Three Investing Lessons from a Challenging 2025 Market

I sat down this week with Grayson Roze to reflect on our experiences as investors in 2025, focus on key lessons learned through a challenging market year, and look forward to potential outcomes in early 2026.

Mindful investors make time to review their performance, think critically about their investment process, and focus on areas of improvement for the new year. So I jumped at the chance to talk about markets, routines, and mindset with Grayson. Together, we dug into the four main phases of market action in 2025, how each period seemed to have a unique character, and what this all could mean for the S&P 500 over the next 12 months.

Today I’d like to share three key takeaways from that discussion, with the hope that it encourages you to reflect on your own investing journey in 2025. And between this review on StockCharts TV and with my recent webcast covering the ten questions every investor should ask at year end, I hope you have plenty of ideas on how to upgrade your routines in 2026!

Process mattered more than prediction in 2025

I have often found that investors spend way too much time on things that are out of their control. There are a number of things that can definitely affect your portfolio, from what the market may do tomorrow to how a stock could trade around an upcoming earnings release. But there’s not much you can do to directly impact those particular events.

Mindful investors focus instead on what is in their control to change. For example, we can change what we read, what we watch, how we make investment decisions, and what routines we use to improve our market awareness.

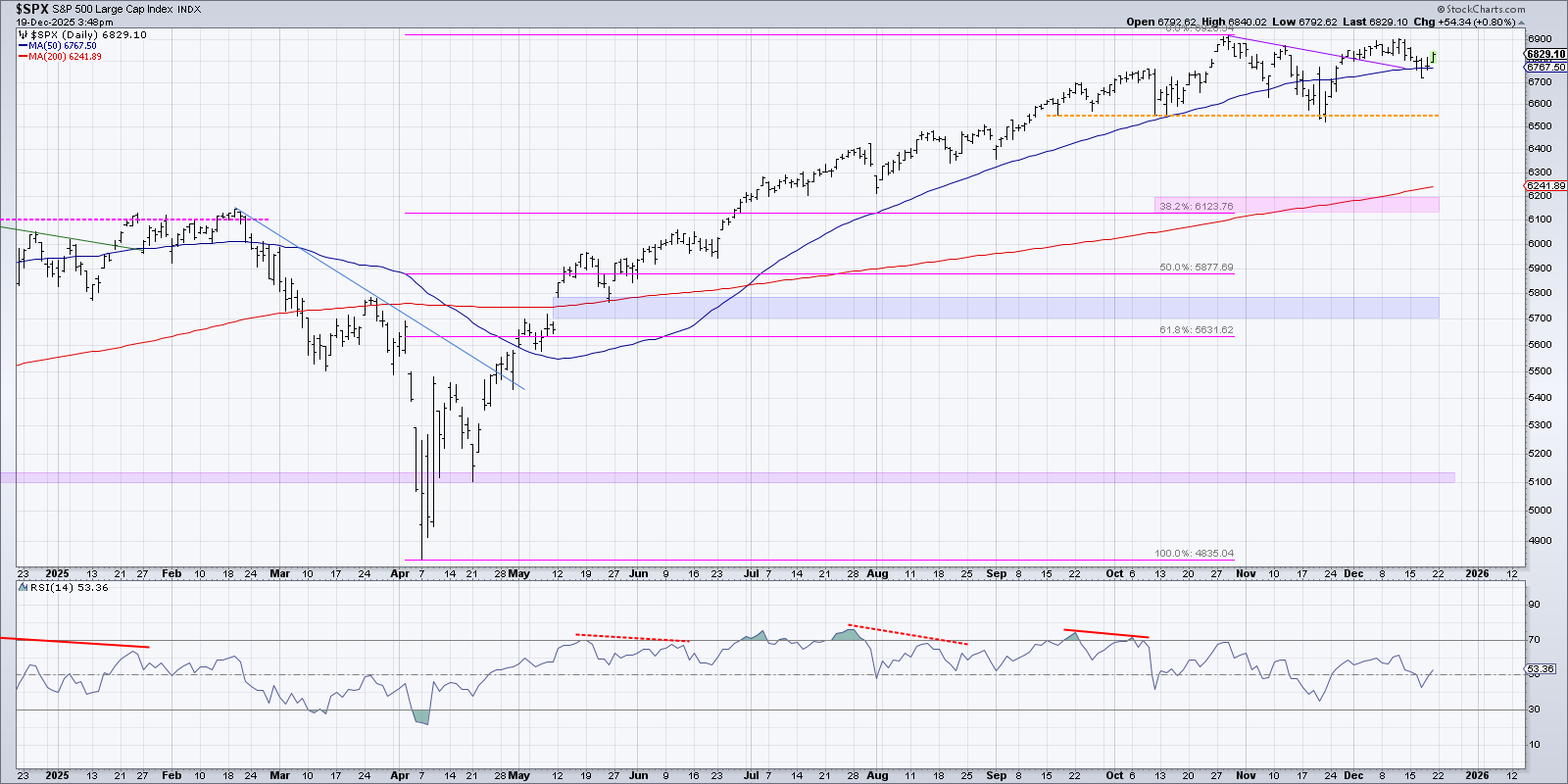

When I think about the S&P 500 in 2025, I can summarize the market year in four distinct phases. Each phase had its own character, and there were clear signs that the next phase was upon us. Let’s see how a consistent process could have helped us identify these changes.

