MEMBERS ONLY

CARZ Revs its Engine (while it Still Can)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Some of the old Ford and GM cars can still rev their engines, but the sound of a revving engine could go the way of the dodo with EVs. Perhaps, I should say that the Global Auto ETF (CARZ) price chart is revving its engine and poised for a breakout....

READ MORE

MEMBERS ONLY

Gold, Silver the 200-day and Realistic Expectations

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Gold SPDR (GLD) crossed above its 200-day EMA in early May and its 200-day SMA this past week. Both signals are "bullish" and point to a long-term uptrend, but tell us little regarding realistic expectations going forward. To get a better understanding, we need to know which...

READ MORE

MEMBERS ONLY

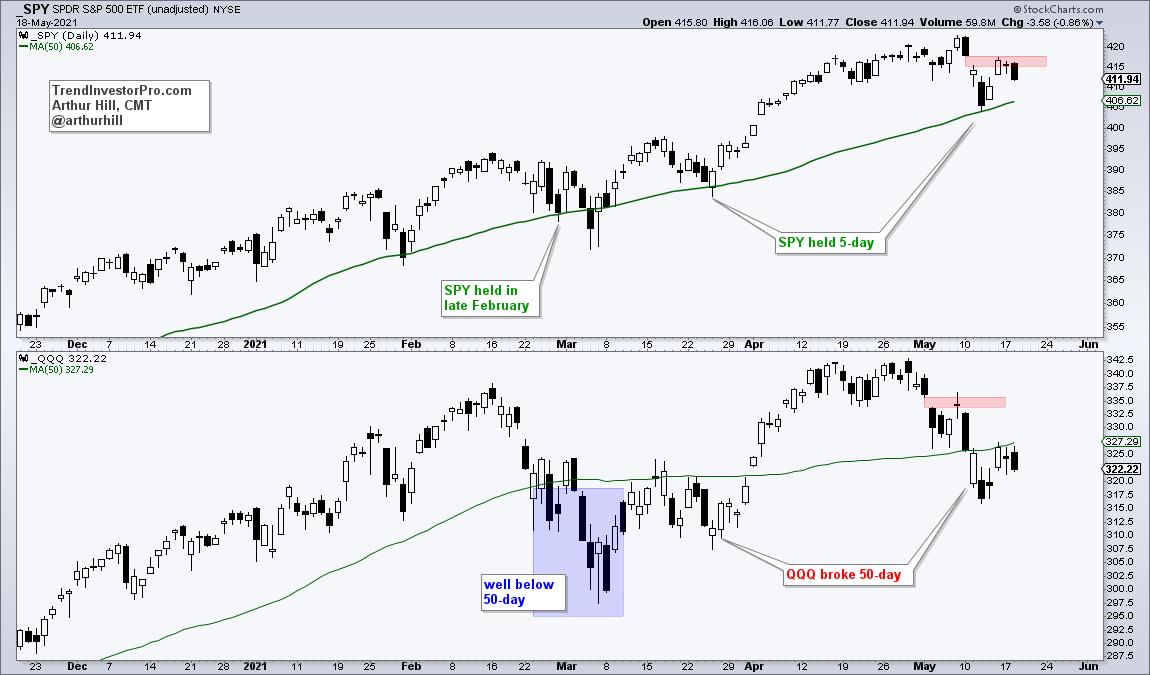

The 50-day and the early Gap Tell the Tale for QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can compare performance by using the 50-day SMA as a benchmark level. Names that exceed their 50-day SMAs show more strength than those that do not exceed their 50-day SMAs. By this yardstick, QQQ is underperforming SPY and weighing on the broader market. Oh, and mind the gap as...

READ MORE

MEMBERS ONLY

A Tech ETF Forming A Short-term Bullish Pattern within a Bigger Bullish Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Cybersecurity ETF (CIBR) was hit with the rest of the tech sector over the last few weeks, but it held the March lows and is on my radar as a possible triangle forms over the last few months. In particular, I am watching the downswing within this triangle for...

