Two Markets That Could Be Influenced by a Peace Settlement in Ukraine

There have been lots of reports today of a potential settlement between Ukraine and Russia. I have my own views as to how a truce might affect the financial markets. However, I thought it would be a good idea to ask the oracles at Microsoft’s Copilot to see what they might have to say on the matter. Armed with that knowledge, it then made sense to examine those markets in closer detail to see whether they are discounting the possibility of a truce or not.

Copilot’s initial conclusion was, “A Ukraine truce would ripple across oil, gas, wheat, and fertilizer markets, easing inflation and stabilizing growth expectations. The 5-year Treasury is especially sensitive, serving as a pivot for medium-term inflation sentiment.” That reference to the 5-year period may have been independently generated. It could also have been a follow-up on recent queries I had made about that specific maturity in a completely different chat.

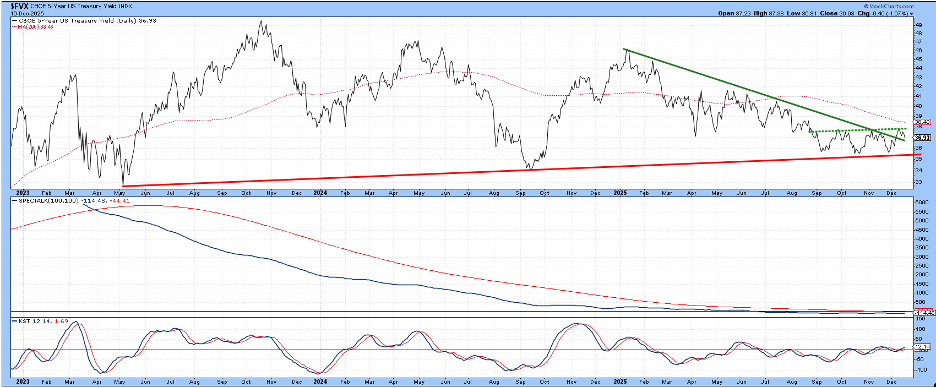

Regardless, Chart 1 shows the 5-year yield broke above its 2025 resistance trendline last week and currently looks headed higher. That’s not consistent with the deflationary effects of a peace settlement.

That said, when we step back and consider more price action, as shown in Chart 2, it is apparent that the overall technical picture is extremely finely balanced, as the Special K (SPK) in the middle window has gone completely flat for over a year. If last week’s breakout turns out to be genuine, then the balance will tip to the positive side. That will be especially true if the yield can break above the dashed green trendline marking the top of a recent trading range; that line is around the 3.8% area. A rising short-term KST in the bottom window suggests that its chances of doing so are high.

Nonetheless, we can also see that the yield is not too far from its red support trendline emanating from 2023. That means a global deflationary shock, such as a truce in Eastern Europe, could have the power to change the credit market’s current calculus, causing the yield to break to significant new lows. In effect, the bond market is not forecasting a truce right now, but it would not take much effort to be consistent with one. The moral of the story is, “watch that 5-year yield like a hawk!”

Copilot wrapped up my session with some additional thoughts, which it summarized as follows: “A settlement in Ukraine would likely reduce geopolitical risk in Europe, which tends to support European equities by boosting investor confidence… Overall, a Ukraine truce would be supportive for European stocks relative to the U.S., but structural factors like the U.S. tech sector dominance would still play a major role in long-term performance differences.”

Chart 3 features the ratio between the iShares MSCI Eurozone ETF (EZU) and the SPDR S&P 500 ETF (SPY). There is no perfect way to construct a down trendline during the period of European relative underperformance that began in 2008. That said, the line displayed in the chart has been touched or approached on numerous occasions since 2011. It seems to be a good fit, especially as its post-mid-2025 correction found support at the extended line. Obviously, this ratio is influenced by numerous factors apart from war or peace in Eastern Europe, but its recent action is certainly consistent with a possible truce.

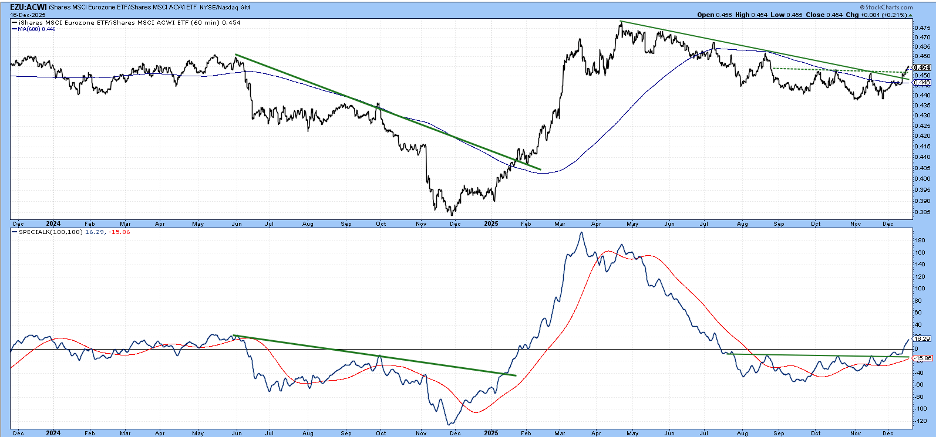

Chart 4 shows more recent action but, this time, the iShares MSCI World ETF (ACWI) has been substituted for the SPY. Note that the ratio has violated its solid 2025 down trendline and broken above the dashed green line, marking the top of a five-month base. The SPK has also completed and broken out from a base and moved decisively above its signal line, all of which suggests superior European performance.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates.