MEMBERS ONLY

Bonds Hold Trend and Outperform Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Bonds are outperforming stocks as money flows into relative safety and shuns risk. Overall, relative strength in bonds reflects risk aversion in the financial markets. Relative strength in bonds also indicates that investors should prefer bonds over stocks right now. Like all market dynamics, it is subject to change, but...

READ MORE

MEMBERS ONLY

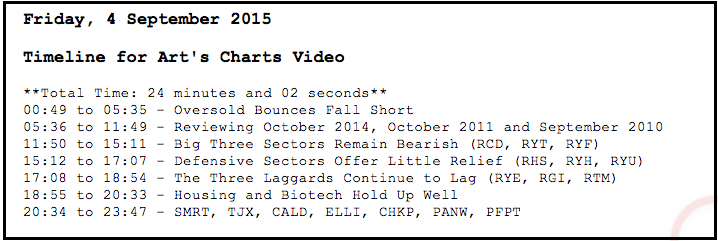

Oversold Bounces Fall Short, Reviewing Bottoms in 2014, 2011 and 2010, Big Three Sectors Remain Bearish, Defensive Sectors Offer Little Relief, Housing and Biotech Hold Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Oversold Bounces Fall Short

The overall trend remains down for the major index ETFs (QQQ, SPY and IWM). Trading turned volatile with the mid August breakdowns, but the breakdowns remain and these are the dominant feature on most stock-related charts. Current volatility makes it hard to determine what will happen...

READ MORE

MEMBERS ONLY

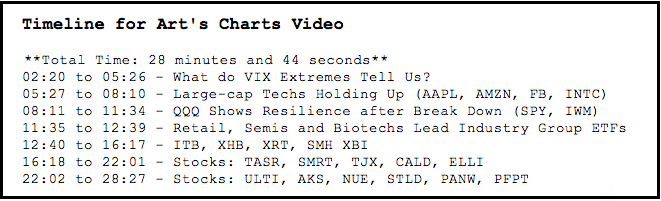

Trading VIX Extremes, Big Techs Hold Up Well, QQQ Rebounds, Housing Holds, XRT Finishes Strong, Semis Surge and 11 Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

What do VIX Extremes Tell Us?

Even though it can be difficult to trade based on extremes, note that the volatility indices are at extremes that suggest plenty of fear and this could foreshadow a bounce. The first chart shows daily closing values for the S&P 500 Volatility...

READ MORE

MEMBERS ONLY

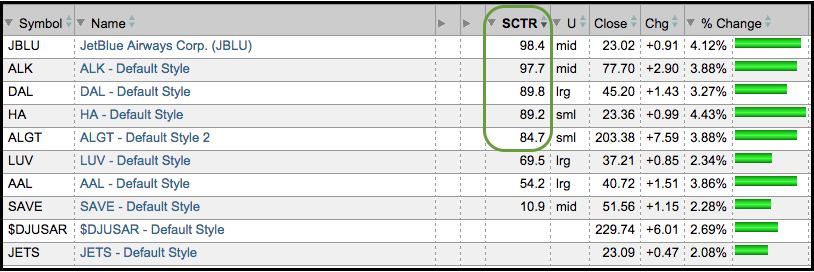

5 Airline Stocks with Strong SCTRs and 6 Charts worth Watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This is just a quick and dirty note regarding today's strength in airline stocks. The table below shows eight airline stocks, the Airline ETF (JETS) and the DJ US Airline Index ($DJUSAR). Notice that the StockCharts Technical Rank (SCTR) for two stocks is above 90 (JBLU and ALK)...

READ MORE

MEMBERS ONLY

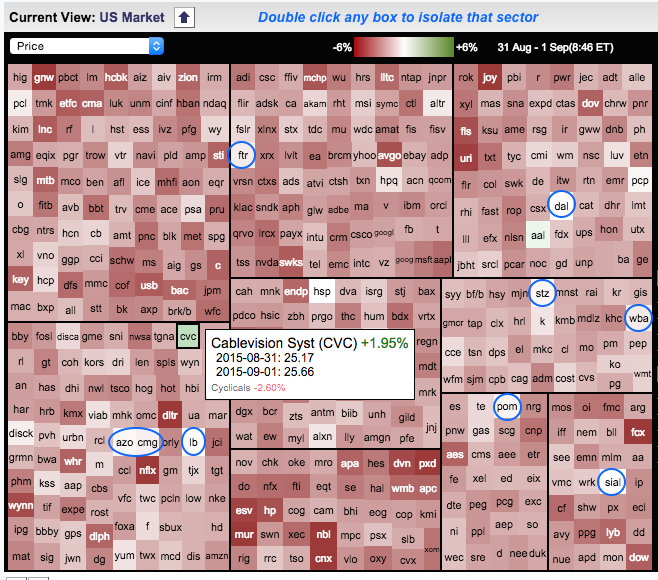

One Group and 3 Stocks Showing Relative Strength on Tuesday

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Selling pressure was quite intense on Tuesday as some 497 stocks in the S&P 500 declined on the day. This means there were only three winners on the day: CableVision (CVC), American Airlines (AAL) and Sigma-Aldrich (SIAL), which is going to be acquired by Merck. Cablevision, which is...

READ MORE

MEMBERS ONLY

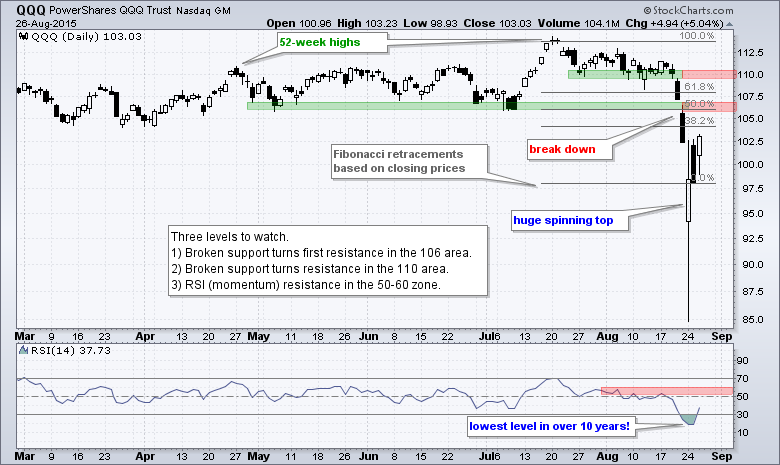

QQQ Fails at Support Break, Defensive Sectors Less Weak, Housing Holds, Retail and Banking Break and Biotechs Weigh

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stock futures are sharply lower on Tuesday morning and this means the oversold bounce is failing below the support break for the major index ETFs, sector ETFs and most industry group ETFs. Stocks became very oversold in mid August and then rebounded with sharp rallies last week. The deeper the...

READ MORE

MEMBERS ONLY

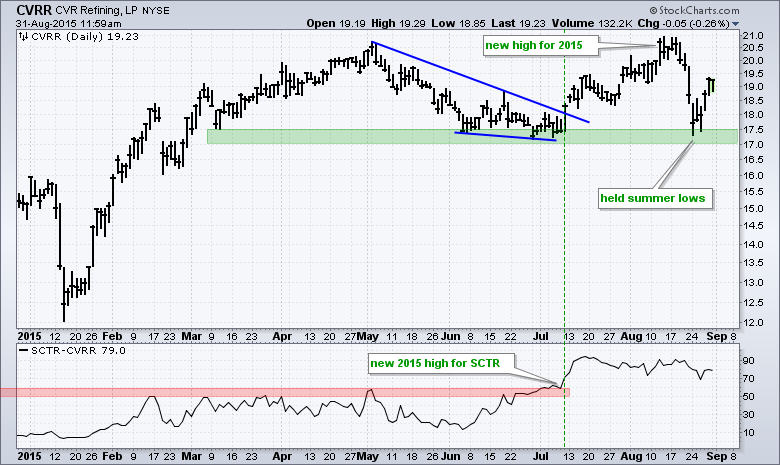

CVR Refining Shows Relative Strength and Chart Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit hard in mid August with the S&P 500 and many stocks plunging below their spring-summer lows. This means stocks that held their summer lows are by definition showing relative chart strength because they did not break a key level. The chart below shows CVR Refining...

