MEMBERS ONLY

More Bad News Ahead for CBS?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart for CBS Corp (CBS) is already bad news and the news could get even worse.

First and foremost, the long-term trend is clearly down as the stock hit a 52-week low in early November and remains below the falling 200-day SMA. The stock also broke below the May-June...

READ MORE

MEMBERS ONLY

The VIX Flashes a Warning Sign as More Industry Groups Correct

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* VIX Disconnnet Signals Caution.

* Charting Past Occurrences.

* Correction Targets for the S&P 500.

* More Industry Groups Join Correction.

* 3 Semiconductor Stocks to Watch.

VIX Disconnet Signals Caution

The S&P 500 Volatility Index ($VIX) usually moves opposite the S&P 500, but this is not the...

READ MORE

MEMBERS ONLY

NCLH Cruises towards New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Norwegian Cruise Line (NCLH) broke out of a long consolidation and looks poised to hit new highs soon. The long-term trend is up as the stock surged to new highs with a 50+ percent advance from November 2016 to August 2017. Also note that the PPO(50,200,0) is...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - As Boring as Boring Gets

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* New Highs in Major index ETFs (again).

* SPY: As Boring as Boring Gets.

* Materials SPDR Breaks Out of Bullish Pennant.

* REIT SPDR Springs a Bear Trap.

* XLI Forms Bullish Pennant.

* Some Groups are Already Correcting.

* ITB, IYT and SOXX Move into Corrective Mode.

* TLT Holds Neckline Support (for now).

* Oil...

READ MORE

MEMBERS ONLY

Finding Stocks with Good Chances of Hitting New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Looking for Future 52-week Highs.

* 3 Stocks with Corrections after 52-week Highs.

* Goldman Sachs Surges to a New High.

* Two Materials Stocks with Recent Upturns.

Looking for Future 52-week Highs

Stocks in long-term uptrends are more likely to hit 52-week highs than stocks in downtrends. Furthermore, stocks that hit 52-week...

READ MORE

MEMBERS ONLY

The Mother of All Reversals is Building in the Bond Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 10-year Treasury Yield peaked near 16% in 1982 and fell as a secular bear market took hold for over 30 years. After stabilizing the last few years, the 10-year Yield traced out a large bullish reversal pattern and confirmation would end the secular bear market.

Note that the 10-yr...

READ MORE

MEMBERS ONLY

Biotech and Finance-Related ETFs Lead as SPY Extends Extraordinary Run

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

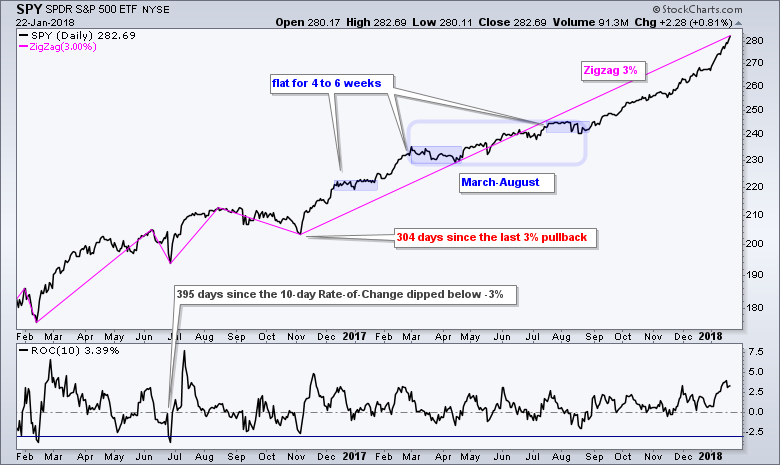

* SPY Extends Extraordinary Run.

* Biotech ETFs Lead Healthcare Sector.

* Finance-Related ETFs Extend Breakouts.

* Copper ETN Pulls Back within Trend.

* Is Telecom Turning the Corner?

