MEMBERS ONLY

FedEx Hits Channel Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After surging on good volume, FedEx (FDX) hit channel resistance around 57. Notice that FDX peaked in early May and then worked its way lower the last eight weeks. This series of lower lows and lower highs defines the channel, which is also an 8-week downtrend. Look for a breakout...

READ MORE

MEMBERS ONLY

Dow Bullish Percent Gets Frothy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The DJIA Bullish Percent Index ($BPINDU) moved above 70% in June and remains at lofty levels. Mid December and early January were the last two occasions above 70%. Currently, 73% of the Dow stocks (30) are on Point & Figure buy signals. Even though this is technically bullish, an advance...

READ MORE

MEMBERS ONLY

Charts Worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Charts featured: SPY, DIA, GRMN, HOG, PFCB, FITB, HCBK, JPM, LAZ, MMC, USB, WFC, AMAT, NVDA, TIBX.

- Click here for today's video.

- Next update will be Tuesday (June 30) by 9AM ET.

*****************************************************************

Trading remains tricky as we approach the end of the second quarter. There is...

READ MORE

MEMBERS ONLY

HP Holds the Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the S&P 500 took a hit in June, Hewlett-Packard (HPQ) managed to hold its breakout and stay relatively strong. HP broke triangle resistance in early June. Broken resistance then turned into support the last three weeks. Also notice that the price relative moved higher throughout June....

READ MORE

MEMBERS ONLY

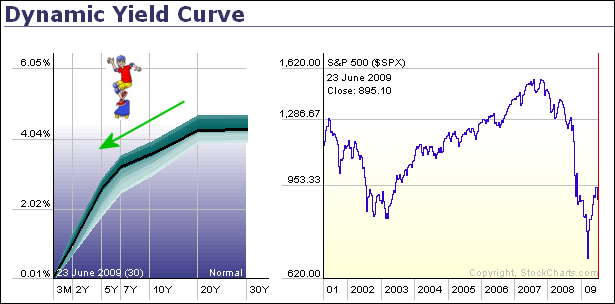

Yield Curve Remains Steep

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A static shot of the dynamic yield curve reveals a curve steep enough to temp a skateboarder. As this curve shows, interest rates start low at the short end and rise as the maturities lengthen. Typically, a steep yield curve reflects loose monetary policy designed to stimulate the economy and...

READ MORE

MEMBERS ONLY

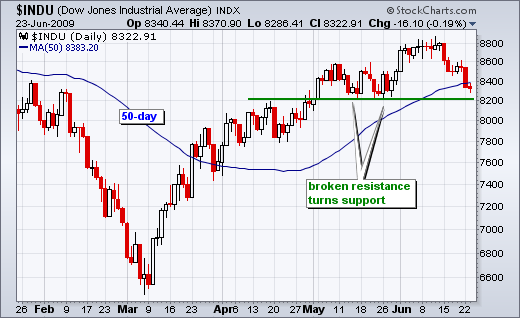

Dow Tests Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow Industrials is testing support around 8200. A key tenet of technical analysis is that broken resistance turns into support. After breaking 8200 in early May and this level turned into support twice in May. With a sharp decline in June, the Dow is once again poised for a...

READ MORE

MEMBERS ONLY

Charts Worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

- Index ETF Charts: SPY, $RUT, $OEX, $NAHL

-Stock Charts: WHR, XHB, DHI, CAKE, KR, SLE, WMT, FLO, INTC, KLAC, INTC

-Today's video will be posted by 10:15 AM ET

- The next update will be Friday (June 26) by 9AM ET.

*****************************************************************

The major index ETFs broke...

READ MORE

MEMBERS ONLY

UPS Leads the Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

UPS is a key part of the Dow Transports and perhaps a leading indicator for the stock market. Notice how the price relative (UPS:$SPX ratio) bottomed ahead of the stock market in March. UPS started showing relative strength before the actual market bottom. Most recently, the price relative peaked...

READ MORE

MEMBERS ONLY

VIX BREAKS A TRENDLINE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A downtrend in the S&P 500 Volatility Index ($VIX) underpins the current rally in the S&P 500. After all, decreasing fear gives way to confidence. The chart below shows the VIX as a 3-day SMA to smooth out daily fluctuations. The VIX broke support on 12...

