MEMBERS ONLY

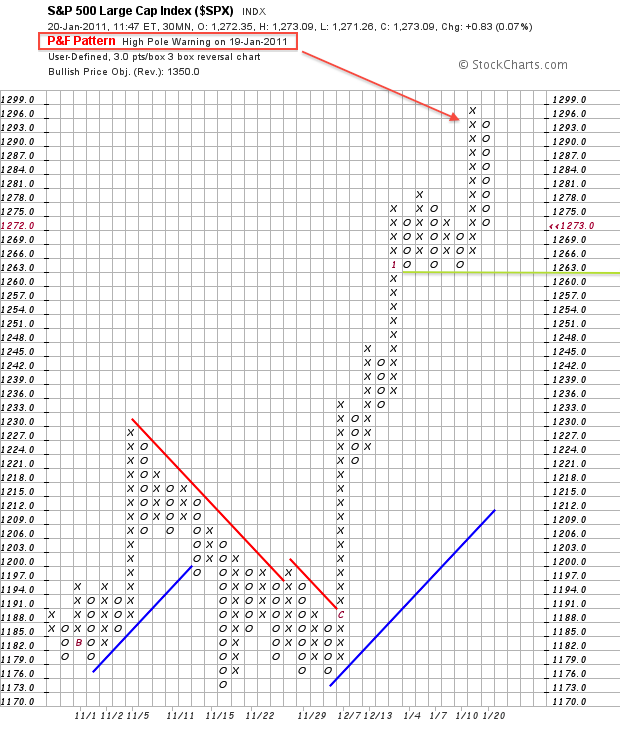

A High-Pole Warning hits P&F Chart for the S&P 500

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 surged above 1296 and then quickly fell below 1278 to forge a high-pole warning on the P&F chart. Despite this warning, the index remains above a clear support level marked by three reaction lows at 1263. Notice how the three columns of O&...

READ MORE

MEMBERS ONLY

SPY Tests Channel Trendline as RSI Hits Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Overall, SPY continues to move higher within a tight rising price channel. Obviously, this channel cannot hold forever. Wednesday's decline (-.98%) was the sharpest 1-day loss since late November, the 26th to be exact. This means we have just witnessed the most selling pressure in 37 trading...

READ MORE

MEMBERS ONLY

Charts of Interest: AZO,DRI,ECL, KMX,KO,LLY,MHK,PNRA,RHT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ECL bucks the trend with wedge breakout. KO forms bearish wedge. PNRA forms bearish pennant. Plus AZO, DRI, KMX, LLY, MHK and RHT.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or...

READ MORE

MEMBERS ONLY

Platinum Outperforms Gold as Auto Stocks Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the Gold Trust SPDR (GLD) pulled back rather sharply in 2011, the Platinum ETN (PGM) held strong and recorded a new 52-week high this week. Platinum was lagging gold until from early August until late November. The PGM:GLD ratio bottomed at the end of November and moved sharply...

READ MORE

MEMBERS ONLY

Euro breaks resistance as Gold forms Bull Wedge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The intermarket arena continues to heat up as the Euro Currency Trust (FXE) breaks resistance and the Gold SPDR (GLD) forms a bull wedge. As noted yesterday, the Euro broke support in early January, but this support break failed to hold and the ETF rallied all the way back to...

READ MORE

MEMBERS ONLY

Six weeks of no Pain for QQQQ Bulls

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQQ) has not seen a loss greater than 1/2% since November 30th, around six weeks ago. There have been plenty of gains greater than 1/2% and even a few losses, but no painful losses. Moreover, this remarkable streak shows no signs of ending as...

READ MORE

MEMBERS ONLY

Bond Yields Tests Support as Euro Challenges Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the stock market analysis. Both the medium-term (daily chart) and short-term (60-minute chart) trends are up with no signs of selling pressure. Focus may turn to the intermarket area as bond yields test support, the Euro challenges resistacne and trades at a multi-week low. The...

READ MORE

MEMBERS ONLY

Charts of Interest: AVP, ERTS, GERN, HRB, SUSS, YHOO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AVP fails to hold breakout. GERN forms small ascending triangle. YHOO extends consolidation. Plus ERTS, HRB, SUSS.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think...