SPY Extends Extraordinary Run

The major index ETFs remain in strong uptrends, both short-term and long-term. The S&P 500 SPDR and Dow SPDR are...

READ MORE

MEMBERS ONLY

H&R Block Tests its Breakout Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart for H&R Block (HRB) shows two corrective patterns, one confirmed and one working. First, HRB retraced around 61.8% of the February-August advance and formed A big wedge. The wedge pattern and the retracement amount are typical for corrections after a sharp advance. HRB broke out...

READ MORE

MEMBERS ONLY

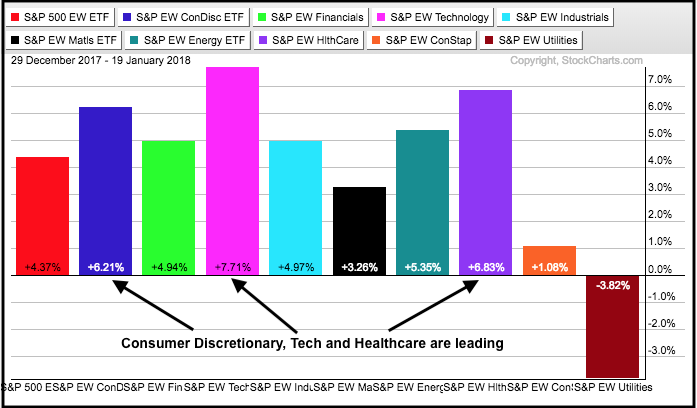

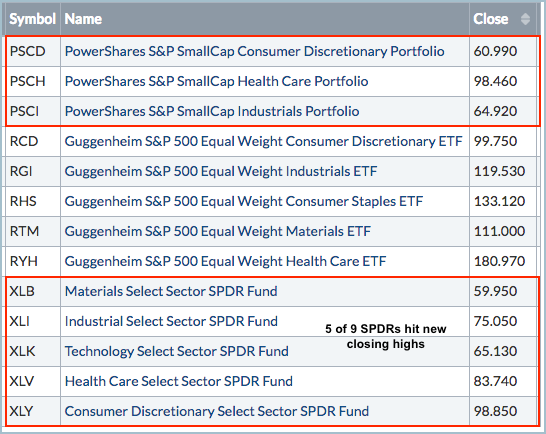

A Surprising Small-cap Sector is Leading in 2018

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

2018 is off to a great start with the S&P 500 SPDR (SPY) up 5% in just 13 trading days. The rally is quite broad with six of the nine equal-weight sectors up 5% or more. I am showing the equal-weight sectors first because they reflect performance for...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Pow, Straight to the Moon!

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Pow, Straight to the Moon!

* Group Leaders and Laggards.

* Strategy Going Forward.

* Fresh Highs for SPY and QQQ.

* A Tough Week for Small-Caps.

* Eight of Ten Sector SPDRs Hit New Highs.

* XLU and IYR Drop out of Oversold Watch.

* Pullbacks Zones to Watch (XME,SLX,COPX,XES, AMJ).

* Money Continues...

READ MORE

MEMBERS ONLY

SystemTrader - The Dip is Your Friend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Setting the Market Regime and Ground Rules.

* Sample Signals for SPY and IJR.

* Backtest Results.

* I Know What You are Thinking.

* Conclusions.

Mean-reversion trading systems are designed to buy the dip during bull markets. The assumption is that the trend is the major force at work and prices will revert...

READ MORE

MEMBERS ONLY

PayChex Looks to Hit Payday with Momentum Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

PayChex (PAYX), which has nothing to do with Chex cereal, ended its correction with a three-day surge and wedge breakout. First and foremost, the long-term trend is up as the stock broke out in early October and hit a 52-week high in December. The stock was quite extended after 30%...

