MEMBERS ONLY

SPY hits short-term resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Last week's breakout and extended surge reversed the August downtrend. Also note that SPY formed a higher low in late August. With strong breadth and strong follow through on Thursday and Friday, this breakout looks like the start of an extended advance. However, SPY is already short-term overbought...

READ MORE

MEMBERS ONLY

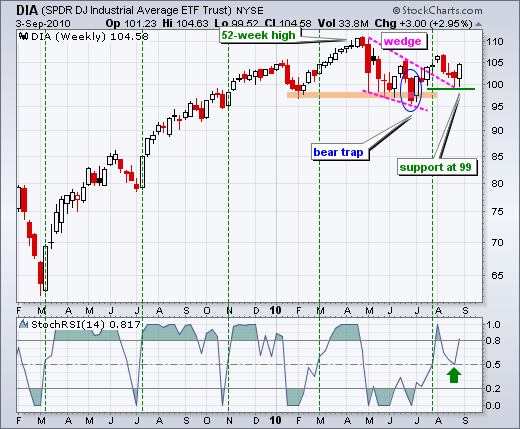

FIVE POSITIVES FOR THE DOW SPDR IN 2010

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks have been largely range bound throughout 2010, but the positives still outweigh the negatives overall. Chart 7 shows the **Dow SPDR (DIA)** starting the year just below 105 in January and finishing just below 105 this week. While it appears that DIA has nothing to show for eight months...

READ MORE

MEMBERS ONLY

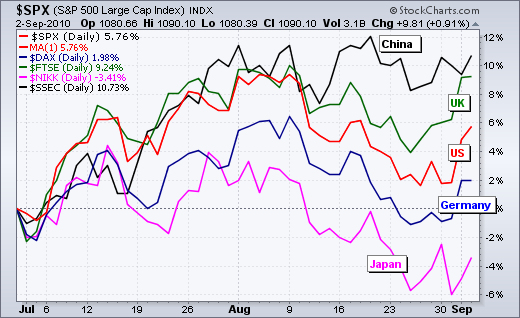

China leads the summer rally $SSEC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It has been quite a roller coaster the last two months. The S&P 500 (red) surged in July, fell sharply in August and surged over the last few days. While the S&P 500 went on its roller coaster ride, the Shanghai Composite (black) surged in July...

READ MORE

MEMBERS ONLY

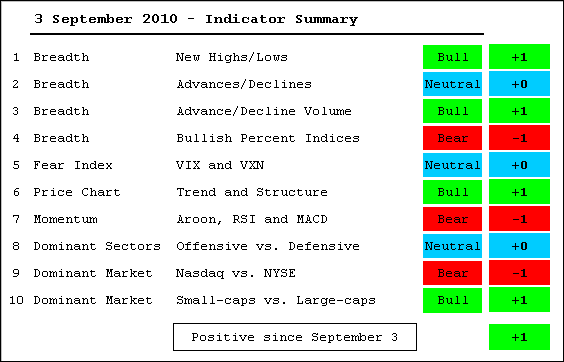

Indicator Summary turns positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Big swings continue to whipsaw the indicator summary. The S&P 500 first closed below 1100 on May 20th. Since then the index has crossed the 1100 level at least nine times as the index trades within a large consolidation. There have been four swings of at least 8%...

READ MORE

MEMBERS ONLY

Setting first resistance for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is not much change on the daily chart. SPY held above its July low and found support near the May-June lows. With a channel breakout, the ETF forged a reaction low and the inverse head-and-shoulders becomes a possibility. Neckline resistance resides around 113 and this is the next big...

READ MORE

MEMBERS ONLY

A breakout on big breadth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks around the world surged on Wednesday with many stock indices breaking out of their August downtrends. In the US, small-caps led the way higher with the Russell 2000 surging 3.81%. The Nasdaq and S&P 500 were both up around 3%. All sectors were up with consumer...

READ MORE

MEMBERS ONLY

A sea of green as Rowan leads

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P Sector Market Carpet shows a sea of green on Monday. All sectors were up sharply with consumer discretionary (+1.7) and technology (+1.6) showing the biggest average gains. Keep in mind that these numbers represent the average gain or loss for all stocks in the...

