MEMBERS ONLY

Charts of Interest: APD, CSCO, CTAS, EL, MDP, STJ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

APD Shows Relative Weakness as Triangle Takes Shape.

CSCO Fails to Follow Microsoft and Intel Higher.

Plus CTAS, EL, MDP, STJ

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We...

READ MORE

MEMBERS ONLY

A Few Greenies in a Sea of Red as AMD Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market was down sharply on Wednesday, but there were a few big gainers. Chartists can spot the rebels by looking for green on the Sector Market Carpet. Today, we have AMD surging over 14% and T-Mobile (TMUS) advancing over 6%. Three of the top five gainers came from...

READ MORE

MEMBERS ONLY

TLT Consolidates ahead of FOMC - UUP Breaks April Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their gains with the Nasdaq 100 ETF (QQQ) and S&P MidCap 400 SPDR (MDY) leading the way on Tuesday. Large techs, small-caps and mid-caps showed relative strength yesterday, but the overall gains were muted as we head into a FOMC announcement on Wednesday. The economic data...

READ MORE

MEMBERS ONLY

Tables Turn as Techs Lead and Defensive Sectors Lag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After months of leadership from the three defensive sectors, the tables turned over the last seven days as the Technology SPDR (XLK) started leading the market. Notice that the Healthcare SPDR (XLV) and Consumer Staples SPDR (XLP) are actually down since 22-April, while the Utilities SPDR (XLU) is up less...

READ MORE

MEMBERS ONLY

SPX AD Line Hits New High - QQQ Outperforms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks continued their march higher as the S&P 500 ETF (SPY) challenged its mid April high and the Nasdaq 100 ETF (QQQ) hit a new high for 2013. The Russell 2000 ETF (IWM), however, remains a laggard because it formed a lower high in mid April and fell...

READ MORE

MEMBERS ONLY

Charts of Interest: BBY, FNSR, KSS, LOW, XCO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BBY Consolidates within Uptrend.

FNSR Bounces Off Support with Good Volume.

Plus KSS, LOW, XCO

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves...

READ MORE

MEMBERS ONLY

Apple Forms Inside Week on High Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Apple (AAPL) remains in a downtrend overall, but signs of firmness emerged as the stock forged an inside week. This occurs when the week's high-low range is inside the prior week's high-low range. Also notice that the stock advanced on the highest upside volume since April...

READ MORE

MEMBERS ONLY

XLF and XLY Hit New Highs ahead of Big Economic Week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a set back two weeks ago, stocks rebounded last week with the Finance SPDR (XLF) and Consumer Discretionary SPDR (XLY) leading the charge. Both XLF and XLY recorded 52-week highs last week to extend their uptrends and establish support based on their April lows. Last week's rebound...

READ MORE

MEMBERS ONLY

Facebook Springs to Life with Gap and MACD Cross

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Facebook (FB) has underperformed the market this year, but momentum is improving as MACD moved above its signal line this week. Notice how the stock held support in the 25 area and gapped up on Friday. This gap is bullish as long as it holds. A move below 25.9...

READ MORE

MEMBERS ONLY

Bulk of the Technical Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a big rebound this week, the indicator summary remains firmly in the bullish camp. The NYSE AD Line hit a new high. The NYSE and Nasdaq AD Volume Lines also hit new highs. The Consumer Discretionary SPDR (XLY) and the Finance SPDR (XLF) led the offensive sectors this week...

READ MORE

MEMBERS ONLY

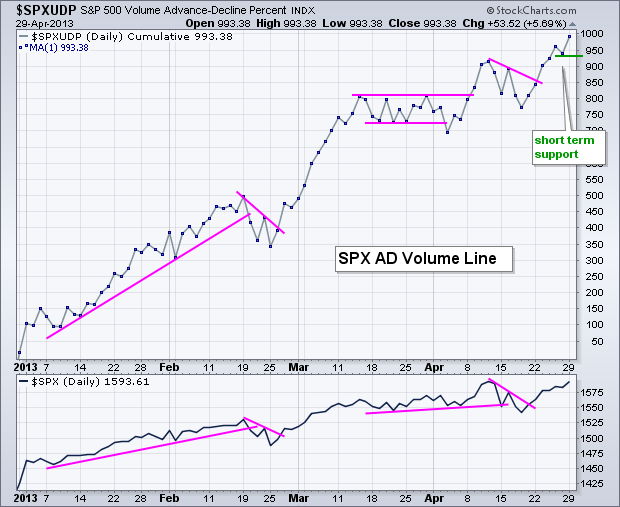

SPX AD Line and AD Volume Line Hit New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Its been quite a rally over the last five days with the S&P 500 getting close to another all time high. Stocks, however, sold off in the final 90 minutes of trading and the major index ETFs closed off their highs for the day. Nevertheless, the major index...

