MEMBERS ONLY

The Single Best Thing a Stock Can Do

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are lots of indicators out there, but one metric stands head and shoulders above the rest. No, it is not a head-and-shoulders pattern. There are hundreds, if not zillions, of ways to measure the trend and identify trend reversals. Over the years, I have found trend reversals to be...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook - Large-caps Take the Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Market Overview - New Highs Are?

* Breadth Remains Strong Enough.

* Large-caps Lead New High List.

* SPX Turns Up after Mild Pullback.

* Small-caps Lag on Upturn.

* QQQ Bounces from Oversold Level.

* XLY and XLV hit new highs as XLK turns Up.

* XLI Continues to Lead as XLF Lags.

* Bond Correlations Break...

READ MORE

MEMBERS ONLY

Brokers Weigh on Finance Sector, Staples Stay Strong and 4 Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* XLF Stalls at Resistance.

* IAI Breaks Triangle Line (plus key stocks).

* Regional Bank SPDR Falters.

* XLP goes from Laggard to Leader (plus key stocks).

* Checkpoint, Biomarin, Cerner and Walgreens.

* Interview with Financial Sense.

XLF Stalls at Resistance

The Financials SPDR (XLF) led the market higher from late June to early...

READ MORE

MEMBERS ONLY

Henry Schein Starts to Shine

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Outside of company specifics, the broad market environment and the sector are the biggest influences of a stock's price. The S&P 500 hit a new high recently so we are in a bull market. The Health Care SPDR (XLV) also hit a new high recently and...

READ MORE

MEMBERS ONLY

The Little Engine that Could - A Mild Pullback - Risk Appetite and Six Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Large-Techs and Small-Caps Still Leading.

* QQQ Bounces as IJR Flags.

* Junk Bonds and International Indexes.

* Charts Worth Watching.

* On Trend on Youtube.

....QQQ and IJR Still Leading Year-to-Date...

...The major index ETFs are in long-term uptrends and short-term downtrends. There is no denying the long-term trend because we saw fresh...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - Industrials Perk up as Defense Leads

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Market Overview.

* S&P 500 Retreats from All Time High.

* Would you have the Nerve?

* Selling Pressure Contained.

* XLI Exceeds Late August High.

* Aerospace & Defense iShares Hits New High.

* Lockheed Martin and Raytheon Break Out.

* XLU and XLP Lead and Lag.

* Always Defer to the Price Chart.

* Utilities,...

READ MORE

MEMBERS ONLY

SystemTrader - Finding Established Uptrends and Quantifying Pullbacks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Introduction.

* RSI for Trend Identification.

* RSI to Quantify Pullbacks.

* Scan Code Progression.

* Conclusions and Tweaks.

Introduction

Stocks making big upside moves and higher highs are clearly in uptrends, but this says little about the length of the trend or the depth of the pullbacks. Trends have a tendency to persists...

READ MORE

MEMBERS ONLY

One Semiconductor Equipment Stock Stands Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Semiconductor SPDR (XSD) broke out to new highs last week and hit another new high on Tuesday. Despite strength in this broad-based semiconductor ETF, there are still pockets of weakness within the group.

Namely, the semiconductor equipment stocks have been weak in 2018. These include Applied Materials (AMAT), Lam...

READ MORE

MEMBERS ONLY

Banks, Bonds, Cyber Security and On Trend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* XLF Shows a Little Leadership.

* Stocks to Watch in XLF.

* TLT Backs off Resistance.

* Two Cyber Security Stocks Bounce off Support.

* Ametek Ends Consolidation.

* Video Food for Thought.

* On Trend on Youtube.

...XLF Shows a Little Leadership

... The Financials SPDR (XLF) led the sector SPDRs on Tuesday with a .49%...