READ MORE

MEMBERS ONLY

Stocks Lead and Gold Lags in 2011

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With two weeks underway, stocks are taking the lead and gold is taking the lag for 2011. Of the five inter-market related ETFs, the S&P 500 ETF (SPY) and the US Dollar Fund (UUP) are up this year. The USO Oil Fund (USO), 20+ year Bond ETF (TLT)...

READ MORE

MEMBERS ONLY

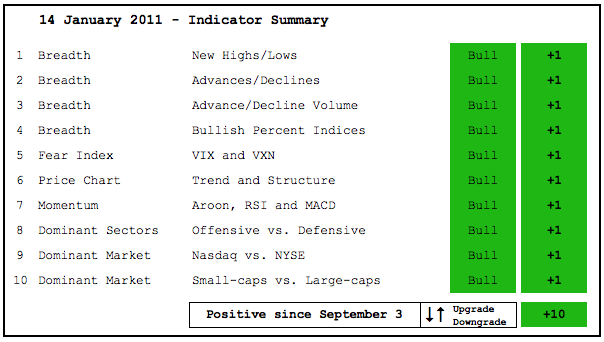

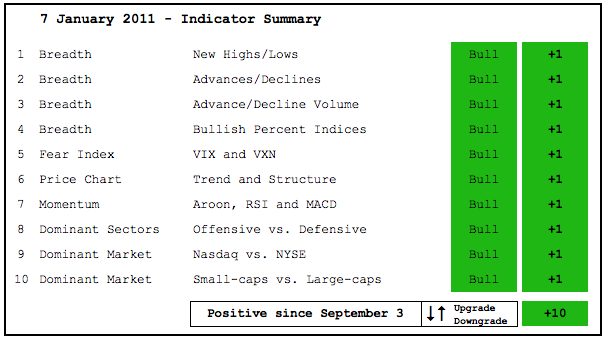

Indicator Summary Remains Firmly Positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market appears to be on bullish auto-pilot. In fact, it seems that a bit of complacency may be setting in. While I remain concerned with excessively bullish sentiment, a bearish signal in the put-call ratio and overbought conditions, there is simply no evidence of selling pressure on the...

READ MORE

MEMBERS ONLY

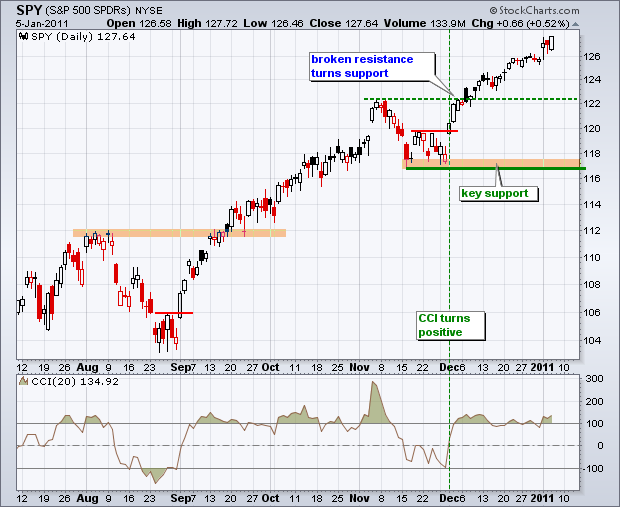

SPY Continues to Grind Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Unsurprisingly, there is not change in the analysis of the daily or 60-minute charts. This December-January advance is looking awfully familiar. Looking back, we can see that SPY surged in early September, CCI became overbought and the ETF continued higher the next seven weeks. Looking at the current rally, we...

READ MORE

MEMBERS ONLY

The Squeeze is on for Analog Devices

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a tight trading range the last several weeks, the Bollinger Bands have significantly narrowed for Analog Devices (ADI) - and the squeeze is on. A close above the upper band would be short-term bullish, while a close below the lower band would be short-term bearish. Be careful. Sometimes the...