READ MORE

MEMBERS ONLY

SPY consolidates within downtrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The overall trend for most short-term indicators remains down and important resistance levels were established with Monday's decline. As with the major index ETFs, I will be watching the Friday-Monday highs for a breakout and trend reversal. The charts below show the Nasdaq AD Volume Line and NYSE...

READ MORE

MEMBERS ONLY

Nasdaq breadth leads lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The AD Line and cumulative Net New Highs line shows relative weakness in Nasdaq stocks. From the breadth indicators page at Stockcharts.com, the chart below shows these two Nasdaq indicators moving sharply lower the last three weeks. The cumulative Net New Highs lines for the NYSE and Amex are...

READ MORE

MEMBERS ONLY

SPY establishes new resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After big gains on Friday, stocks gave it back with big losses on Monday. A shallow pullback on modest breadth would have been positive, but yesterday's decline did not fit that bill. All nine sectors were lower, declines out numbered advances 4 to 1 and declining volume swamped...

READ MORE

MEMBERS ONLY

Dow bounces near key retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the close at 10040 on Tuesday, the Dow retraced around 61.8% of its prior advance (Jul-Aug). This Fibonacci retracement sometimes marks a reversal zone. The Dow managed to recover after dip below 10000 on Friday and close above 10100. Resistance might not be far off through. The 50-day...

READ MORE

MEMBERS ONLY

Stocks surge with strong breadth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a rather volatile first hour on Friday, stocks found their footing and moved steadily higher throughout the day. Friday's action produced a few positives as we move into an important week. First, stocks managed to overcome early weakness. SPY moved below 104.5 in the first 40...

READ MORE

MEMBERS ONLY

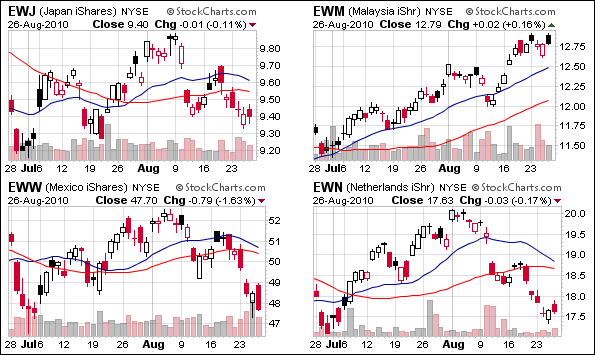

Malaysia bucks the world trend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks markets around the world have been moving lower the last few weeks, but there are some pockets of strength to be found in Asia. As this snippet from the CandleGlance International iShares page shows, the Malaysia iShares (EWM) shows relative strength as it trades near its highs for the...

READ MORE

MEMBERS ONLY

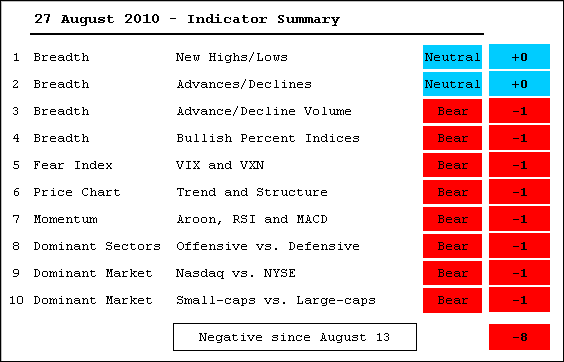

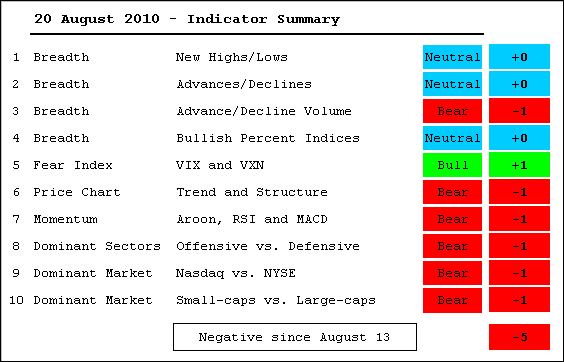

Indicator Summary remains negative

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary moved further into the red as the Bullish Percent Indices turned bearish and the S&P 500 Volatility Index ($VIX) broke above its mid July high. The NYSE AD Line and NYSE Net New Highs are the only two indicators keeping this summary from total negativity....