READ MORE

MEMBERS ONLY

When the Minority becomes the Majority - Weighting the Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 hit a new high in August, but only four of the ten sector SPDRs joined in on this high: the Consumer Discretionary SPDR, the Technology SPDR, the Health Care SPDR and the Real Estate SPDR. This suggests that the other six are lagging in some...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with video) - Ebb, Flow and September

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-caps Stall as Large-cap Techs Lead

* More Strength than Weakness

* S&P 500 Notches a New High

* Seasonal Patterns are Mixed

* The Ebb and Flow of QQQ

* Big Flows in SKYY, HACK and IGV

* Big Three are Up Big (XLK, XLY, XLV)

* Notes from the Art's Charts...

READ MORE

MEMBERS ONLY

Biotech and Defense-Aerospace Show Leadership - How to Create a ChartList from ETF Holdings

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Biotech and Defense/Aerospace Show Leadership.

* Creating a ChartList with ETF Holdings.

* 3 Defense-Aerospace Charts to Watch.

* 3 Biotech Charts to Watch.

Chartists looking for bullish stock setups can use industry group ETFs as the first filter. It is easy to find ETF components, upload them to a ChartList and...

READ MORE

MEMBERS ONLY

Bottom Fishing for Broadcom - Plus Danaher and 3 Semiconductor Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Selling Climax and Retest for Broadcom.

* Analog Devices, Qorvo and Semtech.

* Danaher Extends String of Higher Lows.

A Selling Climax for Broadcom

Broadcom (AVGO) hit a potential reversal zone on a selling climax and could be poised for a rebound. First and foremost, I readily admit the Broadcom is...

READ MORE

MEMBERS ONLY

Semis Send a Message to the Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chips are leading the market again as the broad-based Semiconductor SPDR (XSD) broke out of a triangle consolidation and hit a new high. A new high in this cyclical group is positive for the technology sector, the Nasdaq and the broader market.

First note that XSD has 34 components and...

READ MORE

MEMBERS ONLY

Treasury Bond ETF Hits Major Road Block

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The unadjusted 20+ YR T-Bond ETF (_TLT) surged to resistance on Friday and backed off on Monday. The long-term trend is down and this resistance level could mark a near term top.

First note that the chart shows unadjusted prices for TLT by preceding the symbol with an underscore (_TLT)...

READ MORE

MEMBERS ONLY

Software Stocks and Cyber Security Lead Technology Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Software Is Red Hot.

* Microsoft, ServiceNow and Tableau.

* HACK Hits a New High.

* Qualys and Proofpoint Bounce off Support.

Software Is Red Hot

The software group is part of the technology sector and this industry group is red hot. Several key stocks in this group hit 52-week highs last week...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - Removing Some of the Guesswork

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Market Overview

* Majority of Stocks in Up Trends

* New Highs Expand in $SPX, $MID and $SML

* An Unenthusiastic, but Steady Advance

* Current Uptrend > January High

* Small-caps Continue to Lead

* Retail Powers Consumer Discretionary

* XLK Edges above Flag Line (plus XLC)

* Regional Banks Lead Finance Sector

* XLI Extends Upswing (plus...

READ MORE

MEMBERS ONLY

Semiconductor ETF Forges a 4 Candlestick Reversal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Semiconductor iShares (SOXX) has been locked in a trading range the last few months, but the big trend is still up and a recent candlestick reversal could signal the start of an extended advance.

It is important to keep perspective, even when looking at a short-term pattern. In the...

READ MORE

MEMBERS ONLY

Oil Bounces off Support - XLE and XES Bounce after Becoming Oversold - Four Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Oil Bounces off Support

* XLE: Support Break or Oversold Opportunity?

* Biotechs Get a Bounce (IBB, XBI)

* Schwab Firms at Support

* Stocks to Watch: GSP, FFIV, TXN

* On Trend Highlights and Link

Oil Bounces off Support

The Light Crude Continuous Contract ($WTIC) fell over 10% from early July to mid August,...

READ MORE

MEMBERS ONLY

Healthcare Sector Takes the Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Health Care SPDR (XLV) moved into the sector lead with a 52-week high this week. As far as the charts are concern, the Real Estate SPDR (XLRE) and XLV are the only two sector SPDRs hitting fresh highs. XLV gets the edge because it is up around 11% year-to-date,...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook - Defensive Sectors Lead in August

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Market Overview.

