The Best Five Sectors This Week, #47

Key Takeaways

- Top five sectors remain unchanged in composition despite S&P 500 gains

- Health Care leads with strong momentum on both weekly and daily timeframes

- Technology holds the number two spot but shows initial relative weakness

- Utilities surge to third position with confirmed strength across timeframes

- Communication Services is weakest in the top five, with conflicting signals between weekly and daily RRGs

Sector Rankings Hold Steady

After a strong week for the S&P 500, sector rankings showed only marginal adjustments. The composition of the top five and bottom six sectors remained unchanged. The only notable shift occurred within the top group: Utilities advanced from fifth to third place, pushing Energy and Communication Services down to fourth and fifth, respectively. Health Care continues to hold the top position, followed by Technology in second. Below the top five, the order remains Consumer Discretionary, Industrials, Financials, Real Estate, Materials, and Consumer Staples.

- (1) Health Care - (XLV)

- (2) Technology - (XLK)

- (5) Utilities - (XLU)*

- (3) Energy - (XLE)*

- (4) Communication Services - (XLC)*

- (6) Consumer Discretionary - (XLY)

- (7) Industrials - (XLI)

- (8) Financials - (XLF)

- (9) Real-Estate - (XLRE)

- (10) Materials - (XLB)

- (11) Consumer Staples - (XLP)