READ MORE

MEMBERS ONLY

Volume Picks Up for SW Airlines

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After surging in March-April, SW Airlines (LUV) went into corrective mode with a falling wedge in May-June. This wedge is still falling, but volume on up days is starting to increase. The bounce in early June occurred on above average volume and Wednesday's volume was the third highest...

READ MORE

MEMBERS ONLY

Charts Worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

- Charts Worth Watching: $USD, AAPL, BBBY, CHKP, CSCO, DHI, ENR, FXE, GLD, INTC, IWM, K, KFT, NVDA, PEP, QQQQ, SLE, SPY, SWK, WAG, WHR

- Click here for today's video.

The next update will be Tuesday (June 22) by 9AM ET.

*****************************************************************

It is touch-and-go in the stock...

READ MORE

MEMBERS ONLY

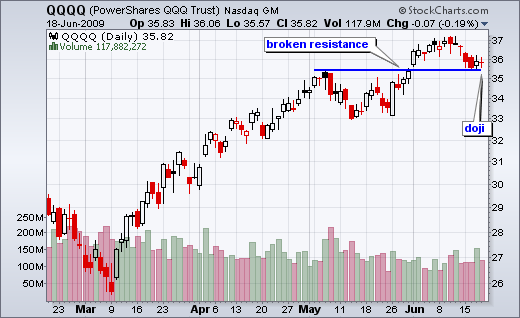

QQQQ Turns Indecisive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQQ) formed a doji on Thursday to signal indecision at support. Doji look like plus signs because there is little change from open to close. In addition, notice that QQQQ closed in the middle of its high-low range. The candlestick looks like a small plus sign...

READ MORE

MEMBERS ONLY

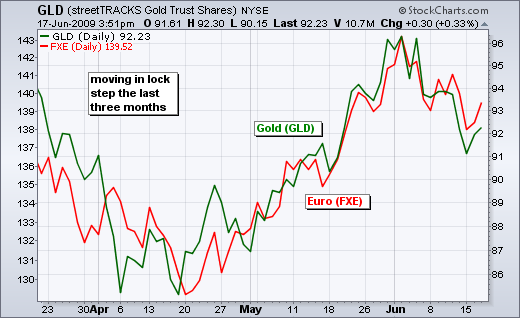

Euro and Gold Dancing Together

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Euro ETF (FXE) and the Gold ETF (GLD) have been moving step-for-step over the last three months. In broad terms, both declined into mid April, advanced into early June and declined over the last two weeks....

READ MORE

MEMBERS ONLY

Triple Bottom Breakdown For CCL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Carnival Corp (CCL) came up on the Triple Bottom Breakdown scan. After failing to hold its May breakout (blue arrow), the stock broke support with a sharp decline in June. You can probably see some other patterns at work here as well. Think Fibonacci, wedge and broken support....

READ MORE

MEMBERS ONLY

Charts Worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

- Charts Worth Watching: $USD, BBY, CI, EL, GDX, GLD, IPCR, KMB, LLL, MHP, RTN, SPY, XLF , XLK, XLV, XLY

- Click here for today's video.

-The next update will be Friday (June 19) by 9AM ET.

*****************************************************************

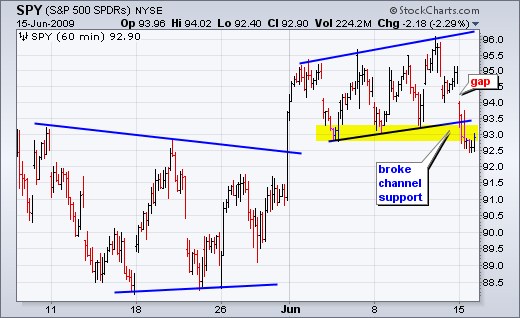

With a sharp decline over the last two days, the major...

