MEMBERS ONLY

Using the %Above Indicators for Signals and Sector Rankings

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Breadth Burst for the Finance Sector.

* Industrials and Finance Lead July Surge.

* Ranking by %Above 200-day EMA.

* Finding these Symbols.

... Signals from %Above Indicators

... The percentage of stocks above the 20-day EMA is a short-term breadth indicator that measures participation. StockCharts calculates and publishes this indicator for the major...

READ MORE

MEMBERS ONLY

A Momentum Divergence for the Regional Bank SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I do not use bullish and bearish divergences with momentum indicators very often because they usually form in the direction of the bigger trend. For example, most bearish divergences form in uptrends and most bullish divergences form in downtrends. I trade in the direction of the bigger trend and prefer...

READ MORE

MEMBERS ONLY

Biotech ETFs Near New Highs, Fab Five Lead QQQ and Four Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Biotech ETFs Near New Highs

* Fab Five Lead QQQ Higher.

* SOXX Turns Up within Triangle.

* A Mean-Reversion Setup for Analog Devices.

* Two Inside Days for Cisco.

* A Flag Breakout for ICE.

* Perkin Elmer Perks Up.

... IBB and XBI Near New Highs

... The Biotech iShares (IBB) surged over 15% the last...

READ MORE

MEMBERS ONLY

Healthcare Leads as Industrials and Finance Attempt Bounces

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* SPY Extends Laborious Uptrend.

* Back in the Saddle.

* QQQ Maintains Leadership with New High.

* Healthcare Takes the Lead in July.

* Industrial Sector Pulls Ahead of Finance.

* Aerospace & Defense ETF Turns Up within Range.

* Mind the Gap in the Broker-Dealer iShares...

... The major index ETFs were in long-term uptrends and...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook - How Bad is It?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* June Swoon Looks Pretty Tame.

* Programming Note: Up Coming Vacation.

* High-Low Lines Still Rising.

* S&P 500 Sets up First Test.

* Short-term Oversold in Long-term Uptrend.

* XLF and XLI Toy with Support.

* Three Tech ETFs Become Oversold.

* Notes from the Art's Charts ChartList.

...There are plenty of...

READ MORE

MEMBERS ONLY

Mind the Gap in XLK - Falling Yields Weigh on Banks, Boost Utes

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Mind the Gap in XLK.

* Offensive Sectors Lead the Correction.

* Bonds Continue to Rise.

* Banks, Utes and the 10-year Yield.

* Yuan Breaks Support.

... Mind the Gap in XLK

... The Technology SPDR (XLK) hit a new high and then gapped down for the third time this year. The red annotations show...

READ MORE

MEMBERS ONLY

Oil & Gas Equip & Services SPDR hits Reversal Zone, but Lags Oil

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Oil & Gas Equip & Services SPDR (XES) is trading near a potential reversal zone, but the ETF is not keeping pace with strength in oil.

The first chart shows XES, the Light Crude Continuous Contract ($WTIC) and the Correlation Coefficient for the two. XES bounced between 13 and...

READ MORE

MEMBERS ONLY

Measuring Participation During Big Moves - The State of the Market - XLF versus XLV

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Measuring Participation during a Big Move.

* The State of the Market

* QQQ Nears First Support Test

* IJR Corrects after Big Move

* XLV Stocks Versus XLF Stocks

* StockCharts TV and On Trend.

... Measuring Participation during a Big Move

... AD Percent is the first breadth indicator I check after a big up...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook - Still Net Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Binary Approach to Indicators.

* Wobbly S&P Holds Breakout Zone.

* A Small Pullback in the E-Mini.

* The Dow? Fughedaboutit!

* QQQ and IJR Hit Fresh New Highs.

* Retail and Amazon Power XLY.

* XLV Holds Breakout.

* XLK Starts to Stall.

* XLF Tests a Big Support Zone.

* Oil Holds Support Near...

READ MORE

MEMBERS ONLY

Paypal Guns for a New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks making new 52-week highs are clearly in uptrends and leading. Even though Paypal is just shy of a 52-week high, the bigger uptrend and wedge point to new highs in the near future.

First and foremost, Paypal is in a long-term uptrend because the 50-day EMA is above the...

READ MORE

MEMBERS ONLY

Regional Banks and Biotechs are Leading - Plus 4 Healthcare Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Remember the Failed Flag in SPY?

* XLI Fails and Breaks Support.

* KRE Holding Up Well.

* USB Forges Island Reversal.

* Biotech ETFs Breakout.

* 4 Healthcare Stocks to Watch.

* On Trend on Youtube.

... Remember the Failed Flag in SPY?

