MEMBERS ONLY

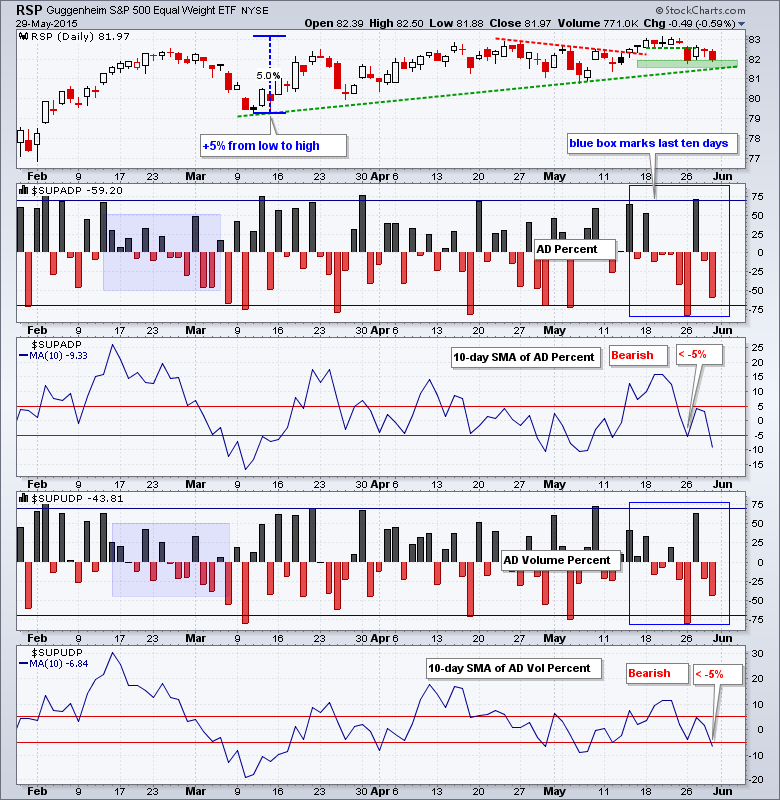

Breadth Turns Bearish, IWM Contracts and USO Challenges Channel Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were all over the place last week. The S&P 500 plunged on Tuesday, rebounded on Wednesday and fell back on Thursday-Friday. For the week, the major index ETFs ended lower by around 1%. All sectors were lower with energy and industrials leading the way down. The healthcare...

READ MORE

MEMBERS ONLY

Range Narrows for IWM, Industrials Lag and Tech Leads

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks sank on the open, but quickly firmed and rebounded somewhat in the afternoon. For the day, the major index ETFs finished fractionally lower, but the S&P SmallCap iShares (IJR) bucked a little with a fractional gain. The sectors were mostly lower with energy and industrials leading the...

READ MORE

MEMBERS ONLY

QQQ Leads Bounce, RYT Hits New High, USO Maintains Downtrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks swooned on Tuesday and then recovered most of their losses on Wednesday. Techs led the way as the Technology SPDR (XLK) hit a new high and QQQ closed at a new closing high. Semiconductors led the rebound as the Semiconductor SPDR (XSD) surged over 3% and hit a new...

READ MORE

MEMBERS ONLY

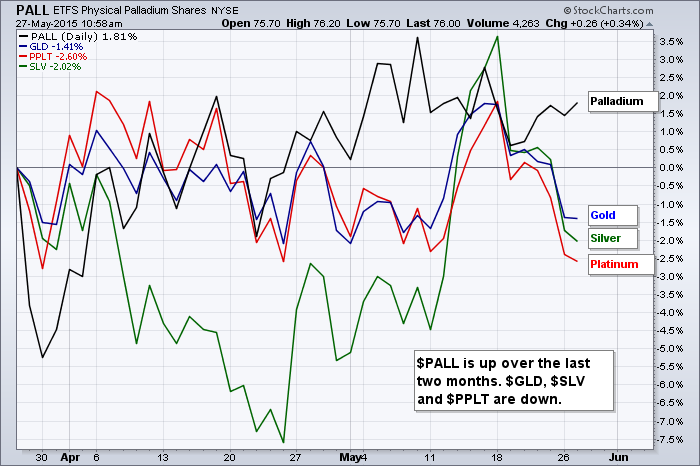

Palladium Holds Up Better than Gold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Palladium ETF (PALL) caught my eye on Tuesday because it held up quite well when other metals were getting hit hard. Gold was down around 1.5%, while platinum and silver fell around 2%. PALL was down just .26% and the ETF is edging higher in early trading on...

READ MORE

MEMBERS ONLY

IWM Breaks Support, TLT Breaks Resistance and GLD Plunges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks fell with selling pressure across the board. The major index ETFs were all down around 1% and the declines were pretty even. All sector SPDRs and equal-weight sector ETFs were down. The Consumer Discretionary SPDR (-.71%) and the Utilities SPDR (-.63%) were down the least and held...

READ MORE

MEMBERS ONLY

SPY Holds Uptrend, IWM Still Lags, UUP Breaks Out and Oil Trends Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 finished the week with a gain, but was hit with selling pressure in the final hour on Friday. For the week, the index surged on Monday and then traded flat from Tuesday to Friday. Small-caps led Friday's pullback as the Russell 2000 iShares...

