The Best Five Sectors This Week, #50

Key Takeaways

- Energy drops out of the top five as industrials make their entrance

- Technology is losing relative momentum rapidly on the daily RRG, a warning signal worth watching

- Consumer discretionary is playing with all-time highs, while communication services struggle to follow through

- Portfolio performance is improving, now down just 10% behind the S&P 500

Sector Rotation Update Shows Industrials Rising

Last week, the S&P 500 closed almost unchanged, while the Nasdaq 100 and technology in general showed a little uptick. This had a few implications for the composition of our sector ranking. Energy dropped out of the top 5 and was replaced by Industrials, while Consumer Discretionary and Communication Services swapped places.

This leads to the following ranking: Technology remains firmly at number one, followed by Health Care at number two, Consumer Discretionary at three, and Communication Services at four.

Industrials enter the top five from six, while financials rise to number six from number seven. Energy, which had just entered the top five last week, has now dropped to number seven.

Utilities remain at eight, and materials, staples, and real estate hold steady at nine, ten, and eleven.

- (1) Technology - (XLK)

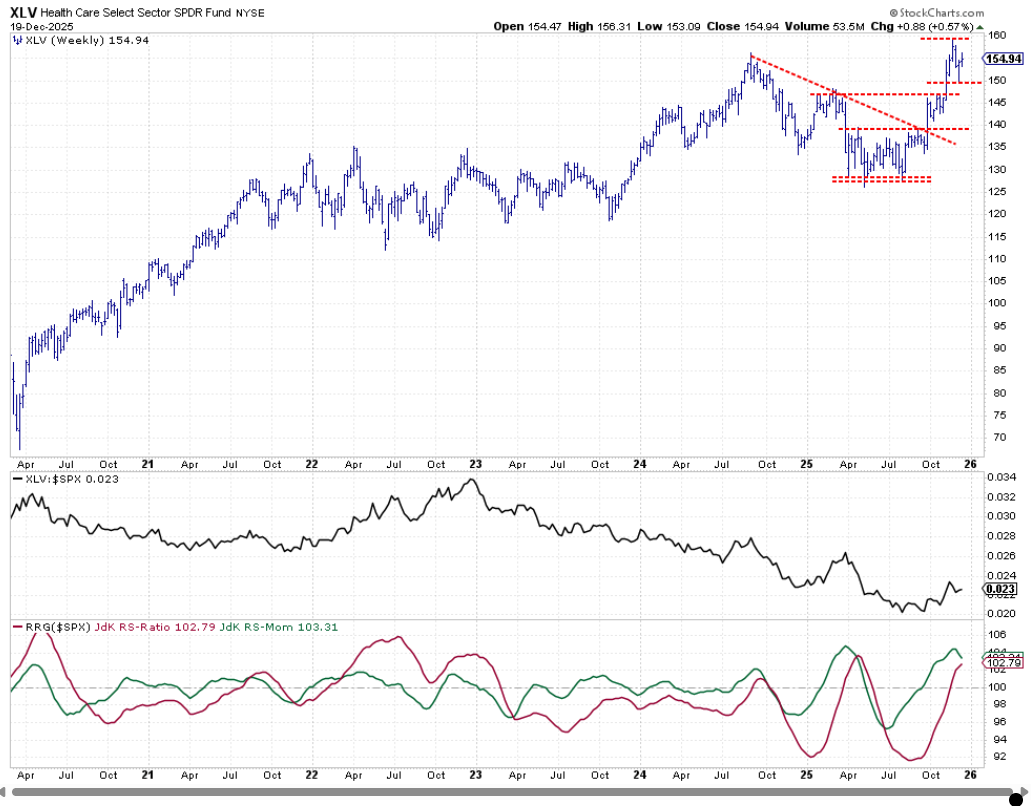

- (2) Health Care - (XLV)

