MEMBERS ONLY

Steel ETF Breaks Flag Resistance with Big Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the long-term trend remains down, the Steel ETF (SLX) is making some bullish waves with a flag breakout on Thursday. After an advance from late June to mid July, SLX consolidated with a falling flag, which is a bullish continuation pattern. Today's breakout signals a continuation...

READ MORE

MEMBERS ONLY

QQQ Continues to Lead - Yen Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak, but quickly firmed and consolidated at lower levels the rest of the day. The overall losses were small with the Russell 2000 ETF (IWM) loosing .71% and the Nasdaq 100 ETF (QQQ) falling just .18%. QQQ continues to lead the major index ETFs and show the most...

READ MORE

MEMBERS ONLY

Charts of Interest: AEP, AMX, HD, INTU, SO, TE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AEP Firms at Broken Resistance.

AMX Surges to Consolidation Highs.

Plus HD, INTU, SO, TE

Video at end of commentary

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/iPhone Version

This...

READ MORE

MEMBERS ONLY

Chuy's Holdings Forms Bearish Engulfing at Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chuy's Holdings came across the intraday bearish engulfing scan on Wednesday. Even though the trading day has just begun, notice that the stock broke down in July and retraced 62% with a bounce back to 40 in August. The gap and 62% retracement mark resistance as the stock...

READ MORE

MEMBERS ONLY

Marking Short-Term Support for the SPX AD Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks pulled back on Tuesday with the Home Construction iShares (ITB), Gold Miners ETF (GDX) and Biotech SPDR (XBI) leading the way lower. ITB is on the...

READ MORE

MEMBERS ONLY

ITB Stalls at Trend Line - GLD Breaks Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks meandered on Monday. Trading was listless and volume was light. Yes, the dog days of summer are upon us. The Russell 2000 ETF (IWM) edged higher,...

READ MORE

MEMBERS ONLY

Charts of Interest: AGN, D, HCA, MU, THC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AGN Consolidates at Trend Line Resistance.

D Forms Pennant after Big Surge.

Plus HCA, MU and THC

Video at end of commentary

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/iPhone...

READ MORE

MEMBERS ONLY

Only One Bullish Percent Index is Below 50%

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

StockCharts calculates the Bullish Percent Index for over a dozen groups, including several major indices, the main sectors and a few industry groups. A list can be found on the end-of-day market summary page. Notice that all BPIs are at or above 50%, which favors the bulls. The Gold Miners...

READ MORE

MEMBERS ONLY

SPY Holds Breakout as QQQ Leads Market Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

