MEMBERS ONLY

TLT Fails to Hold Breakout as SPY Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Programming Note: I will be at the MTA Symposium on Thursday and Friday, and Art's Charts will not be published on those days.

The first trading day of the month lived up to its bullish reputation as stocks surged with a fairly broad-based rally. The Nasdaq 100 ETF...

READ MORE

MEMBERS ONLY

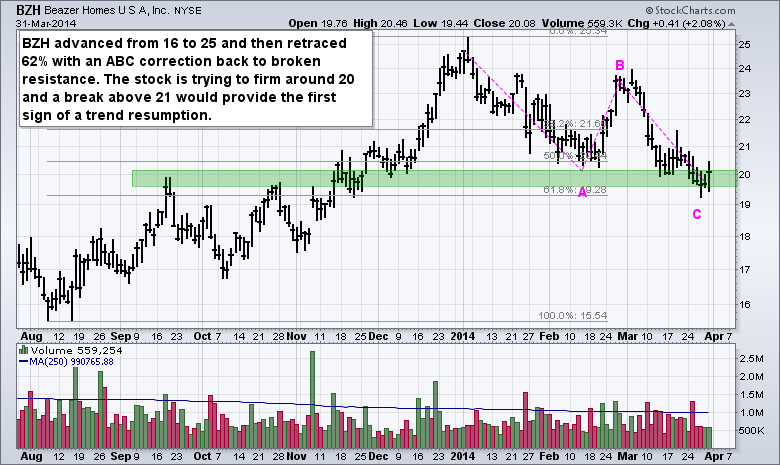

Charts: BZH, CROX, F, JCI, TMUS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BZH Forms Classic Elliott Setup.

CROX Forms Continuation Triangle.

Plus F, JCI and TMUS

Individual charts are below video

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Note: I am travelling this week and there...

READ MORE

MEMBERS ONLY

XLP Hits New High, but Still Lags - SPY Gaps Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Programming Note: I will be at the MTA Symposium on Thursday and Friday, and Art's Charts will not be published on those days. https://symposium.mta.org/ Stocks put in a pretty solid performance on the last day of the quarter as small-caps and healthcare led the way...

READ MORE

MEMBERS ONLY

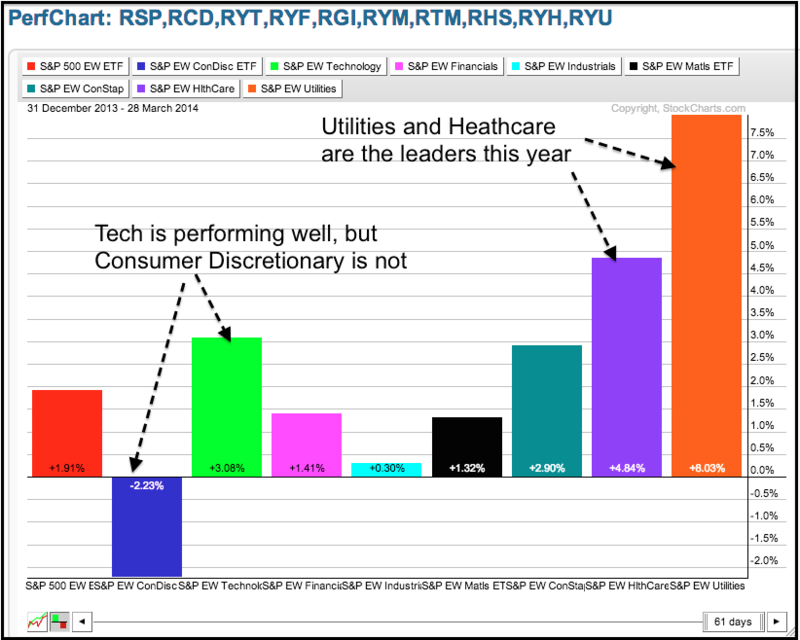

Utilities Lead on Equal-Weight Sector PerfChart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Equal-weight Utilities ETF (RYU) is the best performing sector year-to-date with an 8% gain. The Equal-Weight Consumer Discretionary ETF (RCD) is the only sector in the red with a 2.23% loss. Absolute weakness in RCD and relative weakness in the Equal-weight Industrials ETF (RGI) are the main reason...