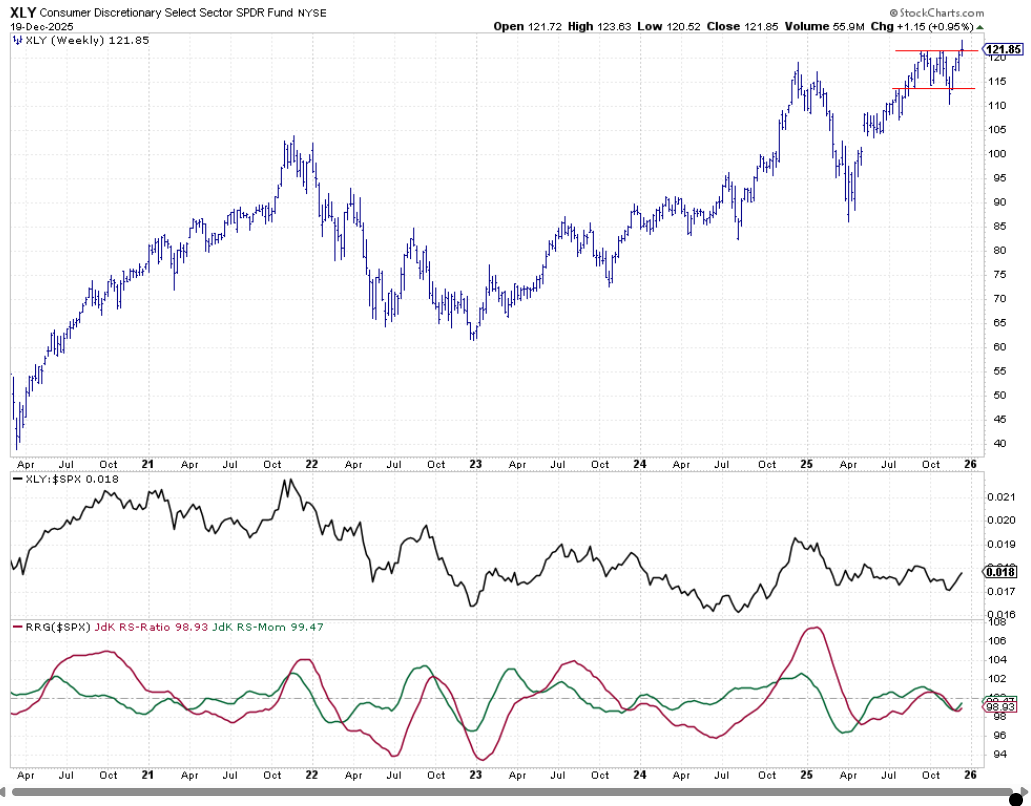

- (4) Consumer Discretionary - (XLY)*

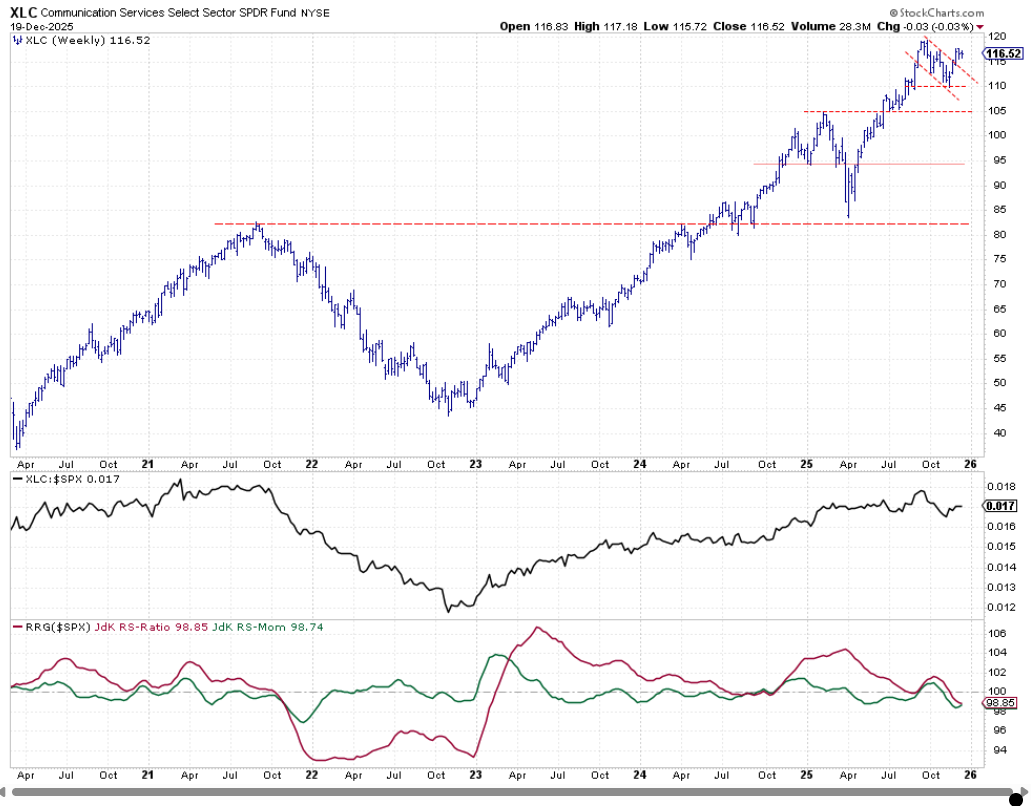

- (3) Communication Services - (XLC)*

