MEMBERS ONLY

An Indicator to Define the Trend and Quantify Momentum

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 200-day SMA is perhaps the most widely used long-term moving average. As its name implies, it is a simple indicator that chartists can use for trend-following and momentum strategies. For trend-following, we just need to know where prices stand relative to the 200-day SMA. For momentum, we need to...

READ MORE

MEMBERS ONLY

Rates Look Set to Rise as TLT Resumes its Downtrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 20+ Yr Treasury Bond ETF (TLT) failed again at the falling 40-week SMA and looks poised to resume its bigger downtrend. Keep in mind that bonds and yields move in the opposite direction. A resumption of the downtrend in TLT translates into a resumption of the uptrend in the...

READ MORE

MEMBERS ONLY

Oil & Gas Equipment & Services ETF Resumes its Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Oil & Gas Equipment & Services ETF (XES) is showing strength here in March as it breaks back above its 40-week SMA. More importantly, the long-term trend is up and this week's breakout argues for a continuation of this uptrend.

The chart below shows XES with a...

READ MORE

MEMBERS ONLY

Using the ATR Trailing Stop to Manage the Trade and Define the Trend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As its name suggests, the ATR Trailing Stop is normally used to trail a stop-loss for a long position. It can also be used to identify an outsized decline that could reverse an uptrend. Today's example will show how to apply the ATR Trailing Stop on a breakout...

READ MORE

MEMBERS ONLY

Spotting Tradable Pullbacks after Trend Reversing Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Most stocks surged with the broader market in the fourth quarter of 2023. SPY and QQQ extended their advances in 2024, but some stocks did not partake and fell back. Even so, some of these stocks show signs of long-term trend reversals and their declines in 2024 look corrective. This...

READ MORE

MEMBERS ONLY

Finding Leaders and Bullish Signals on the Price Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can improve their odds by focusing on stocks that are in long-term uptrends and showing upside leadership. This is similar to a dual-momentum approach, which was covered last week. Today's example will use the 40-week SMA to define the trend, a 52-week high to confirm upside leadership...

READ MORE

MEMBERS ONLY

Capturing the Momentum Phenomenon - Nvidia vs Tesla

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The momentum phenomenon has been a fixture in the US equity markets for decades. There are two types of momentum to consider: absolute momentum and relative momentum. Absolute momentum refers to the underlying trend, up or down. Relative momentum quantifies the strength of the uptrend and compares it to other...

READ MORE

MEMBERS ONLY

Generals March On, but Fewer Troops are Following - Get the Essential Breadth Indicator ChartList

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Divergences reflect a disconnect between price and the indicator. A bearish divergence forms when price forges a higher high and the indicator fails to confirm this high. In the case presented below, we have the S&P 500 moving higher and fewer stocks making it back above their 50...

READ MORE

MEMBERS ONLY

Gold is Making Waves within a Long-Term Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gold is not the most exciting asset at the moment, but it is in a long-term uptrend and perhaps the strongest commodity out there. There are also signs that the January decline is ending as RSI hits a momentum support zone and a bullish continuation pattern forms. Note that GLD...

READ MORE

MEMBERS ONLY

A Biotech Stock with a Breakout on the Weekly and a Classic Retracement on the Daily

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This week's analysis will stick with the multiple timeframe approach. Today we are featuring a biotech stock with a channel breakout on the weekly chart and a classic retracement on the daily chart. Moreover, a larger bullish reversal pattern could be forming on the daily chart.

The weekly...

READ MORE

MEMBERS ONLY

Using Two Timeframes to Increase the Odds - Starting with the Strategic View

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking to increase their odds should consider two timeframes for their analysis. The longer timeframe sets the strategic tone, while the shorter timeframe defines the trading tactics. Strategically, I am interested in stocks with long-term uptrends. Tactically, I am looking for bullish continuation patterns to trade after a correction....

READ MORE

MEMBERS ONLY

Putting a Mean-Reversion Strategy Into Practice

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Mean-reversion strategies typically buy stocks when they are oversold, which means catching the falling knife. These declines are often rather sharp, but the odds favor some sort of bounce after reaching an oversold extreme. While there are no guarantees, chartists can mitigate risk by insuring that the stock is still...