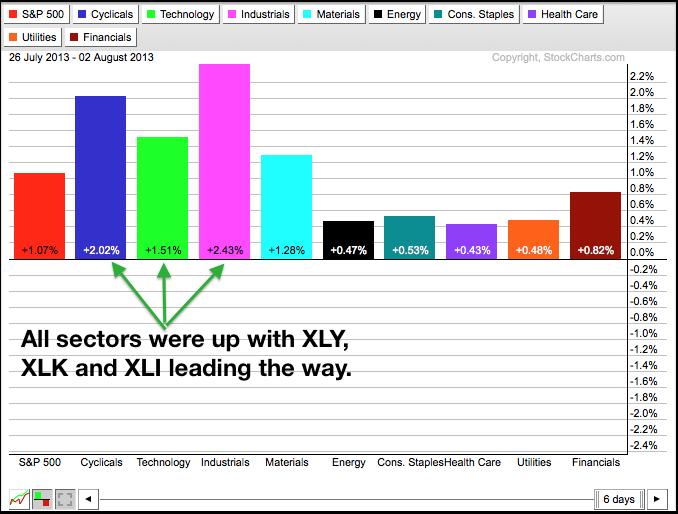

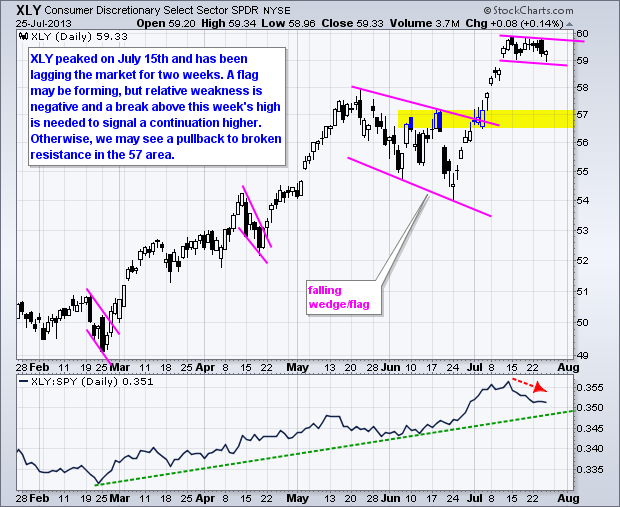

It was a good week for the stock market. The major index ETFs gained and hit fresh 52-week highs. The Nasdaq 100 ETF (QQQ) and S&P MidCap 400 SPDR (MDY) led the way with 2+ percent gains. All sectors were up with the Consumer Discretionary SPDR (XLY) and...

READ MORE

MEMBERS ONLY

Key Breadth Indicators Confirm Underlying Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major stock indices recorded 52-week highs this week and these highs were confirmed by the breadth indicators for the S&P 1500. Note that the S&P 500, S&P MidCap 400, S&P SmallCap 600, Nasdaq 100 and Dow Industrials recorded fresh 52-week highs...

READ MORE

MEMBERS ONLY

Elder Bars Turns Green as ARIA Breaks Flag Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking for stocks on the move can turn to our pre-defined scans page and the Elder bar scans. Stocks with an Elder bar turning green are turning up. Those with an Elder bar turning red are turning down. The chart below shows Ariad Pharma with a big green Elder...

READ MORE

MEMBERS ONLY

Nasdaq Scores with New Highs in AD Line and AD Volume Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs affirmed their uptrends with new highs this week. In addition, the Consumer Discretionary SPDR (XLY) and the Industrials SPDR (XLI) hit new highs, as did the Nasdaq AD Line and AD Volume Line. There are simply no signs of weakness in the market right now. Breadth...

READ MORE

MEMBERS ONLY

SPY Hits 52-week High as TLT Hits 52-week Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved higher on positive economic news, and bonds moved lower. The ISM Manufacturing Index rose to 55.40, which is a two year high. Initial jobless claims fell to 326,000, which is the lowest level since January 2008. Stocks took the news well with the major index ETFs...

READ MORE

MEMBERS ONLY

S&P MidCap 400 SPDR Takes the Lead with a New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged after Fed day with the S&P MidCap 400 SPDR (MDY) hitting a new high early Thursday. The indicator window shows the price relative (MDY:SPY ratio) hitting a new high as well. Notice that the ETF's Technical Rank (SCTR) has been above 70 the...

READ MORE

MEMBERS ONLY

QQQ Leads with New High - GLD Forms Bullish Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were all over the place on Wednesday, but the overall range was relatively small and the day-to-day change was miniscule. Stocks surged immediately after the Fed statement, peaked at 3PM and moved lower the final hour. I am not going to read too much into this late decline because...

READ MORE

MEMBERS ONLY

Charts of Interest: ATML, CHS, FST, NVDA, SWKS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ATML Forms Continuation Pattern.

CHS Show Signs of Accumulation.

Plus FST, NVDA and SWKS

***Video edition is at the end***

iPad and iPhone Version

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF...

READ MORE

MEMBERS ONLY

Dow and Nasdaq Hit New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

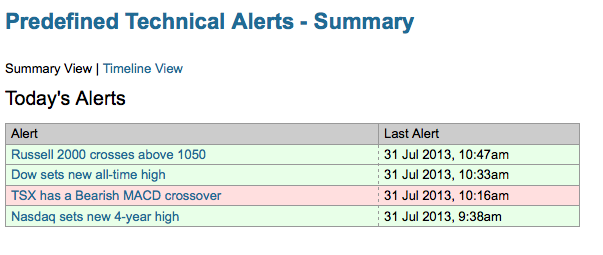

Even though stocks were all over the place on Wednesday, the Dow recorded an all time high and the Nasdaq recorded a four year high. Not shabby at all. StockCharts users can keep abreast of these milestones on the Predefined Technical Alerts page.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

Stocks, Bonds, the Dollar and Gold Await the Fed

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks meandered again on Tuesday. Large techs caught a modest bid with the Nasdaq 100 ETF (QQQ) advancing .70% on the day. The remaining moves were non events. The sectors were mixed with the Technology SPDR (XLK), Industrials SPDR (XLI) and Utilities SPDR (XLU) finishing modestly higher. The Basic Materials...