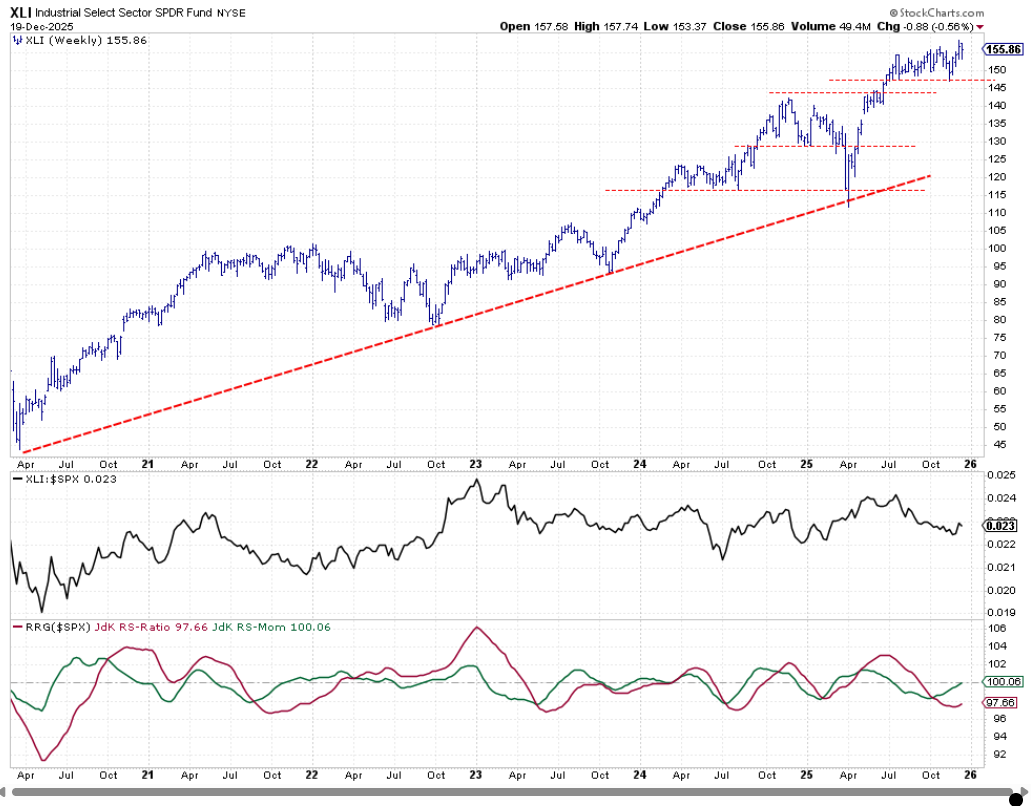

- (6) Industrials - (XLI)*

- (7) Financials - (XLF)*

- (5) Energy - (XLE)*

- (8) Utilities - (XLU)

