The Market's Muscle: What Broad Tech Strength Says About This Bull Run

Key Takeaways

- Tech is driving the market, but it's not just the big names

- When the cap-weighted and equal-weighted tech ETFs move in sync, it suggests the sector is healthy

- Key earnings reports could shift sentiment so keep an eye on volatility

No tricks, just trades!

There was nothing spooky about this Halloween! With trade deals stabilizing in the background and the Fed meeting now behind us, the market’s attention has shifted back to earnings.

Tech Titans Steal the Show

This week was all about the tech giants. With most of the large-cap tech names reporting, the market was primarily moved by just a handful of big players. Technology was this week’s top-performing S&P 500 sector with a 2.42% gain, while Consumer Discretionary came in second with a 0.96% gain. If it weren’t for Meta’s 12.19% tumble, Communication Services would have easily landed in the top 3.

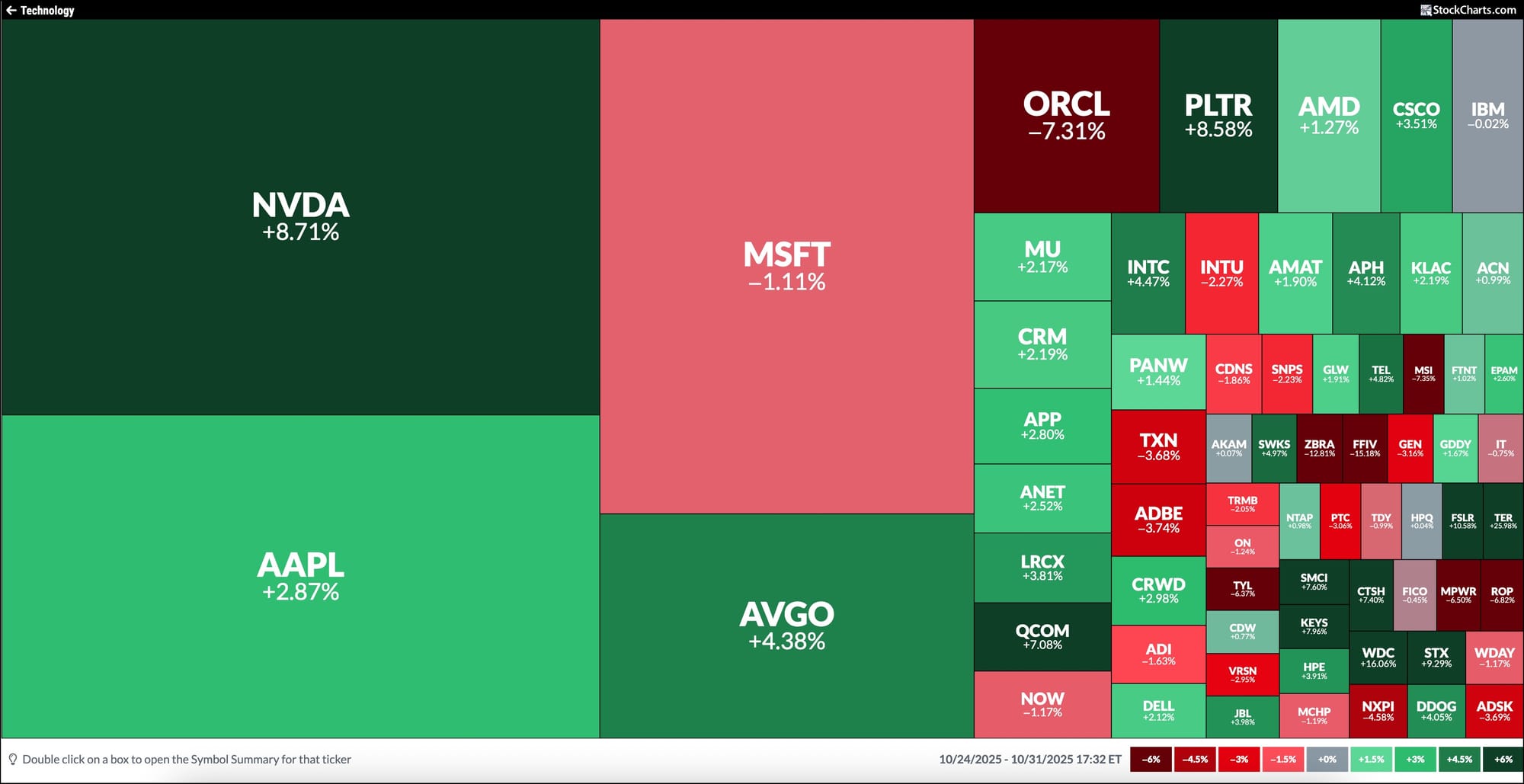

You can really see that the strength lies in the mega-cap, AI-related stocks that continue to flex their muscles. The Technology sector remains the powerhouse, and what’s encouraging is the broad participation we’re seeing across many tech names, not just the heavyweights. Zeroing in on the Technology sector, you can see that besides the heavily weighted stocks in the sector, several others experienced a >6% gain for the week (dark green squares).

This kind of broad participation signals that the Technology sector is in a strong bull market.

If you compare the Technology Select Sector SPDR ETF (XLK) to its equal-weight counterpart, the Invesco S&P 500 Equal Weight Technology ETF (RSPT), you’ll notice that, over the past year, the two have moved in near lockstep aside from a few short blips.

That tells us that this tech rally isn’t just about a few big names. Is this the case with all sectors?

What’s Coming Up Next Week

Earnings season isn’t done yet, as next week brings more reports from energy, tech, and biotech companies. Palantir Technologies (PLTR) is the one to watch. We’ll also get some economic data and some Fed speeches, which could add some excitement to the week.

Keep an Eye on Volatility

And before wrapping up, let’s talk about volatility. On Friday, the Cboe Volatility Index ($VIX) jumped by more than 6% before cooling off as the major indexes rallied. Keep this chart on your radar, as it could tell you a lot about how the market behaves as we head into the home stretch of 2025.

End-of-Week Wrap-Up

Stock Market Weekly Performance

- Dow Jones Industrial Average: 47,562.87 (+0.75%)

- S&P 500: 6,840.20 (+0.71%)

- Nasdaq Composite: 23,724.96 (+2.24%)

- $VIX: 17.44 (+6.54%)

- Best performing sector for the week: Technology

- Worst performing sector for the week: Real Estate

- Top 5 Large-Cap SCTR stocks: IREN Ltd. (IREN); Bloom Energy (BE); Sandisk Corp (SNDK); Nebius Group (NBIS); Oklo Inc. (OKLO)

On Our Radar Next Week

- October ISM Manufacturing

- September PPI

- October ISM Services PMI

- Earnings from Palantir Technologies (PLTR), BioNTech (BNTX), ON Semiconductor (ON), Advanced Micro Devices (AMD), Uber (UBER), Shopify (SHOP), Novo Nordisk (NVO), Robinhood (HOOD), ConocoPhillips (COP), Constellation Energy (CEG), Duke Energy (DUK), and lots more.

- Fed Speeches

- October inflation expectations

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.