MEMBERS ONLY

Charts: AAN, BBRY, BTU, CHH, FCX, FDX, SYMC, XME

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAN Fails to hold Breakout.

BBRY Underperforms the Market.

Plus BTU, CHH, FCX, FDX, SYMC, XME

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for...

READ MORE

MEMBERS ONLY

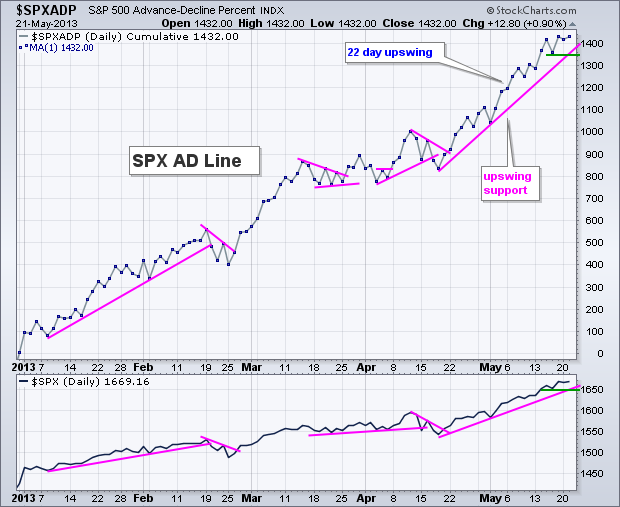

SPX AD Line and AD Volume Line Extend Uptrends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The advance may be slowing, but stocks continue to grind higher. The major index ETFs finished with small gains as the Russell 2000 ETF (IWM) gained .02% and the S&P 500 ETF (SPY) advanced .14%. The sectors were mixed with the Technology SPDR (XLK) edging lower and the...

READ MORE

MEMBERS ONLY

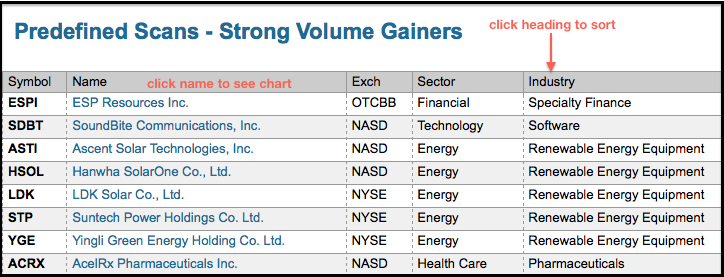

Solar Stocks Dominate the Scan for Big Volume Gainers

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Solar stocks are on the move today and volume is increasing in several names. The image below comes from the "strong volume gainers" scan on the pre-defined scans page. Click any of the headings to sort this table. There are five solar-related stocks making the cut.

Click this...

READ MORE

MEMBERS ONLY

QQQ Holds Small Channel as SPY Holds Flag Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks edged higher in the morning and lower in the afternoon. As a result, the major index ETFs finished mixed on the day with the Russell 2000 ETF (IWM) closing slightly higher and the Dow Industrials SPDR (DIA) closing slightly lower. The Energy SPDR (XLE) led the sectors with a...

READ MORE

MEMBERS ONLY

Charts of Interest: ANF, BSBR, FDX, FNSR, STLD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BSBR Gets Set for another Go at Resistance.

FDX Breaks Pennant Resistance.

Plus ANF, FNSR, STLD

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for...

READ MORE

MEMBERS ONLY

Oil & Gas Equipment/Services SPDR Surges to 52-week High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Energy related stocks are catching a bid as Spot Light Crude ($WTIC) challenges the $97. The chart below shows the Oil & Gas Equipment/Services SPDR (XES) breaking flag resistance and hitting a 52-week high on Monday. The flag zone now turns into support.

Click this image for a live...

READ MORE

MEMBERS ONLY

Channels Extend for SPY and QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are simply no sellers out there. We can argue about low volume levels, the artificial Fed affect and lackluster economic data, but there are clearly more buyers than sellers in the stock market and stocks are rising. Admittedly, stocks are getting quite overextended again and ripe for a rest....