- (9) Materials - (XLB)

- (10) Consumer Staples - (XLP)

- (11) Real Estate - (XLRE)

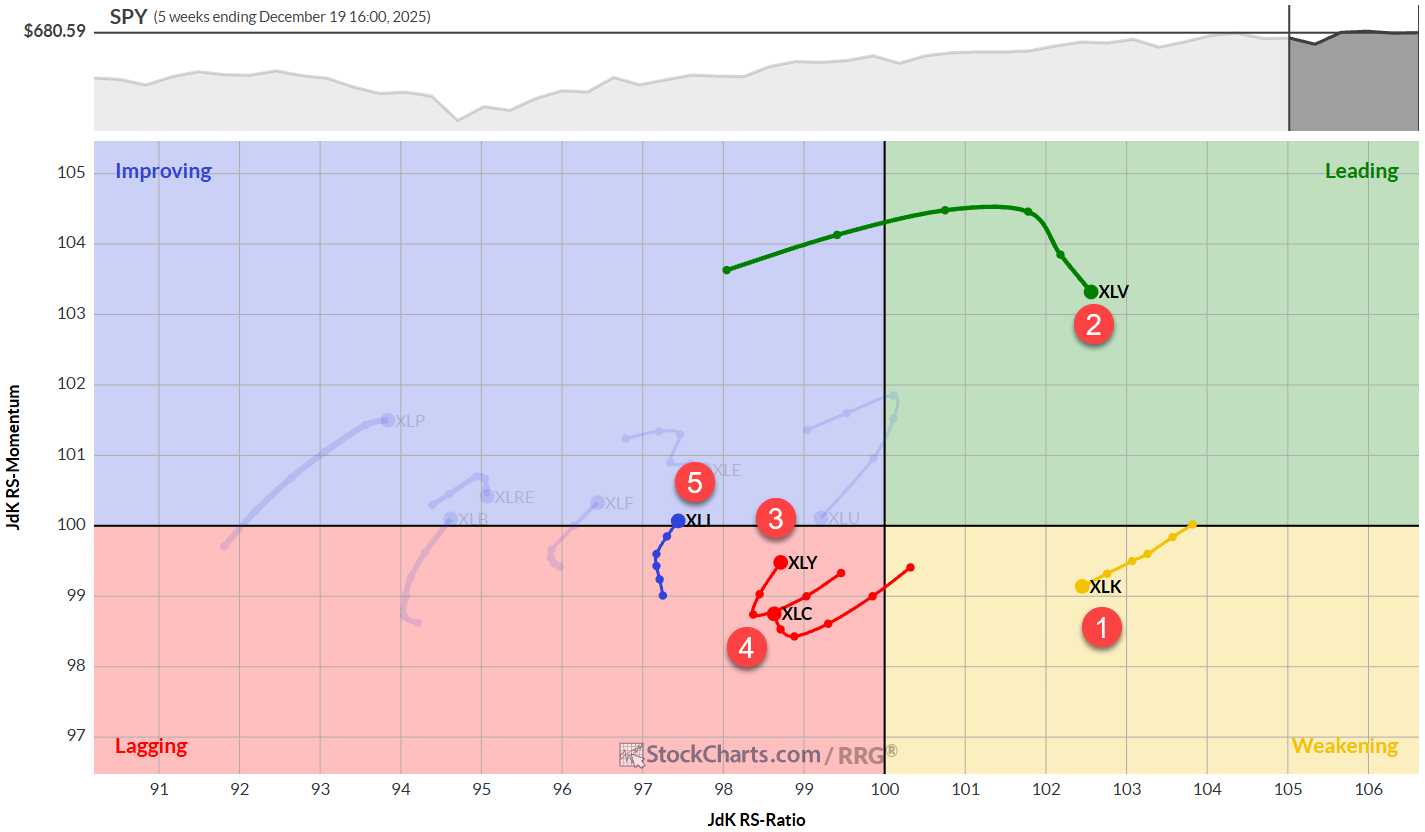

Weekly RRG

On the weekly RRG, Technology and Healthcare are positioned at the highest RS ratio levels in the universe. Technology sits inside the weakening quadrant, still heading at a negative trajectory, but that elevated RS ratio level is what's keeping it inside the top five.

