Technology Selling is Creating Huge Opportunities Elsewhere

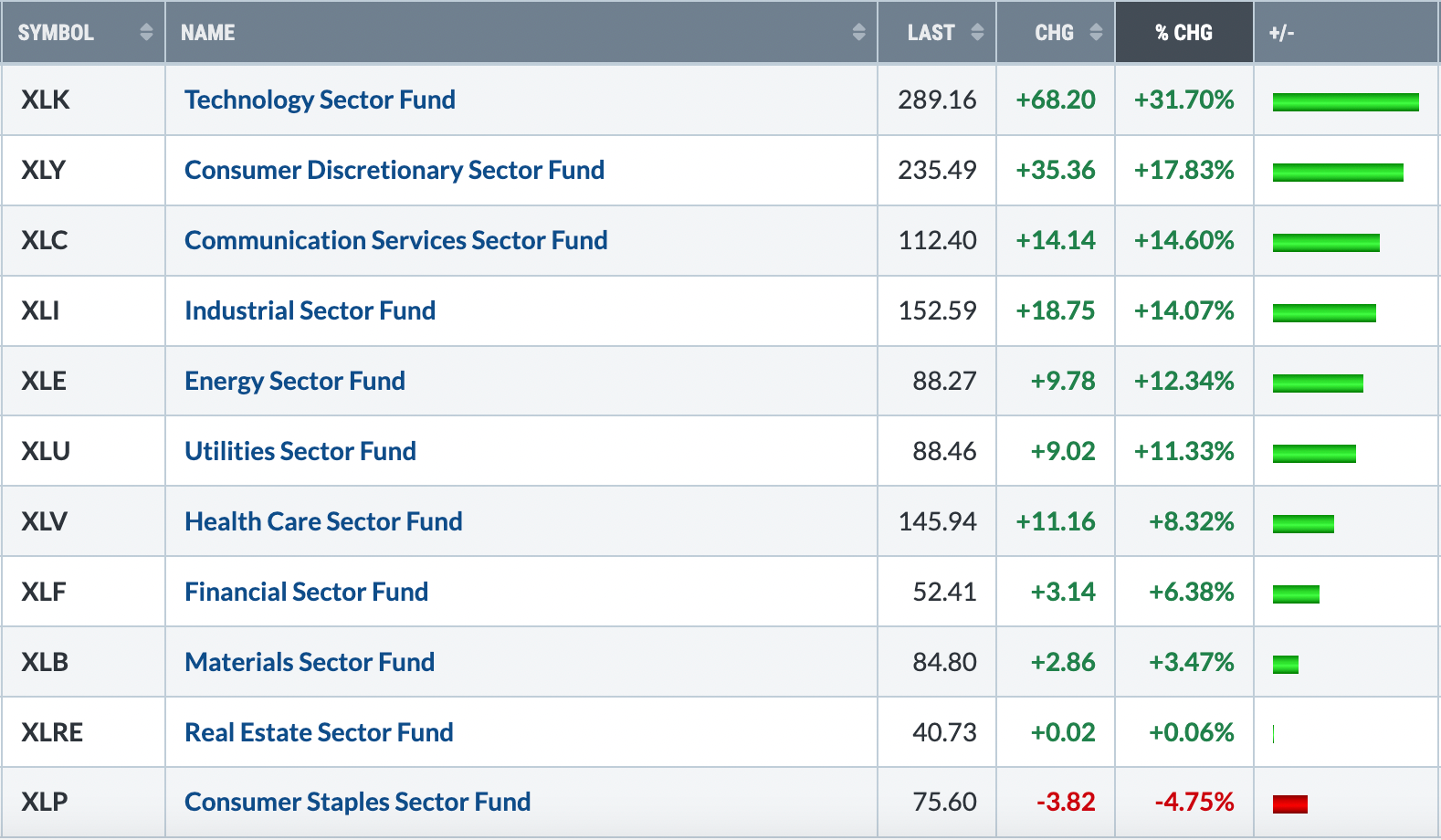

I think most everyone can agree that technology (XLK) needed a break. It has been single-handedly carrying the S&P 500 and NASDAQ 100 to new all-time highs. Pull up a Sector Summary for the last six months and you'll see that Technology (XLK) has been the clear leader:

Another way to better visualize the XLK relative strength is to use a price relative chart like this:

Pullbacks are normal. Many will immediately jump to bearish conclusions when we finally see money rotate away from technology and other key aggressive sectors, but it's a normal occurrence during secular bull market advances. These groups are not going to rise every single day, week, or month. They'll take breaks, and the Technology sector is on a break right now. What I'll look for is whether we start to see key price support lost.

Back in August, XLK began floundering on a relative basis, but if you check out the absolute chart, price support was never lost. In order for the bears to have any chance of this weakness accelerating into some type of significant correction or bear market, the two key levels of price support that I've annotated above will have to be lost on the XLK. Maybe that happens, but most likely it doesn't.

There's always a silver lining, however.

Improving Strength in Other Areas

When technology sells, money rotates into other areas. For instance, have you noticed breakouts in any of these groups?

Delivery Services ($DJUSAF)

Biotechnology ($DJUSBT)

Industrial Machinery ($DJUSFE)

Commercial Vehicles & Trucks ($DJUSHR)

Heavy Construction ($DJUSHV)

Medical Supplies ($DJUSMS)

Pharmaceuticals ($DJUSPR)

Apparel Retailers ($DJUSRA)

Broadline Retailers ($DJUSRB)

Steel ($DJUSST)

Many other industry groups are performing well, especially key areas like semiconductors ($DJUSSC), internet ($DJUSNS), renewable energy ($DWCREE), investment services ($DJUSSB), electrical components ($DJUSEC), etc. My point in this article is that we can look at the stock market as a glass half full or half empty. The choice is yours.

I remain fully confident that this period of selling is nothing more than a temporary hiccup in an otherwise very strong secular bull market.

Fantasy Stock DRAFT Competition!

I'm VERY excited to announce that Grayson Roze and Julius de Kempenaer, both of StockCharts.com, will be joining me on Saturday, November 15th at 10:00am ET for a fantasy stock draft! I'll be pitted against two heavyweights, but I'll be looking to hold my own. I'll have major advantages over both of them. Grayson, living on the West Coast, will just be getting out of bed, while Julius, living in the Netherlands, will be interrupting his dinner. It's guaranteed to be loads of fun with plenty of smack talk (and education) throughout!

🗓️ Mark your calendar and be sure to register for this amazing event HERE! It's totally FREE!!!

Think you can outsmart us? There'll be plenty of opportunities for you to chime in with your two cents as we fill out our lineups. And there's one more thing. The StockCharts SCTR ranking system will challenge all 3 of us and select its own team! You don't want to miss this! CLICK HERE to register NOW!

Happy trading!

Tom