MEMBERS ONLY

QQQ Breaks Consolidation Resistance - TLT Hits Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The market brushed off the fiscal cliff BS as the Santa bulls got into high gear on Tuesday. All of the major index ETFs advanced over 1% with the Nasdaq 100 Equal-Weight ETF (QQEW) leading the way (+1.52%). Small-caps were also strong with the Russell 2000 ETF (IWM) up...

READ MORE

MEMBERS ONLY

Nasdaq 100 Equal-Weight ETF Breaks September Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 Equal-Weight ETF (QQEW) continues to lead the Nasdaq 100 ETF (QQQ) with a break above its autumn highs. After forming a doji and a hammer, QQEW broke channel resistance in late November and never looked back. The indicator window shows the price relative breaking out in early...

READ MORE

MEMBERS ONLY

XLK Bounces off Support - TLT Fails at Broken Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Santa Claus rally continued on Monday with the major index ETFs scoring nice gains. The Nasdaq 100 ETF (QQQ) led the way with a 1.33% rise. All sectors were up with the consumer discretionary, technology, finance and utilities sectors leading the way. In fact, five of the nine...

READ MORE

MEMBERS ONLY

Charts of Interest: BP, CHS, CQP, COH, FITB, USB

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BP Forms Triangle Consolidation,

CHS Bounces off Support.

Plus CQP, COH, FITB, USB

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it...

READ MORE

MEMBERS ONLY

Consumer Discretionary SPDR Forms Pennant after Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Discretionary SPDR (XLY) is showing strength with a channel breakout in November and a pennant consolidation in December. XLY surged over 1.4% on Monday to form the second low for the pennant. A breakout would signal a continuation higher.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

SPY Hits Support Zone - USO Attempts a Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trading could get real tricky (volatile) has we head into the fiscal-cliff endgame and holiday season. First, the markets will become extra sensitive to the news flow out of Washington over the next two weeks. Second, trading volume will thin, which means any uptick in volume could cause an outsized...

READ MORE

MEMBERS ONLY

KB Home Forges Quadruple Top Breakout on P&F Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Intraday P&F charts are good for capturing short-term and medium-term price movements. The chart below is a 60-minute P&F chart for KB Home (KBH). Notice how the stock broke the Bearish Resistance Line and forged a breakout at 15 this week.

Click this image for a...

READ MORE

MEMBERS ONLY

Indicator Summary Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their uptrends on Monday-Tuesday, but fell back after the Fed meeting and declined on Thursday. Even though a post-Fed decline may seem negative, it could be just a little buy-the-rumor and sell-the-news at work. In addition, the fiscal cliff circus continues to dominate the news. With stocks holding...

READ MORE

MEMBERS ONLY

IWM Pulls Back to Breakout - USO Firms at Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks retreated after the Fed announcement. Of course, the fiscal cliff deadlock got the blame. Never mind that the S&P 500 was up some 6% from its mid November lows and ripe for a pullback or consolidation. Thursday's decline was not enough to reverse the short-term...

READ MORE

MEMBERS ONLY

Drug Retailers Lead the Consumer Staples Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the consumer staples sector showing some relative strength on Thursday, I went to the sector summary to find the strong industry groups within this sector. The image below shows the 10 industry groups with the DJ US Drug Retailers Index ($DJUSRD) leading the way. Users can click on the...

READ MORE

MEMBERS ONLY

TLT Breaks Support as GLD Forms Bear Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were all over the place on Wednesday. The major index ETFs opened strong, pulled back in the late morning, surged after the Fed announcement and pulled back again in the final hour. The end result was mixed as the S&P 500 ETF (SPY) and Nasdaq 100 Equal-Weight...

READ MORE

MEMBERS ONLY

Charts of Interest: AMT, CCL, DHI, M, STLD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMT Breaks out to a 52-week High.

CCL Forms Ascending Triangle within Uptrend.

Plus DHI, M, STLD

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think...

READ MORE

MEMBERS ONLY

NYSE AD Line Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The NYSE AD Line ($NYAD) reflects broad market strength with a move above the September-October highs this week. In fact, the indicator is trading at a 52-week high. There are no signs of weakness here.

Click this image for a live chart....

