MEMBERS ONLY

A Healthcare Stock Poised to End its Correction

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Bollinger Band squeeze signals a volatility contraction that can lead to a volatility expansion. But which way? For directional clues, we need to analyze price action and other indicators. Henry Schein caught my eye because the stock has a Bollinger Band squeeze, a bullish chart pattern, an uptrend and...

READ MORE

MEMBERS ONLY

Trend Composite Turns Fully Bullish for Verizon

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Verizon (VZ) participated in the market surge from late March to mid April, but then stumbled with a decline into mid June. This stumble, however, looks like a classic correction and the stock broke out with a strong move over the last six weeks. In addition, the TIP Trend Composite,...

READ MORE

MEMBERS ONLY

New 52-week Highs Underwhelm, But Outpace New Lows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The total number of new highs in the S&P 500, S&P MidCap 400 and S&P SmallCap 600 continues to underwhelm. Even so, new highs are still outpacing new lows and this is enough to keep the uptrend since late March going.

The first chart...

READ MORE

MEMBERS ONLY

Four Stocks Poised to Drive Healthcare Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Healthcare SPDR (XLV) is one of the strongest sectors in 2020. Even though it does not sport the biggest gain, XLV recorded a new high in July and some 80% of its components are above their 200-day EMAs. The new high points to a long-term uptrend and upside leadership,...

READ MORE

MEMBERS ONLY

RSI for Trend-Following and Momentum Strategies - Apple Example

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

RSI is widely used as a momentum oscillator to identify overbought and oversold levels. A dive into the formula, however, reveals that RSI is quite well equipped for trend-following strategies. It can even be used to rank ETFs and stocks to find those with the strongest momentum.

The strategy basically...

READ MORE

MEMBERS ONLY

QQQ Goes on a Bender

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

QQQ can do little wrong here in 2020, but the ETF is ripe for a corrective period as it becomes the most extended since 1999. Current conditions, while frothy, are not quite the same as they were in 2000 so I do not expect another crash. For those of us...

READ MORE

MEMBERS ONLY

A BB Breakout or the Dreaded Head Fake?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There were a number of Bollinger Band squeeze plays over the last two weeks and also a number of breakouts. These breakouts are bullish until proven otherwise, but chartists should also be aware of the head fake. In his book, Bollinger on Bollinger Bands, John Bollinger puts it as follows:...

READ MORE

MEMBERS ONLY

Measuring the Balance of Power in the Equal-weight Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 200-day SMA is a long-term trend indicator that chartists can use across the equal-weight sectors to measure the balance of power in the broader market. The more sectors trading above their 200-day SMAs, the more bullish the market. The more sectors trading below their 200-day SMAs, the more bearish...

READ MORE

MEMBERS ONLY

Stocks and Treasuries: The Yin and Yang of the Markets

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 20+ Yr Treasury Bond ETF (TLT) retreated as stocks advanced from mid April to early June and then popped as stocks dropped this week. Bonds are the natural alternative to stocks and TLT appears to be forming a classic bullish continuation pattern.

Let's first compare performance for...

READ MORE

MEMBERS ONLY

Knowing When to Add Risk and When to Reduce Risk

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is the most widely used benchmark for the US stock market and the 200-day SMA is perhaps the most widely used moving average. These two came together again in late May as the index crossed back above on May 27th. Today we will quantify the...