READ MORE

MEMBERS ONLY

Setting Upside Targets, RSI Resistance, A Selling Climax in XLE?, Oil forms Two Inside Days, ITB Tests Support Zone, Four ETFs Showing Some Relative Chart Strength, Bond Update. Precious Metals Dim, Base Metals Extend Downtrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Setting Upside Targets for the Big 3

We are going to start with some candlestick charts so chartists can see the volatility of the last few days. There are few things to note overall. First, stocks became very oversold after sharp declines from August 18th to August 24th (five trading...

READ MORE

MEMBERS ONLY

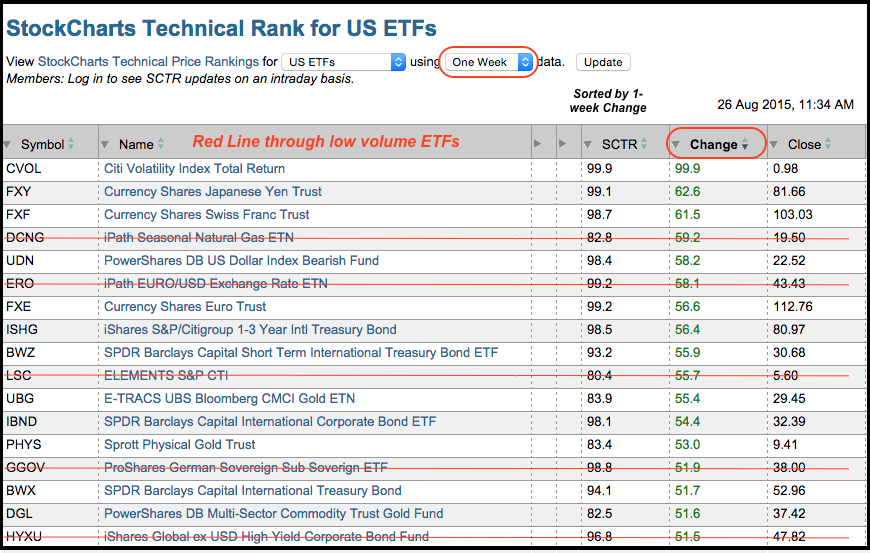

SCTRs Surge for Non-Stock ETFs (Yen, Euro, Volatility, Gold and Bonds)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There has been a big changing of the guard over the last few weeks as stock alternatives gained in relative rankings. The table below shows the StockCharts Technical Rank (SCTR) for our ETF universe, which excludes inverse and leveraged ETFs. It is sorted by the one-week change for the SCTR....

READ MORE

MEMBERS ONLY

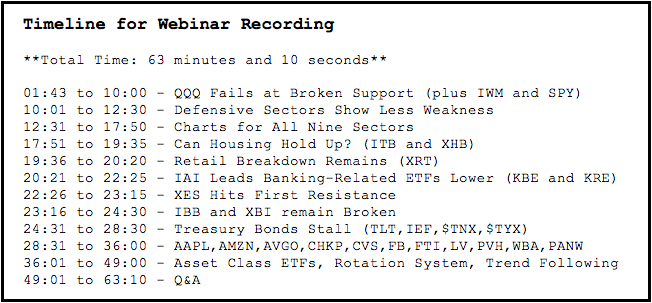

Index Table Turns Deep Red, Does a Day Make a Difference?, Sector Table Turns Majority Red, First Resistance for Tech, Discretionary and Finance SPDRs, Utilities Take the Lead (for now), REITs Break Down, Careful of Panic, Webinar Topics

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

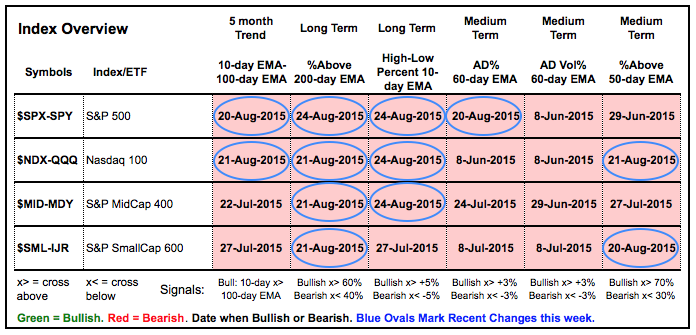

Index Table Turns Deep Red

The charts and commentary are part of Tuesday's webinar. Click here for the recording. Unsurprisingly, the breadth-trend table has turned decidedly bearish over the last few days. The blue ovals mark the breadth indicators that turned bearish this past week. Last Tuesday, this...

READ MORE

MEMBERS ONLY

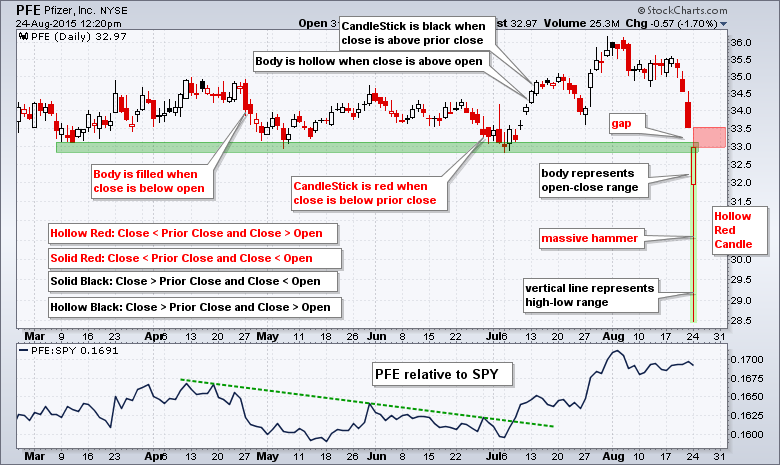

Massive Hollow Red Hammers Taking Shape

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak, plunged after the open and then recovered around midday. The Dow dipped below 15500 in the morning and then moved back to the 16200 area by noon ET. The opening gap, deep dip and recovery mean that several stocks could form big hammers today. These are short-term...