Healthcare is well inside the leading quadrant and, while I've noticed it losing some relative momentum over the last few weeks, the sector continues moving higher on the RS ratio scale, a pretty solid position overall that gives confidence.

Consumer Discretionary and Communication Services are in the lagging quadrant but are turning back up, heading towards improving at a positive RRG-heading. A continuation of this rotation would bring both sectors back in sync with their weekly tails.

Industrials just crossed over into the improving quadrant, coming out of lagging at a positive heading.

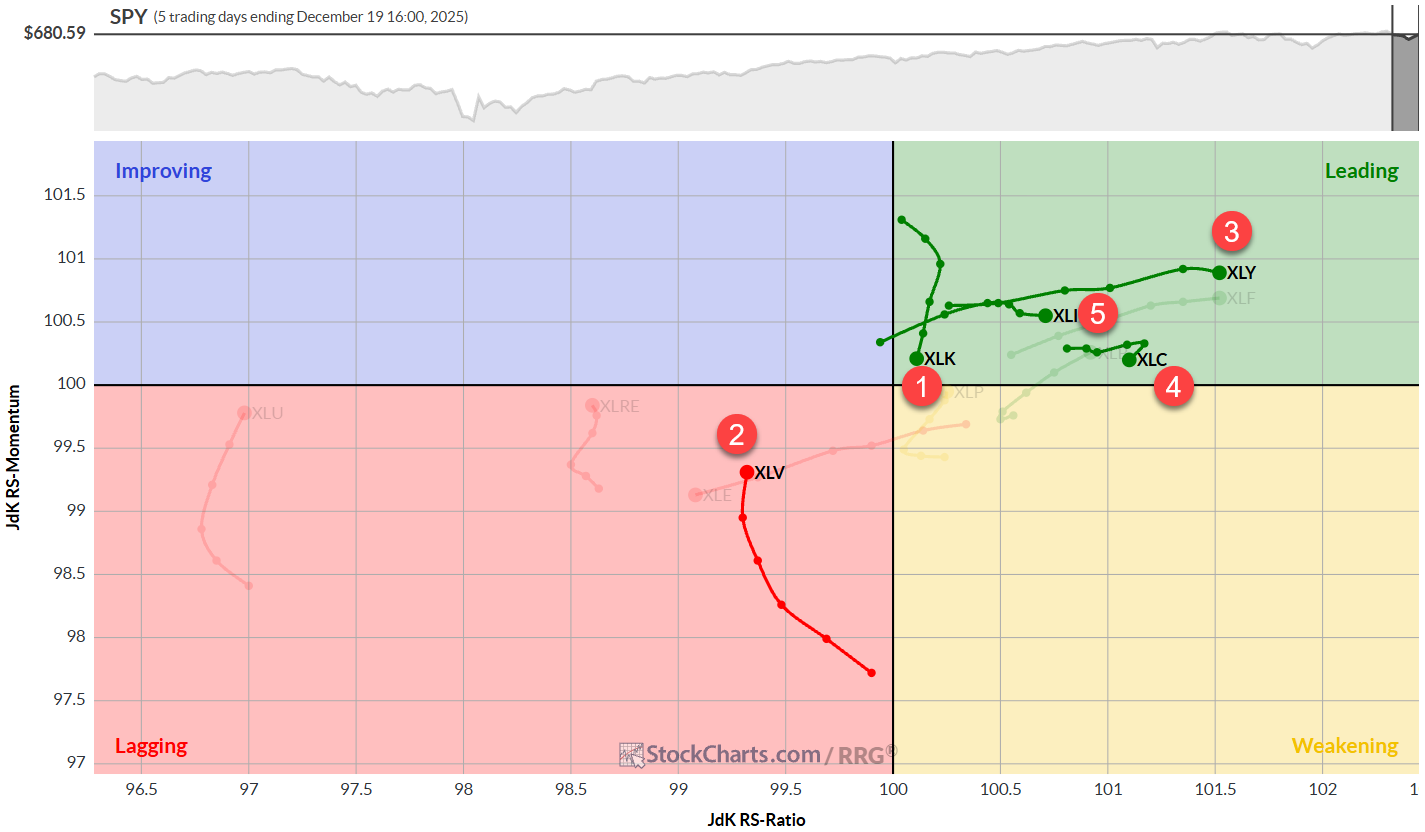

Daily RRG

The daily RRG tells a slightly different story. The technology tail has rolled over almost immediately after entering the leading quadrant and has started to lose relative momentum. That's a bit of a warning signal worth paying attention to.