READ MORE

MEMBERS ONLY

SPY Holds Flag Breakout as USO Waffles Near Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

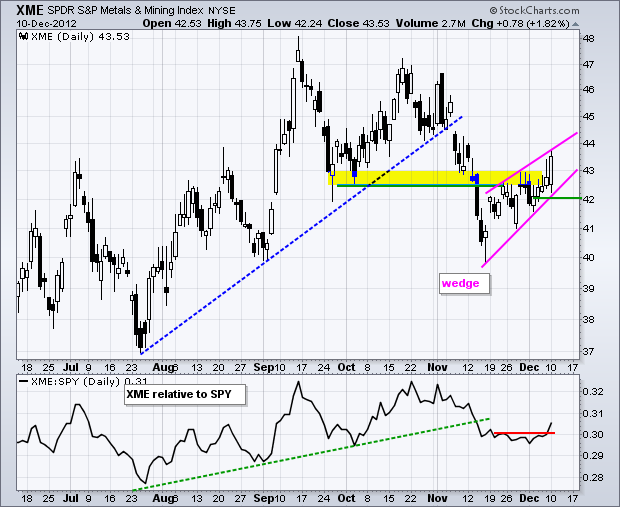

The bulls kept up the pressure on Tuesday with the technology sector leading the charge. The Semiconductor SPDR (XSD) led tech stocks with a 2.71% surge. There was also strength in the Airline ETF (FAA), which advanced 2% and hit a new 52-week high (intraday). Elsewhere, the Steel ETF...

READ MORE

MEMBERS ONLY

Techs Lead on Sector Carpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

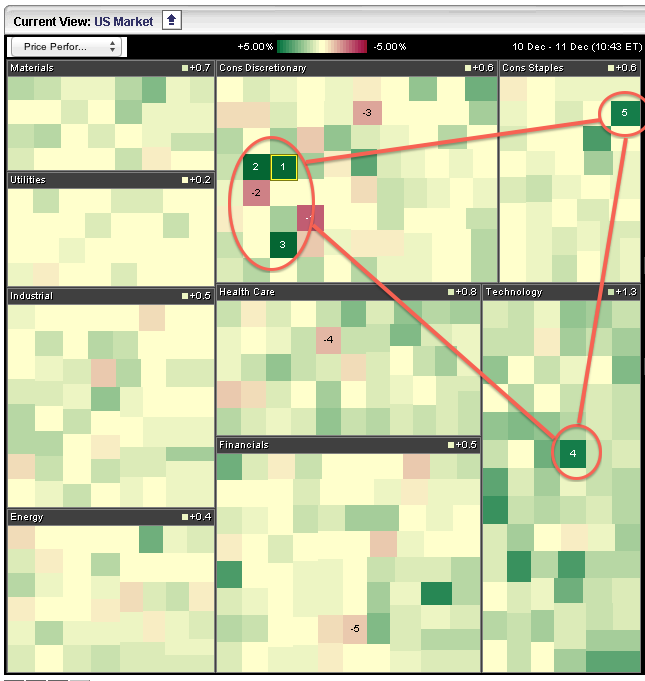

The technology sector is showing upside leadership with the average stock gaining 1.3% on Tuesday. The red ovals highlight the top five stocks in the S&P 500 today. Three of the top five are in the consumer discretionary sector, one comes from the sector and one from...

READ MORE

MEMBERS ONLY

IWM Edges Above Flag Resistance - GLD Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks edged higher in mixed trading. The major index ETFs ended the day with small gains, but the sectors were split. In particular, the Finance SPDR (XLF) and the Consumer Discretionary SPDR (XLY) edged lower, while the Technology SPDR (XLK) and the Industrials SPDR (XLI) moved higher. Buoyed by recent...

READ MORE

MEMBERS ONLY

Charts of Interest: ATVI, BMY, BSX, CHRW, CRM, MDR, VIP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ATVI Forms Bull Flag at Resistance.

CHRW Consolidates with Triangle.

Plus BMY, BSX, CRM, MDR, VIP

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for...

READ MORE

MEMBERS ONLY

Expeditors Leads with Flag Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a surge from mid to late November, Expeditors International (EXPD) hit resistance from the early November high around 38. A falling flag formed into early December and the stock broke flag resistance with a surge above 38 on Monday. This signals a continuation of the prior advance and the...