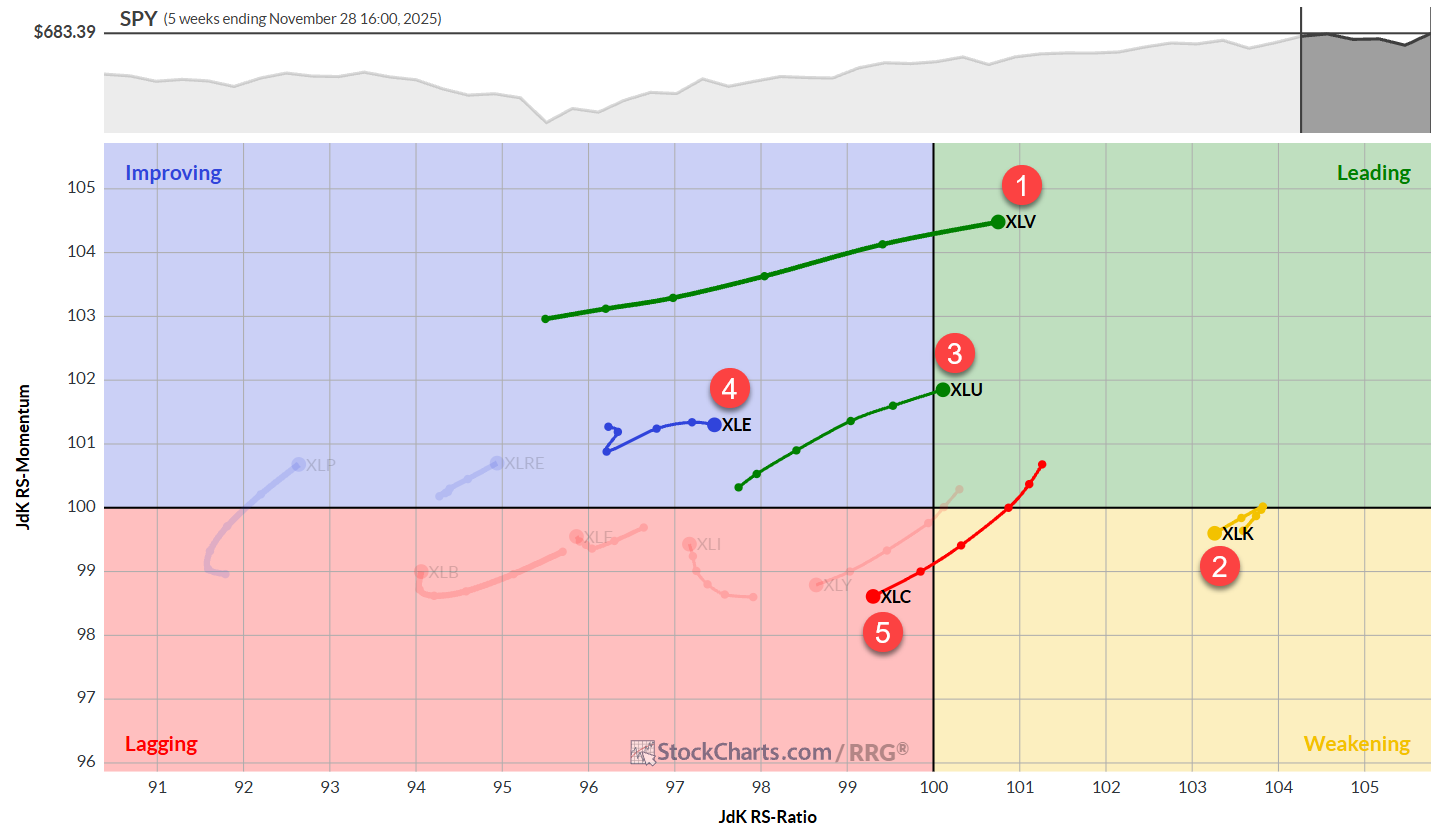

Weekly RRG

The weekly Relative Rotation Graph shows a robust tail and strong heading for Health Care, which maintains clear leadership. Utilities is strengthening as well, rotating into the Leading quadrant at a positive RRG heading.

Technology remains on the right-hand side of the plot at a high RS-Ratio level, but is positioned inside the Weakening quadrant and moving at a negative heading.

Energy remains inside the Improving quadrant, rising on the RS-Ratio axis while RS-Momentum stabilizes rather than rises. Communication Services is now the weakest member of the top five on the weekly scale, having rotated into the Lagging quadrant.