* A Bull Market for the S&P 500.

* IJR Leads IWM and the Rest.

* S&P 500 Leads New High List.

* Tech, Healthcare and Industrials Lead New High List.

* XLC Starts Trading.

* XLU and IYR Extend Breakouts.

* Cloud Computing ETF Forms Bull Flag.

* Regional Bank SPDR...

READ MORE

MEMBERS ONLY

Staying on the Right Side of the Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The first rule of trading is to stay on the right side of the broad market trend. There are different indexes and indicators we can use to determine the broad market trend, but few are as efficient as the S&P 500 and its 12-month EMA.

The chart below...

READ MORE

MEMBERS ONLY

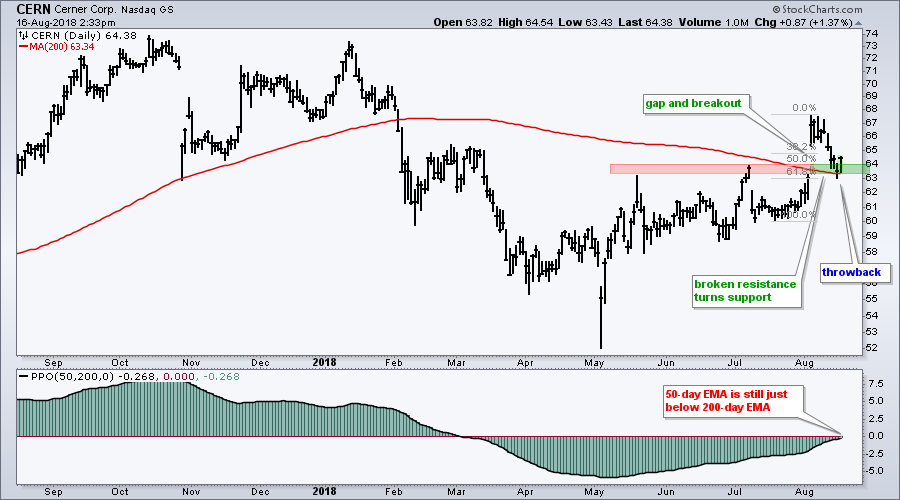

Throwback Thursday for Cerner

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Cerner (CERN) remains in a long-term downtrend, but the stock broke a resistance level and pulled back to this breakout zone, which now turns into support. This is called a throwback and it could offer a second chance to partake in the breakout.

First and foremost, CERN is in the...

READ MORE

MEMBERS ONLY

An Island Reversal for SPY - Minding the Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* An Island Reversal for SPY.

* XLI and Lead the Gap Parade.

* SOXX Leads Tech Lower with Gap.

* IAI Forges Lower Highs.

* ITB Hits New Low for Year.

* Utes and Telecom Hold Up.

... There were short-term reversals last week as a number of stocks and ETFs gapped up on Tuesday and...

READ MORE

MEMBERS ONLY

Anadarko Gets a Mean-Reversion Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Anadarko Petroleum (APC) has had quite a good year with a 25% gain in 2018 and 52-week highs in June and July. The stock fell over the last five weeks, but this decline is viewed as a correction within a bigger uptrend. Moreover, RSI became oversold and a mean-reversion bounce...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - Small-Caps Lead and Bonds Spring

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Weekly Performance Review.

* Market Overview.

* A Correction for the S&P 500?

* First Levels to Watch for SPY.

* QQQ Double Top - NOT!

* IJR is Holding up Just Fine.

* XLV, XLK and XLY are Leading.

* XLI and XLF Hit Resistance.

* XLE Remains Stuck (plus XES).

* Oil Corrects within Uptrend....

READ MORE

MEMBERS ONLY

Gilead Gets another Bollinger Band Squeeze

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gilead is in the midst of its fourth Bollinger Band squeeze in the past year. The last four instances foreshadowed pretty strong moves so I will be watching the current squeeze closely for the next directional clue.

