Visionary Leadership and Strong Fundamentals as Drivers of a Winning Stock

Oracle’s Larry Ellison and Tesla’s Elon Musk both saw their companies’ shares jump this week as they showcased bold advances in artificial intelligence and autonomous technologies. Beyond the short-term stock moves, their leadership style reflects a timeless quality shared by legendary CEOs like Walmart founder Sam Walton - the ability to harness innovation to transform entire industries.

Walton’s forward-thinking use of technology was exactly the kind of trait famed investor William O’Neil sought in market leaders, as Walmart was one of his first big, winning stocks. As early as the 1960s and 70s, Walmart invested in computerized inventory systems and built its own logistics network - a radical move at the time. This early adoption gave Walmart unparalleled control over costs and efficiency. Walton's relentless focus on innovation and expense control turned Walmart into the largest retailer in the world.

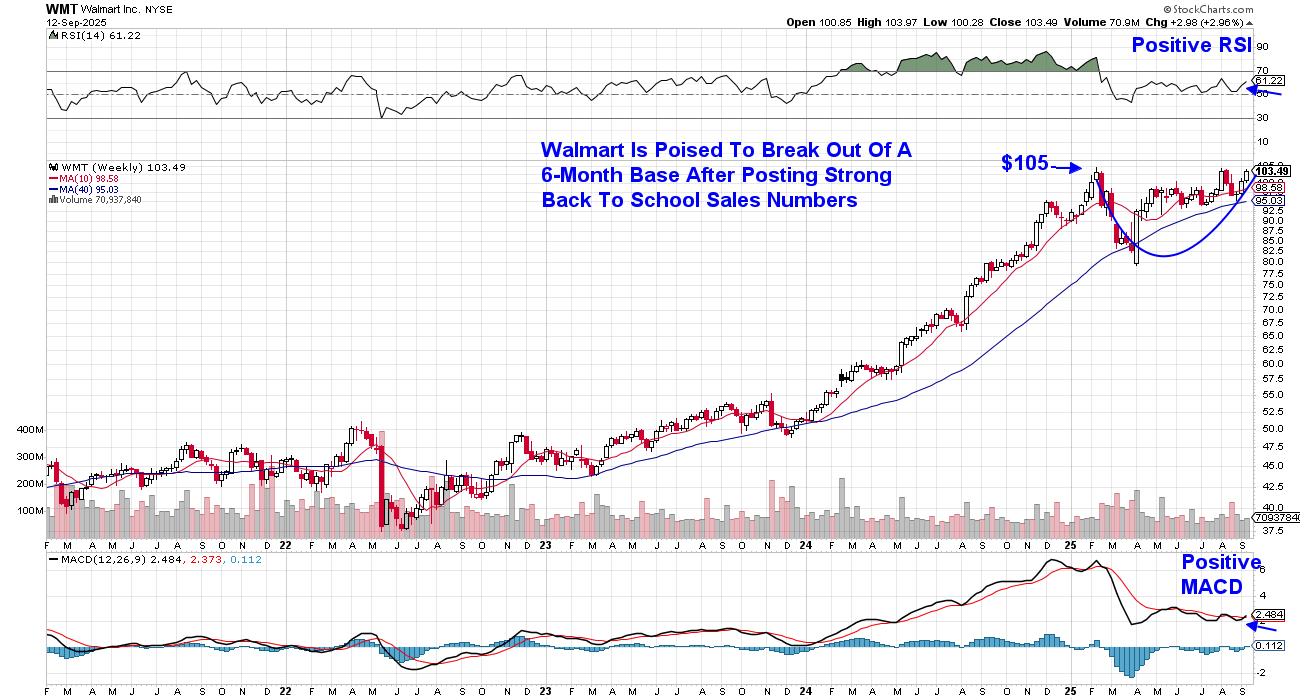

Walmart (WMT) is continuing its winning ways with AI-powered shopping assistants and drone-powered deliveries in over 100 stores. The stock is poised to break out of a 6-month base at the $105 level; however, a stronger growth outlook would have me more interested.