READ MORE

MEMBERS ONLY

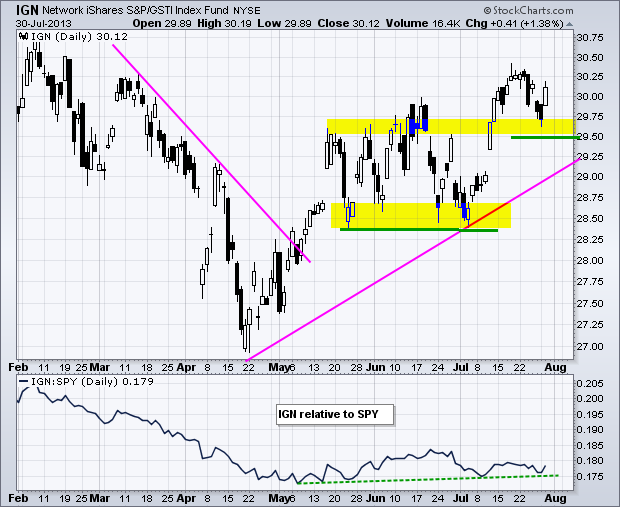

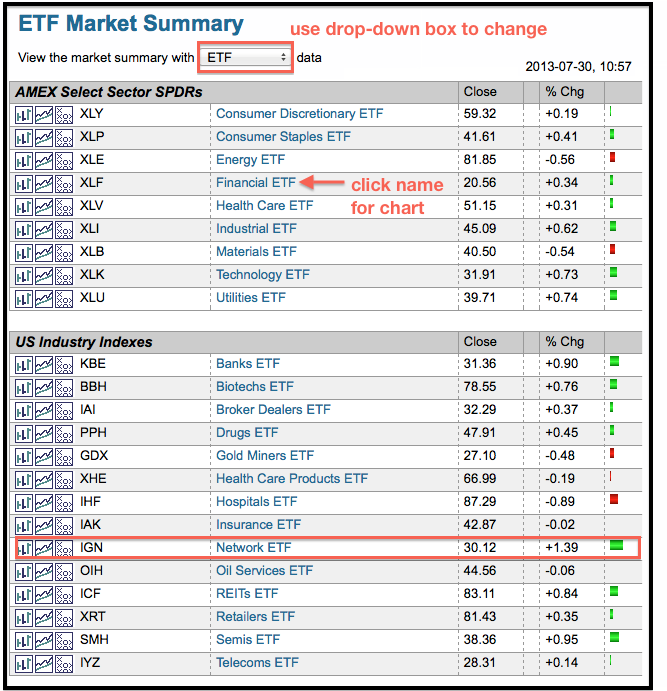

Networking iShares Leads Industry Group ETFs on Market Summary Page

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Market Summary (ETF mode) provides a quick overview of performance for groups of ETFs. These include broad market, sector, industry group, international, bond, commodity and currency ETFs. Within the industry group ETFs, the Networking iShares (IGN) is leading with a 1+ percent gain in early trading on Tuesday.

Click...

READ MORE

MEMBERS ONLY

SPY Extends Consolidation - MOO Bounces on Good Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks edged lower on Monday with the Russell 2000 ETF (IWM) leading the way (-.70%). Losses were relatively small as selling pressure was contained. Seven of nine sectors were down with the Energy SPDR (XLE) leading the way lower (-.94%). The Basic Materials SPDR (XLB) and the Utilities...

READ MORE

MEMBERS ONLY

Charts of Interest: ADSK, AMKR, FSLR, PBI, R, WTW

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ADSK Hits Resistance at Retracement Zone.

AMKR Corrects with Small Wedge.

Plus FSLR, PBI, R, WTW

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for...

READ MORE

MEMBERS ONLY

Bearish Resistance Line Holds on Alcoa P&F Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

StockCharts gives users the power to chart intraday P&F charts with trend lines. In this example, the 60-minute P&F Chart shows Alcoa (AA) breaking the Bullish Support Line in June (red 6) and moving to new lows. The July bounce carried the stock to the Bearish...