READ MORE

MEMBERS ONLY

IWM Extends Flag Pattern - TLT Tests Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks remain dazed and confused. After falling sharply the first two weeks of November, stocks bottomed in mid November and surged the next two weeks. These gains wiped out the early November losses and made it as if November never really happened. Despite this strong rally, stocks hit a wall...

READ MORE

MEMBERS ONLY

Gasoline Breaks Down as Oil Forms Bear Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gasoline Jan13 (^RBF13) formed a lower high and broke support with a sharp decline this week. First, notice that the trend since mid September is down with a series of lower lows and lower highs taking shape the last few months. This week's breakdown signals a continuation of...

READ MORE

MEMBERS ONLY

Apple Reverses at Long-term Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Apple (AAPL) tested its mid November low and long-term support with a dip below 520 on Thursday. Support in the 520 area extends back to the May low. Notice how the stock forged an intraday reversal for the second time in two months. Also notice that volume exceeded 40 million...

READ MORE

MEMBERS ONLY

Indicator Summary Turns Positive with Two Upgrades

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks held their gains with consolidations this week and two upgrades pushed the indicator summary back into positive territory. Nasdaq and NYSE Net New Highs turned bullish again. Nasdaq Net New Highs are not as strong as NYSE Net New Highs though. The momentum group also turned bullish as the...

READ MORE

MEMBERS ONLY

IWM Maintains Flag Formation - UUP Surges to Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks will simply not give up the bid or the hope of a fiscal cliff solution. The major index ETFs became short-term oversold last week and pretty much consolidated this week. The Russell 2000 ETF (IWM) and the S&P MidCap 400 SPDR (MDY) held up the best with...

READ MORE

MEMBERS ONLY

Aroon Turns Bullish for Semiconductor ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Market Vectors Semiconductor ETF (SMH) is challenging resistance with a big surge over the last few weeks. Aroon confirms strength as Aroon Up (green) moved above Aroon Down (red) and hit the +100 level. This sometimes signals the start of a new trend. You can read more about Aroon...

READ MORE

MEMBERS ONLY

IWM Stalls with Flat Flag - USO Fails at Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks continued to drift on Wednesday with the major index ETFs finishing mixed. The Dow Industrials SPDR (DIA) advanced .66% as the Nasdaq 100 ETF (QQQ) plunged 1.11%. Apple led the way lower for QQQ. Note that the Nasdaq 100 Equal-Weight ETF (QQEW) was up .37% and it was...

READ MORE

MEMBERS ONLY

Charts of Interest: AMTD, BTU, CERN, JOY, LSI, SYMC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMTD Forms a High and Tight Pennant.

CERN Consolidates after Massive Gap.

Plus BTU, JOY, LSI, SYMC

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think...

READ MORE

MEMBERS ONLY

Finance, Industrials and Utilities Lead Market Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

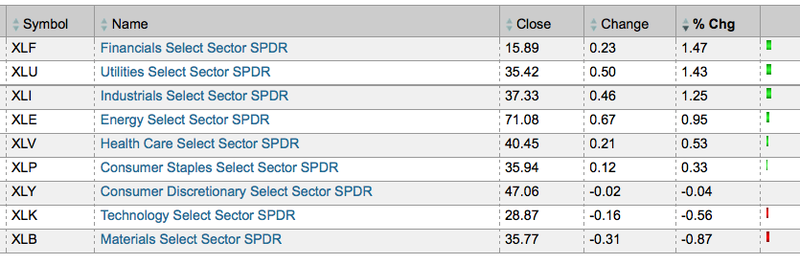

Acheck on the sector summary shows the finance, industrials and utilities sectors leading the market on Wednesday afternoon with 1+ percent gains. Users can click on the sector names to drill down and see which industry groups are leading and lagging within the sector.

Click this image for a live...