READ MORE

MEMBERS ONLY

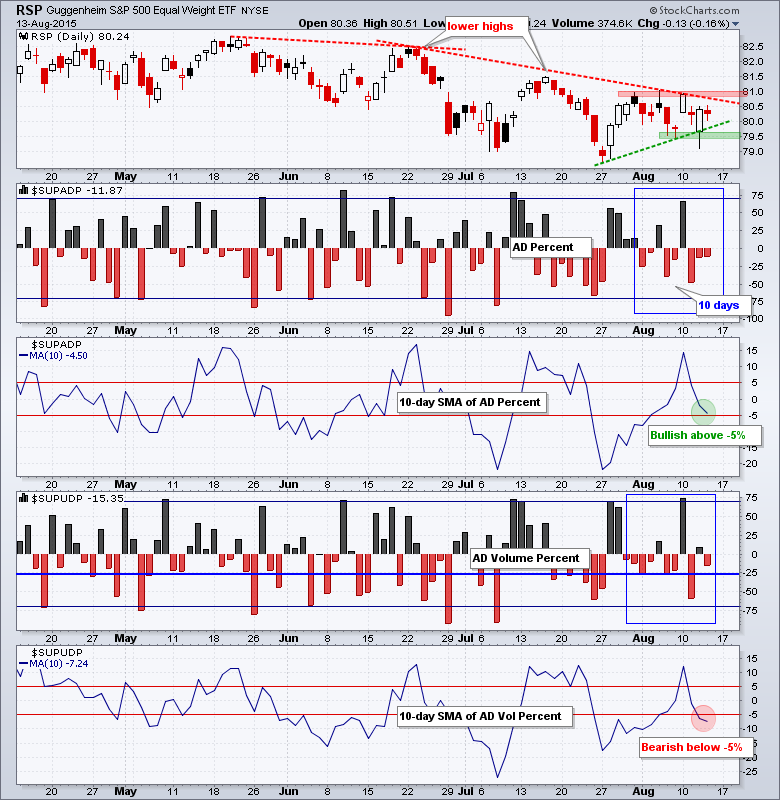

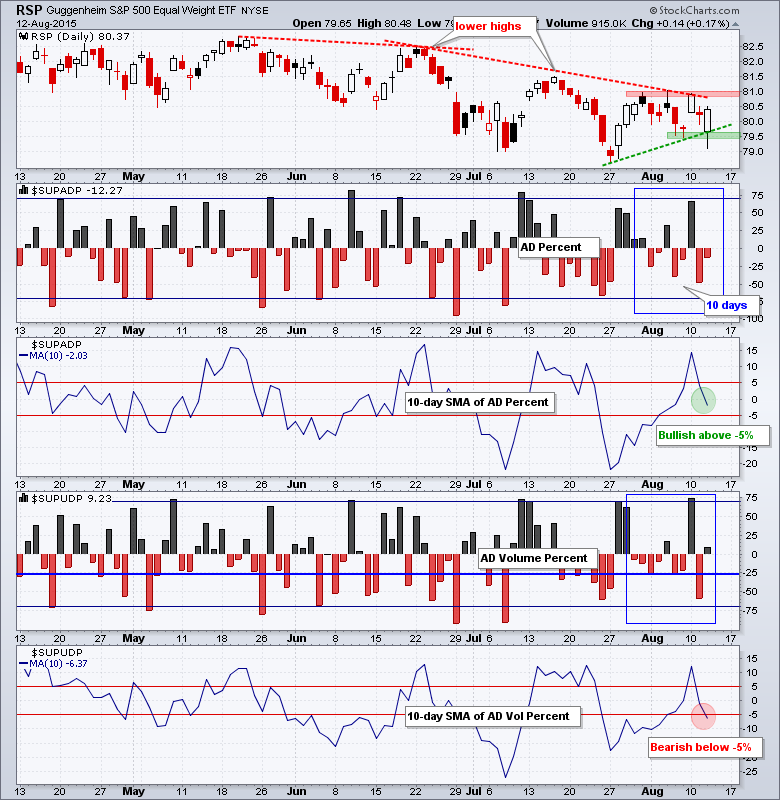

SPY-QQQ Head for Support Test, A Head-and-Shoulders Reversal for RSP?, Technology Sector Weakens Further, Second Shoes Drop for Media and Semis, Gold Target, Treasury Yield Hits a Wall, BroadCom Hits Retracement Zone as Facebook Corrects

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs remain in corrective mode, but two of the four are close to breaking long-term support levels. The challenge with corrections is we never know which corrections will evolve into bigger downtrends. As the charts now stand, QQQ and SPY hit new highs in mid July and...

READ MORE

MEMBERS ONLY

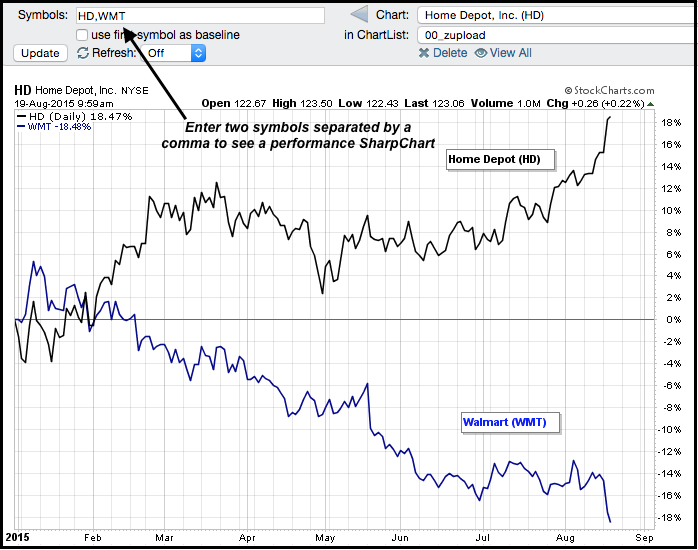

Yes, Virginia, there Really Is Information in Stock Prices

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Just ask HD and WMT. These two big retail stocks are part of the Dow Industrials and the S&P 500. Despite a common industry group, the performance for these two stocks could not be any more different. The chart below shows year-to-date performance for Home Depot (HD) and...

READ MORE

MEMBERS ONLY

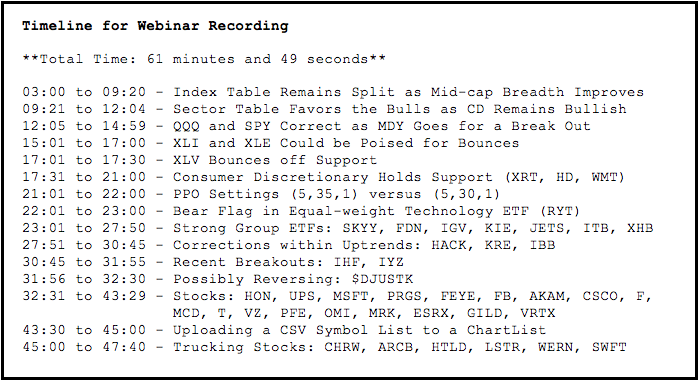

Webinar Recording, Sector Weightings Still Bullish, MidCaps Perk Up, Consumer Discretionary Hangs Tough, A Breakout in HealthCare, 3 Correcting ETFs, 7 Strong ETFs, Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's webinar and commentary will take a top down look at the stock market. First, the index table with the breadth indicators shows a split market with half bullish and half bearish. The sector table, however, still tilts towards the bulls with five of the nine sectors in...

READ MORE

MEMBERS ONLY

Amgen Returns to the Scene of the Crime

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Amgen (AMGN), a big biopharma stock, broke out with expanding volume in July and hit a new 52-week high. After becoming short-term overbought, the stock fell back to the breakout zone. There are two things to note here. First, broken resistance turns into the first support zone. Second, a pullback...

READ MORE

MEMBERS ONLY

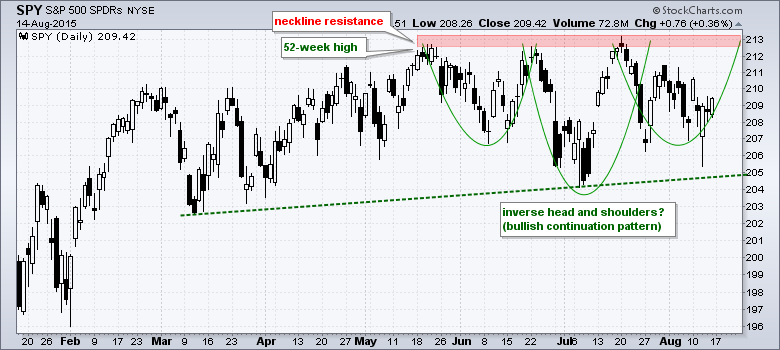

Are Signs of Accumulation Emerging in SPY?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR remains largely range-bound since March, but a pair of potentially bullish patterns emerged and signs of accumulation are appearing. First, note that SPY hit new 52-week highs in May and July, and the overall trend is still up. The ETF is trading within 2%...

