MEMBERS ONLY

Retail SPDR Hits Channel Trend Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Retail SPDR (XRT) has been one of the strongest industry group ETFs this year with a 25+ percent advance. Even though the ETF is looking overextended as it hits the upper trend line of a rising channel, it is by no means weak. Notice that XRT has traded in...

READ MORE

MEMBERS ONLY

Gentiva Bucks the Selling Pressure with 3-Day Advance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The healthcare sector is one of the strongest sectors in the market, but Gentiva (GTIV) has lagged and failed to keep pace. Even though the stock is in a medium-term downtrend, this decline could be a correction. Notice how the decline formed a falling wedge and retraced 62%. Also notice...

READ MORE

MEMBERS ONLY

ITB Stalls after Breakout - UUP Breaks Flag Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Programming note: I am on the road Friday and commentary for Art's charts will not be published on Friday. The next commentary will be on Monday. Taper talk allegedly weighed on the market Wednesday, but the declines in the major index ETFs were minimal. The S&P...

READ MORE

MEMBERS ONLY

Charts of Interest: APC, ATML, DHI, EMC, HPQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

APC Forms Flag after High Volume Decline.

ATML Springs a Bear Trap.

Plus DHI, EMC and HPQ

Individual charts are below video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Sorry but your browser doesn&...

READ MORE

MEMBERS ONLY

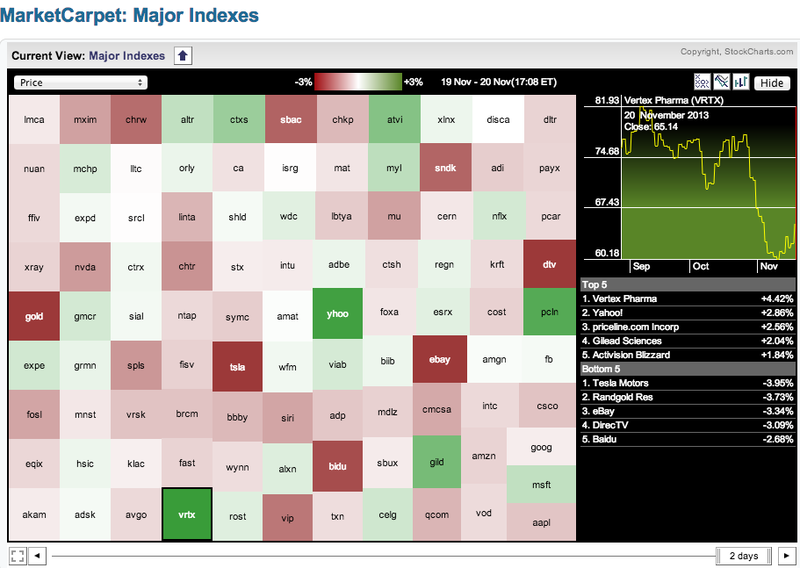

Vertex and Yahoo! Lead Nasdaq 100 MarketCarpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 MarketCarpet was mixed on Wednesday with several big losers and a handful of strong gainers. The dark green boxes show big gains in Yahoo! (YHOO), Vertex (VRTX), PriceLine (PCLN) and Gilead Science (GILD). These gains were countered with sizable losses in Tesla (TSLA), Randgold (GOLD), Ebay (EBAY)...

READ MORE

MEMBERS ONLY

Semis Weigh as XSD Breaks Flag Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks corrected the last two days with relatively mild selling pressure. The Russell 2000 ETF (IWM) lost .62% and the S&P 500 ETF (SPY) fell just .22%. IWM continues to show relative weakness over the last six weeks. The sectors were mixed with six down and three up....

READ MORE

MEMBERS ONLY

Under Armour Forms Bearish Candlestick Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Under Armour (UA) is currently in a long-term uptrend, but the stock stalled over the last three months with a head-and-shoulders pattern taking shape. The right shoulder is under construction with a bearish engulfing marking the high. The September-November lows mark neckline support in the 75-76 area.

Click this image...

