Stock Market Looks Quiet, But Important Shifts are Underway

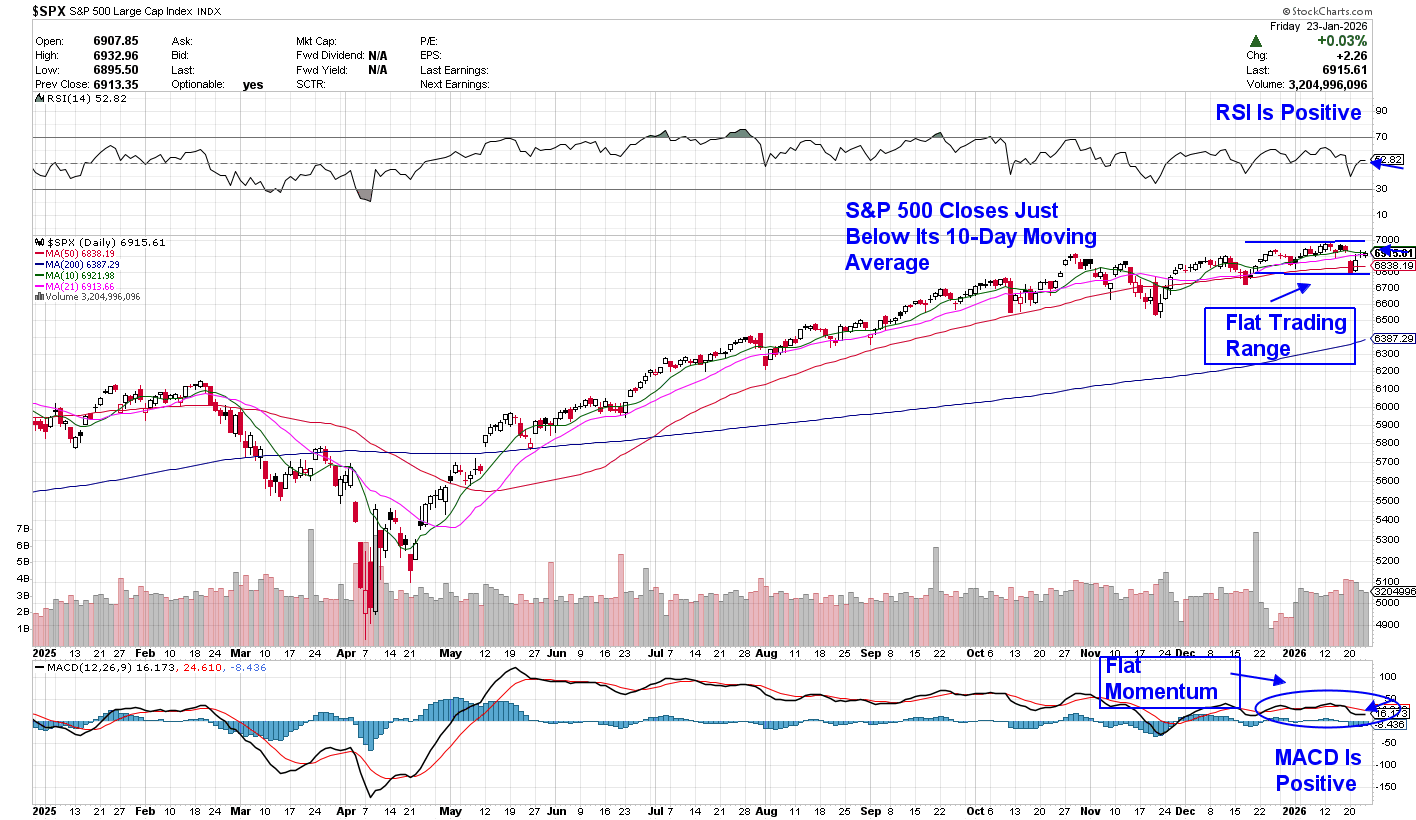

At the index level, the market appears relatively contained. Volatility ebbs and flows, major averages churn, and the overall picture can seem deceptively calm. Beneath the surface, however important changes are unfolding, with leadership changing, correlations breaking down, and opportunity becoming more selective.

More than ever, this is a market that rewards where you’re positioned, not simply whether you’re invested. If you’re using broader-market ETFs to participate, you’re missing a lot of opportunities.

For those interested in being alerted to individual stock opportunities, my twice-weekly MEM Edge Report provides entry and exit points on select leading stocks while also providing market insights. Use this link here for a no-cost trial.

AI Remains Central, But Focus is Narrowing

Artificial intelligence continues to be a dominant long-term driver, but the character of the trade is evolving. The market is moving past the initial enthusiasm phase and toward a more discriminating assessment of who can translate AI investment into earnings and cash flow.

We continue to see interest in areas like semiconductor equipment, advanced manufacturing, data center infrastructure, and power-related names. In software, investors are becoming more selective, favoring companies that can demonstrate tangible monetization rather than long-dated potential.