READ MORE

MEMBERS ONLY

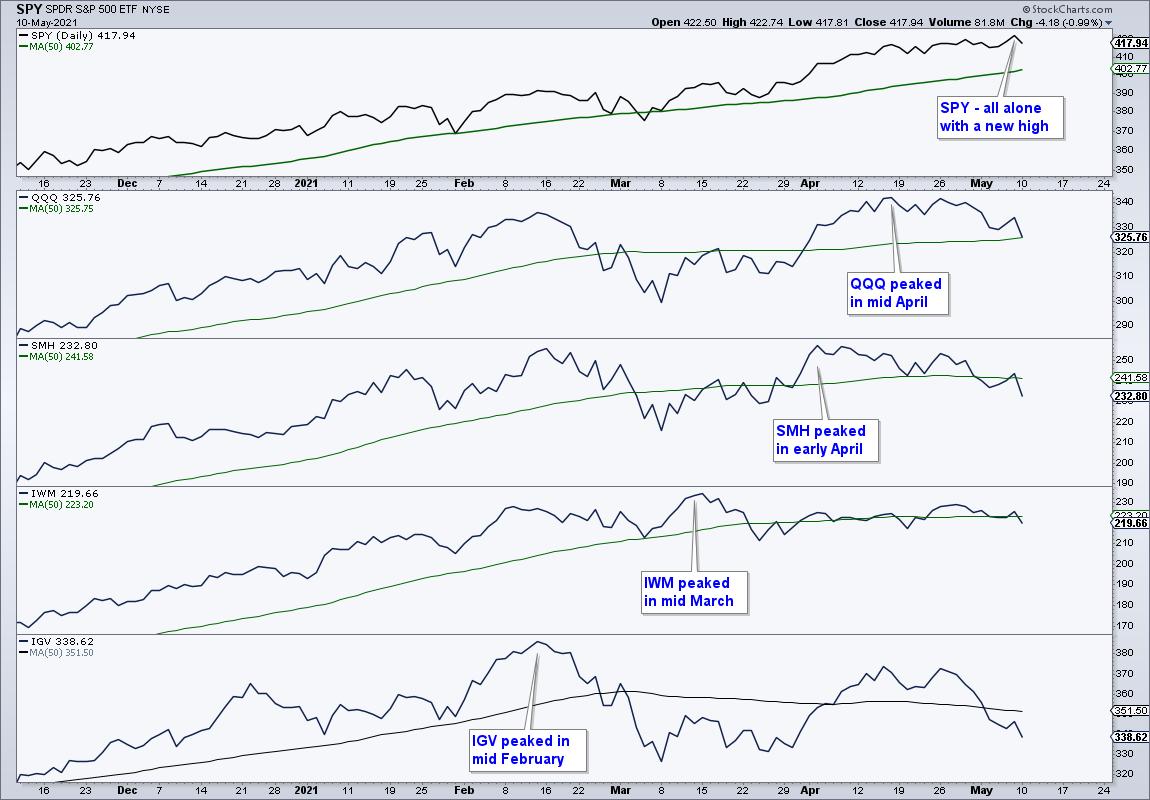

Non-confirmations show Creeping Correction that Could Expand

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR hit a new high last week, but it was alone at the top because several other major index ETFs did not confirm. In fact, these non-confirmations have been building since March as fewer groups participated. Of note, several tech-related ETFs peaked in mid February,...

READ MORE

MEMBERS ONLY

KRE Breakout Holds and Bodes well for Small-caps

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Regional Bank ETF pattern over the last few months is similar to that of the S&P SmallCap 600 SPDR and Russell 2000 ETF. This is not surprising because the financial services sector accounts for 17.8% of IJR and 16.34% of IWM, and is the second...

READ MORE

MEMBERS ONLY

Semis Lose Their Shine

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The long-term trend for the Semiconductor ETF (SMH) remains up, but the ETF is coming under some selling pressure and underperforming the broader market. While this is not enough reason to turn long-term bearish, it does increase the odds of corrective period in the coming weeks.

First, let's...

READ MORE

MEMBERS ONLY

Small-caps Keep Everyone Guessing - Here's Mine

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P SmallCap 600 SPDR (IJR) and Russell 2000 ETF (IWM) are lagging the market, but they are still in uptrends and the noose is tightening. Today we will look at the volatility contraction in IJR and the loss of trend in IWM, and then show what to...

