The Best Five Sectors This Week #52

Key Takeaways

- Energy took the lead during my absence.

- We can see strong rotations on weekly RRG for XLB, XLI, and XLE.

- Technology and Communication Services dropped out of the top 5 after long stints.

- Both cap-weight and equal-weight remain behind the S&P 500.

Energy Takes the Lead as Technology Falters

The last article in this series was published at the end of last year (on December 29, to be exact). At that time, the best five sectors were led by Health Care, followed by Technology, Consumer Discretionary, Communication Services, Financials, Industrials, Materials, Utilities, and Energy. Consumer Staples and Real Estate were the last sectors in the ranking.

I have reconciled the rankings since then, and the image with the rankings shows how the changes have occurred over the last six weeks.

You can follow the colors and see how the various sectors have moved through the ranking. For example, Technology moved out of the top five at the start of this week. Energy, which ranked ninth on December 29, rose to the top, reaching number one on February 2. Things moved very quickly.

Let's pick up where we left off and start publishing the best five sectors on a weekly basis again. At the start of this week, the ranking was as follows:

- Energy - XLE

- Materials - XLB

- Industrials - XLI

- Health Care - XLV

- Consumer Staples - XLP

- Communication Services - XLC

- Technology - XLK

- Consumer Discretionary - XLY

- Financials - XLF

- Utilities - XLY

- Real Estate - XLRE

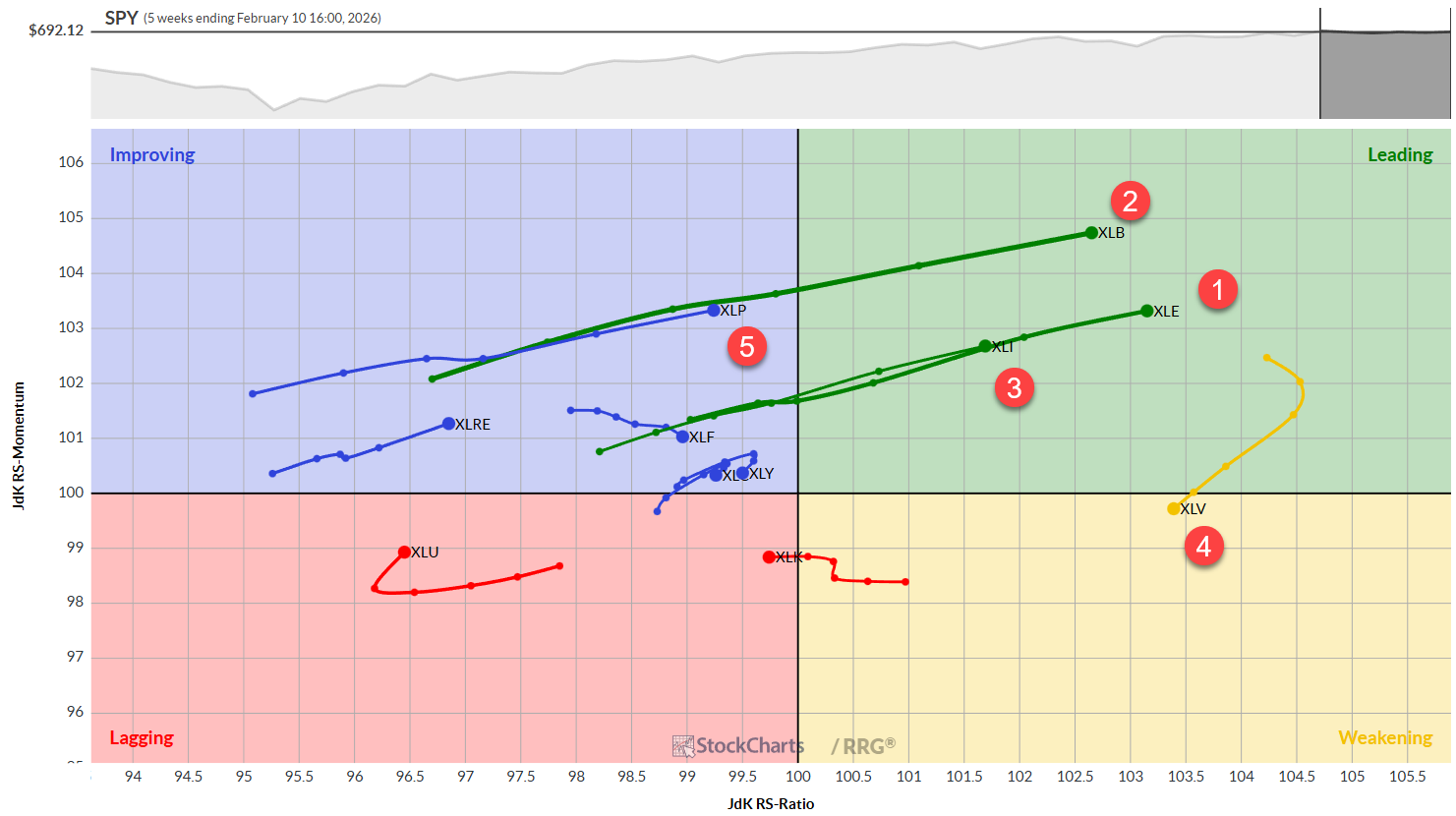

The Weekly RRG

When we plot those sectors on the weekly RRG, we see incredible strength with long green tails for sectors like Materials, Energy, and Industrials. Consumer Staples is following suit inside the improving quadrant. The Health Care sector, currently ranked fourth, moved out of the leading quadrant into weakening, but still has the highest RS ratio on this weekly timeframe.

