A Stock Market Rally With a Twist: What's Strengthening and What's Cracking?

Key Takeaways

- The Fed rate cut sparked broad strength across equities, with major indexes, small caps, banks, and semiconductors breaking above key resistance levels.

- Market breadth is improving, which is a healthy sign for bulls.

- Despite the broad strength, pockets of weakness persist.

T’was hours before the Fed meeting, and the stock market was comfortably quiet. But once a 25-basis-point rate cut was announced, things finally woke up. Stocks perked up, bond yields slipped, and precious metals, especially silver, shone a little brighter. By the close, 10 of the 11 S&P 500 sectors were in the green.

A solid 2% productivity growth generated optimism and put investors at ease. The S&P 500 ($SPX) closed above its November 12th high, a key level I’ve been watching; it now sits within striking distance of its all-time high. All the major indexes closed higher, setting a positive tone.

Lots to Cheer About

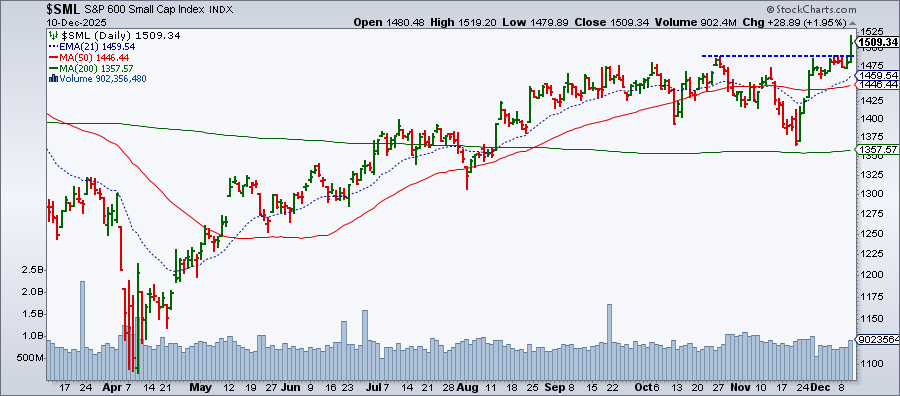

Small caps had an especially strong showing. The S&P 600 Small Cap Index ($SML) rallied nearly 2% to close at 1,509.34. Even better, it pushed through a key resistance level and is getting close to its all-time high of 1532.61. For a group that has had a tough time keeping up with its large-cap cousins, this is a welcome sign.

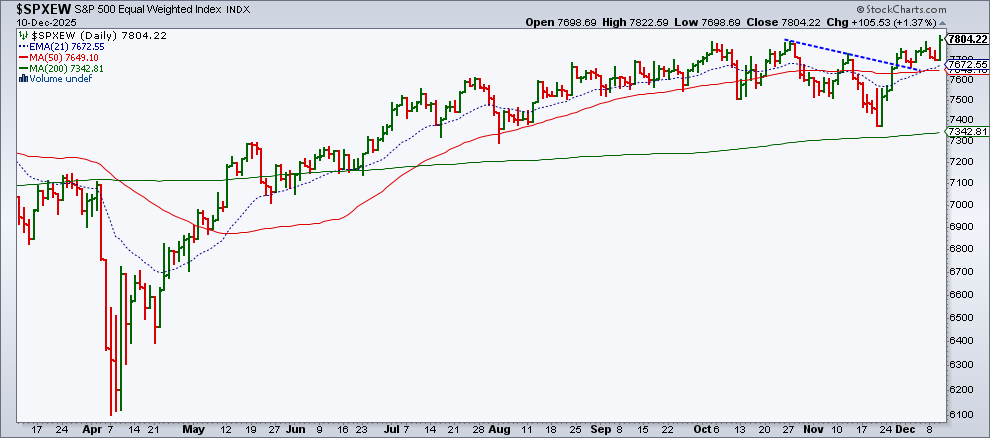

Market breadth also leaned bullish. The Equal-Weighted S&P 500 Index ($SPXEW) rose 1.37%, easily outpacing the S&P 500's 0.67% gain. Looks like $SPXEW beat the S&P 500 to its new high.