READ MORE

MEMBERS ONLY

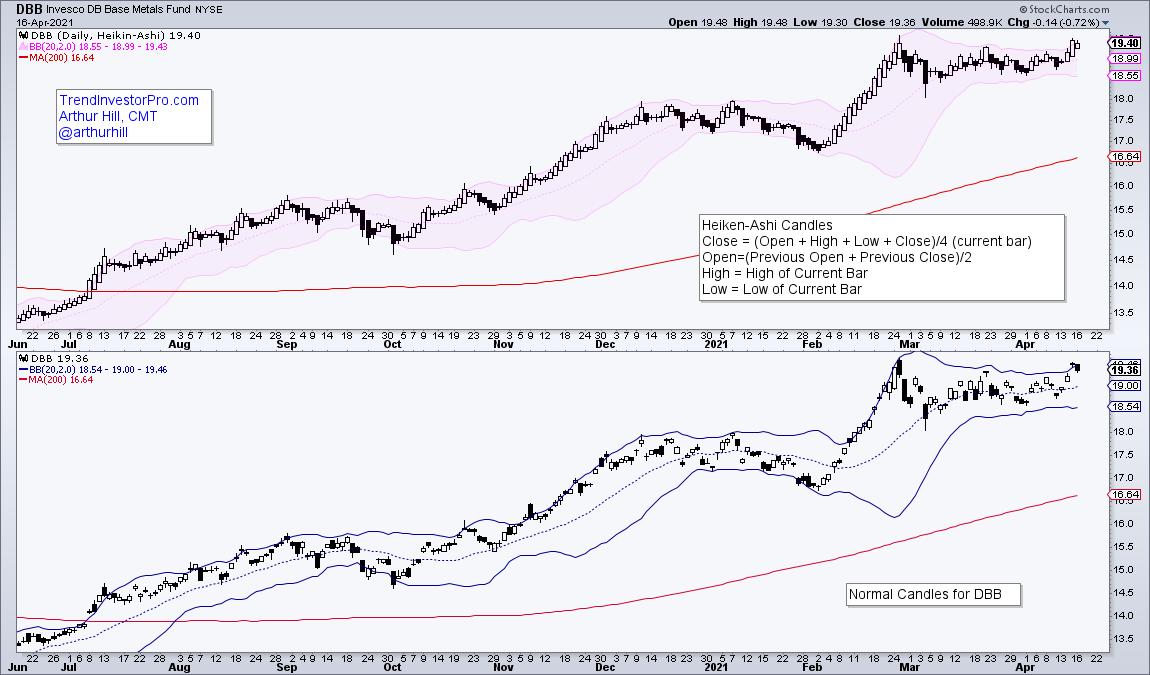

Base Metals ETF Gets the Squeeze

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The DB Base Metals ETF (DBB) is breaking out of a bullish continuation pattern after a Bollinger Band squeeze and this signals a continuation of the long-term uptrend.

The first chart shows the DB Base Metals ETF (DBB) with Heikin-Ashi candlesticks in the top window and normal candlesticks in the...

READ MORE

MEMBERS ONLY

Healthcare SPDR Looks Poised to Extend Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Healthcare SPDR (XLV) formed two bullish continuation patterns within its long-term uptrend and recent breakouts bode well for further gains.

First and foremost, the long-term trend is up for XLV. The ETF is above its rising 200-day SMA and within 1% of its January high, which was a 52-week...

READ MORE

MEMBERS ONLY

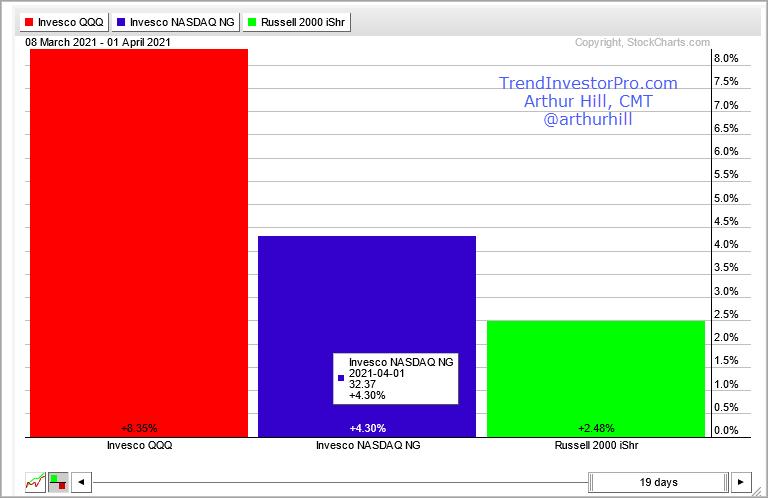

A Relative Strength Clue for QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) represents the largest stocks in the Nasdaq and the Nasdaq 100 Next Gen ETF (QQQJ) covers the next 100 (101 to 200). Stocks at the top of the latter group are knocking on the door and trying to fatten up for inclusion into the legendary...