READ MORE

MEMBERS ONLY

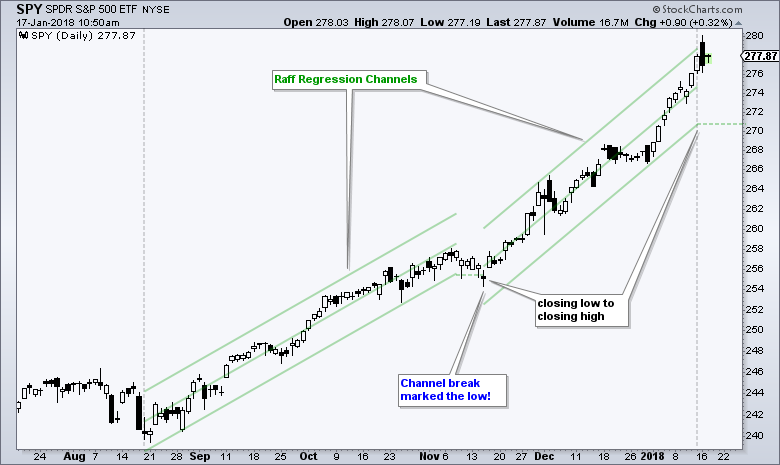

Defining Steep Uptrends, Setting Trailing Stops and Projecting Flag Targets

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Raff Regression Channels and Steep Uptrends.

* Chandelier Exit Holds Entire Uptrend.

* SPY Nears Flag Target.

* Buy the Dip in Bull Markets.

Raff Regression Channels and Steep Uptrends

There is no such thing as the perfect indicator or the perfect settings, but I would like to show a method to quantify...

READ MORE

MEMBERS ONLY

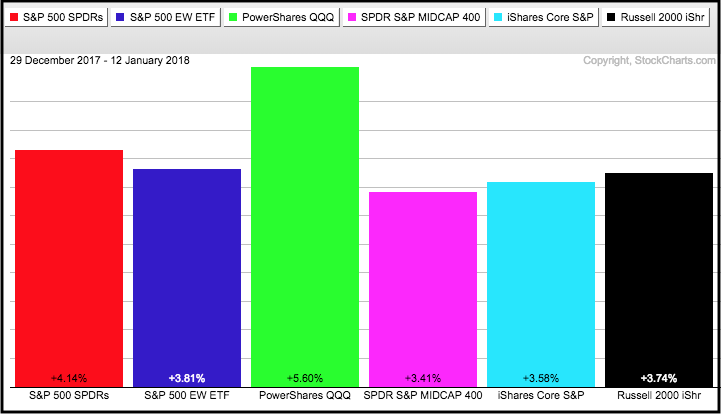

Trend Mode Versus Corrective Mode - Playing the Pullbacks (8 Stock Setups)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* SPY and QQQ Lead the 2018 Surge.

* Moving from Corrective Mode to Trend Mode.

* Déjà vu for HRB and ACH.

* Playing the Short Correction (NEWM, LYV, YUM).

* AXL Breaks Out of Big Correction.

* LPX Makes Good on Third Bounce.

* AGCO Forms Classic Bullish Continuation Pattern.

SPY and QQQ Lead the...

READ MORE

MEMBERS ONLY

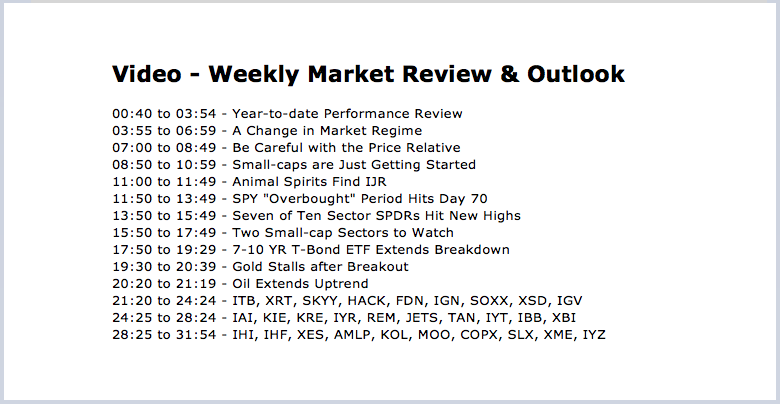

Weekly Market Review & Outlook (w/ Video) - Animal Spirits Coming to a Small Cap Near You

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Change in Market Regime.

