Three Brand Name Companies Outside Of Tech That Are On The Move

Last week’s push to new highs in the market continued to favor AI stocks as well as Quantum and Crypto-related names. The risk-on appetite among investors was highlighted by a sharp gain in Biotech stocks as well, following news of Pfizer’s deal with U.S. President Donald Trump.

Of note was a re-entry into a handful of consumer names — companies that combine brand strength with near-term operational fixes, or an attractive valuation reset — seeing buying activity. Levi Strauss (LEVI), Chipotle Mexican Grill (CMG), and Williams-Sonoma (WSM) stood out, each for different reasons.

Traders are hunting for unique opportunities inside a still-uncertain consumer backdrop. Many consumer/retail stocks have been underperforming year to date, creating possible opportunities if sentiment turns. Next week, LEVI will be reporting earnings, while consumer confidence for September will be released.

As for the tariff headwinds negatively impacting retailers, the U.S. Supreme Court is scheduled to hear arguments on November 2025 regarding the legality of some of the sweeping duties that were imposed by President Trump. Any abolishment of these levies would certainly provide a positive catalyst for retailers.

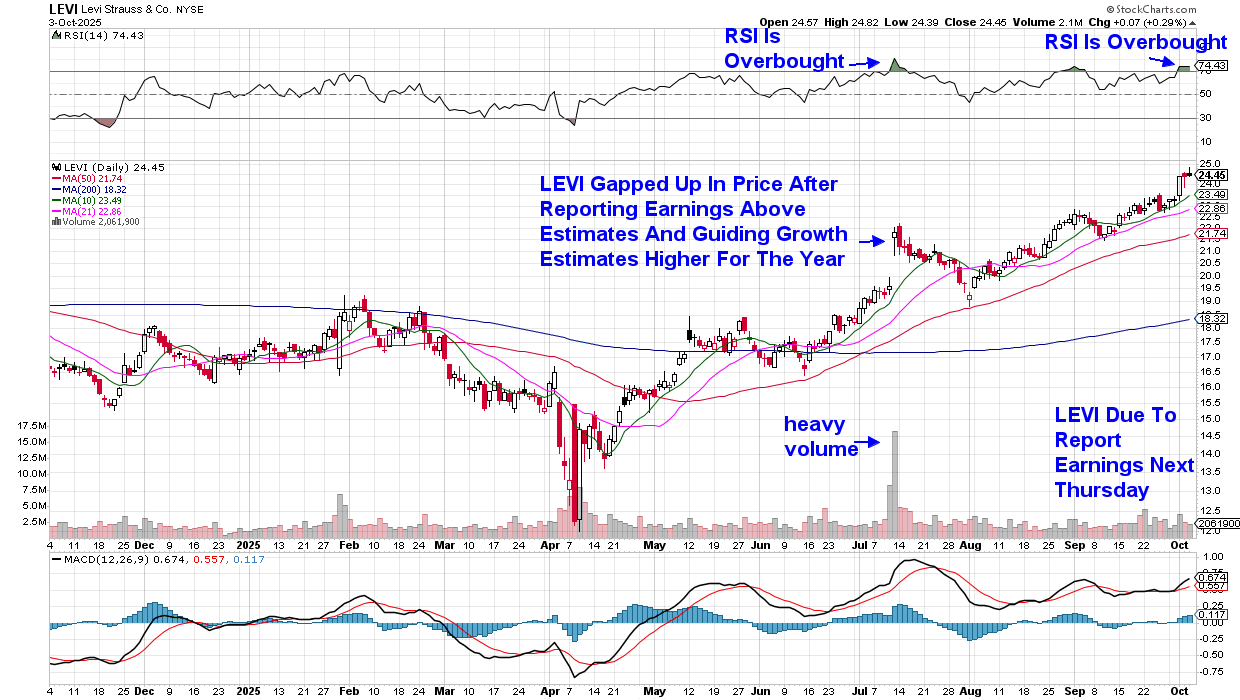

Levi Strauss At Near-Term High

Let’s take a look at LEVI, which is due to report earnings next Thursday. The stock received several analyst upgrades going into the release of its results, which pushed it to a near-term high. In addition to citing increased global demand for denim, analysts highlighted the company's ability to reduce tariffs by procuring products from its curated list of 28 countries it works with.

LEVI closed the week at a near-term high, going into next week with the Relative Strength Index (RSI) clearly in an overbought condition. As you can see from its earnings release last quarter, the move to a new high was met with profit-taking. We may see a similar pullback next Thursday, which would set the stock up for further upside going forward.