READ MORE

MEMBERS ONLY

SPY and IWM Hold Consolidates ahead of Big Economic Week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs remain in short-term uptrends, but these uptrends stalled over the last two weeks. While a consolidation after an advance is generally considered a bullish continuation pattern, relative weakness in the Consumer Discretionary SPDR (XLY) and Technology SPDR (XLK) is a concern. The PerfChart below shows XLY...

READ MORE

MEMBERS ONLY

Technology Market Carpet Separates Winners from Losers

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

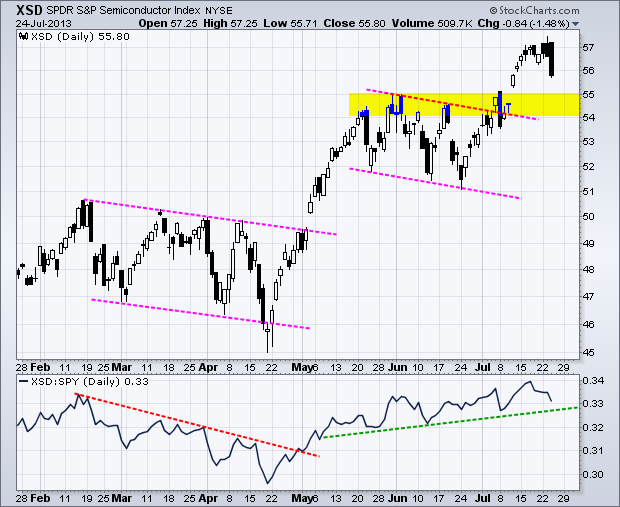

It was a rough two weeks for tech stocks as Broadcom (BRCM), AMD (AMD), Microsoft (MSFT) and Seagate (STX) led the way lower with double digit losses. Micrsoft, Google and Ebay weighed on the sector because they have relatively large market caps. Note that this market carpet is set in...

READ MORE

MEMBERS ONLY

Bulk of the Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks may be overbought after big moves since late July, but we have yet to see signs of material selling pressure. In fact, we have yet to see even modest selling pressure. There are some pockets of weakness as homebuilders and big techs underperform the broader market. Nevertheless, the bulk...

READ MORE

MEMBERS ONLY

IWM and SPY Stall above Short-term Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs ended the day higher, but gains were mixed with some pockets of weakness in the market. Small-caps led the way as the Russell 2000 ETF (IWM) gained almost 1%. The Dow Industrials SPDR (DIA), however, only gained .01% and the S&P 500 ETF (SPY)...

READ MORE

MEMBERS ONLY

Rising Treasury Yields may be Affecting the Homebuilders

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 10-year Treasury Yield ($TNX) surged from 1.6% to 2.6% and then consolidated for a few weeks. Yields could be starting another leg up as $TNX bounces off support this week. This is having a negative impact on homebuilders. Notice that the correlation between the 10-year Treasury Yield...

READ MORE

MEMBERS ONLY

Treasuries Break Down as Dollar Firms Near Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mostly lower on Wednesday with small-caps leading the way. The Russell 2000 ETF (IWM) lost around .83% and the S&P 500 ETF (SPY) lost around .37%. Techs were mixed with the Nasdaq 100 ETF (QQQ) adding .32% and the Nasdaq 100 Equal-Weight ETF (QQEW) losing .63%...

READ MORE

MEMBERS ONLY

Charts of Interest: ARO, ARUN, CHRW, FAST, X

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ARO Stalls with Possible H&S Looming.

ARUN Hits Key Retracement with Wedge Pattern.

Plus CHRW, FAST, X

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need...

