The Best Five Sectors This Week, #37

Key Takeaways

- S&P 500 continues upward trend for another week.

- Technology sector crosses into weakening quadrant, but maintains strength.

- Communication services and consumer discretionary push into the leading quadrant.

- Industrials and financials remain weak, but hold top 5 positions

Sector Rotation: Tech Slowing, Comm Services Surging

The latest sector rankings, based on the RRG model, reveal minimal changes, with the top five sectors remaining stable. Technology maintains its leadership position, followed by communication services, consumer discretionary, industrials, and financials. The only shift occurs in the bottom half, with utilities climbing to seventh place, pushing energy down to eighth.

- (1) Technology - (XLK)

- (2) Communication Services - (XLC)

- (3) Consumer Discretionary - (XLY)

- (4) Industrials - (XLI)

- (5) Financials - (XLF)

- (6) Materials - (XLB)

- (8) Utilities - (XLU)*

- (7) Energy - (XLE)*

- (9) Real-Estate - (XLRE)

- (10) Healthcare - (XLV)

- (11) Consumer Staples - (XLP)

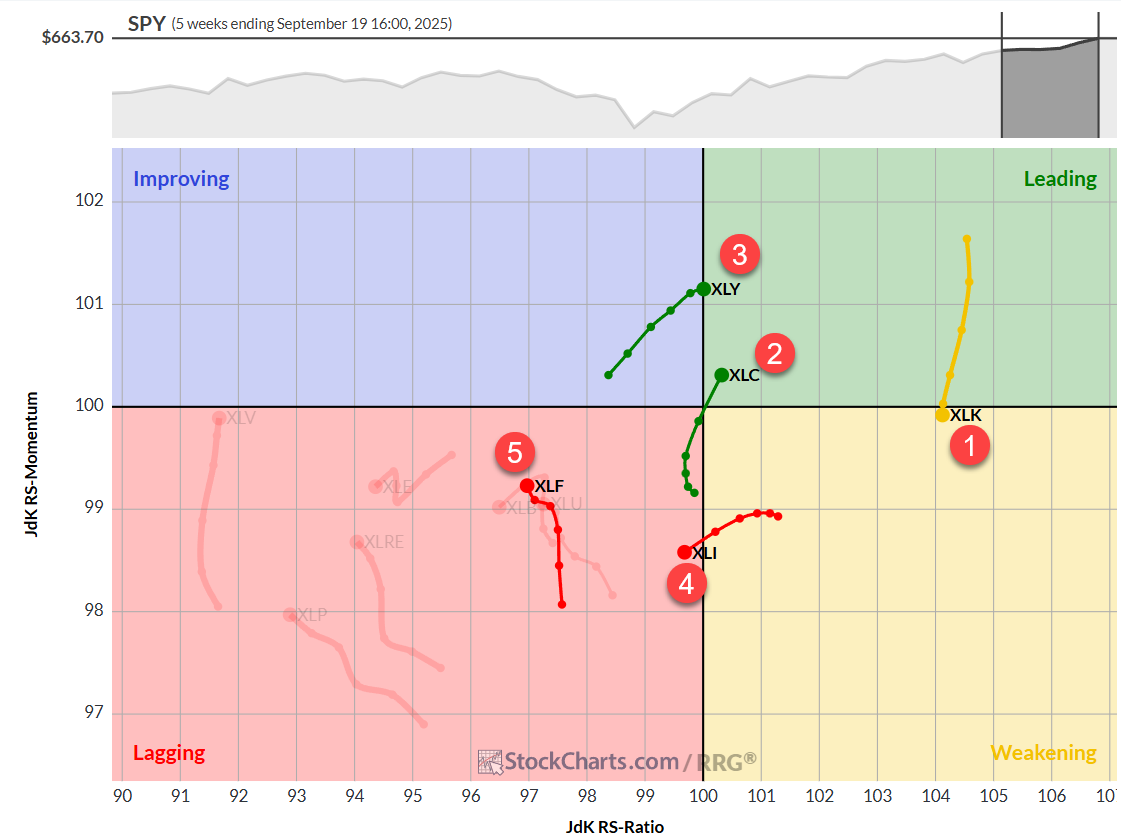

Weekly RRG

On the weekly Relative Rotation Graph, Technology has crossed into the weakening quadrant, but don't sound the alarm just yet. This move comes with minimal loss of relative strength, suggesting a temporary rotation that's likely to turn back up into leading. The high RS ratio reading supports this view.