READ MORE

MEMBERS ONLY

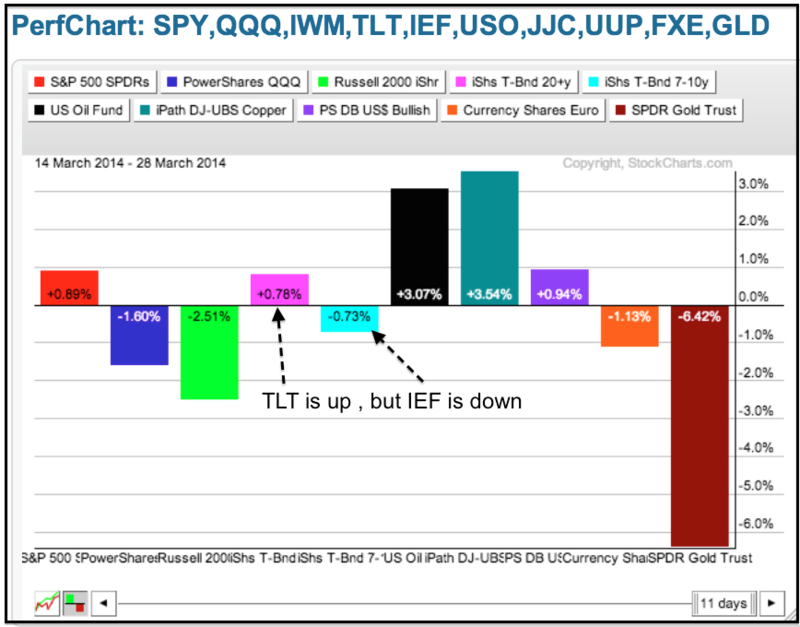

SPY Tests Support, but Underperforms TLT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Programming Note: I will be at the MTA Symposium on Thursday and Friday, and Art's Charts will not be published on those days.

Stocks did the old pop-and-drop on Friday and finished the day mostly higher. Overall, it was a tale of two markets with the S&...

READ MORE

MEMBERS ONLY

100 Hammers Hit the Pre-defined Scans Page

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking for specific candlestick reversal patterns should check out the predefined scans page, which is updated intraday and end-of-day. Thursday's end-of-day results show a surge in the number of hammers (from 42 to 100 for a +58 gain). This indicates that many stocks dipped after the open...

READ MORE

MEMBERS ONLY

SPY Toys with Support - UUP Forms Bullish Pennant

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks remained under selling pressure on Thursday, but selling pressure was not that strong and the major index ETFs closed with small losses. Seven of the nine sectors were down with the Finance SPDR (XLF) leading the decline (-.54%). The Energy SPDR (XLE) and Utilities SPDR (XLU) gained. The...

READ MORE

MEMBERS ONLY

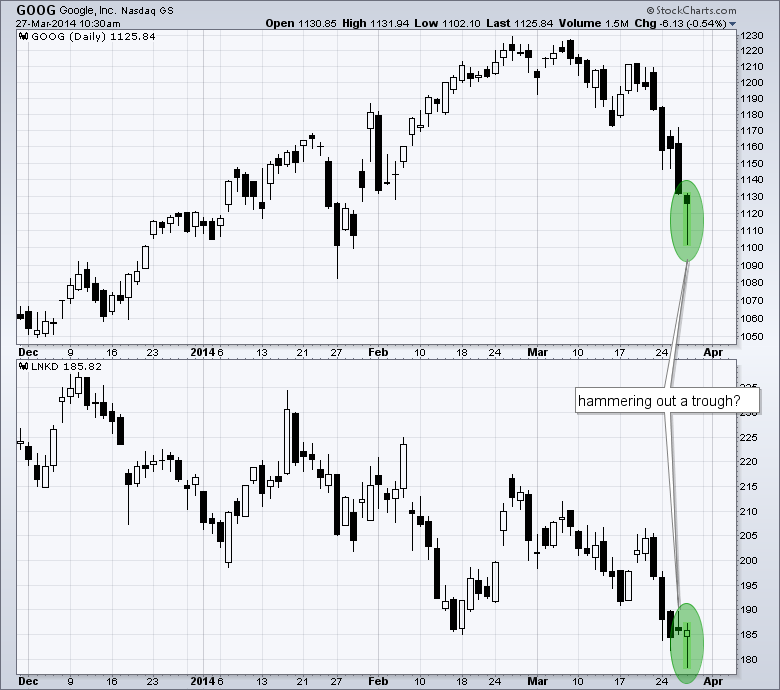

Google and LinkedIn Try to Hammer Out Short-Term Bottoms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Google, LinkedIn and other momentum stocks fell sharply this month and became short-term oversold this week. Signs of a short-term low are emerging early Thursday as Google (GOOG) and LinkedIn (LNKD) trace out hammer patterns. Keep in mind that it is still early and these hammers are subject to change...