* Be Careful with the Price Relative.

* Small-caps are Just Getting Started.

* Animal Spirits Find IJR.

* SPY "Overbought" Period Hits Day 70.

* Seven of Ten Sector SPDRs Hit New Highs.

* Two Small-cap Sectors to Watch.

* 7-10 YR T-Bond ETF Extends Breakdown.

* Gold Stalls after...

READ MORE

MEMBERS ONLY

Focusing on Cyber Security with Two Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Cyber Security ETF Surges to New High.

* Two Cyber Security Stocks to Watch.

* Finisar Bounces off Key Retracement.

* Win Some and Lose Some (AYI, BLL).

Cyber Security ETF Surges to New High

The Cyber Security ETF (HACK) lagged the broader market from June to mid November, but caught fire and...

READ MORE

MEMBERS ONLY

Ready to Roll the Dice with MGM?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

MGM Resorts (MGM) is gearing up for a resistance challenge and the speculator in me expects a breakout. First and foremost, MGM is in a long-term uptrend with the September 7th spike marking a 52-week high. The 50-day EMA is also above the 200-day EMA and price is well above...

READ MORE

MEMBERS ONLY

Small Caps and Banks Looked Poised to Move - Plus Three Bullish Healthcare Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-cap ETF Triggers a Signal.

* Regional Bank SPDR Gaps within a Triangle.

* Earnings Season Starts Soon.

* Five Automakers Hit New Highs - Who's Next?

* Three Healthcare Stocks Setting Up Bullish.

Small-cap ETF Triggers a Signal

The S&P SmallCap iShares (IJR) hit a 52-week closing high on...

READ MORE

MEMBERS ONLY

Will Price Follow Volume for Broadcom?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Broadcom (AVGO) fell on hards time in December with a decline to the breakout zone, but this zone ultimately held and it looks like the uptrend is ready to resume. First and foremost, AVGO is in a long-term uptrend after the big breakout in October and the 52-week highs in...

READ MORE

MEMBERS ONLY

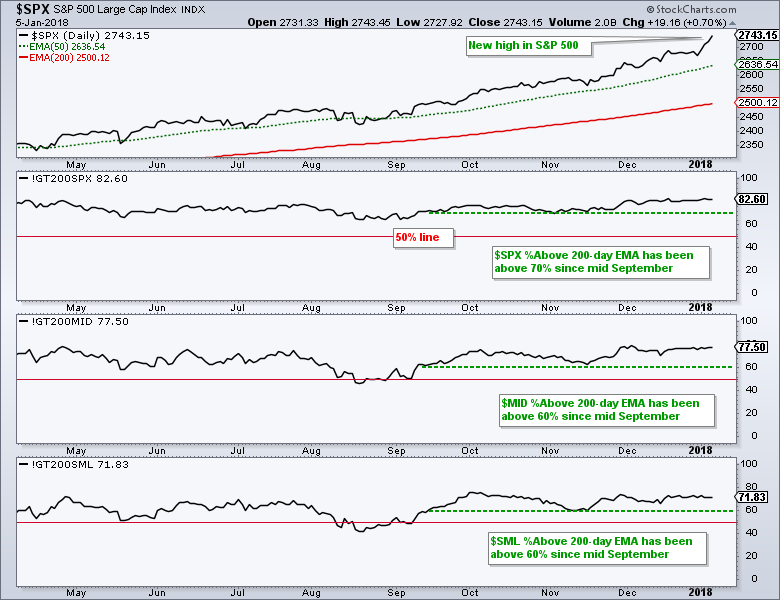

Pockets of Strength Outweigh Pockets of Weakness

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market is never 100% bullish with all stocks participating in an uptrend. There are always some holdouts and pockets of weakness, but the broader market can continue higher as long as the pockets of strength are greater than the pockets of weakness.