READ MORE

MEMBERS ONLY

SPY Leads with New High, TLT Firms in Oversold Territory and UUP Holds Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 edged higher on Thursday, but market action was mixed overall. QQQ and SPY closed slightly higher, while IWM closed slightly lower. Seven of the nine sector SPDRs were up with energy, industrials and technology leading the way. XLI got a nice bounce from GE, which...

READ MORE

MEMBERS ONLY

IWM Starts to Lead, RYH Leads Sectors and UUP Holds Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks did the old pop and drop as the S&P 500 surged to 2135 after the Fed minutes and then plunged back to its starting point (2125). The index ended the day unchanged and nothing has changed regarding the trend. Yesterday's pop and drop was just...

READ MORE

MEMBERS ONLY

What Matters Most for the S&P 500?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is in the midst of one of the strongest and most consistent trends ever. The chart below shows the S&P 500 twice. The top window shows the index with a 7% Zigzag indicator in pink and the bottom window shows a 10% Zigzag....

READ MORE

MEMBERS ONLY

TLT Becomes More Oversold, UUP Breaks Out, GLD Fails First Test

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks meandered on Tuesday with the S&P 500 trading on either side of 2130 the entire day. The ETF fell below 2130 in the afternoon and closed at 2127 (-.06%). The sectors were mostly lower with energy leading the decline. The Finance SPDR (XLF) was the strongest...

READ MORE

MEMBERS ONLY

Small-Caps Start to Lead as Dollar Bounces, SPY Hits New High, GLD Holds Breakout and USO Stalls

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks continued higher with the S&P 500 and Dow Industrials recording new all time highs. They were not the leaders though. The Russell 2000 iShares (IWM) led and was the only major index ETF to gain over 1% on the day. Seven of the nine sector SPDRs finished...

READ MORE

MEMBERS ONLY

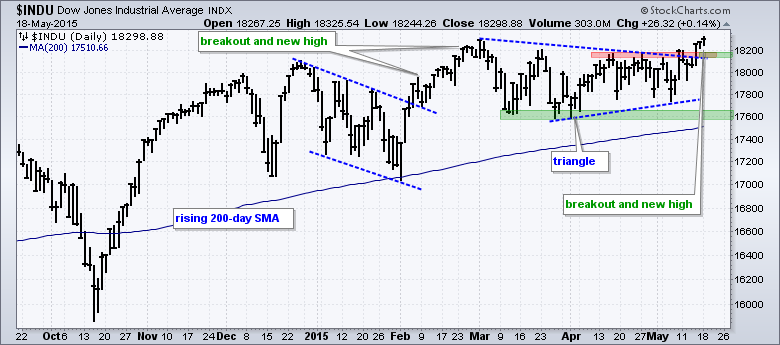

Dow Joins S&P 500 with New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 hit a new high last week and the Dow Industrials followed suit with a new high this week. Overall, the Dow broke triangle resistance with a surge on Thursday and this breakout signals a continuation of the current uptrend. Broken resistance turns first support to...

READ MORE

MEMBERS ONLY

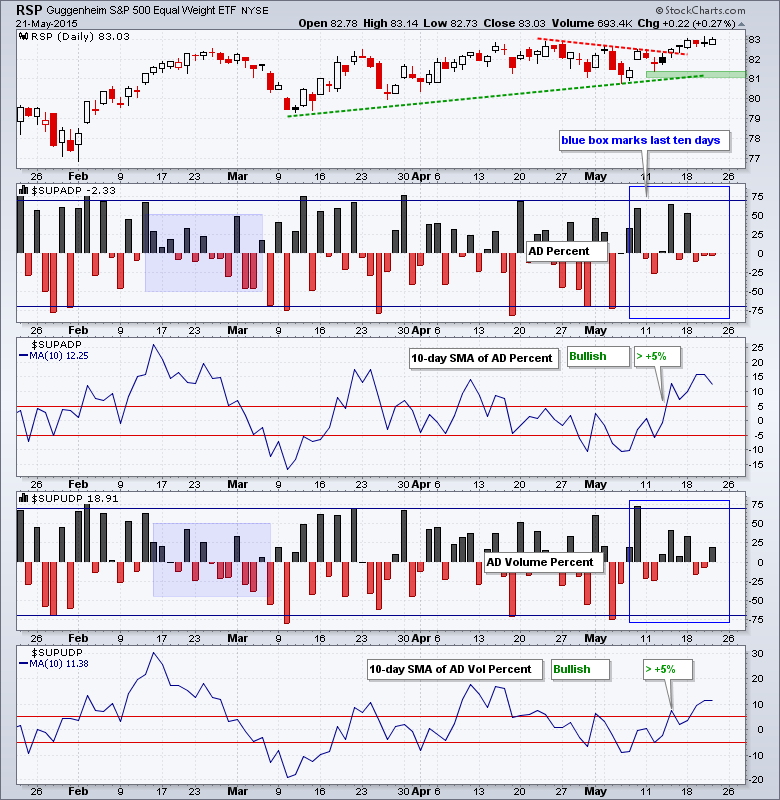

EW Industrials Leads Sector Surge - SPY Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was a pretty wild week for stocks. The S&P 500 started weak with a 25 point decline and dip below 2090. This dip did not last long as the index surged back above 2115 on Thursday and hit an all time high on Friday. Yes, an all...

