MEMBERS ONLY

One Stock in the Energy Sector Hit a New High This Month

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Energy SPDR (XLE) is by far the weakest sector in the market right now. Most of its 43 components are in downtrends and well below the summer-autumn highs. One stock, however, stands out from this crowd. The chart below shows Tesoro (TSO) breaking out to new highs in mid...

READ MORE

MEMBERS ONLY

Signs of Weakness Creep into the Stock Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mostly higher last week, but there were some pockets of weakness. QQQ led the broader market with a 1.59% gain and IWM lagged as the ETF fell a fraction (-.02%). The consumer discretionary and technology sectors gained and showed relative strength last week. The finance, energy...

READ MORE

MEMBERS ONLY

Stock Indices may be Overbought, But They are by No Means Weak

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

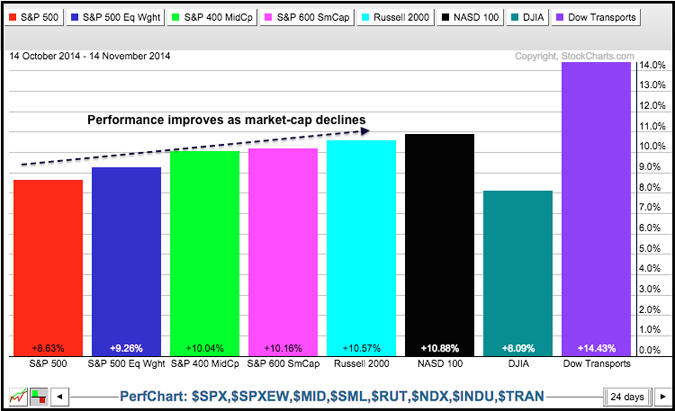

The stock market is in a clear uptrend, but is short-term overbought after a big run the last four weeks. I am assuming that the trend is up because the S&P 500, S&P 500 Equal-Weight Index, Dow Industrials, Dow Transports, Nasdaq 100 and Nasdaq Composite recorded...

READ MORE

MEMBERS ONLY

IWM and QQQ Hold Breakouts - GLD Forms Bearish Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks finished very mixed on Thursday. DIA, QQQ and SPY finished with small gains, while IWM and IWC finished with modest losses. The Russell 2000 iShares (IWM) fell .85% and the Russell MicroCap iShares (IWC) was down 1.10%. Weakness in small-caps is the reason many breadth indicators were negative...

READ MORE

MEMBERS ONLY

The 20+ YR T-Bond ETF Gets the Squeeze

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 20+ YR T-Bond ETF (TLT) went ballistic in mid October with a surge above 125 and then sharply reversed with a close below 122 the next day. The ETF has since worked its way lower and volatility has seriously contracted. Notice that Bollinger BandWidth is at its lowest level...

READ MORE

MEMBERS ONLY

Small-caps and Two Key Industry Group ETFs Take the Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was another lackluster day, but there were some notable pockets of strength. Small-caps perked up as the Russell 2000 iShares (+.45%) and S&P SmallCap iShares (+.68%) led the major index ETFs. The gains may be incremental, but they were gains and they were the leaders. The SmallCap...

READ MORE

MEMBERS ONLY

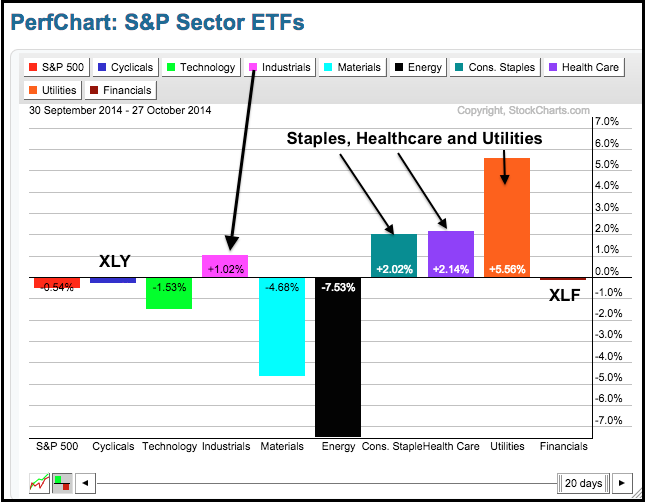

Oil Citations and Sector Performance are Revealing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

