Trend Signals in Healthcare and Healthcare Stocks, 5 New Signals, 12 Leading Uptrends

Welcome to the Friday Chart Fix!

Today's report focuses on the Health Care sector, which sprang to life this week as the Trend Composite turned positive. This, however, was not the first bullish signal. The Health Care sector showed signs of capitulation at the end of July, with a double bottom breakout in late August, and a bull flag forming into late September. We will review these signals and show what to watch going forward.

Within the sector, there were five new Trend Composite signals days, and a dozen stocks have been in uptrends for 100 days or more.

Key Takeaways

- Trend Composite turns bullish for Health Care SPDR

- XLV's chart displayed a classic bullish setup at the end of September

- Currently, 36 stocks in the Health Care sector are in uptrends, which supports the uptrend in XLV

Trend Composite Turns Bullish for Health Care SPDR

The Trend Composite, an indicator that aggregates signals in five trend-following indicators, turned bullish this week for the Health Care SPDR (XLV). This bullish signal reverses the bearish signal from November 14, 2024. With the Trend Composite at +3, this means four indicators are bullish and one bearish (4 - 1 = 3). The five indicators are Bollinger Bands, Keltner Channels, StochClose, CCI, and Moving Average Trend. This indicator is one of 11 indicators in the TIP Indicator Edge Plugin for StockCharts ACP.

It's Not the First Bullish Signal for XLV

Trend Composite signals are good for trend-following strategies and watchlists. Chartists looking to get a jump on trend changes need to monitor price action regularly.

XLV first came across my radar on July 25, when it became long-term oversold. As noted in this report, the 40-week Rate-of-Change was below 10%, and prior capitulation setups led to outsized returns over the next two years. Capitulation setups rarely mark the exact bottom, but can be part of the basing process. XLV eventually formed a Double Bottom and broke above its 200-day SMA (see report on September 12).

A Breakout, Then a Shakeout (Flag)

The breakouts did not hold as XLV fell back below its 200-day SMA and moved lower into late September. This, however, was not a bearish development. After a 9.3% advance and break above the summer highs, XLV was entitled to a correction. Based on the prior breakouts and analysis, XLV was on my watchlist for tradable setups and short-term oversold conditions.

XLV obliged with a classic bullish setup at the end of September. As the chart above shows, the ETF formed a falling flag that retraced around 50% of the prior advance, and %B became oversold with a move below zero. This setup was shown to premium subscribers on September 30. Note that TrendInvestorPro specializes in these types of setups for stocks and ETFs.

Recent reports and videos at TrendInvestorPro:

- Trailing Stops for Breakouts in 11 Tech ETFs

- Healthcare Sets Up with Bull Flag after Breakout

- Stock Setups: AMD, CSCO, MSFT, COIN, HEI, ROK

- Gold/Silver Miners Go Parabolic

- Uranium and Copper Extend on Breakouts

Click here to take a trial and gain full access.

36 Uptrends, 5 New Uptrends, 12 Old Uptrends

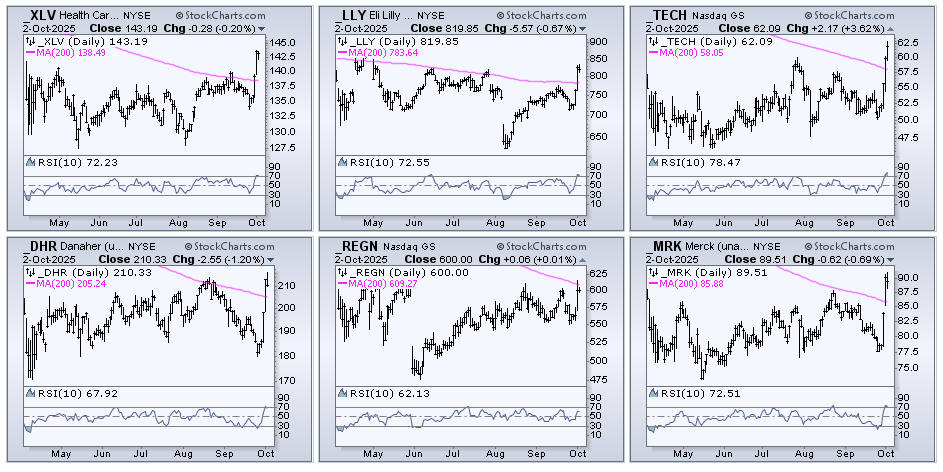

TrendInvestorPro tracks Trend Composite signals for S&P 500 stocks. Currently, 36 stocks in the Health Care sector are in uptrends and 23 are in downtrends. The majority (61%) are in uptrends, and this supports the uptrend in XLV. Of note, there were five new uptrend signals over the last five days. The CandleGlance charts below show these names with the 200-day SMA (pink line) and RSI(10). Put these names on your watchlist for tradeable pullbacks and short-term oversold conditions.

This week's trend signals are positive for these five stocks. Note, however, that 31 stocks were already in uptrends. These 31 are actually leading because they turned bullish before XLV. The CandleGlance charts below show 12 healthcare stocks that have been in uptrends for 100 days or more; these stocks are leading within the sector, and some of them also sport short-term bullish setups.