READ MORE

MEMBERS ONLY

Weakening Dollar Boosts Large-cap Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The falling Dollar is boosting large-caps and they are outperforming small-caps. This makes sense because large-caps are typically multinational companies that derive a good portion of their revenue abroad. The Financial Times estimates that companies in the S&P 500 generate around 40% of their revenues abroad. These foreign...

READ MORE

MEMBERS ONLY

SPY Leads, IWM Falls Short and GLD Gets Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 opened strong and finished strong, and Thursday's close above 2120 was a new closing high for the index. The index has yet to hit an intraday high, but the trends are up and new intraday highs should follow. The rally was pretty broad-based,...

READ MORE

MEMBERS ONLY

Short-Term Trend Analysis 14-May-15

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 did just the opposite of Tuesday. The index opened weak on Tuesday, rebounded and then traded flat. On Wednesday, the index opened strong, immediately fell back and then traded flat. This is par for the course because it has been swinging above/below 2100 the...

READ MORE

MEMBERS ONLY

Paccar Holds Big Breakout and Goes for Another

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Paccar (PCAR) sports a bullish looking chart with two breakouts in as many months. The stock surged from October to December and then corrected with a decline that retraced 62%. After three bounces off the 62% retracement area, the stock broke out with a surge in mid-April. This breakout ended...

READ MORE

MEMBERS ONLY

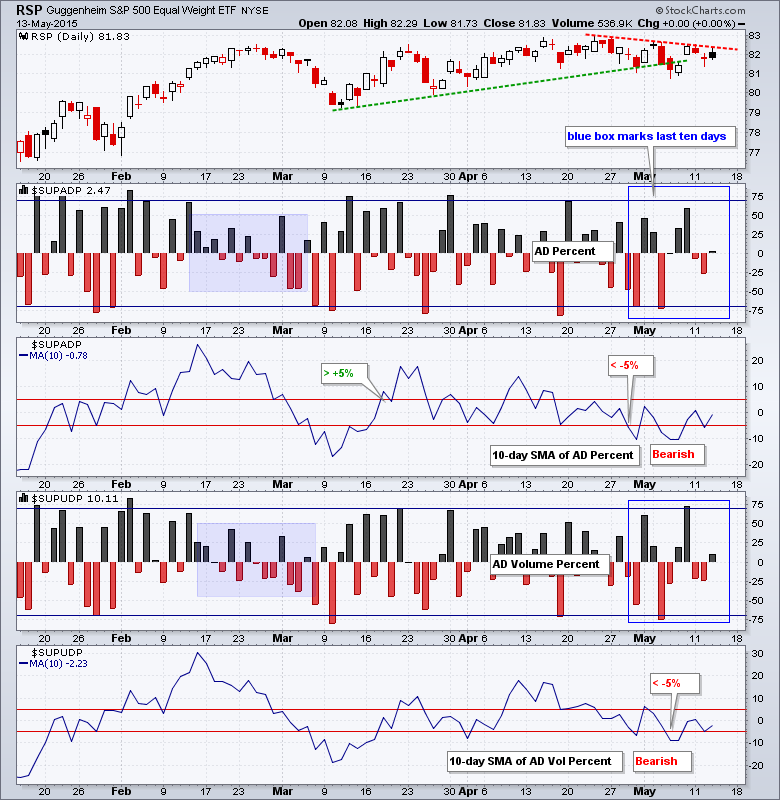

Short-Term Trend Analysis 13-May-15

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

You got to give the bulls credit on Tuesday. The S&P 500 opened weak with a 20 point decline and move below 2090. This decline wiped out Friday's gain and made the bulls look weak. Instead of continuing lower though, the index immediately firmed and bounced...

