The Best Five Sectors This Week, #38

Key Takeaways

- Technology maintains top position despite moving into weakening quadrant

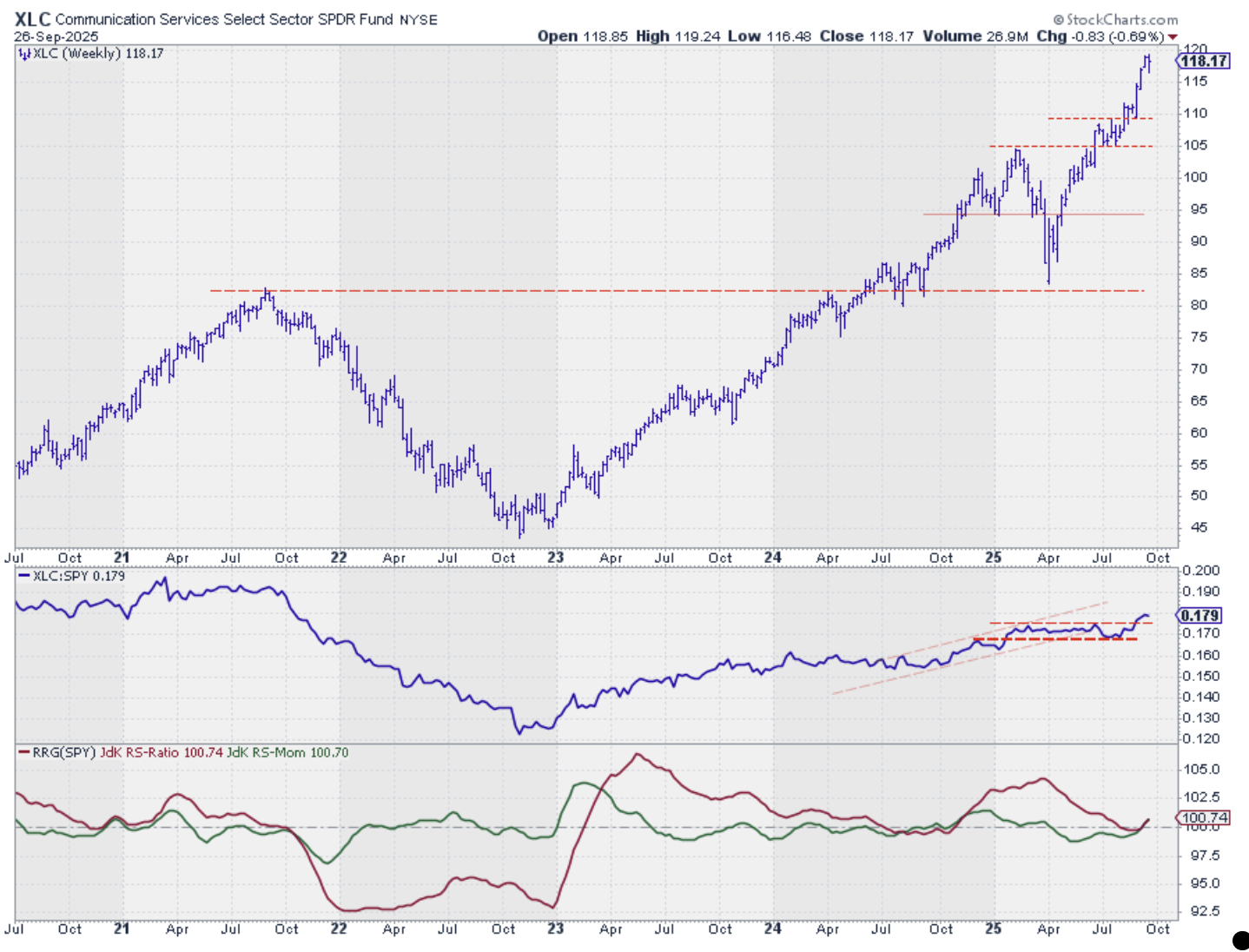

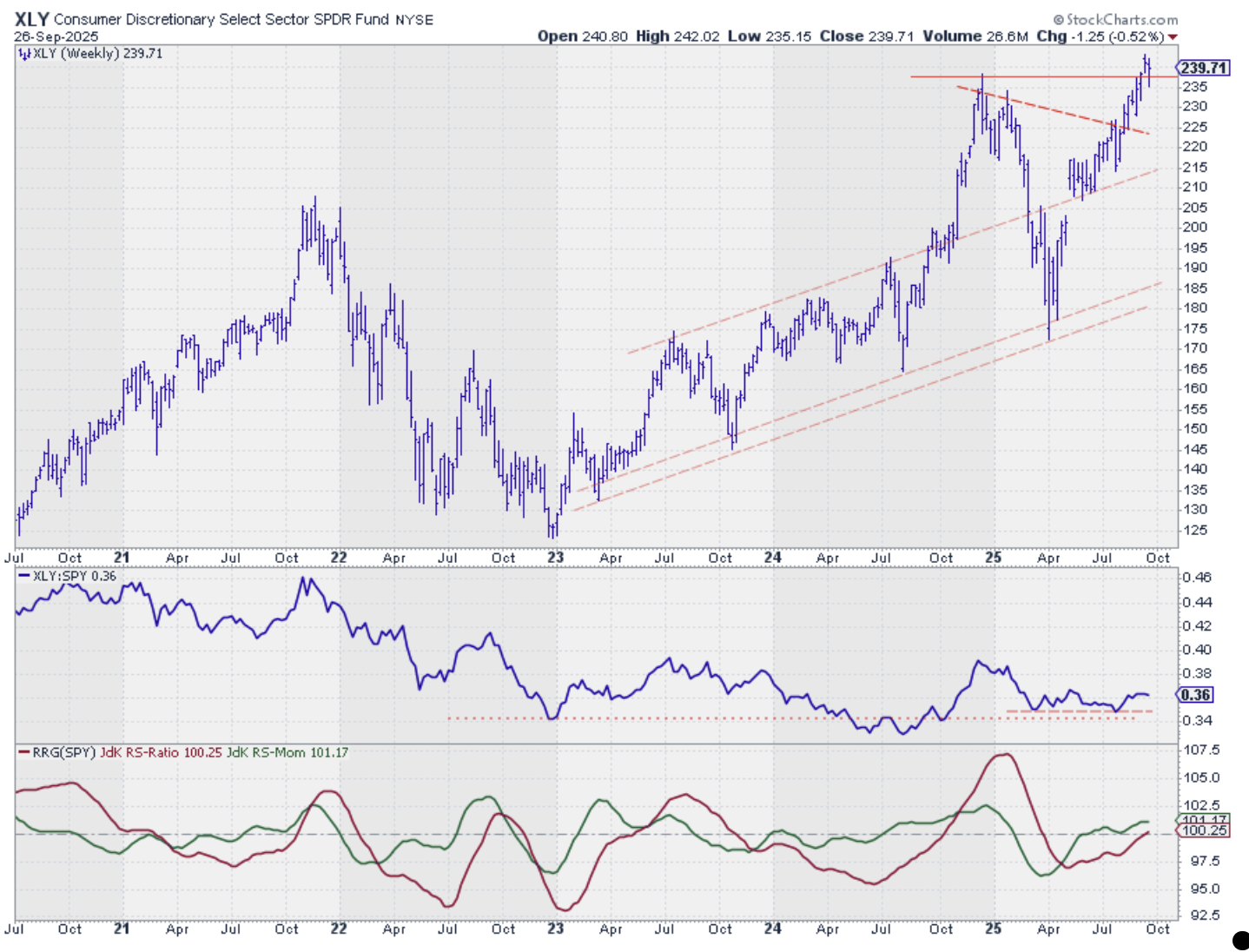

- Communication Services and Consumer Discretionary show increasing strength

- Materials sector drops from 6th to 8th place in rankings

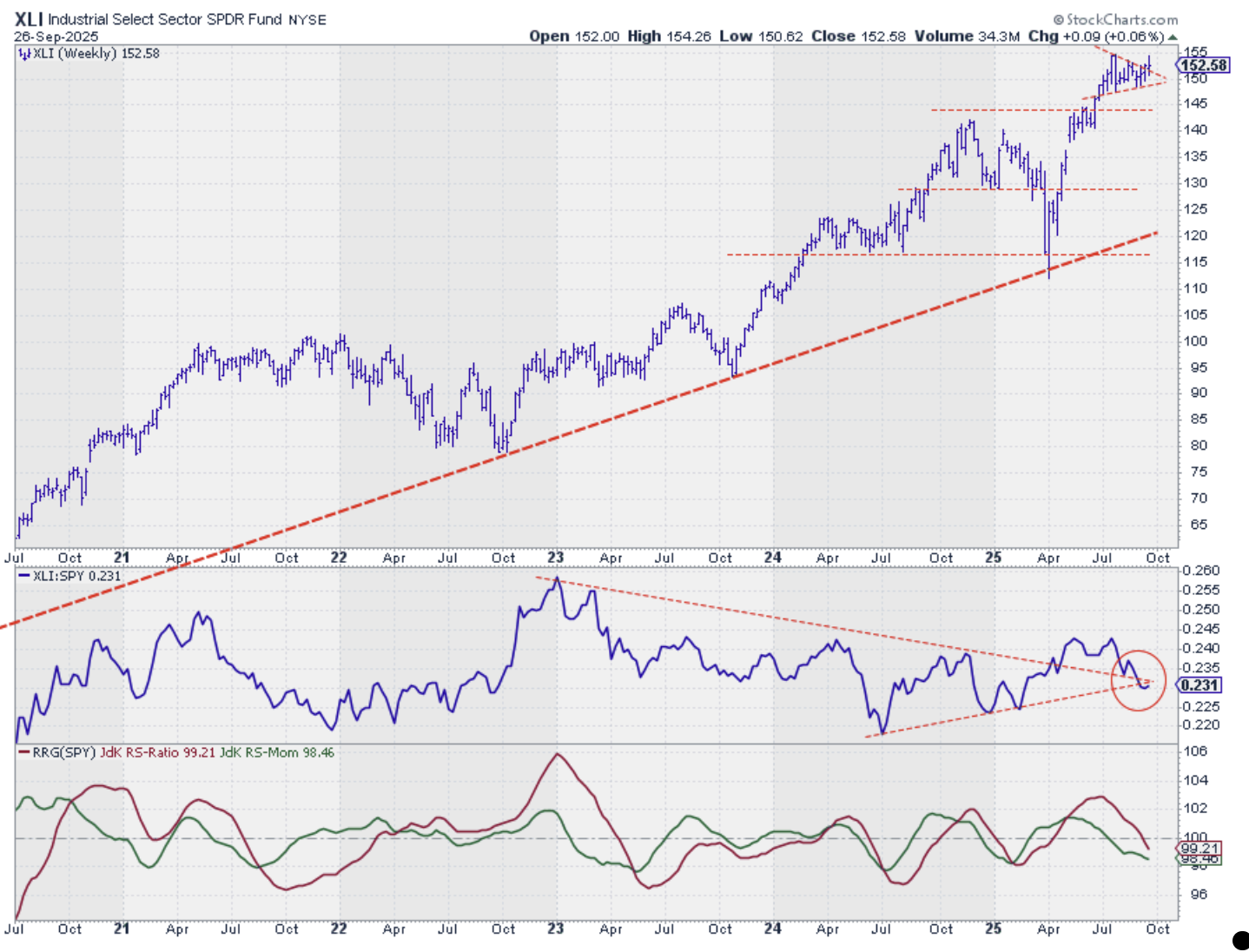