READ MORE

MEMBERS ONLY

Apple hits Support-Reversal Zone - What is it and Why Does it Matter?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Tech stocks were hit with selling pressure to start the year, but many are still in long-term trends and some are nearing support-reversal zones. In particular, Apple (AAPL) fell to a support-reversal zone and I am on alert for a bounce. Let's investigate.

First, the long-term trend is...

READ MORE

MEMBERS ONLY

Momentum Madness and Nasdaq 100 Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks went on a tear the last seven weeks with Nasdaq 100 stocks leading the charge. The S&P MidCap 400 SPDR (MDY) and Russell 2000 ETF (IWM) gained more than QQQ over the last seven weeks, but QQQ is still the only major index ETF to exceed its...

READ MORE

MEMBERS ONLY

Is Overbought Really Bearish?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR (SPY) surged over 10% since late October and exceeded the upper Bollinger Band (125,1). This means price is more than 1 standard deviation above the 125-day SMA. Surely, this means SPY is overbought. But is this actually bearish? Historical evidence suggests that this...

READ MORE

MEMBERS ONLY

Long-term Breadth Indicators Hit Moment of Truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The percentage of stocks in long-term uptrends rebounded sharply in November and returned to the highs from late August and early September. This rebound is impressive, but the absolute levels are still not that inspiring. We need to see participation breakouts and higher participation levels to get the broad bull...

READ MORE

MEMBERS ONLY

Charting the S&P 1500 Zweig Breadth Thrust - And More...

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

StockCharts users can chart the Zweig Breadth Thrust for the S&P 1500 or any other index that has Advance-Decline Percent data. All we have to do its convert the Zweig Breadth Thrust levels to their equivalents using Advance-Decline Percent.

The Zweig Breadth Thrust is based on percent advances...

READ MORE

MEMBERS ONLY

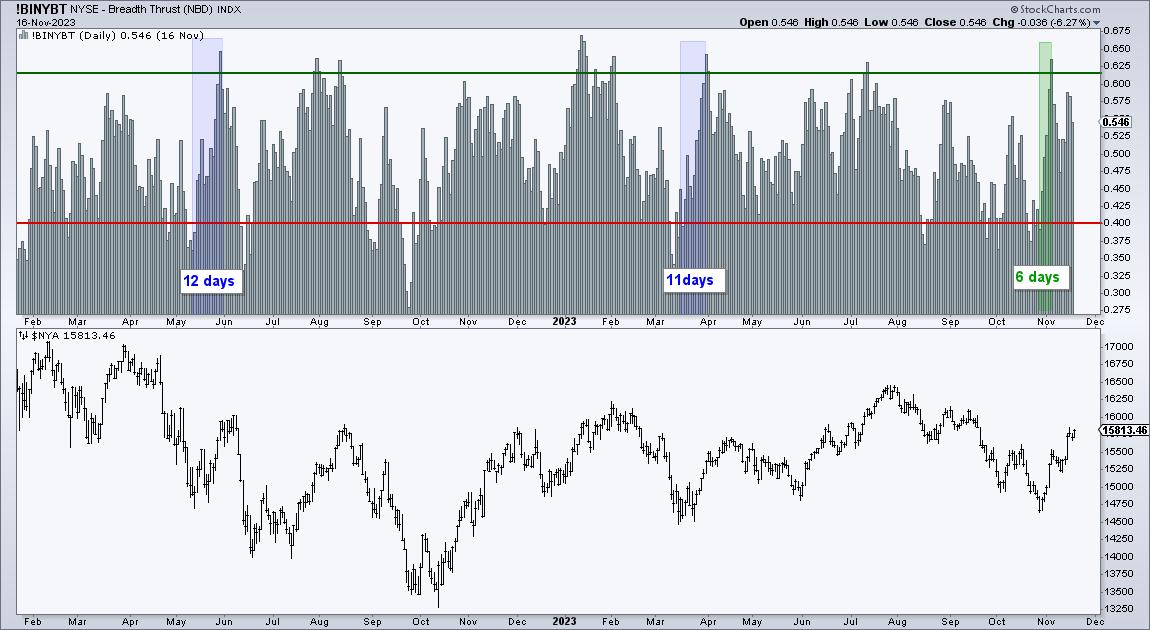

The Zweig Breadth Thrust Triggers, but the Indicator is Missing Something

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's report features the Zweig Breadth Thrust, which was developed by the late, and great, Marty Zweig. Zweig appeared regularly on Wall Street Week, contributed to Barrons, published The Zweig Forecast and wrote Winning on Wall Street in 1986. Among other things, his timeless book shows us how...