READ MORE

MEMBERS ONLY

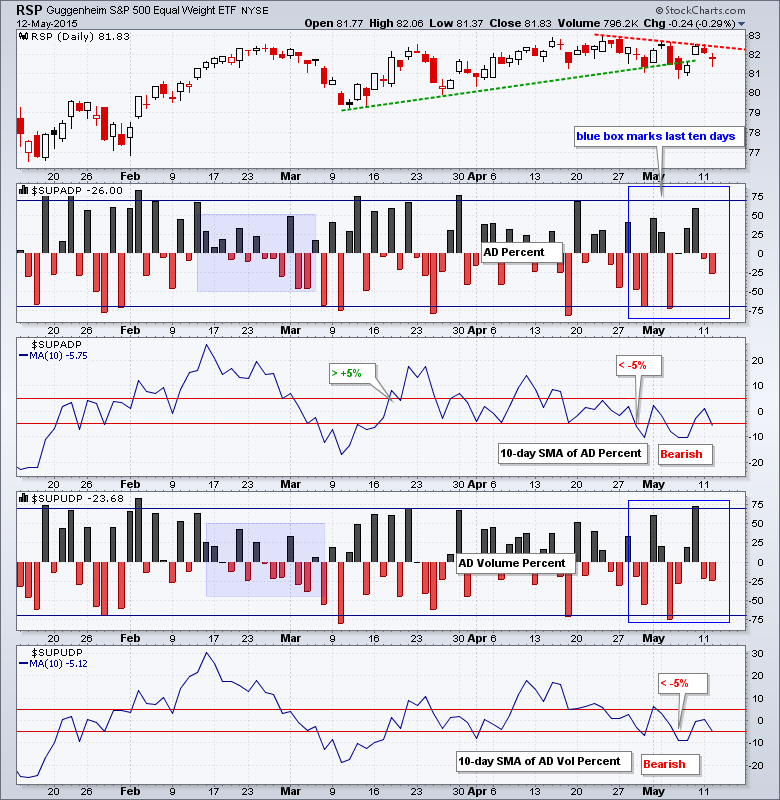

Short-Term Trend Analysis 12-May-15

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 surged on Friday morning, traded flat the rest of the day and then worked its way lower on Monday. The overall loss (.50%) was modest and this could be just a correction after the Friday surge. The sectors were mostly lower with energy leading the...

READ MORE

MEMBERS ONLY

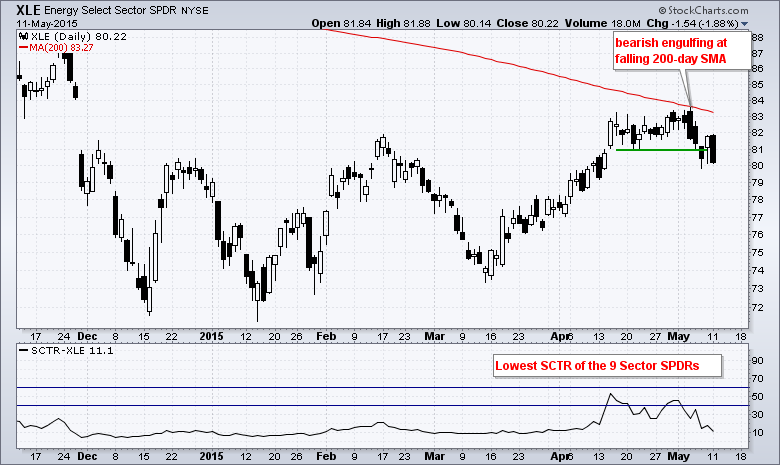

Energy SPDR Fails at Long-term Moving Average

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Energy SPDR (XLE) is in a long-term downtrend and it looks like the short-term uptrend reversed over the last few days. The chart below shows XLE failing at the falling 200-day moving average with a bearish engulfing last week and breaking below short-term support at 81. The ETF bounced...

READ MORE

MEMBERS ONLY

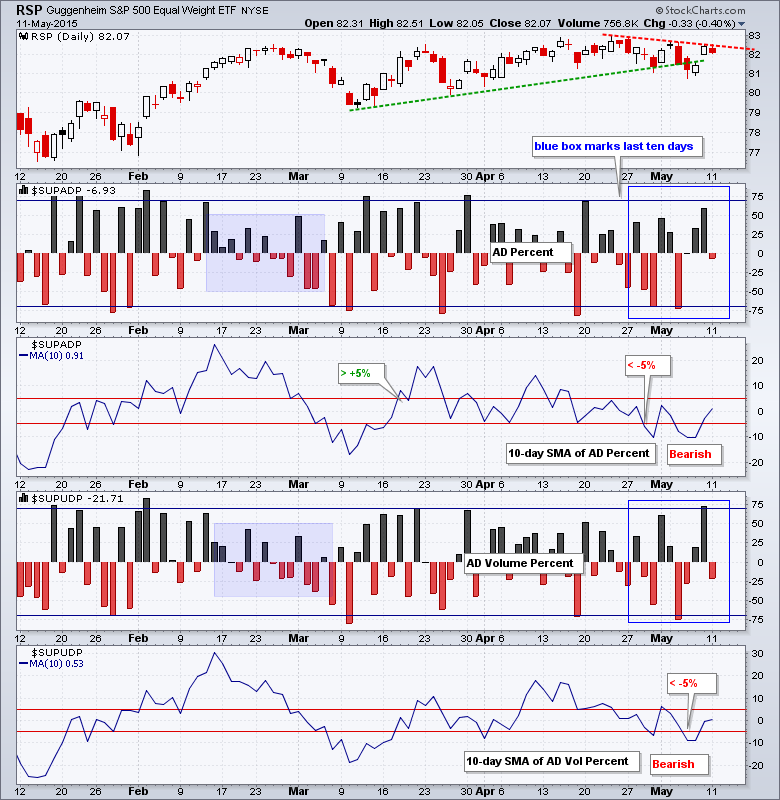

Stocks Surge with Uninspiring Breadth - GLD Forms Two Flags

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged on Friday as the S&P 500 opened around 2113 and closed around 2116. Even though the index held the opening surge, there was not much movement after the surge (+3 points). The major index ETFs closed higher, but small-caps and mid-caps lagged. MDY and IWM were...

