MEMBERS ONLY

GNG TV: Inflection Point for a Rising Rate Environment

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As the 10-Year Treasury Yield reaches 2.6% and Fed minutes point to a far more aggressive stance by many central bank governors, $TNX presents a critical inflection point on a multi-decade basis. Going back to 1981, the steady downward sloping trendline has presented resistance over and over again. From...

READ MORE

MEMBERS ONLY

Flight Path: Risk-On in a Rising Rate Environment?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

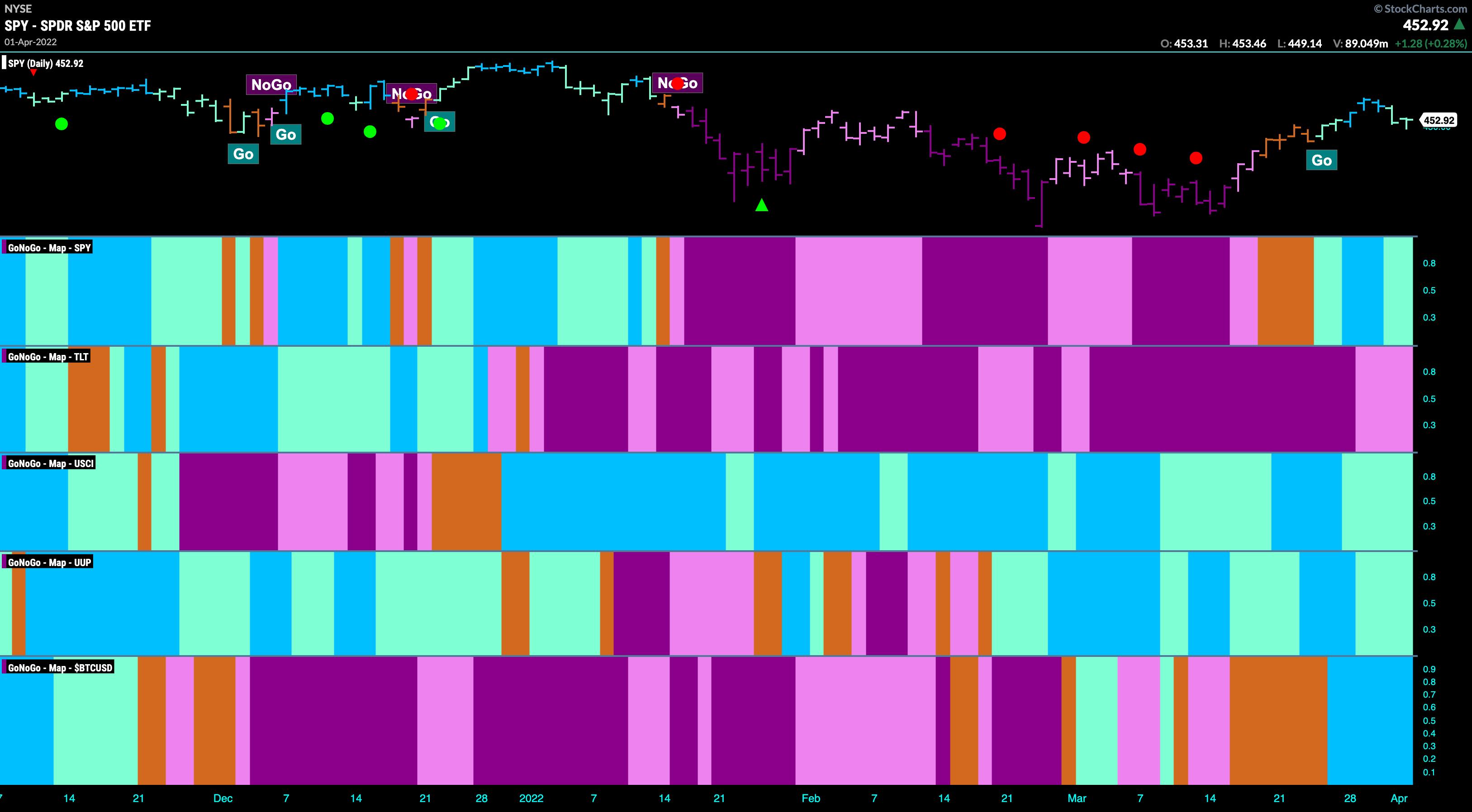

Good morning and welcome to this week's Flight Path. For this week, let's take a look at the below GoNoGo Asset Map. The top panel shows that the trend in U.S. equities continues in its new "Go" trend, albeit weakening to end the...

