Tech Takes the Lead Again, but Market Breadth Raises Questions

Key Takeaways

- The Nasdaq is leading the market, powered by strength in tech and semiconductor stocks, but index highs aren't being fully confirmed by breadth.

- Market breadth indicators are diverging from price as major indexes remain in bullish trends.

- With volatility still low and earnings mixed, this is a time to stay alert, monitor support levels, and be prepared to adjust if conditions change.

The S&P 500 ($SPX) briefly crossed the 7,000 level but couldn’t quite stick the landing, closing the day at 6,978. Meanwhile, the Nasdaq Composite ($COMPQ) tells a more encouraging story, pushing above its January 12 high of 23,804 and continuing to hold above that level. Between the two indexes, the Nasdaq looks better positioned for a breakout, which is worth paying attention to, especially with tech earnings now rolling in.

More importantly, the Technology sector is back in the leadership seat, with semiconductors continuing to shine. The VanEck Semiconductor ETF (SMH) logged another record close as Intel (INTC) and Micron Technology (MU), two heavily weighted stocks, helped drive the move higher.

Beneath the Surface

Here’s where things get interesting. A quick scan of the Market Summary page shows the Technology sector’s Bullish Percent Index is currently neutral. Consumer Staples, Energy, and Materials are the only sectors flashing bullish readings.

Will we see a transition back to Technology? It’s something to keep on your radar.

Market breadth adds another layer to the narrative. While the broader indexes remain in clear uptrends, breadth has been treading water.

Let’s start with the Nasdaq Composite. The index is comfortably above its 20-, 50-, 100-, and 200-day moving averages, and those moving averages are stacked in the right bullish order. However, the percentage of Nasdaq stocks trading above those same moving averages isn’t confirming the strength we’re seeing in the index. This divergence is worth noting.

The S&P 500’s breadth is a bit healthier. More than 50% of its stocks are trading above their key moving averages. Still, there’s a caveat, which is that, besides the percentage of stocks trading above their 200-day moving average, the other market indicators are starting to trend lower (see chart below).

With Magnificent Seven earnings now underway, and results so far mixed, I’ll be keeping a close watch on breadth. If we see further softening in the large-cap space, the key support levels I’ve marked on the chart will become especially important.

In addition to support levels, keep an eye on the moving averages. Focus on three things: trend direction, proper order (20 > 50 > 100 > 200), and whether price starts to cross below these moving averages.

When the market hesitates instead of making a decisive move higher, it’s time to get proactive. Know which levels matter to you and decide ahead of time where a breakdown (or breakout) would prompt you to adjust your portfolio.

To monitor overall market breadth

- Log in to your StockCharts account.

- Select the Market Analysis tab.

- Click Market Summary.

- Review the panels covering overall market price action, breadth, and sentiment. Be sure to download the MarketSummary ChartPack. Note: The charts used in this article are available in this ChartPack.

Watch Sentiment

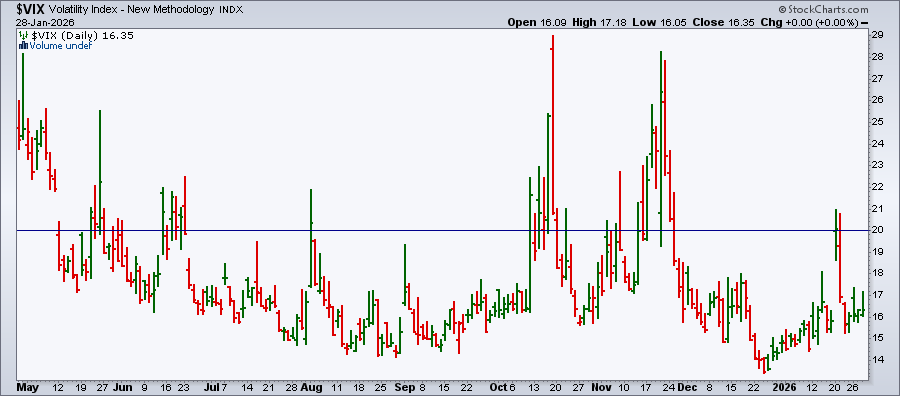

One sentiment gauge to keep front and center is the Cboe Volatility Index ($VIX). Right now, it’s below the 20 level, suggesting investors are relatively calm, for now.

There are also geopolitical uncertainties simmering, which helps explain the persistent strength in gold and silver, among other reasons. This is a time to be especially alert. Pull up your ChartLists, identify key support levels, and annotate them on your charts. If the market starts to roll over, you want a plan in place to to protect your positions.

We’ve enjoyed a great bull run. If it starts to crack, the last thing you want is to give back your hard-earned gains.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.