READ MORE

MEMBERS ONLY

Skip the Noise and Focus on the Signal by Effectively Using the 200-day SMA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is battling the 200-day SMA with four crosses over the last eleven days. We are also seeing a rise in volatility as this market benchmark plunged 5.86% in nine days (18-27 October) and then surged 5.85% the last five days. With such conditions,...

READ MORE

MEMBERS ONLY

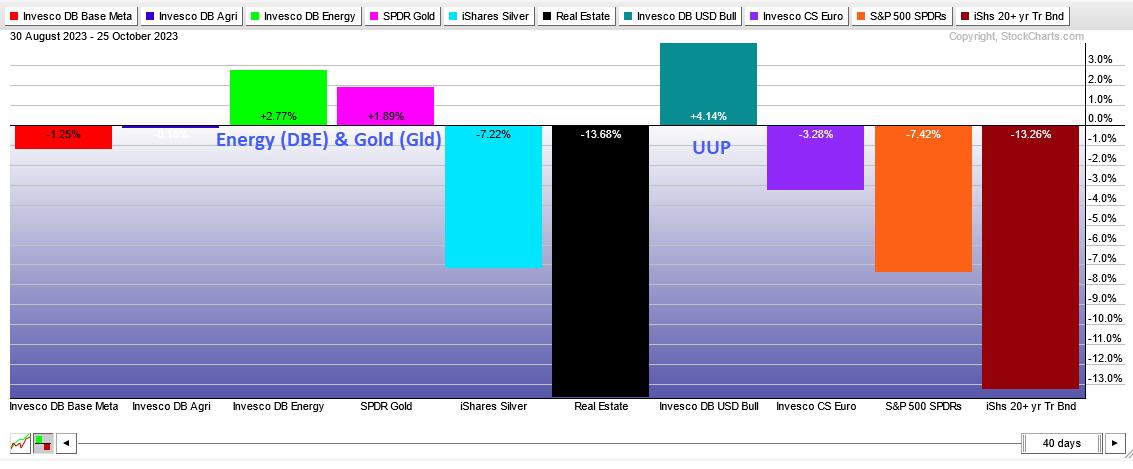

Looking Outside the Stock Market for Opportunities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Correlations rise during bear markets. This means more stocks participate in broad market declines than broad market advances. In other words, the odds are stacked against us when picking stocks in bear markets. Traders are better off looking outside of the stock market for opportunities.

The Perfchart below shows the...

READ MORE

MEMBERS ONLY

Home Construction ETF Breaks and a Home Builder Sets up for Further Downside

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Home Construction ETF (ITB) led the market the first seven months of the year, but fell on hard times the last two months and reversed its long-term uptrend. Today's report/video will look at the trend reversal in ITB using the RSI Trend Range indicator. We will...

READ MORE

MEMBERS ONLY

Equal-weight Semis Break Down - Is SOXX Next? - with video (Free)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's report will compare charts and performance for the Semiconductor ETF (SOXX) and the Semiconductor SPDR (XSD). SOXX represents large-caps and is holding up. XSD represents the average semiconductor stock and it is not holding up. Broad weakness within the semiconductor group is likely to spread to large-cap...

READ MORE

MEMBERS ONLY

EBAY Cannot Hold a Bid

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a rough ride in September, the S&P 500 is still up 14% year-to-date and the Nasdaq 100 is up a whopping 40%. The gains here, however, do not tell the entire story because many stocks are struggling in 2023. In fact, around half of the stocks in...

READ MORE

MEMBERS ONLY

Trading the Swing within the Pattern: IGV Example

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking to get the jump on a bigger breakout can turn to the swings within a developing pattern. For example, a Symmetrical Triangle after an advance is a bullish continuation pattern. We can get the jump on a breakout by trading a downswing reversal within the pattern. Let'...