READ MORE

MEMBERS ONLY

QQQ Channels Lower - USO Hits Another New Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks chopped around on Thursday and the major index ETFs ended the day with little change. The Dow Diamonds (DIA) was up .06% and the S&P 500 SPDR (SPY) was down .12%, twice as much as DIA, but still a fraction. Consumer discretionary and finance led, while energy...

READ MORE

MEMBERS ONLY

SPY Recovers, but Remains in Downtrend - UUP Breaks Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the day under selling pressure as the S&P 500 fell around 1.5% in the first hour trading. The buyers then stepped in and pushed the index above its prior close for a small gain. The big hammer candlestick formed as a result. While this intraday...

READ MORE

MEMBERS ONLY

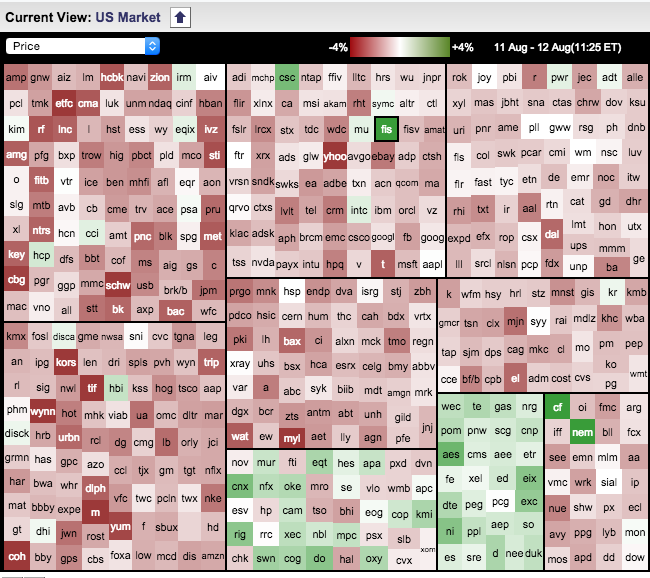

Two Sectors and a Few Stocks Bucking the Selling

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major stock indices were hit with selling pressure on Wednesday, but two sectors and a few stocks bucked the selling and moved higher. How can we find these? Chartists can use the Sector MarketCarpet to easily spot the gainers because they are green and stick out like a sore...

READ MORE

MEMBERS ONLY

SPY Fails to Hold Gap - GLD Holds Small Break Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Easy come, easy go. Stocks surged on Monday and then gave it back on Tuesday. Most sectors and industry groups were hit with selling pressure on Tuesday. Some interest-rate sensitive groups bucked the selling pressure as the 20+ YR T-Bond ETF (TLT) surged and the 10-YR Treasury Yield ($TNX) fell....

READ MORE

MEMBERS ONLY

QQQ Gaps within Falling Wedge - GLD Breaks Minor Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rallied with a broad advance that lifted most boats. The sectors and industry groups that were hit the hardest over the last few months got the biggest bounces. These include energy, materials, mining, gold and steel. Elsewhere, the EW Consumer Discretionary ETF (RCD) surged 1.5% and held support....

READ MORE

MEMBERS ONLY

Texas Instruments Leads Semiconductor Rebound

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Semiconductor SPDR (XSD) has been one of the weakest industry group ETFs within the technology sector over the last two months, and Texas Instruments (TXN) has been one of the weakest stocks in the group. That might be changing. The middle window on the chart below shows TXN relative...

READ MORE

MEMBERS ONLY

SPY and QQQ in Short-Term Downtrends - TLT Extends Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with selling pressure last week, but it was not that intense. QQQ lost 1.5%, SPY declined 1.2% and IWM was down 2.5%. Small-caps remain relatively weak and continue to lead on the way down. Also note that the Equal-Weight S&P 500 ETF...

READ MORE

MEMBERS ONLY

SPY Breaks Range, IWM Lags and USO Hits New Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with selling pressure on Thursday with QQQ leading the way lower. Actually, the Nasdaq 100 Equal-Weight ETF (QQEW) led with a 2% decline because selling pressure in the technology sector was quite broad. Healthcare and consumer discretionary, which have been leaders, also came under selling pressure. The...

READ MORE

MEMBERS ONLY

QQQ and Tech Start to Lead - TLT Tests Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks caught an early bid and even held their gains to close positive. There was no follow through to the morning pop so traders can read into this as they please. The bears will point to no follow through, while the bulls will point to the ability to hold gains....

READ MORE

MEMBERS ONLY

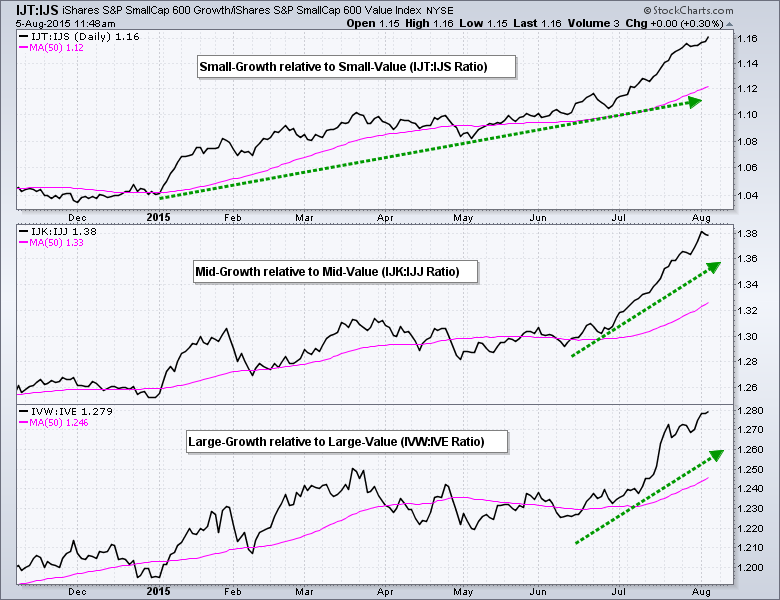

Growth Whips Up on Value with the Usual Suspects to Blame

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 1500 can be divided into the S&P 500, S&P MidCap 400 and the S&P SmallCap 600. These three ETFs can be further divided into their growth and value components to create six different index styles (small-growth, small-value, mid-growth, mid-value, large-growth,...

READ MORE

MEMBERS ONLY

UUP Bounces off Support - TLT Remains in Steep Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were all mixed up with no place to go on Tuesday. The Nasdaq 100 Equal-Weight ETF (QQEW), which treats Apple as a mere mortal, managed a small gain to lead the major index ETFs. The rest were down fractionally. The sectors were mixed with fractional gains and fractional losses....

READ MORE

MEMBERS ONLY

SPY Adheres to Trading Range - TLT Surges as USO Drops

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Let the choppiness begin. Or rather, let the choppiness continue. Stocks started flat, moved lower around noon and then bounced in the final hour. The major index ETFs still finished down on the day, but the declines were fractional and they managed to close off their lows. Even so, note...

READ MORE

MEMBERS ONLY

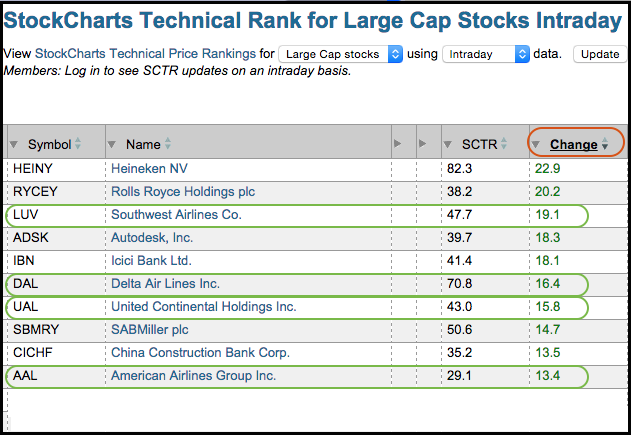

Delta Leads as SCTRs Pop for Four Airline Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mostly lower in afternoon trading, but a few airlines bucked the trend with gains and big moves in their StockCharts Technical Rank (SCTR). The table below shows the SCTRs for large-caps and the table is sorted by "change". Just click the column heading to sort. Notice...