The first challenge was identifying the major market top in February. This came down to recognizing the weakening momentum breadth and momentum conditions while the SPX was still remaining around 6100. The second phase involved the V-bottom in April and identifying clear signals of a sudden upside surge in the spring.

Next, we had a low volatility uptrend through the summer months, with the S&P 500 making a consistent pattern of higher highs and higher lows on lower volatility. Finally, the fourth quarter has been marked by leading growth names struggling while value-oriented sectors emerged in a position of strength.

I would argue that navigating 2025 wasn't so much about predicting these new phases before they occurred as it was about just having a consistent process in place to review the charts and recognize the changes of character.

Leadership concentration creates risk and opportunity

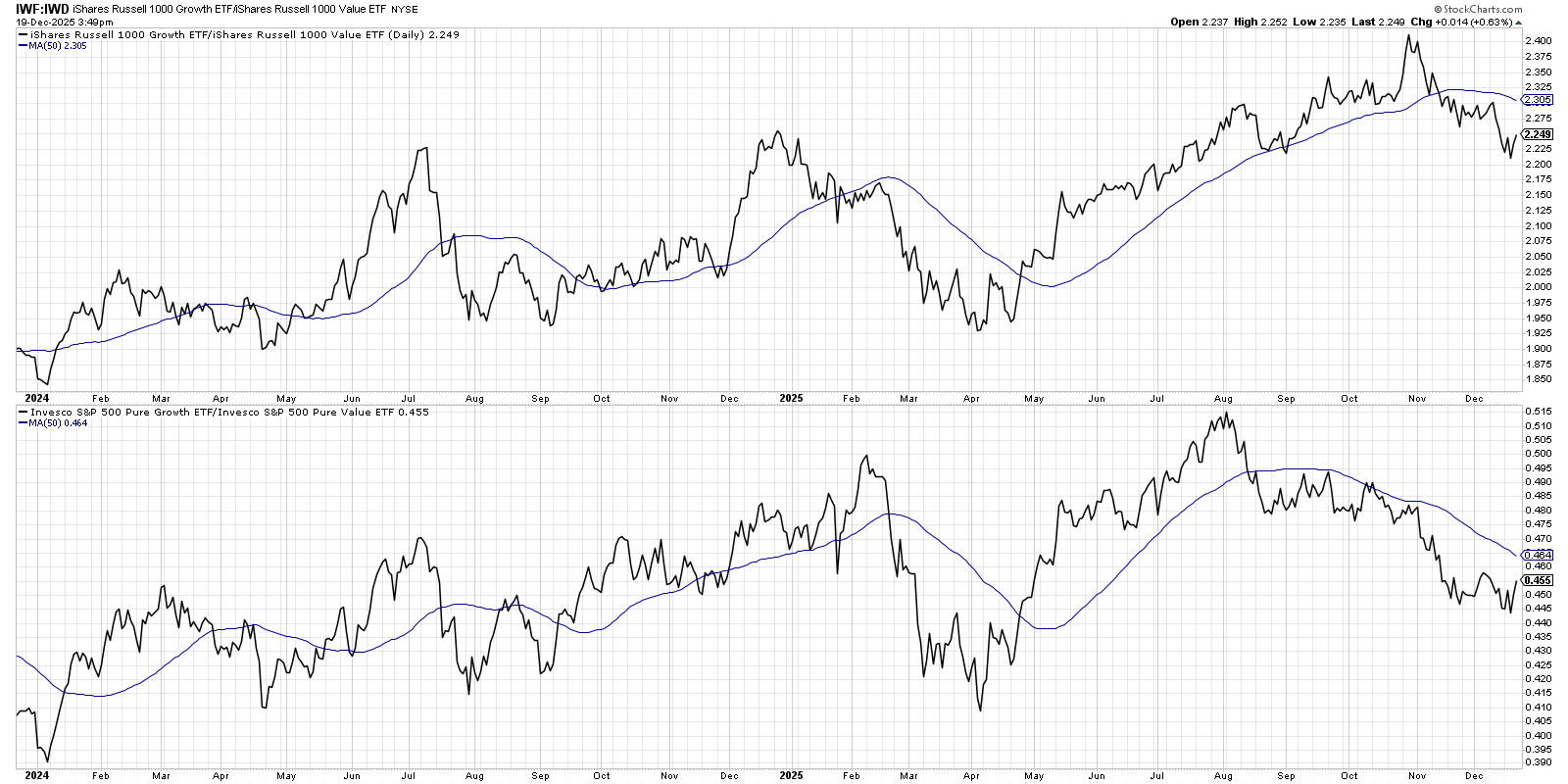

Those four phases listed above also featured very different themes in terms of sector leadership. Here, we’re showing the ratio of Russell 1000 Growth vs. Russell 1000 Value ETFs in the top panel, and a ratio using their “pure growth” counterparts in the bottom panel.

While the S&P 500 and Nasdaq 100 remain very close to their all-time highs, we’ve recognized a dramatic rotation from growth sectors to value sectors. As stocks like NVIDIA (NVDA) and Broadcom (AVGO) have pulled back, value-oriented sectors like Health Care and Financials have demonstrated clear signs of strength.

I find investors can struggle if they think too much about which sectors “should” outperform due to their traditional role as offense or defense, instead of simply watching the charts for signs that a sector is rotating into favor. And if you remain with the sectors and themes that have driven the market higher in the last market phase, without recognizing that new leadership has arrived, you’ll miss out on great opportunities to profit through that rotational period.