The percentage of stocks above the...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Market Strength Broadens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

---- Strong Pockets Outweigh Weak Pockets

---- Large-caps Lead New High Expansion

---- SPY Momentum Remains Strong

---- QQQ Continues to Lead

---- IJR Stalls Near Prior High

---- Seven of Ten Sectors Hit New Highs

---- Materials, Industrials and Finance Lead New Highs

---- MLP ETF Breaks Out

----...

READ MORE

MEMBERS ONLY

Finance Sector Springs to Life - Regional Banks Surge - Citigroup, Morgan Stanley and USB Break Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

---- S&P MidCap SPDR Catches a Bid

---- Finance SPDR Springs to Life

---- Citigroup and Morgan Stanley End Pullbacks

---- US Bancorp Leads Regional Bank SPDR

---- Broker-Dealer iShares Breaks Out of Flag ----

S&P MidCap SPDR Catches a Bid ----

Large-caps are leading so...

READ MORE

MEMBERS ONLY

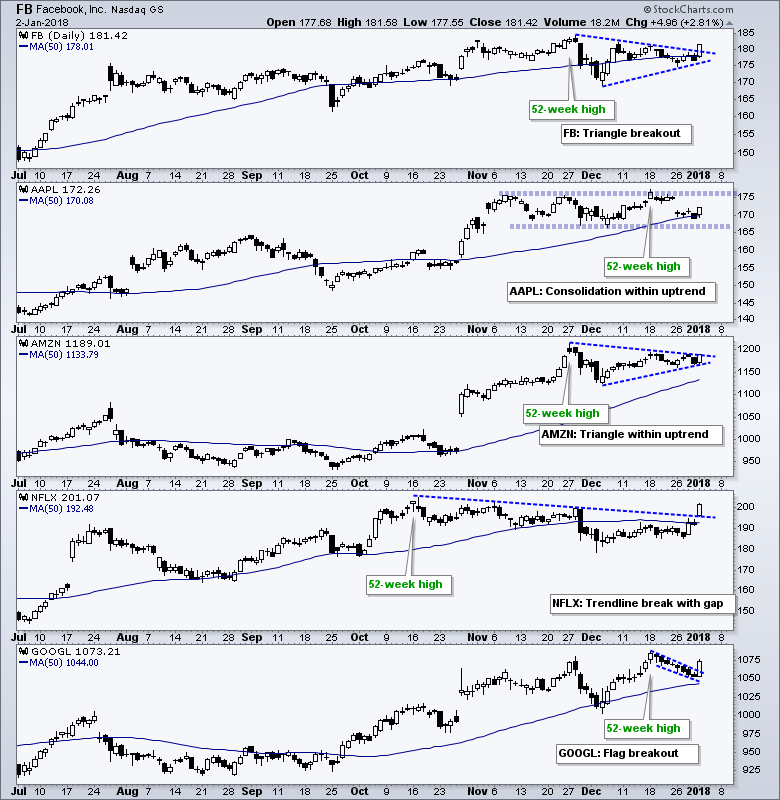

FAANG Starts the Year with a Baang

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The five FAANG stocks, Facebook, Apple, Amazon, Netflix and Google (Alphabet), started the year strong as three moved back above their 50-day SMAs on Tuesday. Alphabet and Amazon were already above their 50-day SMAs so this means all five are back above these key moving averages. The chart below shows...