READ MORE

MEMBERS ONLY

QQQ Leads Late Sell Off - KOL Forms Bearish Engulfing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks traded relatively flat the first part of the day and then got hit with selling pressure in the afternoon. Techs led the way down with the Nasdaq 100 ETF (QQQ) losing around 1%. Eight of the nine sectors were down with the Consumer Discretionary SPDR (XLY) and Energy SPDR...

READ MORE

MEMBERS ONLY

Charts: CAT, COF, DOW, FB, MOVE, NVR, PEG, RDC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CAT Extends Post-Gap Consolidation.

COF Shows Relative Weakness as Wedge Forms.

Plus DOW, FB, MOVE, NVR, PEG, RDC

Individual charts are below the video.

Sorry but your browser doesn't support HTML5 video.

Click here for iPad/iPhone Version

**This chart analysis is for educational purposes only, and should...

READ MORE

MEMBERS ONLY

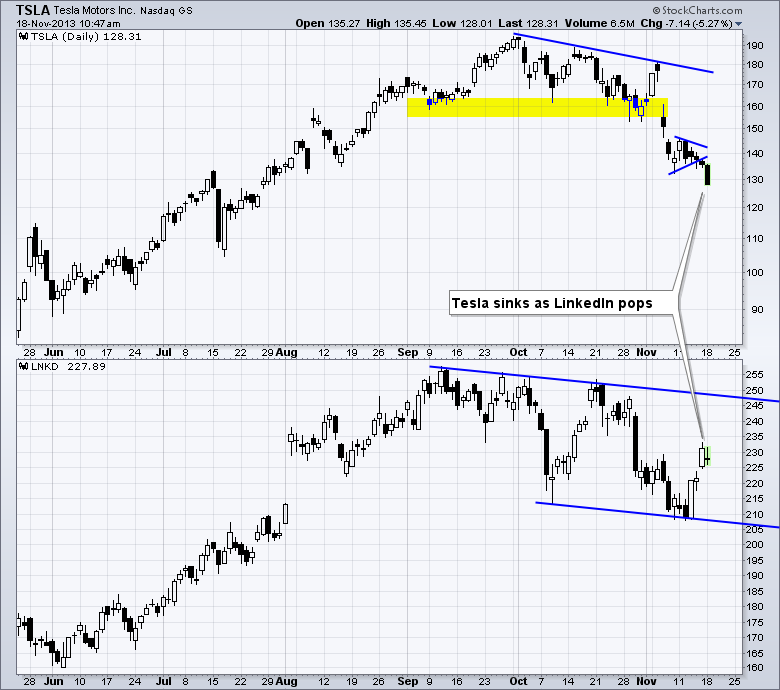

LinkedIn and Tesla Go their Separate Ways

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There was a time when LinkedIn (LNKD) and Tesla (TSLA) were joined at the hip and led the momentum crowd. Both stocks surged from January to September and then corrected from early October to mid November. This relationship appears to be changing as Tesla sank to new lows for the...

READ MORE

MEMBERS ONLY

ITB Reverses Downswing and GLD Bounces off October Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulls continue to press their case as the major index ETFs scored modest gains for the week. It is not as if buying pressure is especially strong. Buying pressure, however, is clearly stronger than selling pressure. In fact, selling pressure is pretty much non-existent. The Nasdaq 100 Equal-Weight ETF...

READ MORE

MEMBERS ONLY

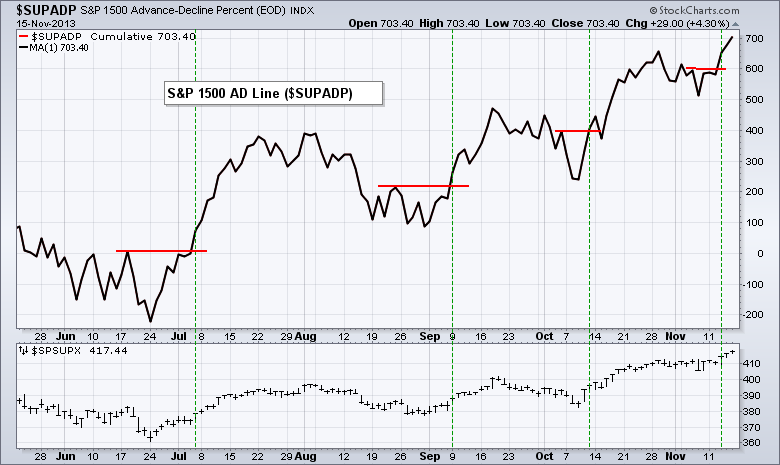

Breadth Indicators Confirm with New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

