The "AI Bubble" Didn't Burst. It Went on Sale.

If you read the headlines over the last two weeks, the narrative is clear: The "SaaSpocalypse" has wiped out billions in software market cap, and investors are panic-selling the hyperscalers, convinced that their massive capital expenditure is a repeat of the dot-com excesses.

The market is wrong.

According to our latest research, the consensus view that AI infrastructure is "overbuilt" is fundamentally flawed. In fact, we believe it is structurally underbuilt.

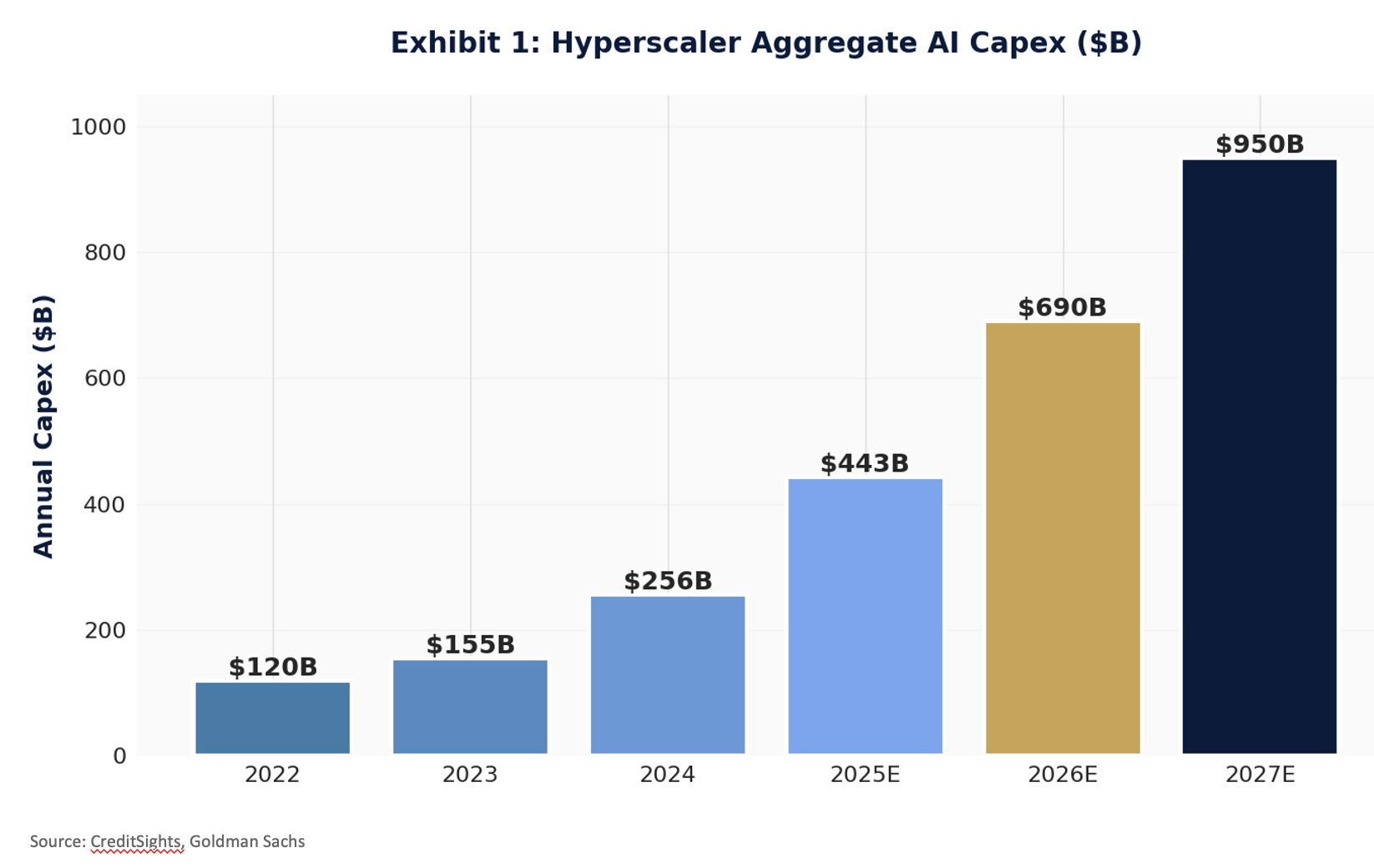

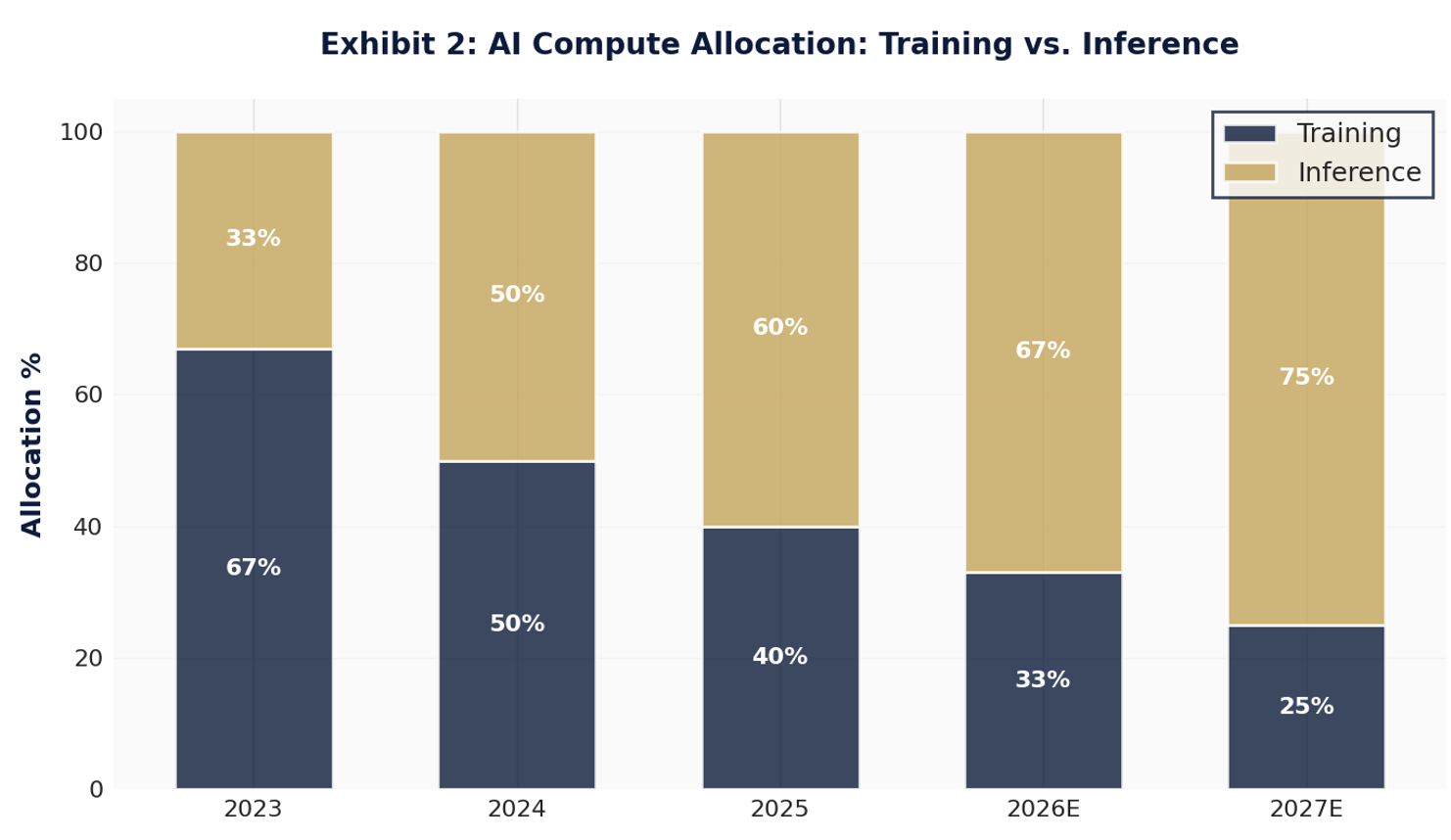

While the market balks at the projected $600 billion in hyperscaler capex for 2026, they are missing the demand side of the equation. We are shifting from "Training" (building models) to "Inference" (using models). Specifically, the rise of OpenAI and Anthropic’s Agentic AI—autonomous agents that execute multi-step workflows—is about to create a tsunami of compute demand that current infrastructure simply cannot support.

Amazon (AMZN) is at the center of this storm. The company raised its 2025 capex guidance to $125 billion (+61% YoY). The market treated this as "wasteful spending" and punished the stock. We view it as a defensive moat. Amazon isn't burning cash; it is building the only infrastructure that can support the next decade of agentic computing.

The Opportunity: The panic selling has created a massive disconnect between Amazon's long-term value and its short-term price. The stock has crashed hard, flushing out the weak hands and giving us a rare opportunity to enter a "Magnificent 7" leader at a deep discount.

The Technical Signal

The fundamental thesis is that the market is mispricing the capex cycle. The technical thesis is that the selling has reached exhaustion.

We are looking at a classic "Bullish Counter-Trend" setup. After a sharp waterfall decline, AMZN has slammed right into a major institutional support zone near $195. The Relative Strength Index (RSI) is deeply oversold, and the volume is starting to churn, suggesting that the sellers are running out of ammunition and the "smart money" is stepping in to accumulate shares at these levels.

The Perfect Trade Execution

Catching a falling knife is dangerous if you buy the stock outright. If the selling continues, you take 100% of the pain.