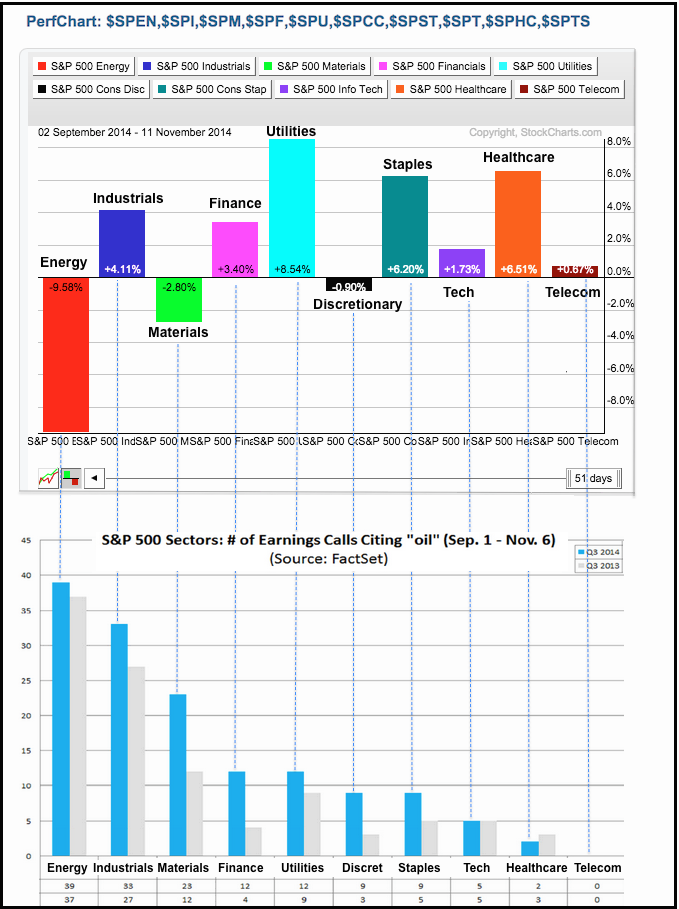

The top chart shows sector performance since the beginning of September. The bottom chart, from factset.com, shows the number of times companies in these sectors cited oil in their earnings calls (from 1-Sep to 6-Nov). Oil fell around 10% from mid June to late August and around 20% from...

READ MORE

MEMBERS ONLY

A Narrow Range Day Takes Shape - The Coil Tightens for TLT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trading was rather lackluster on Tuesday as the major index ETFs finished with fractional gains, and I do mean fractional. QQQ gained .31%, SPY rose .10% and IWM advanced .07%. Buying pressure is waning, but we have yet to see any significant selling pressure. Of note, the high-low range for...

READ MORE

MEMBERS ONLY

Aroons Cross to Trigger a Signal in Tesla

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Tesla (TSLA) gapped down and fell sharply in early October, but ultimately held support from the July low and rising 200-day moving average. The stock moved higher the last four weeks and surged above the September trend line with a 3+ percent gain on Tuesday. Also notice that Aroon Up...

READ MORE

MEMBERS ONLY

Small-Cap AD Line Breaks Sep High - Plus COW, K, TSLA and UA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

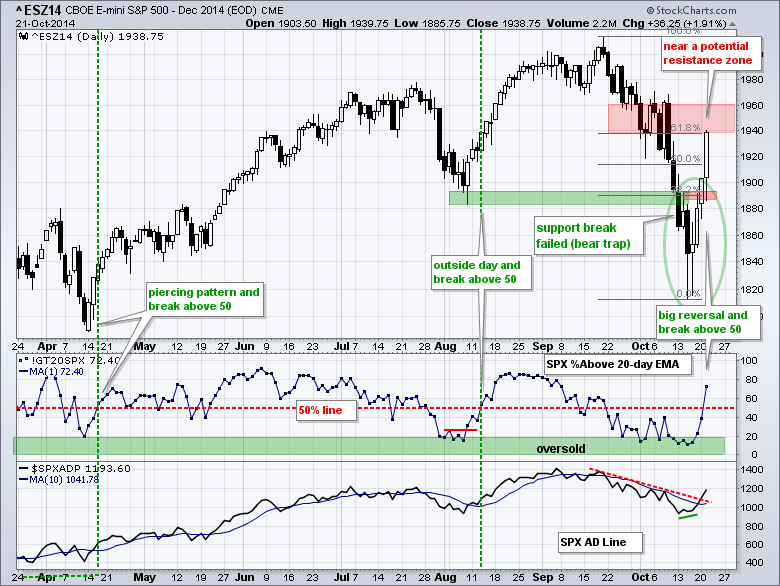

The December E-mini S&P 500 (^ESZ14) hit another new high with another incremental step. Since the close above 2000 at the end of October, the gains have been rather incremental and upside momentum has slowed. Is this bearish? Buying pressure may not be as strong as it was...

READ MORE

MEMBERS ONLY

Industrials and Healthcare Lead the Big Recovery

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

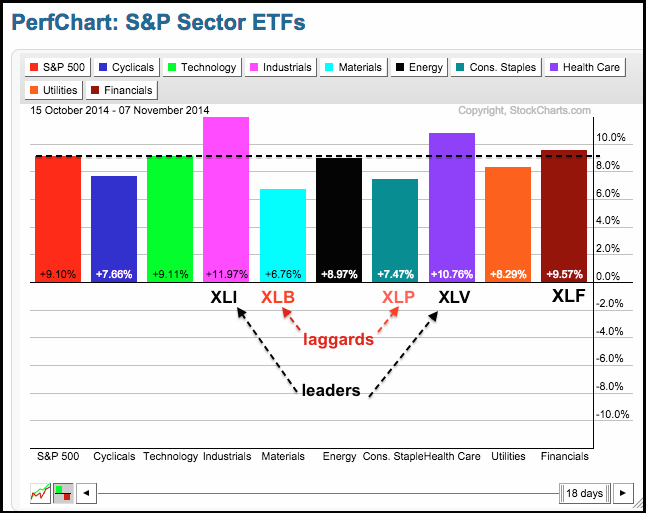

The stock market bottomed in mid October and then surged over the last 18 days. Chartists can find the leaders (and laggards) for this period by setting the PerfChart for 18 days. Simply double click the date tab and enter a number. The PerfChart below shows all nine sectors and...

READ MORE

MEMBERS ONLY

Bullish Consolidations form in QQQ and IWM - Noose Tightens for TLT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The December E-mini S&P 500 (^ESZ14) hit a new high intraday, but closed slightly lower and formed a doji on the day. These candlesticks signal indecision, which is caused by a standoff between buying and selling pressure. The current upswing is quite amazing because the emini has been...

READ MORE

MEMBERS ONLY

Stocks Price in Positive News, But Bonds Hesitate

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

And now for the employment report. This week's economic reports were positive, the ADP Report was above 200K and initial claims continue to fall. The economic cup is clearly half full and this bodes well for today's employment report. Stocks have perhaps already priced in some...