... Not too long ago, the S&P 500 SPDR (SPY) surged and...

READ MORE

MEMBERS ONLY

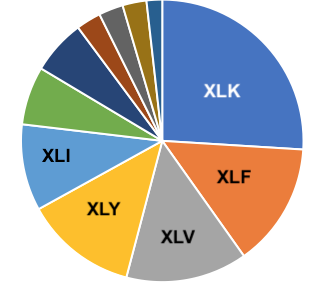

The Single Biggest Influence on Individual Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Correction Time?

* XLI and XLF Resume their Lagging Ways.

* Charting the Big Five Sectors.

* Watch the Risk-Off Assets.

* On Trend and Stocks to Watch.

... The Single Biggest Influence on Individual Stocks

There are several influences on the price of an individual stock, but one influence rises far above the others....

READ MORE

MEMBERS ONLY

Ross Stores Stalls after Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ross Stores was hit hard with a high volume gap down in late May, but immediately firmed and recovered. The stock broke out of a long triangle in early June and then stalled with a small flag last week. Basically, we have two bullish continuation patterns at work.

The long-term...

READ MORE

MEMBERS ONLY

Two Continuation Patterns Take Shape in XLI

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Industrials SPDR (XLI) has struggled in 2018 and is pretty much unchanged year-to-date. Despite flat performance this year, a pair of bullish continuation patterns are taking shape. Let's look at the key levels to watch going forward.

Long-term, the trend is still up because the PPO(50,...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (w/ Video) - Summer Doldrums for Stocks, but Not Bonds

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* S&P 500 Digest Short-term Gains.

* QQQ Leads with New High Expansion.

* IJR Stalls above Breakout Zone.

* Three Big Leaders and Two Laggards.

* XLF Turns Down from Resistance.

* XLI Tests Flag Breakout.

* XLV Extends on Breakout.

* Bonds Get a Bounce.

* USO Slowly Bounces off Key Retracement.

* The Noose Tightens...

READ MORE

MEMBERS ONLY

A Mean-Rervsion Opp in Gasoline - Inside Weeks for Gold - A Peak for REITs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Gasoline ETF Firms after Pullback

* Notes on RSI Parameters and Levels

* Three Inside Weeks for Gold

* Bollinger Contractions for GLD and GDX

* Dollar Gets Extended

* Unadjusted REIT SPDR Hits Reversal Zone

* Questions, Comments or Feedback?

... Gasoline ETF Firms after Pullback

The US Gasoline ETF ($UGA) has a mean-reversion setup working...

READ MORE

MEMBERS ONLY

Rockwell Automation: A Big Correction, but an Even Bigger Advance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Rockwell Automation reversed its downtrend with a big surge in May, worked off overbought conditions and looks poised to resume its uptrend.

The chart below shows ROK with a high-volume plunge in late April, a high-volume reversal day and a sharp recovery in early May. This recovery extended with high...

READ MORE

MEMBERS ONLY

On Trend Preview - Finance Sector and Big Banks Lag as Fed Looms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Two Breakout Zones to Watch on SPY.

* On Trend Preview.

* TLT Affirms Resistance.

* Banks and Utilities Cue off Bond Market.

* Finance Sector and Big Banks Continue to Lag.

* Aetna Breaks Out of Bull Flag.

* Questions, Comments or Feedback?

Two Zones to Watch on SPY

...The S&P 500 SPDR...

READ MORE

MEMBERS ONLY

A Classic Continuation Pattern Takes Shape in Danaher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Danaher (DHR) is a conglomerate that is the 15th largest component (1.91%) of the Health Care SPDR (XLV) and the 5th largest component (5.43%) of the Medical Devices ETF (IHI). XLV broke out last week and IHI has been leading for some time. The stock is also looking...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - Strong, but Getting Frothy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Strong, but Getting Frothy.

* S&P 500 High-Low Percent Exceeds 10%.

* S&P 500 Extends Breakout.

* QQQ and IJR Hit New Highs.

* Two New Highs and Two Breakouts.

* Sector SPDRs Mask Strength Within.

* Setting Resistance for Treasury Bond ETFs.

* A Mean-Reversion Setup in Oil.

* Notes from the Art&...

READ MORE

MEMBERS ONLY

The Bull Market Broadens - XLI Breaks Out, Healthcare Perks Up and Financials Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* The Big Drivers in the S&P 500.

* Industrials SPDR Breaks Out of Massive Wedge.

* Boeing Leads XLI with New High.

* Healthcare Holds Support and Breaks Out.

* Blame J&J and Celgene.

* Pfizer, Merck and Amgen hold Breakouts.

* XLF Remains within Corrective Pattern.

* Questions, Comments or Feedback?