READ MORE

MEMBERS ONLY

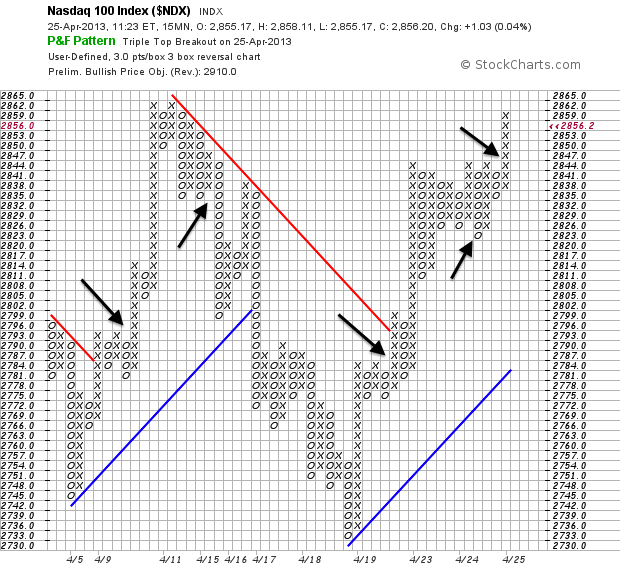

Nasdaq 100 Breaks Out on 15 minute P&F Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ($NDX) swings have been quite wild this month, but the 15 minute P&F chart captured these pretty well. In particular, the Triple Top Breakout and Triple Bottom Breakdown identified the early April upswing, the mid April downswing and the upswing over the past week. There...

READ MORE

MEMBERS ONLY

SPY Extends Upswing. TLT Forms Bull Flag. USO Nears Key Retracement.

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

**************************************************************************

Key Reports and Events (all times Eastern):

Thu - Apr 25 - 08:30 - Jobless Claims (AMZN, ALT...

READ MORE

MEMBERS ONLY

Charts of Interest: AMD, APOL, CAKE, CHS, CTXS, HSP, TEVA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMD Surges off Key Retracement.

CAKE Reverses on High Volume.

Plus APOL, CHS, CTXS, HSP, TEVA

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for...

READ MORE

MEMBERS ONLY

Consumer Discretionary and Finance Sectors Lead the Rebound

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a sharp decline last week, stocks recovered with bounce the last three days. The Sector PerfChart shows the Consumer Discretionary SPDR (XLY), Finance SPDR (XLF) and Basic Materials SPDR (XLB) leading this bounce. Also note that the Consumer Staples SPDR (XLP) and Healthcare SPDR (XLV) are also outperforming because...

READ MORE

MEMBERS ONLY

SPY Surges off Support - TLT Extends Consolidation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a decline last week, the bulls reasserted themselves this week and pushed the major index ETFs up sharply the last three days. IWM and QQQ are up over 3% since Friday. SPY is up 2.36% in three days. The Consumer Discretionary SPDR (XLY) and the Finance SPDR (XLF)...

READ MORE

MEMBERS ONLY

Silver:Gold Ratio Plunges to 52-week Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Silver:Gold Ratio broke down in February and exceeded its summer low in April with a sharp decline. The 52-week low shows that silver is much weaker than gold. This fits with weakness in copper because silver is more of an industrial metal than gold.

Click this image for...

READ MORE

MEMBERS ONLY

Charts of Interest: ADM, AMX, EA, MAR, SPWR, UAL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ADM Forms Continuation Pattern after Breakdown.

AMX Bounces off Support.

Plus EA, MAR, SPWR, UAL

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves...

READ MORE

MEMBERS ONLY

QQQ Hits Key Retracement - TLT Forms Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak, but quickly found their footing as the major index ETFs worked their way higher the rest of the day. The Nasdaq 100 ETF (QQQ) gained 1% with strength in Microsoft, Intel, Apple and Amazon. Gains in the broad market ETFs were smaller with the S&P...

READ MORE

MEMBERS ONLY

Charts for Six Stocks Reporting Earnings on Monday

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It is a big week for earnings so here are CandleGlance charts for six stocks reporting today. Of interest, ACE is hitting support from broken resistance, CAT is nearing the November low, HAL remains in a falling channel and Texas Instruments is testing support.

Click this image for a live...