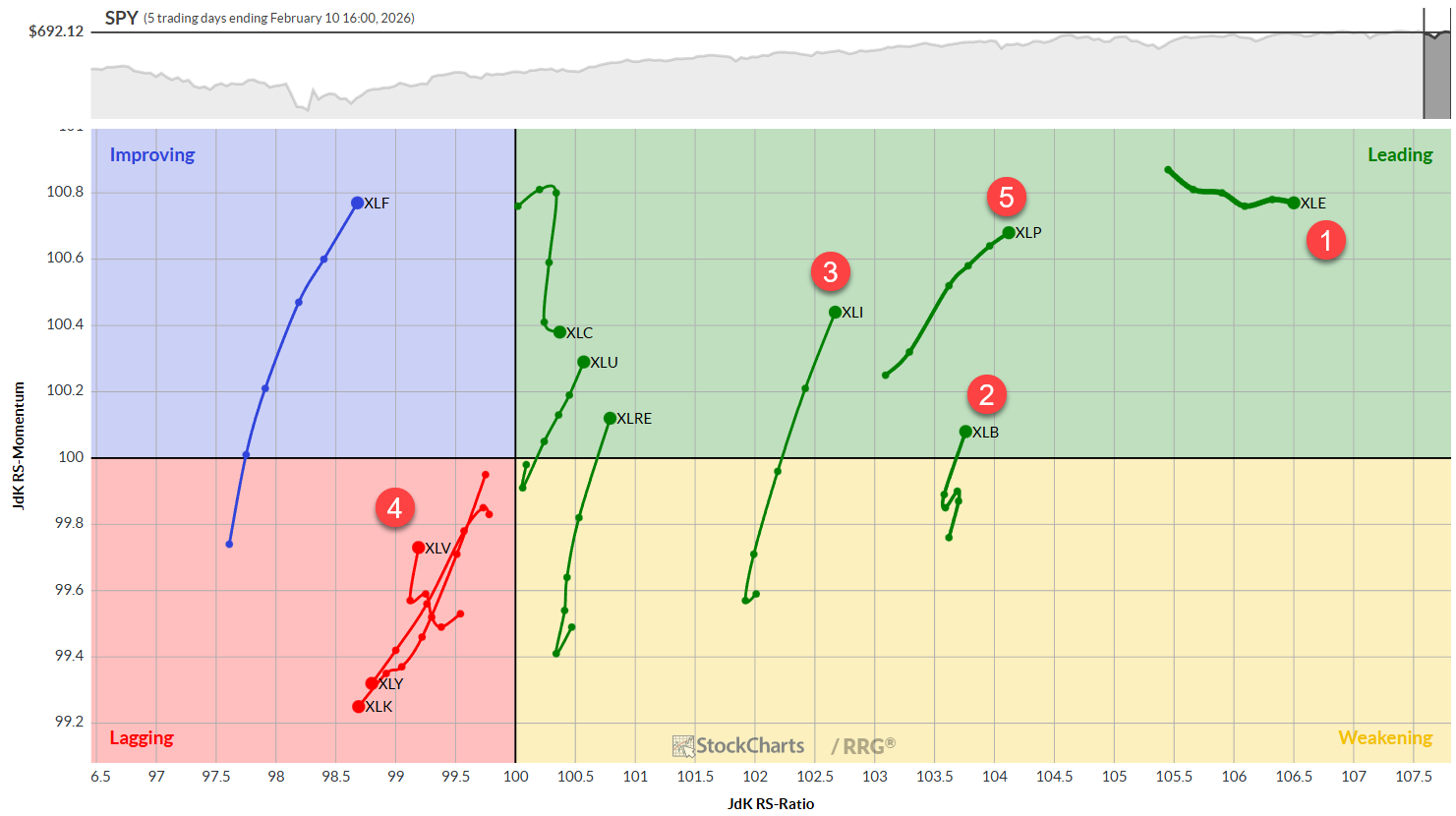

The Daily RRG

On the daily RRG, energy is confirming its strength with the highest RS-ratio reading, deep inside the leading quadrant, and still moving higher on the RS-ratio scale.

Materials, number two, is rotating back into the leading quadrant from weakening. Industrials are making a similar move from weakening back into leading. Consumer Staples, the number five sector, is stable in the leading quadrant and continues to move higher on the RS-ratio scale.

The only sector on this daily RRG inside the lagging quadrant is Health Care, still inside the top five at position number four, and it has already started to pick up relative momentum again.

The big losers over the last few weeks are technology and consumer discretionary. On the weekly RRG, technology has moved into the lagging quadrant, while consumer discretionary has rolled over back down towards the lagging quadrant. On the daily chart, that's even more visible, with technology and consumer discretionary deep inside the lagging quadrant and heading further into it.

