Will the Dow Transports Give Traders Something to Be Thankful For?

Key Takeaways

- Uber and FedEx are the notable Dow Transport stocks to watch this holiday season

- Macro headwinds could reverse into tailwinds next year, but technical work is needed

- As 2026 outlooks pepper our inboxes, price action in transports will be the ultimate arbiter

Fed rate-cut hopes have floated back to the market’s surface. There’s about a 70% market-implied chance that the FOMC will execute a third consecutive quarter-point ease when it meets next on December 9–10. That would presumably be a boost for cyclical slices of the U.S. economy. What’s more, we’ll get more reads on the “real” macro picture this week, now that official government data is back on tap.

Transports: A Long-Time Laggard

Price action last Friday was sanguine for one of the most economically sensitive parts of the market: transports. The Dow Jones Transportation Index was pennies from its best session since May 12 ahead of this holiday-shortened trading week. Today, I’m climbing aboard the 20-stock index, which has been flashing warning signs throughout the year.

The Dow Transports has been a long-time laggard, with the index basically unchanged from May 2021. There have been fits and starts, but a few bearish narratives and weak industry groups have kept the transports from chugging ahead with vigor.

Winners, Losers, and Flat Tracks

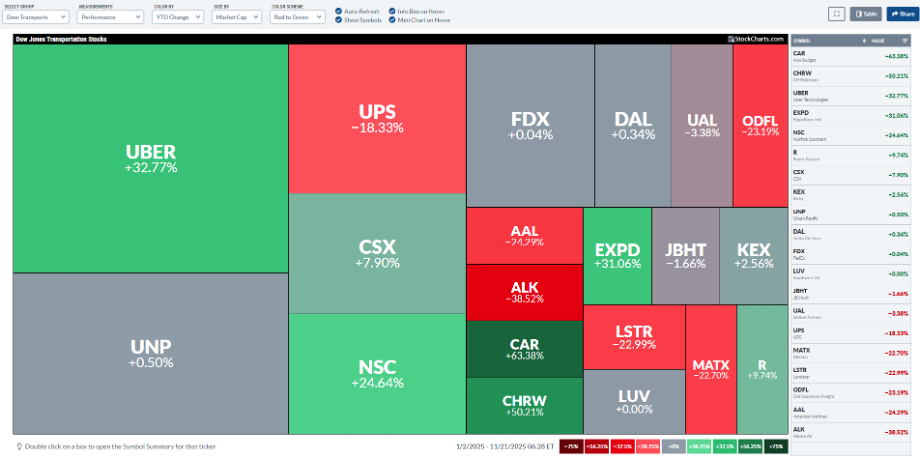

To illustrate the point, I’d like to taxi readers over to StockCharts’ MarketCarpets. We’ll drop down to the Dow Transports group and view the year-to-date change.

Yes, there have been some clear winners, including Avis Budget (CAR), C.H. Robinson (CHRW), and retail-favorite Uber (UBER), but airlines have been descending, freight names have been tapping the brakes, and even the railroads have been tracking merely sideways.

Dow Theory: A Split Screen

Big picture, $TRAN is up by less than 1% so far this year, underperforming the Dow Jones Industrial Average by some eight percentage points. Even novice technicians and market-watchers know that one of the six tenets of the Dow Theory is that price confirmation between $TRAN and $INDU is desired.

Zoom in on the six-month view, however, and we see that both of the blue-chip collections of stocks are up a tidy 10%. So, it’s not entirely bearish, particularly as we head into December—a month that usually sports gains after a down November within an up year.

Uber’s Bearish Detour

Key to year-end performance may be the largest component—the aforementioned UBER. Investors have been on a wild trip with the ride-hailing app company in the last few months. Downside action on Thursday last week took the shares of the $174 billion market-cap company below their 200-day moving average for the first time since just after “Liberation Day.”

Hammer Time for the Ride-Hailer?

Notice in the chart below that UBER printed a hammer/doji candlestick pattern to close out November’s penultimate week. The intraday drop-and-pop was made all the more critical as it occurred on high volume. Between Thursday and Friday, it was nearly the highest-volume two-day event since February.