READ MORE

MEMBERS ONLY

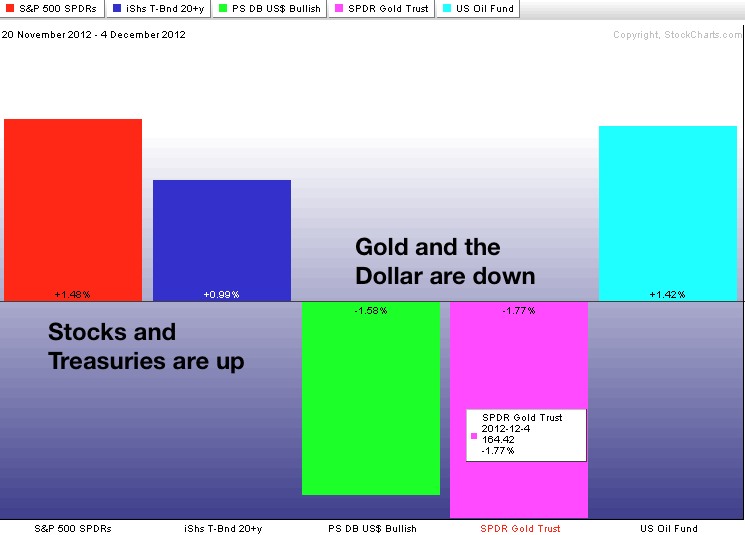

Intermarket Picture Shows Confusion

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a sharp advance the prior two weeks, stocks became short-term overbought and stalled the last two days. Resistance levels from prior consolidations and key retracements were also evident on the daily charts. Stocks looked ripe for at least a pullback, but downside has been limited this week. SPY is...

READ MORE

MEMBERS ONLY

Aaron Forms A Fibonacci Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Aaron (AAN) surged above 32 and then fell all the way back below 29. Even though this decline looks excessive, note that it retraced 62% of the prior decline and the stock firmed near broken resistance. A break above the mid November high on good volume would be bullish.

Click...

READ MORE

MEMBERS ONLY

SPY Forms Bearish Engulfing as USO Fails at Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was drop and pop last Wednesday as stocks opened weak and then rallied. Monday was different as stocks opened strong and then sold off. The S&P 500 was up just over 1/2% in early trading, but fell after the ISM Manufacturing Index was reported. ISM fell...

READ MORE

MEMBERS ONLY

Charts of Interest: ARO, DE, HON, MMM, MS, X

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ARO Forms Ascending Triangle.

DE Holds Gap within Short-Term Downtrend.

Plus HON, MMM, MS, X

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves...

READ MORE

MEMBERS ONLY

Coal ETF Forms Bearish Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After hitting big resistance in the 26 area, the Coal ETF (KOL) moved sharply lower and then formed a rising flag the last two weeks. These are bearish continuation patterns that typically form after a sharp decline. A move below flag support would signal a continuation lower.

Click this image...

READ MORE

MEMBERS ONLY

SPY Stalls at Fibonacci Retracement - GLD Breaks Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

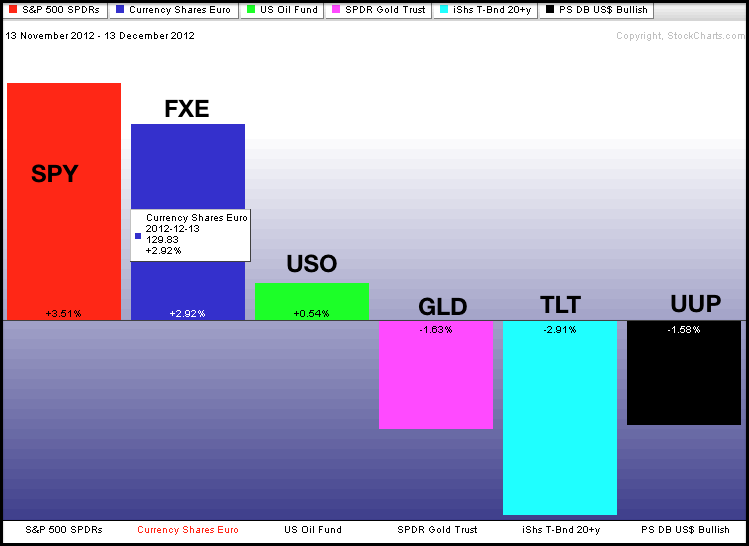

Despite all this talk on the fiscal cliff, it seems that the Euro is more important to the stock market right now. On the 60-minute chart, the indicator window shows the Euro Currency Trust (FXE) bottoming on 13-Nov and the S&P 500 ETF (SPY) bottoming on 16-Nov. Both...