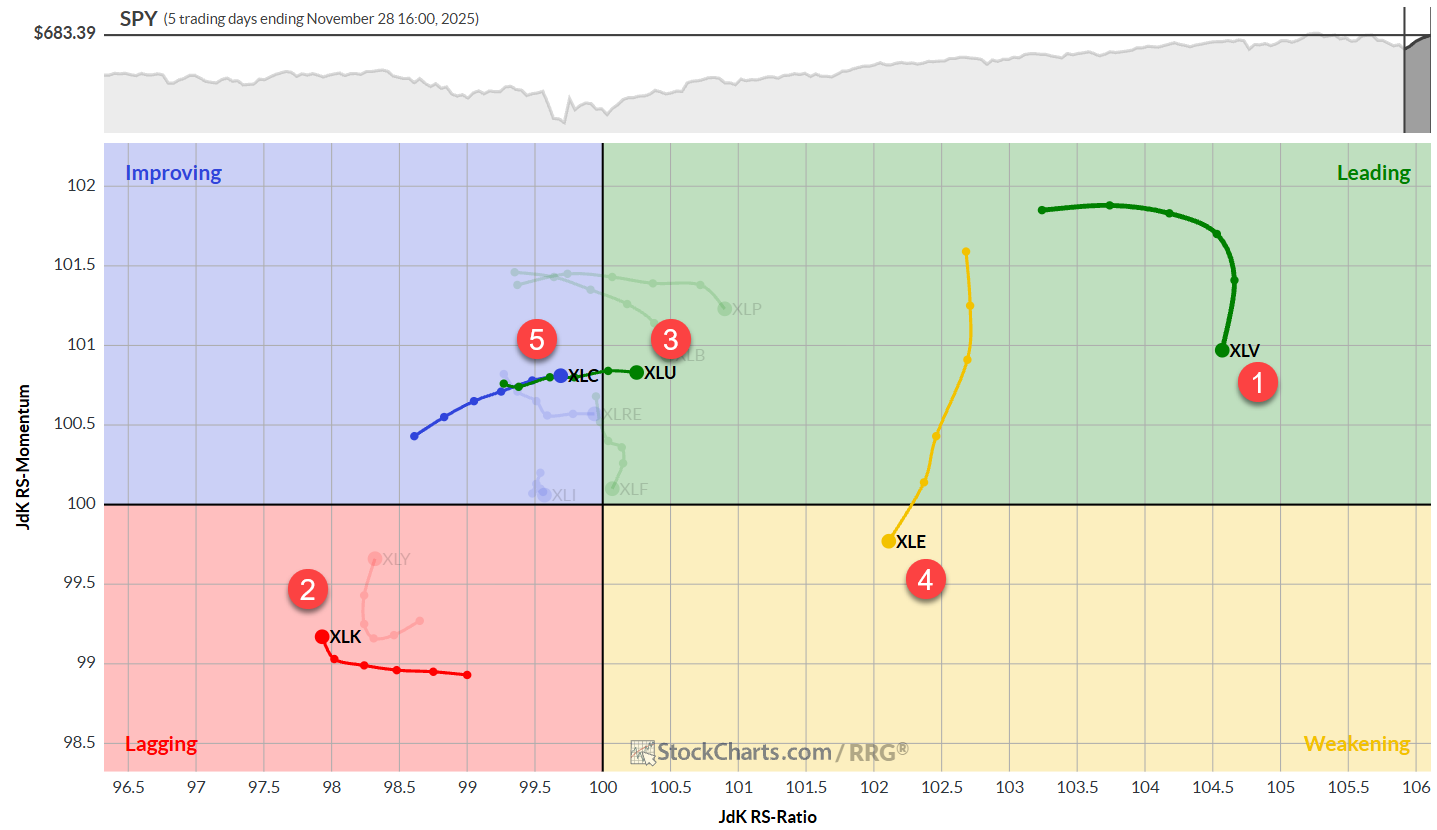

Daily RRG

On the daily RRG, Health Care is the strongest sector, positioned deep inside the Leading quadrant, though it is beginning to roll over and lose relative momentum on this shorter time frame.

Technology, which ranks second on the overall list, appears in the Lagging quadrant and is only gradually recovering relative momentum. Its RS-Ratio reading, however, remains the lowest across all sectors on the daily time frame.

Utilities is confirming the strength seen on the weekly graph by moving into the Leading quadrant on the daily RRG as well. Energy rotated from Leading into Weakening but continues to maintain a strong RS-Ratio reading, reinforcing its position inside the top five when combined with its weekly strength.

Communication Services shows a stark contrast between time frames: while the weekly tail is weak and pressing deeper into Lagging, the daily tail is inside Improving and pushing toward Leading. The combination keeps the sector in the top five for now.