READ MORE

MEMBERS ONLY

SPY Hits Middle of Range as TLT Extends Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was a choppy week, but the major index ETFs managed to finish with small gains. The S&P MidCap SPDR (MDY) led with a 1.85% advance and QQQ lagged with a .77% gain. The sectors were mostly higher with industrials, materials and healthcare leading. Healthcare has been...

READ MORE

MEMBERS ONLY

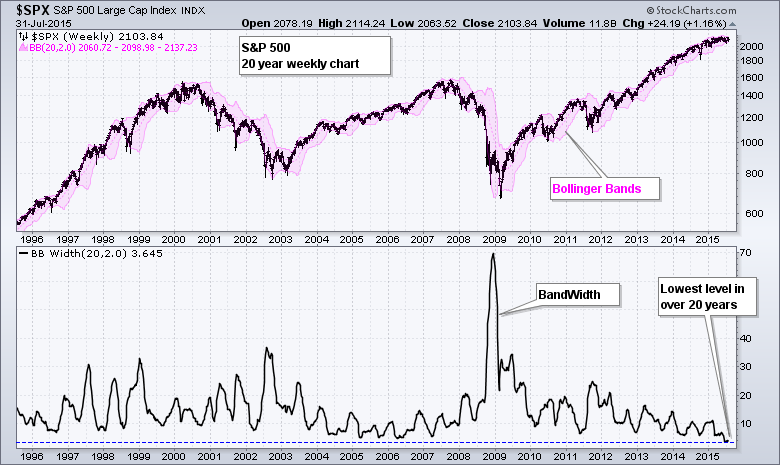

S&P 500 Hasn't Done this in over 20 Years

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is locked in a 100 point trading range (2040-2140) since March because of a serious split in sector performance. At less than 5% this is the narrowest range in several years. Note that Bollinger Bandwidth on the weekly chart reached a 20+ year low in...

READ MORE

MEMBERS ONLY

SPY Holds Short-term Uptrend, UUP Holds Break and TLT Tests Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs closed fractionally higher in listless trading. QQQ led with a .48% bounce. MSFT and GILD lifted QQQ and have bullish looking charts. The sectors were mixed with energy and consumer staples losing ground. The consumer discretionary, finance and materials sectors gained. Of note, the Home Construction...

READ MORE

MEMBERS ONLY

SPY Leads Again, IWM and QQQ Lag, GLD Forms Mini-Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved higher on Wednesday, but the bounce was rather lopsided. Large-cap techs weighed on QQQ as the ETF gained .38%. The Nasdaq 100 Equal-Weight ETF (QQEW), in contrast, gained .93% on the day. The Russell 2000 iShares (IWM) gained just .28% and continues to lag. The S&P...

READ MORE

MEMBERS ONLY

Merck Forms Key Outside Reversal on High Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The HealthCare SPDR (XLV) has been one of the strongest sectors in 2015, but Merck (MRK) has lagged both the market and the sector. The first chart shows the HealthCare SPDR (XLV) relative to the S&P 500 SPDR (SPY) using the price relative (XLV:SPY ratio). This ratio...

READ MORE

MEMBERS ONLY

SPY Leads Oversold Bounce - UUP Tests Uptrend Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks bounced with gains across the board. Most of the major index ETFs gained over 1%, but the Russell 2000 iShares (IWM) lagged with a .85% gain. All sectors were up with the oversold sectors getting the biggest bounces (energy, materials and industrials). The finance, consumer discretionary and technology sectors...