READ MORE

MEMBERS ONLY

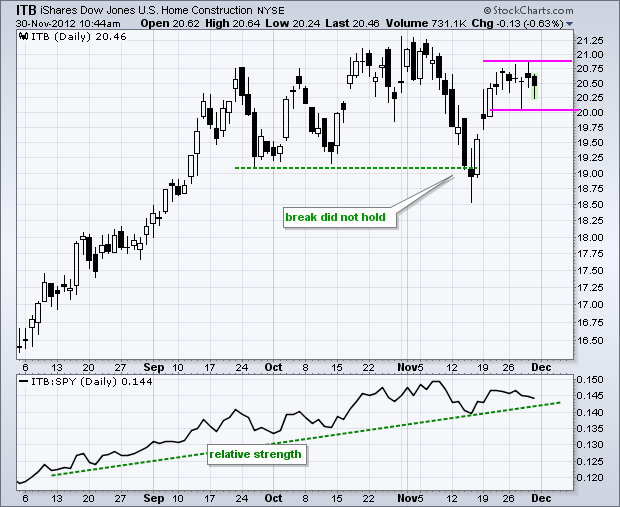

Home Construction iShares Consolidates after Rebound

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Home Construction iShares broke below support in mid November, but this break did not hold as the ETF quickly surged back above 20. A flat consolidation has since formed and traders should watch these boundaries for the next directional clue. An upside breakout signals a continuation higher, while a...

READ MORE

MEMBERS ONLY

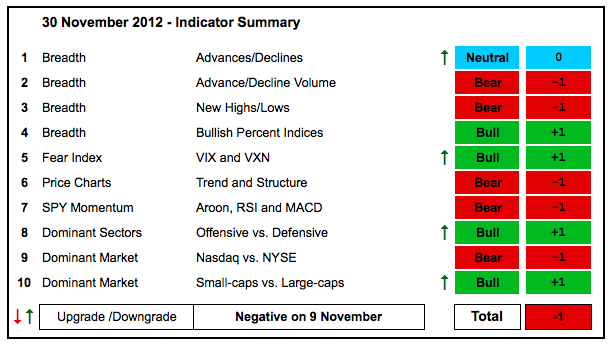

Indicator Summary Improves with Sharp Rally

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

<div style="width: 600px;">With a sharp rally the last two weeks, several indicator groups were upgraded. Namely, the NYSE AD Line surged to its October-November highs and is close to a 52-week high. The cumulative line for NYSE Net New Highs hit a new high....

READ MORE

MEMBERS ONLY

SPY Moves to Top of Resistance Zone - GLD Tests Support Break

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the 60-minute chart, SPY edged higher on Thursday and moved to the top of its resistance zone. Broken support, the early November highs and the 61.80% retracement mark resistance in the 143 area. Even though the bigger trend may be down, this short-term upswing remains in play as...

READ MORE

MEMBERS ONLY

First Solar Breaks Ascending Triangle Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

First Solar (FSLR) is leading solar stocks with an ascending triangle breakout on expanding volume. As a bullish continuation pattern, the breakout signals a continuation of the prior advance and targets a move to the low 30s.

Click this image for a live chart....

READ MORE

MEMBERS ONLY

SPY Keeps Upswing Alive, but USO Falters Again

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the day weak as the major index ETFs gapped down on the open. This gap did not last long as stocks rallied the rest of the day and closed higher. The actual gains were not huge, but the ability to rally after a gap down shows resilience. The...

READ MORE

MEMBERS ONLY

Charts of Interest: AA, ALTR, BOOM, KLAC, LLTC, ORCL, TJX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AA Bounces off Support with mini-breakout.

ORCL Advances Nine Days Straight.

Plus ALTR, BOOM, KLAC, LLTC, ORCL, TJX

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to...

READ MORE

MEMBERS ONLY

MACD Turns Positive for lululemon

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Momentum is improving for lululemon (LULU) as MACD turned positive for the first time since late October. On the price chart, the stock is challenging the upper trend line of a falling channel. A breakout would signal a continuation of the August-September advance and target a move to new highs....

READ MORE