Where Has Industrials Leadership Gone? A Sector Drill Down

Key Takeaways

- Once a market leader, the diverse Industrials sector is in consolidation mode as the S&P 500 prints records.

- Mike highlights the underperforming single-stock culprits and analyzes the group’s momentum situation.

- Hope is not lost, with the technical groundwork in place for a late-2025 Industrials rally.

It was mid-October 2022 when stocks lifted from the depths of the inflation-induced drawdown, and now the S&P 500’s bull run edges closer to three years. Tech, of course, led the way, with ChatGPT’s launch on November 30 of that year fueling what would become a narrow initial rally. Adjacent to the AI trade, however, was (and still is) the Industrials sector.

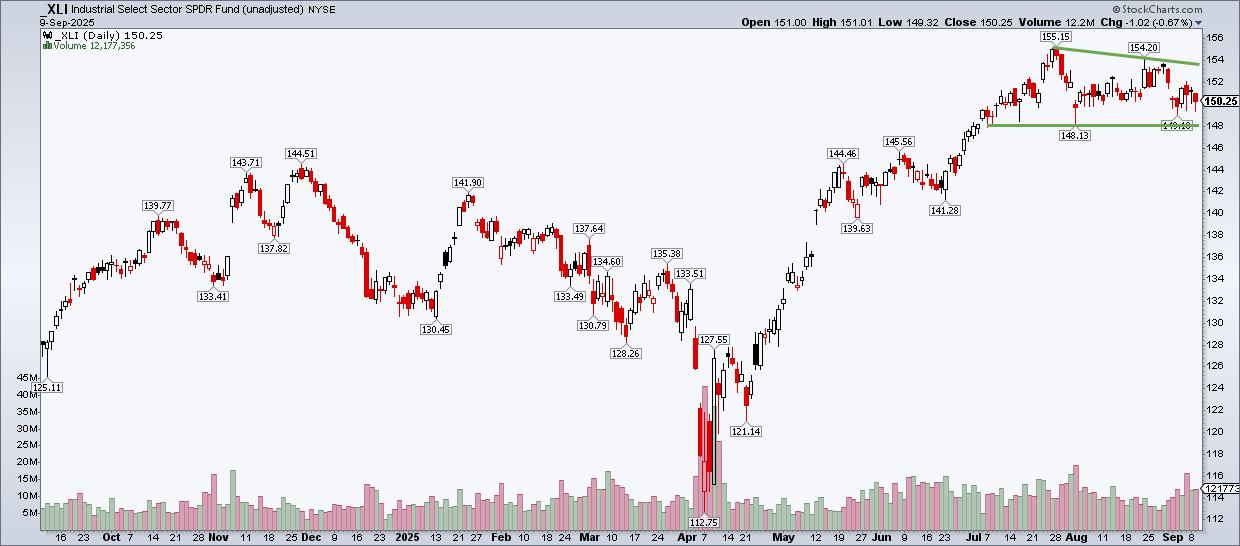