READ MORE

MEMBERS ONLY

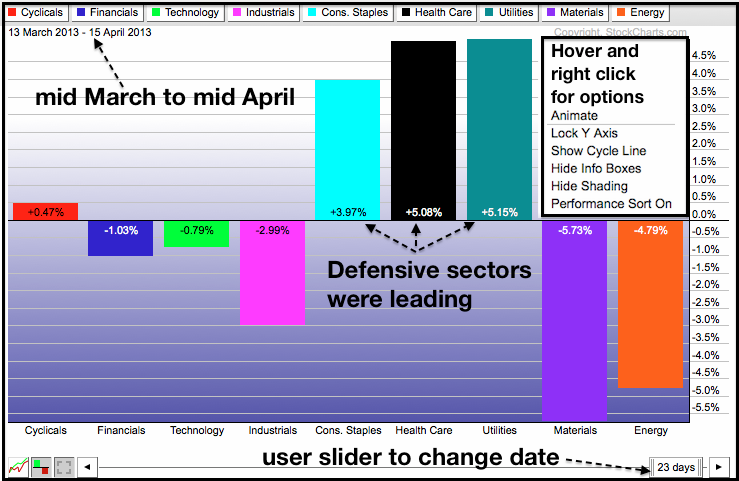

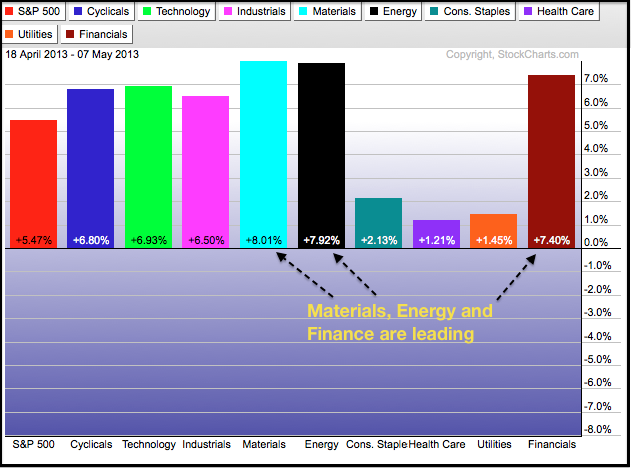

PerfCharts Show the Tectonic Shift from Defense to Offense

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There were concerns a month ago when the defensive sectors were leading the market, but this changed as the offensive sectors took control over the past month. The defensive sectors include healthcare, consumer staples and utilities. The offensive sectors include technology, consumer discretionary, industrials and financials. Chartists can use PerfCharts...

READ MORE

MEMBERS ONLY

Dollar and Stocks Lead in the Inter-market Arena

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks and the Dollar are performing well as both trade near six month highs. This strength is at the expense of Treasuries and gold, which are trading well below their November levels. The US Dollar Index ($USD) is trading at its highest levels since last summer. Spot Gold ($GOLD) has...

READ MORE

MEMBERS ONLY

AD Lines and AD Volume Lines Hit New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the indicator summary as stocks extended their gains again this week. The AD Lines and AD Volume Lines hit new highs. Net New Highs remain firmly positive. Momentum is bullish, if not short-term overbought. However, as we have seen since mid November, the term overbought...

READ MORE

MEMBERS ONLY

XHB Forms Bearish Engulfing as Treasuries Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were trading flat most of the day, but got hit with selling pressure in the final hour. As a result, the major index ETFs closed modestly lower. The S&P MidCap 400 SPDR (MDY) and S&P 500 ETF (SPY) fell around .50% on the day. Eight...

READ MORE

MEMBERS ONLY

Cisco and Network Appliance Show Biggest Gains in StockCharts Technical Rank

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can view the StockCharts Technical Rank (SCTR) for stocks in the S&P 500, S&P SmallCap 600, S&P MidCap 400 and Toronto Stock Exchange. These ranks can be sorted by change to find the biggest movers. Simply click the column heading the sort. Cisco...

READ MORE

MEMBERS ONLY

Charts of Interest: ALTR, ANN, BG, CIEN, EMC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ALTR surges and forms small flag.