READ MORE

MEMBERS ONLY

A Key Momentum Indicator Shifts from Bullish to Bearish for QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

QQQ remains well above the rising 200-day SMA, but clearly shifted from bullish to bearish over the last two months. Today's report/video will show this momentum shift and analyze the short-term continuation pattern taking shape.

The chart below shows QQQ trading well above the rising 200-day SMA....

READ MORE

MEMBERS ONLY

Two Holding Up and Two Breaking Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The pockets of strength are shrinking as more stocks succumb to selling pressure. The Nasdaq 100 is the strongest of the major indexes, while the Finance sector is one of the weakest sectors. Today's report will highlight two leaders within the Nasdaq 100 and two laggards within the...

READ MORE

MEMBERS ONLY

Which Cyber Security ETF is the Strongest?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit hard the last two weeks with the S&P 500 SPDR (SPY) breaking below its August low. SPY also forged a lower high from July to August. Stocks and ETFs that held above their August lows are showing relative strength. With that in mind, the three...

READ MORE

MEMBERS ONLY

Finding the Leaders after a Sharp Decline - with Video

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks fell sharply in September with the S&P 500 SPDR (SPY) breaking below its August low. Chartists can now use this low as a benchmark low to gauge relative performance. Stocks that held above the August low are showing relative strength. This is valuable information because stocks that...

READ MORE

MEMBERS ONLY

Energy-related Commodities Lead, but Oil Looks Vulnerable

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

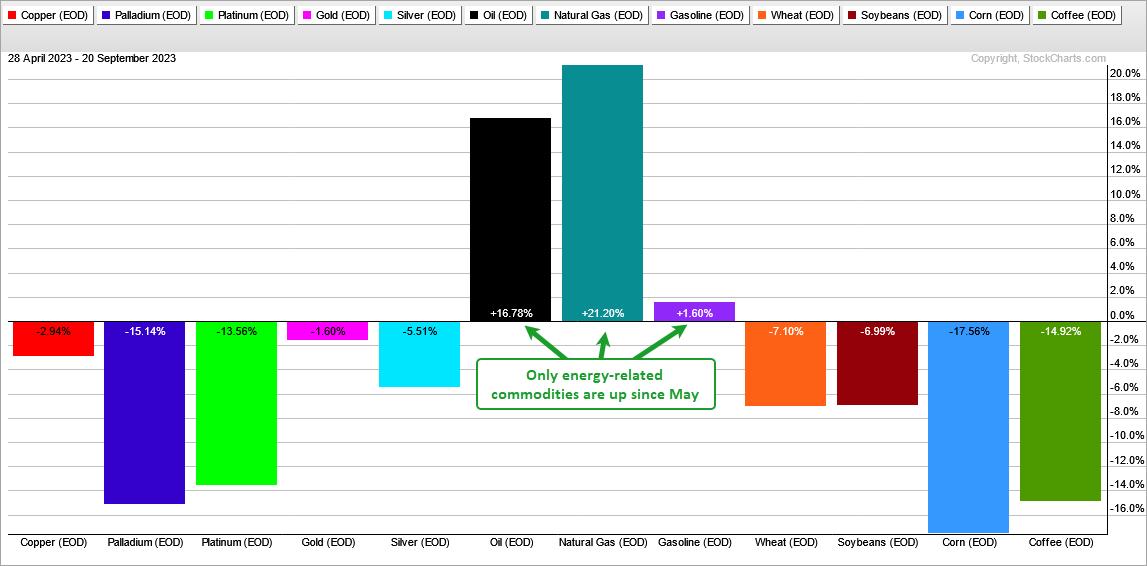

It has been a rough ride for most commodities this year and especially over the last 100 trading days (since May). Of the twelve spot prices I track, nine are up and three are down. Precious metals, base metals, lumber and grains are all down. The energy complex is the...

READ MORE

MEMBERS ONLY

Two Key Groups Take a Turn for the Worse

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A few large-caps and large-cap techs are holding up, but other areas of the market are showing weakness. Namely, the Retail SPDR (XRT) and Regional Bank ETF (KRE) are two of the weakest groups right now. These two groups are under selling pressure and this could bode ill for the...