READ MORE

MEMBERS ONLY

News Flash! Big Advances Deserve Big Corrections and Proper Perspective - Tesla Example

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Dozens of high flying stocks and ETFs are down double digits from their February highs, but chartists should put these declines into perspective when analyzing the charts. The ARK Innovation ETF (ARKK), the Clean Energy ETF (PBW) and the Solar Energy ETF (TAN) declined over 30% from their February highs...

READ MORE

MEMBERS ONLY

IBB: Still a Correction within a Bigger Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I wrote about the Biotech ETF (IBB) on February 28th as it pulled back from a new high. The pullback was viewed as a correction within the bigger uptrend, but the correction extended further than expected. At the time, I drew a falling wedge on the chart and marked resistance...

READ MORE

MEMBERS ONLY

Applying Multiple Timeframe Analysis to the Healthcare SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As its name suggests, multiple timeframe analysis looks at two or more timeframes to find a setup. Typically, the longer timeframe is used to define the long-term trend and set the trading bias. The shorter timeframe is then used to find setups in harmony with the bigger trend. Nothing is...

READ MORE

MEMBERS ONLY

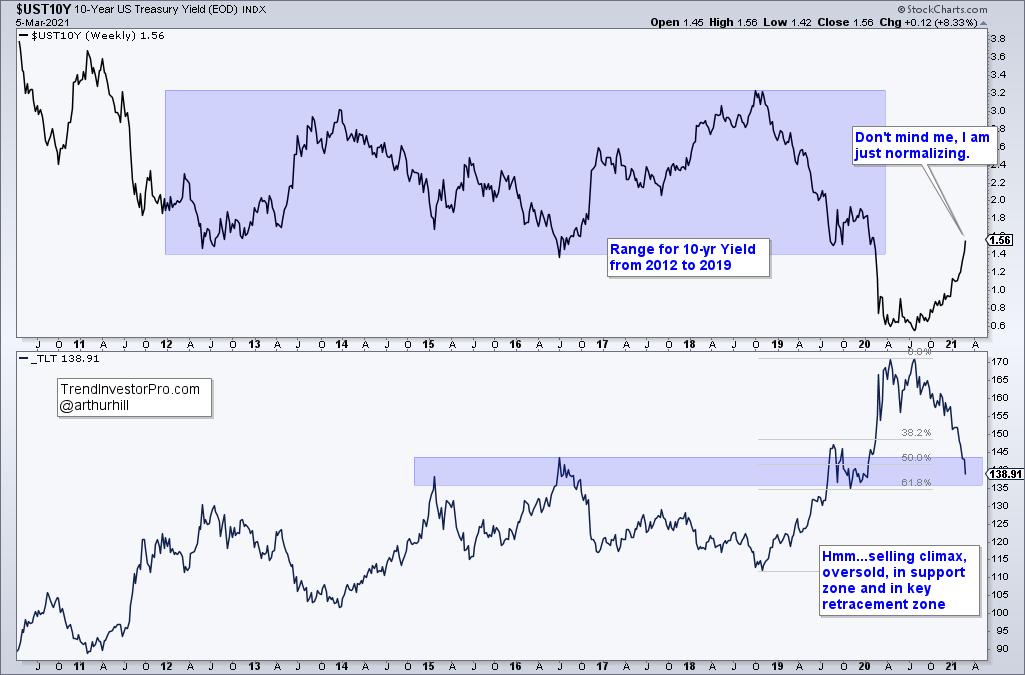

Does the 10-Year Yield Really Matter?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Two items are dominating the news narrative right now: the rise in interest rates and the decline in tech stocks. Are rising rates really an issue for tech stocks? The charts suggest that the evidence is mixed, at best. In fact, it is not very hard to find periods when...