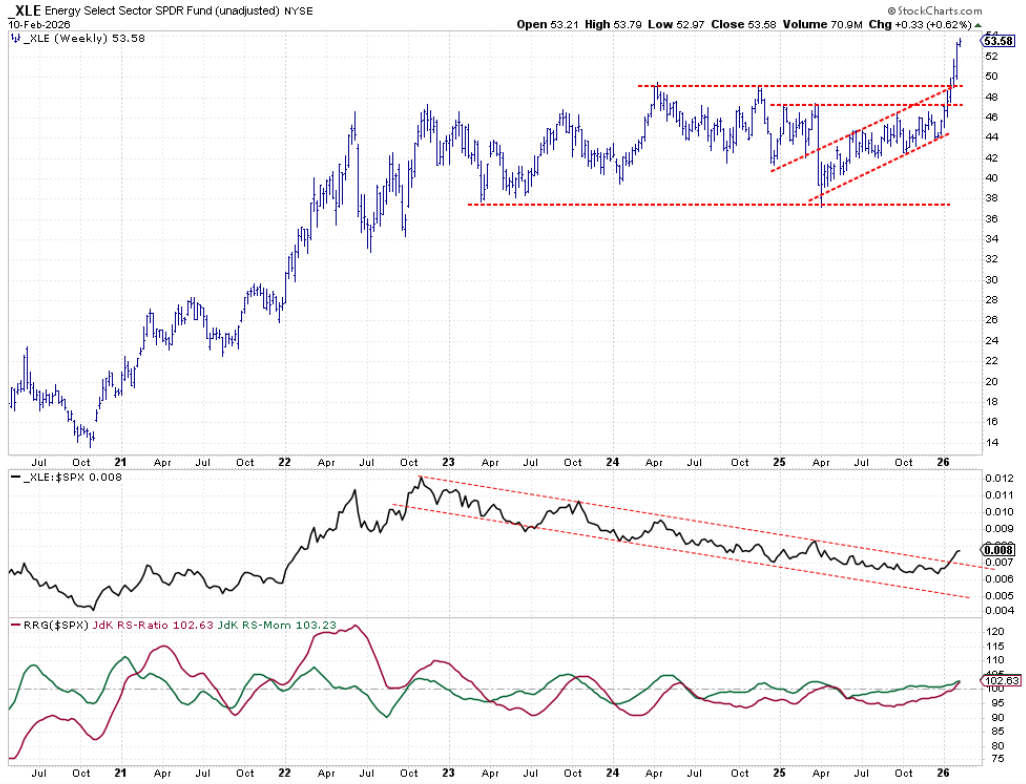

Energy

The Energy sector broke out of a broad trading range at the end of January with a strong follow-through, pushing to new all-time highs every week since.

More importantly, the move in the raw relative strength line shows the steady downtrend that started at the end of 2022 has been broken to the upside, and the RRG lines are following through, both moving above 100, positioning the energy tail inside the leading quadrant.

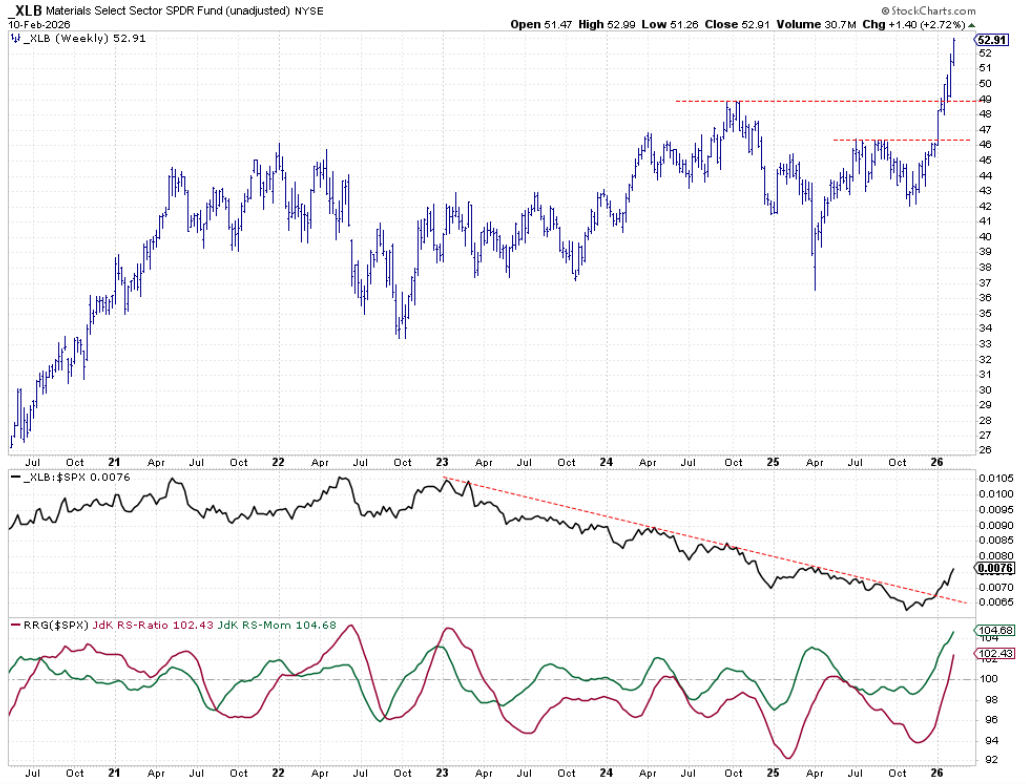

Materials

The Materials sector also showed a strong breakout at the end of January, with follow-through, pushing the sector to new all-time highs on a weekly basis. Here, we see an upward break above a falling resistance line that started at the beginning of 2023, now broken to the upside with strong momentum. Both RRG lines are pushing above 100, positioning the materials tail deep inside the leading quadrant.