READ MORE

MEMBERS ONLY

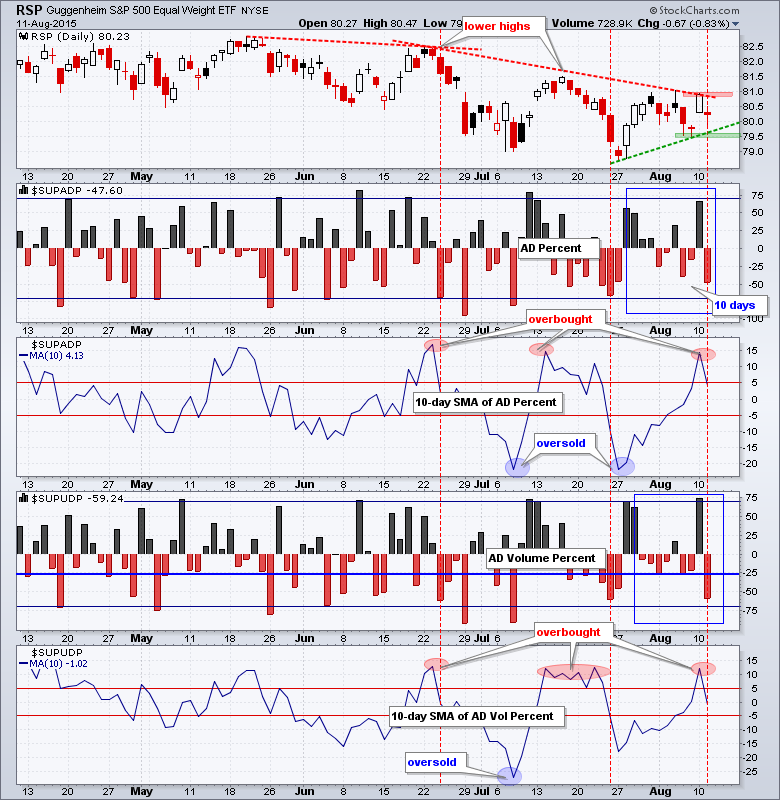

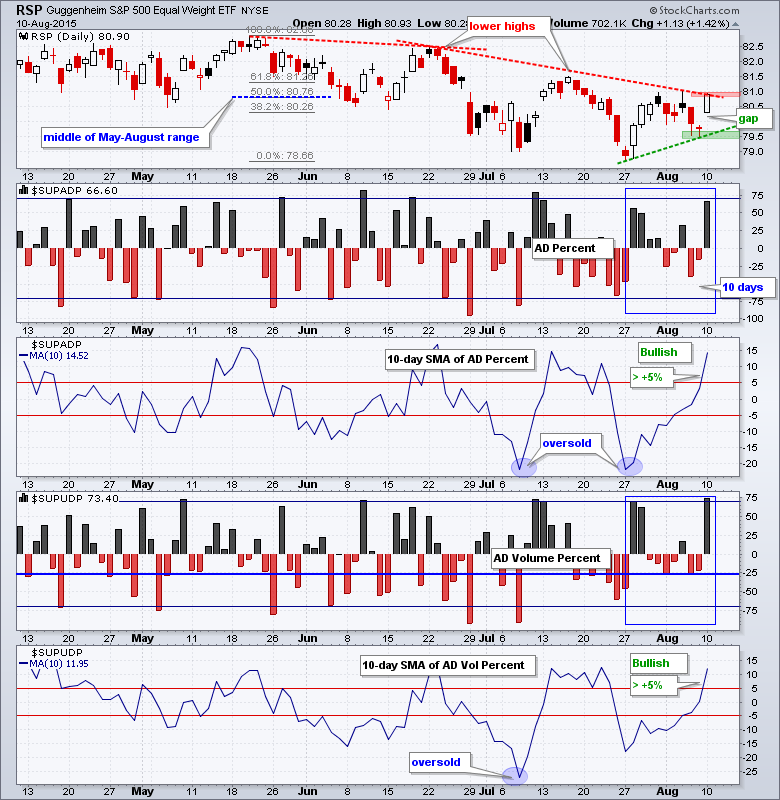

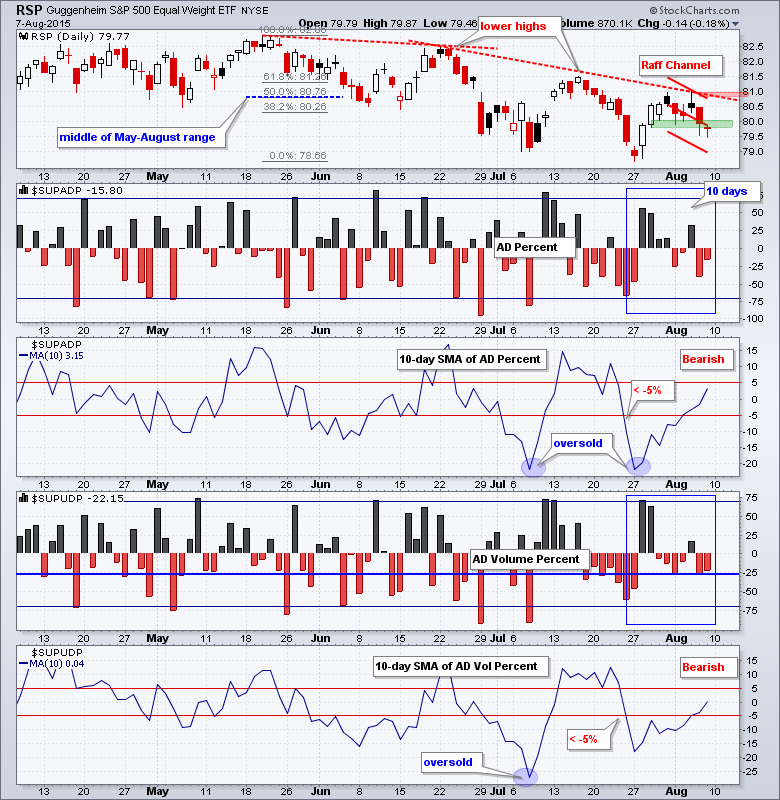

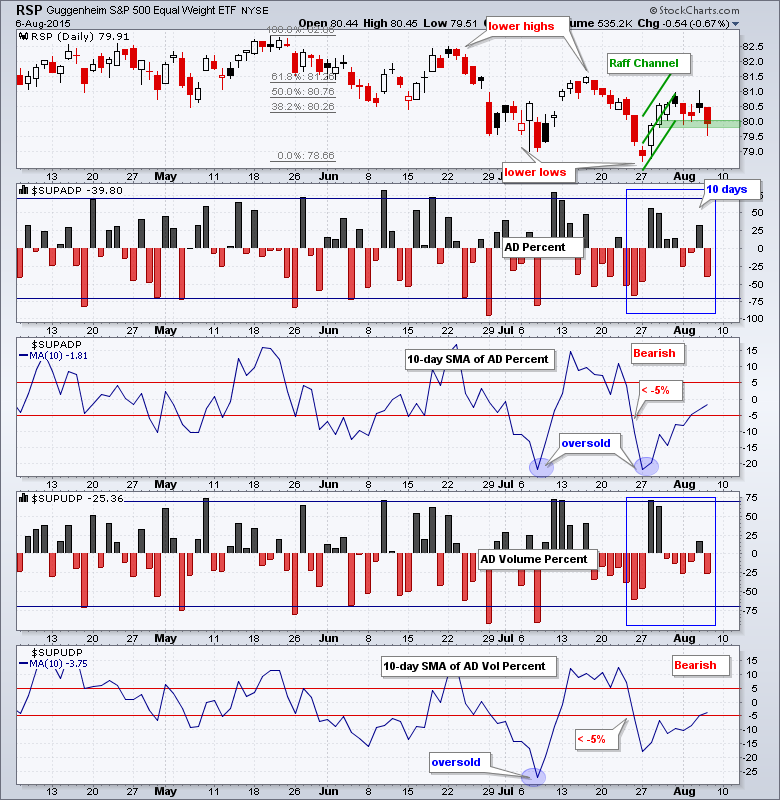

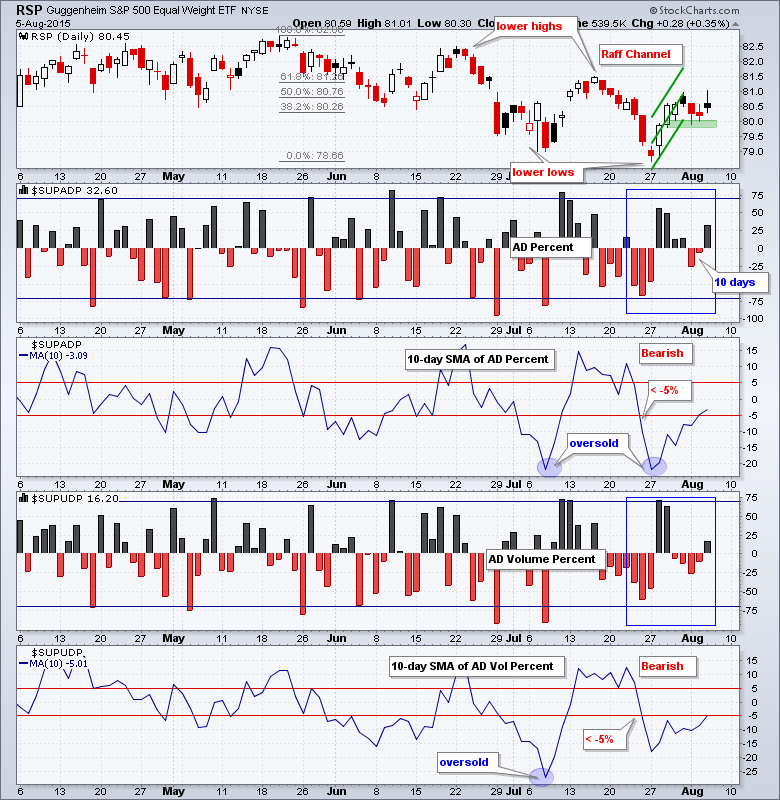

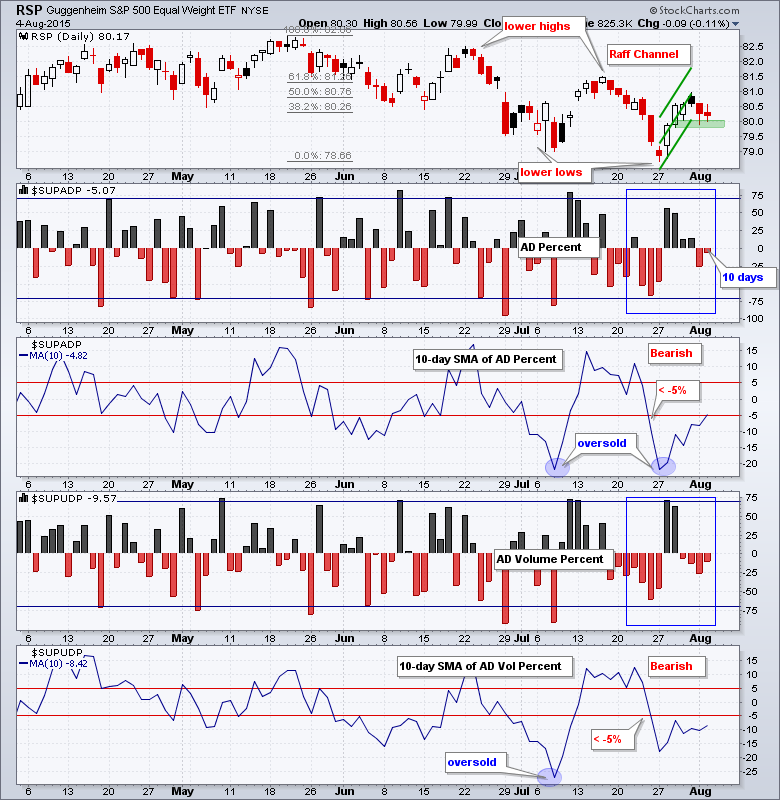

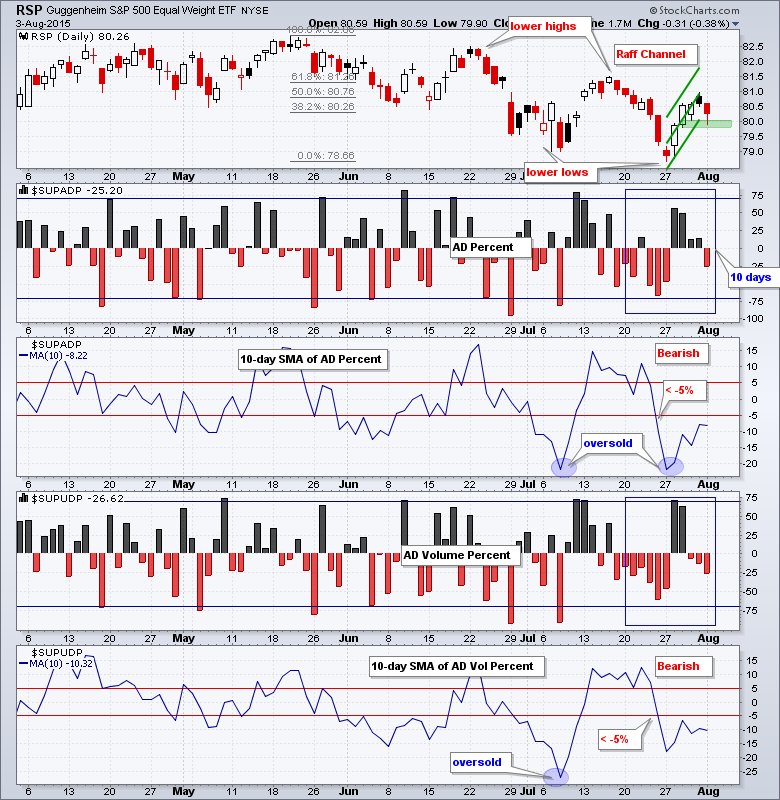

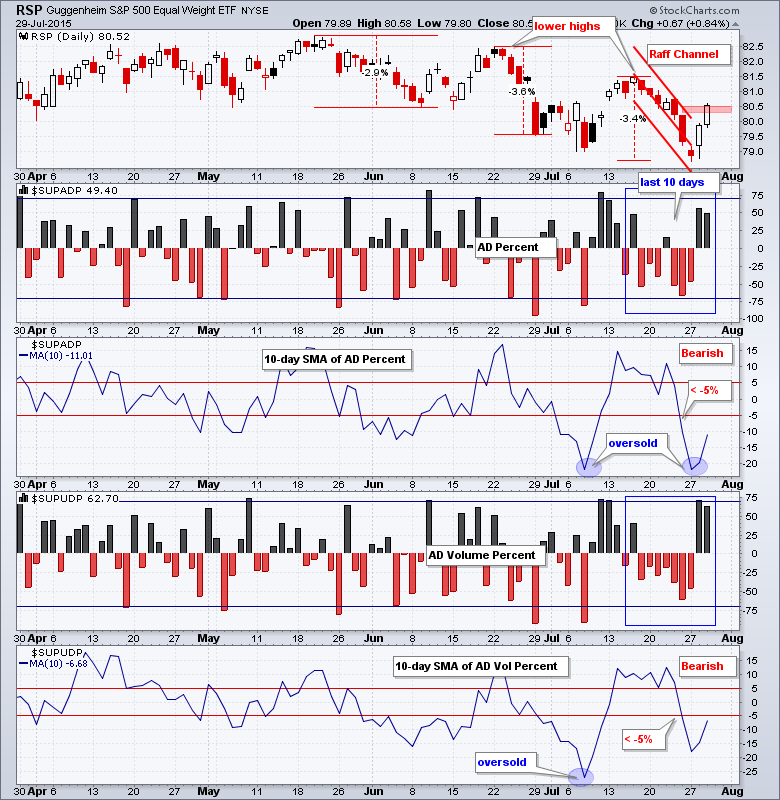

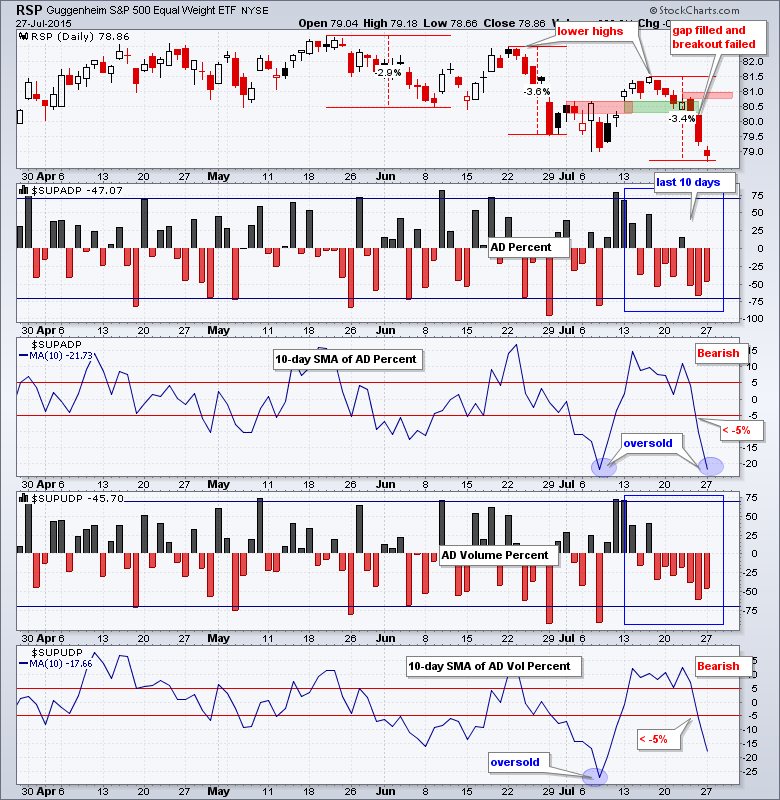

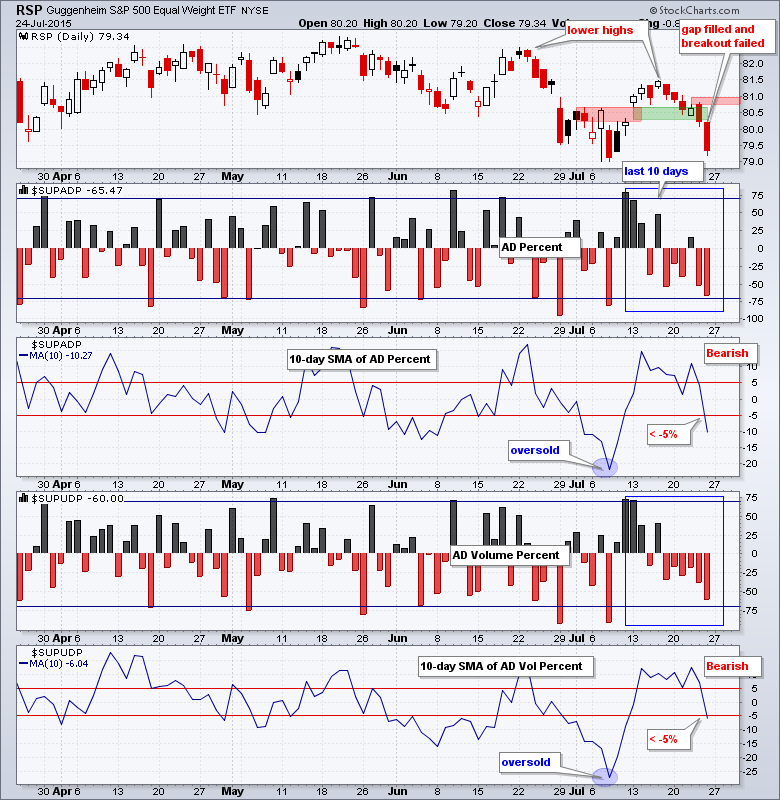

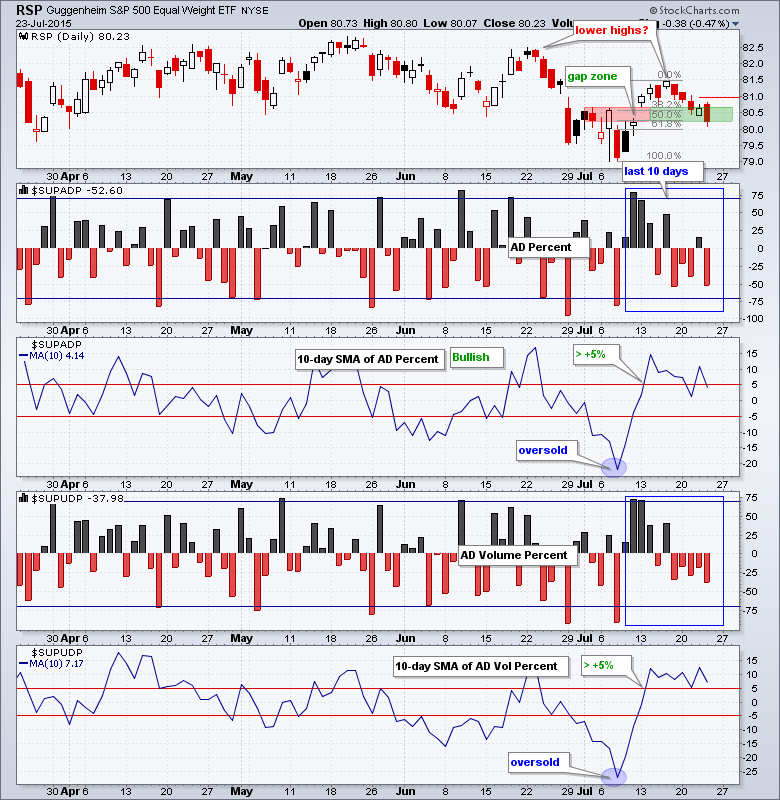

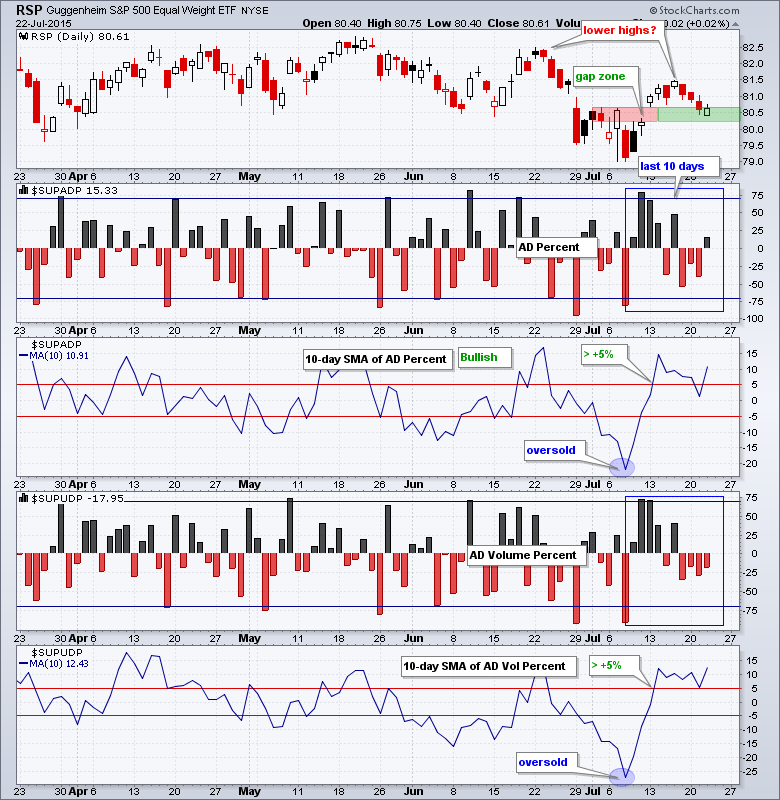

Breadth Becomes Short-Term Oversold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with further selling pressure on Monday, but selling pressure was rather contained. IWM, QQQ and SPY declined between .50% and 1%. Eight of the nine sectors were down with utilities bucking the selling pressure. Healthcare and consumer staples also held up relatively well with fractional declines. The...