A Bollinger Band squeeze occurs when the bands contract and the Bandwidth indicator...

READ MORE

MEMBERS ONLY

Finding Leading Stocks in Strong Uptrends (Trend Following)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trend following strategies are built on the premise that trends persist and we can make money by simply following the trend until it ends. There will be losers along the way, but a few strong trends will more than make up for the losses. It sounds great in theory, but...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook - 3 Sectors Pick up the Slack

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Weekly Performance Review.

* Changing of the Guard Continues

* S&P SmallCap iShares Outperforms Russell 2000 iShares

* S&P 500 is in a Bull Market

* High-Low Lines Continue to Rise

* QQQ Becomes Short-term Oversold

* IJR Consolidates Near Highs

* Measuring Trend Strength with Stochastics

* XLF and XLI Challenge Resistance

* This...

READ MORE

MEMBERS ONLY

Utes and REITs form Bullish Continuation Patterns - HACK and XBI Become Short-term Oversold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Pick your Timeframe to Suit your Message.

* Aroons Signal Consolidation in XLU.

* XLRE Breaks Out of Flag.

* REITs, Utilities and the 10-year Correlation.

* HACK Becomes Oversold in an Uptrend.

* The Dreaded Double Dip in RSI.

.... Timeframe and Message

... The Utilities SPDR (XLU), the Energy SPDR (XLE) and the Real Estate...

READ MORE

MEMBERS ONLY

Waters Corp Stalls Near Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Waters Corp led the market in 2017 with a 65 percent gain, but lagged in 2018 as the stock corrected the last six months. I am watching this correction pattern for a breakout that would signal a continuation of the bigger uptrend. Waters Corp makes analytical equipment and software for...

READ MORE

MEMBERS ONLY

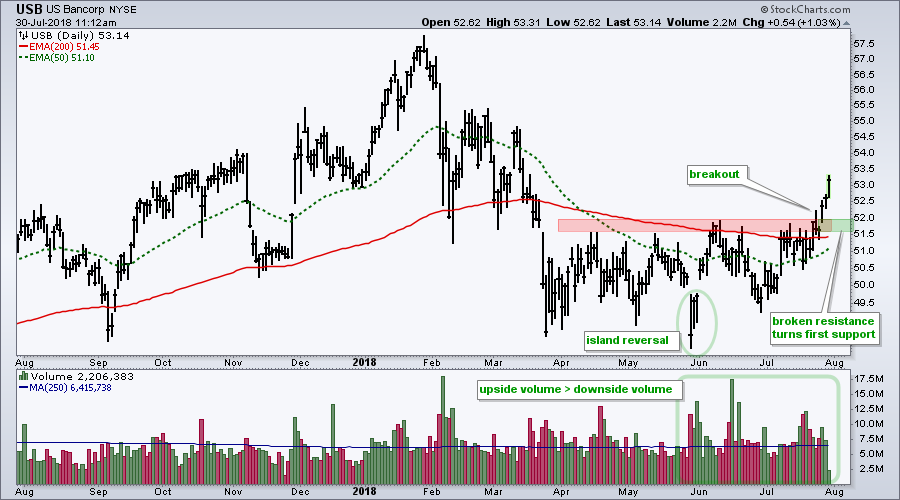

US Bancorp Makes a Break for It

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

US Bancorp lagged the broader market the first half of the year, but managed to firm from March to June and lead with a breakout in July.

The chart shows USB falling from 57 to 49 with a sharp decline from late January to late March. The stock managed to...

READ MORE

MEMBERS ONLY

Oil Extends Uptrend and Lifts Energy-Related Shares

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Oil Surges back above $70.

* XLE Turns Up within Range.

* XES Surges off Support.

* Chevron Bounces on Big Volume.

* Halliburton versus Baker Hughes.

... Oil Surges back above $70

... Oil fell on Friday and rebounded on Monday to keep its mean-reversion bounce alive. I highlighted oil, XLE and the Oil &...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook - Large Caps Show Upside Leadership

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Weekly Performance Review.