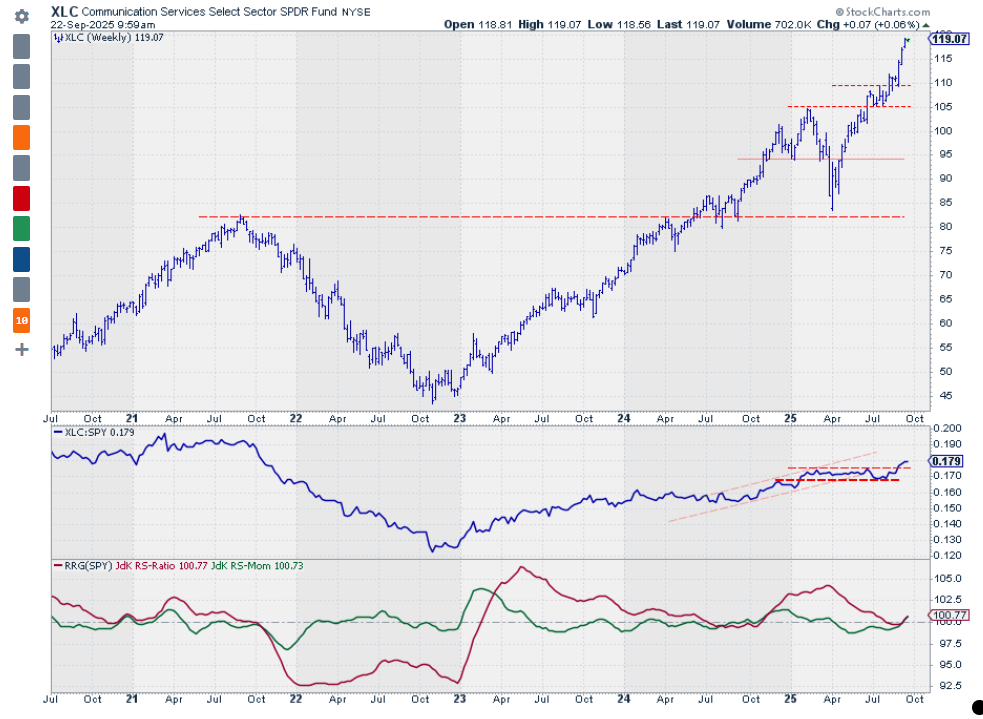

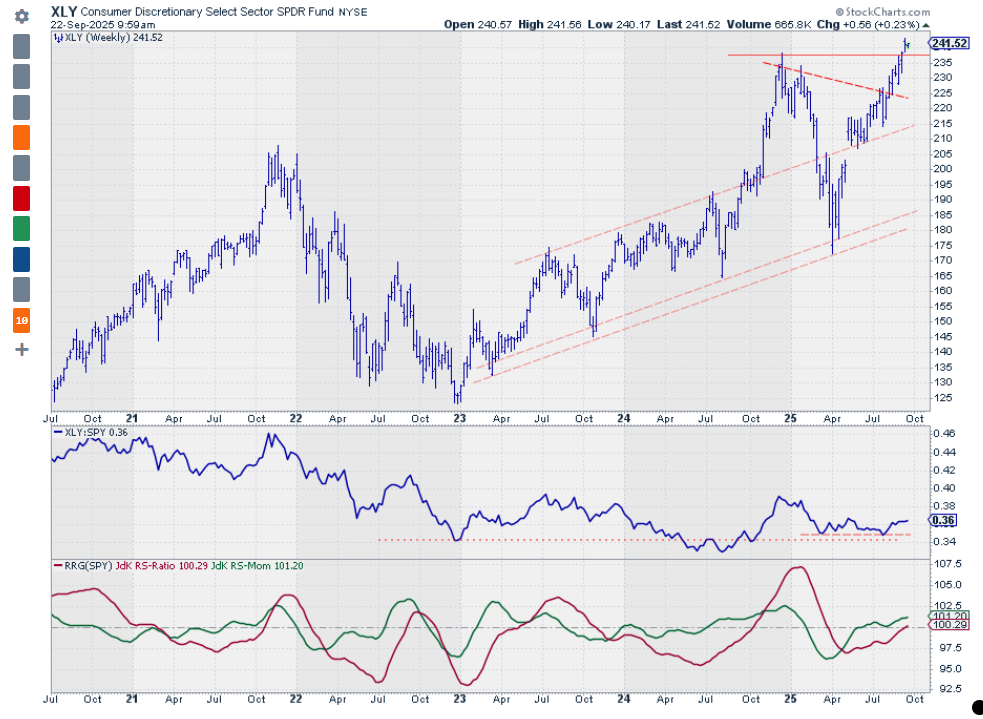

Communication services is making waves, pushing decisively into the leading quadrant with increasing RRG velocity. This underscores the power behind its move. Consumer discretionary isn't far behind, crossing into leading with the highest relative momentum of all sectors, a bullish sign.