READ MORE

MEMBERS ONLY

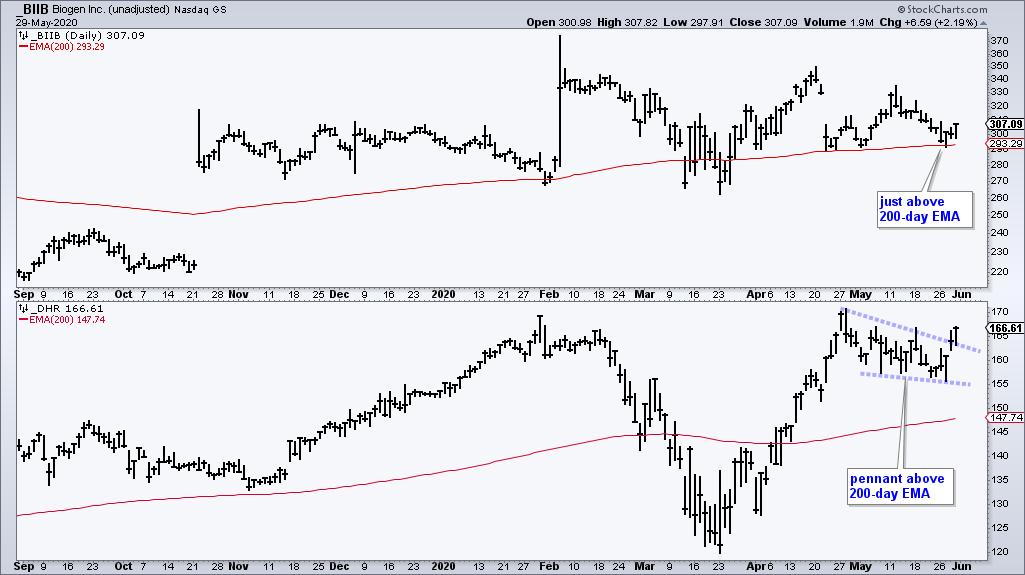

A Bullish Continuation Pattern for a Sector with Strong Breadth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can separate the leading sectors from the lagging sectors by sorting with various breadth indicators. The 200-day EMA is a long-term trend indicator that can also be used as a breadth indicator. A stock is in an uptrend when above the 200-day EMA and in a downtrend below. The...

READ MORE

MEMBERS ONLY

Quantifying the QQQ Effect on SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

We all know that many stocks in the Nasdaq 100 ETF (QQQ) are also part of the S&P 500 SPDR (SPY). In addition, it is clear that these QQQ stocks affect the performance of SPY. But how much exactly? Today we will answer that question and compare performance...

READ MORE

MEMBERS ONLY

Timing the S&P 500 Using the Bullish Percent Index

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

StockCharts calculates and publishes the Bullish Percent Indexes for several major indexes and sectors. Just search for the term $BP to find them because all the symbols begin with these three characters. These indicators are not part of my breadth models for broad market timing, but I do follow them,...

READ MORE

MEMBERS ONLY

Strong April Seasonality Gives Way to May and June

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

When it comes to analysis and trading signals, seasonality is behind price action in the pecking order of importance. In general, seasonal patterns carry most weight when they jibe with the underlying trend. For example, bullish seasonal patterns in an uptrend can provide a tailwind. Nevertheless, price action is still...

READ MORE

MEMBERS ONLY

Putting the Big Bounces into Perspective

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a massive advance the last six weeks, the bulk of the evidence indicates that we are still in a bear market environment. The advance off the March low, while impressive on its own, still pales in comparison to the prior decline. The S&P 500 SPDR retraced around...

READ MORE

MEMBERS ONLY

Big Biotechs Make a Big Statement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The two most popular biotech ETFs are leading the market this month and making big statements. Before looking at these two, note that they are quite different. The Biotech ETF (IBB) is dominated by large-cap biotechs with the top ten holdings accounting for over 50%. The Biotech SPDR (XBI), on...

READ MORE

MEMBERS ONLY

A Few Get Back to Positive, but Many Remain Beaten Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a surge over the last 18 days, the S&P 500 reclaimed the 50-day moving average for the first time since February 21st. The move is truly remarkable, but the index remains well below the falling 200-day SMA. Moreover, a 28.5% surge in 18 days recovered just...

READ MORE

MEMBERS ONLY

Elevators, Oversold Bounces and Long Recoveries

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 went from a historic decline to a historic bounce to an above average drop. This key benchmark fell 33.9% in 23 days, surged 17.55% in three days and then dropped 5.25% the last four days. In fact, the index has experienced nine...

READ MORE

MEMBERS ONLY

Quantifying Leaders and Laggards on this Historic Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking to measure relative performance based on retracements can use the Stochastic Oscillator to quantify these bounces. Way back on March 1st, I posted an article showing how Chartists can quantify downside retracements using Williams %R. For upside retracements or bounces that retrace a portion of the prior decline,...

READ MORE

MEMBERS ONLY

High-Low Percent Takes a Tumble - Plus The Essential Breadth Indicator ChartList

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The broad market environment is bearish and volatility remains high, even with stock alternatives, such as gold and bonds. This is hardly a conducive environment for trading or investing, but there are alternatives, such as a bear market project. This can be remodeling a room, finally clearing out the garage...