ANN breaks wedge resistance with good volume.

Plus BG, CIEN and EMC.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to...

READ MORE

MEMBERS ONLY

SPY Hits Channel Trend Line - USO Breaks Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their uptrends with modest gains. All of the major index ETFs moved higher with the S&P MidCap 400 SPDR (MDY) and S&P 500 ETF (SPY) leading the way. Both were up just less than 1%. Eight of the nine sectors were up with only...

READ MORE

MEMBERS ONLY

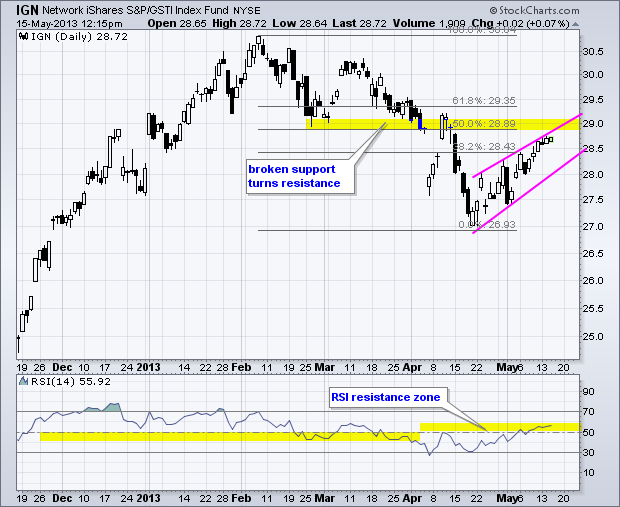

Networking iShares Hits Moment-of-truth of Truth as Cisco Looms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Networking iShares (IGN) moved lower from early February to mid April and then bounced the last five weeks. This bounce is forming a rising wedge and nearing broken support, which turns resistance. RSI is also in its resistance zone (50-60). Thus, the moment-of-truth of truth is near with Cisco...

READ MORE

MEMBERS ONLY

Plunge in Treasuries Fuels Stock Market Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged and closed strong with small-caps leading the charge. All of the major index ETFs were up, but the Nasdaq 100 ETF (QQQ) and Nasdaq 100 Equal-Weight ETF (QQEW) lagged with relatively small gains (less than .50%). Apple was down sharply and weighed on QQQ. Relative strength in small-caps...

READ MORE

MEMBERS ONLY

Bounce in Commodities Weighs on Treasuries

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

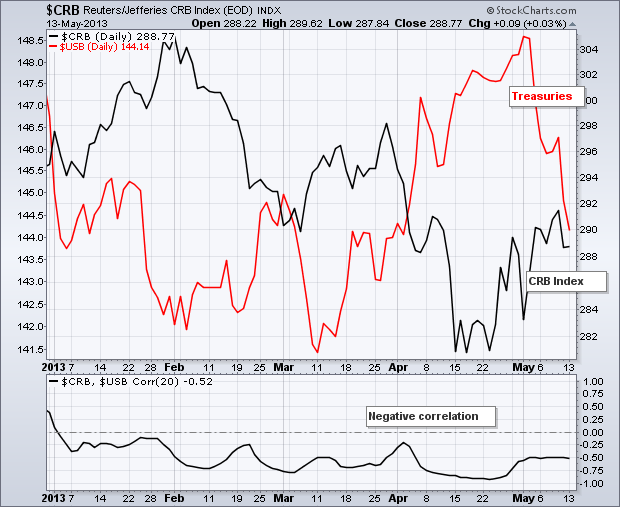

The overall trend for the CRB Index ($CRB) is down this year, but the index bounced back above 288 this month. It looks like a strong jobs report and rebound in commodities was more than Treasuries could take as the 30-Year US Treasury ($USB) fell over 4% this month. Notice...

READ MORE

MEMBERS ONLY

Charts of Interest: ABC, FLIR, HPQ, PG, T

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ABC Forms Bear Flag.

FLIR Traces out Rising Wedge.

Plus HPQ, PG, T

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it...