Semiconductors joined the celebrations too. Even with NVIDIA (NVDA) slipping, the VanEck Semiconductor ETF (SMH) broke above a key resistance level and closed at a new all-time high. Strength in chips often bodes well for the broader tech sector.

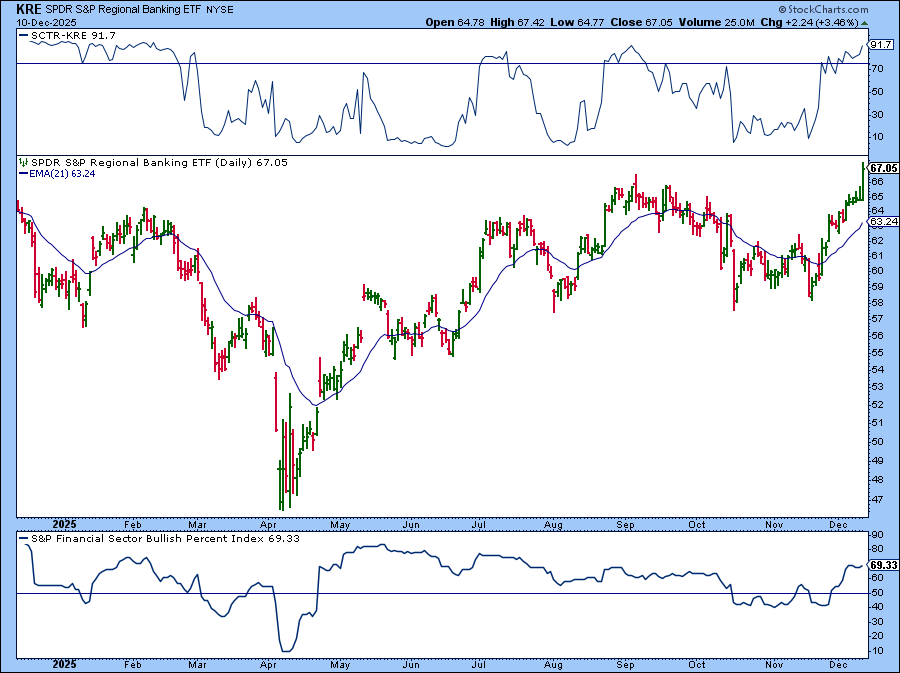

Bank stocks also stepped in. The KBW Bank Index ($BKX) rose 2.62% to notch a new all-time high. Regional banks participated as well.

The chart below of the SPDR S&P Regional Banking ETF (KRE) encapsulates the performance of the Financial sector. KRE hit a new 52-week high, posted a StockCharts Technical Rank (SCTR) score of 91.7, and the Financial Sector has a Bullish Percent Index (BPI) of 69.33.

So, after more than a week of quiet, sideways action, the stock market finally looks like it's trying to make another move higher. But not everything is rosy.

It’s Not All Smiles

Oracle (ORCL) announced earnings after Wednesday’s close, and because of its ties to the AI theme, investors will be watching the stock's price action closely. While ORCL beat on earnings, revenues came up short. That was enough to send the stock down by more than 10% in after-hours trading.

Bitcoin also didn’t join the risk-on rally. For a moment, it looked like it might take out the previous day's high, but it fizzled and ended the session down 0.20%.

The Moving Average Convergence/Divergence (MACD) line is showing a little life, but with it still below zero, momentum just isn't strong enough yet to give Bitcoin a meaningful push higher.

The Bottom Line

Stocks finally showed some spark after the Fed meeting, suggesting this market may have room to run. Broadcom (AVGO) earnings are on Thursday, after the close. If earnings come in strong, tech stocks could get an extra boost. Other than that, it may take an unexpected headline to move the market in the near term.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.