READ MORE

MEMBERS ONLY

Minding the Gap on QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The London Tube is famous for its automated announcements reminding commuters to "mind the gap" between the train and the platform (don't fall in). QQQ has a gap that we should also mind. Notice how the ETF opened above 101 and closed above 101 the last...

READ MORE

MEMBERS ONLY

Market Indicators Pointing Up - Plus AMZN, JJU, BWA, GE, RCI

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mostly higher on Wednesday with the major index ETFs posting modest gains. SPY advanced .63% and the Russell 2000 iShares (IWM) added just .18%. The energy sector rebounded with a big move as oil got a small bounce. Devon (DVN) and EOG Resources (OEG) exceeded their late October...

READ MORE

MEMBERS ONLY

New Highs in Key AD Line Affirm Long-term Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

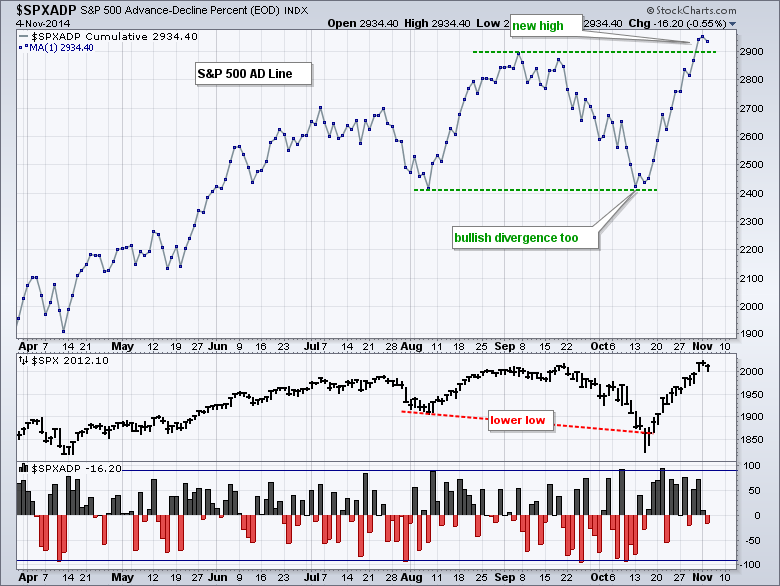

The S&P 500 AD Line ($SPXADP) confirmed the new high in the S&P 500 by hitting a new high of its own. The chart below shows the AD Line holding its early August low in mid October and surging above its early September high on Friday....

READ MORE

MEMBERS ONLY

XLY:XLP Ratio Breaks Down - AD Lines Remain Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with pockets of selling pressure on Tuesday. The consumer discretionary, energy and materials sectors led the way lower. Consumer staples, financials and healthcare held up relatively well. Relative weakness in the consumer discretionary sector caused the XLY:XLP ratio to break down and turn negative for stocks...

READ MORE

MEMBERS ONLY

TLT Extends Downtrend - USO Triggers Continuation Signal - DD, LULU and TOL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