READ MORE

MEMBERS ONLY

Dollar Holds Break-out as Gold Holds Break-Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

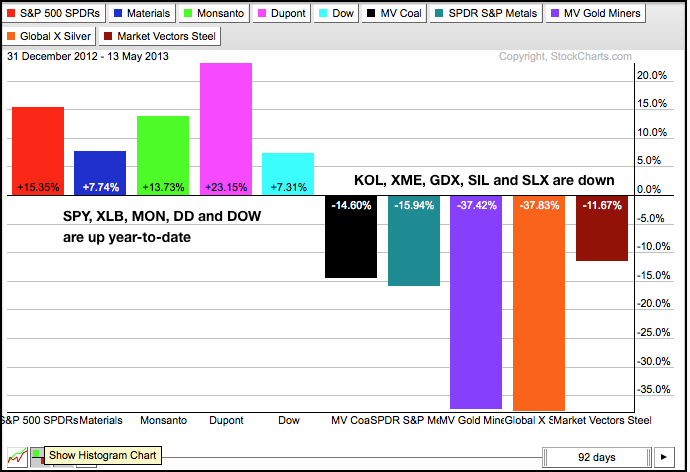

Stocks meandered on Monday as the major index ETFs finished the day mixed. The Russell 2000 ETF (IWM) and S&P 500 Equal-Weight ETF (RSP) edged lower, while the S&P 500 ETF (SPY) and Nasdaq 100 ETF (QQQ) finished slightly higher. The materials sector was hit as...

READ MORE

MEMBERS ONLY

PowerShares Energy Trust Leads Rebound in Commodity Trusts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

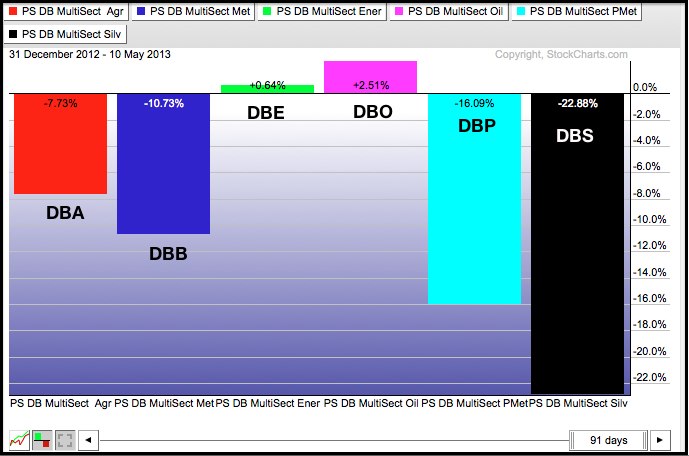

The chart below shows six commodity group ETFs from PowerShares. The Silver Trust (DBS) and Precious Metals Trust (DBP) are the weakest year-to-date, while the Energy Trust (PBE) and Oil Trust (DBO) the only ones with gains, albeit small gains. These year-to-date gains stem from strength in Natural Gas ($NATGAS)...

READ MORE

MEMBERS ONLY

Dollar Could Derail Bounce in Oil and Commodities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The intermarket picture is getting interesting with some big moves last week. First, stocks and oil have been moving higher since April 19th. The US Oil Fund (USO) is up almost 9%, while the S&P 500 ETF (SPY) is up just over 5%. Strength in these two helped...

READ MORE

MEMBERS ONLY

Percentage of S&P 500 Stocks above their 200-day Reaches Extreme

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 %Above 200-day SMA ($SPXA200R) is a breadth indicator that measures the degree of participation. The S&P 500 is trading near a 52-week high and over 90% of its components are above their 200-day moving average. This shows a high degree of participation and...

READ MORE

MEMBERS ONLY

Offensive Sectors Lead Major Index ETFs to New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It does not get more bullish than this, which may be a sign that things are getting too bullish. The AD Lines, AD Volume Lines, major index ETFs and offensive sectors all hit 52-week highs this past week. It is as if the bull market got back in sync as...

