The Best Five Sectors This Week, #35

Key Takeaways

- S&P 500 edged up slightly last week.

- Materials sector pushed financials out of the top five.

- Technology maintains #1 position, consumer discretionary climbs to #2.

- Industrials showing signs of weakness, at risk of dropping out of top five.

The S&P 500 managed a modest gain last week, but, beneath the surface, we're seeing some interesting sector rotation dynamics play out. Let's dive into the latest shifts in sector rankings and what they might mean for the market's near-term direction.

Materials Enter Top Five

The top of the sector leaderboard is seeing one change this week. Technology remains firmly entrenched in the #1 spot, but we're seeing movement just below. Consumer discretionary has climbed to the #2 position, pushing communication services down to #3. Industrials is holding steady at #4, but here's where it gets interesting – materials has muscled its way into the #5 spot, shoving financials down to #6 after having spent only one week inside the top five.

In the bottom half of the rankings, we're seeing energy climb from #8 to #7, utilities drop from #7 to #8, and real estate improve from #10 to #9. Health care managed to escape the cellar, moving from #11 to #10, which leaves consumer staples bringing up the rear at #11, down from #9 previously.

- (1) Technology - (XLK)

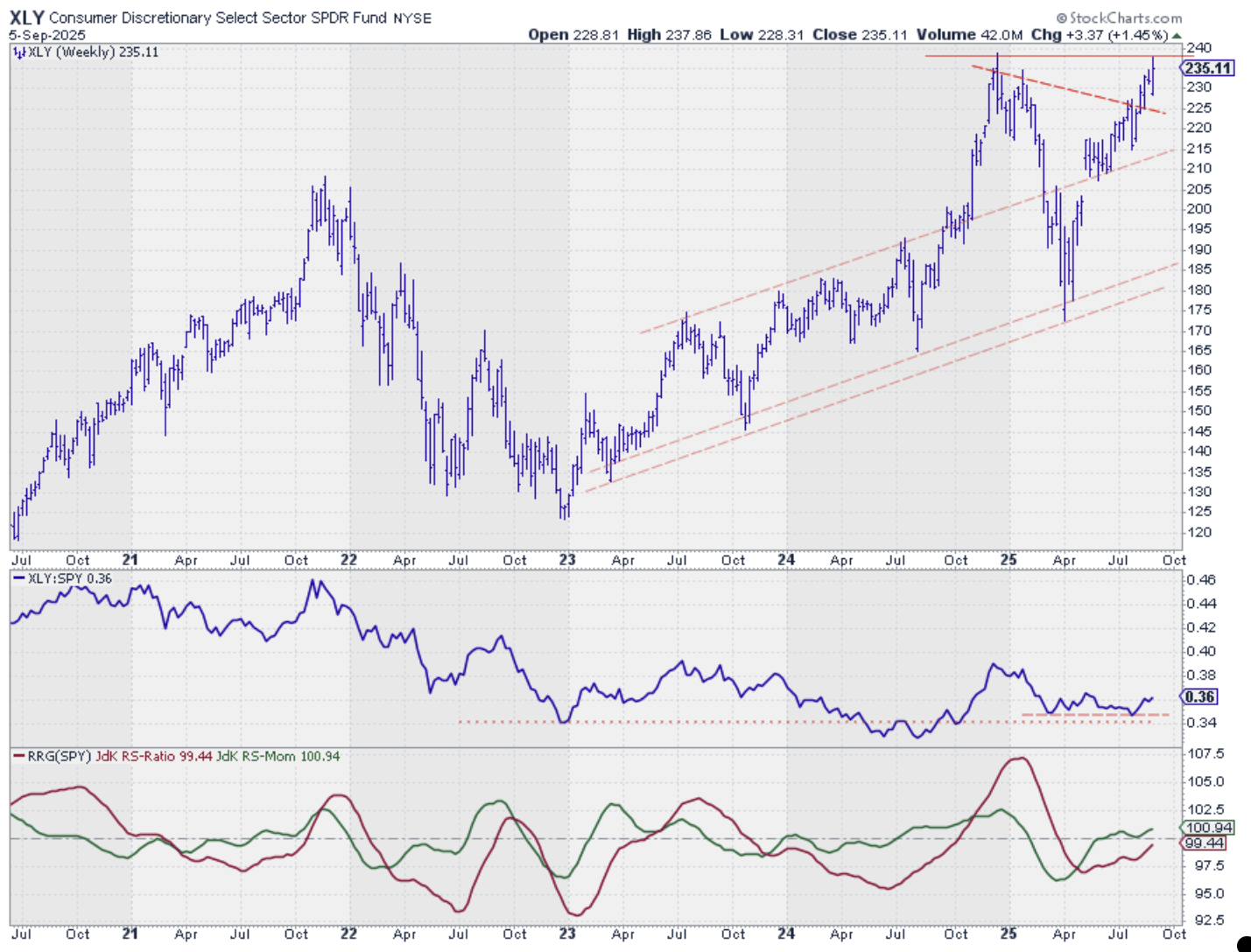

- (3) Consumer Discretionary - (XLY)*

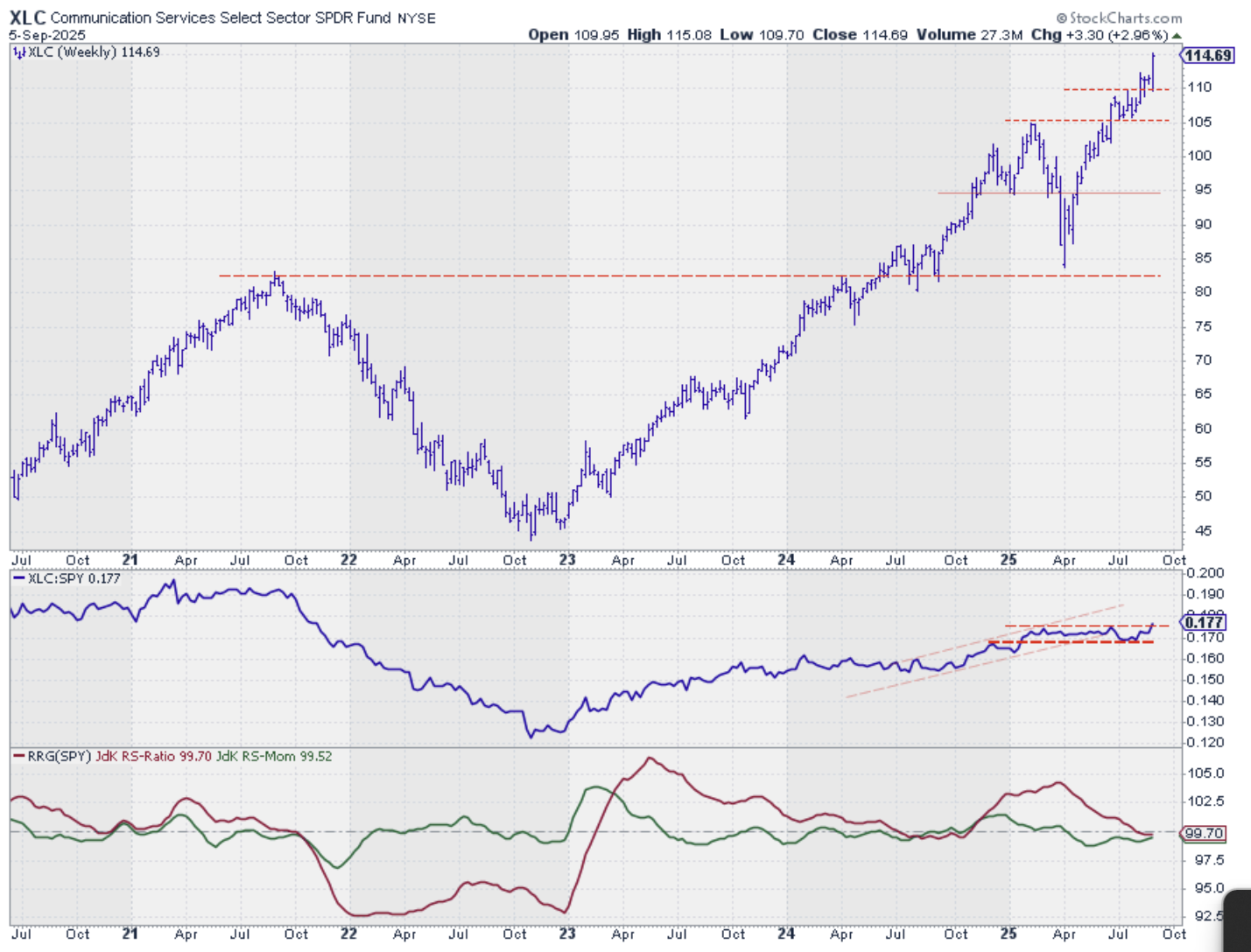

- (2) Communication Services - (XLC)*

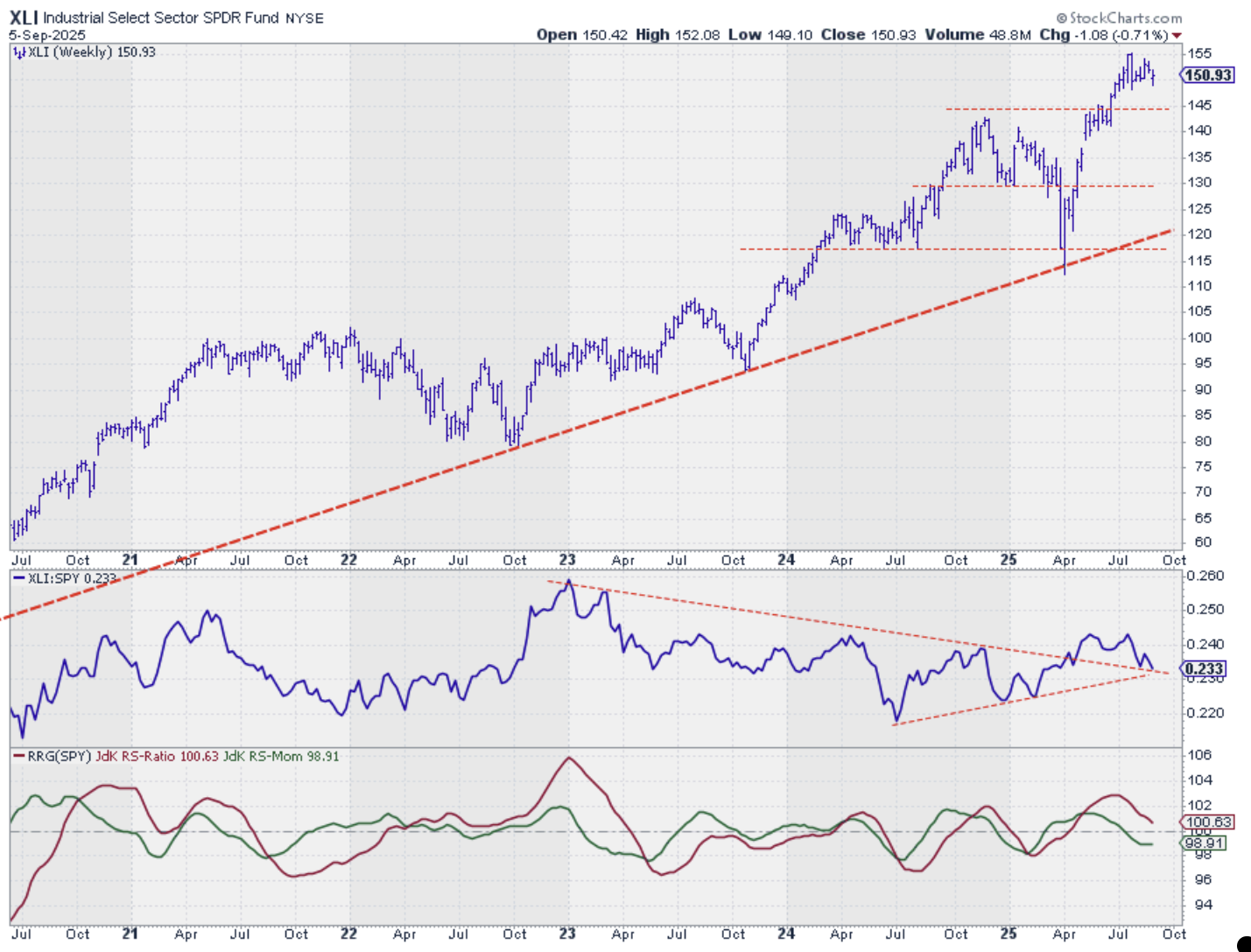

- (4) Industrials - (XLI)

