MEMBERS ONLY

Stocks Get Oversold Bounce within Correction

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks caught a bid on Thursday as the major index ETFs advanced over 1% on the day. A better-than-expected retail sales report put stocks on a positive footing from the start and they extended their advance throughout the day. There is also talk that the Fed will start jawboning down...

READ MORE

MEMBERS ONLY

Two Technical Features Suggest Support for the Homebuilders SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Homebuilders SPDR (XHB) is finding support with a bounce last week and small gain in early trading on Thursday. Notice that the ETF is trading near the November trend line and the 61.80% retracement. These two items suggest support is at hand. A break above last week'...

READ MORE

MEMBERS ONLY

Charts of Interest: ANF, BHI, FL, IBM, MMM, NEM, URBN

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ANF Forms Island Reversal.

BHI Gaps Down and Tests Support.

Plus FL, IBM, MMM, NEM, URBN

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for...

READ MORE

MEMBERS ONLY

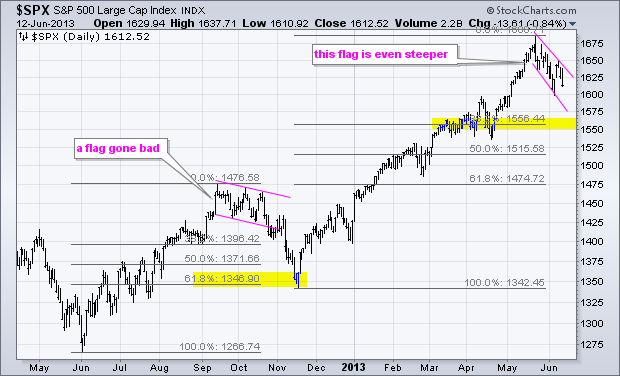

Setting a Fibonacci and Support Target for the S&P 500 $SPX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Asian rout continues as the Shanghai Composite ($SSEC) caught up with a 2.83% decline on Thursday. The Hang Seng Index ($HSI) fell another 2.3% and the Nikkei 225 ($NIKK) plunged over 6%. European stocks are also down with the major indices falling around 1% in early trading...

READ MORE

MEMBERS ONLY

Treasury Bond ETFs Forge Intraday Reversals

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 7-10 year T-Bond ETF (IEF) opened weak and closed strong on Tuesday to forge an outside reversal day or bullish engulfing pattern. This is potentially positive, but we have yet to see follow through with a break above first resistance at 105. Also notice that the Commodity Channel Index...

READ MORE

MEMBERS ONLY

SPY and SPX AD Volume Line Fail at Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak, got a pretty nice bounce and then turned lower to close weak. The major index ETFs were down around 1%. All sectors were down with the Energy SPDR (XLE) and Basic Materials SPDR (XLB) leading the way. Weakness in these two can be attributed to declines in...

READ MORE

MEMBERS ONLY

Regional Bank SPDR Challenges Flag Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a bounce after the open on Tuesday, the Regional Bank SPDR (KRE) is showing resilience as it challenges flag resistance. Notice how the ETF surged from mid April to mid May and then corrected with the falling zigzag (flag). A breakout at 33.25 would signal a continuation higher....

READ MORE

MEMBERS ONLY

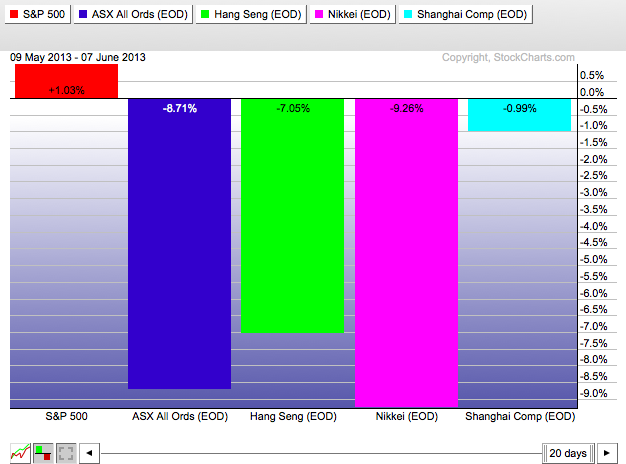

Asian Shares Get Hammered as SPY Hits Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

US stocks are actually looking vulnerable on the charts as the major index ETFs stall near resistance levels and key retracements. Also note that Asian stocks were weak on Tuesday with the Shanghai Composite ($SSEC), Hang Seng Index ($HSI) and Nikkei 225 ($NIKK) falling over 1%. Emerging stock markets were...

