Technology’s Sideways Market Is Hiding a Big Shift

While the broader markets have largely moved sideways, price action beneath the surface has been anything but quiet. Investors continue to reposition in response to geopolitical developments, policy initiatives out of Washington, and ongoing interest rate uncertainty. Over this past week, earnings season has added another powerful catalyst to that mix.

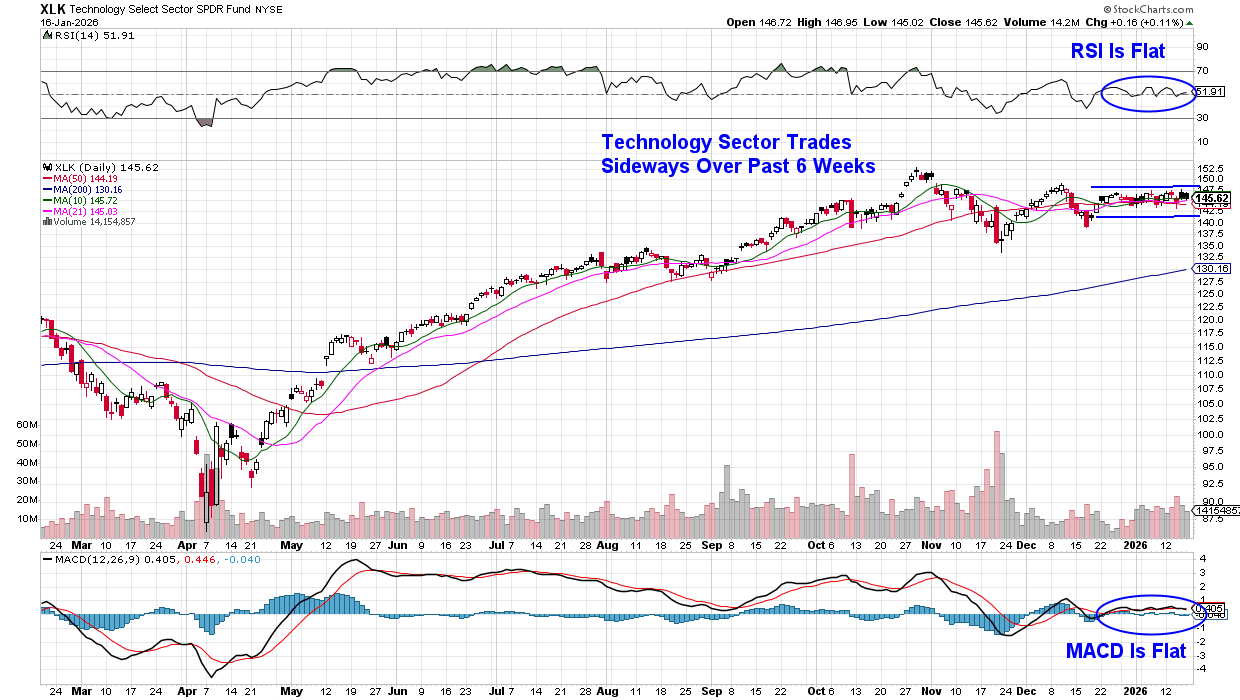

From decades of studying market cycles and working closely with top fund managers, one lesson stands out: earnings ultimately matter more than any headline. In periods of sideways index movement, earnings become even more influential, driving sharp divergences at the sector and stock level. Nowhere is this more evident than in the Technology sector, which may appear range-bound on the surface but is undergoing significant internal shifts.

The Technology sector is a dominant presence in the stock market, accounting for roughly 36% of the S&P 500’s total market capitalization. After an extended period in which most tech stocks moved higher together, a clear divergence has now taken shape, particularly within the AI trade. Not surprisingly, that split has been driven by earnings.