READ MORE

MEMBERS ONLY

Stocks move lower after opening higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the day on firm footing after jobless claims were better-than-expected. However, the morning pop did not last long as SPY moved into negative territory by 11AM. Selling pressure continued throughout the day and the index closed near its lows. Stocks failed to rally on "good" news...

READ MORE

MEMBERS ONLY

SPY finds support with modest bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the day week, but recovered and closed near the highs for the day. The Dow SPDR (DIA) firmed near its mid July low, the Nasdaq 100 ETF (QQQQ) formed a bullish engulfing near its 62% retracement and the Russell 2000 ETF (IWM) bounced off its early July low....

READ MORE

MEMBERS ONLY

AAPL dominates Nasdaq 100 and QQQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A look at the Market Indices Carpet in market cap mode shows Apple (AAPL) taking up the most real estate with the largest rectangle. This means Apple carries the most weight in the index. Click the "Nasdaq 100" header to focus on the Nasdaq 100. Click the market...

READ MORE

MEMBERS ONLY

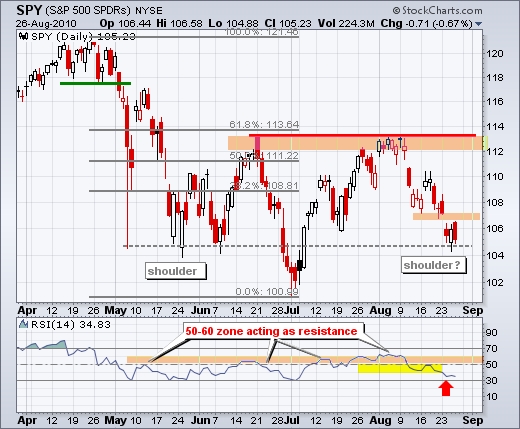

SPY tests May-June lows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a gap down and sharp decline, the S&P 500 ETF (SPY) closed below 106 for the first time since early July. Selling pressure has been quite intense since August 9. SPY has closed down 9 of the last 11 days (red candlesticks) with three sizable down gaps...

READ MORE

MEMBERS ONLY

XLU bucks the trend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were down sharply in afternoon trading on Tuesday, but the Utilities (SPDR) was bucking the trend with a small gain. As this screen grab from the Market Summary page shows, XLU was the only sector in positive territory. Looks like utilities like low interest rates.

Click this image for...

READ MORE

MEMBERS ONLY

Buying pressure drying up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

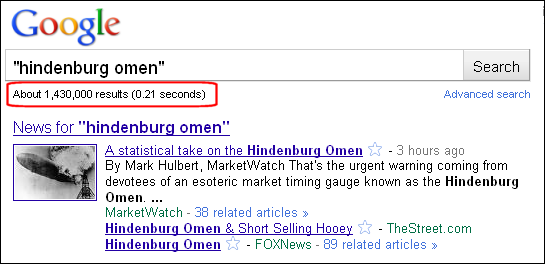

Despite excessively bearish sentiment, the technical conditions in the stock market are clearly bearish for the short-term and medium-term. Sentiment is hard to quantify, but I get the feeling that sentiment is overwhelmingly bearish as we head into the September-October period. Consider the following. First, the NY Times reports that...