READ MORE

MEMBERS ONLY

SPY Moves into Upper Half of Rising Channel

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This December-January advance is looking awfully familiar. Looking back, we can see that SPY surged in early September, CCI became overbought and the ETF continued higher the next seven weeks. Looking at the current rally, we can see that SPY surged in early December, CCI became overbought and the ETF...

READ MORE

MEMBERS ONLY

Charts of Interest: AMGN, BAX, ERTS, GILD, JWN, K

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMGN forms bull flag. BAX surges off support with good volume. ERTS firms within small wedge. Plus GILD, JWN, K.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all...

READ MORE

MEMBERS ONLY

Another Consolidation Breakout for the Materials SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Basic Materials SPDR (XLB) remains on of the top performing sectors in the market. Since breaking resistance in September, the ETF advanced with a series of consolidation breakout. With the surge over the last three days, the ETF broke flag/wedge resistance and scored a 52-week high today.

Click...

READ MORE

MEMBERS ONLY

Bonds Hit Resistance as Euro and Gold Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the SPY trends so I will add coverage of the 10-year Treasury Yield ($TNX), Euro Currency Trust (FXE) and Gold SPDR (GLD) today. Interest rates remain in an uptrend overall and the 10-year Treasury Yield has been consolidating since mid December. Support resides at 3....

READ MORE

MEMBERS ONLY

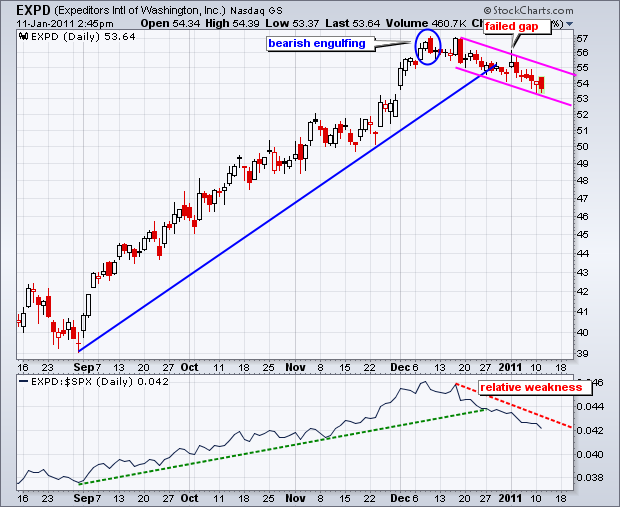

A Bearish Engulging and Failed Gap Define Downtrend for Expeditors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the market has been moving higher since mid December, Expeditors has been under pressure and shown relative weakness. It all started with a bearish engulfing in early December. The stock gapped up on the first trading day of 2011, but failed to hold the gap and declined the...

READ MORE

MEMBERS ONLY

SPY Holds Short-term Support to Maintain Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the analysis for the medium-term (daily chart) or short-term (60-minute chart). SPY remains in a medium-term uptrend as the ETF recorded a new 52-week high last week. SPY started the week strong with an open above 126, but then stalled the rest of the week....

READ MORE

MEMBERS ONLY

Charts of Interest: CHUX, GERN, ISRG, MMM, NEM, THO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ISRG challenges resistance. MMM bounces with long white candle. NEM hits channel support. Plus CHUX, GERN, NEM, THO

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to...

READ MORE

MEMBERS ONLY

Oil and Oil Service HOLDRS Go Their Separate Ways

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Oil is trading up over 1% early Monday, but the Oil Service HOLDRS (OIH) is down over 1.5%. OIH seems to have some doubts regarding this pipeline related pop in crude.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

Short-term Breadth Remains Bullish as SPY Tests Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Short-term breadth indicators turned bullish in early December and remain bullish. These are the 10-day SMA for Net Advances and Net Advancing Volume for both the Nasdaq and NYSE. There are two breadth indicators for each major exchange. Breadth is bullish when all four break above +100 and breadth remains...