READ MORE

MEMBERS ONLY

GNG TV: Growth Equities - Return or Revert?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

On this week's edition of the GoNoGo Charts show, Alex and Tyler take a look at the cross-asset GoNoGo Heat Map® for a sense of overall bullish and bearish trends this week. The top panel shows that U.S. equities reversed the trend last week into "Go&...

READ MORE

MEMBERS ONLY

GoNoGo TV: Risk On, But What Has Changed?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

The market rally over the last 10 days has been impressive. A huge relief to investor portfolios beaten down in 2022 YTD. In this week's edition of the GoNoGo Charts show, the question Alex and Tyler seek to answer is whether or not the safe haven trading was...

READ MORE

MEMBERS ONLY

Going, Going, Gone: End of Week Themes with GoNoGo Charts

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As the week ends, let's look at some of the thematic charts from a GoNoGo perspective.

Below is the GoNoGo Chart of $SPY. We have seen a strong rally that started on Wednesday as prices have climbed higher. We were watching the zero line on the oscillator closely...

READ MORE

MEMBERS ONLY

GoNoGo TV: Downside on Multiple Timeframe Perspectives

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

It is no mystery that US equity indices are chopping around volatile swings each and every day. The trend conditions remain "NoGo" as markets deliver continued lower highs and lower lows. The weight of the evidence remains to the downside on daily and weekly timeframes. However, Wednesday delivered...

READ MORE

MEMBERS ONLY

Flight Path: S&P Sinks Toward Prior Lows; Materials Not Miserable

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

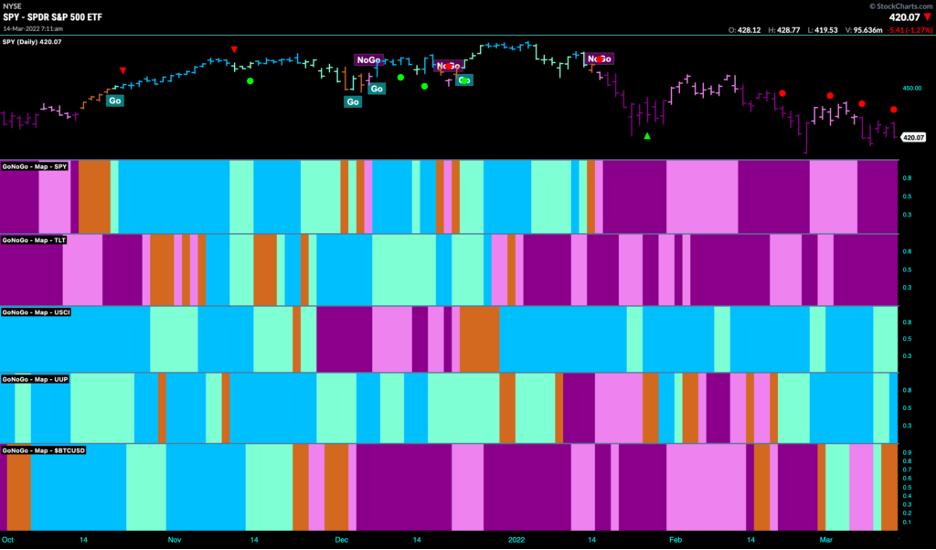

Good morning and welcome to this week's Flight Path. Let's take a look at the below GoNoGo Asset Map for this week. The top panel shows that the trend in U.S. equities has remained a "NoGo" and strengthened this week on purple bars....