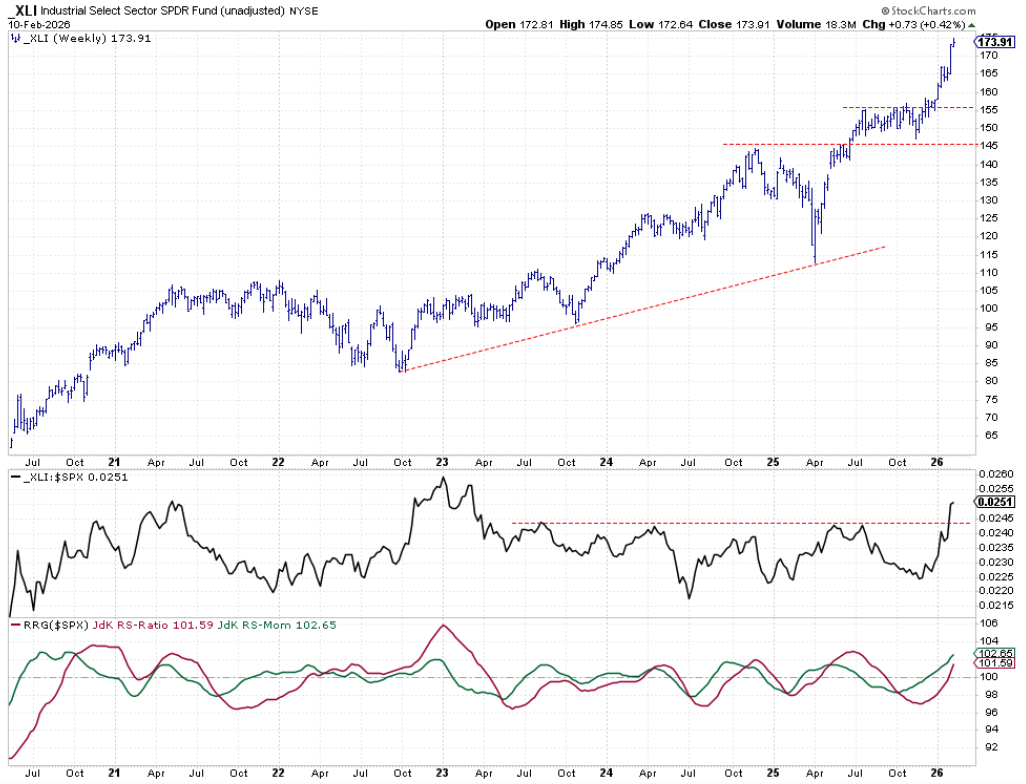

Industrials

Industrials already broke out above its resistance around 155 at the end of December, but the real move started at the start of January, with a slight consolidation at the end of the month followed by a renewed rally, which continues to push the price of XLI higher.

This also resulted in a break above the raw RS line, which had been in a resistance range since 2023 and was just taken out to the upside, unlocking significant new relative potential for this sector. Both RRG lines are well above 100, positioning industrials inside the leading quadrant.