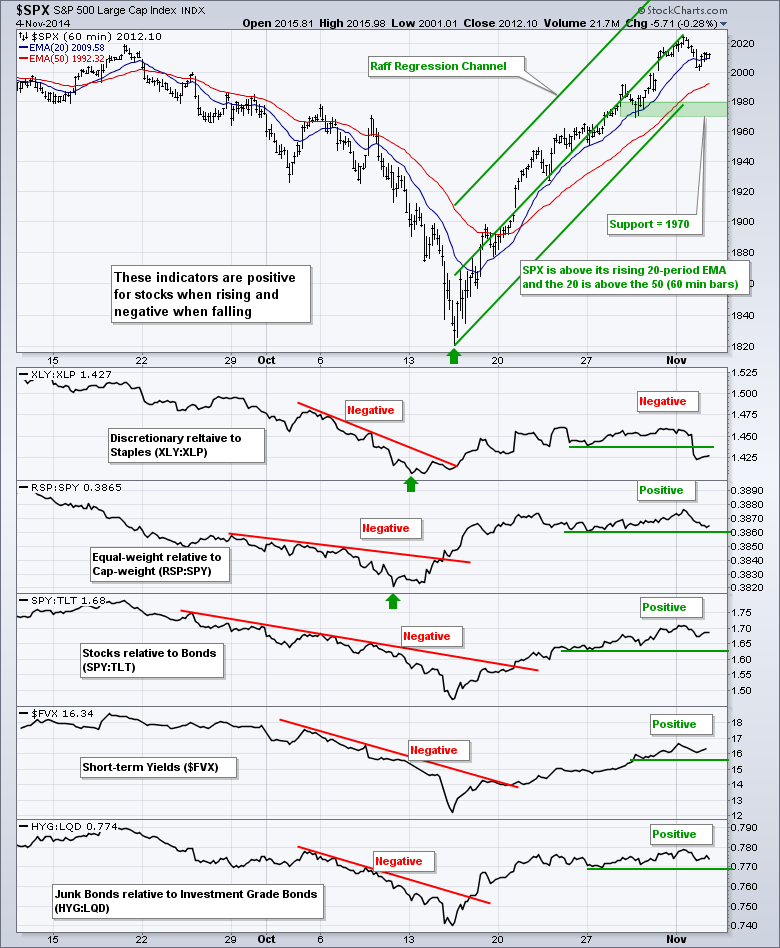

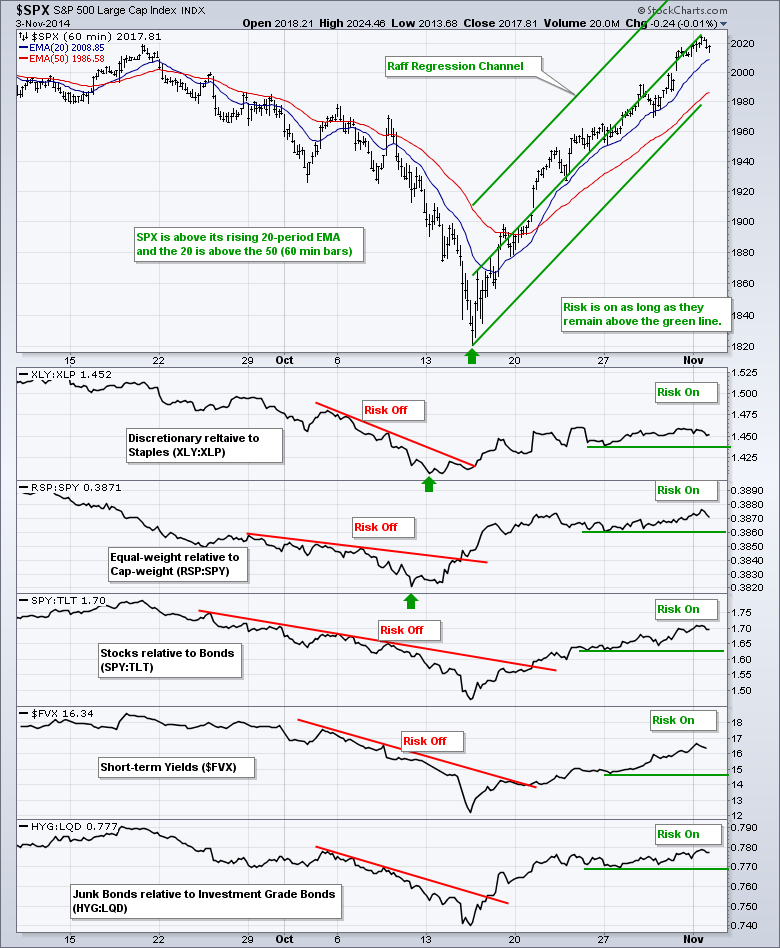

Today we will start with a short-term look at the risk on-off dynamics in the stock market right now. Note that I am only referring to the stock market. Oil, gold, the Dollar and the Euro do not fit into this equation right now. I am using five things to...

READ MORE

MEMBERS ONLY

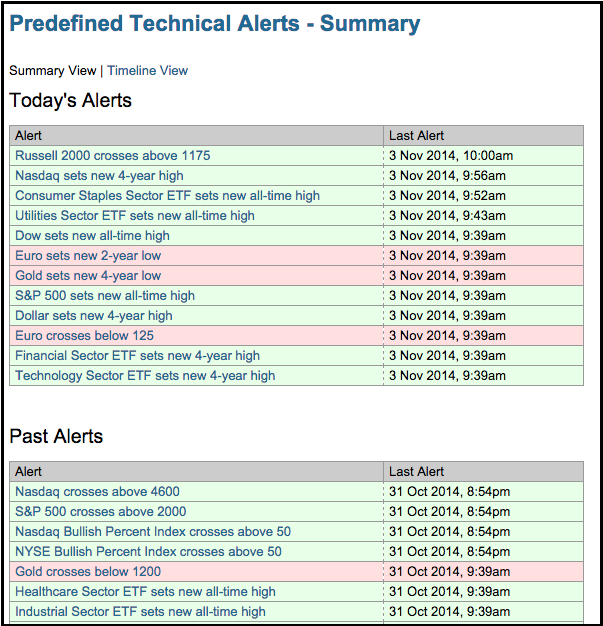

Predefined Technical Alerts Say it All - Gold, Oil, Dollar, Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can get a good idea of market conditions just by looking at the predefined technical alerts page. Today's alerts are at the top and users can view past alerts by scrolling down the page. Today, we can see several major indices and sector ETFs hitting multi-year highs,...

READ MORE

MEMBERS ONLY

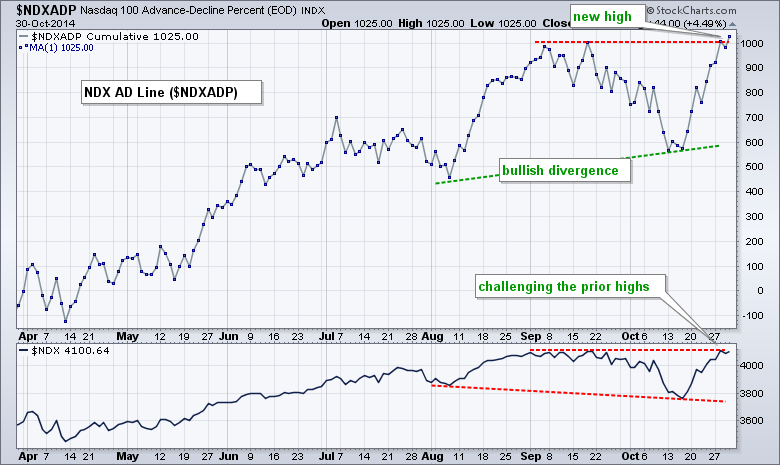

Stocks Overbought, but Still Strong - USO Extends Consolidation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

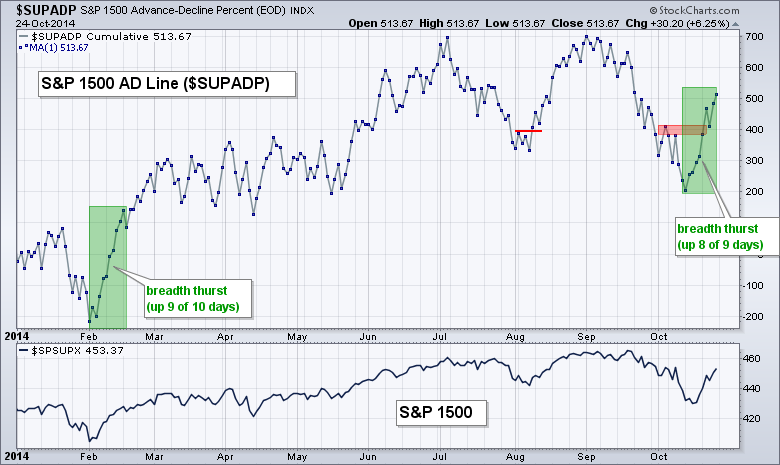

Breadth behind the most recent advance was quite strong as the AD Lines for the S&P 500, S&P 1500 and Nasdaq 100 recorded new highs. Of these three, notice that the S&P 500 AD Line held its August low and the Nasdaq 100 AD...