READ MORE

MEMBERS ONLY

Charts of Interest: AAPL, AEO, COST, FCX, MHK, VLO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Battles Resistance after Announcements.

AEO Forms Bear Flag.

Plus COST, FCX, MHK, VLO

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when...

READ MORE

MEMBERS ONLY

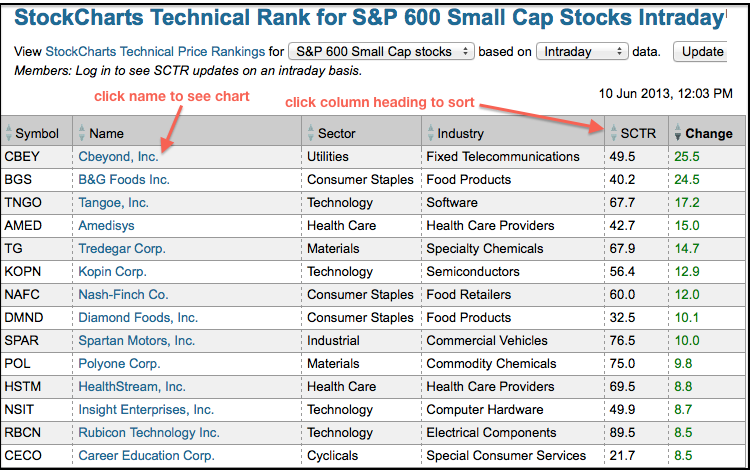

Cbeyond Shows Relative Strength on Small-cap SCTR Table

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

StockCharts Technical Rank (SCTR) for the S&P SmallCap 600 ($SML) ranks 600 small-cap stocks according to their technical strength. Chartists can also sort this table by change to find the bigger (relative) movers. Cbeyond (CBEY), B&G Foods (BGS) and Tangoe Inc (TNGO) are leading today with...

READ MORE

MEMBERS ONLY

SPY, QQQ and IWM Challenge Short-Term Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks reacted positively to a rather routine employment report. The Labor department reported a 175,000 increase in non-farm payrolls for May. This is the not-to-hot and not-to-cold version of the jobs report. It is enough to suggest modest economic growth and keep the hopes alive for sustained quantitative easing....

READ MORE

MEMBERS ONLY

QQQ Follows Thru on High Volume Hammer

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) fell below 72 on Thursday, but rallied to forge a strong close and form a hammer. Also notice that volume surged to its highest in over three months. QQQ followed through with a gap and move above 73, but has yet to break flag resistance...

READ MORE

MEMBERS ONLY

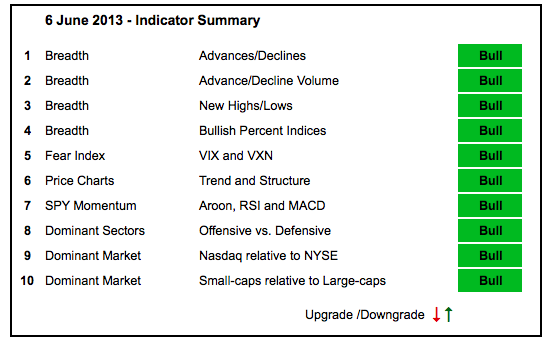

Correction Pushes 3 Indicators to Make-or-Break Points

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The market is hitting its first make-or-break point. The bulk of the evidence remains bullish and this decline is still considered a correction within a bigger uptrend. The current decline, however, has extended long enough to push some indicators to the brink though. NYSE Net New Highs have been flirting...

READ MORE

MEMBERS ONLY

SPY Bounces off First Support as USO Hits Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

And now for the employment report. Here's the thing with these big reports. Traders have to get two things right to successfully trade the report. First, you have to guess the non-farm payroll number. Second, you have to guess the market's reaction. The report can be...