READ MORE

MEMBERS ONLY

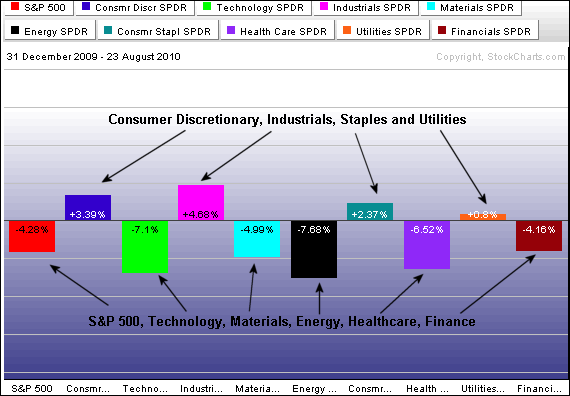

Sector performance is mixed for 2010

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Year-to-date sector performance shows five up and four down. In a rather strange twist, the consumer discretionary and industrial sectors are up, but the technology and finance sectors are down. Performance for the S&P 500 reflects the net result for the nine sectors (down 4.28%).

Click this...

READ MORE

MEMBERS ONLY

Hitting support in a downtrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The August trend remains down for the major index ETFs, but techs are starting to show relative strength with QQQQ edging higher on Friday. Despite some signs of firmness, we have yet to see any signs of significant strength that would warrant a bullish stance. The first chart shows the...

READ MORE

MEMBERS ONLY

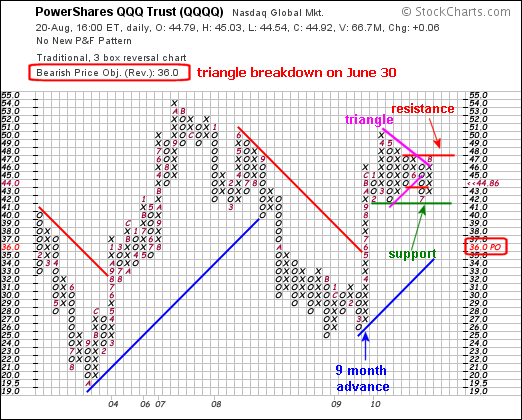

P&F BATTLE LINES DRAWN FOR QQQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Point & Figure chart for QQQQ shows clear support and resistance lines for 2010. The ETF advanced for 9-10 months with a long column of X's in 2009 and then embarked on a consolidation in 2010. Notice that the X's started in March 2009 and...

READ MORE

MEMBERS ONLY

SPY fills gap on volume increase

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) gapped up on Tuesday and then filled that gap with a long red candlestick on Thursday. The inability to hold the gap is clearly negative. Also notice that volume increased as the ETF declined last week and this week.

Click this image for...

READ MORE

MEMBERS ONLY

Indicator Summary remains negative

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary would be much more negative were it not for strength in the NYSE breadth statistics. NYSE Net New Highs remain positive and the AD Line has yet to break down. Another decline next week would likely push these two indicators into bear mode. Another decline next week...

READ MORE

MEMBERS ONLY

SPY fills gap to affirm downtrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY gapped up on Tuesday and then filled that gap with a long red candlestick on Thursday. Some traders apply a three day rule to gaps. A gap that holds three days is valid. One that fails within three days is not. Tuesday's gap has been invalidated. In...

READ MORE

MEMBERS ONLY

Another weak finish, but gap holds

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It is one of those times when I can make pretty good arguments for both the bullish and bearish case - short-term and medium-term. This means we could be in for some choppy trading the next few days, weeks or even months. On the bullish side, sentiment seems to be...

READ MORE

MEMBERS ONLY

Financials dominate most active list

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Half of the 10 most active NYSE stocks on Wednesday came from the finance sector. The Free Charts page at Stockcharts.com shows the 10 most active for the Nasdaq and NYSE. Even though the market was mixed today, nine were up and only one was down. All five financials...

READ MORE

MEMBERS ONLY

A weak finish and weak breadth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks bounced on Tuesday, but I was not impressed with the finish or with breadth. First, let's look at breadth. The charts below show the AD Volume Line and Net Advancing Volume for the NYSE and Nasdaq. NYSE Net Advancing Volume reached the +1000 level four times during...

READ MORE

MEMBERS ONLY

China and XLB moving together

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Shanghai Composite ($SSEC) and the Materials SPDR (XLB) have been moving together in 2010. The moves in XLB are a little more exaggerated, but the positive correlation is clear. Most recently, both bottomed in early July and moved higher the last six weeks.