READ MORE

MEMBERS ONLY

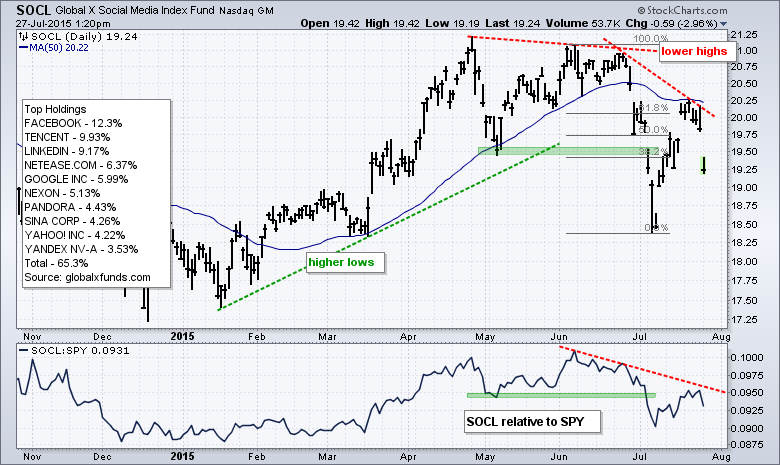

Chinese Holdings Weigh on Global X Social Media ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Social Media Global ETF (SOCL) fell sharply on Monday to signal a continuation of the prior decline. The chart below shows SOCL breaking support with a sharp decline in late June and early July. This is the break that broke the bull's back. Notice how the ETF...

READ MORE

MEMBERS ONLY

IWM Leads Lower and QQQ Tests Resistance Break

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with selling pressure last week as the Russell 2000 iShares (IWM) fell 3.32% and the S&P 500 SPDR (SPY) declined 2.11%. IWM is in a short-term downtrend because it is already testing the early July low. QQQ is holding up the best and...

READ MORE

MEMBERS ONLY

IWM Fills mid July Gap and TLT Breaks Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with selling pressure on Thursday as the major index ETFs fell across the board. The Russell 2000 iShares (IWM) led the way with a 1.1% decline. All sector SPDRs were down and eight of the nine equal-weight sector ETFs were down. The EW Energy ETF was...

READ MORE

MEMBERS ONLY

Finance Leads, IWM Hits Gap Zone and TLT Nears Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed on Wednesday with QQQ taking a big hit and IWM getting a small bounce. The S&P 500 SPDR (SPY) finished modestly lower and the S&P MidCap SPDR (MDY) managed a small gain. It is pretty amazing that small and mid caps were lagging...

READ MORE