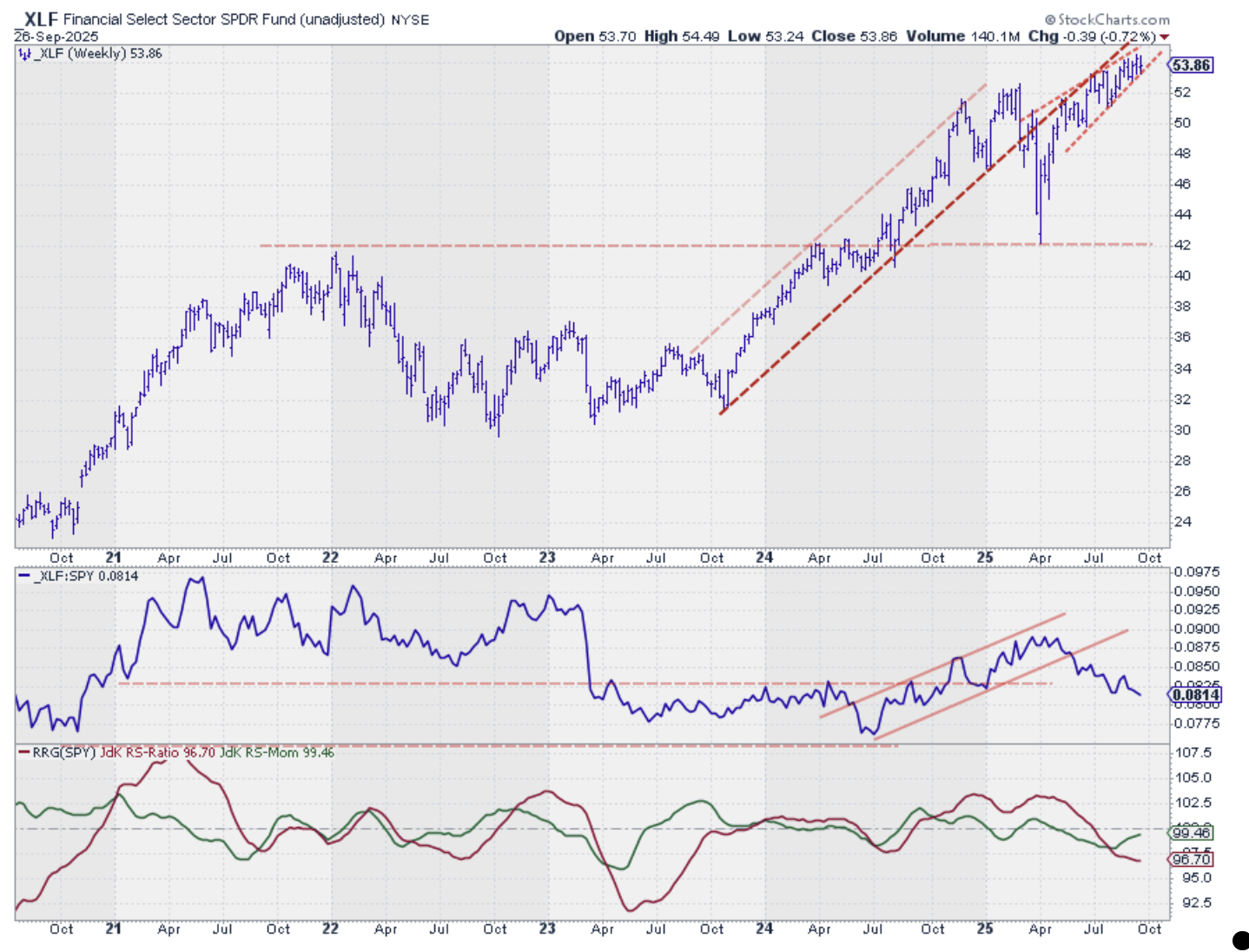

- Industrials and financials display potential for improvement

Sector Rotation: Tech Leads, Materials Slip

The S&P 500 ended slightly lower this week, but the top five sector rankings remained unchanged. This stability at the top masks some movements in the broader sector landscape, particularly in the bottom half of the rankings.

Technology continues to hold the crown, followed by communication services, consumer discretionary, industrials, and financials, rounding out the top five. The real action this week happened in the bottom half, where we saw three changes primarily driven by weakness in the materials sector. Materials tumbled from 6th to 8th place, allowing utilities to move up to 6th and energy to claim the 7th spot. The bottom three, those being real estate, health care, and consumer staples, remain unchanged.

- (1) Technology - (XLK)

- (2) Communication Services - (XLC)

- (3) Consumer Discretionary - (XLY)

- (4) Industrials - (XLI)

- (5) Financials - (XLF)

- (7) Utilities - (XLU)*

- (8) Energy - (XLE)*

- (6) Materials - (XLB)*

- (9) Real-Estate - (XLRE)

- (10) Healthcare - (XLV)

- (11) Consumer Staples - (XLP)