READ MORE

MEMBERS ONLY

Euro Tests Key Support Level as USO Consolidates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks took a little breather on Thursday as the major index ETFs edged lower. The losses were fractional, but the markets were clearly shaken by something in the afternoon. Rumors were swirling that the Fed may hint at changes to its quantitative easing program. This is believable because jobless claims...

READ MORE

MEMBERS ONLY

Defensive Sectors Run out of Gas

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) surged to new highs in May, but the defensive sectors did not go along for the ride. The CandeGlance charts below show the Healthcare SPDR (XLV), Consumer Staples SPDR (XLP) and Utilities SPDR (XLU) peaking in late April. XLP and XLV have traded...

READ MORE

MEMBERS ONLY

Charts: APOL, DNDN, FNSR, HSY, LAZ, WIN, WTW

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

APOL Holds Support after Pullback.

FNSR Fails to Hold Breakout and Forms Bearish Pattern.

Plus DNDN, HSY, LAZ, WIN, WTW

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all...

READ MORE

MEMBERS ONLY

GLD Surges to Resistance as FXE Bounces off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

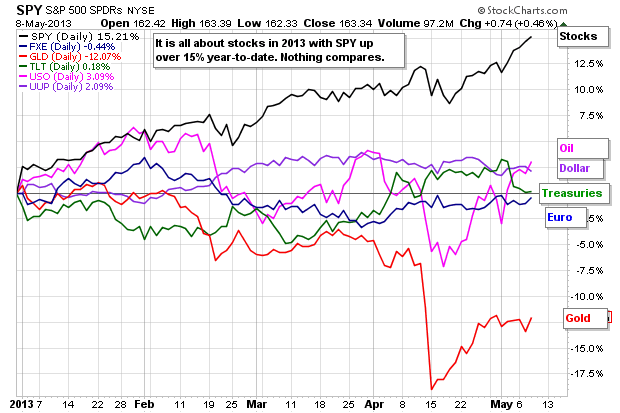

Stocks are the place to be, the only place to be. The performance chart below shows the S&P 500 ETF (SPY) up a whopping 15.21% year-to-date. 99.99% of fund managers would kill the other .01% for an annual return like this, not to mention a six...

READ MORE

MEMBERS ONLY

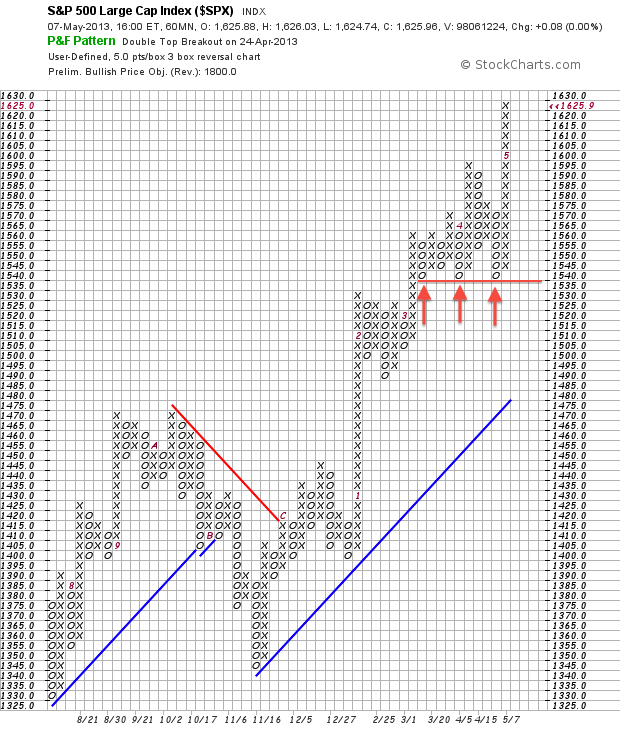

60-minute P&F Chart Shows Clear Support for S&P 500

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Point & Figure charts filter out the noise and ignore time to give chartists a clean look at price action. On the 60-minute P&F chart below, the S&P 500 bounced off the 1540 level three times since mid March. This is about as clear of a...