READ MORE

MEMBERS ONLY

IWM Closes below Long-term Moving Average. Does it Matter?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

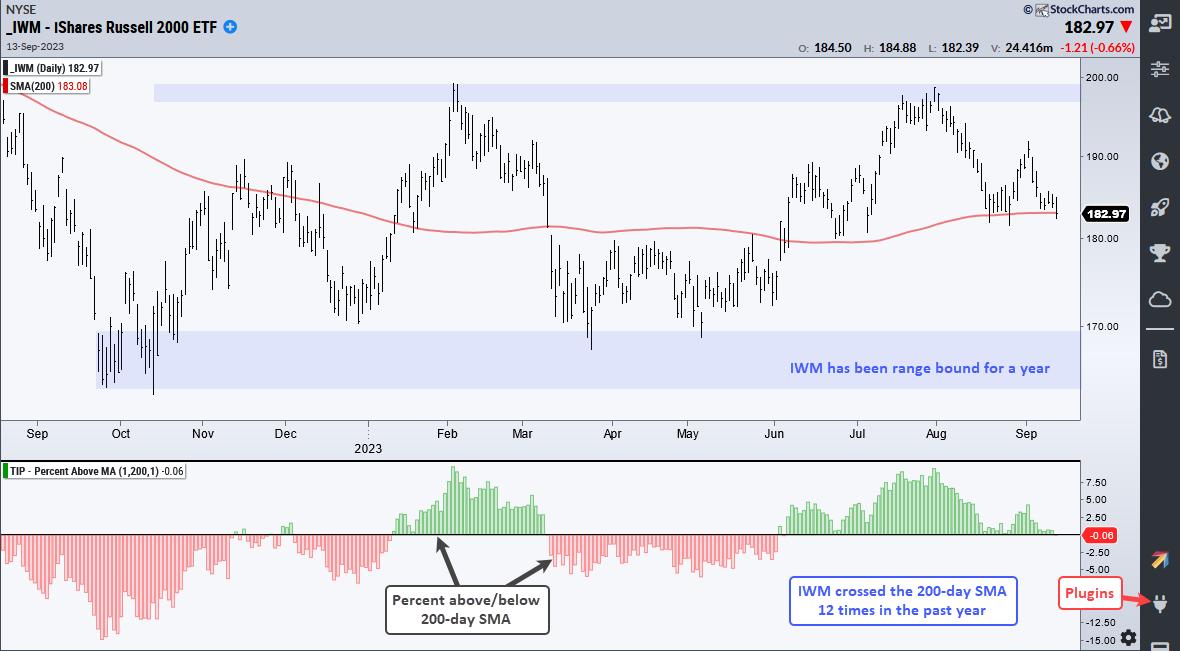

The Russell 2000 ETF (IWM) closed below the 200-day SMA for the first time since, well, June 1st. The last cross was not that long ago and recent crosses simply resulted in whipsaws. Truth be told, 200-day SMA crosses are not that relevant for IWM.

The chart below shows IWM...

READ MORE

MEMBERS ONLY

Breadth is Not Keeping Pace with the Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