READ MORE

MEMBERS ONLY

Charts: BAC, CQP, CTB, HCA, PFE, WHR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BAC Zigzags Higher.

CQP Holds Support with a Bad Tape.

Plus CTB, HCA, PFE, WHR

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or...

READ MORE

MEMBERS ONLY

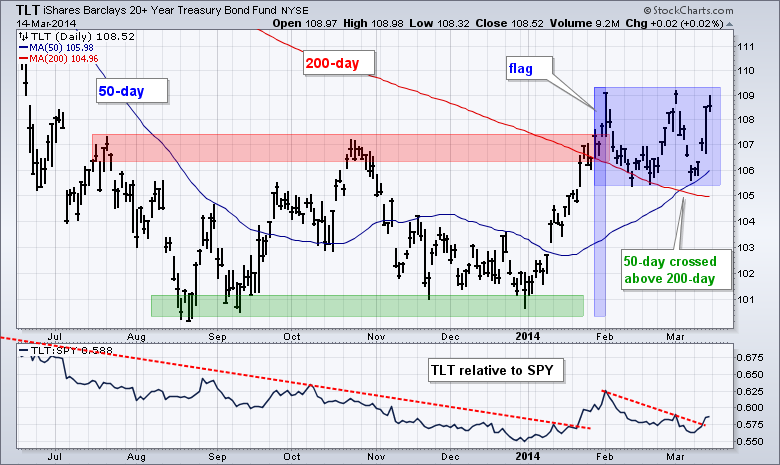

SPY Tests Support Again - TLT Breaks Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks fell on Wednesday with relatively broad-based selling pressure. The Russell 2000 ETF (IWM) and Russell MicroCap iShares (IWC) led the way lower as money moved out of the riskiest stocks. Eight of nine sector SPDRs were down three of the four offensive sectors falling over 1%. The materials sector...

READ MORE

MEMBERS ONLY

Cree Breaks Down with Expanding Volume CREE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After lagging the market and the semiconductor group this year, CREE finally succumbed to selling pressure with a triangle break the last few days. Note that the S&P 500 SPDR and Semiconductor SPDR hit new highs in March, but CREE fell well short of its January high. The...

READ MORE

MEMBERS ONLY

SPY Bounces off Support, but IWM and QQQ Lag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks put in a mixed performance on Tuesday with the S&P 500 SPDR (SPY) edging higher and the Russell 2000 ETF (IWM) closing fractionally lower. Seven of the nine sector SPDRs were up with industrials and energy leading. The consumer discretionary and finance sectors lost ground. While I...

READ MORE

MEMBERS ONLY

Charts: BBRY, CMCSA, IDCC, JBLU, JOY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BBRY Firms at Support.

CMCSA Forms Big Doji at Support.

Plus IDCC, JBLU, JOY

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short...

READ MORE

MEMBERS ONLY

SPY Tests Support as TLT Challenges Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks came under selling pressure with the Russell 2000 ETF (IWM) and Nasdaq 100 ETF (QQQ) leading the way lower. The losses, however, were still relatively modest. IWM lost 1.14%, QQQ declined .88% and SPY was down just .41%. Eight of the nine sectors were down with XLU providing...

READ MORE

MEMBERS ONLY

QQQ Underperforms and Tests First Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks worked their way higher last week with volatile trading. SPY started the week strong with a surge on Monday-Tuesday, but then got hit with selling pressure after the FOMC policy statement and conference call. Stocks rebounded on Thursday and continued higher on Friday morning, but selling pressure appeared in...

READ MORE

MEMBERS ONLY

SPY Holds Breakout and Gap - UUP Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved higher on Thursday with the finance sector leading the charge. The Finance SPDR (XLF) gained 1.58% and the Regional Bank SPDR (KRE) advanced 2.04%. The finance sector and banks clearly like what they heard from the Fed. The Home Construction iShares (ITB) fell back with a...