READ MORE

MEMBERS ONLY

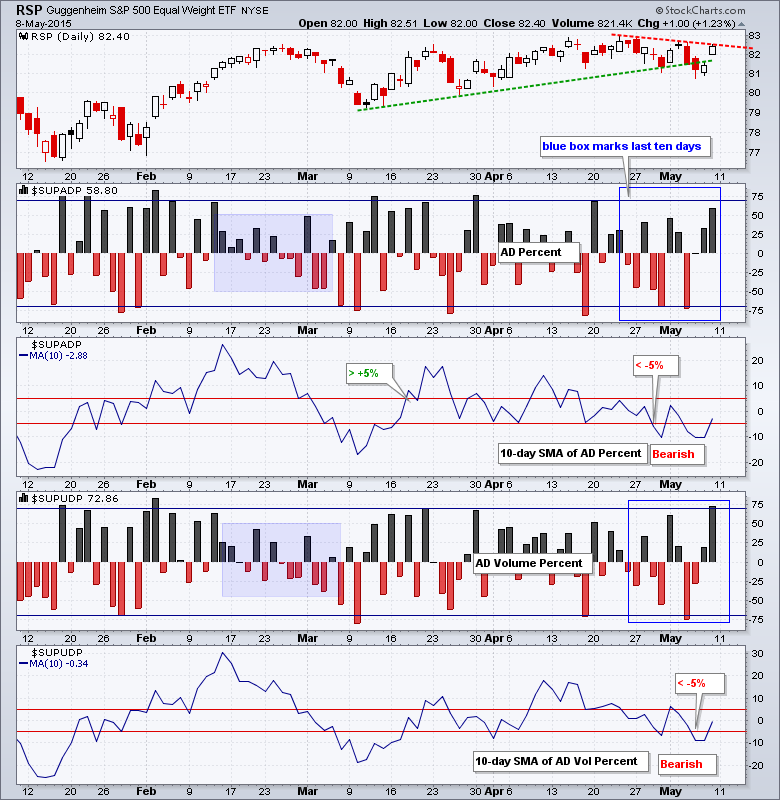

Short-Term Trend Analysis 08-May-15

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks bounced and the major index ETFs closed modestly higher. Eight of the nine sector SPDRs were up. Energy fell because oil was down sharply. The decline in oil boosted the Airline ETF (JETS) and this helped the Transport iShares (IYT) to a 1.11% gain. Commodities were down pretty...

READ MORE

MEMBERS ONLY

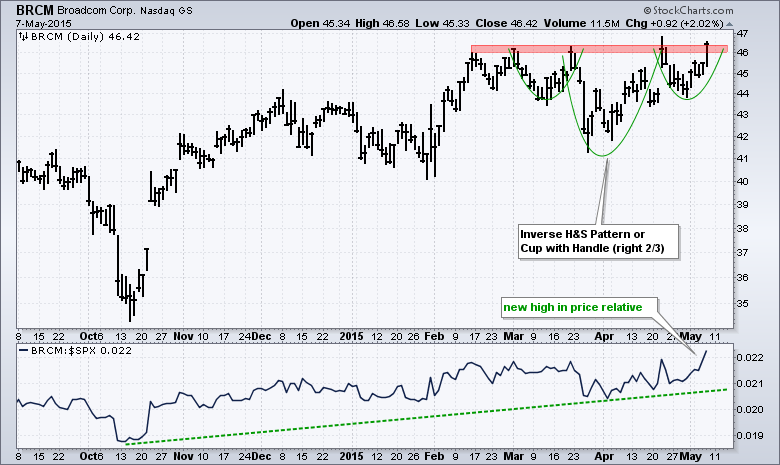

BroadCom Forms Bullish Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It has been a rough month for stocks overall, but Broadcom (BRCM) is bucking the selling pressure and challenging resistance. There are two bullish continuation patterns possible on this chart. First, an inverse head-and-shoulders pattern extends back to early March. Second, the right two-thirds of the pattern looks like a...

READ MORE

MEMBERS ONLY

Short-Term Trend Analysis 07-May-15

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks closed lower again on Wednesday, but a late afternoon bounce pushed the major index ETFs off their lows. IWM and MDY actually closed with small gains as small and mid-caps held up well on Wednesday. QQQ and SPY closed fractionally lower. The Equal-Weight Consumer Discretionary ETF (RCD) led the...

READ MORE

MEMBERS ONLY

Merck Holds Up and Outperforms its Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks have been under pressure the last eight days with the S&P 500 SPDR (SPY) down around 2% from its late April high and the HealthCare SPDR (XLV) down around 4% from this high. At times like this, it is good to look around and see what is...