READ MORE

MEMBERS ONLY

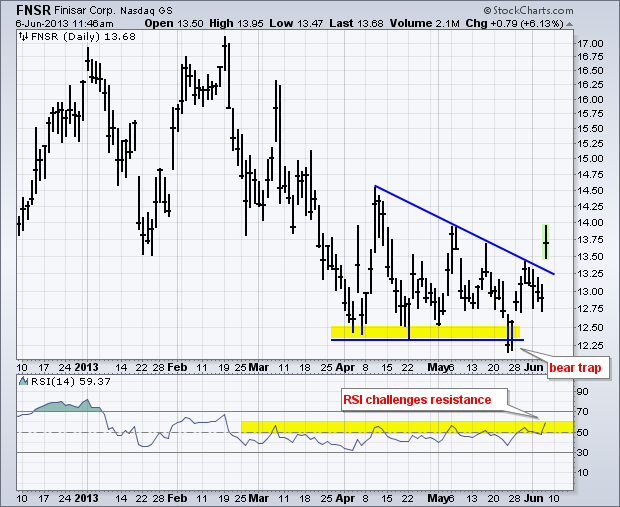

Finisar Makes the Gap Scan with a Surge Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Finisar (FNSR) has had a tough year so far, but the stock is showing signs of life after a bear trap in late May (failed support break) and gap breakout in early June. Also notice that RSI is challenging range resistance and a breakout at 60 would be bullish for...

READ MORE

MEMBERS ONLY

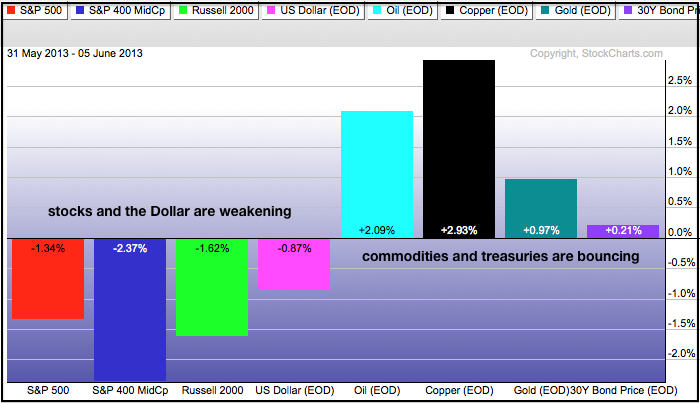

Stocks Extend Correction - Weak Dollar Helps Commodities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was a sea of red on Wednesday as the major index ETFs extended their declines and all nine sectors fell. That's the bad news. The good news, perhaps, is that the stock market is short-term oversold now. The upcoming employment numbers represent the uncertain news. The economic...

READ MORE

MEMBERS ONLY

Charts of Interest: BBRY, DE, IMAX, KBH, MWV, PKI

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BBRY Tests Channel Support with Bounce.

DE Breaks Flag Support.

Plus IMAX, KBH, MWV, PKI

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves...

READ MORE

MEMBERS ONLY

Target Fills Gap after Shooting Star

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Target (TGT) surged to a new high above 72, but failed to hold above 72 as a shooting star candlestick formed on Tuesday. The stock went on to fill Tuesday's gap with a long filled candlestick on Wednesday. This confirms the shooting star and resistance in the 71-72...

READ MORE

MEMBERS ONLY

GLD Tests Rising Wedge Support - USO Forms Small Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were all over the place on Tuesday. The major index ETFs opened stronger, moved lower during the day and bounced in the afternoon. Despite this bounce, the major index ETFs closed lower with the Russell 2000 ETF (IWM) leading the way (-1.06%). All sectors were lower with the...

READ MORE

MEMBERS ONLY

Facebook Lags, but Support Could be Near

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Facebook (FB) led the market from late October until early January, but stumbled in January and has lagged the S&P 500 since. Despite relative weakness and a 4-5 month downtrend, support could be near as the stock trades near the 61.80% retracement and broken resistance.

Click this...

READ MORE

MEMBERS ONLY

IWM Holds Up Best with a Pennant Formation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak, but firmed and rebounded in the afternoon. The major index ETFs finished mixed on the day with the S&P MidCap 400 SPDR (MDY) falling .34% and the Russell 2000 ETF (IWM) rising .95% on the day. Wow, you don't see that very often....