READ MORE

MEMBERS ONLY

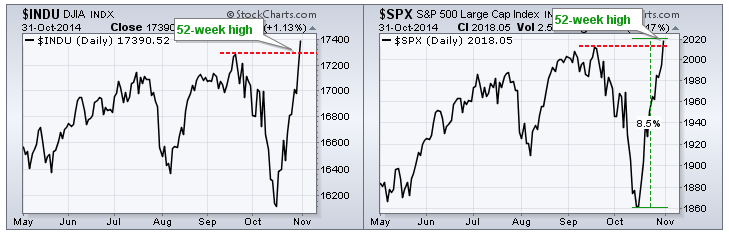

Array of New Highs Reflects Broad Market Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Not every index and not every sector recorded a new high this week, but several key indexes recorded new highs and the majority of sectors hit new highs. This shows broad market strength that validates the long-term uptrend in stocks. The only negative is that stocks are short-term overbought after...

READ MORE

MEMBERS ONLY

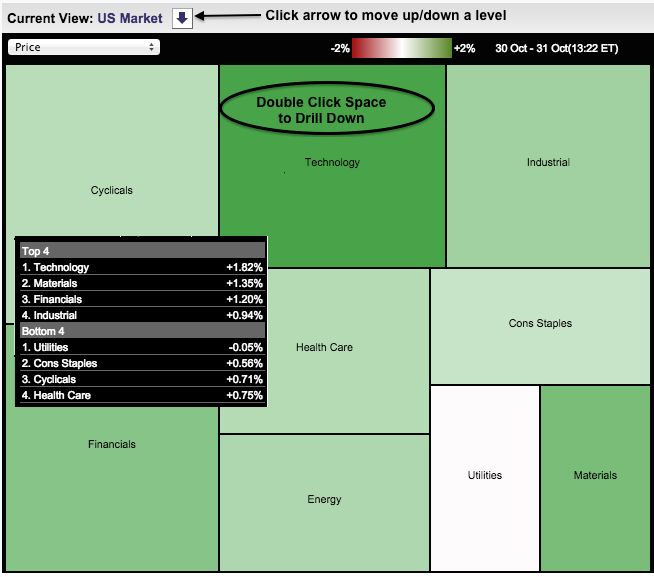

Sector Carpet Shows a Preference for Risk

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved sharply higher on Friday with the Technology sector leading and the Utilities sector lagging. As the Market Carpet shows, the average utilities stock is down .05% and the average technology stock is up 1.82%. This shows a preference for higher risk stocks (offense). Notice that the tech...

READ MORE

MEMBERS ONLY

QQQ Continues to Lead - USO Remains in a Trading Range

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs notched another gain with the Dow Diamonds (DIA) leading the way (+1.30%). The gains in the other major index ETFs were, however, modest. Stock futures are pointing sharply higher after the Bank of Japan announced another round of quantitative easing. The European Central Bank (ECB)...

READ MORE

MEMBERS ONLY

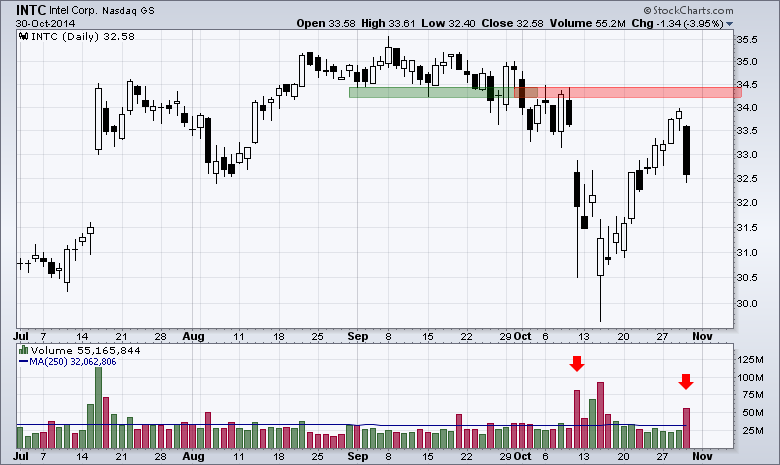

Intel Gaps Down to Lead Semis Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Intel (INTC) weighed on the semiconductor group Thursday with a gap down and high volume decline. The chart below shows the stock reversing near broken support, which turned into resistance. This is classic technical analysis: broken support turns first resistance and broken resistance turns first support....

READ MORE

MEMBERS ONLY

Dollar Extends Breakout, Gold Extends Break Down, Plus CSCO, IMAX, MON, PEP and PLCE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks turned mixed as the Fed nixed quantitative easing. While I do not think this is the reason for mixed trading, the end of QE provides a good excuse for a rest. Stocks went on a tear the last two weeks and the market is entitled to a breather at...