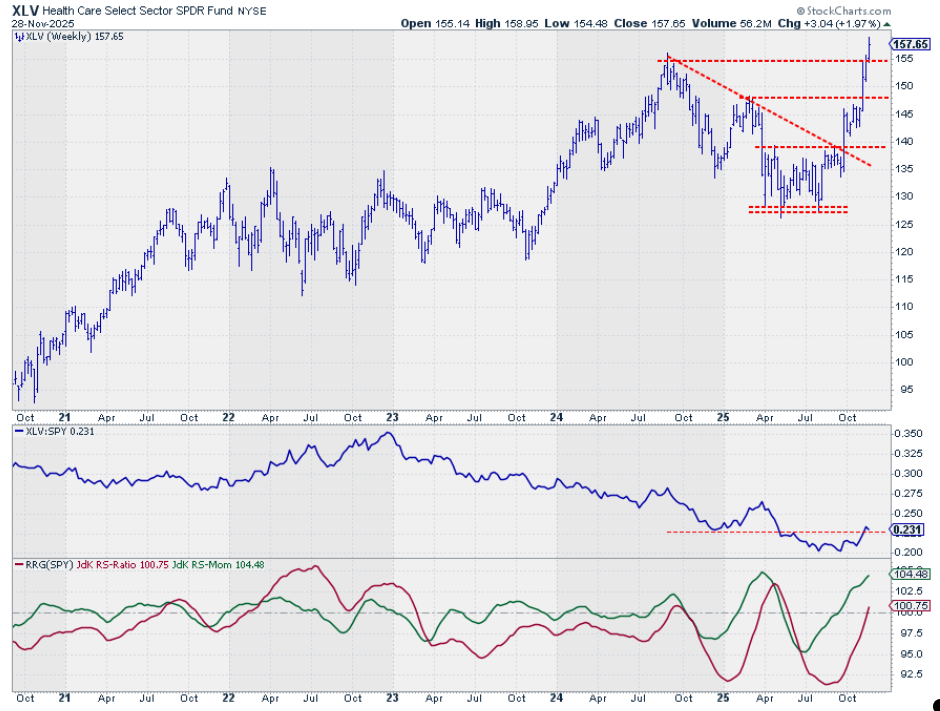

Health Care

Healthcare is now leading both the ranking and its price chart. The sector is holding firmly above its breakout level, with the area around 155 acting as solid support.

The advance in price is lifting the raw RS line, pulling both RRG-Lines above 100, and positioning XLV inside the Leading quadrant.

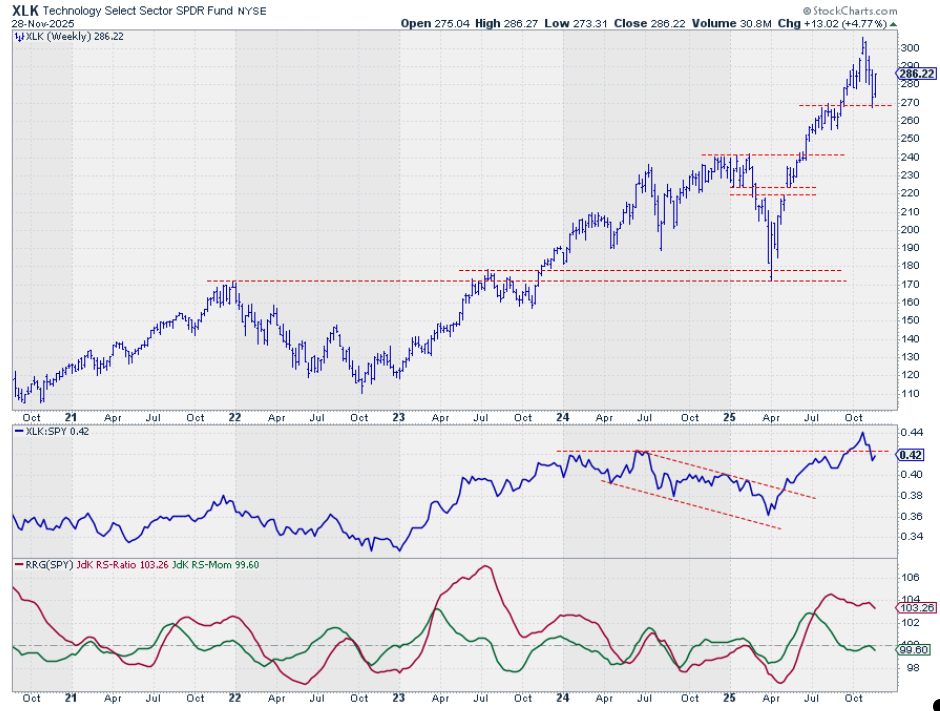

Technology

Technology held support just below 270 and is currently rallying. However, the raw RS line has slipped below its own support level, indicating early signs of relative weakness.

Both RRG-Lines are responding accordingly by turning lower. The RS-Momentum line (green) has already dipped below 100, placing XLK inside the Weakening quadrant.