READ MORE

MEMBERS ONLY

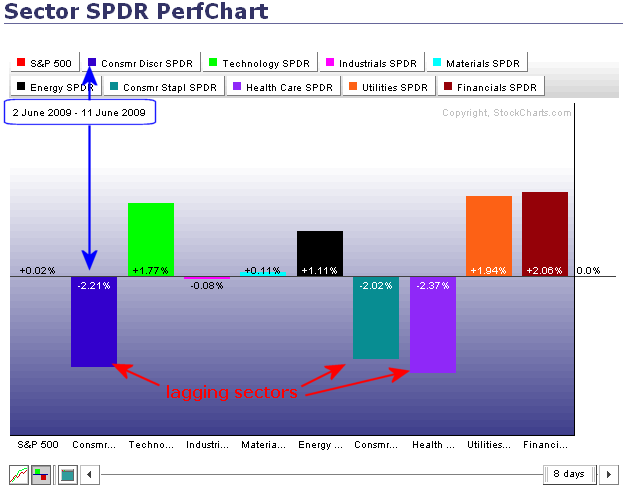

Consumer Discretionary Lagging in June

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P Sector PerfChart from 2-June until 11-June shows the consumer staples, healthcare and consumer discretionary sectors lagging the broader market. Each is down over 2%, while the S&P 500 is up .02% (a fraction) over this timeframe. It is a strange trio, but it is...

READ MORE

MEMBERS ONLY

Charts Worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

- Charts Worth Watching: AEP, BDK, BMY, CNP, DIA, DKS, DUK, ENR, HD, IWM, IWM, JPM, KRE, LLY, LOW, PFE, QQQQ, RX, SO, SPY, TE, WHR, XLU, XLV, XLY

- Click here for today's video

- The next update will be Tuesday (June 16) by 9AM ET.

*****************************************************************

The...

READ MORE

MEMBERS ONLY

QQQQ Channels Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

June has been one choppy month, but the Nasdaq 100 ETF (QQQQ) continues to work its way higher within a rising channel. This channel features a series of higher highs and higher lows that define the 9 day uptrend....

READ MORE

MEMBERS ONLY

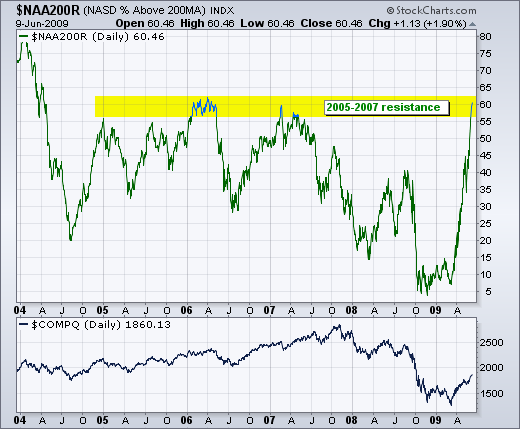

Over 60% of Nasdaq Stocks above their 200-day

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The percentage of Nasdaq stocks that are trading above their 200-day moving average reached its highest level since early 2006. As the chart below shows, fewer than 10% of Nasdaq stocks were trading above their 200-day moving average in March. With the March-June rally, 60.46% of Nasdaq stocks are...

READ MORE

MEMBERS ONLY

Growth Leading Value

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As the price relative below shows, the S&P 500 Growth ETF (IVW) is outperforming the S&P 500 Value ETF (IVE). The price relative is simply a plot of the IVW:IVE ratio (enter IVW:IVE for the symbol). The ratio increases when IVW (numerator) rises more...

READ MORE

MEMBERS ONLY

Charts Worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

- Charts Worth Watching: $INDU, ACN, ATHR, BDK, DHI, JPM, KRE, PKI, QQQQ, RJF, TGT, USB, XHB

- Link to today's video.

- The next update will be Friday (June 12) by 9AM ET.

*****************************************************************

As evidenced by yesterday's last hour surge, trading remains quite tricky right...

READ MORE

MEMBERS ONLY

Homebuilders Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the major stock indices were trading sharply lower on Monday afternoon, a few of the homebuilders showed nice gains. The gainers are easy to spot using the S&P Sector Carpet. As the blue arrows show, Lennar (LEN) was the second biggest gainer and DR Horton (DHI)...

READ MORE

MEMBERS ONLY

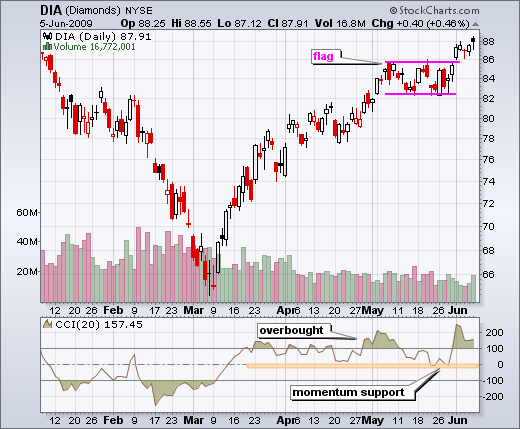

OVERBOUGHT AND BULLISH

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even thought the Dow Diamonds (DIA) is overbought medium-term, the recent breakout is short-term bullish and this breakout is holding. On the daily chart, DIA broke above flag resistance with a surge on Monday. This move pushed CCI above 100 to turn momentum overbought. Even so, I would consider the...