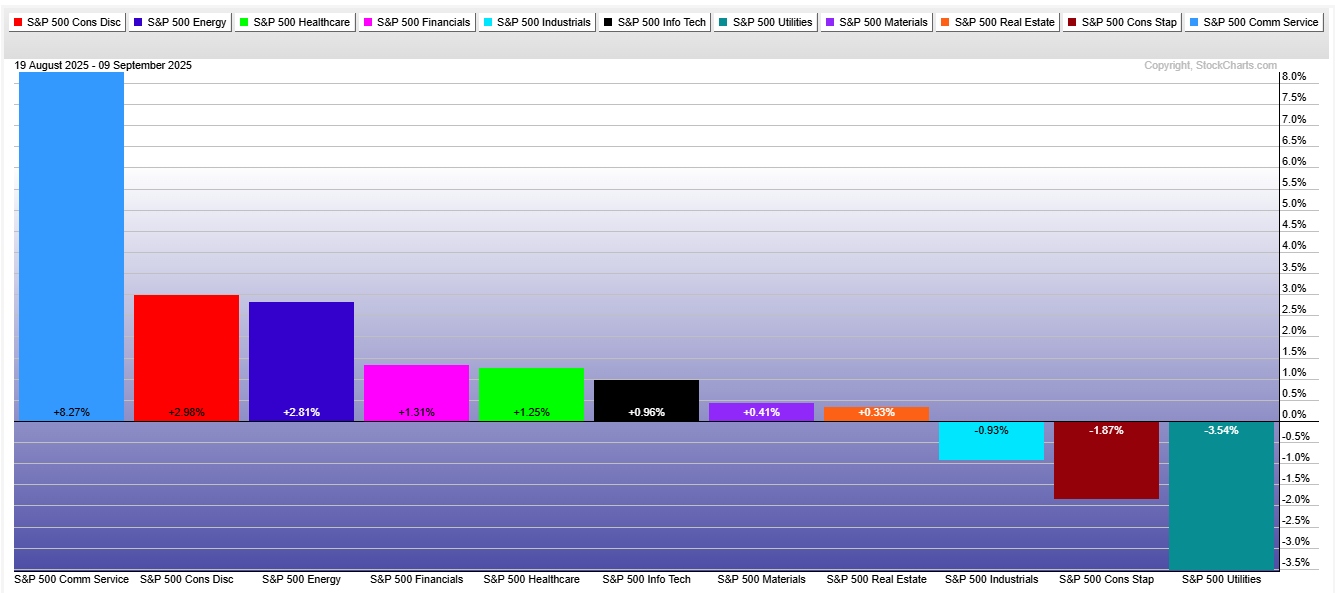

On August 20, I asserted that Financials and Industrials were set to play leading roles in the stock market’s next performance stretch. Financials has done fine, with the S&P 500 Financials Index rising 1.3% since August 20. Industrials, however, is down 1%. (You can sift through all the S&P 500 sector performance trends on a PerfChart I bookmarked.) More concerning is how the sector’s relative strength line has rolled over sharply.

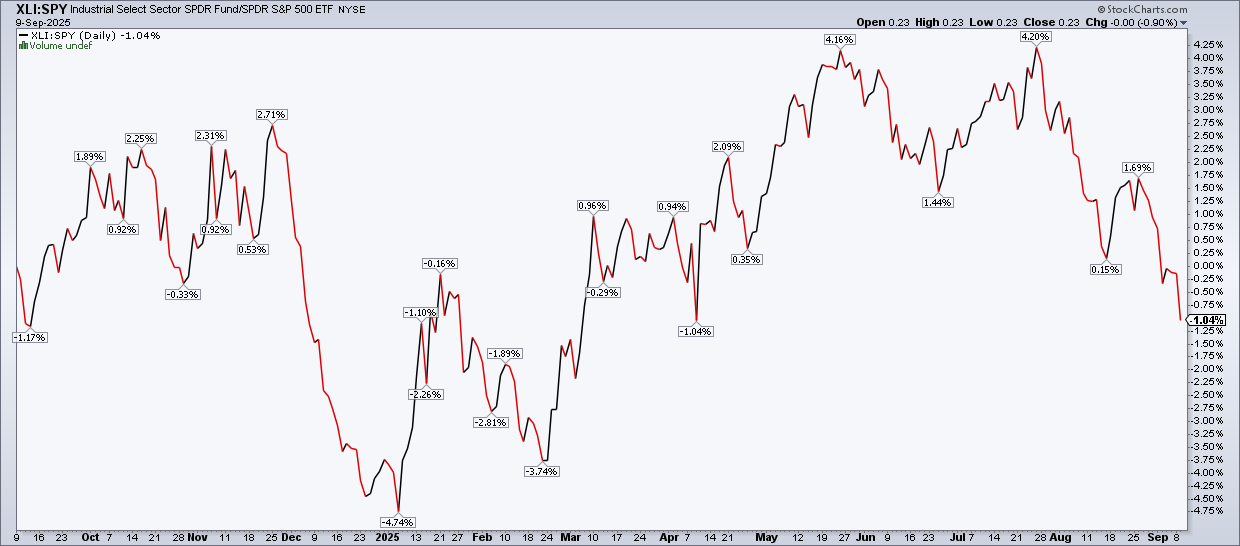

The Industrial Select Sector SPDR ETF (XLI) is now at its lowest spot compared to the SPDR S&P 500 ETF (SPY) since the April 9 market bottom. More than half of the relative gains from early January to the double-top logged in May and July have been wiped away.