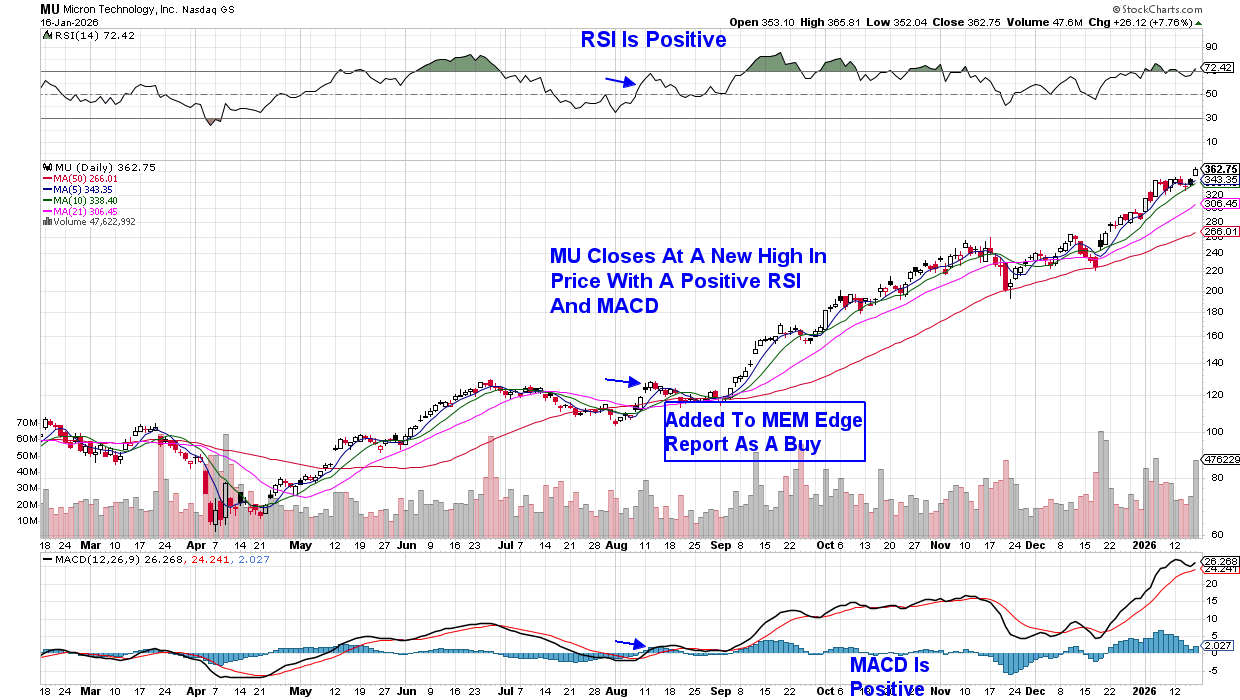

While semiconductor and memory companies, the “picks and shovels” of the AI boom, continue to post explosive growth, much of the software sector is struggling. Investors are no longer treating AI as a single growth story, instead favoring infrastructure providers with visible demand over software application developers still searching for durable revenue models. That divergence was reinforced by growth signals out of CES 2026, where industry leaders pointed to accelerating demand for memory, semiconductors, and AI-driven hardware infrastructure.

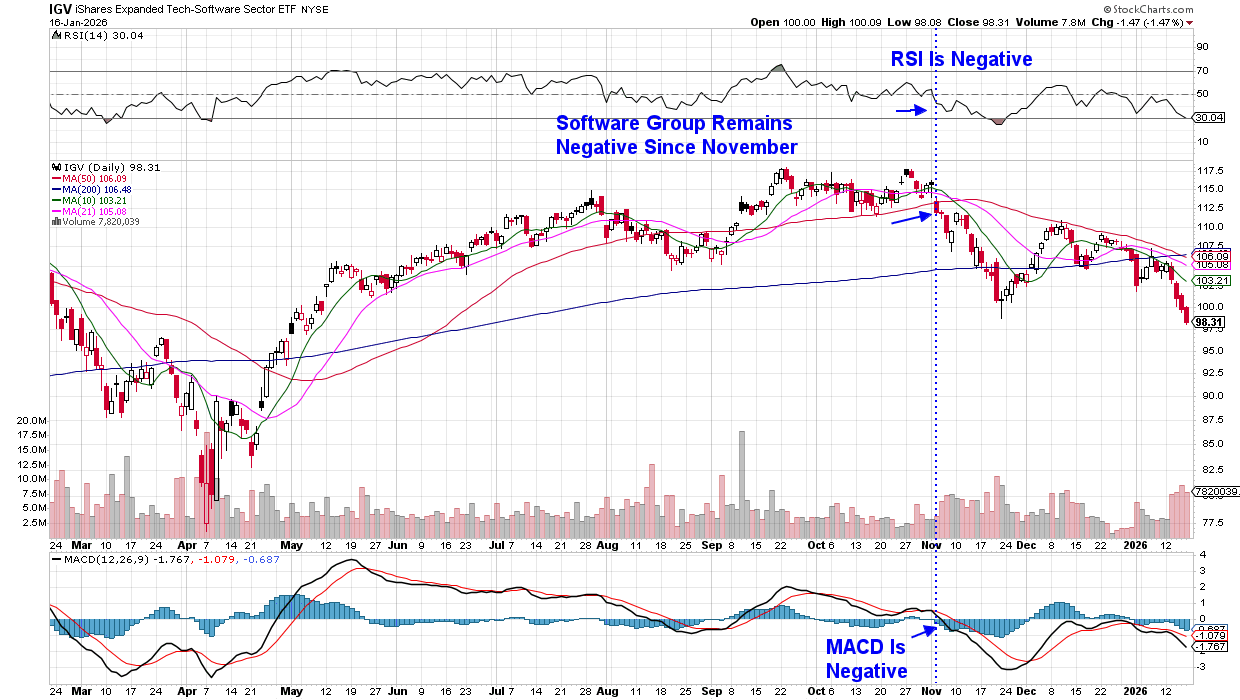

At the same time, software leaders such as Adobe (ADBE) and Salesforce (CRM) have struggled to reassure investors that AI copilots are meaningfully boosting revenue. Instead, investors are focusing on the threat that AI poses to software, as it may have the ability to replicate their current product offerings.

This imbalance has triggered a notable capital rotation over recent quarters. Semiconductor stocks have continued to lead, while the software-heavy IGV has underperformed both hardware and the broader market. The result has been a widening valuation gap, with hardware names maintaining premium valuations as many Software as a Service (SaaS) stocks trade at their lowest multiples in years.

Policy has reinforced this trend. Recent U.S. regulations treating advanced AI chips as strategic assets have effectively increased the scarcity and value of physical infrastructure. Looking ahead, this divergence is likely to persist until software companies can demonstrate a credible “second wave” of AI revenue. Until that transition gains traction, the infrastructure trade remains the clearest way to gain exposure to AI growth in 2026.

My twice-weekly MEM Edge Report alerted investors to the shift away from Software stocks in late October, when the group closed below its 50-day moving average with a negative RSI and MACD. As for the move into memory stocks, we highlighted Micron (MU) as entering a new uptrend in mid-August, and it’s been on our buy list ever since. More recently, we’ve added other stocks poised to trade higher as spending on AI continues to grow.

If you’d like immediate access to the list of Technology stocks on our buy list, use this link here. You’ll also uncover leading Defense, Infrastructure, and Financial stocks that are poised to trade higher.

Wishing you a happy holiday weekend!

Warm Regards

Mary Ellen McGonagle

MEM Investment Research