The Market Just Made a Powerful Shift: These Stocks Poised to Rise the Highest

The financial market reacted sharply to one of the biggest corporate investment announcements in history: Amazon revealed plans to spend approximately $200 billion in capital expenditures in 2026, primarily focused on artificial intelligence, cloud infrastructure, custom chips, and data center buildout. This figure surpasses many analysts’ expectations and has driven a seismic re-rating of the data center and digital infrastructure opportunity.

When you combine this with other hyperscale cloud providers’ commitments — namely those of Microsoft, Alphabet, Meta, and others — the total tech sector CapEx tied to AI, cloud, and data center expansion now exceeds roughly $600 billion. That’s a significant structural shift in global investment patterns.

So how do you position a portfolio around this shift? For that, it helps to view the data center landscape not as a single silo but, rather, an interconnected system of specialized segments. In this way, you can identify the companies that are at the heart of each segment’s growth trajectory.

This ecosystem approach offers multiple angles of exposure. To begin, Semiconductor stocks are at the heart of the artificial intelligence (AI) boom, acting as the critical "picks and shovels" for the entire industry.

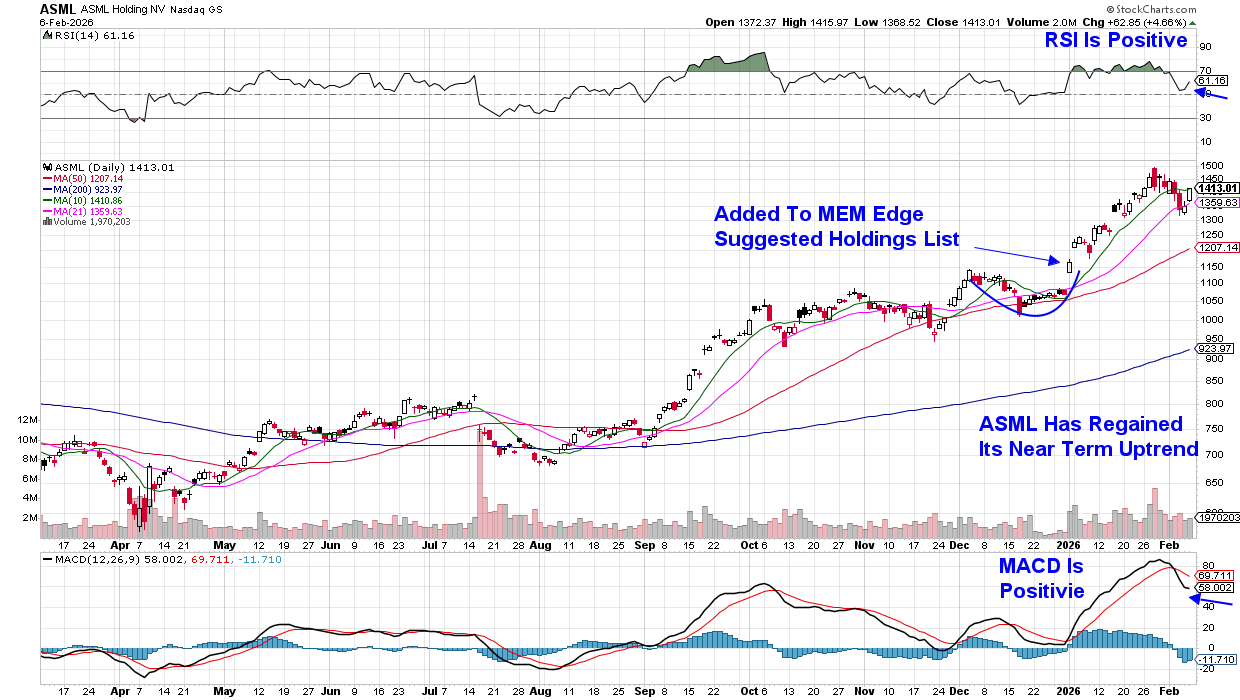

ASML's Uptrend

Among Semiconductors, ASML (ASML) is considered a top AI stock, holding a monopoly on the extreme ultraviolet (EUV) lithography machines required to manufacture the high-performance logic and DRAM chips that power AI applications.

Subscribers to my twice weekly MEM Edge Report were alerted to ASML following its base breakout at the beginning of this year. As a critical "pick-and-shovel" infrastructure provider, ASML enables the entire AI ecosystem. Other top Semi leaders have been identified as well, which you can access using the link above.