Large-caps...

READ MORE

MEMBERS ONLY

Oil Hits Potential Reversal Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Oil fell rather sharply over the last two weeks, but the long-term trend is up and two technical indicators point to a bounce.

The chart below shows the USO Oil Fund (USO) in the top window, RSI for USO in the middle and the Light Crude Continuous Contract ($WTIC) in...

READ MORE

MEMBERS ONLY

On Trend Preview - AD Lines Hit New Highs, New Highs Expand in Two Key Sectors and Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Expect Trends to Continue, Not Reverse.

* Broad Market AD Lines Record New Highs.

* 52-week Highs Expand in Two Key Sectors.

* Retail Propels Consumer Discretionary Sector.

* Copper and COPX Bounce off Support (plus PALL).

* Stocks to Watch.

This is a preview for today's show, On Trend. This show airs...

READ MORE

MEMBERS ONLY

Apple Breakout Could Lift these Two Suppliers

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Apple (AAPL) broke out of a pennant formation with a surge on Friday and this breakout could bode well for Qorvo (QRVO) and Skyworks (SKWS).

The first chart shows Qorvo surging over 20% and then stalling with a contracting consolidation. This is a pennant and it is a bullish continuation...

READ MORE

MEMBERS ONLY

Two Key Sectors to Watch this Week - And Lots of Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Broad Strength in the Nasdaq 100.

* Nvdia and Netflix Lead the Top 10.

* Google Gets its Mojo Back.

* Lots of Bull Flags within XLI.

* Merck and Pfizer Break Out of Triangles.

* Questions, Comments or Feedback?

The Nasdaq 100 and big techs led the market higher in 2017 and they continue...

READ MORE

MEMBERS ONLY

S&P 500 Gets Third Bullish Breadth Thrust

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There were eight breadth thrusts in the month of May and seven of these were bullish (>70%). In particular, there were three bullish breadth thrusts last week. These strong readings show broad participation and give the bulls the edge going forward.

Chartists can measure daily breadth by using the...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - 3 Big Sectors Dragging as June Starts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Bullish Breadth Thrust, but...

* S&P 500 Toys with Triangle Breakout

* June can be a Rough Month

* Seasonality and the Turn of the Month

* QQQ Holds Up better than SPY

* Small-caps Hold Breakout

* XLK and XLY Hold Up the S&P 500

* Mind the Gap in XLF...

READ MORE

MEMBERS ONLY

A Bullish Continuation Pattern Forms in the Biotech iShares

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Biotech iShares (IBB) surged off support in mid-May and then stalled the last two weeks with a bull flag taking shape.

A bull flag is a short-term bullish continuation pattern. These patterns form after a sharp advance and represent a rest or consolidation. This is often needed to digest...

READ MORE

MEMBERS ONLY

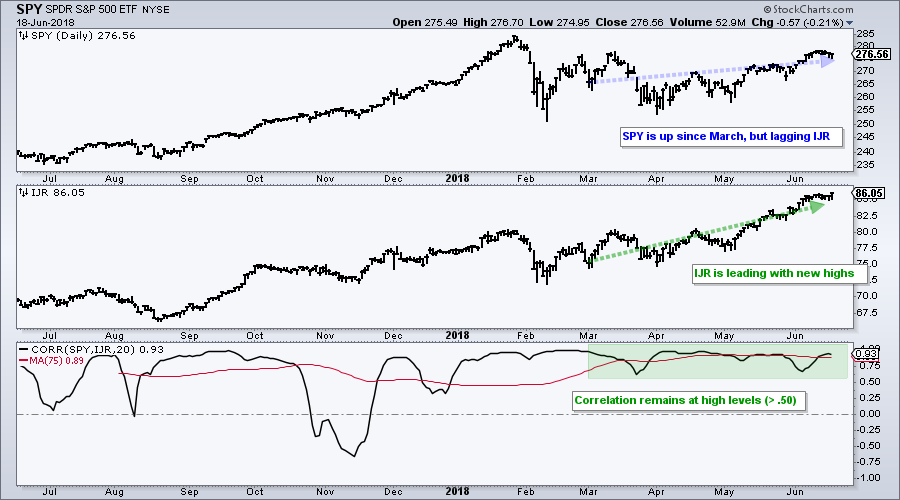

SPY Drags as Small-Caps and Large-Techs Lead - 6 Flags in the Nasdaq 100

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-caps and Large-Techs Still Leading.

* IJR Holds above Breakout Zone.

* QQQ Falls Back into Pennant.

* Six Flags over the Nasdaq 100.

* Strike One on SPY.

* Selling Pressure Concentrated in Large-caps.

* On Trend Highlights...