Furthermore, UBER has broken an uptrend support line, and there’s now a high amount of volume by price above the current level—that will make rally attempts tough for the bulls to bring the stock through significant overhead supply. Still, support is seen in the low $80s, so we have some price levels to monitor into year-end. Shareholders hope that UBER’s sub-30 RSI is decent enough for an oversold bounce.

FedEx Delivering the Goods

Another Dow Transportation component to watch? FedEx (FDX).

While UBER is stuck in technical traffic, the delivery-services industry company within the Industrials sector stuck its best close since January last Friday. A bullish golden cross pattern, in which the short-term 50-day moving average moves above the 200-DMA, was certainly encouraging, and the long-term moving average is now fractionally on the rise. That suggests the bulls have snatched control of the primary trend.

And while UBER’s momentum has ground to a halt, it’s blue skies ahead for FedEx. The RSI has been flirting with 70. But I see a potential pause at the current spot, as FDX is right back to its breakdown point from Q1. I would not be surprised to see the stock churn ahead of its December 18 earnings event (one of the major off-season reporters).

2026 Forecasts Hit the Runway

At the macro level, it’s that time of year when sell-side year-ahead outlooks begin to litter Wall Street. $TRAN is arguably most tied to what happens with U.S. economic growth.

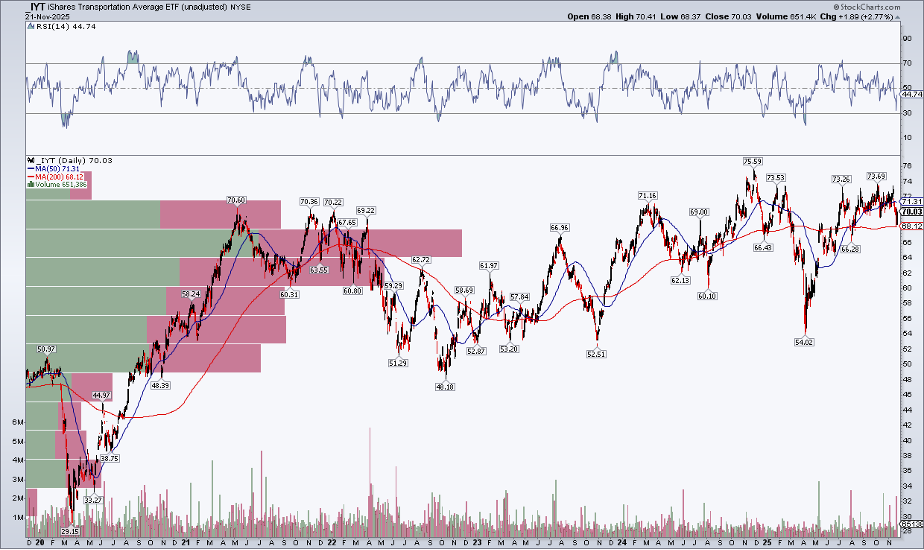

If generally optimistic forecasts come to pass next year (gradually improving employment, easing inflation, a friendly Fed, low oil prices), transports could be a decent place to be positioned in 2026. While not a perfect match to the Transportation Average, the iShares U.S. Transportation ETF (IYT) is a common play on the niche.

IYT’s Road to Redemption

The ETF’s two biggest positions are UBER and Union Pacific (UNP). In fact, Railroads is the largest industry weight. Too bad IYT’s chart looks no prettier than that of $TRAN. The bulls hope for a reroute, and the $75.59 all-time high from 12 months ago might have to be taken out. Shares are likewise unchanged since May 2021, with a flat 200-DMA.

The Bottom Line

Semiconductors seem to have supplanted transports as the ultimate U.S. economic bellwether equity industry group. Still, there’s some signal we can glean from this segment of the real economy. UBER has pulled to the shoulder lately, while FDX is delivering year-end gains just as the holiday-shopping season kicks into high gear. Ultimately, 2026 will be a show-me year for the Transportation Average, and much hinges on how the macro unfolds.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.