READ MORE

MEMBERS ONLY

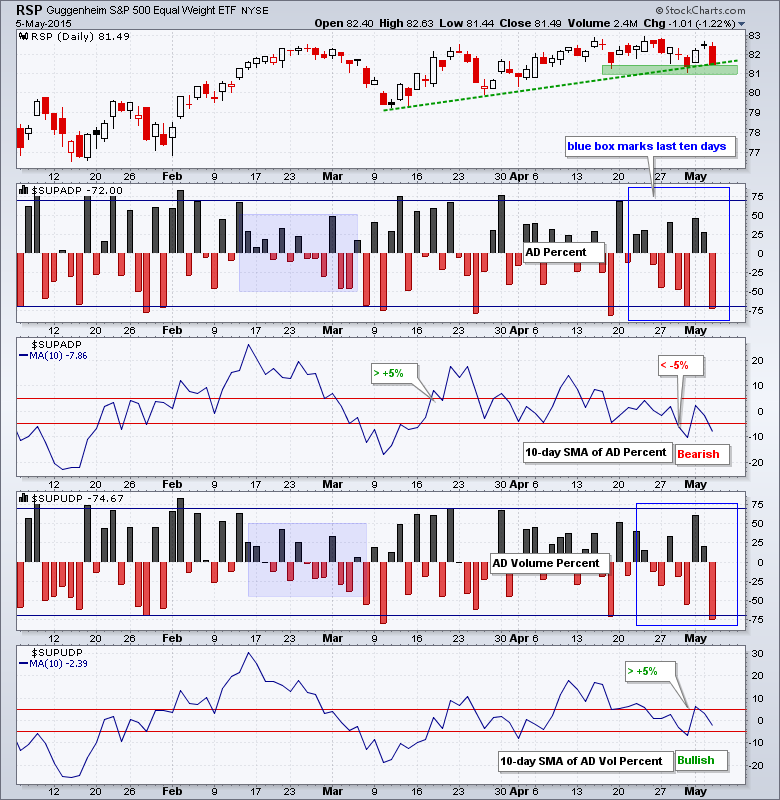

Short-Term Trend Analysis 06-May-15

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with broad selling pressure on Tuesday with the Nasdaq 100 ETF (QQQ) leading the major index ETFs lower. All sectors were down with utilities getting hammered. Looks like XLU finally caught on to the rise in rates and followed the REIT iShares (IYR) lower. Techs were hit...

READ MORE

MEMBERS ONLY

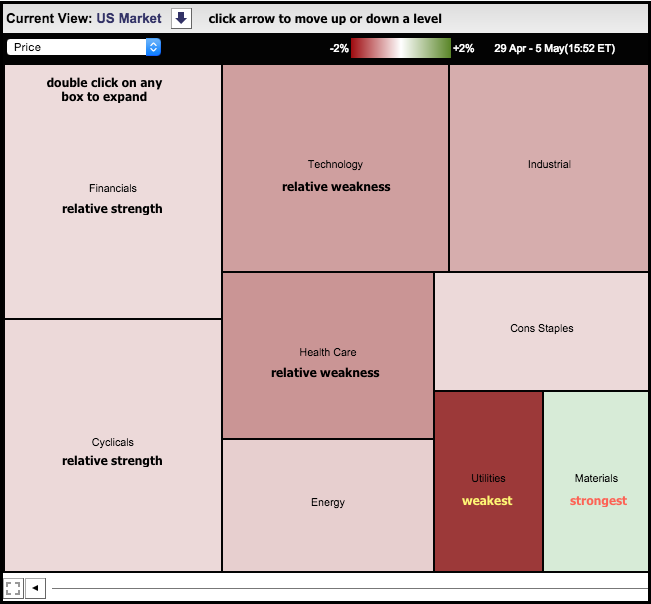

A Rough Ride for Utilities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart below shows the Sector MarketCarpet over the last five days (29-Apr to 5-May) and utility stocks are the weakest. The average stock in the sector is down over 2% during this timeframe, which is why the box is dark red. Healthcare and technology stocks also came under selling...

READ MORE

MEMBERS ONLY

Short-Term Trend Analysis 05-May-15

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks closed modestly higher on Monday with the technology, healthcare and utilities sectors leading the way. It is most interesting to see utilities higher because the 10-YR Treasury Yield ($TNX) is up sharply over the last two weeks. Utilities have been negatively correlated to Treasury yields the last few months,...

READ MORE

MEMBERS ONLY

Short-Term Trend Analysis 04-May-15

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks fell from Monday to Thursday and then surged on Friday with a strong open and strong close. QQQ and large-caps led the bounce, while IWM and small-caps lagged with smaller gains. The consumer discretionary, technology, industrials and materials sectors led with 1+ percent advances. The Home Construction iShares (ITB)...

READ MORE

MEMBERS ONLY

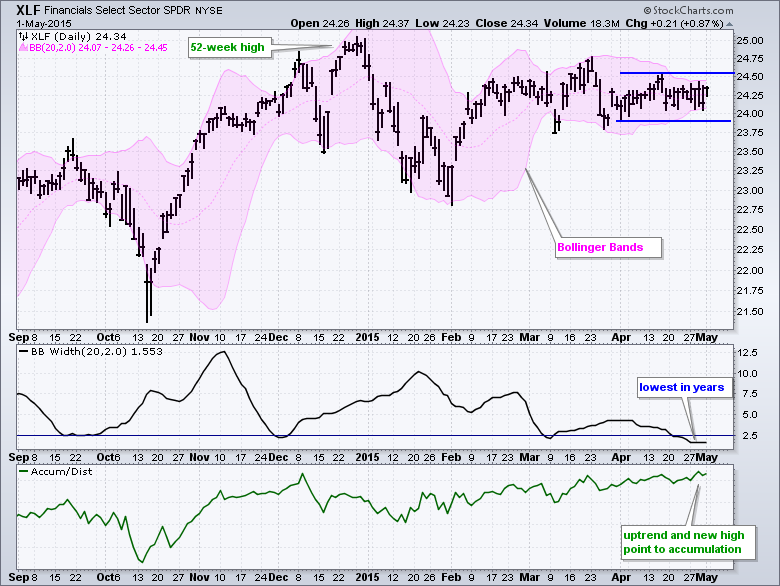

The Noose Tightens for the Finance SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Finance SPDR (XLF) has become the most boring of the nine sector SPDRs over the last five weeks. Boring today does not mean it will be boring tomorrow though. The chart below shows the Finance SPDR (XLF) surging to new highs in December, bouncing around in January-February and then...

