Stocks Keep Soaring, But Could an AI Bubble Be Looming?

Key Takeaways

- Stock market indexes keep hitting new highs, but caution flags are waving

- The AI boom and Fed rate cut hopes are fueling optimism, but bubble concerns are rising

- Gold is hitting record highs, silver is near its all-time peak, and Bitcoin surged to new highs

You’d think a government shutdown would spook the markets. Surprisingly, however, Wall Street isn’t losing any sleep. Even without Friday’s all-important jobs, stocks kept climbing, and the Dow Industrials ($INDU), S&P 500 ($SPX), and Nasdaq Composite ($COMPQ) all hit fresh highs this week. The S&P 500 and Dow closed higher for six days straight while the Nasdaq cooled off a bit on Friday. For the week, all indexes closed higher.

What’s Fueling the Optimism?

One spark came from the tech world. OpenAI, which is making big waves in artificial intelligence, was recently valued at around $500 billion. That hefty price tag has got people whispering about a possible bubble, but, for now, the market is looking strong.

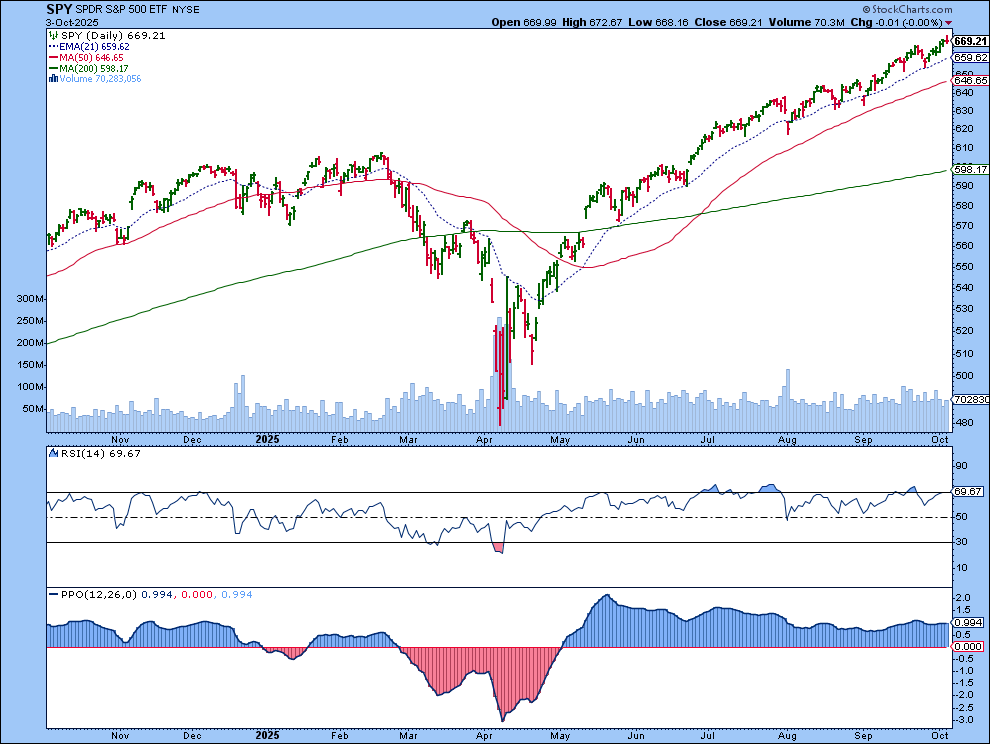

If you look at the daily chart of the SPDR S&P 500 ETF (SPY), you’ll see that it’s been steadily climbing higher with a pattern of higher highs and higher lows. Note that its Relative Strength Index (RSI) is slightly below 70 (bottom panel), indicating the ETF still has room to run. The Percentage Price Oscillator (PPO) shows momentum is still positive.

Investors should keep an eye out for SPY or any other major index to break below significant support levels. If the break coincides with weakening market breadth and sentiment, it would signal a potential pullback. Until that happens, the market is likely to continue its bullish ride.

The bullish sentiment isn’t just in U.S. stocks, with markets around the world also rallying. The global snapshot tab in the Market Summary page shows that European and Asian stock indexes are joining the party.

Much of the optimism stems from expectations of two more Fed rate cuts this year – lower rates tend to boost stocks. Gold and silver have also been on a tear, with gold hitting new highs and silver inching closer to its own records. Even $BTCUSD hit a fresh high this week.

Is an AI Bubble Brewing?

Tech stocks are where the risks may show up first. On Friday, the Nasdaq wobbled a bit in afternoon trading but, overall, the uptrend remains intact. The Breadth panel in the Market Summary page shows that, for the Nasdaq, the percentage of advancing issues has shifted into neutral territory.

Yet this is not something to be alarmed about. The other breadth indicators, Sector Adv/Dec, and Moving Averages, also display similar sentiment. The signs aren’t flashing bearish, but it’s worth keeping an eye on.

The Technology Select Sector SPDR (XLK) is trading well above its 21-day exponential moving average (EMA), momentum remains strong, and while its RSI is edging lower, it’s still above 70. In short, the tech rally hasn’t run out of steam just yet.

The bottom line: Right now, there’s no technical evidence that this bull run is slowing. But, that doesn’t mean things can’t break down. In an overstretched market, it pays to stay alert and have a plan in place, just in case the momentum shifts.

End-of-Week Wrap-Up

Stock Market Weekly Performance

- Dow Jones Industrial Average: 46,758.28 (+1.10%)

- S&P 500: 6,715.79 (+1.09%)

- Nasdaq Composite: 22,780.39 (+1.32%)

- $VIX: 16.65 (+1.36%)

- Best performing sector for the week: Health Care

- Worst performing sector for the week: Energy

- Top 5 Large Cap SCTR stocks: IREN Ltd. (IREN); Nebius Group N.V. (NBIS); Oklo Inc. (OKLO); BitMine Immersion Technologies (BMNR); Bloom Energy (BE)

On Our Radar Next Week

- Several Fed Speeches

- October Mortgage Rates

- FOMC Minutes

- October Consumer Sentiment

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.