READ MORE

MEMBERS ONLY

SPY and IJR Stall into Yearend - Energy, Materials and Industrials Finish Strong - 3 Materials Stocks and an Industrial to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

---- SPY Ends the Year with a Stall

---- IJR Consolidates into Yearend

---- Energy, Materials and Industrials Finish 2017 Strong

---- Oil Finishes at High of the Year

----Aluminum, Copper and Nickel Finish Strong

---- Three Materials Stocks to Watch (MLM, VMC, NUE)

---- Acuity Bases in Third Quarter...

READ MORE

MEMBERS ONLY

Regional Bank ETF Winds Up before Next Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Regional Bank SPDR (KRE) surged to a 52-week high in late November and then formed a bullish continuation pattern as it consolidated the last few weeks. First and foremost, the long-term trend is up for KRE because of the breakouts in September and November, and the 52-week high in...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - A Mean-Reversion Strategy for Sectors and Major Index ETFs in 2018

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... SPY Hits Another New High

.... A Mean-Reversion Strategy for 2018

.... Breadth Symbols for Other ETFs

.... Time off for Happy Holidays!!

.... IJR Follows QQQ with Flag Breakout

.... Defensive Sectors Lag as Energy Takes the Lead

.... Oil Goes for a Triangle Breakout

.... Oil & Gas Equip & Services SPDR Pops (plus XOP)...

READ MORE

MEMBERS ONLY

Amgen Goes for a Pennant Break

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Amgen (AMGN) is one of these stocks that is leading year-to-date, but lagging over the last three months. Year-to-date, the stock is up around 25% and the S&P 500 SPDR is up around 22%. Over the last three months, the stock is down around 4% and the S&...

READ MORE

MEMBERS ONLY

A Big Theme Emerges for 2018 - Long-term Price Targets (with Salt) for XLF and KRE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Big Theme to Consider for 2018

* 10-yr T-Yield Targeted above 3%

* An Outsized Move for the 30-yr Yield

* Rising Rates Negative for Gold, XLU and IYR

* Rising Rates Positive for Finance Sector

* Price Targets for XLF and KRE

A Big Theme to Consider for 2018

The 20+ YR T-Bond...

READ MORE

MEMBERS ONLY

Semis Surge - Biotech ETFs Struggle - Oil and XES Stall - H&R Block, Albemarle, Teekay and 4 More

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Small, Equal-weight and Large-cap Sector Leaders

.... Industry Group ETF Leaders

.... Semis Surge from Oversold Levels

.... Biotech ETFs Struggle, but Remain Bullish

.... Oil Consolidates within Uptrend

.... XES Forms Ascending Triangle

.... H&R Block Holds Breakout Zone

.... Albemarle Takes One Step Back

.... Teekay Bids to End Long Correction

.... Stocks to Watch:...

READ MORE

MEMBERS ONLY

Analog Devices Turns at Key Retracement Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is a certain ebb and flow in an uptrend where the advances consistently outpace the pullbacks. Think of it as two steps forward and one step backward. The chart for Analog Devices (ADI) shows a big move to new highs from August to November and then a 50-62% retracement...

READ MORE

MEMBERS ONLY

Overbought - And Built to Stay That Way

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Overbought and oversold are funny terms. Well, actually, they are not that funny when you really think about it. Overbought is often overused in an uptrend and oversold is over used in a downtrend. Let's focus on overbought because that seems to be the term du jour right...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Day 53 Since Becoming "Overbought"

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

---- Day 53 Since Becoming "Overbought"

---- Small-cap Underperformance Becomes Pronounced

---- IJR Forms Bull Flag

---- SPY Hits New High as QQQ Breaks Flag

---- What's Up (literally) with TLT?

---- Junk Bonds Continue to Weaken

---- XLU with Bull Flag and Oversold CCI

----...