READ MORE

MEMBERS ONLY

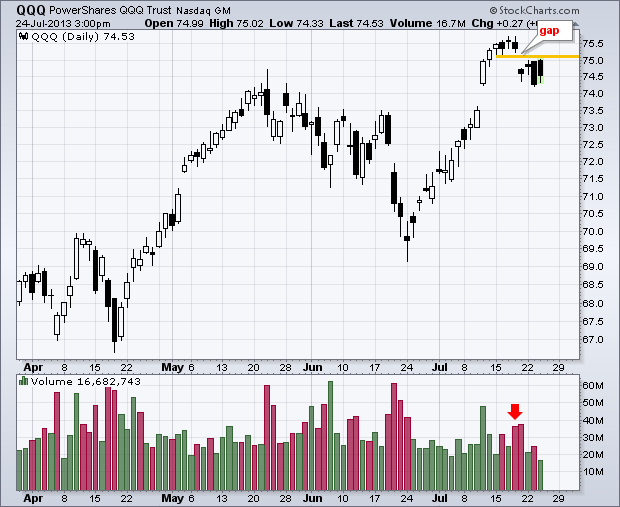

QQQ Hits Resistance at Gap Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) got a lift from Apple on Wednesday, but could not hold its early gains as sharp losses in Broadcom (BRCM) and Panera Bread (PNRA) weighed. The chart below shows QQQ gapping down last week and holding this gap the last four days. Notice that the...

READ MORE

MEMBERS ONLY

SPY and IWM Hold Uptrends - UUP Sinks Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks meandered again on Tuesday with the Dow Industrials SPDR (DIA) closing slightly higher and the S&P 500 ETF (SPY) edging lower. Large techs were under pressure ahead of Apple earnings as QQQ fell around 3/4 of a percent. Apple moved higher after hours and may provide...

READ MORE

MEMBERS ONLY

Home Construction iShares Battles to Hold the Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Home Construction iShares (ITB) broke out with a gap in mid July and this breakout is still holding. The ETF pulled back into the gap zone, but never completely filled the gap to negate the breakout. The indicator window shows RSI moving into the 50-60 zone and stalling. A...

READ MORE

MEMBERS ONLY

QQQ Holds Support Break ahead of Apple Earnings

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks meandered in quiet trading on Monday. The Dow Industrials SPDR (DIA) lost a fraction, while the S&P 500 ETF (SPY) gained a fraction. SPY and IWM remain in short-term uptrends. QQQ is showing the most vulnerability with a support break last week. This support break is holding...

READ MORE

MEMBERS ONLY

Charts of Interest: AAP, AMX, NIHD, NVDA, VRSN

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAP Consolidates after Breakouts.

AMX Stalls at Range Resistance.

Plus NIHD, NVDA, VRSN

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it...

READ MORE

MEMBERS ONLY

Bollinger Bands Narrow as the Retail SPDR Consolidates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Retail SPDR (XRT) surged from late June to mid July and then embarked on a rather narrow consolidation. Notice that the ETF traded between 80.3 and 81.6 since July 11th. The overall trend is up, and this favors an upside breakout or continuation higher. Adding a little...

READ MORE

MEMBERS ONLY

SPY and IWM Break Consolidation Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the week in strong uptrends and short-term overbought conditions after big gains the prior three weeks. This did not deter buyers as the S&P 500 ETF (SPY) and the Russell 2000 ETF (IWM) broke consolidation resistance levels mid week. The Nasdaq 100 ETF (QQQ) was hit...

READ MORE

MEMBERS ONLY

Small-caps Lead the Way and Outperform Large-caps

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 ($RUT) is leading the market higher with a breakout on July 8th and a series of 52-week highs the last two weeks. This key small-cap index was one of the first of the major indices to break above its May high. Even though the index is looking...

READ MORE

MEMBERS ONLY

HealthCare and Industrials Join the New High Club

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Discretionary SPDR (XLY) and the Finance SPDR (XLF) were the first two sectors to reach 52-week highs this month. With big moves over the last few days, the Healthcare SPDR (XLV) and the Industrials SPDR (XLI) join the club. Chart-wise, new highs make these four sectors among the...

READ MORE

MEMBERS ONLY

Net New Highs Surge as Indicator Summary Gets Upgrades

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With big moves over the last three weeks, the indicator summary improved since its last tally (21-June). The AD Volume Lines hit new highs, the Nasdaq AD Line hit a new high and Net New Highs surged. The finance and consumer discretionary sectors are leading the nine sectors. Even though...

READ MORE

MEMBERS ONLY

Techs UnderPerform Market and Could Weigh on QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Big tech misses are weighing on the market as stock futures trade modestly lower after hours. Both Google and Microsoft missed on their revenue estimates. Even though the short-term and long-term trends for the market are up, stocks are overbought after big moves the last 3-4 weeks and these misses...

READ MORE