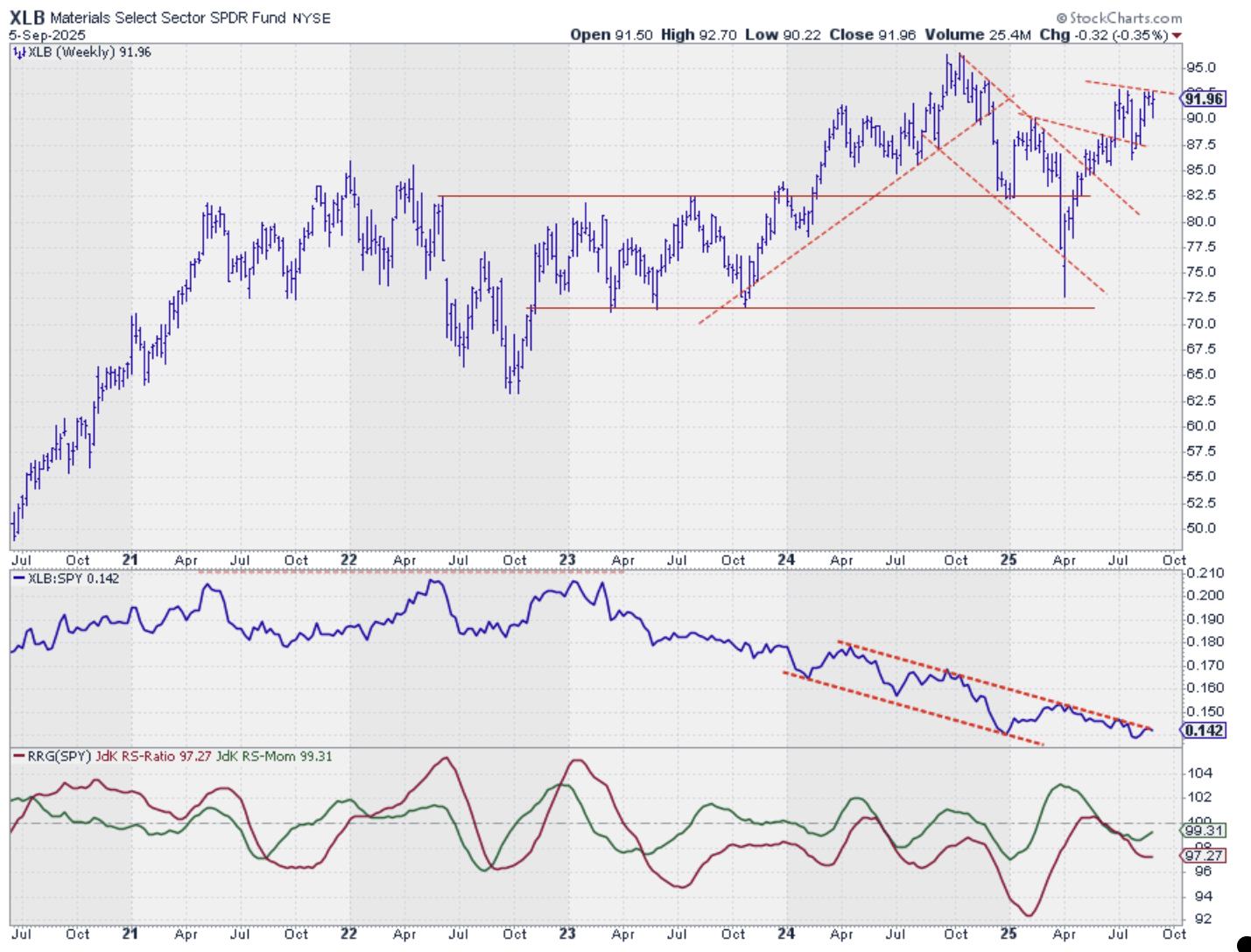

- (6) Materials - (XLB)*

- (5) Financials - (XLF)*

- (8) Energy - (XLE)*

- (7) Utilities - (XLU)*

- (10) Real-Estate - (XLRE)*

- (11) Healthcare - (XLV)*

- (9) Consumer Staples - (XLP)*

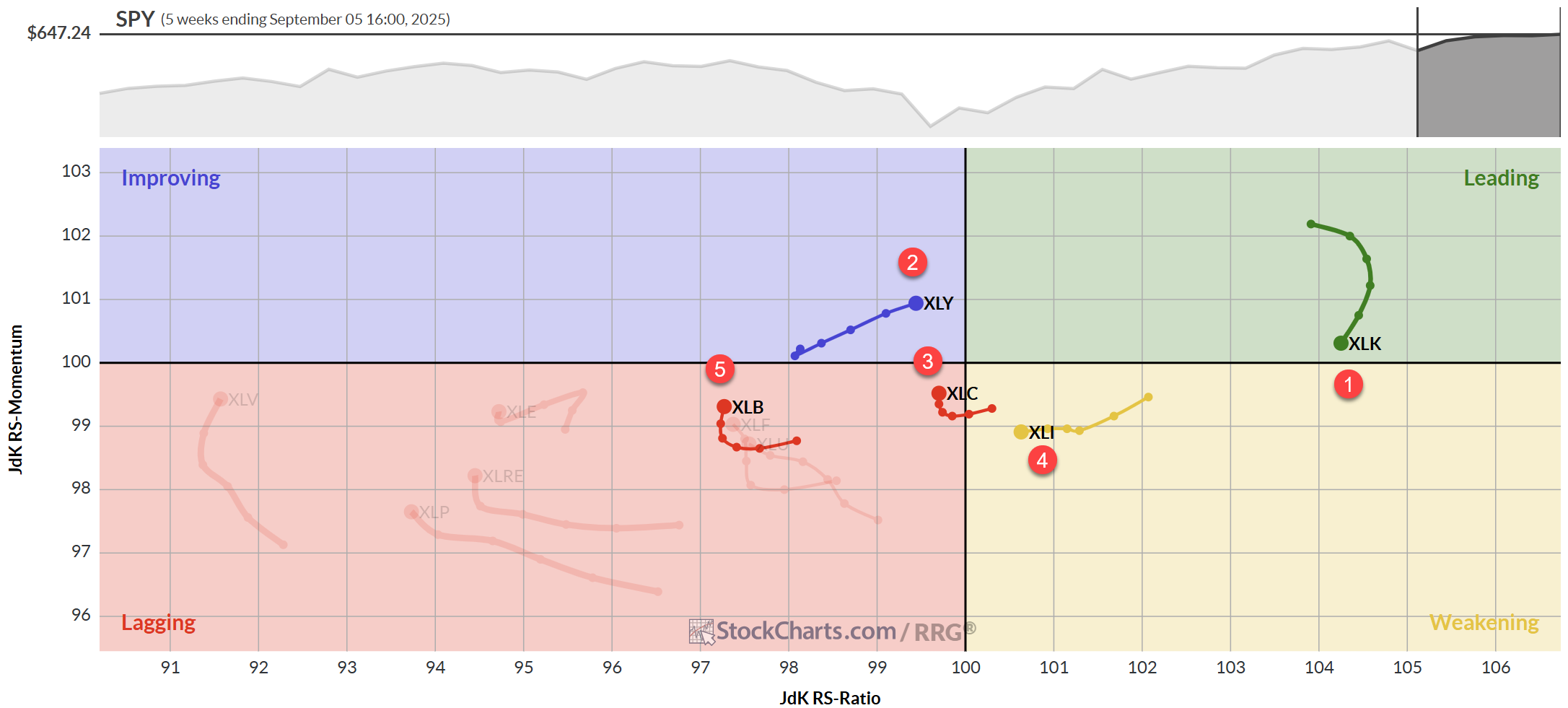

Weekly RRG

Taking a look at the weekly Relative Rotation Graph (RRG), we see XLK (technology) as the lone wolf in the leading quadrant. However, it's starting to lose steam, heading towards the weakening quadrant with a negative RRG-Heading, but its high RS-Ratio is keeping it at the top of the pack for now.

Consumer discretionary continues its positive trajectory in the improving quadrant, knocking on the door of the leading quadrant. Communication services, despite being in the lagging quadrant, is showing signs of life with improving relative momentum.

Industrials, on the other hand, is looking a bit worse for wear. It's in the weakening quadrant and continuing to slide towards lagging, not a great sign for its current #4 ranking.

Materials, our newcomer to the top five, is in the lagging quadrant but has been gaining relative momentum over the past few weeks. This momentum boost is likely what propelled it past financials in the rankings.