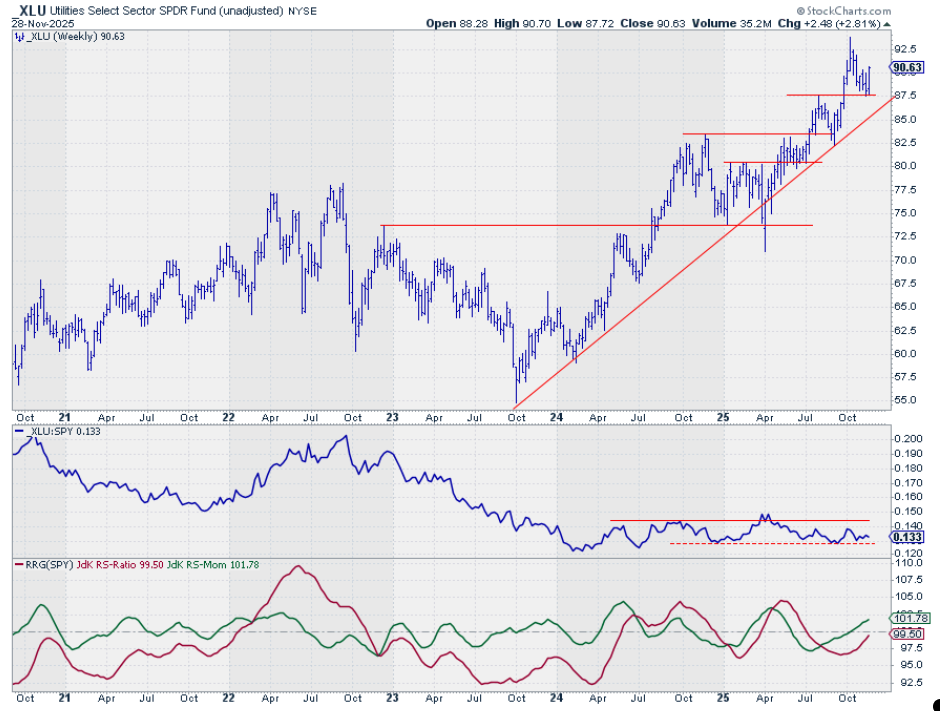

Utilities

Utilities continues to perform well. The sector respected support in the 67–87.5 range and ended the week near the high of the week’s bar, underscoring a gradual improvement in relative strength.

Both RRG-Lines are rising, and the RS-Ratio line is on the verge of breaking above 100.