READ MORE

MEMBERS ONLY

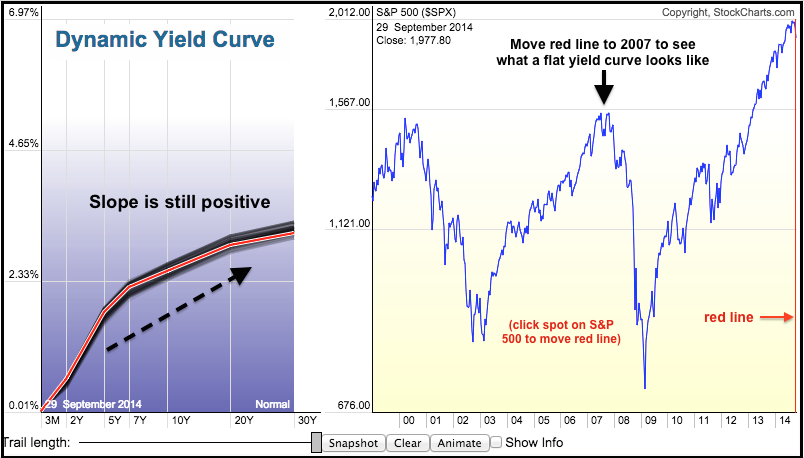

Never mind QE, the Yield Curve Reflects a Dovish Fed

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The end of QE may be on the table, but the yield curve shows that the Fed remains dovish overall. The image below comes from the Dynamic Yield Curve. Notice that short-term yields are the lowest and the yields rise as the maturities extend. This is a "normal"...

READ MORE

MEMBERS ONLY

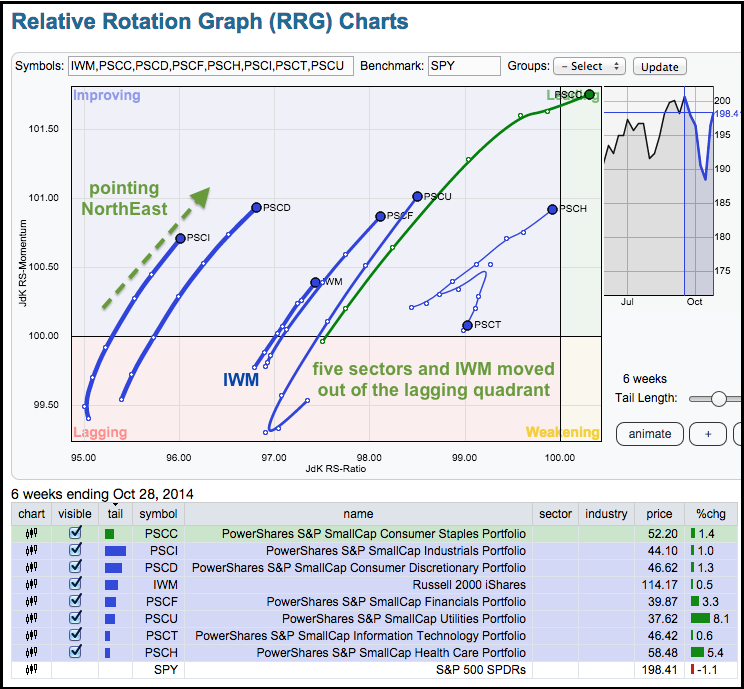

Small-Cap Sectors Make a Move on the Relative Rotation Graph

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

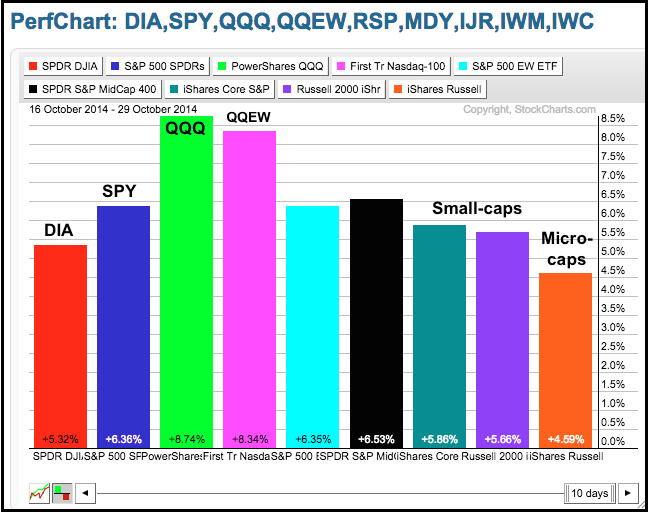

Stocks moved higher again on Tuesday with small-caps and micro-caps leading the charge. The Russell 2000 iShares gained 2.85% and the Russell MicroCap iShares was up over 3%. Keep in mind that it only takes a small rotation to move the needle for small-caps. The S&P 500...

READ MORE

MEMBERS ONLY

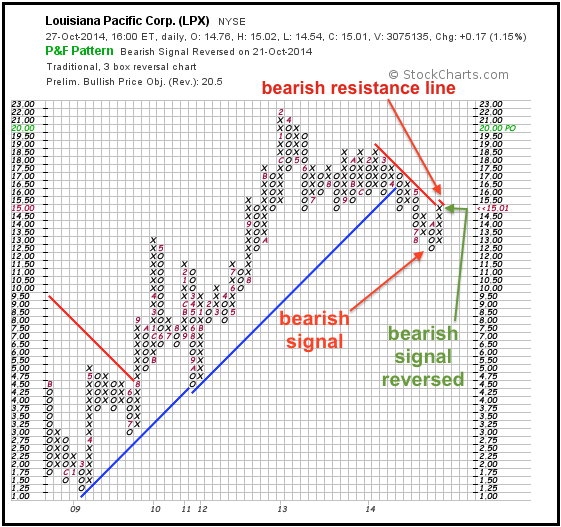

Louisiana Pacific Hits the Bearish-Signal-Reversed Scan

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A failed signal is sometimes as good as a signal. In other words, a failed bearish signal is sometimes just as good as a bullish signal. StockCharts users can find failed P&F signals on the Predefined Scans page. The example below shows LPX with a bearish signal when...