Healthcare sits inside lagging but is moving higher at a mildly positive RRG heading. When I combine this with the weekly RRG, that's pretty okay – not perfect, but acceptable given the broader context.

Consumer Discretionary is leading the charge here on the daily RRG, with a high RS ratio reading and very stable momentum powered by a long tail.

Communication Services is inside leading with a sharp hook lower on Friday. That's something to be aware of but, in general, this is actually still pretty good.

Industrials is solidly inside the leading quadrant at a stable relative momentum pace and well-positioned within that quadrant.

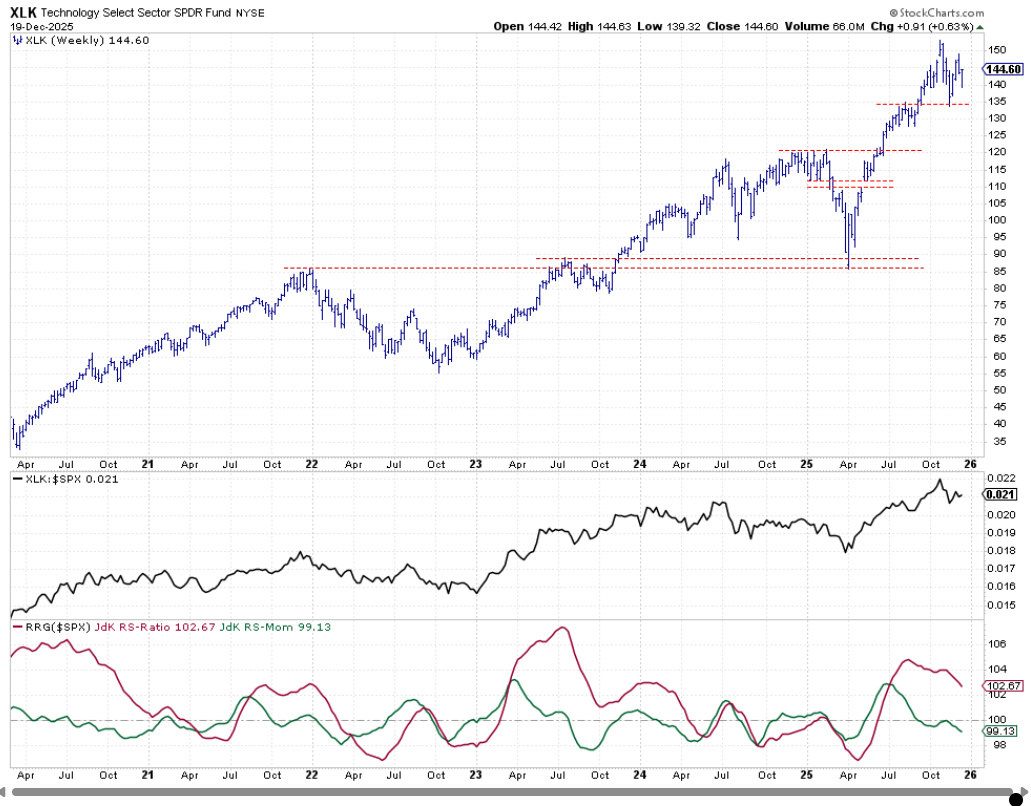

Technology

Technology is still holding up well on the price chart. We have a lower high, which is a sign of slowing down. But we're still well above the previous low, which is now our first level of support that I'm watching around 132.50.

