Strong Earnings and Lower Rates to Drive S&P 500 Higher

There are two key drivers of the stock market — earnings and interest rates. Right now, both are favoring the bulls. As interest rates decline, with everything else being equal, company stock valuations rise. Furthermore, future earnings become more valuable as interest rates drop, leading to expanding PE (price earnings) multiples. I worked in public accounting for two decades and performed valuations.

Valuation Methods

There are many methods used to value companies, and the best method is typically case-specific. For instance, in a company that is real estate asset-rich, valuing the company based on the market value of its real estate assets minus its liabilities is generally ideal. If a company is looking to be sold, valuing it based on comparable businesses sold can be the best method. But for a growth company with a limited balance sheet and little in the way of comparable sales, using a discounted cash flow analysis is usually required. The idea is to project growth rates and cash flows, and then discount those future cash flows using a current required rate of return. This "required rate of return" can vary by investor, but normally falls as interest rates decline.

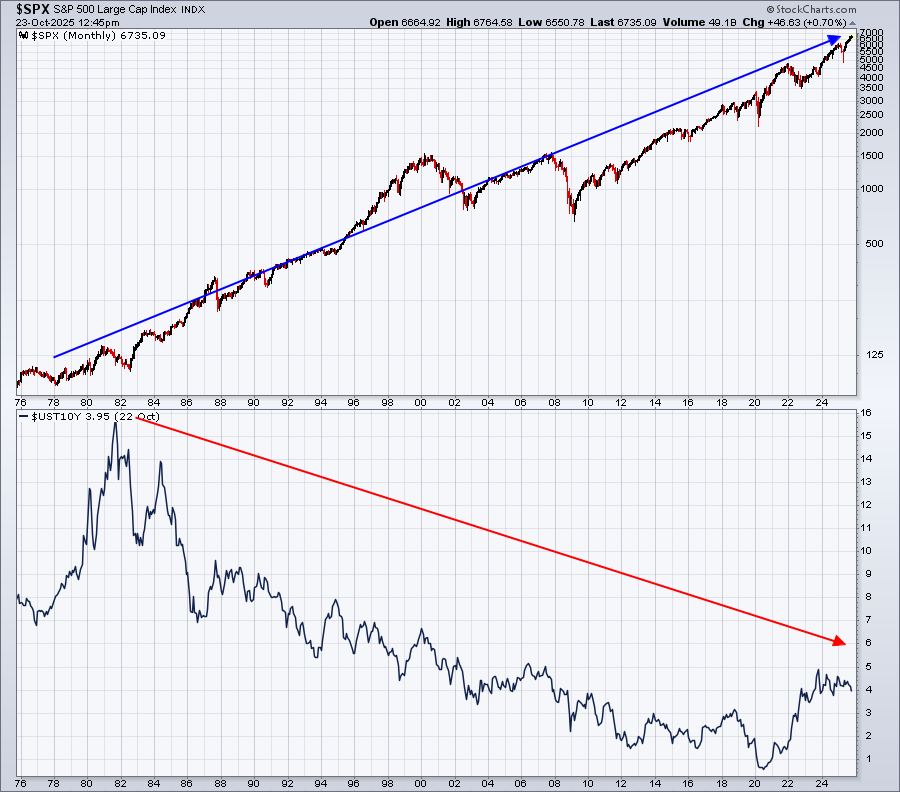

A "risk-free rate" is what I often used back in my public accounting days. This is usually defined as the return on long-term bonds. My preference was to use the 10-Year Treasury Yield ($UST10Y). As this long-term bond yield declines, we should expect market valuations to increase. One look at a long-term chart of the S&P 500 and $UST10Y will confirm this.

This is clearly a very simplistic chart, since there are a ton of variables that play a role in market valuations. However, there is no doubt that falling interest rates for 40 years contributed to an exciting time to own U.S. equities.

Earnings Focus

Earnings — it's what we do. I literally review thousands of earnings reports and charts throughout earnings season to identify what I believe are the best companies to include in our Model and Aggressive Portfolios each quarter. And it's worked!

As of Thursday, intraday prices at approximately 11:15 am ET, our Model Portfolio had gained 358.63% since its inception on November 19, 2018. This performance includes the effects of four cyclical bear markets (Q4 2018, pandemic 2020, inflation surge 2022, tariffs 2025) within an otherwise secular bull market. Here's a comparison of our Model Portfolio to the S&P 500 since its November 2018 inception:

- Model Portfolio: +358.63%

- S&P 500: +149.71%

We "draft" our 10 equal-weighted stocks into our Model Portfolio after most quarterly earnings have been released, and we've been able to monitor their market reactions. So our portfolio quarters run as follows:

- February 19 - May 19

- May 19 - August 19

- August 19 - November 19

- November 19 - February 19

In roughly four weeks, we'll be drafting our Model Portfolio stocks for the next quarter, running from November 19 to February 19. Given the likelihood of declining interest rates, combined with improving earnings, I'm really excited about our prospects for next quarter!

Analyzing CLS

Here is a stock that currently resides in our Model Portfolio and will help to illustrate how we've been able to consistently beat the S&P 500 over a 7-year period:

This chart could be the poster child for "leading stock in leading industry." Dow Jones Electrical Components & Equipment ($DJUSEC) has been a steadily outperforming industry group, and CLS has been one of its best component stocks. It only takes one stock like CLS to help a portfolio crush the S&P 500, and that's exactly why we do the research that we do for our EarningsBeats.com members.

Leading stocks in leading industry groups pave the way to stock market success. Tune out media outlets like CNBC and focus on where Wall Street is putting its money. They won't tell you on CNBC until it's waaaay too late and after the fact. You have to see it on the charts. That's what we do for our members: point out the stocks that have the highest probability of success.

This is what I'm so passionate about — combining fundamental research with technical price action. No one will ever be able to convince me that there's a better way to invest for success.

Coming Up: FREE Saturday Event

I am hosting a FREE event on the morning of Saturday, October 25, at 10:00 am ET, titled "2 Important Drivers of Market Gains", which is intended to provide everyone a look at this fundamental research and technical analysis combination. I believe it'll make a big difference in your trading success. If you struggle using your current investing and trading strategies, this event will open your eyes to a different strategy that has proven success over many years. If you already have a strategy that performs well, you might find a few nuggets of information to further refine and improve your current strategy or process. Either way, I believe you'll find this event quite useful and informative.

For more information and to register, simply CLICK HERE and provide us with your name and email address. That's it! Even if you cannot attend this event LIVE, registering with your name and email address will allow us to send you a complimentary recording of the session for you to watch later at your convenience. Enjoy your weekend, and hopefully I'll see you on Saturday!