READ MORE

MEMBERS ONLY

Blow-Off Top or Trend Acceleration?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler discuss how volatility continues to deliver Fear, Uncertainty and Doubt to investors as the world deals with accelerating inflation and open war against Ukraine. Treasury bond prices remain in a strong "NoGo" trend, painting...

READ MORE

MEMBERS ONLY

Flight Path: Oil Continues to Lead + Using Multiple Time Frames to Help with Entries

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path, originally posted Monday, March 7th. Let's look at the below GoNoGo Asset Map for this week. The top panel shows that the trend in U.S. equities has remained a "NoGo", albeit painting paler pink...

READ MORE

MEMBERS ONLY

Inflation Invasion Relation

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

What is clear about the US Equity markets' trend is that it is down, with a series of lower highs and lower lows despite the tremendous volatility of last week. The GoNoGo Oscillator is testing the zero-line from below, and while the trend condition is in its weaker pink...

READ MORE

MEMBERS ONLY

Flight Path: "Tweezer Bottom" or "Dead Cat Bounce"?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

If you've been away, really away, and all you know is that US Equities were up ~1% last week, then you've been extremely disciplined about your New Year's digital detox resolution!

The S&P 500 began the holiday-shortened week with a 1% decline...

READ MORE

MEMBERS ONLY

S&P 500 NoGo Trend for 2022 YTD

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

For the third week in a row, the major U.S. stock indexes appeared to be on the verge of an overall gain at midweek, only to end up negative after declining on Thursday and Friday. The invasion of Ukraine has made Thursday's selloff even more dramatic, but...

READ MORE

MEMBERS ONLY

Flight Path: February 22, 2022

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Run Lola Run! It's Groundhogs' Day All Over Again

For the second week in a row, the major U.S. stock indexes appeared to be on the verge of an overall gain at midweek, only to end up negative after declining on Thursday and Friday. Indexes fell...