READ MORE

MEMBERS ONLY

Offensive Sectors Turn Leaders as Defensive Sectors Turn Laggards

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their gains on Tuesday with small-caps and mid-caps leading the way. The Nasdaq 100 ETF (QQQ) ended down and showed some relative weakness though. Techs were weighed down by networking and semis. The Networking iShares (IGN) fell 1.3% and the Semiconductor SPDR (XSD) was down .58% on...

READ MORE

MEMBERS ONLY

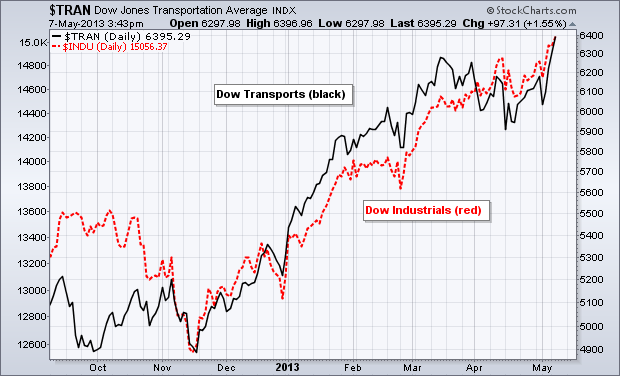

Dow Theory Affirms the Bull Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

According to Dow Theory, a bull signal is in force when both the Dow Industrials and Dow Transports move to new highs. Well, this happened today as both the Dow Industrials and Dow Transports forged fresh 52-week highs. The April lows become the first levels to watch for signs of...

READ MORE

MEMBERS ONLY

Charts of Interest: A, BOOM, EA, GCI, GT, JNS, NTAP, PG

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BOOM Firms in Key Retracement Zone.

EA Gaps above Wedge Resistance.

Plus A, GCI, GT, JNS, NTAP, PG

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to...

READ MORE

MEMBERS ONLY

GLD Form Flag within a Flag - UUP Holds Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their gains with mid-caps, small-caps and micro-caps leading the way. The Russell Microcap Fund (IWC) was up almost 1% on the day. The sectors were mixed with the defensive sectors on the, well, defensive. The healthcare, consumer staples and utilities sectors were all down on the day. The...

READ MORE

MEMBERS ONLY

Chinese Internet Stocks are on the Move BIDU SINA YOKU SOHU

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Three of the four Chinese internet stocks shown below broke resistance with surges over the last 1-2 weeks. SOHU hit a new high with a break above 50. SINA broke wedge resistance and then gapped up. YOKU broke resistance with a high volume surge to 20. BIDU is the laggard...

READ MORE

MEMBERS ONLY

UUP Turns Volatile after Surge - GLD Stalls Near Flag Trend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It seems that market sentiment has done a 180 over the last few weeks. The defensive sectors went from leaders to laggards as the Consumer Discretionary SPDR (XLY) and Technology SPDR (XLK) led the market higher. The March employment report was a big disappointment, but the April report showed improvement...

READ MORE

MEMBERS ONLY

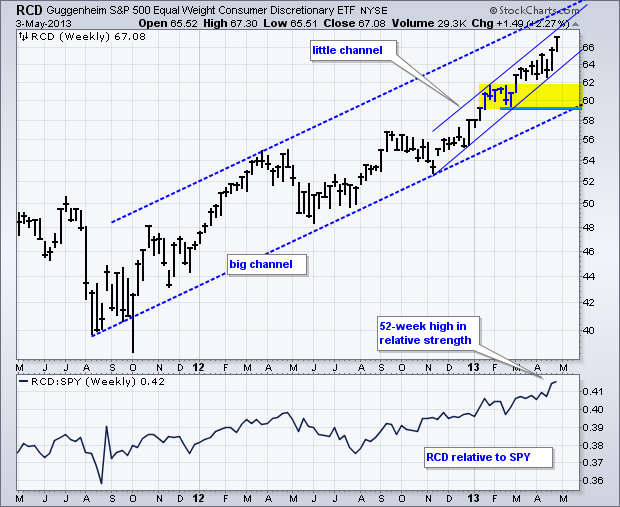

Consumer Discretionary and Retail Continue to Lead the Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Equal-weight Consumer Discretionary ETF (RCD) and the Retail SPDR (XRT) hit 52-week highs in price and relative strength this week. New highs and relative strength in these two groups is very positive for the market overall. As its name suggests, the consumer discretionary sector is the most economically sensitive...