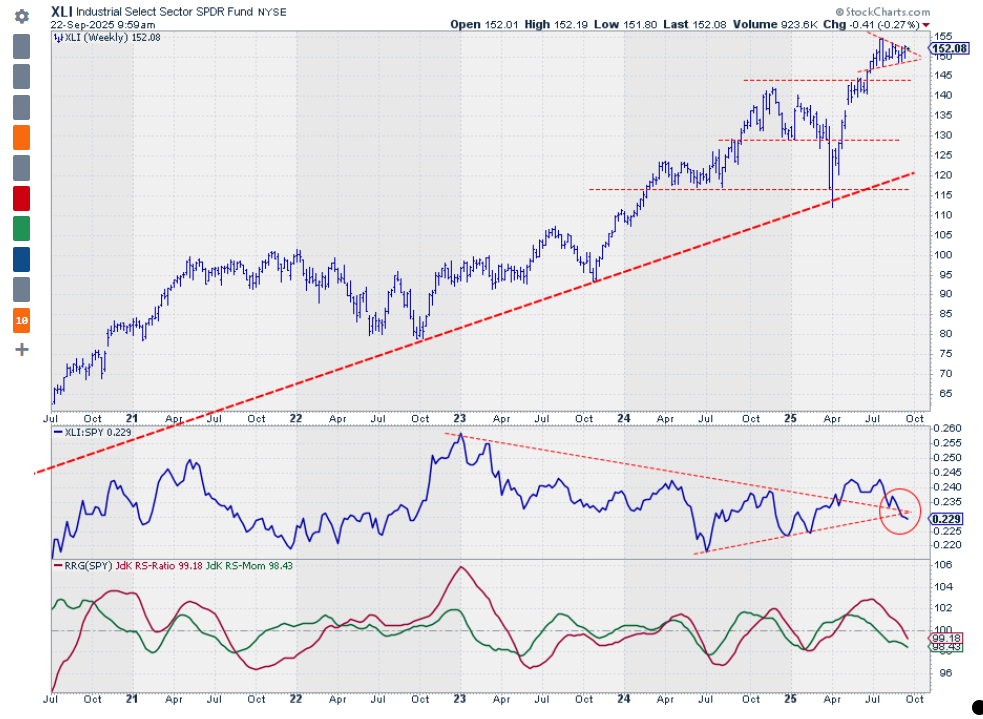

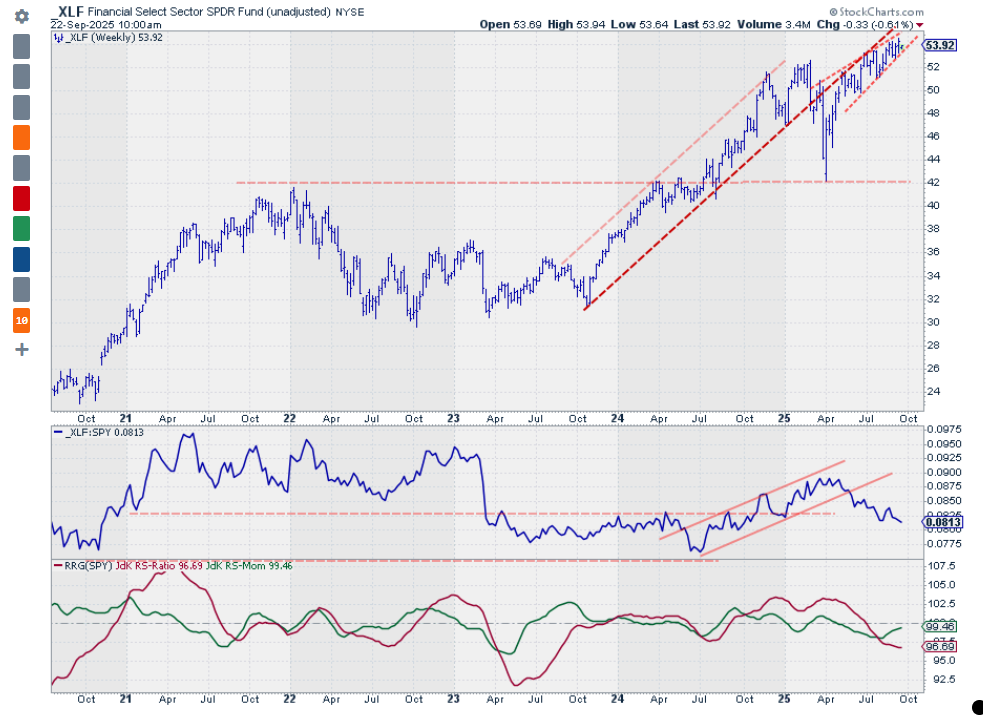

Industrials and financials, despite ranking in the top 5, are showing weakness. Both are crossing into or are already in the lagging quadrant. Their inclusion in the top tier is more a testament to the even greater weakness of other sectors than their own strength.

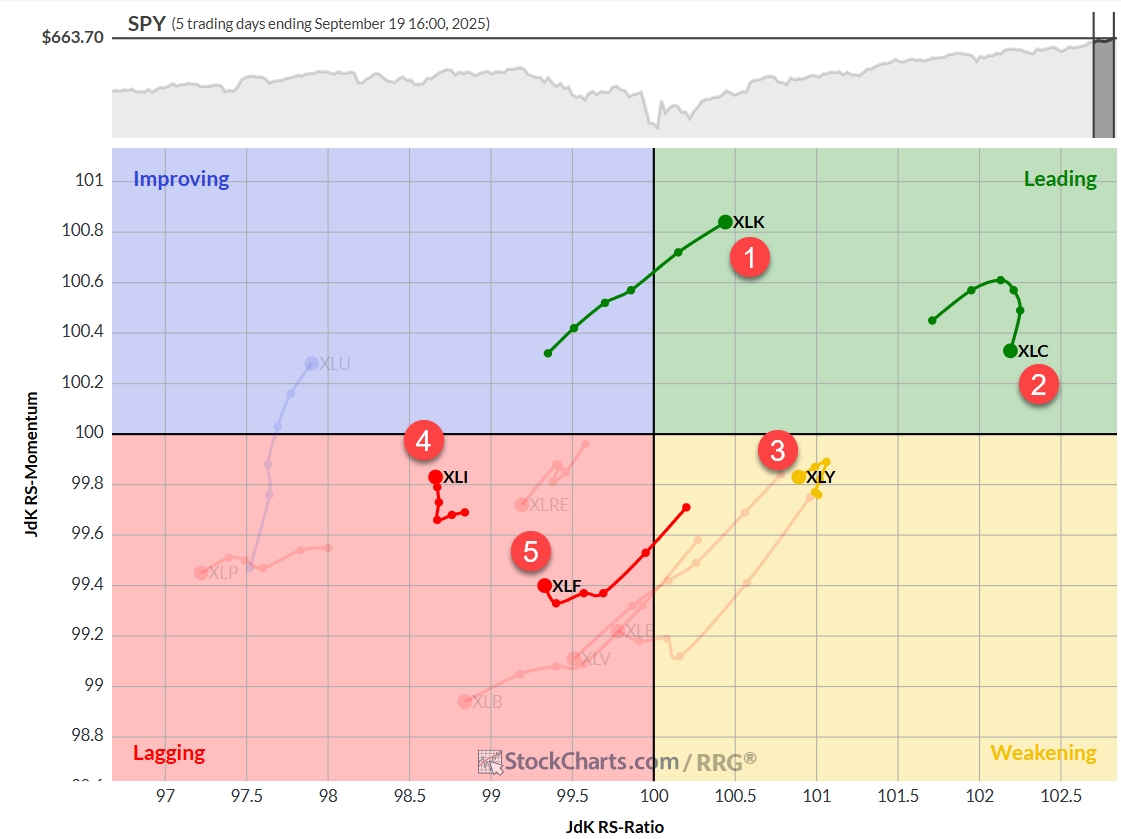

Daily RRG

The daily RRG essentially confirms what we're seeing on the weekly chart. Technology is flexing its muscles, pushing into the leading quadrant with the highest RS momentum and a strong RRG heading. Communication services is rolling over inside leading, losing some momentum after a strong run. But XLC still has the highest RS-Ratio reading on the daily RRG.