The raw RS line is still holding above the previous resistance level, now acting as support. Both RRG lines are moving lower, indicating a loss of momentum and a bit of relative strength. As mentioned earlier, though, we're still pretty high on the RS ratio scale compared to the rest of the universe.

Healthcare

The Healthcare sector bottomed out just below 150 and started to move back up again. Once it challenges its previous high, the all-time high level, it'll become interesting for us to see what happens there.

A solid breakout above that last high will definitely add to this sector's relative strength, and I'll be watching for confirmation. The raw RS line is still in a long-term downtrend, but it looks like it has started to bottom out. We'll need to see a continuation of that to build a sustainable relative uptrend. The RS ratio remains at a decent level, but a slight loss of relative momentum is starting to show up.

Consumer Discretionary

This sector has been fascinating to watch. It's playing with its all-time high levels, dancing around resistance in a way that keeps me on the edge of my seat. If we can see a solid break — preferably a Friday close well above that 122 resistance area — it'll trigger more upside potential. I've seen this pattern play out many times before, and the anticipation never gets old.

The raw RS line is still in somewhat of a trading range. But inside that trading range, we're moving slowly higher, and that's indicated by both RRG lines that are starting to move upward.

Communication Services

The Communication Services sector has broken out of its flag-like pattern, but it's failing to show solid follow-through with an aggressive rise. That would be the expected behavior after a pattern like that, and the lack of it has me questioning the strength of this move.

We're now looking for a break of the previous all-time high level around 120. That is needed to reestablish that overall relative strength versus the rest of the universe. For the time being, communication services is the sector that has been in the top five the longest; because of that, it's still holding up.

I can see some weakness also in the raw RS line, which has broken its trend line. That has caused both RRG lines to drop below 100, where we now see a slight improvement. The question is whether that is the first improvement in a newly established downtrend from a relative perspective, or a turnaround back to a longer-term relative uptrend?

Industrials

Industrials broke above resistance last week but was barely able to hold it this week. So it's gonna be questionable whether this is enough to keep the industrial sector inside the top five.

That's also seen in the strength line, which has shown a small uptick after a few months of moving lower. This has caused the RRG lines to turn back up. Relative momentum is just above 100, which positions industrials inside the improving quadrant. But we do need to see more follow-through from the RS ratio line to get confirmation.