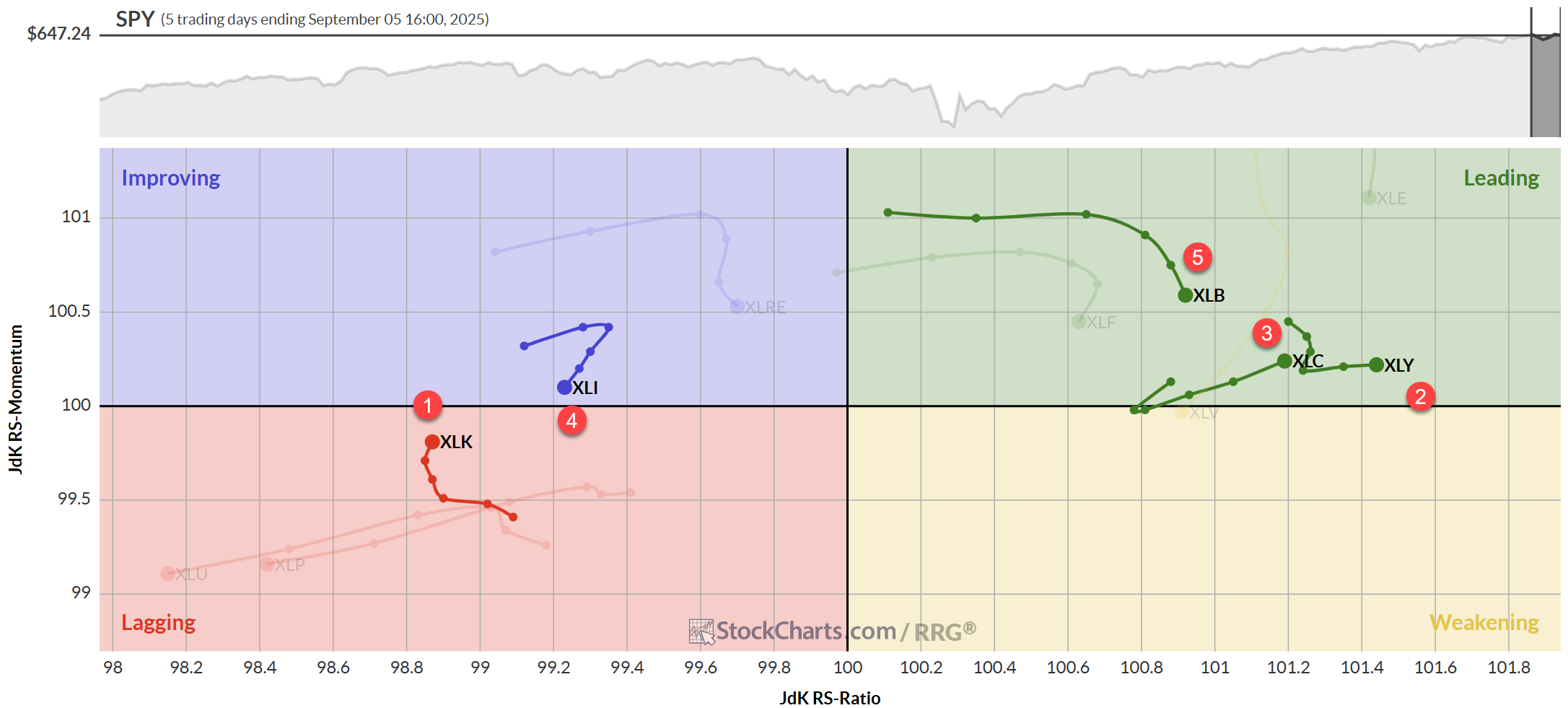

Daily RRG

Shifting gears to the daily RRG, we find ourselves with a slightly different picture. Technology is actually in the lagging quadrant here, but, and this is key, it's starting to pick up relative momentum and has just turned to a positive RRG-Heading. This could mark the end of the corrective move in relative strength, as the daily tail will now start to confirm the strength on the weekly RRG. Therefore, keep a close eye on it.

Consumer discretionary is flexing its muscles on the daily chart, pushing higher on the RS-Ratio scale and now boasting the highest RS-Ratio of all sectors in this time frame. Communication services is also looking strong, moving into the leading quadrant with a robust RRG-Heading.

Industrials, however, is confirming its weakness from the weekly chart. It has turned over inside the improving quadrant and is heading back towards lagging, which is not a great look when combined with its weekly trajectory.

Materials, our new top-five entrant, is in the leading quadrant, but is losing some relative momentum. That said, it's still maintaining a healthy lead in terms of RS-Ratio.