READ MORE

MEMBERS ONLY

Charts of Interest: AMCC, ASEI, CAT, ISRG, JBLU, NIHD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMCC Makes a Move with Good Volume.

ASEI Tests Support with Long Lower Shadow.

Plus CAT, ISRG, JBLU, NIHD

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need...

READ MORE

MEMBERS ONLY

All Ords Index Breaks Key Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Weakness is spreading in Asia as the Australian All Ords Index ($AORD) breaks support from the April lows. The chart below shows the index testing support last week. $AORD closed at 4873 on Monday, which is just below the April lows. Also notice that the index has been underperforming the...

READ MORE

MEMBERS ONLY

SPX AD Volume Line Breaks Support - SPY Breaks Triangle

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs closed lower as stocks were hit with some pretty strong selling pressure Friday afternoon. The S&P 500 ETF (SPY) led the way with a 1.44% decline. All sectors were down with the Healthcare SPDR (XLV), Consumer Staples SPDR (XLP) and Utilities SPDR (XLU)...

READ MORE

MEMBERS ONLY

US Dollar Index Tests Breakout ahead of Big Economic Week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The US Dollar Index ($USD) is in a long-term uptrend, but the index pulled back this week to test the most recent breakout. A strong breakout should hold, while a weak breakout would fold. This is am important test for the greenback as we head into a big economic reporting...

READ MORE

MEMBERS ONLY

Randgold Forges a Double Top Breakout on P&F Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gold stocks remain down in the dumps and in long-term downtrends, but signs of short-term strength are emerging. Randgold (GOLD) formed a higher low in May and the current X-Column broke above the prior X-Column to forge a P&F breakout. This breakout, however, is still below the Bearish...

READ MORE

MEMBERS ONLY

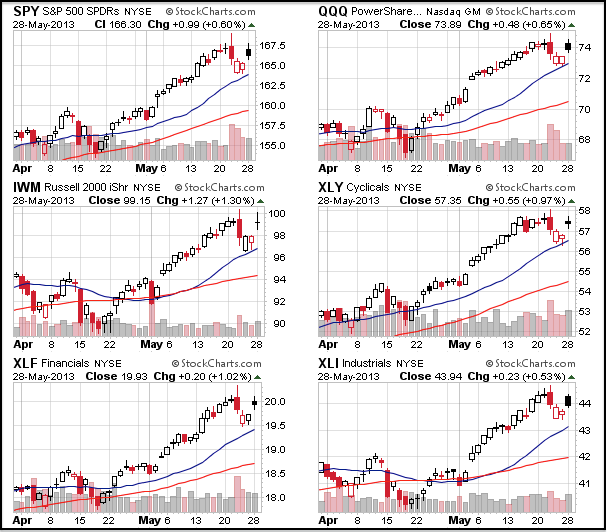

Nasdaq AD Volume Line Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After hitting new highs in mid May, the major index ETFs moved into consolidation patterns the last two weeks. A little rest, or even a pullback, would be healthy for the uptrend. With this sideway movement, there is no change in the indicator summary. Of note, the Nasdaq is showing...

READ MORE

MEMBERS ONLY

SPY AD Volume Line Holds the Short-Term Key

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved higher again on Thursday with mid-caps leading the way. The overall gains were modest though and the major index ETFs remain below Tuesday's highs. The Finance SPDR (XLF) led the sectors here with a 1.2% gain on the day. The Technology SPDR (XLK) and Industrials...

READ MORE

MEMBERS ONLY

Nikkei 225 Hits First Support with another 5+ Percent Decline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

For the second Thursday in a row, the Nikkei 225 ($NIKK) fell over 5% and extended its correction. While the decline from 15900 looks dramatic, it is still just a correction within a bigger uptrend and pales in comparison to the prior surge. The November trend line and broken resistance...

READ MORE

MEMBERS ONLY

Charts of Interest: AAPL, ABX, HCA, JDSU, WNR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Stalls Just below Neckline Resistance.

ABX Breaks Trend Line with Good volume.

Plus HCA, JDSU and WNR

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to...