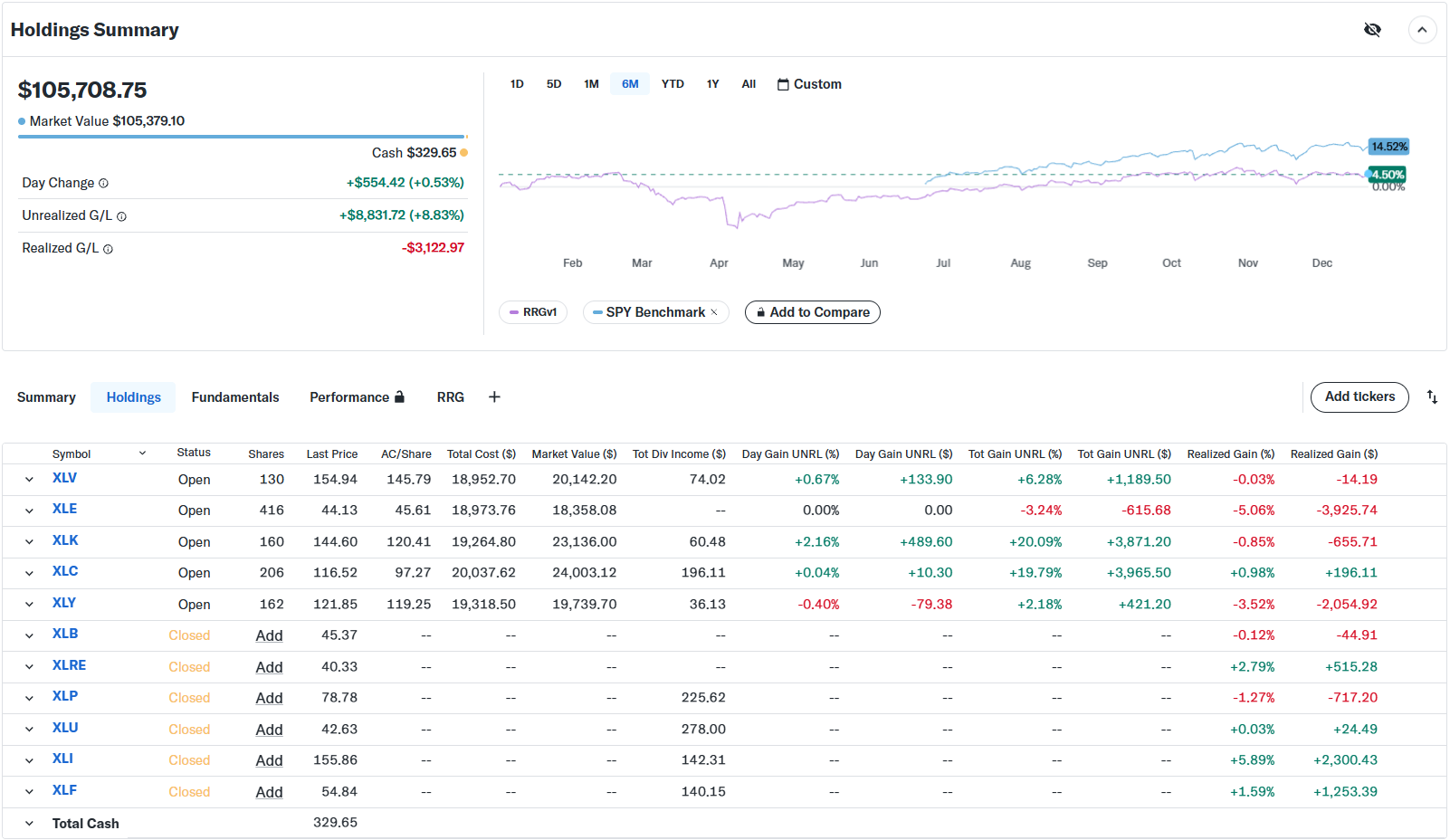

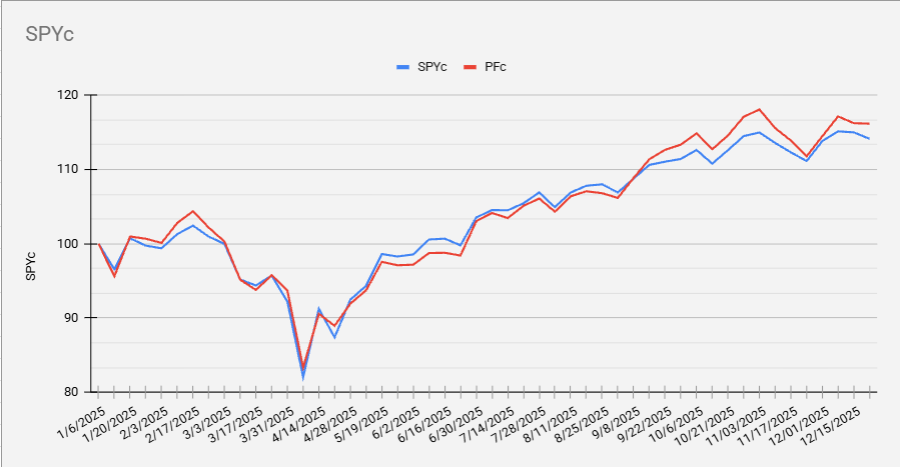

Portfolio Performance

The portfolio continues to improve on an equal-weight footing. We're now down to 10 percentage points behind the S&P 500. That has been 12, almost 13 earlier, so that performance is picking up a little bit, which is encouraging to see.

The cap-weighted performance continues to be slightly above the S&P 500 and maintaining current strength.

#StayAlert and have a great week.