READ MORE

MEMBERS ONLY

Secondary Downtrends in Primary Uptrends Create Opportunities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a pullback led by QQQ and the high flyers, several ETFs have become short-term oversold in a longer term uptrend. In Dow Theory terms, the primary trend for these ETFs is up and the secondary trend is down. A secondary downtrend within a primary uptrend is considered a correction...

READ MORE

MEMBERS ONLY

A Medium-term Breadth Indicator Waves the Caution Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 has been on a tear the last few months with a move to new highs, but a medium-term breadth indicator is not keeping pace here in February. This indicator is simply flashing the yellow caution sign right now and we have yet to see an actual signal...

READ MORE

MEMBERS ONLY

An Industrials ETF with More Juice than XLI

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Not all ETFs are created equal and the name does not always tell the entire story. One would think that the Industrials SPDR (XLI) and the Industrials iShares (IYJ) are similar in makeup and performance. This is not the case because one has a clear edge over the other.

The...

READ MORE

MEMBERS ONLY

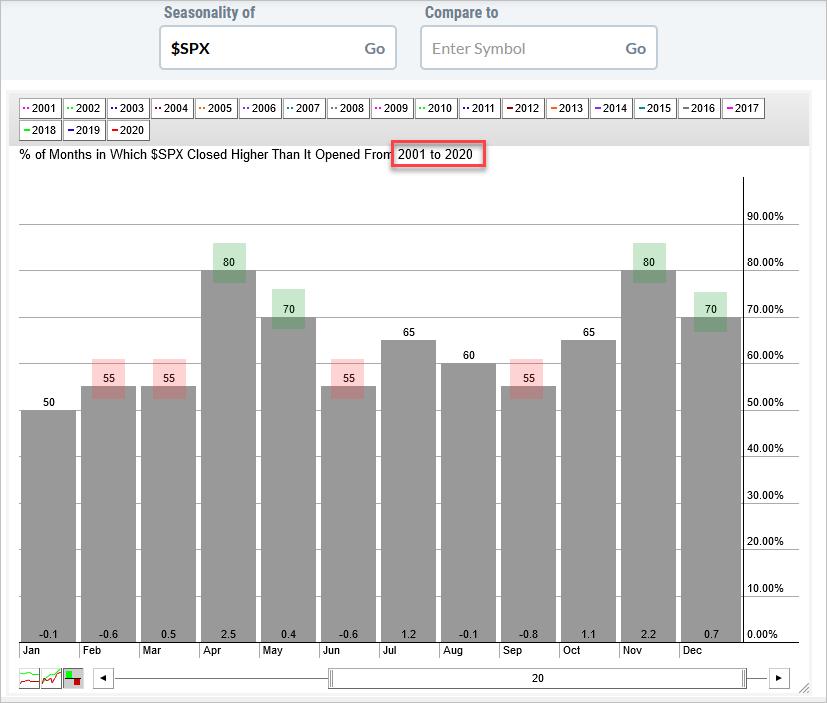

Seasonality Looks Weak, but Price Action is Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The seasonal patterns over the next two months are not very strong, but price action is strong with the S&P 500 hitting a new high. Price action is more important than the seasonal pattern because profits and losses are driven by price changes, not seasonal tendencies. Seasonality becomes...

READ MORE

MEMBERS ONLY

SOXX Follows Overbought Extreme with Outsized Decline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Last weekend's post showed the Semiconductor ETF (SOXX) with a 10 day overbought streak and several ETFs with even bigger overbought streaks. These streaks came to an end this week as SOXX fell 6.21%, its biggest weekly decline since mid March. As measured by Normalized ROC, this...

READ MORE

MEMBERS ONLY

SOXX and other ETFs with Extended Overbought Conditions

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Semiconductor ETF (SOXX) and several other ETFs are on a serious roll in 2021. For the fourth time since 2009, 14-day RSI was above 70 for ten or more days. This is an exceptional streak, but SOXX is not alone and there are even longer streaks. The following list...

READ MORE

MEMBERS ONLY

A Top or a Mere Correction?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Visual chart analysis is prone to subjectivity and biases. While we cannot completely remove subjectivity, we can approach chart analysis in a systematic fashion and increase objectivity. This commentary will show an example using the Home Construction ETF (ITB) because the ETF has traded flat since mid October. Is this...