Industrials now lags the S&P 500 on a total return basis over the past year. But what’s driving the negative alpha? Let’s drill down.

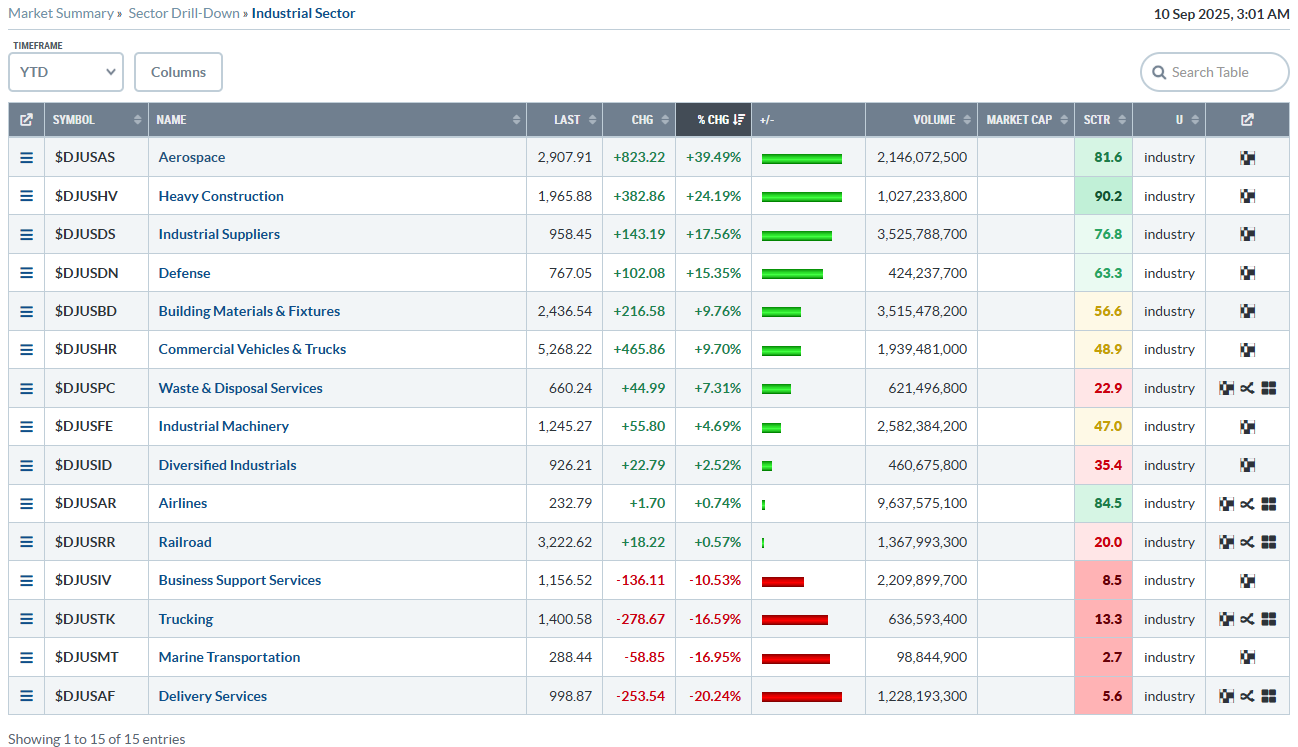

Before we suss the near-term culprit for lousy Industrials price action, it may help to determine what drove the value sector’s impressive gain in the longer term. The StockCharts Sector Drill-Down, filtered for Industrials, reveals that Aerospace, Heavy Construction, Industrial Suppliers, and Defense are the stars.