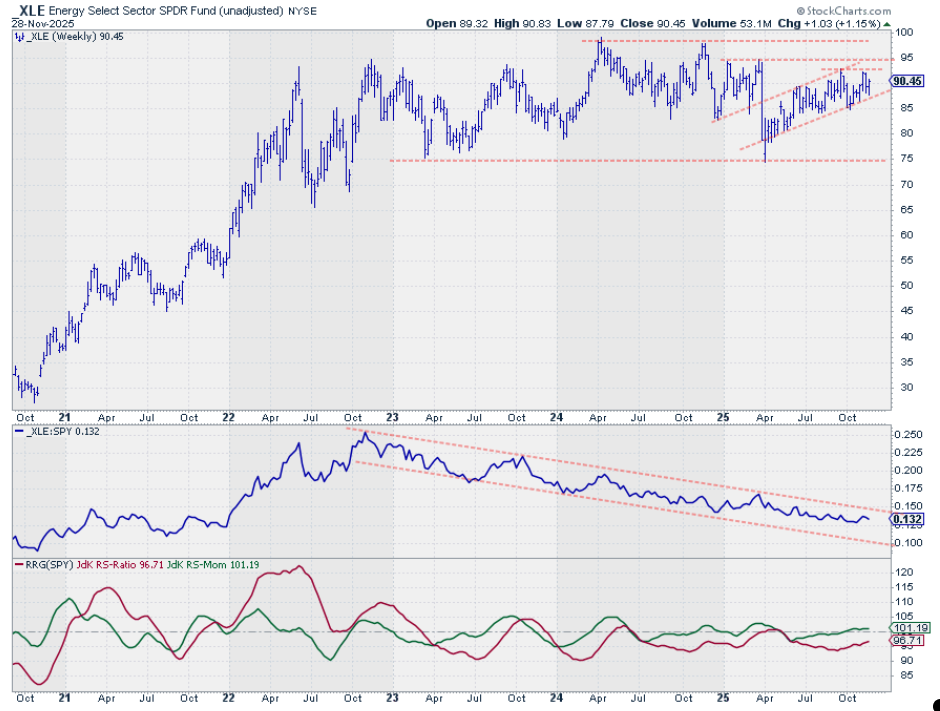

Energy

Energy remains within a shallow rising price channel, which is constructive. The raw RS line has flattened, resulting in a sideways RS-Momentum line.

Over time, this stability is slowly pulling the RS-Ratio line higher and keeping Energy inside the Improving quadrant.

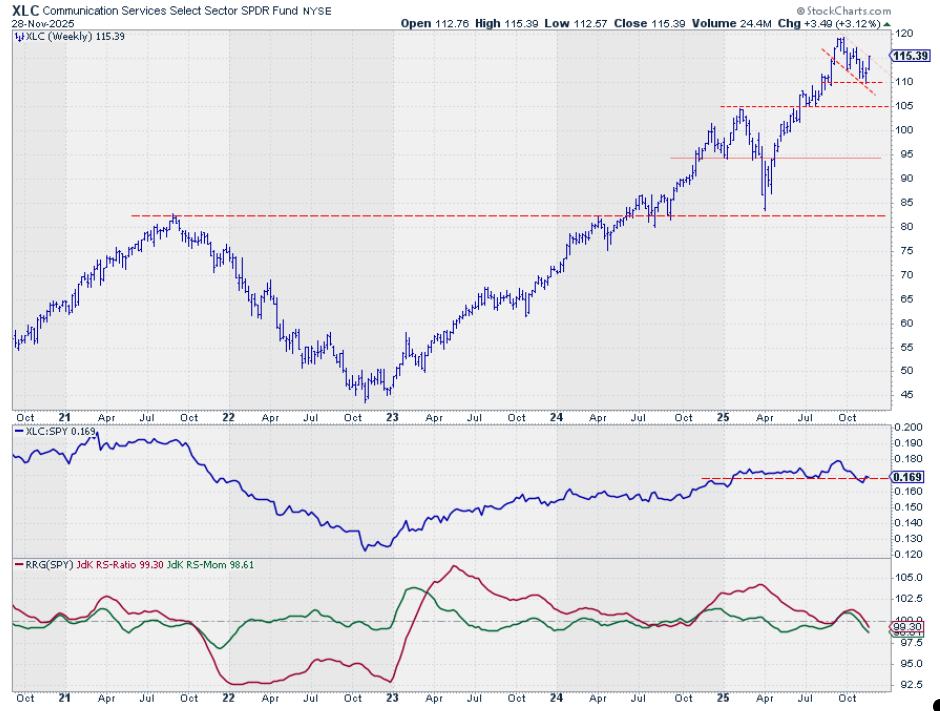

Communication Services

Communication Services has slipped further in the rankings. XLC recently bounced off support near 110.

The corrective phase that began in October, following the new all-time high, could form a flag-like continuation pattern if a breakout follows.

However, the relative picture does not support that scenario at this time. The raw RS line is declining, and both RRG-Lines have dropped below 100, positioning the sector firmly inside the Lagging quadrant.

