The Stock Market’s Sending Mixed Signals: Here’s How to Decode Them

Key Takeaways

- The stock market's recent swings may look dramatic, but they're largely headline-driven.

- While the major indexes are treading water, small-cap stocks are quietly outperforming.

- Even with the broader market looking hesitant, pockets of strength are emerging.

The wild swings are back! After last Friday’s selloff, sparked mainly by President Trump’s comments about sharply higher tariffs on Chinese goods, the stock market looked like it caught its breath for a moment. Yet, we’re not seeing signs of a convincing reversal.

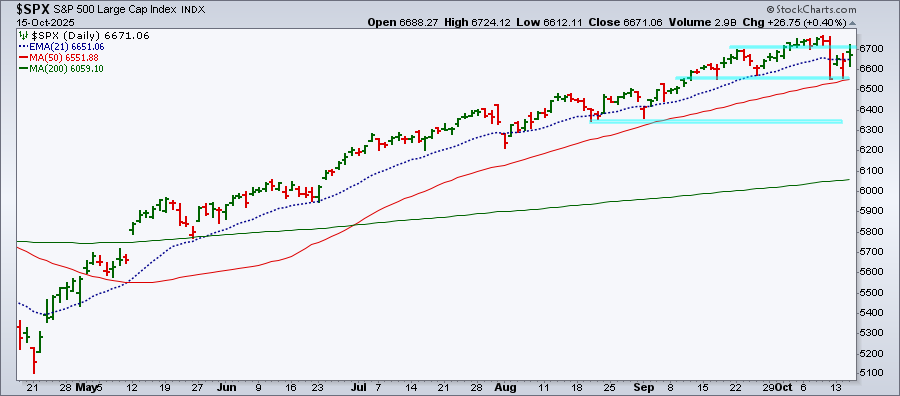

Let’s take a closer look at what’s happening with the S&P 500 ($SPX).

On the daily chart below, notice that the index has held onto the support of the mid-September low, which correlates with the 50-day Simple Moving Average (SMA). That’s good news, but it’s also staying below its September high.

Friday’s sharp move should serve as a good reminder of how quickly the market can swing when headlines hit. The headline-driven market seems to have resurfaced, and that means any negative news can send this market into a significant slide.

Tuesday and Wednesday’s price action has been a mixed bag. Even strong big bank earnings and Fed Chair Jerome Powell’s dovish comments weren’t enough to give the market much of a lift.

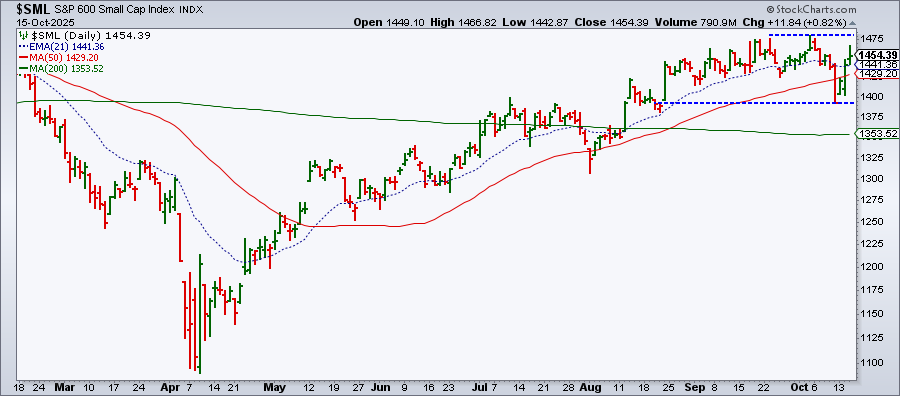

Interestingly, small-cap and mid-cap stocks seem to be holding up better than the big indexes. Let’s focus on the small-caps.

Take a look at the chart of the S&P 600 Small-Cap Index ($SML) below. Friday’s selloff briefly pushed it below the 50-day SMA, but it has already climbed above its 21-day EMA. If the index can break above its September 2025 high, it could open the door for the index to retest its November 2024 high.

When small-caps rally, it often points to a healthier and broader market.