Consumer discretionary sits in weakening, but with a very short tail, indicating a relative uptrend that loses some, but not dramatically. This supports its strength on the weekly chart.

Industrials and financials remain the weak links, both languishing in the lagging quadrant. However, there's a glimmer of hope, as both ticked up towards the end of last week.

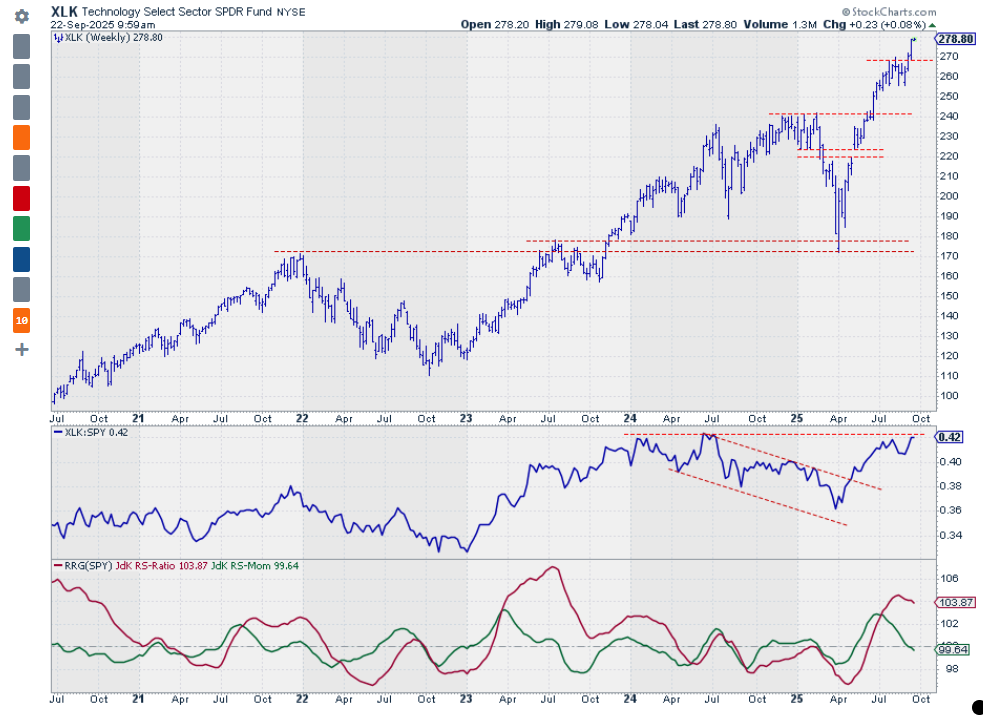

Technology

The tech sector's breakout is holding up admirably. Its RS line is once again testing overhead resistance; an upward break here could unlock significant upside in relative performance. This could very well keep the RS ratio above 100 and curl the RS momentum back up.

Communication Services

XLC is on a roll, rallying for three consecutive weeks after breaking overhead resistance. This has resulted in a clear break of relative strength out of its tight trading range. Both RRG lines are now moving higher above 100, propelling the sector into the leading quadrant with authority.

Consumer Discretionary

XLY is holding its ground after an upward break, a positive sign. The old resistance around $237 is now acting as support. As long as XLY stays above this level, things are looking good. This is causing the RS line to slowly creep higher, dragging both RRG lines above 100 and into the leading quadrant.

Industrials

XLI is consolidating in what appears to be a small triangle formation. The breakout direction will likely dictate its next move. The concerning factor here is the RS line's inability to hold support at the apex of both trendlines in the raw RS graph. This is dragging both RRG lines below 100, pushing industrials into the lagging quadrant.