When a major index records a new high, I go straight to the key breadth indicators to see if these highs were confirmed. Breadth indicators are sometimes called "internal" indicators because they measure what is happening inside a specific index or ETF. We can see what is happening...

READ MORE

MEMBERS ONLY

Peabody Breaks P&F Support as Coal Loses Favor

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Coal stocks were hit with selling pressure after the TVA announced the closing of eight coal-fired power plants. The 60-minute P&F chart shows BTU breaking Quadruple Bottom support and sporting a downside price objective of 18.65. Note that chartists can change the period settings and price fields...

READ MORE

MEMBERS ONLY

Major Index ETFs and NYSE AD Volume Line Hit New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the indicator summary as the bulk of the evidence remains bullish. We saw new highs in SPY, RSP and MDY this week. The NYSE AD Volume Line also hit a new high. Net New Highs surged as buying pressure picked up in November. Volatility remains...

READ MORE

MEMBERS ONLY

SPY and QQQ Hit New Highs, But IWM Drags its Feet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks got a bounce, but there were some pockets of weakness in the market. Get this. The Russell 1000 iShares (IWB) moved higher, but the Russell 2000 ETF (IWM) edged lower. We can blame this on the growth component because the Russell 2000 Value iShares (IWN) was up .22%, but...

READ MORE

MEMBERS ONLY

Zynga Forms Bullish Pattern and Zyngs Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a bullish engulfing on Tuesday, Zynga (ZNGA) surged to triangle resistance with high volume on Wednesday. Overall, chartists can make a bullish case for this internet-mobile gaming company. A higher low formed in August and the stock surged above the July high with good volume in September. The subsequent...

READ MORE

MEMBERS ONLY

Charts of Interest Video: BAX, BIIB, CNL, MAS, SIAL, TE, WFC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Video for Art's Charts:

BAX Bounces off Support with Good Volume.

BIIB Hits an Interesting Juncture.

Plus CNL, MAS, SIAL, TE, WFC

Sorry but your browser doesn't support HTML5 video.

Click here for iPad/iPhone Version

This commentary and charts-of-interest are designed to stimulate thinking. This...

READ MORE

MEMBERS ONLY

IWM and QQQ Surge with Double Flag Breakouts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trading started mixed on Wednesday, but stocks caught a midday bid and raced higher to close strong. The Nasdaq 100 ETF (QQQ) and the Russell 2000 ETF (IWM) led the way. All sectors were up with the Consumer Discretionary SPDR (XLY) leading (+1.58%). Strength in Macy's boosted...

READ MORE

MEMBERS ONLY

Charts of Interest: BAX, BIIB, CNL, MAS, SIAL, TE, WFC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BAX Bounces off Support with Good Volume.

BIIB Hits an Interesting Juncture.

Plus CNL, MAS, SIAL, TE, WFC

Individual charts are below.

Sorry but your browser doesn't support HTML5 video.

Click here for iPad/iPhone Version

**This chart analysis is for educational purposes only, and should not

be...

READ MORE

MEMBERS ONLY

Nasdaq and NYSE Most Actives Go Ten for Ten

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was a big day for stocks as the ten most active stocks on the NYSE and Nasdaq advanced. As the Free Charts page shows, both exchanges went ten for ten. Bank of America (BAC) led the NYSE with a 2+ percent gain. Facebook (FB) led the Nasdaq with a...