READ MORE

MEMBERS ONLY

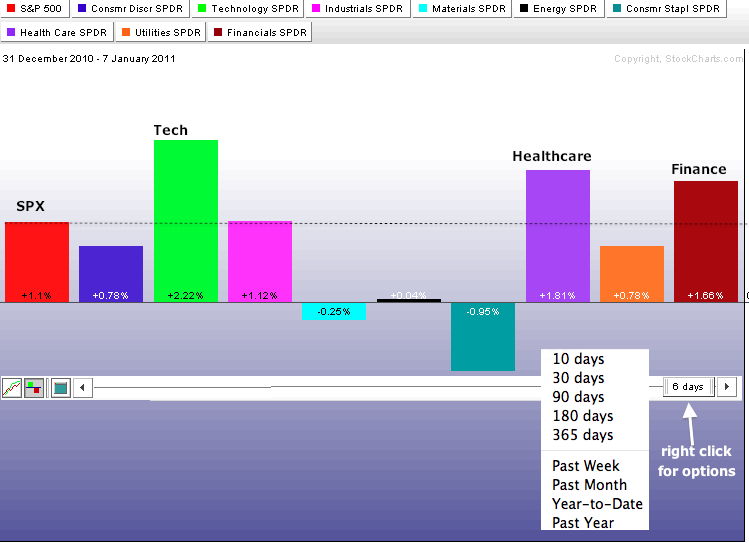

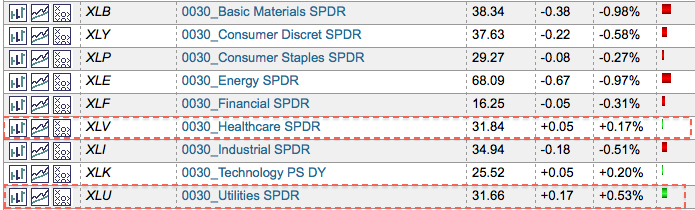

Technology SPDR Leads Sectors in 2011- Intel Lags

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though 2011 has just begun, there are clear leaders and laggards among the nine sectors. In particular, the technology sector is getting off to a great start. The Sector PerfChart shows the nine sector SPDRs and the S&P 500. The black dotted line marks the performance for...

READ MORE

MEMBERS ONLY

Treasury Yields Fall on Jobs Disappointment

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It has been a wild ride in the bond market this week. Treasuries fell and yields surged as the ADP employment report showed strong job growth on Wednesday. This move was reversed on Friday as bonds surged and yields fell after a disappointing non-farm payroll report. Overall, the 10-year Treasury...

READ MORE

MEMBERS ONLY

Indicator Summary Remains Firmly Positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market may be overbought and sentiment may seem excessively bullish, but there is simply no sign of weakness on the price charts or with the indicators. The AD Lines and AD Volume Lines both moved to new reaction highs this year. Net New Highs remain firmly positive and...

READ MORE

MEMBERS ONLY

SPY Holds Uptrend as Employment Report Looms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the short-term or medium-term analysis. Medium-term, the daily chart shows SPY in a clear uptrend with a new 52-week high this week. The ETF is up some 7.6% since December and up 22% since August. These big gains make the ETF overbought by most...

READ MORE

MEMBERS ONLY

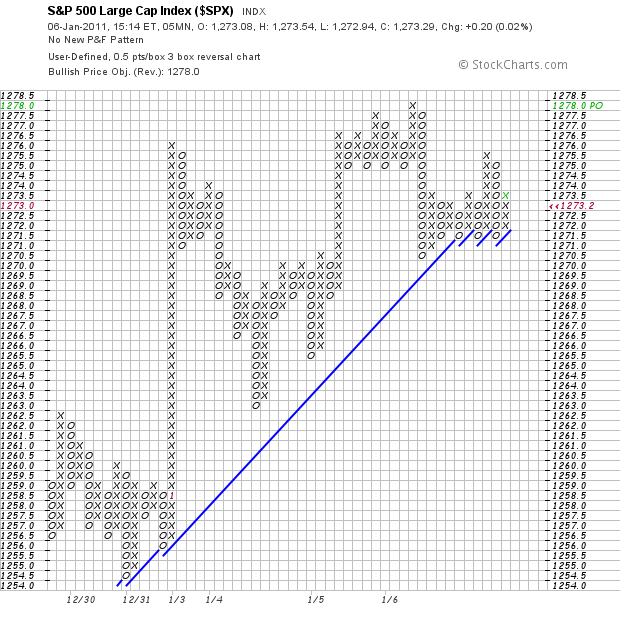

Marking Support with the 5min P&F Chart for SPX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though this is very short-term oriented, the 5 minute P&F chart for the S&P 500 shows a clear support level around 1270. The ETF bounced off this area at least five times today. A break below would argue for some sort of short-term pullback. Keep...