READ MORE

MEMBERS ONLY

SPY Fails to Hold Gap - GLD Continues to Firm

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks weakened on Wednesday with the defensive sectors leading the way down. The Consumer Staples SPDR (XLP), Healthcare SPDR (XLV) and Utilities SPDR (XLU) declined 1.5% or more. Interest rate sensitive stocks continued to slide with the Real Estate iShares (IYR) and Telecom iShares (IYZ) falling around 2%. Homebuilders...

READ MORE

MEMBERS ONLY

SPY and QQQ Gap, but Turn Indecisive after Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks got their pop with a strong surge on the open. Even though stocks closed higher, I was not impressed with post-gap price action. In addition, notice that indecisive candlesticks formed in a number of stocks and ETFs. The charts below show SPY and QQQ forming small black candlesticks with...

READ MORE

MEMBERS ONLY

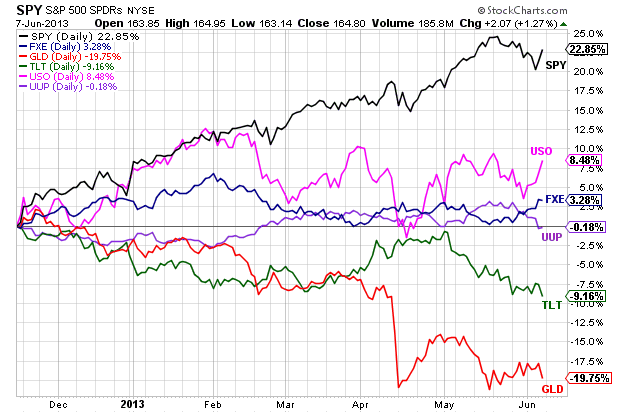

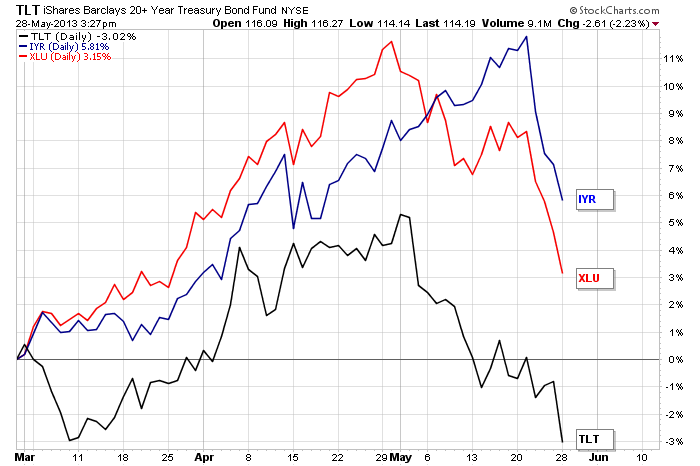

REITs, Utilities and Treasuries Fall Off a Cliff

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Utilities SPDR (XLU) and the 20+ Year T-Bond ETF (TLT) both peaked in early May and declined sharply the last four weeks. The Real Estate iShares (IYR) continued higher into mid May, but peaked last week and fell sharply the last four days. Interest rate sensitive issues are not...

READ MORE

MEMBERS ONLY

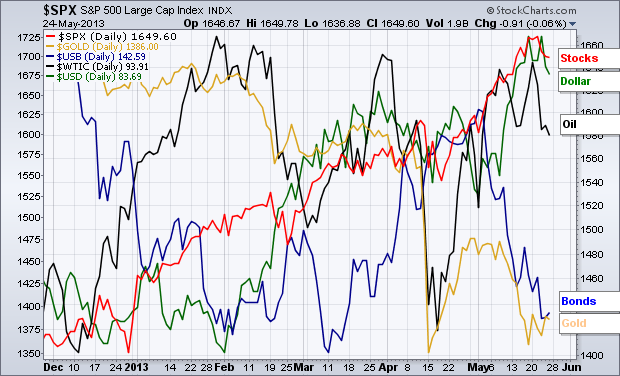

SPY Bounces after Weak Opens - TLT Remains Weak

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks and the Dollar are in uptrends, while Treasuries and gold remain in downtrends. Stocks pulled back on Wednesday and opened weak on both Thursday and Friday. However, buyers stepped in after these weak openings and stocks closed off their lows on both days. The bulls still have the edge...