READ MORE

MEMBERS ONLY

IWM Tests Breakout - GLD Breaks Channel Trend Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stock market action was quite volatile around the Fed policy statement and the major index ETFs closed modestly lower by the time the dust settled. Weakness was pretty much across the board with IWM losing .57%, QQQ falling .54% and SPY declining .53%. Notice, though, that these declines are modest...

READ MORE

MEMBERS ONLY

Charts: AMD, CSCO, DRI, EL, MRVL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMD Breaks Pennant Pattern.

CSCO Firms at Key Retracement.

Plus $DRI, $EL, $MRVL

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said...

READ MORE

MEMBERS ONLY

Amazon Forms Big Spinning Top at Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Amazon (AMZN) remains in a short-term uptrend, but the stock is nearing a potential reversal zone. First, notice that the stock broke down with high volume in late January. After some bouncing in February, AMZN mounted an advance the last four weeks and retraced around 62% of the prior decline....

READ MORE

MEMBERS ONLY

Small-Caps and Techs Lead Flag Breakouts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

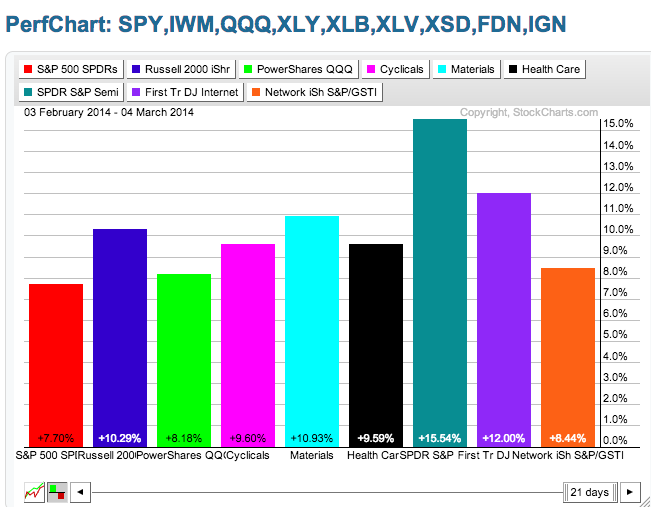

Stocks extended their gains ahead of today's Fed meeting. The Russell 2000 ETF (IWM) led the charge with a 1.5% advance. Techs were also strong as the Technology SPDR (XLK) led the sectors with a 1.3% gain. Strength in the Semiconductor SPDR (XSD), Internet ETF (FDN)...

READ MORE

MEMBERS ONLY

US Steel Tops the List of SCTR Movers

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

US Steel (X) is getting a bounce off support on the price chart and its SCTR is breaking above 50 with a big move. This list below shows eleven S&P 500 stocks with the biggest changes in their StockCharts Technical Rank (SCTR). Two are HMO stocks (UNH, WLP)...