READ MORE

MEMBERS ONLY

Nasdaq Outperforms NY Composite for First Time This Year

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq underperformed the NY Composite ($NYA) from September to January as the $COMPQ:$NYA ratio plunged for five months (yellow area). The ratio stabilized over the last few months, but the Nasdaq did not start outperforming until this week when the ratio broke above its January high. The Nasdaq...

READ MORE

MEMBERS ONLY

Bulk of the Technical Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks remain resilient both short-term and medium-term. SPY dipped in mid April, but surged in late April and hit a new high. The ETF also dipped on Wednesday, but surged to a new high on Thursday. With this rebound, the AD Volume Lines hit new highs and the cumulative Net...

READ MORE

MEMBERS ONLY

SPY Surges to New High as TLT Holds Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After getting spooked by the ADP Employment report on Wednesday, stocks greeted the five year low in Jobless Claims with a buying binge that pushed the S&P 500 ETF (SPY) above its April high. QQQ also erased Wednesday's low and hit a new high for 2013....

READ MORE

MEMBERS ONLY

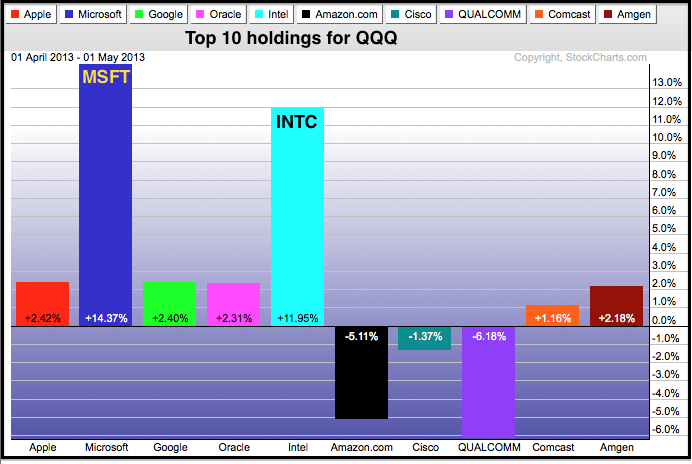

Microsoft and Intel Leave Google and Amazon in the Dust

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) sprang to life in April with the help of two unusual suspects. We would normally expect Google, Amazon or Apple to lead a big tech rally, but April saw the return of old tech as Microsoft and Intel stole the show. Both were up double...

READ MORE

MEMBERS ONLY

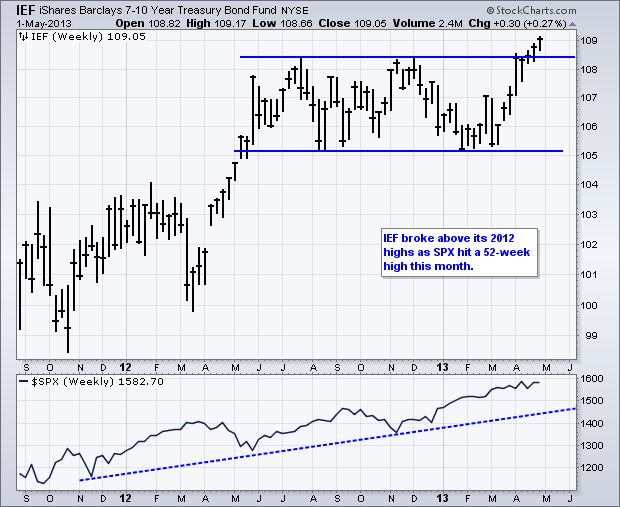

Small-Caps Underperform and Treasuries Break Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the day weak, ignored the Fed and finished the day weak. Small-caps led the way lower with the Russell 2000 ETF (IWM) falling over 2%. The Nasdaq 100 ETF (QQQ) held up the best with the smallest decline. Treasuries moved higher as economic reports continued to disappoint. The...

READ MORE