READ MORE

MEMBERS ONLY

XLF Falls below Breakout Point - QQQ Hits Moment of Truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was another mixed day for the major index ETFs. The Nasdaq 100 ETF (QQQ) edged higher, while the S&P 500 ETF (SPY) edged lower. Six of the nine sector SPDRs finished lower with the Finance SPDR (XLF), Energy SPDR (XLE) and Utilities SPDR (XLU) leading the way....

READ MORE

MEMBERS ONLY

Nikkei Breaks Wedge Resistance as Yen Weakens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nikkei 225 ($NIKK) broke above wedge resistance with a surge to 14589 and extended its long-term uptrend. First, note that the long-term trend is up after the big surge from November to May. Second, this triangle represents a consolidation and the breakout signals a continuation of the uptrend. Third,...

READ MORE

MEMBERS ONLY

SPY Challenges Resistance, but IWM Remains Weak

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks meandered in slow trading on Monday. The Nasdaq 100 ETF (QQQ) edged lower and the S&P 500 ETF (SPY) edged higher. The sectors were mixed with fractional gains and losses. The Retail SPDR (XRT) stood out with a 1% surge that neared its prior highs, while the...

READ MORE

MEMBERS ONLY

Charts of Interest: BRCM, DF, DHI, FNSR, TSO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BRCM Firms at 50-62% Retracement.

DF Forms Bull Flag after Surge. Plus DHI, FNSR, TSO

Video is at top. Individual charts are below.

Click here for iPad/iPhone Version

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short...

READ MORE

MEMBERS ONLY

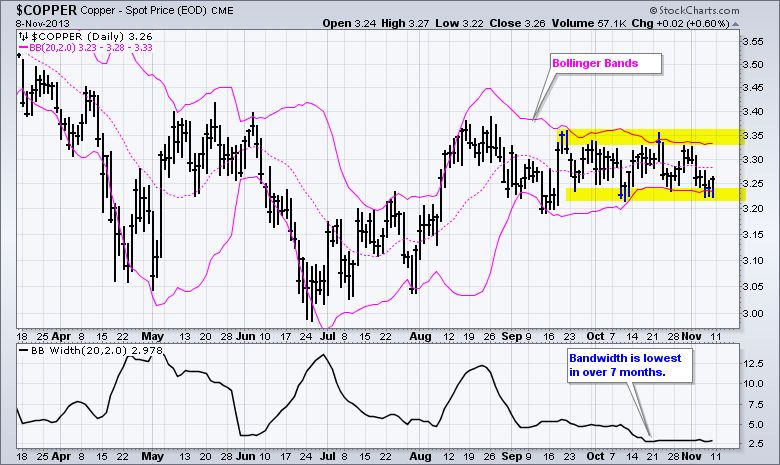

Bollinger Bands Narrow as Copper Consolidates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Spot Copper ($COPPER) has gone nowhere the last three months and a narrowing consolidation is taking shape. The pink lines show the Bollinger Bands narrowing as volatility contracts. This is confirmed by the bandwidth indicator, which is trading near seven month lows. Traders should watch range for a break to...

READ MORE

MEMBERS ONLY

Stocks Are Mixed with SPY Holding and IWM Folding

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulls went on a run after non-farm payrolls beat expectations and prior months were revised higher. Strength in employment put tapering back on the agenda and weighed on bonds. Taper-talk also weighed on gold as the Dollar surged and held last week's breakout. Despite Friday's...

READ MORE

MEMBERS ONLY

Dow SPDR Forms Massive Engulfing Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are bearish engulfing patterns and then there are BEARISH ENGULFING PATTERNS. With a strong open and weak close on Thursday, the Dow SPDR (DIA) formed the latter. This is the second bearish candlestick pattern in two weeks. A follow through break below the early November low would confirm this...

READ MORE

MEMBERS ONLY

How Can I Count the Number of Bars or Days in a Price Move?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This article can be found in the Mailbag blog (click here)....

READ MORE

MEMBERS ONLY

AD Lines and AD Volume Lines Correct Within Uptrends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulk of the evidence remains bullish, but this uptrend is getting long in tooth and the market is ripe for a correction. Note that the majority of technical indicators have been positive for a year now, which is the longest stretch since I began this table. Even though the...