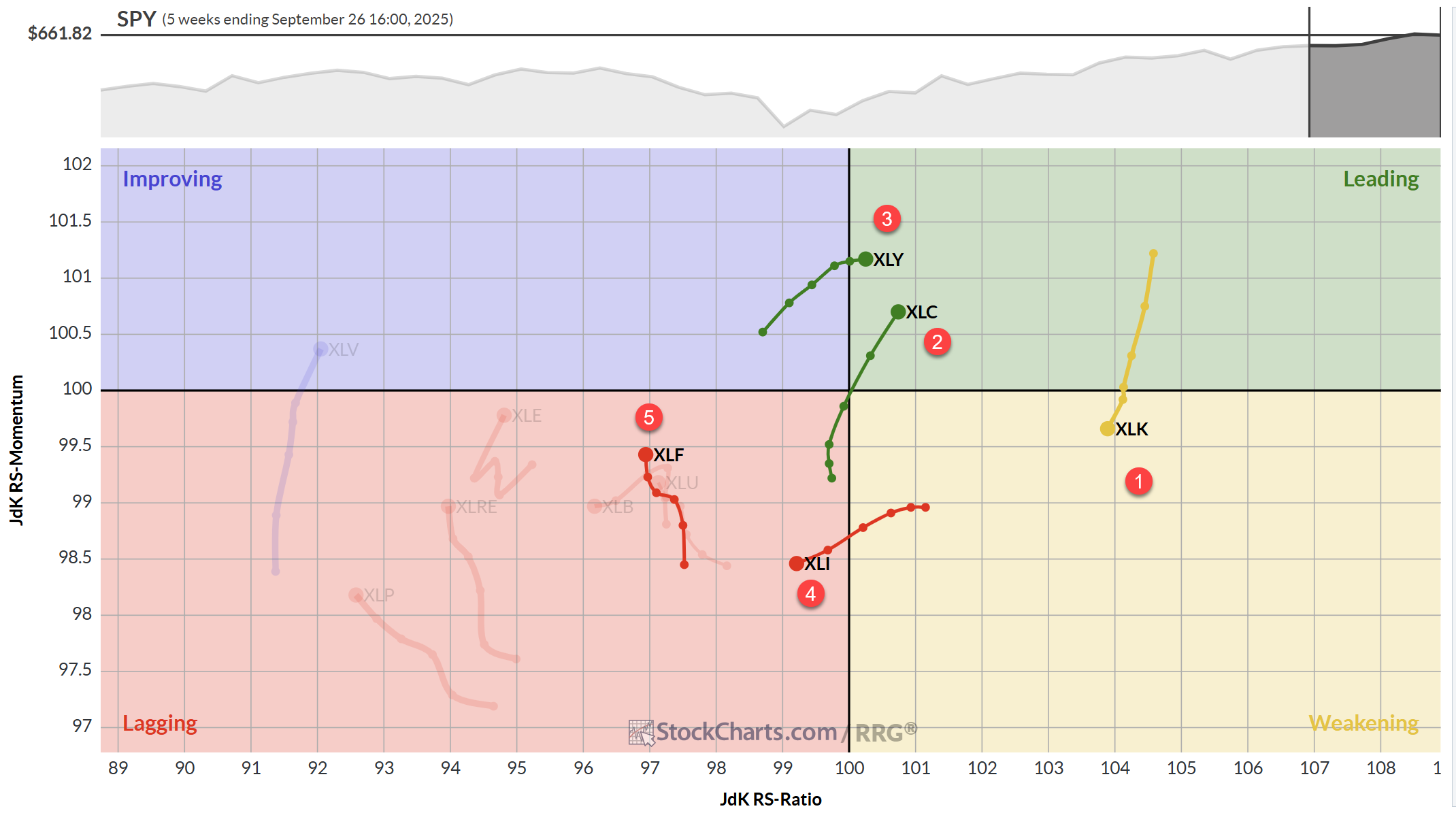

Weekly RRG

Despite its top ranking, the technology sector has dropped into the weakening quadrant; however, based on its high RS-Ratio reading, this is not too alarming for the time being.

Communication services (XLC) is flexing its muscles, pushing further into the leading quadrant with increasing RRG velocity. Consumer discretionary is also making moves, crossing into the leading quadrant and showing the highest RS momentum in this universe.

Industrials, sitting at number four in the rankings, has crossed into the lagging quadrant and seems to be digging in deeper.

Meanwhile, the financial sector, also in lagging territory, is continuing its upward trajectory on the RS momentum scale. Keep an eye on financials; they might soon make a comeback into the improving quadrant.