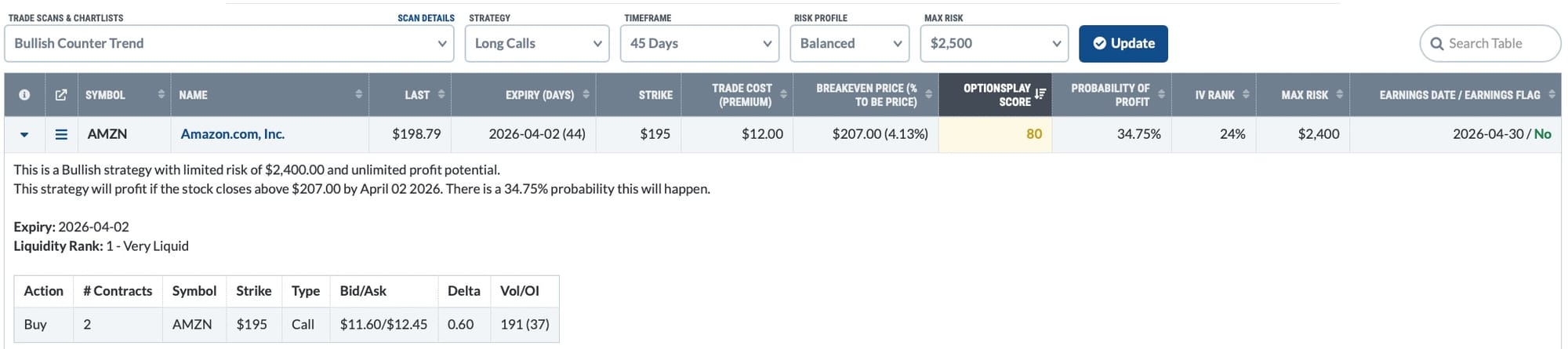

Instead, I used the OptionsPlay integration to find a Long Call setup that leverages this bounce while strictly defining my risk.

The Trade

- Strategy: Long Call

- Expiry: April 2, 2026 (~44 Days)

- Strike: $195 Call

- Cost: $12.00

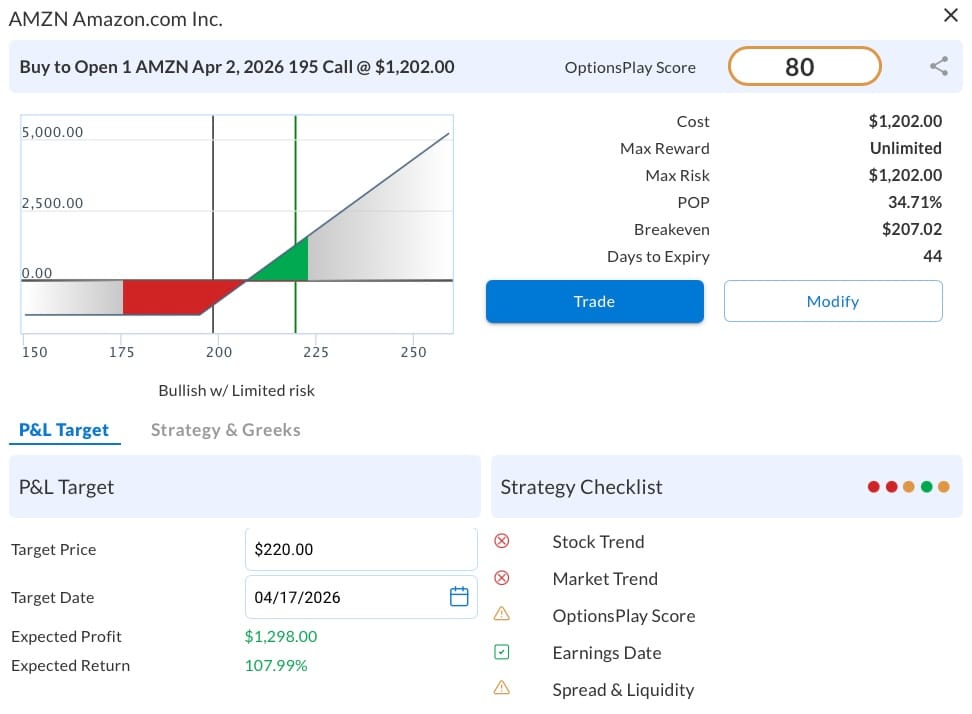

Why this trade works: This is a high-conviction, contrarian play. By buying the $195 call (at-the-money), we gain immediate exposure to a rebound. We are giving the trade 44 days to work, which is plenty of time for the "bubble" narrative to cool off and for investors to realize that Amazon's infrastructure spend is a feature, not a bug.

If AMZN merely rallies to fill its recent gap @ $220, this option could more than double in value. If I'm wrong and the crash continues? I can only lose the premium paid, no matter how low the stock goes.

How I Found This Trade (The Secret)

In a market crash, it is terrifying to buy the dip. You never know which stocks are "cheap" and which are "traps."

I found this AMZN trade in 5 seconds.

I didn't have to guess where the bottom was. I simply opened the OptionsPlay Add-On, selected the "Bullish Counter-Trend" scan, and sorted by "OptionsPlay Score."

The algorithm instantly filtered through the wreckage of the tech sector and identified Amazon (AMZN) as the #1 candidate. It recognized the extreme oversold conditions, matched them with the high liquidity of the options chain, and flagged the $195 level as the optimal strike for a rebound play.

The tool ignored the emotional panic and focused on the math: Amazon is on sale.

See the opportunities you’re missing. Unlock the full potential of your ChartLists with the OptionsPlay Add-On.