READ MORE

MEMBERS ONLY

SPY Continues to Grind Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the short-term or medium-term analysis. Medium-term, the daily chart shows SPY in a clear uptrend with a new 52-week high this week. The ETF is up some 7.6% since December and up 22% since August. These big gains make the ETF overbought by most...

READ MORE

MEMBERS ONLY

Charts of Interest: DELL, FDX, GILD, HRB, MAS, MRK, NE, URBN, YHOO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

GILD gaps above trendline. HRB fills gap after selling climax. URBN hits support with falling wedge. Plus DELL,FDX,MAS,MRK,NE,YHOO

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or...

READ MORE

MEMBERS ONLY

Akamai Traces Out Bullish Engulfing at Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Akamai (AKAM) declined to support in December and formed a rather large bullish engulfing on Wednesday, provided the close is above the prior day's open. Volume also ticked up to exceed the 250-day SMA. This pattern affirms support and follow through would provide an early signal that the...

READ MORE

MEMBERS ONLY

RSI holds Short-Term Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is not much change in the short-term or medium-term analysis. Medium-term, the daily chart shows SPY in a clear uptrend with a new 52-week high this week. The ETF is up some 7.6% since December and up 22% since August. These big gains make the ETF overbought by...

READ MORE

MEMBERS ONLY

Stocks Turns Defensive as Utilities Perk Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big bang to start the year, stocks turned defensive on day two as six of the nine sectors were down as of 3PM ET. Of the three that were up, the utilities and healthcare sectors come from the defensive end of the market. Technology, which is clearly an...

READ MORE

MEMBERS ONLY

A New Year and a New High for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulls started January just like December as stocks surged on the open and remained at high levels throughout the day. The S&P 500 ETF (SPY) advanced just over 1% and recorded yet another 52-week high. SPY is now up 7.6% since the beginning of December. Even...

READ MORE

MEMBERS ONLY

Charts of Interest: ARO, AVP, FXE, GCI, INTC, ISRG, $TNX, VRTX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ARO breaks support. AVP surges above resistance. VRTX forms bullish pennant. Plus FXE,GCI,INTC,ISRG,$TNX.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think...

READ MORE

MEMBERS ONLY

Natural Gas Surges into the New Year

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The US Natural Gas Fund (UNG) remains in a long-term downtrend, but the ETF shows signs of life with a higher low in late December and a surge in early January. Broken support and the January-2010 trendline combine to mark the next resistance around 6.7-6.9.

Click this image...