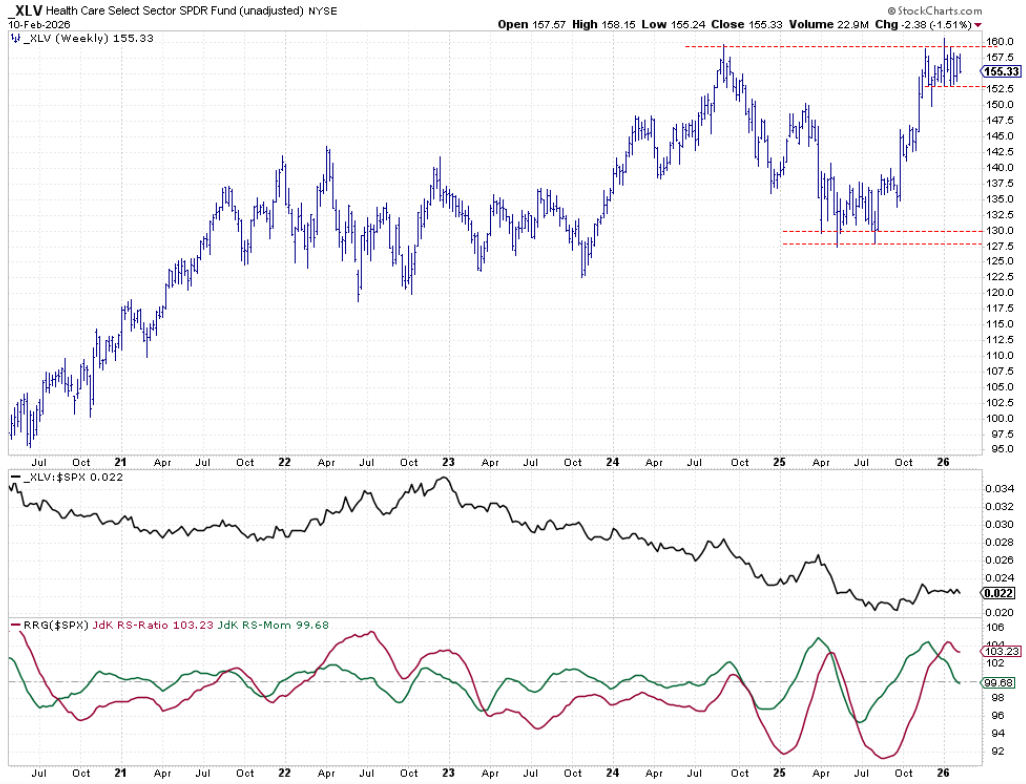

Healthcare

The Health Care sector did not manage to break above its all-time high, which is around 160. There were a couple of attempts in the last few weeks, but they never materialized, resulting in a narrow trading range now between roughly 152.50 and 160.

A breakout on either side will be the trigger for a more aggressive move. Unlike energy and materials, the relative downtrend that started at the end of 2022 has not been broken yet, and the raw RS line has been moving sideways since the end of last year. That has caused the initial strength in RS-ratio to roll over, and RS momentum is now crossing below 100, putting the Health Care sector inside the weakening quadrant.