READ MORE

MEMBERS ONLY

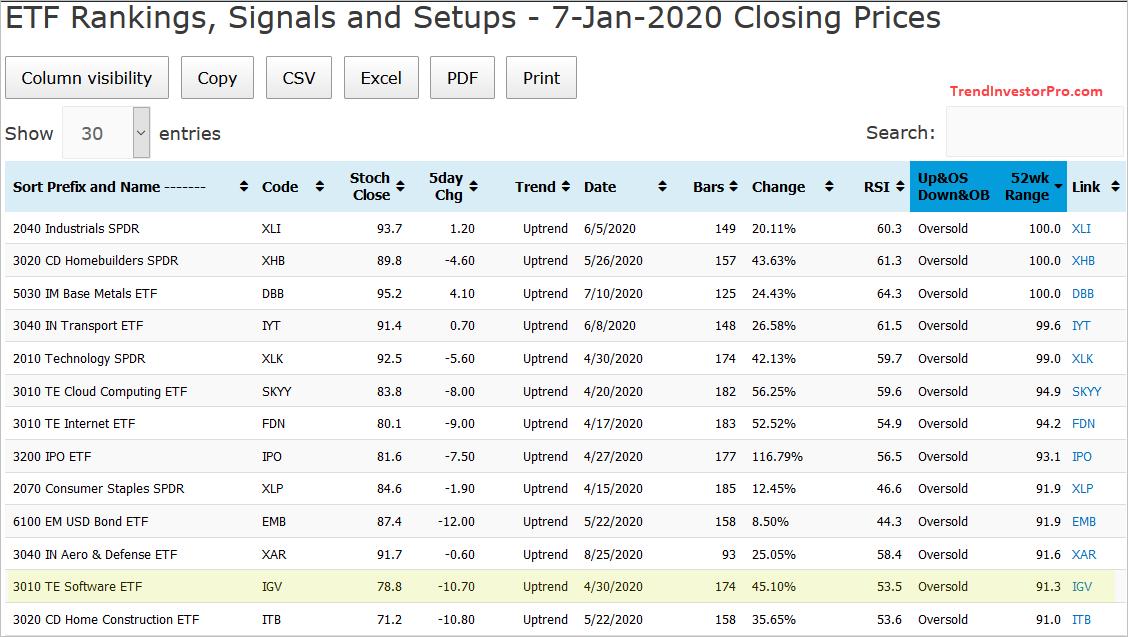

Tracking Trend Signals and Mean-Reversion Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Tech-related ETFs are lagging over the last few weeks, but they are still in uptrends overall. This means bullish setups still matter so today we will look at a classic mean-reversion setup in the Software ETF (IGV).

The IGV setup came to light through the ETF Ranking, Trends and Setups...

READ MORE

MEMBERS ONLY

More Forest and Fewer Trees in 2021

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Way back in early September, a time long long ago, tech-related ETFs were leading the market and recording new highs. The Software ETF (IGV), Cloud Computing ETF (SKYY), Cyber Security ETF (HACK), Internet ETF (FDN) and Semiconductor ETF (SOXX), among others, were up 75 plus percent from late March to...

READ MORE

MEMBERS ONLY

Squeezing the Apple for a Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Several big tech stocks have consolidation patterns working the last few months and Bollinger Band squeezes in December. These include Apple, Amazon, Microsoft and Nvidia. Today's article will focus on the strongest of the four, and the one with a breakout working already. There is a video at...

READ MORE

MEMBERS ONLY

Performance Divergences that Make You Go Hmm...

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There was a serious shift over the last five weeks as commodities surged, bonds fell and the Dollar recorded new lows. There were also some noticeable divergences as the Inflation-Indexed Bond ETF (TIP) edged higher and the 20+ Yr Treasury Bond ETF (TLT) moved lower. This divergence is only five...

READ MORE

MEMBERS ONLY

Cyber Monday Special and Consumer Discretionary Breadth Hits an Extreme

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Discretionary SPDR (XLY) is leading the charge with the most stocks trading above their 200-day EMAs. The table below shows the percentage of stocks above their 200-day EMAs for three indexes and the eleven sectors. This indicator is above 98% for XLY and above 90% for four other...