The S&P 500 SPDR (SPY) broke below its mid-May lows with a sharp decline, but...

READ MORE

MEMBERS ONLY

Risk-Off Assets Get a Bounce as Euro Breaks Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Is the Dollar Strong or the Euro Weak?

* Yen Bounces as Euro Falls.

* A Big Surge for Treasuries.

* Gold is Oversold in an Uptrend.

* Italy and Spain Lead Europe Lower.

* Looking for International Indexes?

* On Trend: Tuesdays at 10:30 AM ET.

Dollar Strength or Euro Weakness? ...

I am starting...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - As Divided as Ever

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* SPX New Highs Continue to Drag.

* Triangle Breakout Holds.

* Bulls and Bears Fight to Go Nowhere.

* Watching the Swing within the Wedge.

* IJR Holds above Breakout Zone.

* QQQ and XLK Form Tight Consolidations.

* XLF Stalls Near April High.

* XLI Stays Strong as XLV Hits Make-or-Break Level.

* Semis are Leading and...

READ MORE

MEMBERS ONLY

Bull Flags in JP Morgan and Morgan Stanley

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I highlighted a number of bull flags in Tuesday's show (On Trend), and there were some breakouts. These breakouts, however, were not very convincing because stocks closed weak and gave back their early gains.

Today I will highlight the flags in JP Morgan (JPM) and Morgan Stanley (MS)...

READ MORE

MEMBERS ONLY

Preparing for that Doh! Moment - The Triangle versus another Wedge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* The Last Thing You Expect ....

* Another Ominous Wedge Takes Shape.

* $SPX-$SML Correlation is High.

* QQQ Shows Short-term Weakness.

* Regional Banks Outperform Big Banks.

* Highlights from On Trend.

The Last Thing You Expect ....

... is probably what will happen. Even though I cannot quantify this expression, we have all experienced such...

READ MORE

MEMBERS ONLY

Hasbro Hits Stiff Resistance Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I do not often highlight stocks with bearish setups during a bull market, but Hasbro shows some serious weakness over the past year and looks poised to peak again.

First and foremost, the chart shows Hasbro (HAS) hitting a 52-week low in early April and this means the long-term trend...

READ MORE

MEMBERS ONLY

Small-caps Lead, but Mid-caps and Large-caps Lack Leadership

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks recording new 52-week highs are the leaders and a key component to broad market strength. Small-caps are doing their part with plenty of new highs, but large-caps and mid-caps are lagging in this category.

The S&P Small-Cap 600 moved to a new 52-week high this week and...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - New Sector and Industry Group Leaders

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* The Mother of all Double Bottoms.

* The Shifting Relationship between Stocks and Bonds.

* S&P SmallCap iShares Hit New High.

* Small-caps Lead Breadth Indicators.

* S&P 500 Pauses Near Breakout Zone.

* Materials and Industrials Show Upside Leadership.

* XLI and XLB Bid to End 2018 Corrections.

* XLF Forms High...

READ MORE

MEMBERS ONLY

Metals, Mining and Steel Lead in May - Plus Copper, COPX and 4 Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Materials Sector Leads in May.

* Metals & Mining SPDR Breaks Out of Consolidation.

* Steel Dynamics, Allegheny and Reliant Lead Group.

* The Long Correction in Copper.

* Copper Miners ETF Challenges Resistance.

* Continuous Commodity Contracts are Mixed.

* Stocks to Watch: ADSK, CA, HPE, HCA.

The EW Technology ETF, EW Industrials ETF and...

READ MORE

MEMBERS ONLY

These Two Materials Stocks are Looking to Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Materials SPDR (XLB) is having a good month with a 4+ percent gain so far in May. Within the sector, I am seeing some strength in two big chemical stocks, Air Products (APD) and Eastman Chemical (EMN).

Before looking at the charts, note that both are above their rising...

READ MORE

MEMBERS ONLY

Highlights from Tuesday's Show (On Trend)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Ranking Sectors by High-Low Percent.

* Sector SPDR Chart Analysis (big wedges).

* Oil and Energy-Related ETFs Continue to Work.

* 10-yr T-Yield Turns Back Up.

* Winners and Losers in Rising Rate Environment.

* Stocks: TSLA, DHR, NKE, ROST, SYK, UNH.

Today's c

ommentary and charts show some highlights from "On...

READ MORE

MEMBERS ONLY

Pfizer Surges within Consolidation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The healthcare sector is coming alive on Monday and leading the broader market. As with the S&P 500, this sector struggled in 2018 and the Health Care SPDR (XLV) is up around 1.5% year-to-date. SPY, for reference, is up almost 3% this year.

The chart below shows...

READ MORE