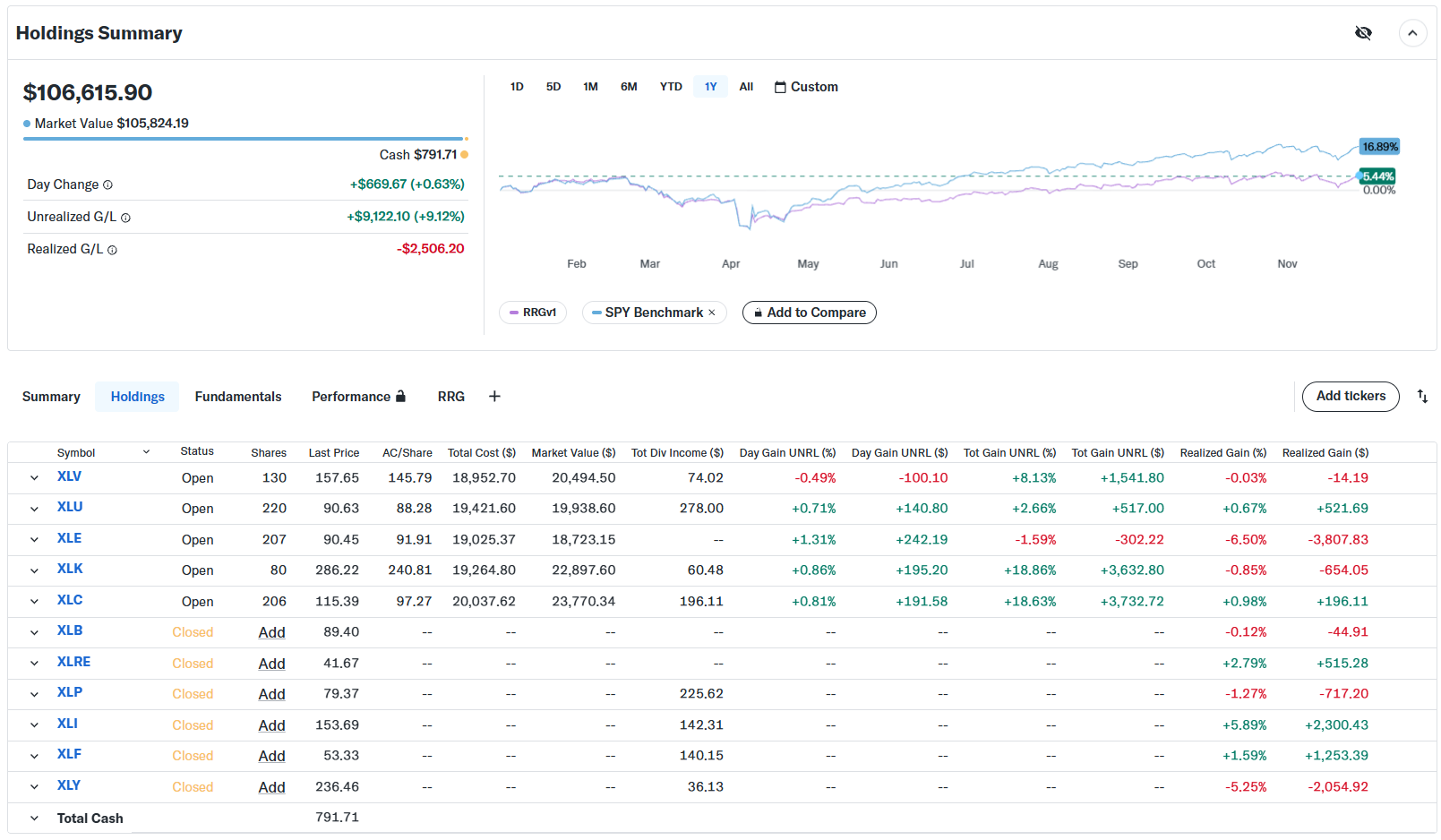

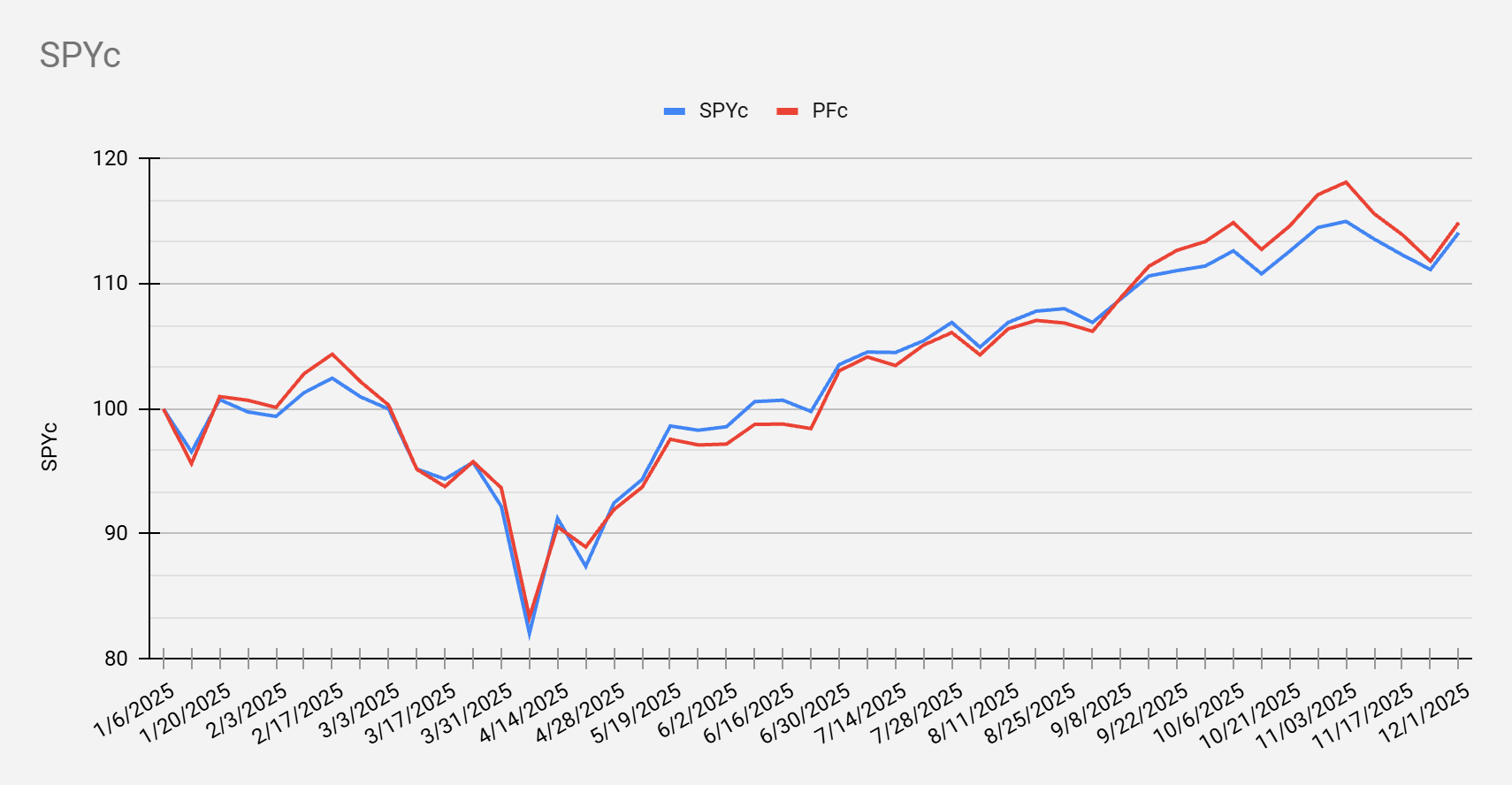

Portfolio Performance Update

The equal-weight sector portfolio posted a solid week. It continues to lag the S&P 500, but the performance gap has narrowed slightly and now sits just below 12%, around 11.5%. The cap-weighted version continues to outperform the S&P 500, with relative gains now approaching 1%.

#StayAlert and have a great week, -Julius