READ MORE

MEMBERS ONLY

Bullish Setups in Two Boring Tech ETFs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Boring and lagging ETFs turned into exciting leaders in November as we saw breakouts in the Regional Bank ETF (KRE) and REIT ETF (IYR). The breakouts are bullish and IYR has a short-term bullish continuation pattern working, but we should not forget about the prior leaders and ETFs with real...

READ MORE

MEMBERS ONLY

The Calm before the Storm in QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The weekly high-low range for the Nasdaq 100 ETF (QQQ) was the narrowest of the year this past week and the ETF is battling triangle resistance. A narrowing range shows indecision and a volatility contraction. Even though this is just one weekly bar, QQQ is at a moment of truth....

READ MORE

MEMBERS ONLY

Two Biotech ETFs: One Stands Out as the other Forges a Big Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the Biotech ETF (IBB) and the Biotech SPDR (XBI) represent the same industry group, their composition is very different and one is clearly outperforming the other. Nevertheless, the laggard still has a big bullish continuation pattern and this group looks bullish as a whole.

First, let's...

READ MORE

MEMBERS ONLY

Two ETFs with Market Leading Charts and Fast Growing Industries

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

New highs and a fast growing industry group make for a powerful combination. Today's article and video (below) will focus on two ETFs that capture two fast growing industries, video gaming and esports. We will show why these two ETFs are leading, why a consolidation within an uptrend...

READ MORE

MEMBERS ONLY

Broad Selling Pressure, but Not Enough to Tip the Scales

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Breadth indicators, such as Advance-Decline Percent, measure the participation behind a move in the underlying index. Sometimes participation is so strong that it tips the scales and signals the start of an extended move. For example, 10-day EMA of SPX AD% triggered a bearish breadth thrust on February 25th and...

READ MORE

MEMBERS ONLY

Two of the Four Commodity Groups Stand Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Broad commodity ETFs are like broad index ETFs: an amalgamation of various components. Traders can improve performance by breaking these down, ignoring the weaker components and focusing on the stronger components. Let's do that with the Invesco DB Commodity ETF.

The Commodity ETF (DBC) can be broken down...

READ MORE

MEMBERS ONLY

Small-Caps Take the Lead: Can They Hold It?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 ETF (IWM) rose from the ashes in late September and surged above its summer highs with a double-digit advance. This is quite amazing considering that IWM closed below its 200-day SMA on 24-Sept and was seriously lagging less than a month ago. IWM is leading over the...

READ MORE

MEMBERS ONLY

Bullish Breadth Thrusts in 5 of the 6 Big Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are 11 sectors in the S&P 500, but the big six are the only ones we need to be concerned with when making a broad market assessment. The big six account for a whopping 82.5% of the S&P 500, which leaves the other 5...

READ MORE

MEMBERS ONLY

Mind the Gap in SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR (SPY) gapped up on Monday and broke out of a classic correction pattern. The breakout is bullish, but the coast is not entirely clear. Here's what to watch going forward.

First, the long-term trend is up as SPY hit a new high...

READ MORE

MEMBERS ONLY

2 Equity ETFs Holding Up Well in September

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR is down around 6% this month and QQQ is down around 8%. These two hit new highs on September 2nd, plunged the next three trading days and then worked their way lower. Both are below their 50-day moving averages for the first time since...

READ MORE

MEMBERS ONLY

The Setup to Anticipate the Breakout - XME Example

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists are often faced with a choice: wait for the breakout or anticipate using a mean-reversion setup. The Metals & Mining SPDR (XME) broke out of a bullish consolidation this week and the breakout signals a continuation of its long-term uptrend. Chartists keying off the mean-reversion setup could have anticipated...

READ MORE

MEMBERS ONLY

Silver Crosses Lose Some Shine

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are fewer silver crosses in the major stock indexes and this shows less participation during the last leg higher, a situation that could foreshadow a correction.

A silver cross occurs when the 20-day EMA crosses above the 50-day EMA. DecisionPoint took this concept on step further and developed breadth...

READ MORE

MEMBERS ONLY

SPY: You Spin Me Right Round

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR (SPY) fell over 2% this week for the biggest weekly decline since June. The long-term trend is still up because SPY remains well above the rising 40-week SMA. However, a big Spinning Top candlestick formed last week and a volatility indicator ticked higher. Spinning...

READ MORE