Warning Signs Are Growing, Be Prepared!

We just ended a very strong three-year period, one of the strongest on record, in fact. Perhaps the most amazing thing is that we suffered through both a correction and a cyclical bear market within this bullish period. Still, the S&P 500 surged on an annual basis for the third year in a row, posting these returns:

- 2023: +24.23%

- 2024: +23.31%

- 2025: +16.39%

As we look ahead to 2026, what could go wrong? Plenty.

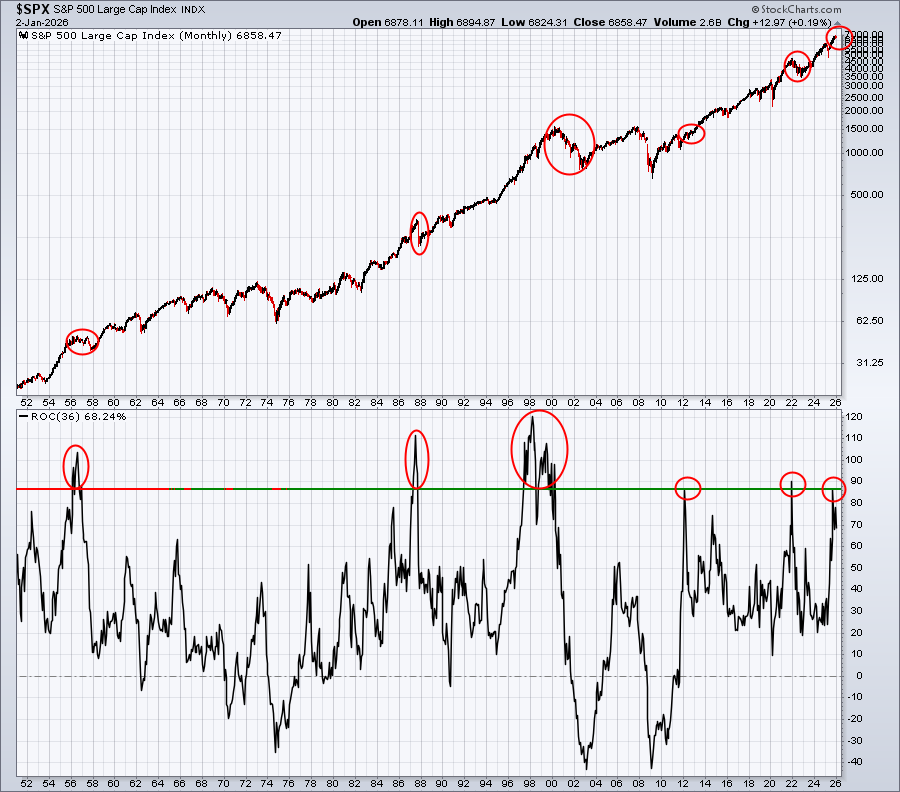

First of all, the S&P 500's three-year return as of October 2025 nearly touched 90%, which has only been achieved on five other occasions. Below is an S&P 500 monthly chart, showing the history of such significant gains and what happened subsequently.

Included in those subsequent periods is a lot of selling. In 1956, a cyclical bear market followed. In 1987, it was the market crash. In the late 1990s, a massive secular bear market followed. 2012 was an exception as the market held up fairly well following a solid three-year gain. But then the nasty bear market of 2022 followed the last such strong three-year gain. In summary, history has not served us well.

I saw a Yahoo Finance article in the past week that said every Wall Street analyst covered is calling for the S&P 500 to finish 2026 higher. That's scary stuff, because we know Wall Street firms rarely DO what they SAY.

To listen to the rest of my Weekly Market Recap on YouTube, simply CLICK HERE.

On Saturday, January 3rd, at 10:00 am ET, I'll be hosting our "MarketVision 2026" event, where I'll provide my annual stock market forecast. You can learn more and REGISTER HERE for the event and earn a FREE 1-YEAR EARNINGSBEATS.COM MEMBERSHIP!

Happy New Year and Happy Trading!

Tom