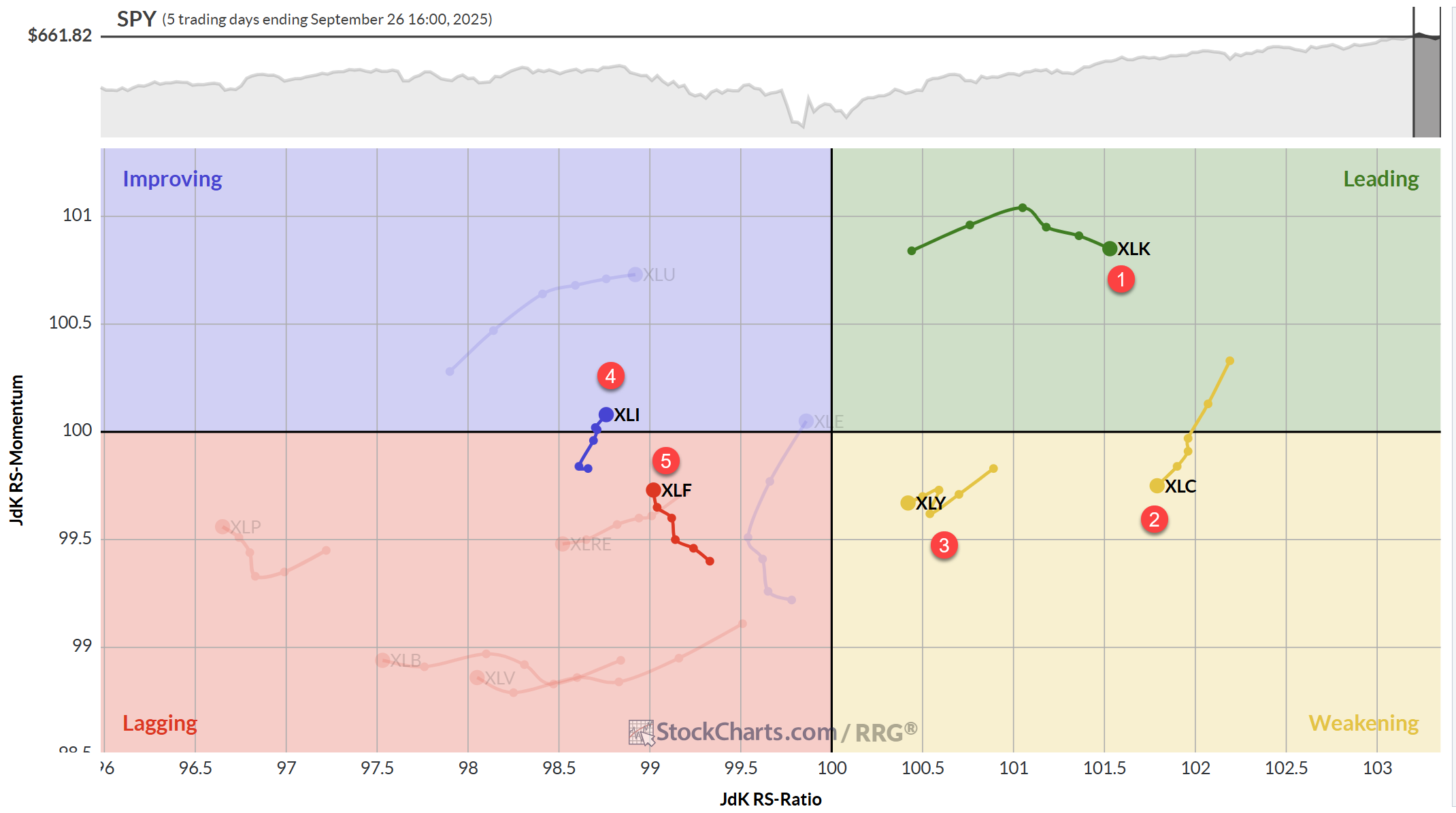

Daily RRG

Zooming in on the daily RRG, we see technology standing alone in the leading quadrant. It's showing the highest RS-ratio and RS momentum readings, though the momentum is slightly dipping. However, there's no need for concern (yet), particularly given its overall strength.

Communication services has taken a brief detour into the lagging quadrant, but its high RS ratio reading suggests we might see a leading-weakening-leading rotation. This aligns nicely with the strength we're observing on the weekly chart.

Consumer discretionary is flirting with the 100 level on the RS ratio scale but remains in the weakening quadrant. There's still a chance for it to rotate back up, which would sync with its strong showing on the weekly RRG.

Industrials are showing some life on the daily chart, crossing into the improving quadrant with a strong RRG heading. If it can maintain this momentum, it might just drag that weaker weekly tail around.

The financial sector, although positioned in the lagging quadrant on the daily RRG, is starting to gain relative momentum, mirroring its behavior on the weekly charts. This dual momentum could be the precursor to renewed relative strength for financials in the near future.