READ MORE

MEMBERS ONLY

Inverse Head-and-shoulders For Ixia

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As its name implies, an inverse head-and-shoulders is an upside down version of the normal head-and-shoulders. Ixia (XXIA) has a one such pattern with a neckline breakout this week. Notice that upside volume started increasing as the right shoulder unfolded....

READ MORE

MEMBERS ONLY

Charts Worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

- Charts Worth Watching: AET, CAT, DE, DIA, EMC, IMKTA, IR, IWM, JPM, LLY, OCR, QQQQ, SNPS, SPY, TTWO, TXT, WFC, XLF, XLI

- Link to today's video (click here).

-The next update will be Tuesday (June 9) by 9AM ET.

*****************************************************************

Even though the major index ETFs are...

READ MORE

MEMBERS ONLY

Corporate Bonds and Treasuries Diverge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Investors are showing a clear preference for corporate bonds over treasury bonds. The chart below shows the 10-Year US Treasury Note ($UST) and the DJ Corporate Bond Index ($DJCBP) going their separate ways since March. $UST is down around 7% since mid March, but $DJCBP is up around 9%....

READ MORE

MEMBERS ONLY

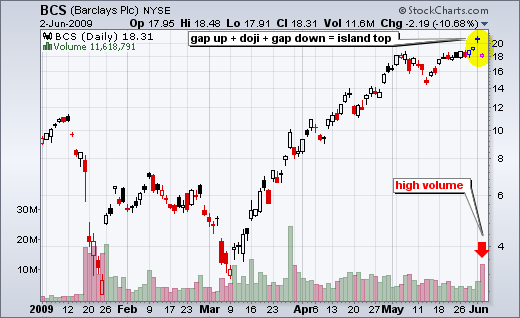

An Island Top for Barclays

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Barclays Plc (BCS) came across the island top scan from Tuesday's close. Notice how the stock gapped up, held the gap for one day with a doji and then gapped down with high volume on Tuesday. The doji represents an island where buyers are now trapped with a...

READ MORE

MEMBERS ONLY

Net New Highs Remain Flat

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though stocks have been rising since early March, the cumulative Net New Highs indicator has been flat since early March. This shows a virtual stalemate between new 52-week highs and new 52-week lows. Obviously, the market can rally with a stalemate. Trouble could start if this indicator moves lower...

READ MORE

MEMBERS ONLY

Charts Worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

- Charts Worth Watching:aa, aci, atmi, csco, DIA, fic, intc,

IWM, jpm, ma, plcm, pmtc, QQQQ, shlm, smh, SPY, v, xlb, xlf

- Link to today's video (click here).

- The next update will be Friday (June 5) around 9 AM ET.

*****************************************************************

After pointing out bullish consolidations...

READ MORE

MEMBERS ONLY

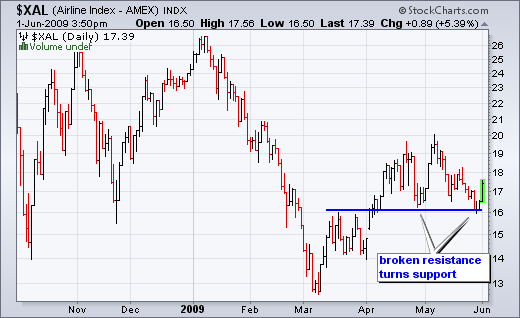

Airlines Fly High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Amex Airline Index ($XAL) surged around 5% with a big move off support on Monday. Notice how broken resistance around 16 turned into support in late April and again in May. Today's bounce reinforces support and makes XAL one of the industry group leaders on Monday....

READ MORE

MEMBERS ONLY

Euro Approaches Resistance Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Euro ETF (FXE) has been red hot with a move from around 125 in early March to 141 in late May. Interestingly, the rise in the Euro coincides with a rise in stock over this same period. FXE is fast approaching a resistance zone around 142.5-145. This zone...