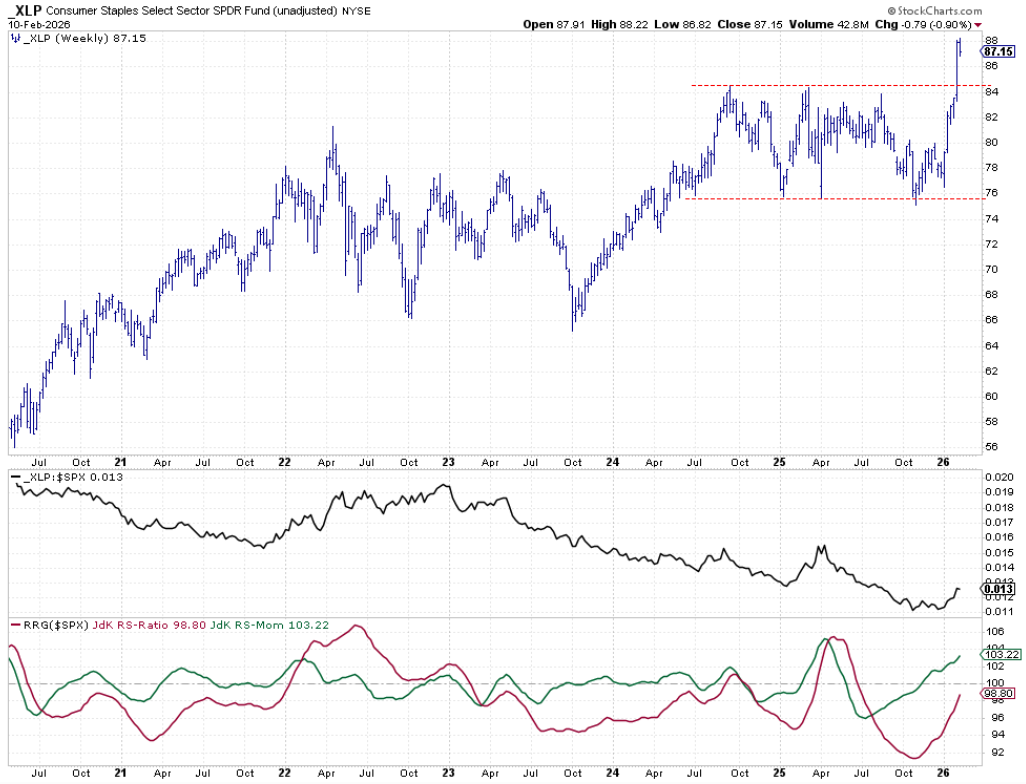

Consumer Staples

Consumer Staples finally managed to break out of its broad trading range, roughly between 76 and 84. That happened last week, and we are seeing a good follow-through this week already. The raw RS line appears to be forming a bottom and moving higher, as reflected by the RS momentum line already well above 100 and pushing higher, starting to pull the RS ratio line upward and almost crossing above 100. The tail is still inside the improving quadrant, but with strong momentum.