Click this image for a live...

READ MORE

MEMBERS ONLY

Firming near short-term retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trend following and mean reversion are two types of trading strategies. Trend followers wait for a reversal and confirmation with a support break or resistance breakout. Mean reversion traders look for overbought or oversold conditions to pick tops or bottoms. The two styles are diametrically opposed, but both systems have...

READ MORE

MEMBERS ONLY

Gold shines in August

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Outside of gold, August has been a tough month for commodities. The PerfChart below shows performance for six commodity related ETFs. Only one is up. Metals, Oil and Natural Gas are down rather sharply. Gold, in contrast is up over 2%. In an interesting twist, notice that gold is up...

READ MORE

MEMBERS ONLY

Short-term breadth breakdown

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Selling pressure was intense enough to produce a short-term breadth breakdown. The charts below show the 10-day SMA for Net Advancing Volume for the Nasdaq and NYSE. Net Advancing Volume is simply the volume of advancing stocks less the volume of declining stocks. A move above +100 shows a significant...

READ MORE

MEMBERS ONLY

Bonds go parabolic - $UST

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Bonds have been on a tear since April with the 10-Year US Treasury Note ($UST) advancing some 8% in three months. The DJ Corporate Bond Index ($DJCBP) is not far behind with a 4.4% gain since early June. The advances over the last two months are exceptional sharp and...

READ MORE

MEMBERS ONLY

Indicator summary flips again

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the indicator summary flipped to positive last week, I noted that a sharp decline from current levels could easily flip a few indicators back to the bears. That is indeed what happened. With sharp declines this week, SPY, IWM and QQQQ failed at important resistance zones. The discrepancy...

READ MORE

MEMBERS ONLY

SPY bounces after weak open

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) gapped down again on the open, but managed to bounce and close well above its open to form a hollow candlestick. Even so, the ETF closed below its prior close to color the candlestick red. Nevertheless, SPY remains below its support break at...

READ MORE

MEMBERS ONLY

Five stocks bucking the decline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were down sharply with a broad based decline on Wednesday, but there were a few stocks swimming against the tide. The S&P Sector Market Carpet provides an easy means to visual scan for green stocks in a sea of red. Carefusion (CFN), Macy's (M), Western...

READ MORE

MEMBERS ONLY

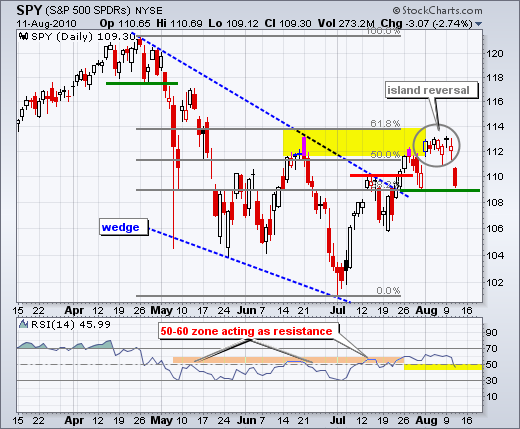

An island reversal for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a gap up, tight consolidation and gap down, the S&P 500 ETF (SPY) formed an island reversal over the last two weeks. It all started with the gap and close above 112 on August 2nd. The ETF traded between 111 and 113 the next six days and...

READ MORE

MEMBERS ONLY

An island reversal for the Industrials SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a gap up eight days ago and a gap down on Wednesday, the Industrials SPDR (XLI) formed an island reversal. Notice how the ETF gapped above 30.5 and largely held above this level for seven days. That ended with a large gap down that signals a reversal. MACD...

READ MORE

MEMBERS ONLY

SPY stalls at resistance as Euro falls

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though stocks bounced after the Fed announcement, S&P futures are down sharply in pre-market trading today. European and Asian stocks are also lower this morning. The Euro is getting slammed (130.5) and this may signal a return to the risk-off trade. Earning season is passing, the...

READ MORE