Aerospace commands a large share of the sector’s market cap. Names like RTX Technologies (RTX), Airbus (EADSY), and Boeing (BA) are a few of the big 2025 winners. BA, in fact, is the best stock on the Dow Jones Industrial Average year-to-date. Other companies, such as GE Aerospace (GE) and Siemens AG (SIEGY), while not technically in the Aerospace industry, were stalwarts in Industrials’ relative strength through late July.

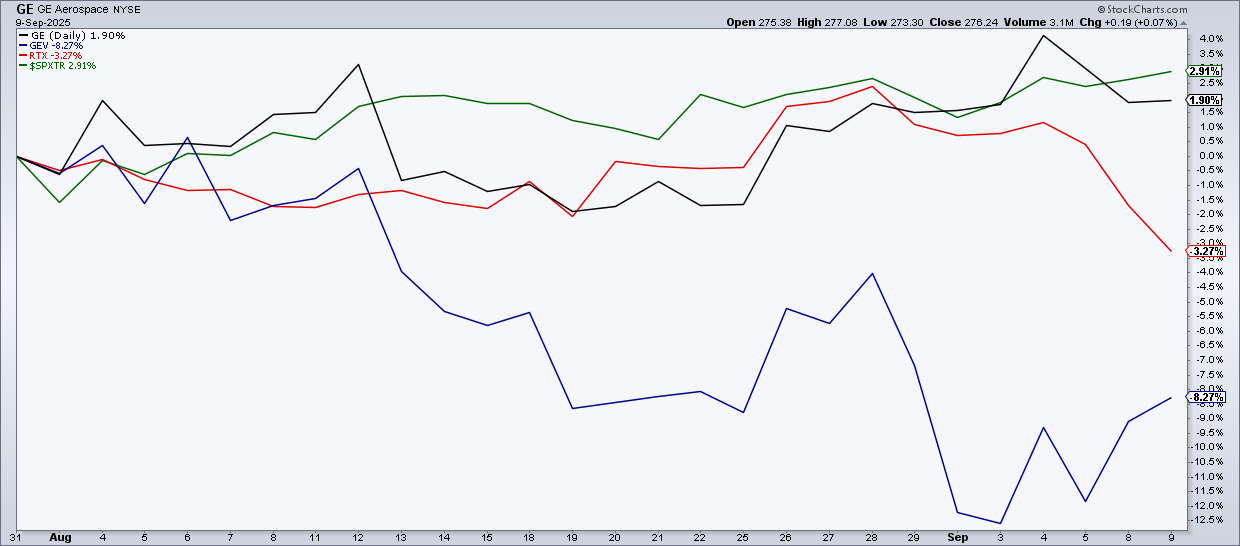

Shares of aerospace and defense stocks have actually held up fine since the middle of last month. GE, Siemens, and RTX (the three biggest-weights) are about flat. Dragging down the Industrials are some heavy hitters in the Industrial Machinery, Commercial Vehicles, and Railroad industries.

As the likes of Oracle (ORCL) and Broadcom (AVGO) continue spurring AI awe, some less-sexy infrastructure niches turned less appealing to momentum investors:

- GE Vernova (GEV), which was a 2025 doubler leading into and just after its Q2 earnings report on July 23, is now in correction territory. But the spin-off success story gained after ORCL’s banger report and in the wake of the sanguine August PPI report today.

- Eaton Corp. (ETN) also reached a zenith early in the third quarter and is now in a 12% drawdown.

- Deere & Co. (DE) delivered a second-quarter double beat. But its solid revenue and earnings numbers came alongside a cautious outlook a month ago, resulting in shares plowing lower by 7%. At $475, the DE bulls now have quite a row to hoe to bring the blue chip back to its record highs near $530.