Today, Ellison and Musk embody that same spirit - combining innovation, vision, and execution to not only drive their companies forward, but to shape the future of entire industries.

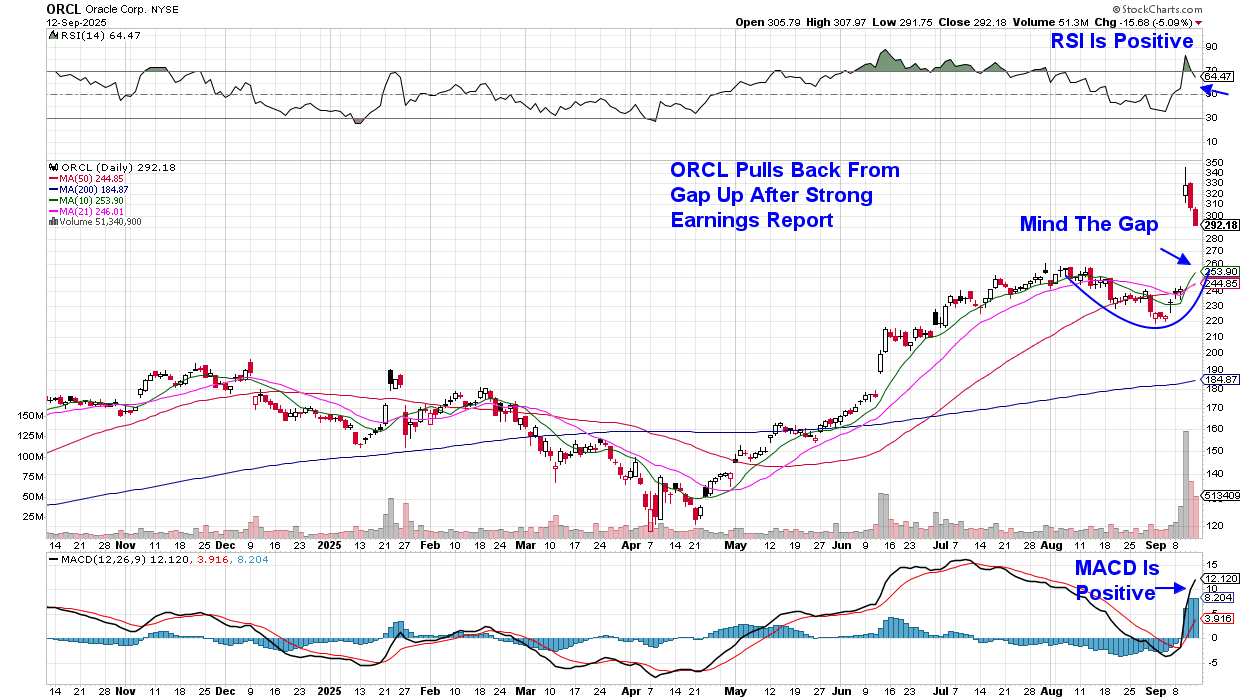

Larry Ellison has spent decades steering Oracle through multiple waves of technological change. This week, his emphasis on surging demand for Oracle’s AI-focused cloud services reminded investors of his foresight in positioning the company at the center of the next digital revolution. Ellison’s ability to recognize and act on industry shifts has kept Oracle relevant and competitive for over 40 years.

Oracle originally posted a gap up in price into a base breakout on heavy volume, which is quite bullish behavior. However, it gave back almost half those gains over the following 2 days. Should the stock trade below its base breakout level of $261, that would be a failed breakout and would point to further downside. A period of consolidation similar to its price action following their mid-June earnings would be quite constructive.

