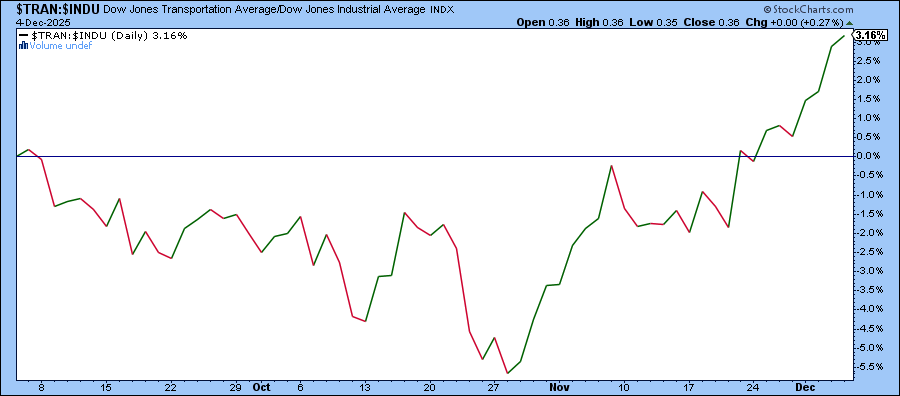

Another index not to be ignored is the Dow Jones Transportation Average ($TRAN). It has now logged nine straight up days (it hasn’t done this since 2021) and two up weeks. It could be gearing up for a test of its November 2024 high.

According to classic Dow Theory, when the Dow Industrials and Dow Transports move up in tandem, it strengthens the bull market argument. Since late November, the Dow Transports has outperformed the Dow Industrials.

Dow Transports Taking the Lead

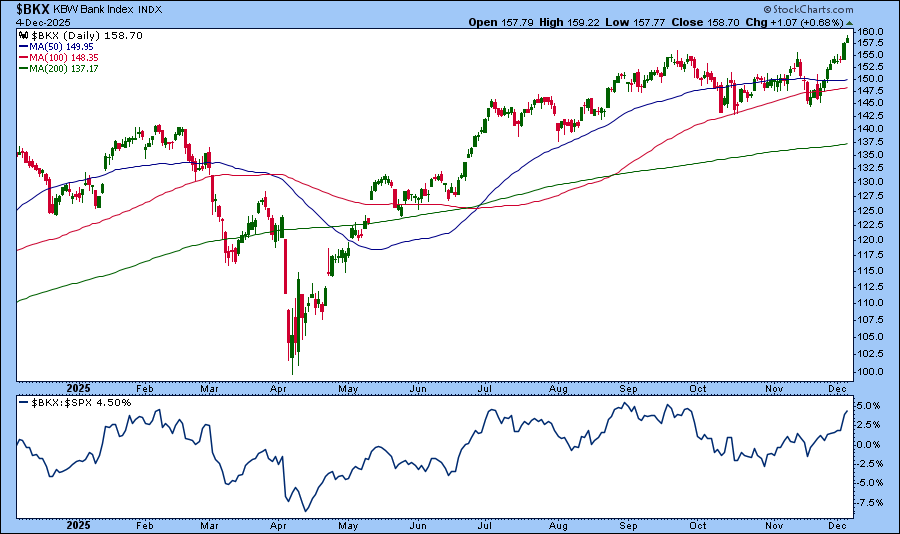

Bank stocks are also flexing some muscles. The KBW Bank Index ($BKX) broke above its $156 resistance level and closed at a new all-time high, outperforming the S&P 500 in the last year.

Banks Outperforming S&P 500

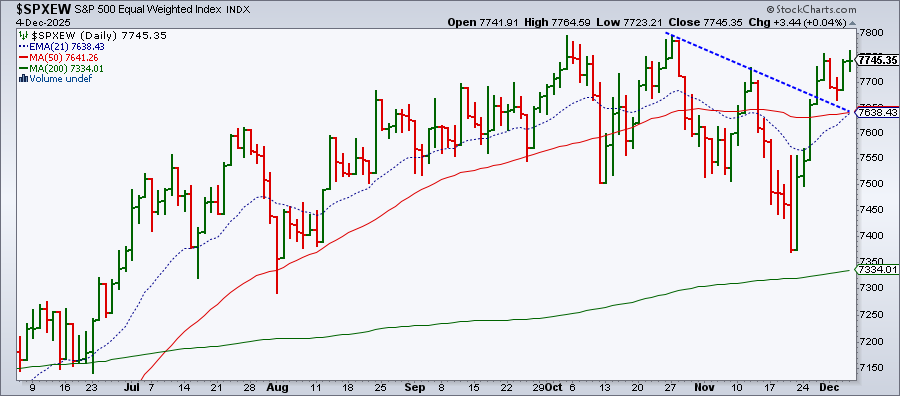

We may be getting an early hint that participation in this market is broadening. The S&P 500 Equal Weighted Index ($SPXEW) is showing a healthier uptrend than the cap-weighted S&P 500 and has broken out of its pattern of lower highs and lower lows. It’s now inching closer to its own all-time high.

S&P 500 Equal Weighted Index Approaching All-Time High

The big question is, will $SPXEW reach a new high before $SPX?

The Bottom Line

We’ve seen this movie play out before — small caps make a spirited run, sentiment improves, and investors get excited. Then eventually, the spotlight drifts back to large-cap tech. This is typical price action behavior of small caps. They are economically sensitive, and when investors anticipate a rate cut, they tend to get an extra boost.

But, is this move sustainable? Friday’s data may tell us more. It’s worth noting which groups react the most. Will small caps continue to lead, or will large-cap growth stocks reclaim the driver’s seat?

As always, the Market Summary and Dashboard pages are excellent tools for quickly assessing changes in momentum and market participation.

Tickers to Watch:

- $SML — will it break above 1,488?

- $BKX — will it continue to lead?

- $SPXEW — will it reach a new all-time high?

If these areas continue to show strong breadth and bullish momentum, it could signal that this bull market has some room to run.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.