READ MORE

MEMBERS ONLY

Finisar Forges an Island Reversal (What now?) - Lumentum Hits Retracement and II-VI Corrects within Uptrend - Plus 4 More

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Selectively Consuming News

.... Finisar and VCSELs

.... Narratives are Dangerous

.... Finisar Forges an Island Reversal

.... Lumentum Firms near Key Retracement

.... II-VI Corrects within Uptrend

.... Stocks to Watch (CENX, JJU, PRGO, LH) ....

I do follow the financial press on a regular basis, but on a very selective basis. I am mostly interested...

READ MORE

MEMBERS ONLY

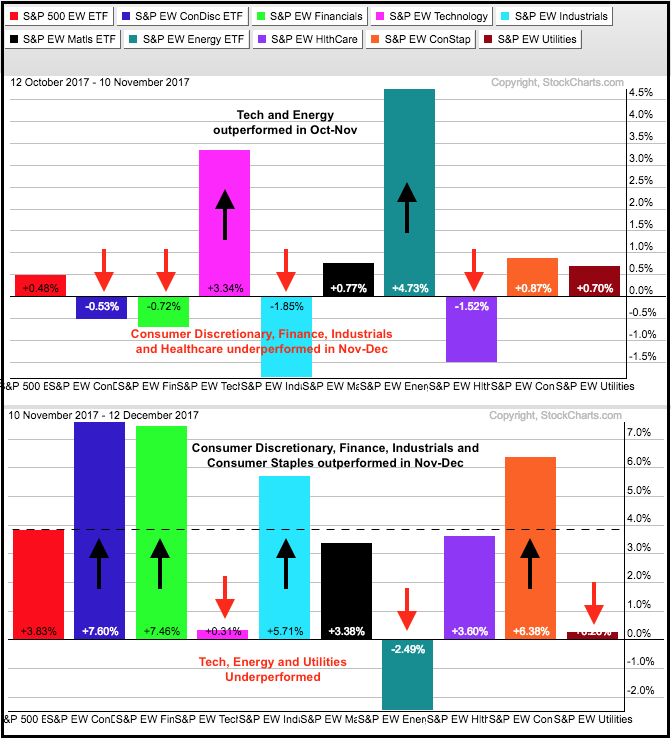

What a Difference a Month Makes for Sector Performance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The two sector Performance charts below show a rather dramatic shift in market leadership over the last two months. First, note that these PerfCharts are using the nine equal-weight sector ETFs. In contrast to the cap-weighted sector SPDRs, these equal-weight ETFs provide us with a performance picture for the "...

READ MORE

MEMBERS ONLY

Healthcare Springs to Life - Five Healthcare Stocks - Two New Tech ETF Leaders - Telsa Bounces off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Health Care SPDR Renews its Breakout

.... Pfizer and Bristol-Meyers Bounce off Support

.... HACK and IGN Confirm Big Continuation Patterns

.... Cisco and Fortinet Lead their Groups

.... Copper Gets Oversold Bounce (plus COPX)

.... Tesla Surges off Support Zone

.... Short-term Ugliness with Long-term Bullishness ....

Health Care SPDR Renews its Breakout

The Health Care...