READ MORE

MEMBERS ONLY

Setting Expectations for Post-Crash Price Action

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 moved from a 52-week high to a 52-week low with lightening speed over the last three weeks. To capture the sharpness of this decline, I am showing a chart with the 3-week Rate-of-Change in the indicator window. At -18.78%, this is the deepest three...

READ MORE

MEMBERS ONLY

When Bullish Retracement Zones and Support become Questionable

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Support levels and bullish retracement zones are questionable, at best, in bear market environments. Why? Because the path of least resistance is down in a bear market. As such, the odds that a support level holds or a bullish retracement zone leads to a reversal are greatly reduced. The odds...

READ MORE

MEMBERS ONLY

Quantifying Retracements to Find Stocks and ETFs that Held Up Relatively Well During the Onslaught

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Looking for an indicator to find stocks and ETFs that held up the best last week? Look no further. Today I will show how to use a classic indicator to quantify last week's decline and rank names by their retracements.

In general, stocks bottomed in early October and...

READ MORE

MEMBERS ONLY

Bank ETF Gets a Bounce, but <BR>Falling Yields Could Spoil the Party

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After falling for over a year, the Regional Bank ETF (KRE) finally got its mojo back in the fourth quarter of 2019 and broke out to new highs. The ETF then became overextended in mid December and fell back to the 200-day SMA here in February. A potentially bullish setup...

READ MORE

MEMBERS ONLY

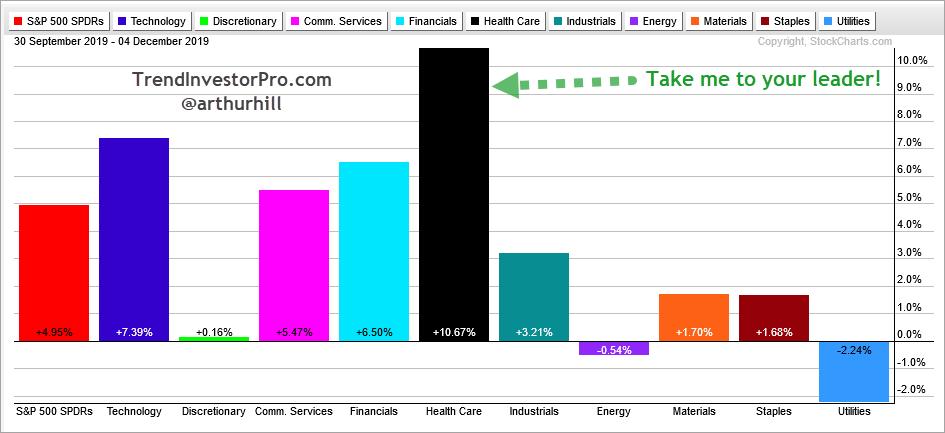

Applying the Dow Theory Principle of Confirmation to Measure Sector Participation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Dow Theory applies the principle of confirmation to confirm primary trends. Charles Dow used the Dow Industrials and Dow Transports to confirm the primary trend for the broader market. The primary trend is up, and confirmed, when the Industrials and Transports both exceed their prior highs and record higher highs....

READ MORE

MEMBERS ONLY

Removing the Amazon Effect from XLY - Plus the Mother of All Cup-with-Handle Patterns

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Amazon is by far the biggest component in the Consumer Discretionary SPDR and its recent breakout bodes well for the ETF. The new highs in XLY and AMZN this month, however, did not carry over to the Equal-weight Consumer Discretionary ETF (RCD). RCD removes the Amazon effect by treating all...

READ MORE

MEMBERS ONLY

A Bullish Hat-Trick for the Aerospace & Defense ETFs - But One is Seriously Lagging

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are three ETFs covering the defense and aerospace group and all three recorded new highs. Even though these ETFs cover the same industry group and have similar price charts, they are quite different when we look under the hood and one is seriously underperforming the other two.

The Aerospace...