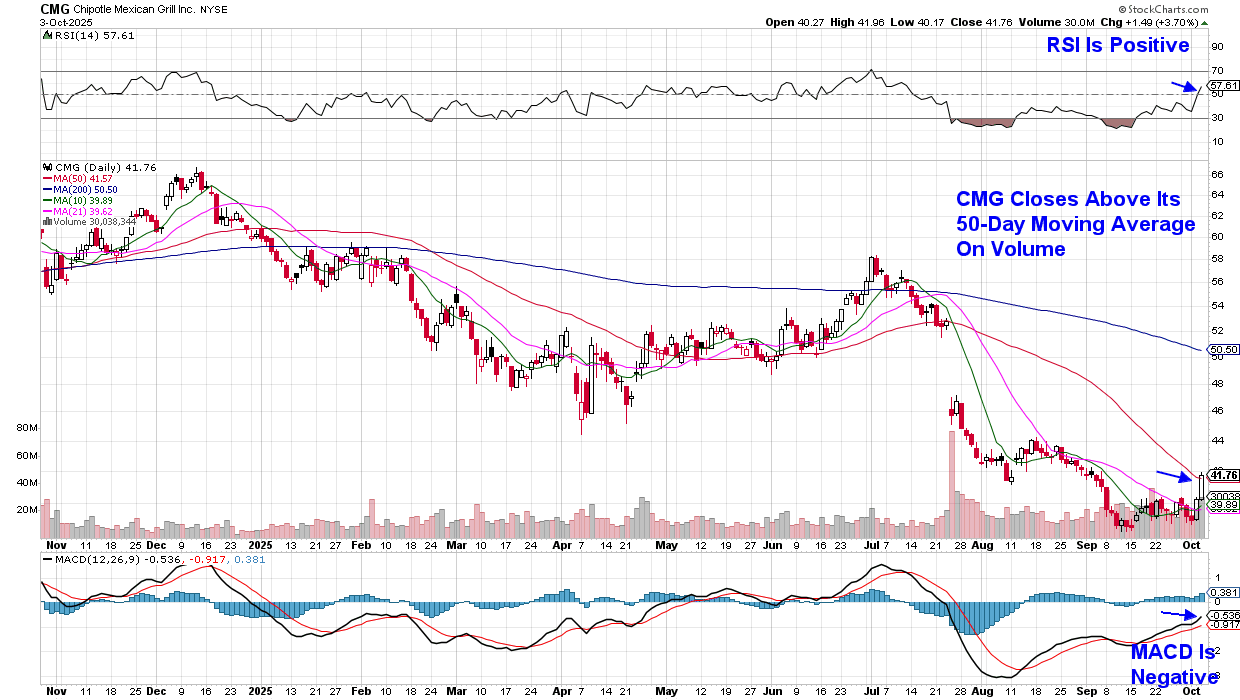

Chipotle: A Deep Value Play

Chipotle (CMG) looks more like a turnaround or deep value play rather than a pure growth bet right now. The stock jumped after a Wall Street upgrade due to the addition of a limited-time menu offering.

CMG has suffered of late, however, due to management lowering its growth guidance for 2025 for a second time in late July. Same-store sales also came in below estimates. Chipotle is down 30% year to date; however, last week’s 4% advance has pushed the stock back above its 50-day moving average with a now-positive RSI.

Chipotle’s recovery attempt is more about value investors probing for a turnaround; however, I’ll need to see further upside based on a stronger plan for increased growth. The Moving Average Convergence/Divergence Oscillator (MACD) would need to turn positive as well. For now, it’s a candidate for your watchlist.

Gildan Activewear At a New High

While not a direct retailer, apparel manufacturer Gildan Activewear (GIL) closed at a new high in price, as the company continues to respond positively to the prior week’s news of its purchase of HanesBrands for $4.4 billion.

Following the news, several Wall Street firms increased their price targets and maintained an outperform rating. The Canadian-based company is expected to generate at least $200 million in annual cost savings with this merger due to operational efficiencies.

While GIL is in a bullish uptrend, waiting for a slight pullback would be prudent as the RSI is now in an overbought position.

Retail stocks can be big winners when the economic and consumer backdrop is strong. Continued weak employment data, such as last Wednesday’s ADP report for September, will continue to temper upside over the near term. Lower inflation, coupled with reduced cost pressures due to tariffs, would also produce a bullish backdrop.

For now, I’ll continue to focus subscribers of my MEM Edge Report on high-growth stocks in Technology and Industrials that are still marching to new highs. If you’d like a look at what’s being recommended right now, use this link here to gain 2 weeks of this twice-weekly report at no cost.

Warmly,

Mary Ellen McGonagle

Founder, MEM Investment Research