READ MORE

MEMBERS ONLY

UUP Holds Breakout, GLD Holds Break Down, Plus BBBY, EXPR, FL and VEEV

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks dipped in early trading as selling pressure hit, but firmed and moved higher in the afternoon. DIA and QQQ closed with fractional gains, while IWM and SPY closed with fractional losses. The sectors were mixed with five up and four days. Energy and materials were slammed. The Oil &...

READ MORE

MEMBERS ONLY

GoPro Gaps with Uptick in Volume GPRO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

GoPro (GPRO) came under pressure last week as a lower high formed and the stock gapped down. Even though the Nasdaq 100 moved higher the last two days, GPRO moved lower and formed three black (filled) candlesticks. With the decline and gap over the last two days, the stock broke...

READ MORE

MEMBERS ONLY

AD Line Gets a Break - USO Stalls after Pennant Break

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

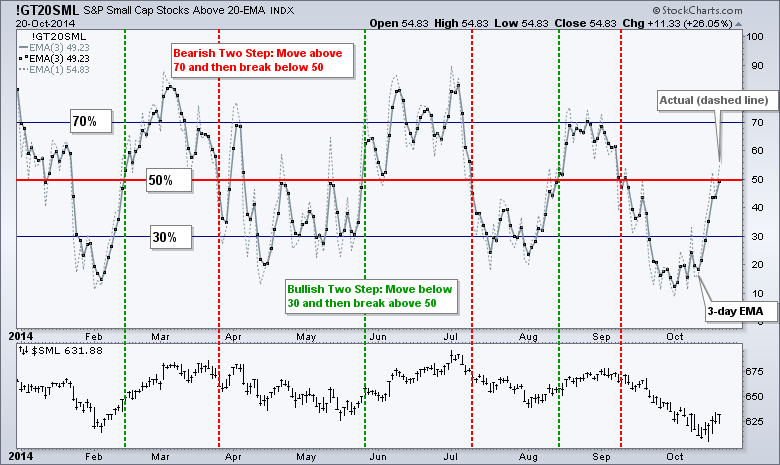

It was another strong week for stocks as the market put in another broad-based rally. Month-to-date, SPY and QQQ are still slightly lower, but IWM is up around 1.5% for October. This suggests that small-caps are showing some upside leadership as we head into November-December. Chart XX shows the...

READ MORE

MEMBERS ONLY

New Highs Surge on the S&P 500

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

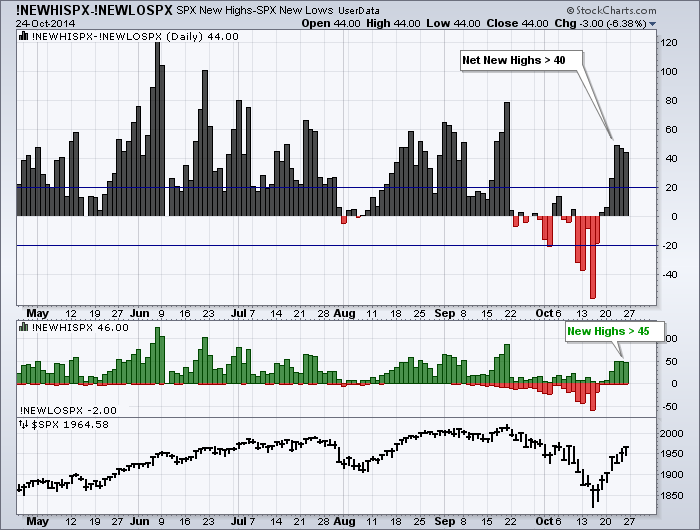

The surge in the S&P 500 over the last six days was accompanied by a surge in new highs the last few days. Notice that Net New Highs exceeded 40 the last three days and new highs exceeded 45 the last three days. There were only two new...

READ MORE

MEMBERS ONLY

SPY and QQQ Hit Resistance Zones, but Uptrends Hold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

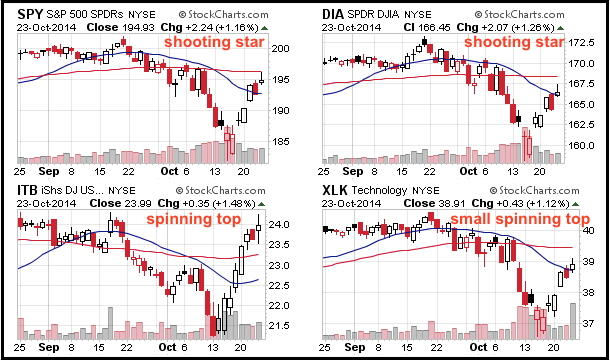

Stocks put in another bullish performance on Thursday with small-caps leading the way. The Russell 2000 Growth iShares (IWO) led the style ETFs with a 2.11% gain. Seven of the nine sectors were up with industrials leading. Several small-cap sectors made big moves with energy, materials and technology surging...