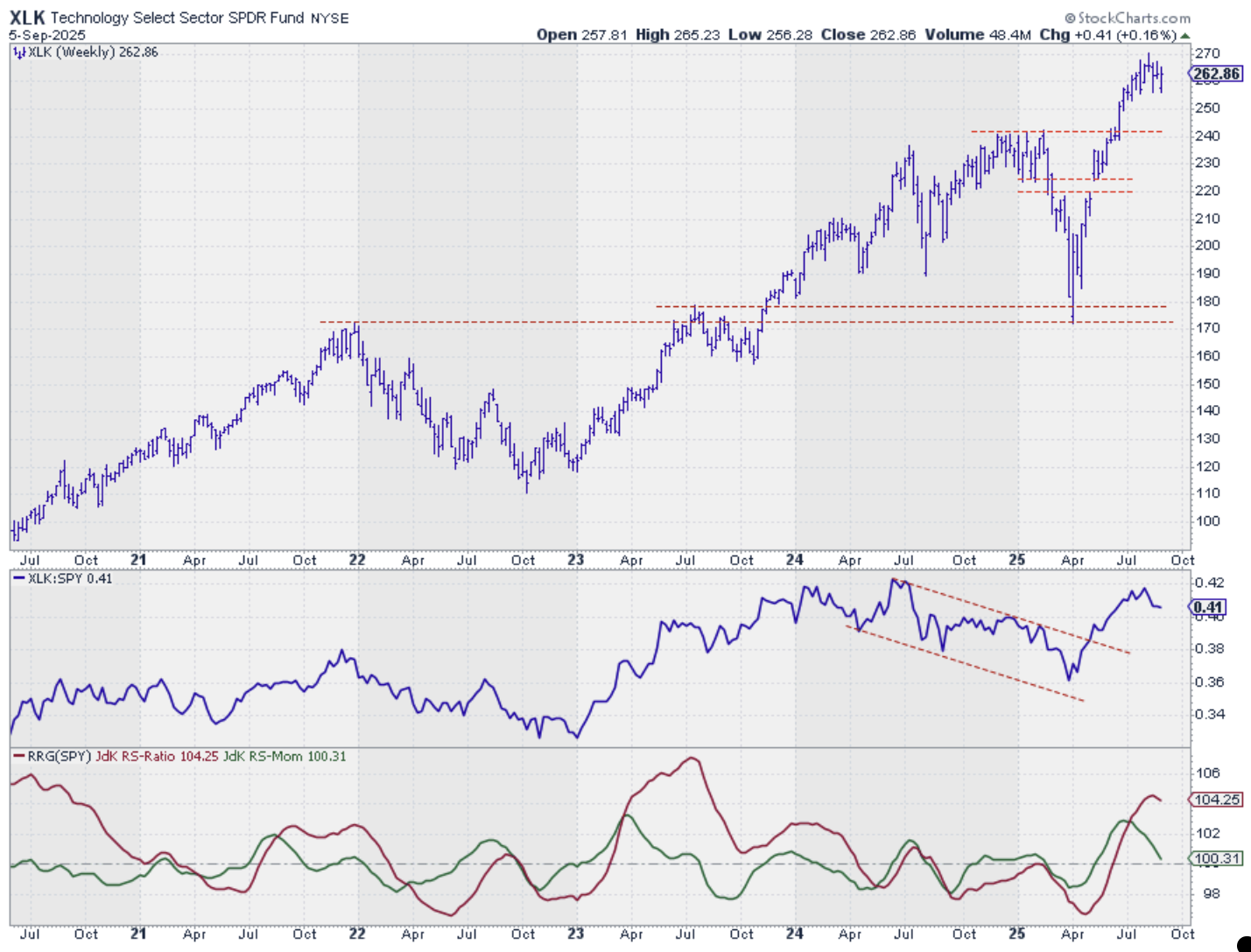

Technology (XLK)

XLK is in a sideways consolidation pattern near its all-time highs. The relative strength line has peaked at its July 2024 high, a significant level to watch. Both price and relative uptrends remain intact, but we'll want to see if it can break to new highs from here.

Consumer Discretionary (XLY)

XLY just put in a strong move, closing near its overhead resistance. This is encouraging for the uptrend, and the relative strength line appears to be bottoming out. It's dragging both RRG lines higher, which explains its positive heading in the improving quadrant.

Communication Services (XLC)

Despite dropping to #3 in the rankings, XLC's price chart is looking robust. It pushed to new highs last week, and the relative strength line is breaking out of a narrow trading range – a bullish sign, imho.

Industrials (XLI)

XLI is consolidating after putting in a lower high. It's still above previous resistance, keeping the uptrend alive, but the relative strength line is testing a former resistance level as support. It needs to hold here to maintain its relative strength, something to watch closely given its weakening RRG position.