READ MORE

MEMBERS ONLY

SPY Bounces off Support as UUP Holds Channel Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It is a HUGE week for earnings, which means we could see extra volatility the next several days. Texas Instruments reports on Monday, Apple reports Tuesday after the close, Qualcom is on deck Wednesday and Amazon reports on Thursday. I am not going to mention Friday because it seems too...

READ MORE

MEMBERS ONLY

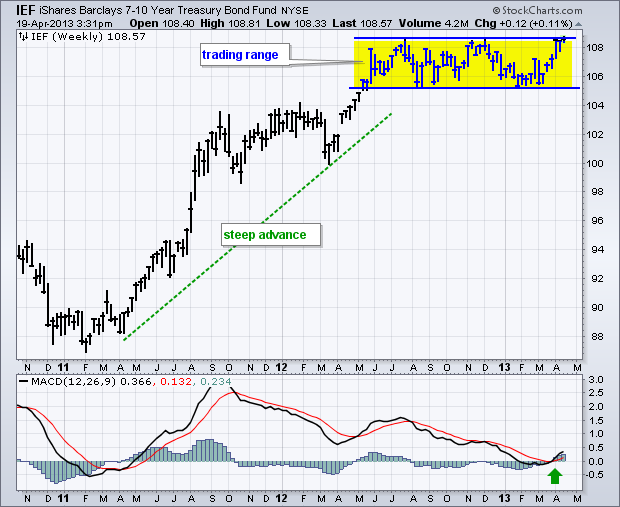

Strength in Treasury Bonds could Haunt the Stock Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 7-10 YR Treasury Bond ETF (IEF) is challenging resistance and a breakout would have negative consequences for stocks. Stocks and Treasury bonds are negatively correlated because they march to the beat of different drummers. Treasury bonds move higher because of deflationary pressures, signs of economic weakness or both. We...

READ MORE

MEMBERS ONLY

Copper ETF Hits Long Term Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a sharp decline this month, the Copper ETF (JJC) entered a support zone that extends back to the 2010 lows. The ETF also become oversold as RSI dipped below 30 for the first time since September 2011. The knife, however, is still falling as long as RSI remains below...

READ MORE

MEMBERS ONLY

Nasdaq AD Line Breaks Support as Offensive Sectors Lag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There were a few downgrades this week as stocks took a big hit for the second time this month. The AD Lines were downgraded to neutral because the Nasdaq AD Line broke support and the NYSE AD Line has yet to break support. The dominant sectors were downgraded because three...

READ MORE

MEMBERS ONLY

Charting Apple - QQQ Hits Broadening Formation Trend Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their losses on Thursday with the Nasdaq 100 ETF (QQQ) leading the way lower. Once again, Apple declined and weighed heavily on QQQ. Apple is down over 8% this week and earnings are scheduled next week. As opposed to the S&P 500, which was priced to...

READ MORE

MEMBERS ONLY

Hindenburg Omen Triggers As New Lows Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Hindenburg Omen triggered on Monday as the percentage of new lows and new highs on the NYSE moved above 2.8%. There is some debate on this threshold because I have seen 2.2% and 2.4% used by other analysts. Using these lower thresholds, the omen triggered again...

READ MORE

MEMBERS ONLY

SPY Heads for Support Test with IWM Leading Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the day weak and ended the day with sizable losses. The Russell 2000 ETF (-1.74%) and Nasdaq 100 ETF (-1.95%) led the way lower. Apple weighed on QQQ as the stock broke below its March lows and recorded a 52-week low ahead of earnings next week....

READ MORE

MEMBERS ONLY

Charts of Interest: ARIA, BIDU, CBS, DHI, EA, HPQ, MON

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ARIA Bucks the Selling with Good Volume.

BIDU Surges and Consolidates.

Plus CBS, DHI, EA, HPQ, MON

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think...

READ MORE

MEMBERS ONLY

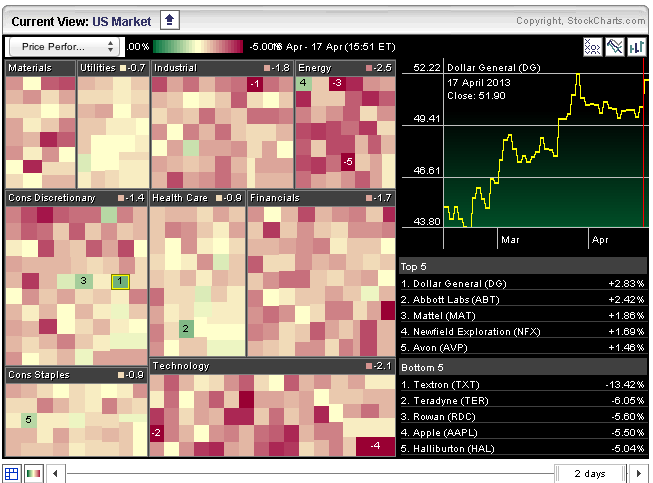

Finding the Winners in a Sea of Red

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with across the board selling on Wednesday. All sectors were down, but there were a few stocks that bucked the selling pressure. As the Market Carpet shows, there are at least ten advancing stocks, which are represented by the green or greenish squares. A list can be...