READ MORE

MEMBERS ONLY

Short-Term Trend Analysis 01-May-15

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the day weak and finished weak. The S&P 500 plunged below 2095 on the open, chopped around and then dipped below 2090 in the afternoon. Small-caps led the way lower as IWM lost over 2%. All sectors were down with healthcare and technology leading the way....

READ MORE

MEMBERS ONLY

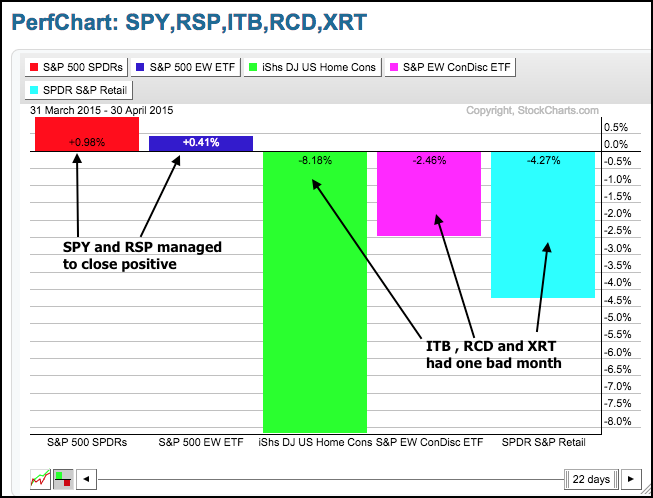

Three Key Groups Lagging in April

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 remains in an uptrend and hit a new high on Monday, but some key groups are showing signs of selling pressure in April. The PerfChart below shows month-to-date performance for the S&P 500 SPDR (SPY), the Equal-Weight S&P 500 ETF (RSP)...

READ MORE

MEMBERS ONLY

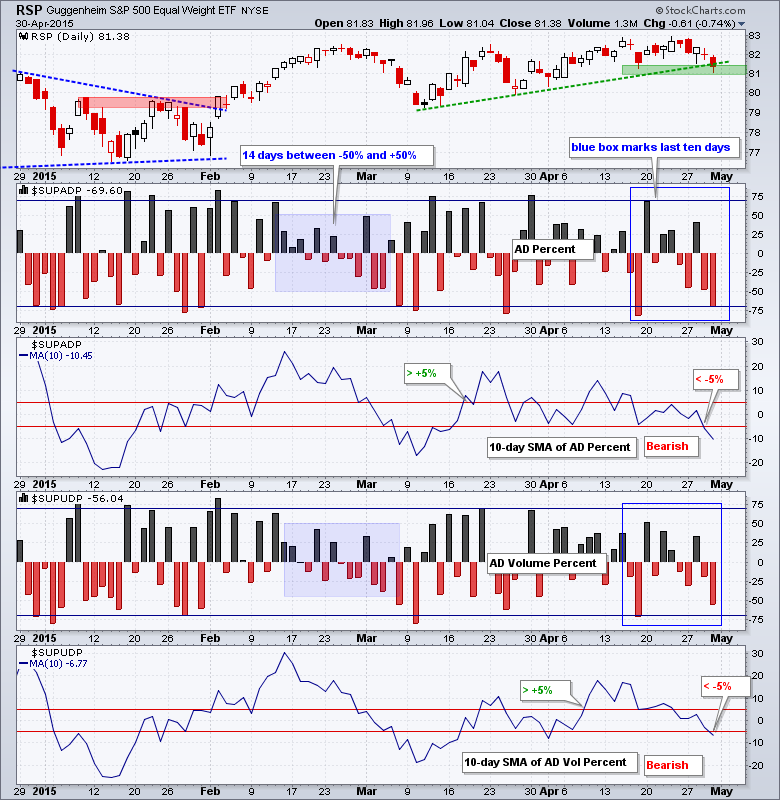

Short-Term Trend Analysis 30-Apr-15

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with selling pressure on Wednesday with small-caps leading the way. IWM and IJR lost around 1.1% on the day and have been underperforming since early April. Eight of the nine sectors were down with consumer discretionary, consumer staples and healthcare leading lower. The Equal-Weight Consumer Discretionary...