READ MORE

MEMBERS ONLY

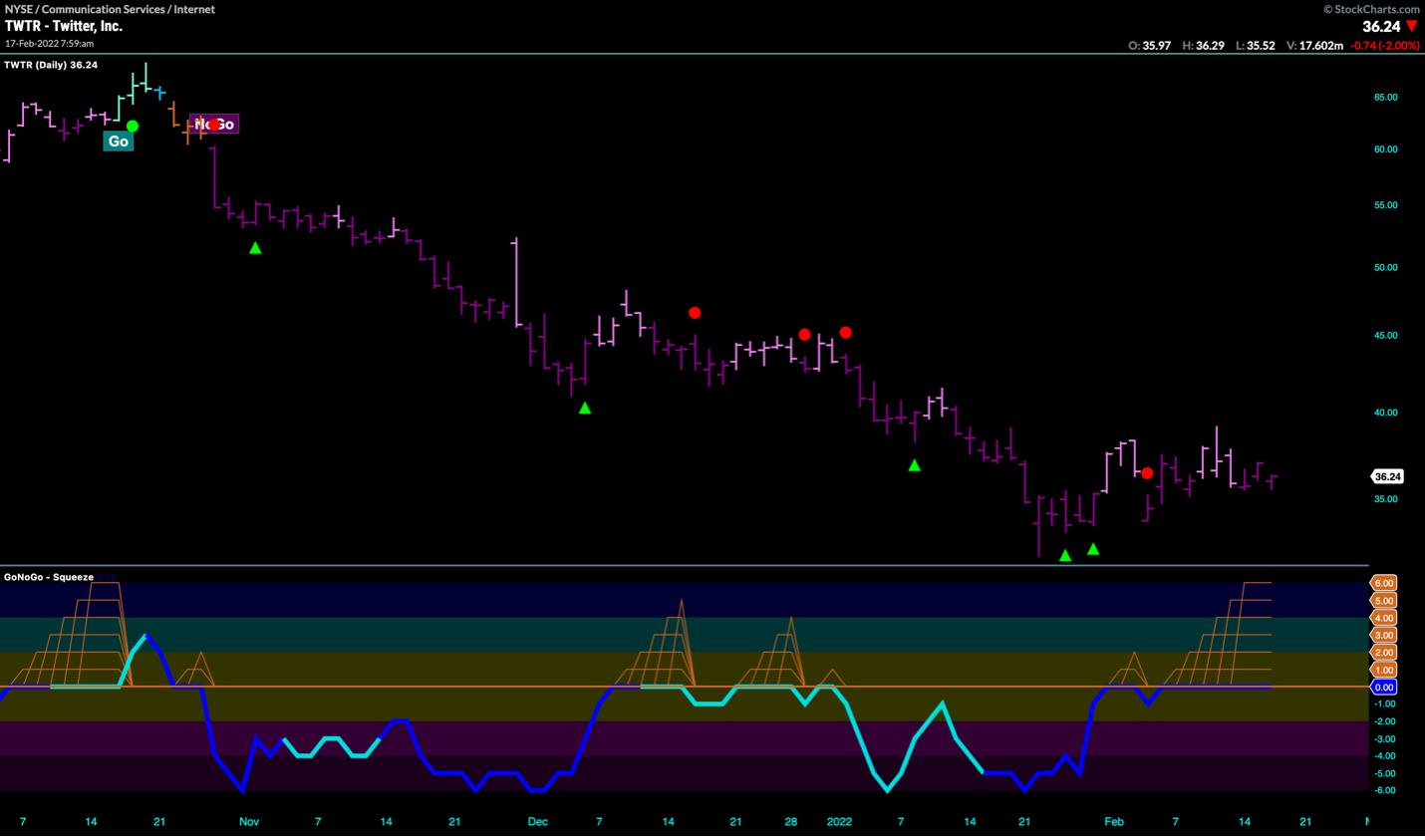

TWTR Analysis + New Video: S&P Hovering at Critical Inflection Point

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Twitter (TWTR) has been in a strong "NoGo" trend since October of last year. While there hasn't been much for bulls to get excited about, we are looking at a pause in the bearish price activity. The GoNoGo Oscillator has been riding the zero line as...

READ MORE

MEMBERS ONLY

Energy & Financials Lead While Rates Jump Higher

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, we have "Go" conditions on the daily chart. US Equities still hovering at inflection point. Overall, we have "NoGo" Conditions for the trend of the S&P 500, but the GoNoGo Oscillator is breaking...

READ MORE

MEMBERS ONLY

Leaders (Survivors) Emerging from the Volatility

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, with US Equity Indices at critical inflection points, Alex and Tyler review the possible scenarios through GoNoGo Charts: is this a bear market counter-trend rally or the bottoming before we resume the bull market trend?

GoNoGo Charts do not...

READ MORE

MEMBERS ONLY

Lack of Risk Asset Demand Pushes S&P Decline

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, the volatility continues as the U.S. domestic markets experience massive intraday swings. Alex and Tyler look at how expectations of 4 rate hikes in 2022 weigh on investors' decision-making by examining charts of the S&P,...

READ MORE

MEMBERS ONLY

Choppy Markets = Potential for Trend Change

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler look at several critical inflection points in the markets. They note key levels of support breaking in tech stocks, growth/value ratios and a continued selloff in US Government Treasuries driving rates on the 10-year above...

READ MORE

MEMBERS ONLY

Rising Rates Fuel a Fresh Rotation into Cyclicals

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler discuss the selloff in equities, which was strong in the first trading week of the year. The continuation on Monday, Jan 10th was short-lived, offering investors yet another "buy-the-dip" opportunity at the index level....

READ MORE

MEMBERS ONLY

GoNoGo Flight Path

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In the first-ever edition of the GoNoGo Charts show, Alex and Tyler wrap up the 2021 markets, then dive into the charts as the new year begins. Starting with the S&P, they move through small-caps, growth, value and healthcare.

This video was originally broadcast on January 6, 2022....

READ MORE