READ MORE

MEMBERS ONLY

SPY Forms Bearish Wedge with 50% Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Let the volatility begin! Stocks plunged on Monday, rebounded on Tuesday and are trading lower before the open on Wednesday. Yahoo! traded sharply lower after hours because it missed estimates on ad revenues. Intel was mixed after reporting weak first quarter earnings. The company reduced capex estimates, which means the...

READ MORE

MEMBERS ONLY

Coca-Cola leads Consumer Staples SPDR with 5% Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After falling 2.5% on Monday, Coca-Cola (KO) recovered with a 5+ percent surge to lead the Consumer Staples SPDR (XLP) higher on Tuesday. KO Has been one of the top performing stocks in 2013 and XLP has been one of the top performing sectors.

Click this image for a...

READ MORE

MEMBERS ONLY

IWM Tests Key Support - UUP Firms at Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit hard on Monday with small-caps and mid-caps leading the way lower. The Russell 2000 ETF (IWM) fell 3.77% and the S&P MidCap 400 SPDR (MDY) declined 3.13%. All sectors were down with the Energy SPDR (XLE) loosing 4.08% and the Basic Materials...

READ MORE

MEMBERS ONLY

Charts of Interest: AAPL, CRM, CTXS, DRI, GOOG, THOR, STMP, ZNGA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Tests March Low with Low Volume.

GOOG Hits Trend Line Support.

Plus CRM, CTXS, DRI, THOR, STMP, ZNGA

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need...

READ MORE

MEMBERS ONLY

Consumer Discretionary Sector Joins the Defense

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Friday was a rather strange day for the sector SPDRs. Notice that the consumer discretionary, consumer staples, healthcare and utilities SPDRs moved higher. It is unusual to see the consumer discretionary sector rise along with the three defensive sectors, especially when the S&P 500 is down for the...

READ MORE

MEMBERS ONLY

Treasuries Surge, Commodities Fall and Stocks Hold Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks came under early selling pressure on Friday morning after an unexpected decline in March retail sales. Selling pressure, however, lasted less than two hours as the major index ETFs found their footing around 11AM and edged higher the rest of the day. Despite this post-open bounce, SPY, MDY, IWM...

READ MORE

MEMBERS ONLY

Nvidia Bucks the Market with a Triangle Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were down in early trading on Friday, but Nvidia (NVDA) got off to a strong start with a surge above 13 and a three month high. NVDA formed a triangle from January to April and broke the upper trend line with this advance. MACD also turned up and crossed...

READ MORE

MEMBERS ONLY

Small-Caps Start to Lag, but Evidence Remains Bullish Overall

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary remains firmly bullish with eight of ten indicators favoring the bulls. The two bearish indicators reflect relative weakness in the Nasdaq and small-caps, which indicates that the tolerance for risk is fading somewhat. In addition, note that the Nasdaq AD Line is underperforming the NYSE AD Line....

READ MORE

MEMBERS ONLY

XLV Leads Market as SPY Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their rally on Thursday with the Consumer Discretionary SPDR (XLY) and the Healthcare SPDR (XLV) leading the way. Led by a big move in retail, XLY advanced .84% and hit a 52-week high. Led by big pharma, XLV advanced .96% and also hit a 52-week high. Healthcare is...

READ MORE

MEMBERS ONLY

Palladium ETF Bounces off Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Palladium ETF (PALL) fell along with gold last week, but managed to firm near the early March low and bounce off support today. Notice that broken resistance turned into support in the 70 area. The indicator window shows PALL relative to the Gold SPDR (GLD). PALL outperformed from November...

READ MORE

MEMBERS ONLY

SPY Surges, TLT Falls and GLD Fails at First Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks took their cue from Treasuries and surged with gains across the board. The 20+ Year T-Bond ETF (TLT) fell sharply and the 10-year Treasury Yield ($TNX) surged as the Fed minutes revealed some dissent on the future of quantitative easing. Even though this is old news based on minutes...

READ MORE