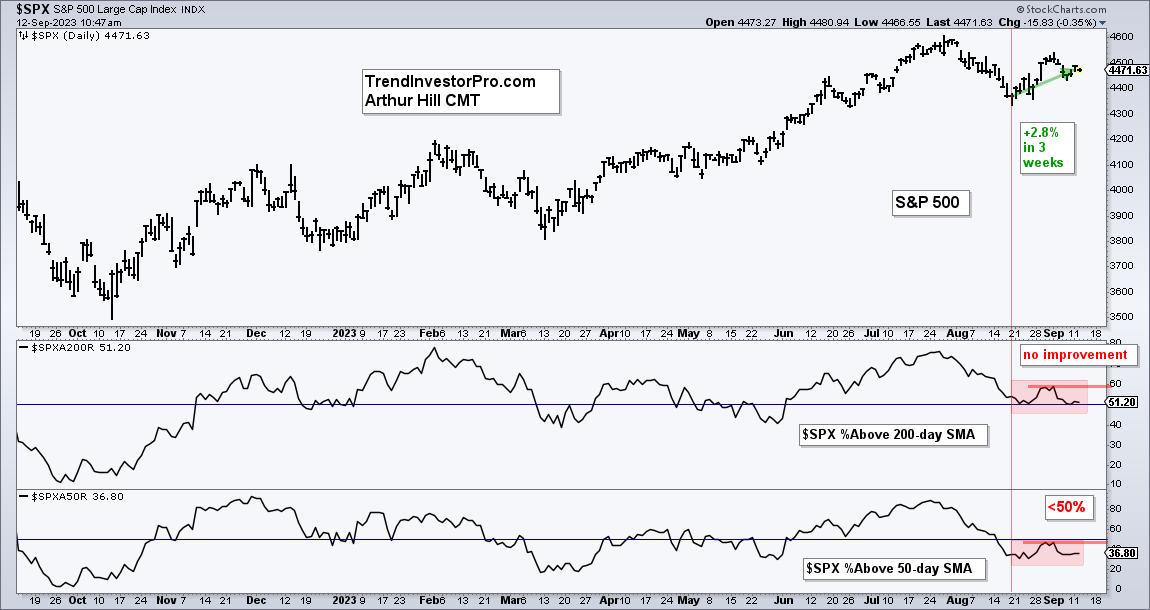

The S&P 500 SPDR bounced the last three weeks, but we did not see an improvement in breadth. Weak breadth is also reflected in performance for mid-caps and small-caps, which are lagging. Even so, SPY and QQQ are in short-term uptrends and I am watching the tech sector...

READ MORE

MEMBERS ONLY

The Key to the August Breakouts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged in the second half of August with several ETFs breaking out of corrective patterns, such as falling flags or falling wedges. Even though September is a seasonally weak month, these breakouts are bullish until proven otherwise. Today's commentary will analyze the breakout in the Technology SPDR...

READ MORE

MEMBERS ONLY

Seasonality versus Simply Market Timing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

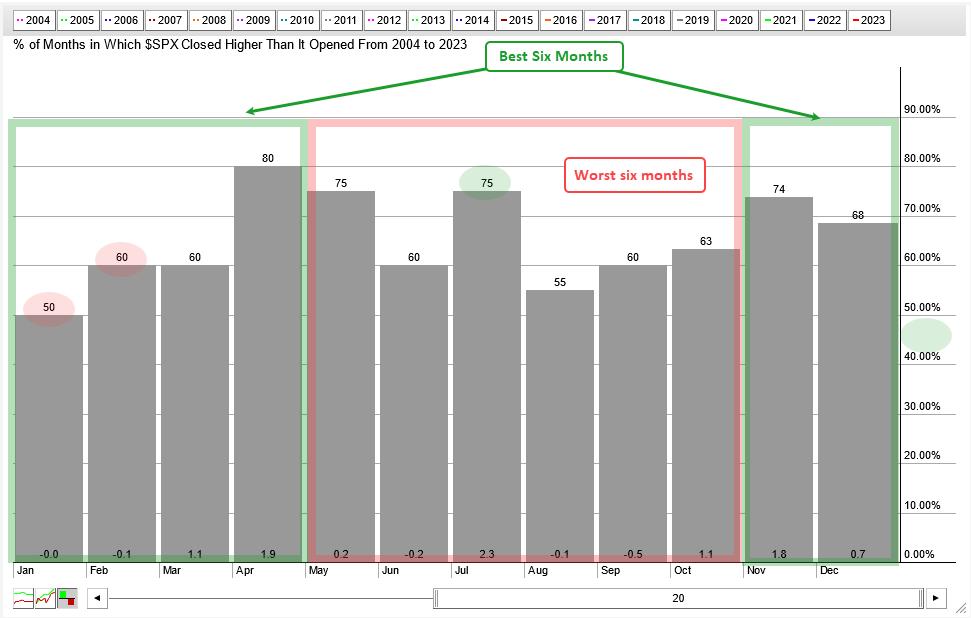

There is some validity to the best six months strategy, but investors would probably be better off with a simple timing tool. According to the Stock Trader's Almanac, the best six-month period runs from November to April. The worst six-month period runs from May to October. This is...

READ MORE

MEMBERS ONLY

A Nasdaq 100 Stock Showing Relative Strength in August

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit hard in August with QQQ leading the way lower and breaking its July low. Stocks that did not break their July lows are holding up better and showing relative strength. These are the stocks I want on my WatchList for tradable pullbacks and short-term breakouts. AMAT is...

READ MORE

MEMBERS ONLY

CrowdStrike Shows Strength and Leadership with Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CrowdStrike (CRWD) is separating itself from the rest of the pack with a breakout and nine month high.