* Large-caps Show Leadership in July.

* New Highs Expand in S&P 500.

* Nasdaq 100 Still the Strongest.

* Internal Improvements in Industrials and Finance.

* XLF and XLI Challenge Spring Highs.

* TLT and IEF Fail at Resistance.

* This Week in Art's Charts.

* Notes from the Art&...

READ MORE

MEMBERS ONLY

Steel Stocks Lead Materials Sector and Metals&Mining SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Breaking Down the Materials Sector.

* Materials SPDR Battles Wedge Breakout.

* Small-cap Materials Sector Leads XLB.

* Establishing an Analytical Bias First.

* Steel ETF Surges off Support.

* Three International Mining/Steel Stocks.

* Three US-Based Steel Stocks.

... Today we are going to dive into the materials sector. I will start by comparing the...

READ MORE

MEMBERS ONLY

Danaher Traces out Large Bullish Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Danaher is part of a strengthening sector (healthcare) and accounts for around 5.5% of the Medical Devices ETF (IHI), which is one of the strongest industry group ETFs this year. XLV is one of the best performing sectors over the last three months and IHI sports a parade of...

READ MORE

MEMBERS ONLY

Honeywell Bids to End Correction

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Honeywell (HON) kicked off earnings season for the big industrial stocks last week and surged on high volume. The stock is already in a long-term uptrend and the correction in the first half of 2018 appears to be ending.

The stock is in a long-term uptrend because it hit a...

READ MORE

MEMBERS ONLY

Mean-Reversion Opportunity in Oil - Test of Bullish Resolve for XES

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Long-term Trend for Oil is Clearly Up.

* RSI Dips into "Oversold" Zone.

* Confirming with Nearby Futures.

* Finding Futures Symbols.

* Oil & Gas Equip & Services SPDR Lags Oil.

* XES Tests Bullish Resolve.

...Long-term Trend for Oil is Up

...Oil pulled back over the last few weeks with a...

READ MORE

MEMBERS ONLY

Two Key Sectors Move from Laggards to Leaders

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

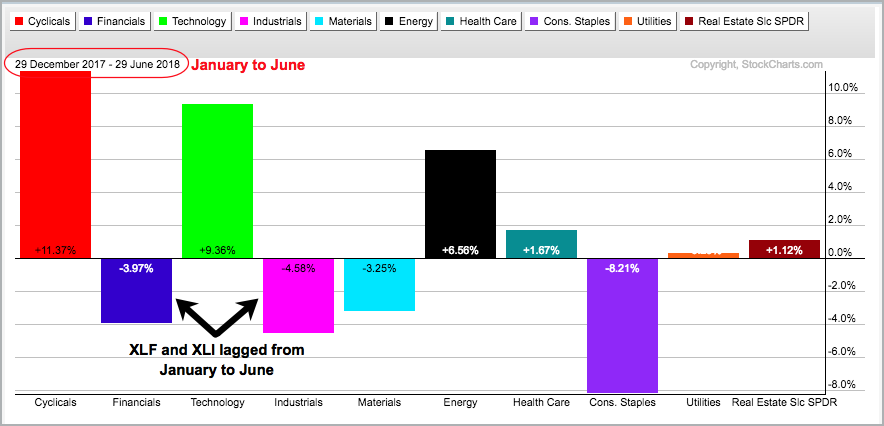

The Financials SPDR (XLF) and Industrials SPDR (XLI) weighed on the broader market the first six months of the year, but perked up in July and started to show some upside leadership.

The PerfChart below shows the percentage change for the ten sector SPDRs from December 29th to June 29th,...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - A Changing of the Guard?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Weekly Performance Review.

* Elevator Down and Stairs Up.

* The Big Four are in Sync.

* A Changing of the Guard?

* Big Wedges Remain for XLI and XLF.

* ITB and XHB Firm at Key Retracements.

* What is the Deal with Bonds?

* Notes from the Art's Charts ChartList.

...There is an...

READ MORE