Real Estate Investment Trusts (REITs) that focus on data centers and digital infrastructure are another specialized AI segment, as they own and operate the essential high-power facilities required to train, store, and run artificial intelligence models. These REITs offer a more stable, dividend-paying alternative to high-volatility chip stocks.

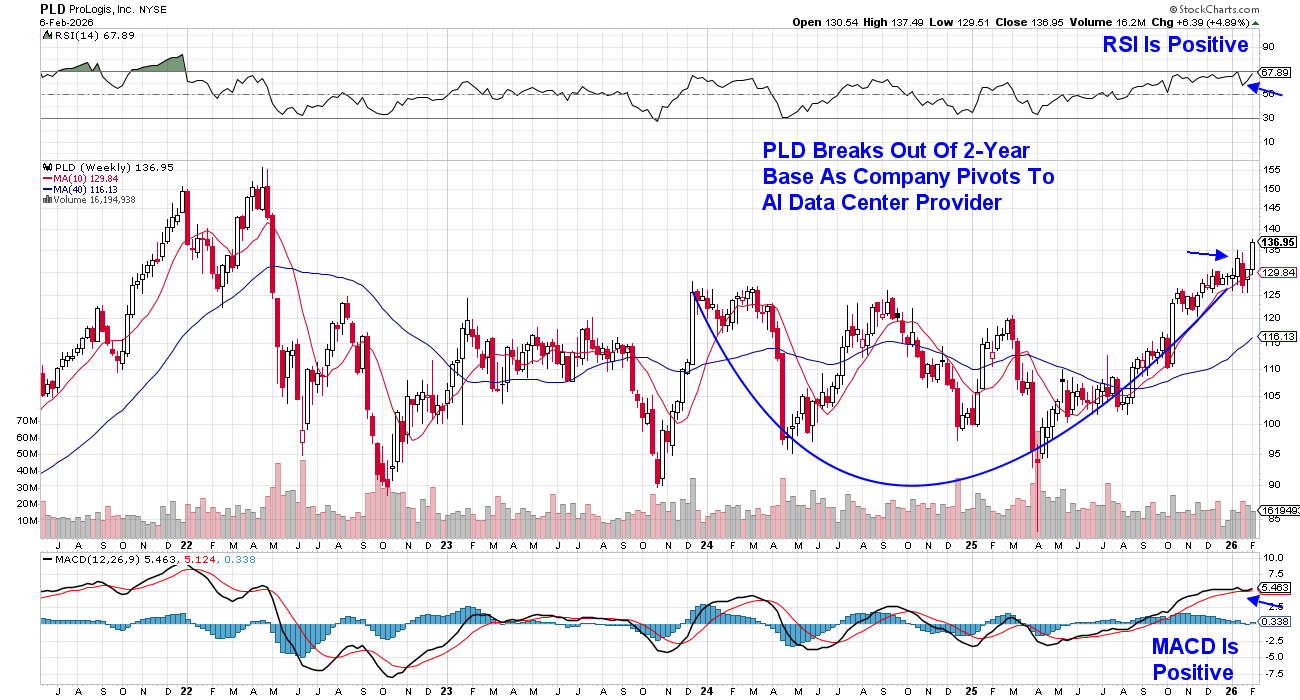

ProLogis Breaks Out

Let’s take a look at ProLogis (PLD), a REIT that provides the essential and power-intensive infrastructure needed to host AI computing hardware. The company has been pivoting from its focus on product warehousing and distribution toward a “power-ready" site that’s ideal for constructing data centers.

PLD recently launched a $25 billion expansion of its data center business, which is expected to increase the company’s profit margins. This month, Prologis announced a collaboration with NVIDIA to develop “micro data centers”. PLD offers a 3% yield.

As AI and global connectivity accelerate, the demand for resilient infrastructure is no longer optional. It’s foundational. The companies enabling this expansion are not just technology suppliers; they are providers of needed infrastructure, with this article highlighting just two areas among many.

For long-term investors, the data center ecosystem represents one of the clearest expressions of how physical infrastructure and digital innovation are converging into a single, multi-decade growth story. To be kept up to date on the current leaders in this rapidly expanding area, use this link here to have immediate access to my twice-weekly MEM Edge Report at no cost. In addition to individual stock picks, you’ll be alerted to shifts in broader market conditions as well as precise buy and sell points.

Warm Regards,

Mary Ellen McGonagle

MEM Investment Research