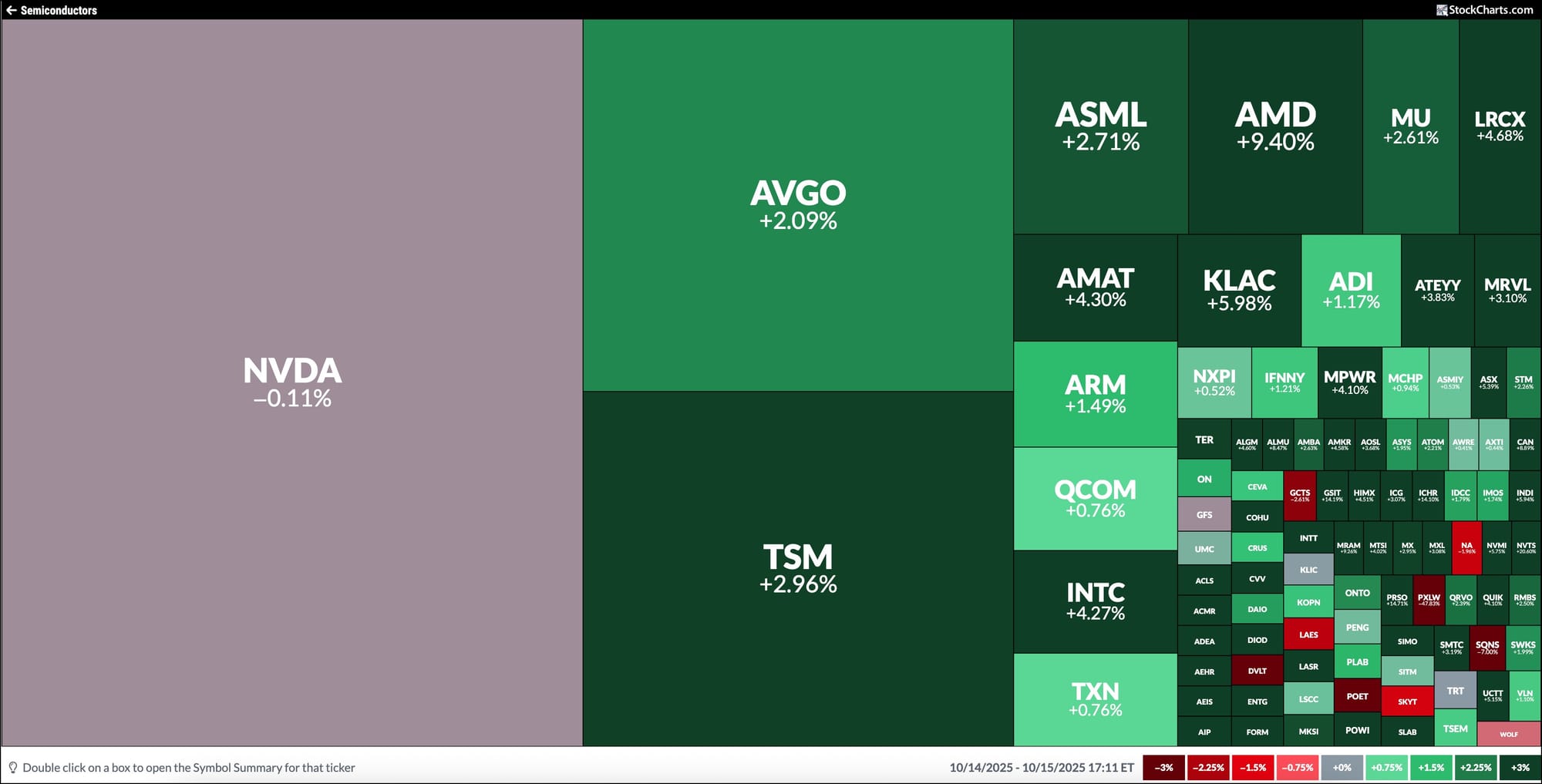

Action in Other Market Areas

We are seeing some impressive moves in specific industry groups. The AI-nuclear energy, rare earth mining, and precious metals have been especially strong.

AI nuclear energy stocks such as Constellation Energy (CEG), Oklo, Inc. (OKLO), and Vistra Corp (VST) continue to power higher. Meanwhile, semiconductors, including Advanced Micro Devices (AMD), ASML (ASML), and others, just keep running.

The MarketCarpet image below highlights the strength in semiconductors in Wednesday’s trading.

What This Means

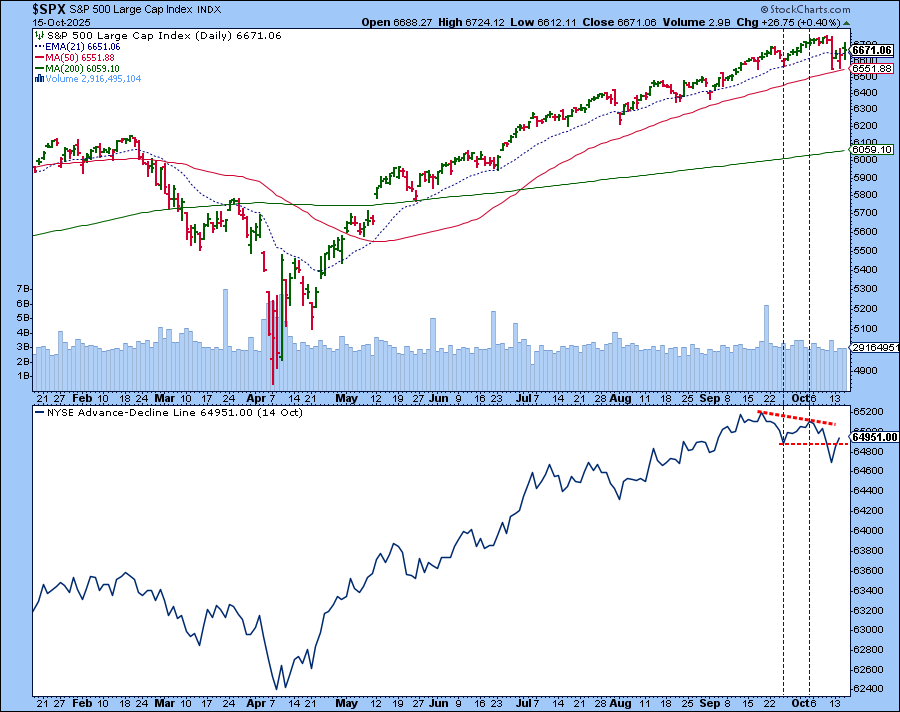

Despite all the day-to-day noise, the broader market isn’t showing signs of breaking. There are, believe it or not, a few hints of underlying strength.

The NYSE Advance-Decline Line (see lower panel in chart below), after diverging from price action and falling below its September low, has started to turn up again. If the S&P 500 pushes higher and the A-D Line climbs above its October high, the S&P 500 could be setting up for another leg higher. But then again, when news headlines drive the market, stocks could take the elevator down. Keep an eye on the A-D Line as a confirmation tool.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.