READ MORE

MEMBERS ONLY

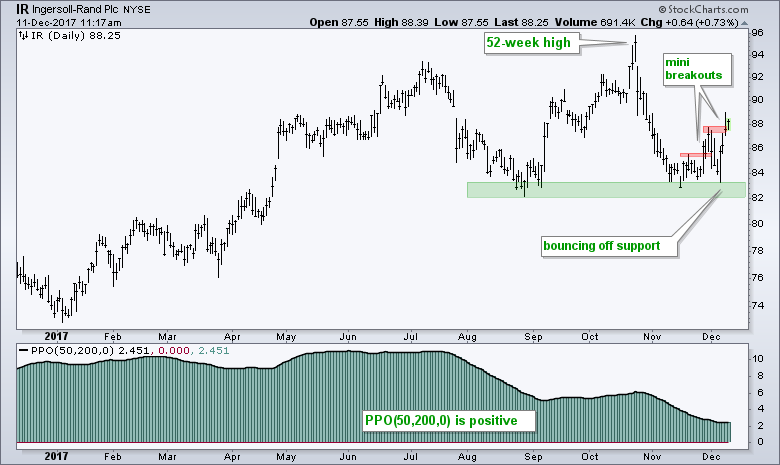

Ingersoll-Rand Surges off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ingersoll-Rand (IR) is showing renewed signs of life with a surge off support and two mini breakouts. Note that IR is part of the industrials sector and this sector is showing upside leadership with a 52-week high recently. First and foremost, Ingersoll-Rand is in a long-term uptrend with a 52-week...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Breadth Confirms Price (with Video)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Breadth Indicators Confirm Chart Strength

.... SPY Stalls as QQQ Edges Lower

.... Watch TLT for Clues on IJR

.... Three New Highs and One Stall

.... XLE Stalls, but Holds its Breakout

.... Getting Perspective on XME

.... Steel ETF Forms Big Continuation Pattern

.... IEF and TLT Remain Divergent

.... Gold Breaks as Dollar Turns Up...

READ MORE

MEMBERS ONLY

Did Uptrends Reverse for Semiconductor ETFs? - Five Semiconductors to Watch - Biotech ETFs and Five Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Did the Uptrends Reverse for Semiconductors?

.... Intel and Four Semiconductor Equipment Stocks

.... Biotech ETF Test November Lows

.... BIIB Shows Relative Chart Strength

.... Bearish Wedges for Two Energy-related ETFs

.... Junk Bonds Continue to Struggle ....

Did the Long-term Uptrends Reverse for Semiconductors?

The Semiconductor SPDR (XSD) and Semiconductor iShares (SOXX) were hit...

READ MORE

MEMBERS ONLY

United Technologies Forms Classic Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

United Technologies (UTX) looks ripe for a breakout to new highs as a bullish cup-with-handle pattern takes shape. Note that UTX is in the industrials sector and the defense-aerospace industry group. The Industrials SPDR (XLI) and the iShares Aerospace & Defense ETF (ITA) both hit new highs on December 1st....

READ MORE

MEMBERS ONLY

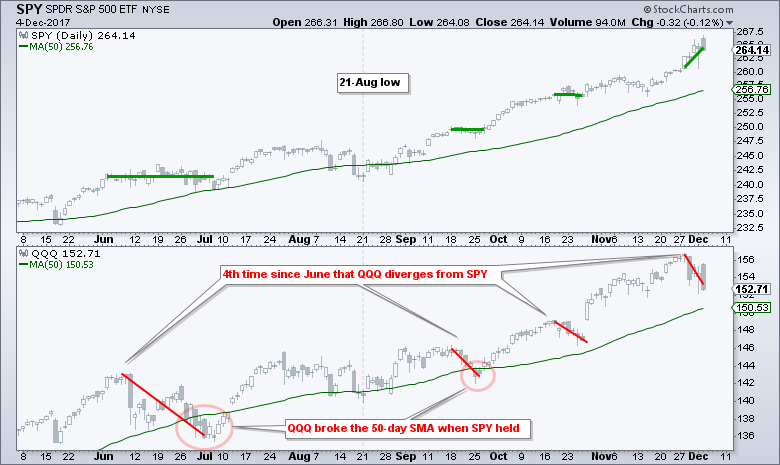

QQQ Diverges from SPY Again - Candles versus Closing Prices - Gold, Bonds and Dollar - Three Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... QQQ Diverges from SPY Again

.... Mid-caps Shine on PerfChart

.... Candlesticks versus Closing Prices

.... Bonds and Dollar Push-Pull Gold

.... IDXX Breaks Flag Resistance

.... EBAY Bids to End Correction

.... Ball Corp Surges off Support Zone ....

QQQ Diverges from SPY Again

QQQ diverged from SPY over the last few days and this marks...

READ MORE