READ MORE

MEMBERS ONLY

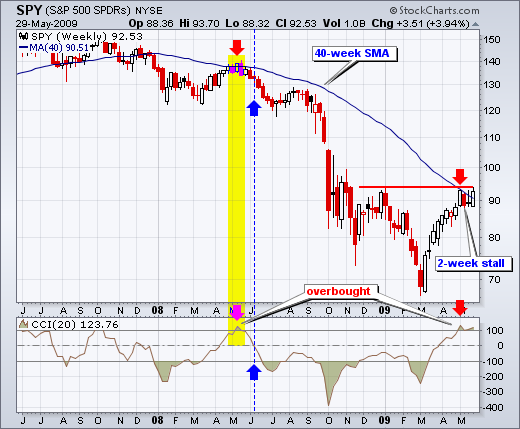

Reflections of May 2008

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a huge rally from early March to late May, the S&P 500 ETF (SPY) is trading just above its 40-week moving average and a key momentum oscillator is overbought. The 40-week moving average is the weekly equivalent to the 200-day moving average (40 weeks x 5 days...

READ MORE

MEMBERS ONLY

Charts Worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Charts Worth Watching: amat, amln, apa, genz,

hal, IWM, lltc, nvls, oih, QQQQ, slb, smh, SPY

I am on the road and today's commentary is abbreviated. There is no video. Normal commentary and video will resume next Tuesday.

The next update will be Tuesday (June 2nd) by 9AM...

READ MORE

MEMBERS ONLY

Natural Gas Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the US Oil Fund ETF (USO) bottomed in February, the US Natural Gas Fund ETF (UNG) continued lower and recorded a new low in late April. There was a big surge in early May and then a deep pullback the last two weeks. Notice that this pullback ended abruptly...

READ MORE

MEMBERS ONLY

Asia Leads The Way

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the western stock markets have clawed their way back towards positive territory the last few months, the Hang Seng ($HIS) turned year-to-date positive in early April and now sports a 24.31% gain. Among the six world indices shown, the Nikkei 225 is a distant second with a 6....

READ MORE

MEMBERS ONLY

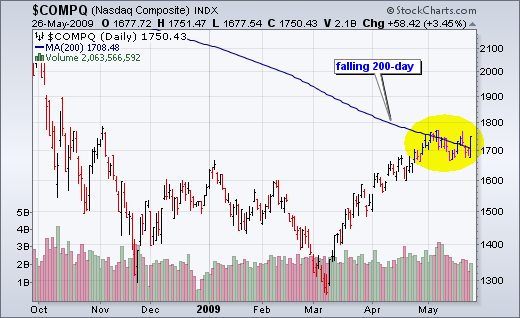

Naz Battles the 200-day

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq extended its battle with the 200-day moving average by jumping back above with a big advance on Tuesday. With this latest move, the index has now crossed the 200-day at least five times this month. Notice that today's surge occurred on the second lowest volume of...

READ MORE

MEMBERS ONLY

Charts Worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Charts Worth Watching: SPY, DIA, IWM, XLB, XRT AND IYT.

Another update will be posted by 12PM ETon Tuesday (26-May). This will include the stock setups and the video.

*****************************************************************

The major index ETFs are showing signs of weakness as a potential correction unfolds. These ETFs include the Dow Diamonds (DIA)...

READ MORE

MEMBERS ONLY

Stock Setups and Video

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Charts: BA, DELL, HD, HON, INTC, K , KFT, LMT, LOW

The next update will be Friday (May 29) by 9AM ET.

Link to corresponding video.

*****************************************************************

Weakness in Home Depot (HD) is negative overall. HD was hit hard with two sharp declines in May. The one-day wonder surge above 26 divides...

READ MORE

MEMBERS ONLY

Charts Worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

- Charts Worth Watching:acv, amgn, amln , asei, bro,

cah, cb, eric, hon, idcc, nke, swy, trv, vrtx

- Link to corresponding video.

The next update will be Tuesday (May 26) by 11AM ET.

****************************************************************

I will start off today with two potentially bullish setups from the consumer staples sector. This...

READ MORE

MEMBERS ONLY

QQQQ Retraces 38.2%

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the March-May advance, QQQQ has now retraced 38.2% of the May-November decline. Where does this number come from? It based on the Golden Ratio Congugate (.618). 1 - .618 = .382 or 38.2%. After a decline, like May to November, the Fibonacci Retracements Tool can be used to...

READ MORE