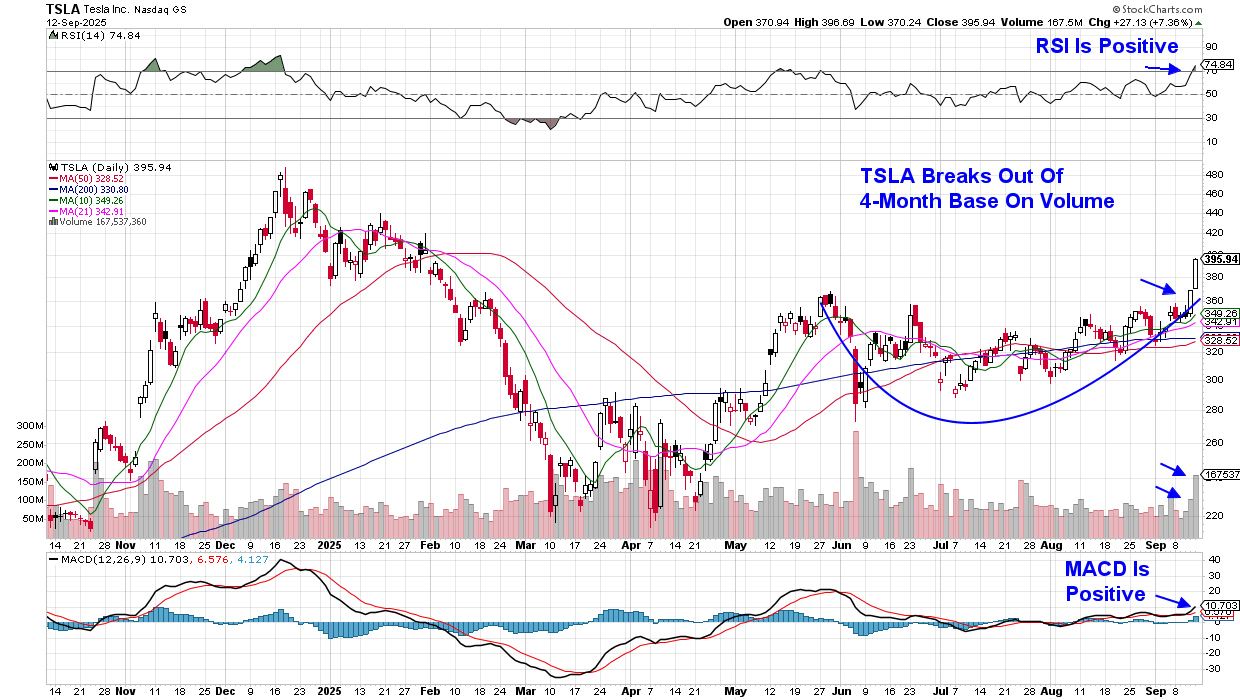

Elon Musk, meanwhile, continues to stretch the boundaries of what Tesla can be. Progress in self-driving technology and robotics is expanding Tesla’s story beyond electric vehicles into new frontiers of mobility and automation. Musk’s boldness in tackling industries most thought untouchable echoes the same daring that has set past business titans apart.

TSLA broke out of a 4-month base on volume on Thursday, and the stock’s advance today has put the stock into an extended position. A pullback into the $375 range would put the stock into a buy zone.

Having worked closely with William O’Neil, I saw firsthand how much weight he placed on visionary leadership when identifying growth stocks. Of course, fundamentals and the market's trend matter; however, leadership is often the decisive factor in whether a company can compound success over time. Walton embodied that principle in retail, and Ellison and Musk are carrying that mantle in technology today.

For access to additional leadership names that are poised to trade much higher as they’re at the forefront of the current adaptation of AI, use this link here for a free 2 week trial of my twice weekly MEM Edge Report.

If you’d like to be alerted to information regarding the release of my upcoming 5-part course, "The Art Of Spotting Winning Stocks", use this link here!

Warmly,

Mary Ellen McGonagle

Founder, MEM Investment Research