And then there are the once-hot momentum names that have taken a breather. Taser-maker Axon (AXON) put in a blow-off top at $886 on August 5, corporate uniform-provider Cintas (CTAS) shows an ugly double-top pattern at $230, and trash stocks (WM and RSG) have tossed away material gains over the last handful of weeks.

Zooming out, the momentum factor peaked in May. Despite a pickup this month, the iShares MSCI USA Momentum Factor ETF (MTUM) trails the S&P 500, thanks to the constant reshuffling of winners. For example, Alphabet (GOOGL) came back to life after a doldrums period, banks and some other value spots turned up mid-year, and Palantir (PLTR) (the poster child for AI momentum) has lost some luster. Just three Industrials are in MTUM’s top 20 holdings today: GEV, GE, and RTX. That trio has been in consolidation mode since the middle of the quarter.

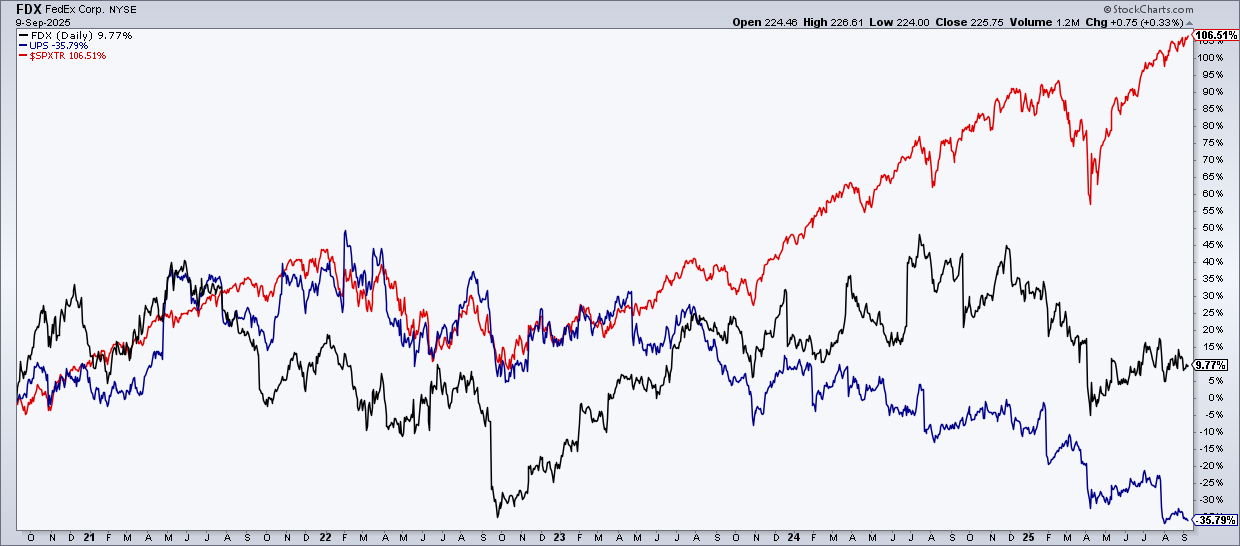

Weighing on Industrials for more than just the last several weeks are FedEx (FDX) and UPS (UPS). It's hard to dub them macro bellwethers anymore. Both stocks peaked years ago, the former in mid-2021 and the latter in early 2022.

Traditional fusion analysis (combining fundamental analysis with technicals) asserts that such absolute and relative weakness among air freight & logistics stocks may portend tepid US GDP growth ahead. Judging price action, I argue that it’s a “boy who cried wolf” story at this stage.

The Bottom Line

The Industrials sector notched an all-time high just as many of its leaders reported Q2 results in late July. The most diverse of the 11 S&P 500 groups, Industrials, has not confirmed the S&P 500's recent record closes, but technical damage is not extreme. Rather, I see XLI’s choppy price-action pattern, ranging near its highs, as a healthy consolidation, potentially setting the stage for a classic mid-October through year-end rally.