The chart below shows CRWD with an uptrend working throughout 2023. The stock bottomed in January, advanced to the 140 area and hit resistance here in March-April (thick red line). The stock...

READ MORE

MEMBERS ONLY

Cisco Takes the Lead with a Classic Bullish Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Cisco (CSCO) is showing leadership qualities again as it breaks out of a classic bullish continuation pattern and hits a new high.

The chart below shows CSCO forming a cup-with-handle pattern, which was popularized by William O'Neil of IBD. This is a bullish continuation pattern, which means the...

READ MORE

MEMBERS ONLY

Chart and Trend Signals Align for Datadog

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It does not always happen, but sometimes the indicator and chart signals align to send a powerful message. Datadog (DDOG) sports a confirmed bullish reversal on the price chart and a trend signal from the Trend Composite. Today's article will review these signals and highlight a developing short-term...

READ MORE

MEMBERS ONLY

Limited Leadership, but Still Plenty of Choice

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The weight of the evidence remains bullish for stocks, but this is not a bull market that lifts all boats. It is a relatively selective bull market led by technology, housing and a few other groups. This is not necessarily bad. It is, however, important to separate the leaders from...

READ MORE

MEMBERS ONLY

The Nasdaq 100 vs the Rest of the World

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

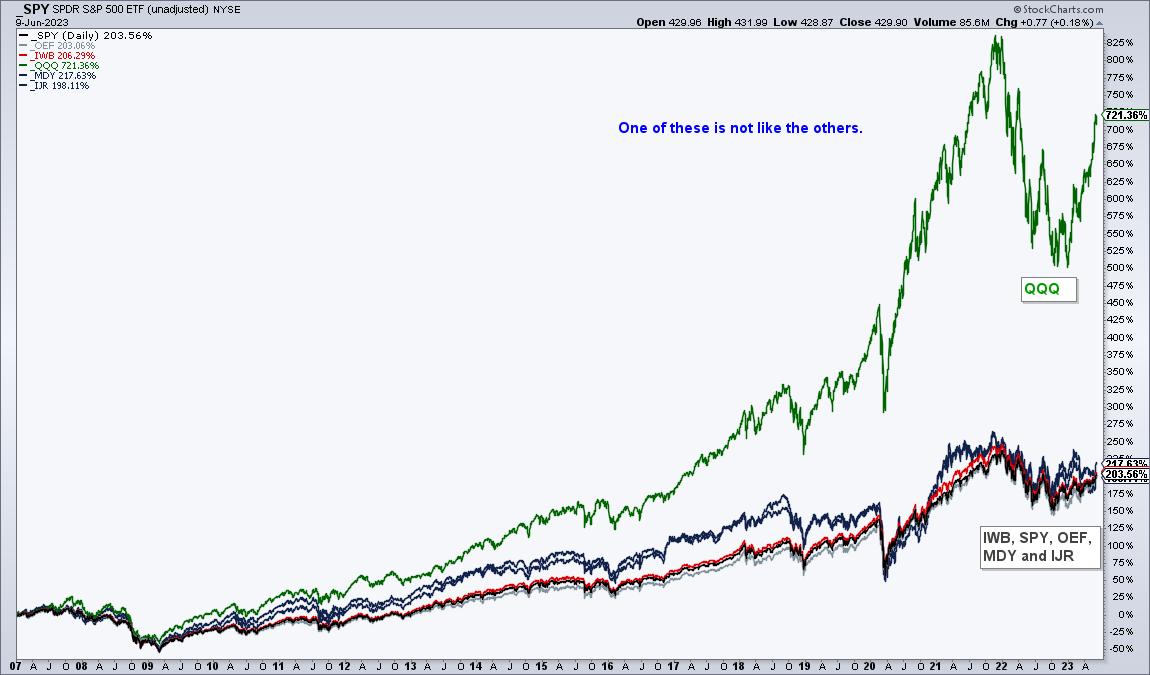

A long-term chart shows why the Nasdaq 100 is the place to be, or at least, "was" the place to be. Past performance does not guarantee future performance. The performance chart below shows the 16+ year percentage gain for QQQ and five other ETFs. These include the S&...

READ MORE