READ MORE

MEMBERS ONLY

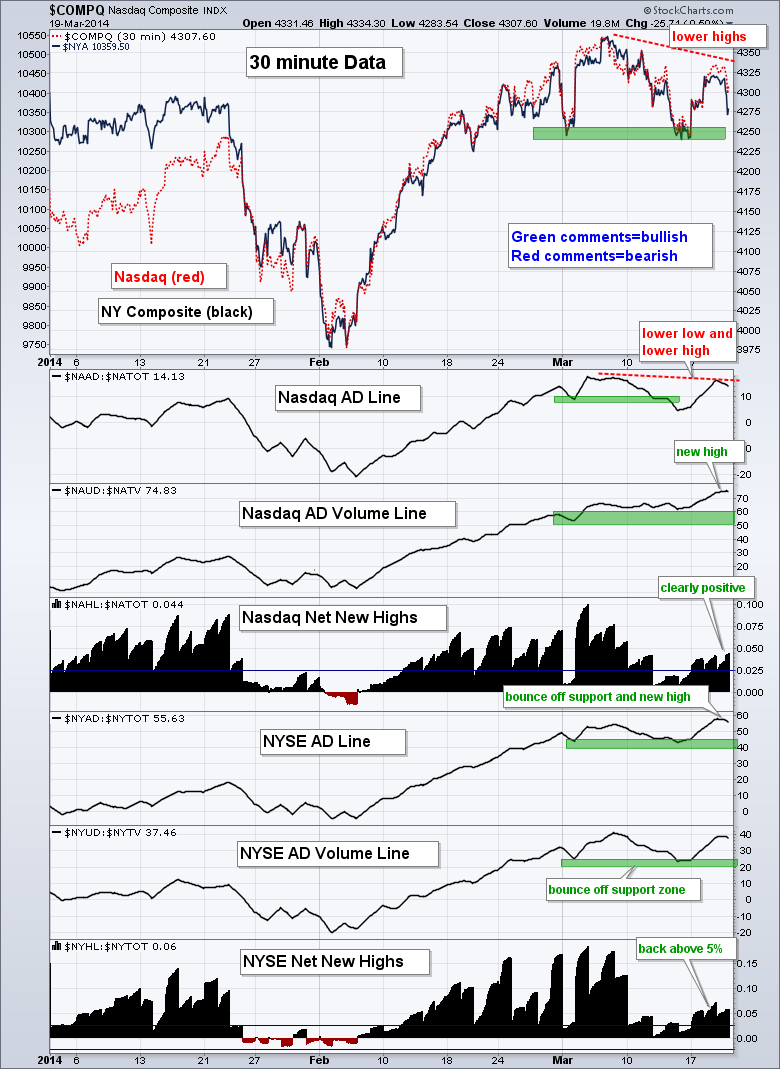

Breadth Indicators Bounce - QQQ Gaps off Feb Lows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged on Monday with the Dow Diamonds (DIA) leading the way (+1.07%). All sectors were higher with the industrials, finance and technology sectors gaining over 1%. The consumer discretionary sector lagged a bit with a .67% gain. Housing stocks will be in focus today and the FOMC will...

READ MORE

MEMBERS ONLY

Charts: AAPL, ADP, COP, CTXS, CY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Breaks Wedge after Engulfing Pattern.

ADP Breaks Out of Flag on Good Volume.

Plus COP, CTXS, CY

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to...

READ MORE

MEMBERS ONLY

QQQ Tests Support - TLT Challenges Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with selling pressure last week as the major index ETFs declined 1.75-2.25 percent. The declines were relatively modest and came the week after most major index ETFs and sector SPDRs hit new highs. This means the long-term trend is still up and any short-term weakness...

READ MORE

MEMBERS ONLY

Treasury Bond ETFs Surge off Golden Crosses

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks and bonds have been inversely correlated for most of the last four years, which means they tend to move in opposite directions. This inverse correlation showed up in January as stocks swooned and Treasuries surged. February was mixed because stocks surged and Treasuries traded flat. The inverse correlation reasserted...

READ MORE

MEMBERS ONLY

Breadth Breaks Down - TLT Surges - SPY Fills Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks came under broad selling pressure with the Nasdaq 100 ETF (QQQ) leading the way lower. The major index ETFs fell with losses ranges from 1% to 1.5%. These losses are relatively modest. Eight of the nine sectors were down. The Utilities SPDR (XLU) bucked the trend and posted...

READ MORE

MEMBERS ONLY

AD Lines Tests Support - QQQ Forms Bull Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Programming note: Charts of Interest will not be posted today and return next Tuesday. Stocks were mixed on Wednesday and the major index ETFs have edged lower over the past week. The Nasdaq and NYSE AD Lines are near support zones, as is the NYSE AD Volume Line. The Nasdaq...

READ MORE

MEMBERS ONLY

Utilities Light up the Sector MarketCarpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks in the utilities sector stood out on Wednesday. As the Sector MarketCarpet below shows, the utilities sector has the most, and darkest, green of the nine sectors (blue outline). Only one square (ED) was red. This showed broad strength within the sector and it was enough to power the...

READ MORE

MEMBERS ONLY

IWM Leads Correction - Oil Breaks Down - Gold Holds Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their correction with small-caps leading the way lower. The Russell 2000 ETF (IWM) and the Russell MicroCap iShares (IWC) led the major index ETFs lower with declines around 1%. All sectors were down with the Materials SPDR (XLB) and Energy SPDR (XLE) getting hit the hardest. Spot Copper...