READ MORE

MEMBERS ONLY

Another Triple 90% Down Day - What is it and what does it mean for stocks going forward?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Selling pressure was extremely broad in Friday with all sectors declining and more than ninety percent of stocks in the S&P 500, S&P MidCap 400 and S&P SmallCap 600 declining. While this kind of broad selling pressure creates a short-term oversold condition, it also...

READ MORE

MEMBERS ONLY

S&P 500 Channels 2018 and Opens a Box of Chocolates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Signs of a correction were building for some time and it now appears that the long awaited corrective period is here. The S&P 500, in particular, is following the script from January 2018 quite closely. After a steady advance from October to December, signs of excess started appearing...

READ MORE

MEMBERS ONLY

A Moment of Truth for the Russell 2000 ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 ETF (IWM) broke out of a pennant formation last week and then fell sharply this week. This puts price back in the pennant and near its make or break level.

Flags and pennants are short-term continuation patterns that form after a sharp move. Bullish versions represent the...

READ MORE

MEMBERS ONLY

Despite Recent Underperformance, the Treasury Bond ETF (TLT) is Starting to Look Interesting

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market started its latest run to infinity (and beyond) in mid August and the 20+ Yr Treasury Bond ETF (TLT) just happened to peak a week or so later. Stocks and bonds were largely on the same page from February to August as both moved higher. Correlation changed...

READ MORE

MEMBERS ONLY

REIT SPDR Holds Key Moving Average as its Biggest Components Spring to Life

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ten of the eleven sector SPDRs are positive over the last three months. The Real Estate SPDR (XLRE) is the only sector sporting a loss (~.75%), but I am not concerned with relative weakness because the price chart looks bullish overall. Note that XLRE was the leading sector in early...

READ MORE

MEMBERS ONLY

Putting Declines into Perspective to Find Opportunities - Plus an Opportunity in the Tech Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

2019 was quite the year with many stocks moving sharply higher from January to July-August. In particular, several Technology stocks moved higher during this period and then corrected into October. We can see this pattern reflected in the Equal-Weight Technology ETF (RYT) as it advanced over 40% and then corrected...

READ MORE

MEMBERS ONLY

2019: A Year Filled with Distractions

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

2019 was a year with lots of distractions, and yet the S&P 500 recorded 52-week highs in six of the last nine months. The index surged 17.7% the first four months and recorded its first 52-week high in late April. It then finished strong with a new...

READ MORE

MEMBERS ONLY

A Boring Stock with a Bullish Theme for 2020

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A theme is a fundamental trend that could influence a stock's price in the coming months, or even years. As powerful as themes seem, they are still secondary to price action. There are many forces driving price movements and we cannot be expected to know them all. In...

READ MORE

MEMBERS ONLY

Signs of Strength within the Gold Miners ETF - Will Price Follow?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Gold SPDR (GLD) and the Gold Miners ETF (GDX) have been trending lower and lagging the broader market since September, but breadth indicators show signs of strength within the Gold Miners ETF. Today we will examine four breadth indicators and analyze the price chart for GDX. While breadth can...

READ MORE

MEMBERS ONLY

Are you Following the Trend or Waiting for Perfection?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

We are seeing breakouts and new highs galore in the stock market. Does this sound the all clear? Hardly. Investors waiting for the all clear will probably be waiting a long time. Moreover, the "all clear" could even mark the top, because that's just the way...

READ MORE

MEMBERS ONLY

This Healthcare Stock Looks Poised to Play Catch Up with a Big Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking for winning stocks should start with leading sectors and industry groups. Having a sector or industry tailwind can greatly improve the odds for a winning trade or investment. Programming note: There is a special announcement at the end of this commentary.

Looking at the sector charts and sector...

READ MORE

MEMBERS ONLY

Three Leading Stocks within the Payments Space - And Three Poised to Hit New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As noted in ChartWatchers this weekend, the Mobile Payments ETF (IPAY) came to life in November with a 7% gain, which was almost twice the gain in the S&P 500 SPDR (+3.62%). IPAY was lagging in September and October, but is now leading the market as the...

READ MORE

MEMBERS ONLY

'Tis the Season for Mobile Payments

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Black Friday weekend is here and the holiday shopping season is just getting started. While I have no clue which retailers will be the big winners or losers this season, the mobile payments industry is likely to be a big winner. Mobile payments are expected to exceed $300 billion this...

READ MORE