READ MORE

MEMBERS ONLY

P&F Chart Nails it for the S&P 500

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

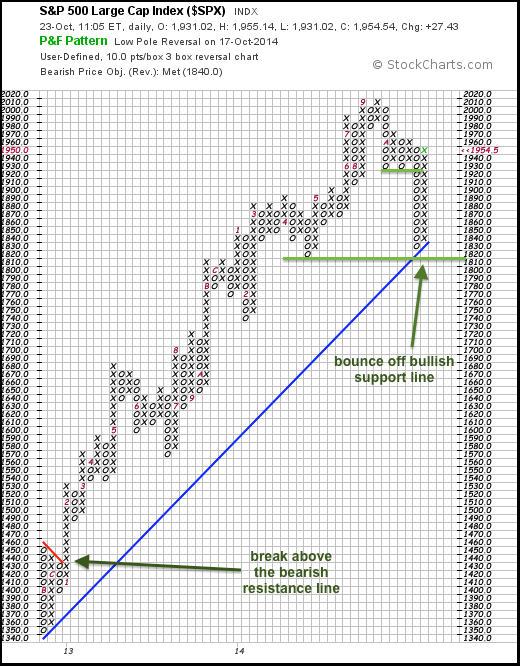

The chart below shows a long-term Point & Figure chart for the S&P 500. Each box is 10 points and a 30+ point move is needed for a reversal (3 boxes). This chart starts with the rally off the November 2012 low. The blue bullish support line was...

READ MORE

MEMBERS ONLY

Dollar Breaks Wedge Trendline - Plus INTC, JPM and WFC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks came under selling pressure on Wednesday with small-caps and micro-caps leading the way lower. These two led the rebound, but this upside leadership faded over the last five days. Seven of the nine sector SPDRs were down with industrials and energy leading the way. Oil fell over 1% and...

READ MORE

MEMBERS ONLY

The Hang Seng Gears Up for a Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

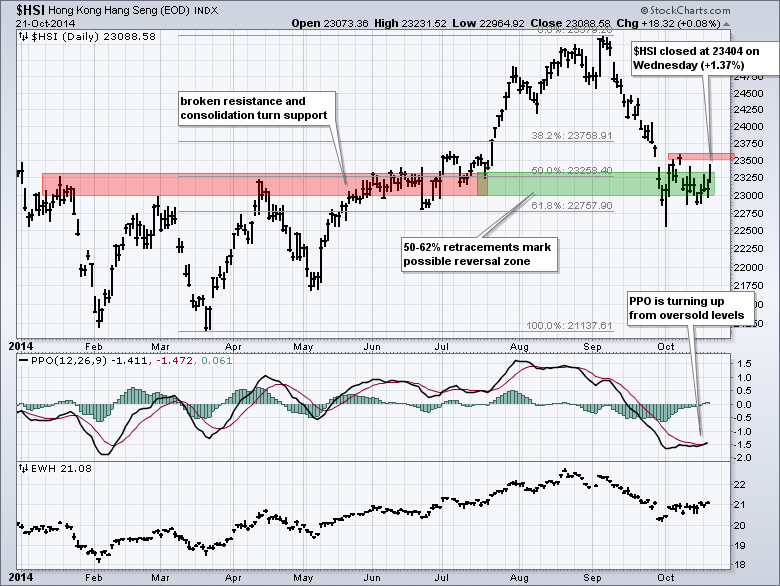

Protests and weakness in global markets weighed on the Hang Seng Composite ($HSI) in September as the index fell to its prior resistance zone. The index stabilized in October and got a nice bounce on Wednesday. This is an interesting area because it also represents a 50-62% retracement of the...

READ MORE

MEMBERS ONLY

SPY Surges to Key Level - TLT Firms Near Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged with broad strength that lifted all boats (except gold miners). Several of the major index ETFs surged over 2%. All nine sector SPDRs were higher, all nine equal-weight sector ETFs were up on the day and all nine small-cap sector ETFs were up. The energy sector led the...

READ MORE

MEMBERS ONLY

Homebuilder and Retail ETFs Make Big Relative Moves

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

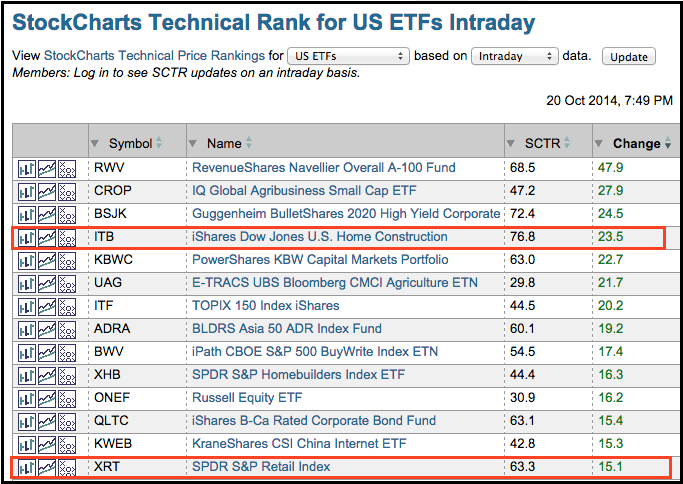

The table below shows the StockCharts Technical Rank (SCTR) for our ETF universe. This table is sorted by "change" with the biggest gainers at the top. In particular, the SCTR for the Home Construction iShares (ITB) surged 23.5 points and moved above 75 and the SCTR for...

READ MORE

MEMBERS ONLY

Small-Caps Continue to Lead - Plus BBBY, GDX, ITB and XRT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Given the IBM miss, I was pretty impressed with market action on Monday. The Dow Diamonds (DIA) had every reason to fill its gap after a weak open, but immediately firmed and closed near the high of the day (and positive for the day). The major index ETFs are holding...

READ MORE

MEMBERS ONLY

Microsoft Bounces off Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart below shows Microsoft (MSFT) falling to broken resistance, firming for two days and bouncing over the last two days. Also notice that this bounce occurred at the 62% retracement. Even though the decline looks steep, support held where it should and the stock is above the rising 200-day...

READ MORE