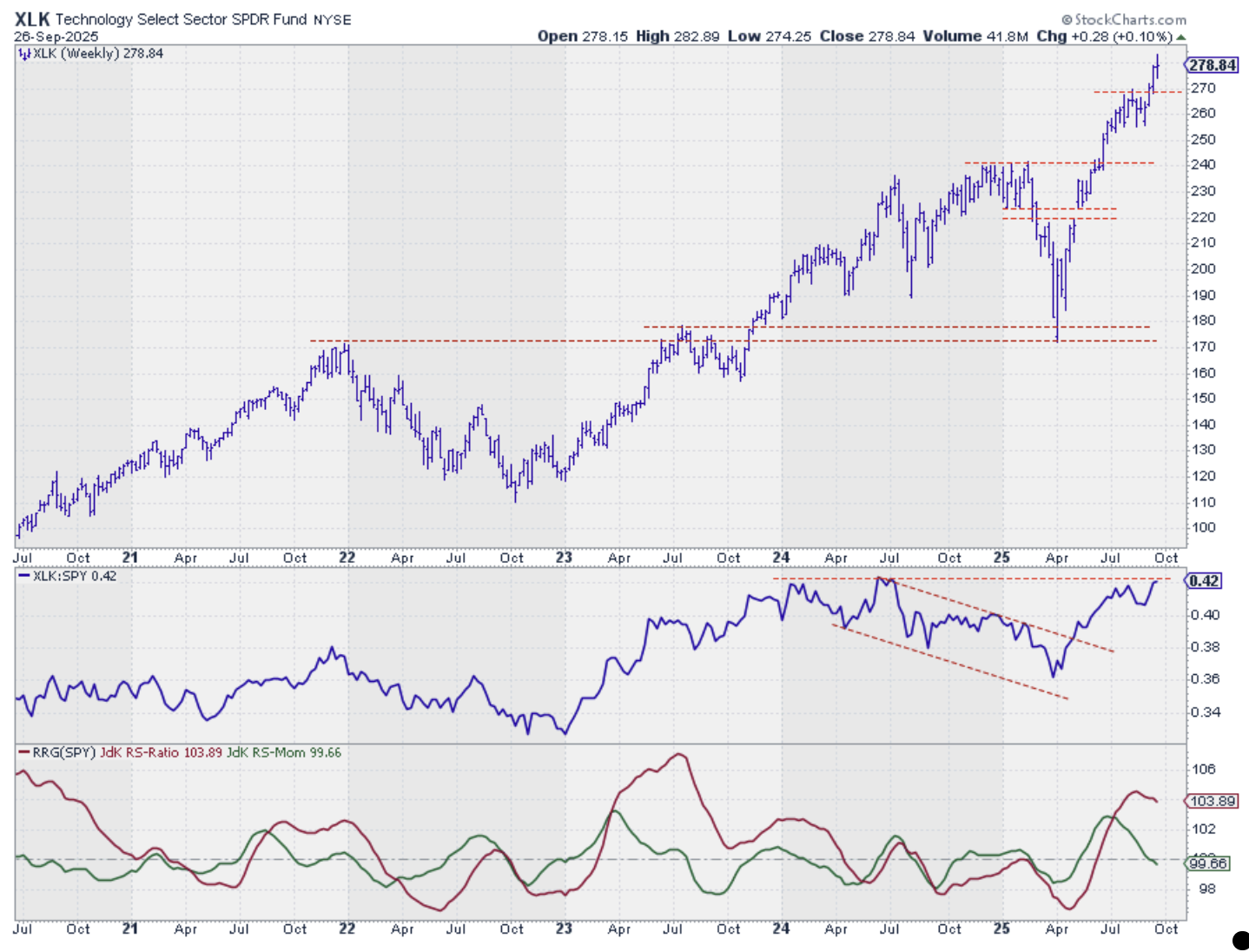

Technology

Tech continues its upward march, closing the week around the same level after a nice push higher.

The raw relative strength is knocking on the door of its previous high; a breakout here could unlock a new wave of relative strength for the sector.

Communication Services

After its breakout, communication services is holding steady and continuing to climb. The raw relative strength line is also pushing higher, having broken out of its narrow range. This combination is pulling both RRG lines higher, creating that strong 45-degree angle on the RRG chart that we love to see.

Consumer Discretionary

Consumer discretionary had a bit of a roller coaster week, dipping below the previous high but recovering to close in the upper half of the bar. This resilience is a good sign; it suggests the previous resistance level, now support, is holding firm. The raw relative strength line is following suit, propelling the RRG lines higher and pushing the sector into the leading quadrant.

Industrials

Industrials, along with financials, are the weaker links in the top five. However, we're seeing a potential upward breakout from a triangle formation on the price chart, which is good news for the price action.

The raw RS line appears to be finding support at its old rising trendline, but we'll need more confirmation before getting too excited. If the RS line can bounce and start moving higher, it could pull both RRG lines up and bring the sector back to the right side of the graph.