Financials

The financial sector continues its slow crawl higher but remains below the old support line, now acting as resistance. This is maintaining pressure on relative strength, which remains in a downtrend. XLF's inclusion in the top five is more a reflection of the strength of other sectors than its own.

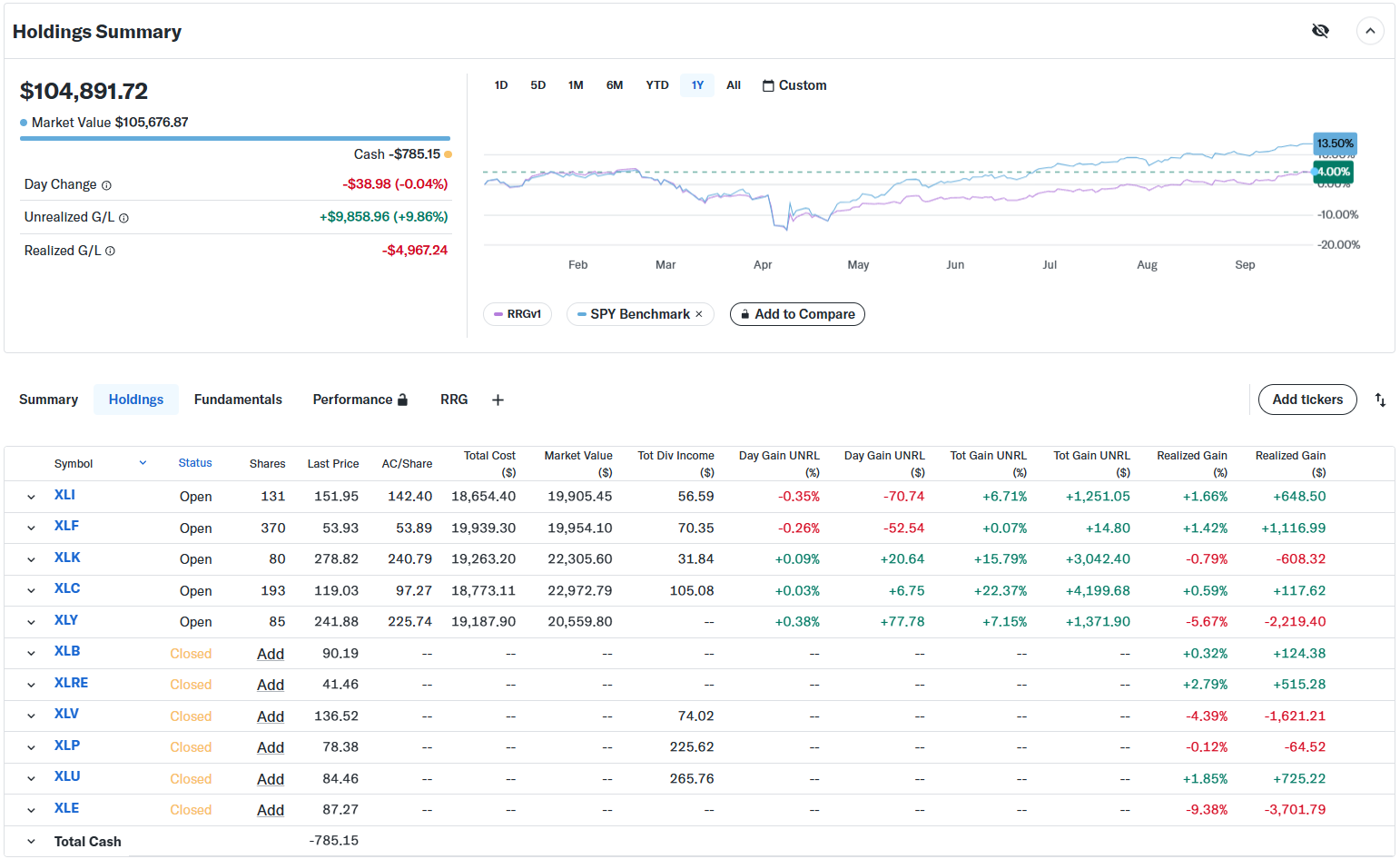

Portfolio Performance

Our portfolio's performance remains unchanged, still lagging behind the S&P 500 by approximately 9%. We're continuing to trust the process and wait for better times in terms of relative performance. Hopefully, we'll see broader participation from important sectors in the near future.

#StayAlert and have a great week. --Julius