READ MORE

MEMBERS ONLY

IWM Leads Lower as SPY Test Key Level

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Things that make you go hmm.... Stocks declined and a few media reports blamed a better-than-expected GDP report. Also note that October same-store retail sales were up 4%, which ain't bad considering all that shutdown stuff. The reasoning suggested that strength in the economy would lead to Fed...

READ MORE

MEMBERS ONLY

Twitter Establishes First Support with Consolidation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is not much historical data for Twitter (TWTR) because it opened for trading just today. However, there are already signs of support near the opening price. The 1-min chart shows TWTR opening at 45.10, surging to 50 and then falling back to the 45 area. Notice how the...

READ MORE

MEMBERS ONLY

Euro, the Dollar and Gold Brace for ECB Meeting

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was a strange day on Wall Street. The Dow Industrials surged over 100 points, but the Russell 2000 fell .43%. The Consumer Staples SPDR (XLP) and Utilities SPDR (XLU) led the market higher, but the Technology SPDR (XLK) also showed relative strength with a 1.01% gain. Strength in...

READ MORE

MEMBERS ONLY

Charts of Interest: LNKD, MDR, MOVE, STX, WIN, YELP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

LNKD Forms Bear Flag at Support.

MDR Surges with Huge Volume.

Plus MOVE, STX, WIN, YELP

Video is at top. Individual charts are below.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for...

READ MORE

MEMBERS ONLY

Facebook Doubles Down with Two Candlestick Patterns in Four Days

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Facebook (FB) came across the bullish engulfing scan twice in the last four days. The stock fell to support last week and then formed a big bullish engulfing pattern on high volume. After a pullback on Friday-Monday, the stock opened weak on Tuesday and closed strong to form another bullish...

READ MORE

MEMBERS ONLY

ITB Hits Key Retracement, but Rising Yields Weigh

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks edged lower on Tuesday with the major index ETFs ending with small losses. The S&P Midcap SPDR (MDY) fell .63% and the S&P 500 ETF (SPY) lost .32%, but the Nasdaq 100 ETF (QQQ) bucked the selling with a fractional gain (+.11%). Eight of the...

READ MORE

MEMBERS ONLY

RSI Breaks Key Level on Carmax Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Carmax is making a move as it bounces off support and breaks wedge resistance. Support in the 46-47 area extends back to the July low. The breakout is valid as long as it holds and I would watch 47.6 for the first signs of failure. The indicator window shows...

READ MORE

MEMBERS ONLY

IWM Hits Key Retracement and Moment of Truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rebounded on Monday with modest gains in the major index ETFs. Small-caps led the recovery as the Russell 2000 ETF (IWM) gained 1.15% on the day. Those looking for a rally excuse can point to the beginning of the month phenomenon because Monday was the second trading day...

READ MORE

MEMBERS ONLY

Charts: BBBY, BOOM, EBAY, GTIV, IGT, IMMR, PMTC, RLGY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BBBY Consolidates After Big Gap.

BOOM Turns Volatile on High Volume.

Plus EBAY, GTIV, IGT, IMMR, PMTC, RLGY

Video is at top. Individual charts are below.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click...

READ MORE

MEMBERS ONLY

Paper-Forest Products Lead Industry Group Market Carpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Market Carpet shown here focuses on the US industry groups from the Market Summary Market. Chartists can focus on a particular section of a Market Carpet by double clicking a square. Notice that the DJ US Paper-Forest Products Index ($DJUSFR) is the best performer over the last five days....

READ MORE

MEMBERS ONLY

IWM Breaks Down, but SPY and QQQ Hold Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks finally took a breather last week as small-caps led the correction. The Nasdaq 100 ETF (QQQ) and S&P 500 ETF (SPY) corrected with trading ranges, while the Russell 2000 ETF (IWM) corrected with a 2.13% decline. The sectors were mixed last week with the Finance SPDR...

READ MORE