Financials

The financial sector is still grinding higher in what might be developing into a rising wedge, typically a bearish pattern, but it is too early to make that call.

What's clear is the downtrend in raw relative strength, keeping the RS ratio line well below 100. The recent stabilization in relative strength is causing the momentum line to tick up slightly, but, with both lines below 100, financials are still camped out in the lagging quadrant.

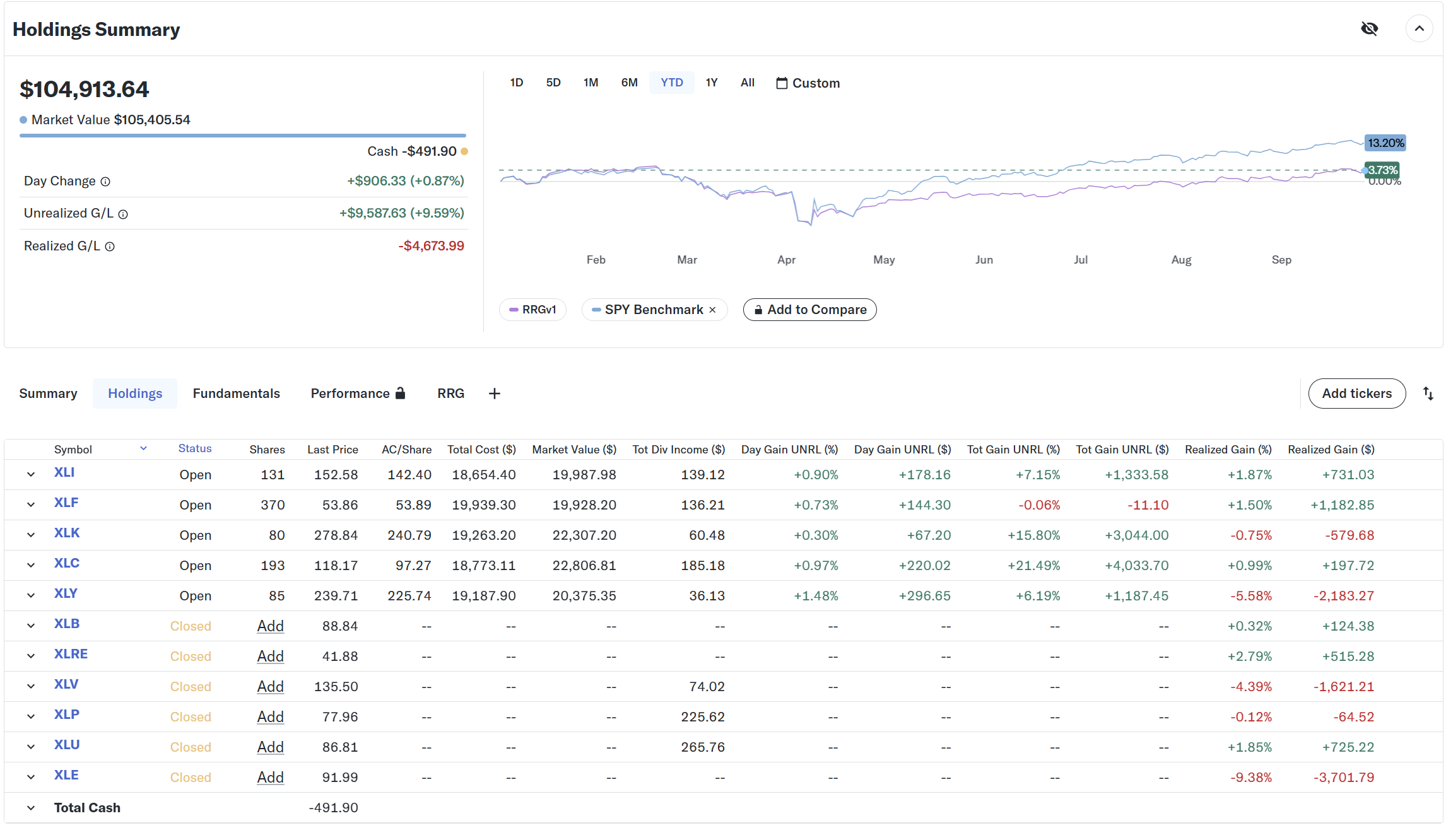

Portfolio Update

At the portfolio level, not much has changed; we're still trailing the S&P by about 9%. But following a strategy means following a strategy, right? We're sticking to the plan and counting on it to pick up steam in the future.

#StayAlert, -Julius