The opportunity is no longer about broad AI exposure. It's about identifying companies experiencing solid growth amid increased demand.

Market Breadth Is Improving, Gradually

One of the more constructive developments has been the quiet improvement in market breadth. Mid-cap and select small-cap stocks, particularly those tied to industrial activity, defense, infrastructure, and reshoring, are beginning to participate more meaningfully.

These areas tend to sit earlier in their earnings cycle and, in many cases, are less crowded than the mega-cap leaders that have dominated returns. While smaller-cap leadership can be powerful, drawdowns can be sharper due to lower liquidity.

Real Assets Are Playing a Bigger Role

Energy, materials, and other real-asset-linked equities are quietly regaining relevance. Capital discipline, structural supply constraints, and rising infrastructure demand tied to electrification and data center buildouts are reshaping the backdrop.

These areas are increasingly being viewed not just as cyclical trades, but as portfolio diversifiers in an environment where growth stocks remain sensitive to rates and policy shifts.

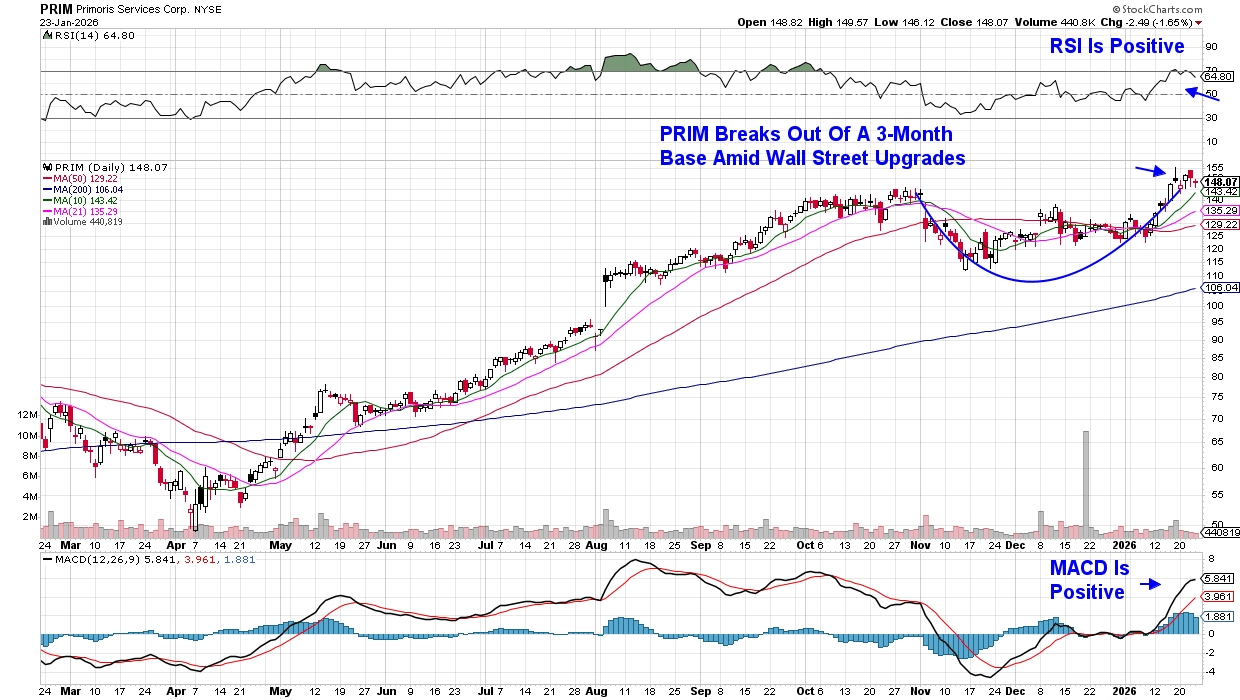

Below is a stock that is both a small-cap name and a real-asset-linked company, which has positive metrics. Primoris (PRIM) is a diversified infrastructure contractor with significant exposure to utility, energy, and civil markets, which are all seeing expansion.

The company has reported an $11 billion backlog in projects, which signals earnings stability. Management has cited ongoing momentum across energy-related markets, including utility-scale solar, battery storage, natural gas generation, and pipeline infrastructure.

This may not be an easy market for investors, but it is an exciting one. Leadership is broadening, earnings quality matters more, and returns are increasingly coming from areas that have been overlooked rather than over-owned.

At the same time, volatility and policy sensitivity are likely to remain features, not anomalies. For investors willing to stay flexible and selective, the opportunity set is expanding, even if the path forward is less linear.

For those who’d like to receive updated stock ideas as well as insightful leads on sector rotation and how to take advantage, use this link for a trial of my twice-weekly MEM Edge Report at no cost.

Warmly,

Mary Ellen McGonagle

MEM Investment Research