READ MORE

MEMBERS ONLY

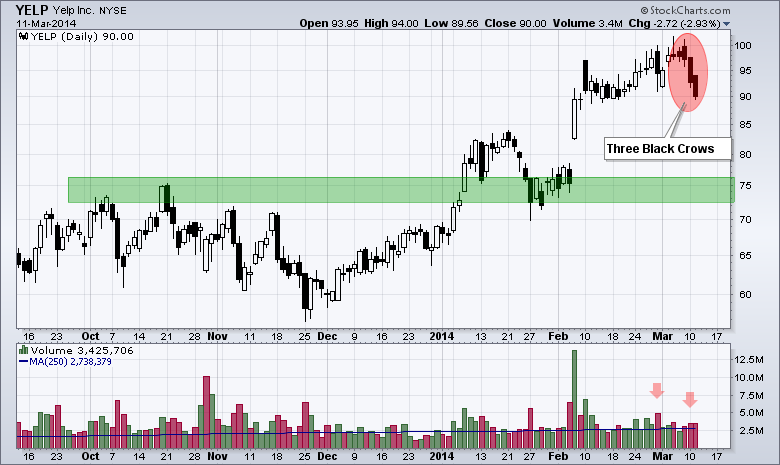

Yelp Traces out a Rare Three Black Crows Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Yelp ($YELP) came across the Three Black Crows scan on Tuesday. It all started with a black candlestick three days ago (Friday). The stock then opened above the Friday's close on Monday and sold off to form another black candlestick. The stock opened above Monday's close...

READ MORE

MEMBERS ONLY

Charts: AKS, DGX, DNR, FNSR, HLF, INTC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AKS Finds Support with Good Volume.

DGX Forms Bullish Hammer.

Plus DNR, FNSR, HLF, INTC

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or...

READ MORE

MEMBERS ONLY

Intraday Breadth Indicators Remain Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks took a breather on Monday as the major index ETFs traded mixed. The Nasdaq 100 ETF (QQQ) closed with a miniscule gain, while the S&P 500 SPDR (SPY) closed with a fractional loss. The sectors were also mixed with the five down and four up. The HealthCare...

READ MORE

MEMBERS ONLY

New Highs Affirm Uptrend, But the Run is Extended

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs extended their uptrends with new highs last week. These advances are getting extended with the Russell 2000 ETF (IWM) and S&P MidCap SPDR (MDY) up around 10% in the last five weeks. Nevertheless, the short-term trends are up and we have yet to see...

READ MORE

MEMBERS ONLY

Identifying Fund Leaders with the Fidelity MarketCarpet (video)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can identify mutual fund leaders and laggards using the Rydex, Fidelity and Profunds MarketCarpets. Note that these are updated after the market close. As the MarketCarpet below shows, the Gold Fund, Leisure Fund, Latin America Fund, Japan Fund and Nordic Fund led on Thursday. Funds associated with Biotechs, Healthcare,...

READ MORE

MEMBERS ONLY

SPX AD Line Hits New High to Show Broad Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks finished mixed again with some strength coming into the S&P 500 SPDR (SPY) and some weakness in the Russell 2000 ETF (IWM). The moves, however, were fractional and insignificant. Six of the nine sectors were up with the three defensive sectors moving lower (healthcare, utilities and consumer...

READ MORE

MEMBERS ONLY

Boeing Turns Down Right Dull

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Boeing (BA) took a hit in January, rebounded in early February and then moved into a tight consolidation. Volatility has slowed to a crawl as the stock traded between 126 and 131 since February 11th. Trading volume is also slowing because Thursday's volume was the lowest of the...

READ MORE

MEMBERS ONLY

Charts: AMD, IMAX, LRCX, NEM, PBCT, WY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMD Forms Tight Consolidation after Surge.

IMAX Bounces off Support Again.

Plus LRCX, NEM, PBCT, WY

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell...

READ MORE

MEMBERS ONLY

Intraday AD Lines Surge to New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks meandered on Wednesday and the major index ETFs finished mixed. The Russell 2000 ETF (IWM) edged lower as the S&P 500 SPDR (SPY) closed slightly higher. The sectors were also mixed, but we saw relative strength from the Consumer Discretionary SPDR (XLY) and the Finance SPDR (XLF)...

READ MORE

MEMBERS ONLY

IWM Leads with Big Gap, but Overbought Conditions Remain

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged on the open with the major index ETFs gapping substantially higher. There was some, but not much follow through after the gap, which suggest that most of the buying pressure occurred in the first twenty minutes. As noted in yesterday's Market Message, there are some pretty...

READ MORE

MEMBERS ONLY

International PerfChart Shows Strength in Developed Markets

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The PerfChart below shows the year-to-date performance for ten country indices. Notice that US, European and Australian stocks are up this year. Asia shows some weakness because the Shanghai Composite, Hang Seng Composite and Nikkei 225 are down. The Bovespa, a big emerging market, is also down sharply this year....

READ MORE