Materials (XLB)

Our new top-five contender is pushing against overhead resistance around the 92 level. A break above could catalyze further upside in price and relative strength. The RS line is still in a falling channel, but momentum is picking up, which could be the start of a trend change.

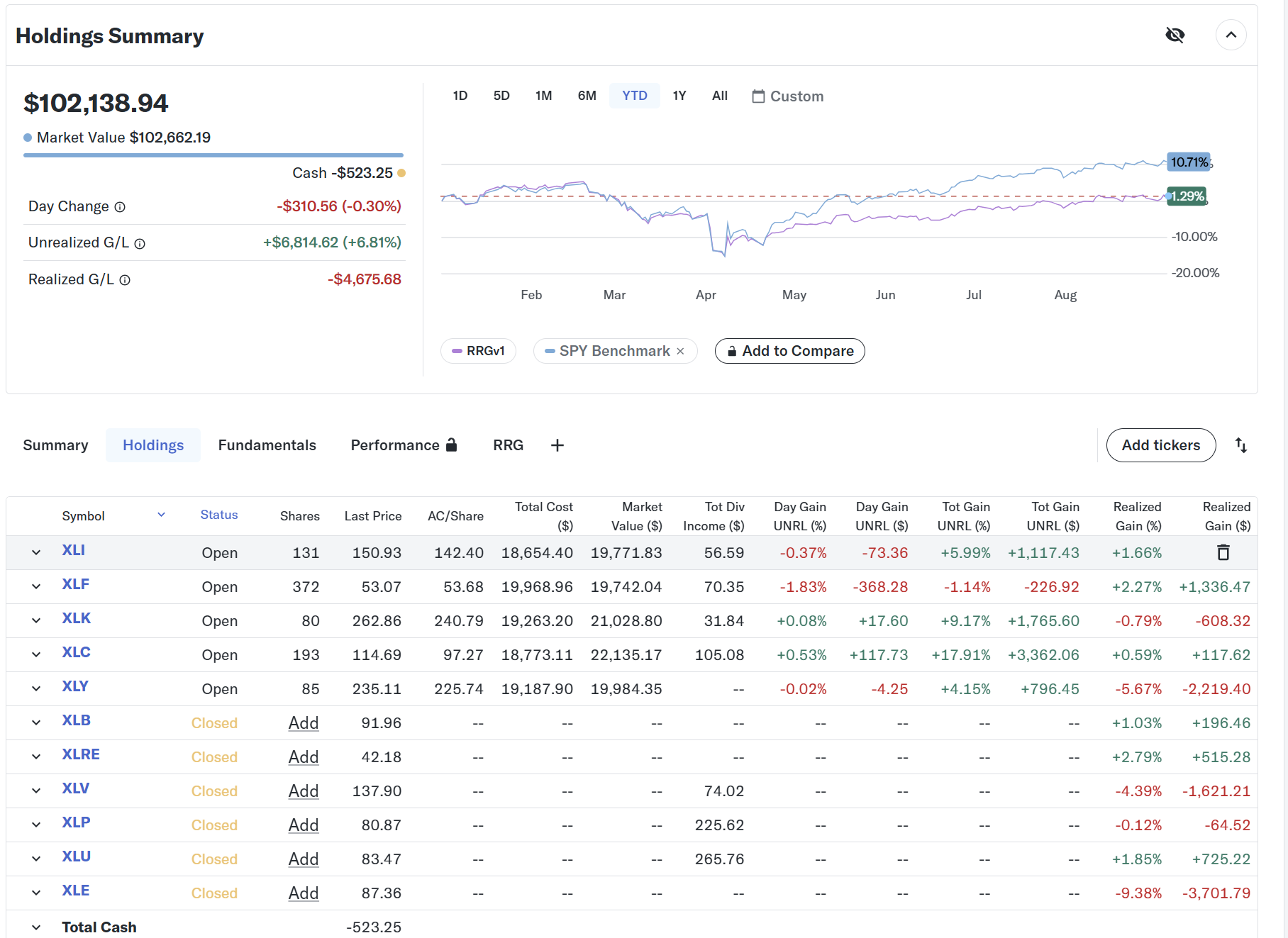

Portfolio Performance Update

Not much has changed on the portfolio front; we're still lagging the S&P 500 by about 9%. The silver lining? The gap is no longer widening significantly. There's clearly still work to do to close that performance gap.

#StayAlert and have a great week. --Julius