READ MORE

MEMBERS ONLY

Narrow Range Days, But Little Selling Pressure

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

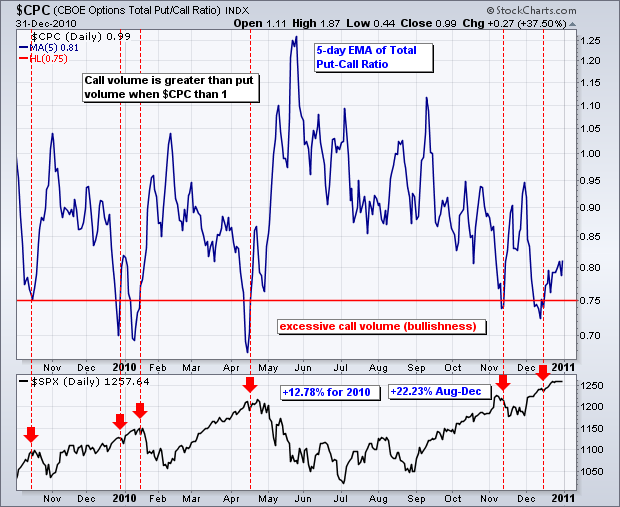

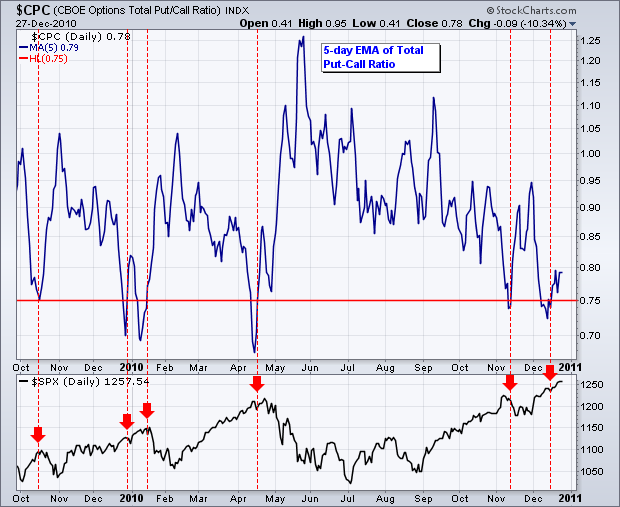

Even though sentiment is excessively bullish and stocks are ripe for a pullback, the major index ETFs simply show no signs of selling pressure and remain strong overall. The CBOE Total Put/Call Ratio ($CPC) dipped below .75 in mid December to show excessive bullishness, but this did not stop...

READ MORE

MEMBERS ONLY

Leading S&P 500 Stocks for 2010

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Hot off the press from our scan engine, 51 of the 500 stocks in the S&P 500 are up over 50% over the last 250 trading days, which is around one year. That's just over 10%, which makes for a pretty amazing year. 3 stocks are...

READ MORE

MEMBERS ONLY

Top 10 Technical Developments in 2010

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Here are the top 10 technical charting developments that happened during 2010 as selected by our crack staff of technical analysts. See if you agree...

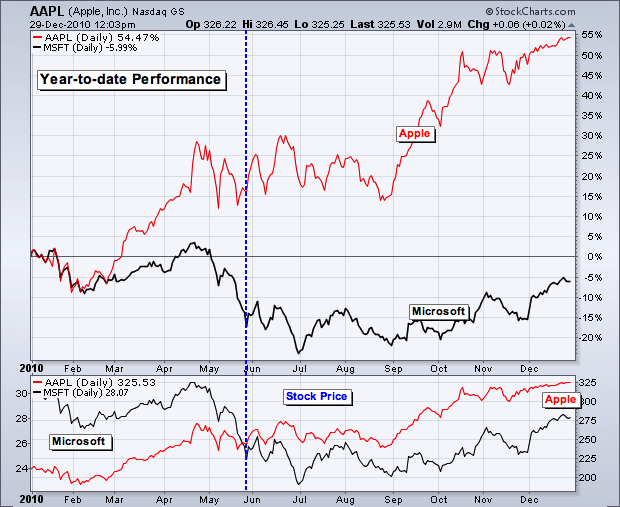

10. Apple surpassed Microsoft in market capitalization on May 26th and gained over 50% on the year.

Apple is currently valued around $298 billion, while...

READ MORE

MEMBERS ONLY

Rates Surge and Stocks Remain Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Rising interest rates are a plus for the greenback. After a pullback in mid December, interest rates resumed their upward trajectory as the 10-year Treasury Yield ($TNX) surged above 3.45% on Tuesday. Rising interest rates are bullish for both the Dollar and the stock market. Rates rise when the...

READ MORE

MEMBERS ONLY

Band Width Contracts as Dow Transports Stall

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow Transports have been flat for four weeks as the Average forms small weekly candlesticks in the 5000-5100 area. A visual assessment indicates that these are the smallest candlesticks of the year. Bollinger Band Width (10,2) contracts as the Average stalls. This volatility contraction could give way to...

READ MORE

MEMBERS ONLY

Sentiment Indicator Hits Extreme as SPY Stays Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no real change in the short-term or medium-term situation. Even though some sentiment indicators show excessive bullishness, SPY remains in a clear uptrend on the 60-minute chart and the daily chart. The chart below shows the 5-day EMA for the CBOE Total Put/Call Ratio ($CPC). A move...

READ MORE