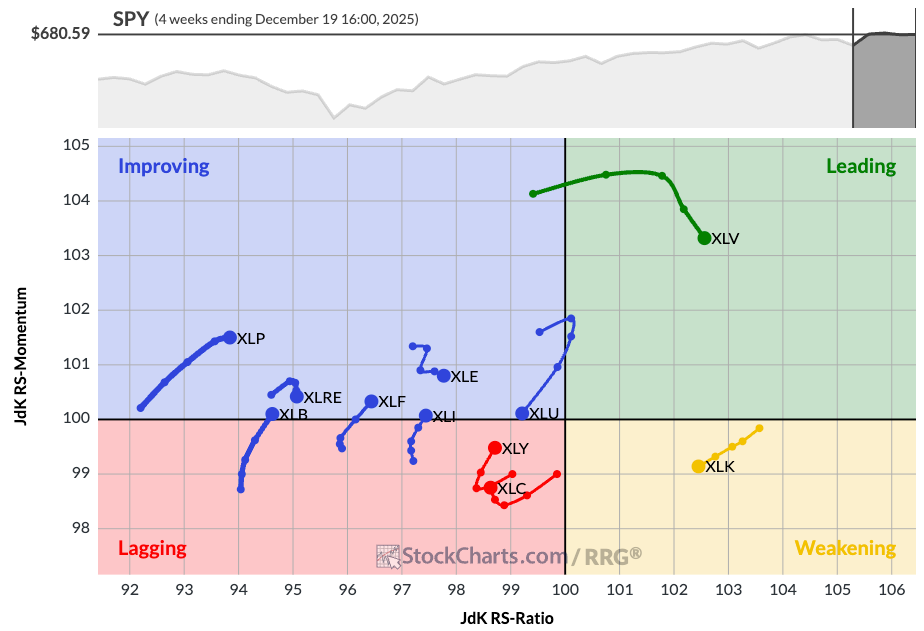

The next cycle will be about rotation, not direction

If large-cap growth stocks continue to chop around and consolidate into Q1, then perhaps the leadership will continue to rotate into value sectors like Financials. Because of the incredibly top-heavy nature of our major equity benchmarks, weakness in Technology would lead to limited upside for the S&P 500. The RRG will remain an important part of my own approach to assessing new leadership themes here.

At this point, the Health Care sector sits alone in the Leading quadrant, as Technology has already moved down to the Weakening quadrant. Consumer Discretionary and Communication Services, two growth sectors, have rotated up and to the right. Industrials and Financials are also showing new strength into the year-end.

While many will rightly be focused on the direction of the S&P 500 and Nasdaq in January, I think the real action may be below the surface in the form of sector themes. My hunch is that this rotation into value-oriented sectors may have further to run, but I’ll also be watching for any signs of strength in the defensive sectors.

Our year-end special on StockChartsTV featured a much deeper dive into these key areas of focus, along with specific takeaways for the S&P 500, the Magnificent 7 stocks, and many other charts. You can watch the entire special over on the StockChartsTV YouTube channel!

RR#6,

Dave

P.S. Ready to upgrade your investment process? Check out my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Research LLC

marketmisbehavior.com

https://www.youtube.com/c/MarketMisbehavior

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.