READ MORE

MEMBERS ONLY

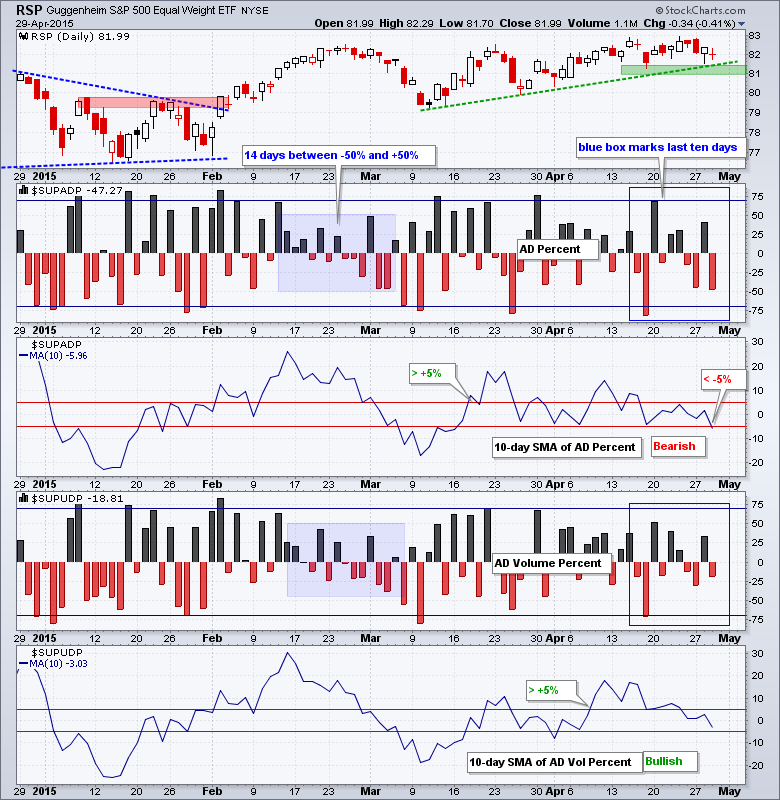

Short-Term Trend Analysis 29-Apr-15

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was pop and drop on Monday, and then drop and pop on Tuesday. Welcome to the week featuring the Fed policy statement on Wednesday and the employment report on Friday. Trading could remain choppy the next few days as these events become reality. Stocks were mostly higher on Tuesday...

READ MORE

MEMBERS ONLY

IWM Lags and Tests Support, GLD Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks got the old pop and drop on Monday as the S&P 500 surged to a new high in the morning and then worked its way lower the rest of the day. The index closed with a modest loss of .41%. IWM led the way lower with a...

READ MORE

MEMBERS ONLY

GLD Breaks Down, TLT Tests Break and IWM Lags

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was all about big techs on Friday as QQQ surged over 1%. The rest of the market was mixed as IWM edged lower and SPY edged higher. Strength in Amazon (+14%) lifted the Consumer Discretionary SPDR (XLY) and strength in Microsoft (+10.5%) lifted the Technology SPDR (XLK). The...

READ MORE

MEMBERS ONLY

SPY and QQQ Hit New Highs - IWM Lags

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks put in another modest performance with the major index ETFs gaining less than a half percent. Well, the S&P SmallCap iShares (IJR) did gain .60% to lead, but this was the exception. The sectors were mostly higher with energy and technology leading the way. The Home Construction...

READ MORE

MEMBERS ONLY

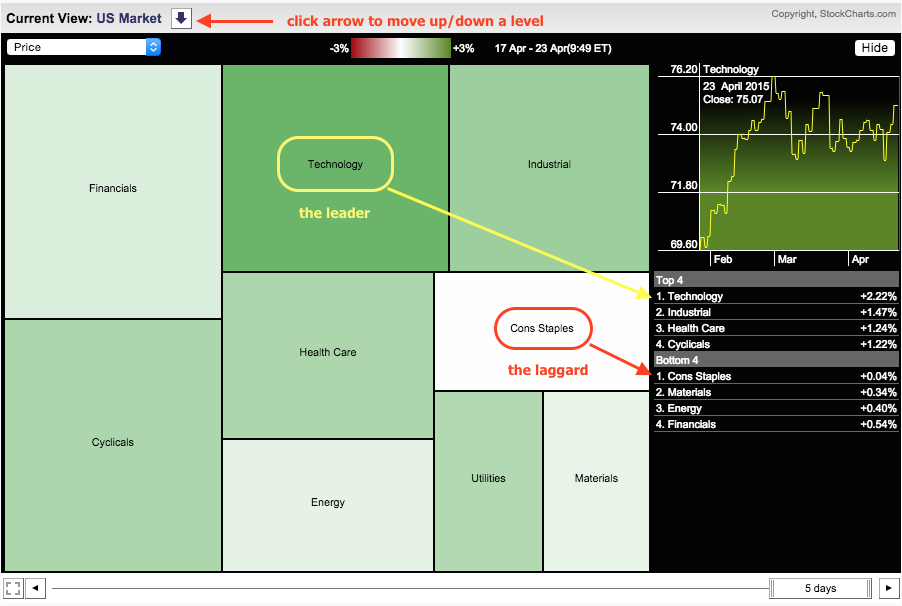

Techs Lead and Staples Lag on Market Carpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The image below shows the Sector MarketCarpet at "sector" level, which means we are seeing solid boxes for each of the nine sectors. There is a table on the left that ranks sector performance and this MarketCarpet shows performance for the current week (so far). The technology sector...

READ MORE

MEMBERS ONLY

SPY Hits Range Resistance, TLT and GLD Break Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks dipped on the open, but quickly caught a bid and moved higher for most of the day. The final gains, however, were modest as QQQ, IWM, SPY and DIA gained around a half percent. The Finance SPDR and the Technology SPDR led the way higher. The consumer discretionary sector...

READ MORE

MEMBERS ONLY

QQQ Holds Gap and Starts to Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks drifted on Tuesday with a slight downward bias as IWM and SPY closed fractionally lower. QQQ bucked the selling pressure with a modest gain. The sectors were mixed. The healthcare sector led the gainers, while the energy sector led the losers. The consumer discretionary sector finished with a small...

READ MORE