READ MORE

MEMBERS ONLY

Charts of Interest: AMGN, BSBR, FAST, MOS, IPI

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMGN Corrects with Falling Wedge.

FAST Surges and Consolidates.

Plus BSBR, MOS IPI

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it...

READ MORE

MEMBERS ONLY

Three Fan Lines Take Shape on the Spot Light Crude Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Spot Light Crude ($WTIC) has been quite volatile the last few weeks with two declines from the 97 area and two bounces off the 92 area. It is possible to draw three trend lines extending up from the mid April low. The mid May lows and third fan line mark...

READ MORE

MEMBERS ONLY

Midweek Pullback is not Enough to Affect Bigger Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with a reversal day on Wednesday, but this was not enough to affect the bigger uptrends. The AD Lines and AD Volume Lines hit new highs just before the reversal day. Net New Highs remain strong and the offensive sectors are leading again. Despite this bullish environment,...

READ MORE

MEMBERS ONLY

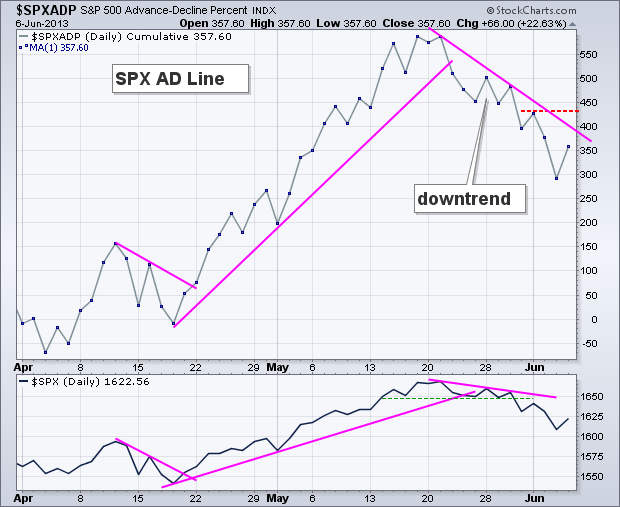

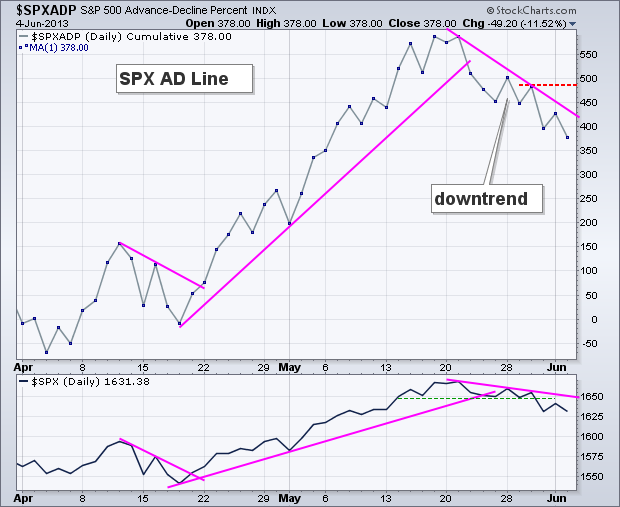

S&P 500 AD Line Breaks Short-Term Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks plunged on Wednesday and firmed somewhat on Thursday. Even though the medium-term trends remain up, the short-term uptrends are in jeopardy and stocks are still ripe for a correction. A correction can form as a sideways consolidation, a decline or as a combination of the two (think zigzag lower)...

READ MORE

MEMBERS ONLY

Lumber Prices Plunge, but Housing Stocks Remain Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

An interesting divergence is brewing between lumber and housing stocks. Lumber Futures ($LUMBER) fell around 25% the last two months, but the Home Construction iShares (ITB) hit a 52-week high recently. Something may need to give because lumber and housing stocks are positively correlated for the most part.

Click this...

READ MORE

MEMBERS ONLY

IWM Breaks Channel Trend Line - USO Breaks Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks finally got spooked as the bulls pulled in their horns and the bears showed their claws. The market opened strong and moved higher in early trading, but quickly reversed and moved sharply lower. The Fed got the blame as investors contemplated an end to quantitative easing. Frankly speaking, an...

READ MORE