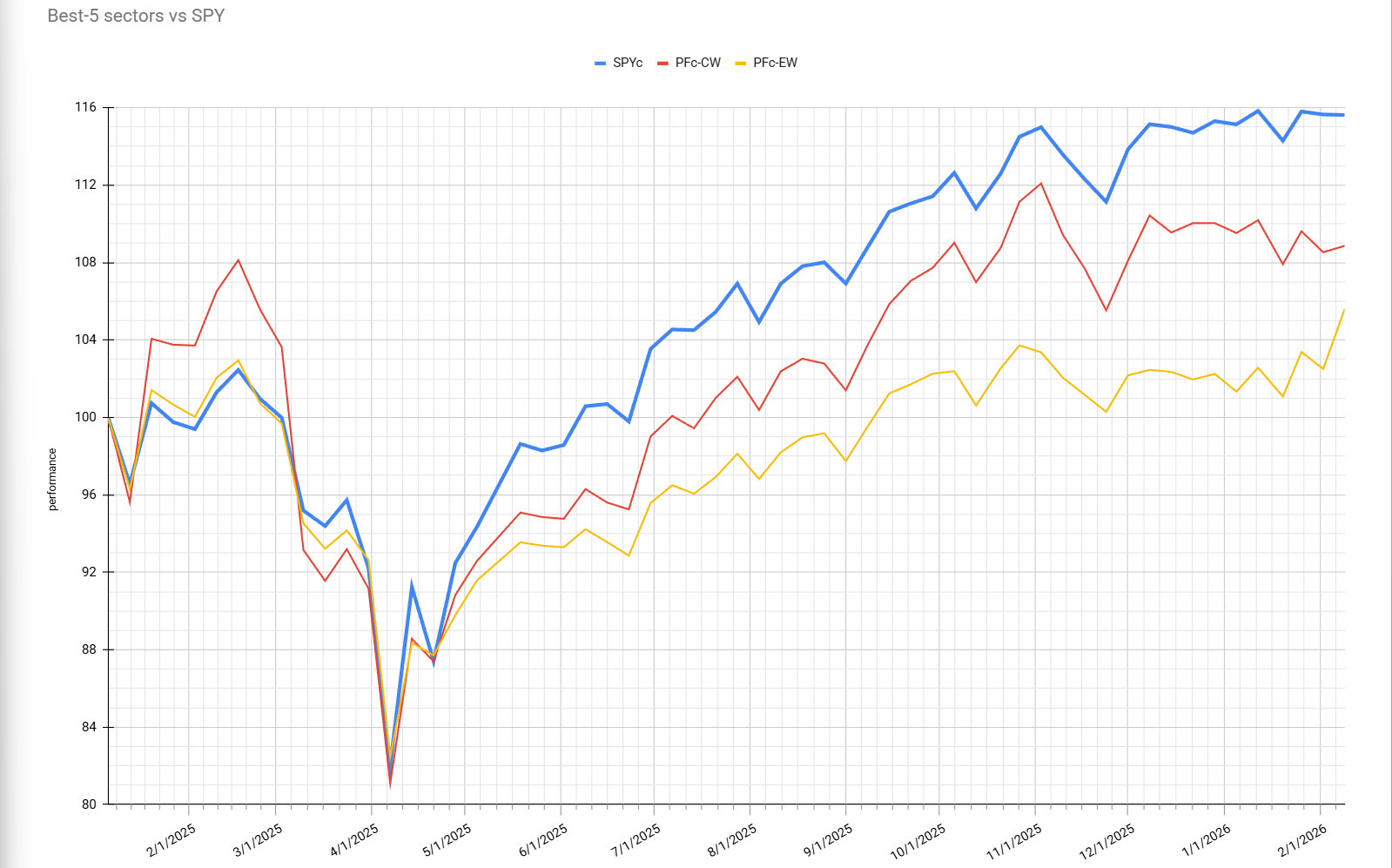

Portfolio Performance

Regarding the performance follow-up, I recorded a long video about a week ago. You can find that video on the StockCharts YouTube channel or click on the blog article that announces that video from last week. I have continued to update my spreadsheet with the rankings starting in 2020. This spreadsheet dates back to 2025, when I began publishing the top five sectors. If you want an in-depth look at how the spreadsheet works, please watch the video; everything is explained there.

Since then, I have created two sections in the spreadsheet: One covering the equal-weight performance, the way we started this series, and a second section that follows the cap-weighted performance, as described in my video. Going forward, I will publish the chart of both performances, so we can see the impact of equal weight versus cap-weighted.

What we see now is that the equal-weight performance suddenly jumps, and the reason is that the weakness in the technology sector did not do too much damage to the portfolio, as it was technically underweight vs SPY.

The reason why the cap-weighted was under pressure while technology was still in the top five is that when you have a heavy overweight in the biggest sector, you need that to contribute to your portfolio's performance. When that sector starts to weaken, as happened with Technology, it will also cause the biggest drag.

The heavy weight of Technology in the cap-weighted portfolio helped it perform better than the equal-weight one but, over the last couple of weeks, that heavy weight has hurt the cap-weighted performance, while it wasn't as painful for the equal weight performance.

I'll continue to publish both, and I can already tell you I am working on a longer-term test, one that shows the long-term performance of this approach. On a longer term, you will see pretty good performance of this approach, but you will also see that it started to flatten out and underperform over the last year and a half, almost two years.

This is a typical back-testing problem. You have something that looks great over the longer-term, and when you look at a long-term performance chart and see a little dip, you think, "Oh, that's a little dip." In reality, it's about a year, a year and a half, or maybe two years. When you follow it week-to-week and do it in your portfolio, that's a completely different experience than just watching a little dip on your PNL over a 25-year period.

That's why I want to continue this experiment, publishing the best five sectors according to this approach, combining daily and weekly RRG values into a ranking, and measuring the performance on a week-to-week basis.

#StayAlert — Julius